“Markets Dip, Yields Rise: Rate-Cut Hopes Fade.”

Introduction

In recent market developments, major indexes have experienced a decline while bond yields have climbed, reflecting a shift in investor sentiment amid diminishing prospects for interest rate cuts. This trend underscores the market’s recalibration in response to evolving economic indicators and central bank signals. As inflationary pressures persist and economic growth shows resilience, expectations for imminent monetary easing have waned, prompting a reassessment of asset valuations and risk appetite. The interplay between equity performance and bond yields highlights the complex dynamics at play as investors navigate an environment marked by uncertainty over future monetary policy directions.

Impact Of Rising Yields On Stock Market Performance

In recent weeks, the financial markets have been characterized by a notable decline in stock indexes, accompanied by a concurrent rise in bond yields. This dynamic has been largely driven by shifting expectations regarding future monetary policy, particularly the diminished prospects for rate cuts by central banks. As investors recalibrate their strategies in response to these developments, the impact of rising yields on stock market performance has become a focal point of analysis.

To understand the current market environment, it is essential to consider the relationship between bond yields and stock valuations. Typically, rising bond yields signal higher borrowing costs, which can dampen corporate profits and, consequently, stock prices. As yields climb, the relative attractiveness of equities diminishes, prompting investors to reassess their portfolios. This shift is particularly pronounced in sectors that are sensitive to interest rate changes, such as technology and consumer discretionary, where future earnings are often discounted at higher rates.

Moreover, the recent increase in yields reflects a broader economic narrative. Central banks, particularly the Federal Reserve, have signaled a commitment to maintaining higher interest rates for an extended period to combat persistent inflationary pressures. This stance has led market participants to adjust their expectations, reducing the likelihood of imminent rate cuts. As a result, the cost of capital is expected to remain elevated, influencing corporate investment decisions and consumer spending patterns.

In this context, the stock market’s response has been multifaceted. On one hand, sectors with stable cash flows and strong balance sheets, such as utilities and consumer staples, have demonstrated relative resilience. These sectors are often viewed as defensive plays during periods of economic uncertainty, offering investors a degree of safety amid market volatility. On the other hand, growth-oriented sectors have faced headwinds, as the prospect of sustained higher rates challenges their valuation models.

Furthermore, the interplay between rising yields and stock market performance is not solely confined to domestic factors. Global economic conditions and geopolitical developments also play a crucial role. For instance, fluctuations in foreign exchange rates, driven by divergent monetary policies across major economies, can influence the competitiveness of multinational corporations and their earnings prospects. Additionally, geopolitical tensions can exacerbate market volatility, prompting investors to seek refuge in safe-haven assets, thereby impacting equity markets.

As investors navigate this complex landscape, diversification remains a key strategy. By spreading investments across various asset classes and geographic regions, market participants can mitigate risks associated with rising yields and potential economic slowdowns. Additionally, a focus on quality stocks with robust fundamentals and sustainable growth prospects can provide a buffer against market fluctuations.

In conclusion, the current market environment, characterized by declining stock indexes and rising bond yields, underscores the intricate relationship between monetary policy expectations and asset valuations. As central banks prioritize inflation control over rate cuts, investors must adapt to a landscape where higher borrowing costs and economic uncertainties prevail. By understanding the implications of these dynamics and employing prudent investment strategies, market participants can better position themselves to navigate the challenges and opportunities that lie ahead.

Analyzing The Decline In Major Stock Indexes

In recent weeks, the financial markets have experienced notable fluctuations, with major stock indexes declining and bond yields climbing. This shift can be attributed to a confluence of economic indicators and policy expectations that have altered investor sentiment. As market participants digest these developments, it is crucial to understand the underlying factors contributing to the current market dynamics.

To begin with, the decline in major stock indexes can be largely attributed to the diminishing prospects of interest rate cuts by central banks. For much of the past year, investors have been buoyed by the anticipation of monetary easing, which typically supports equity markets by lowering borrowing costs and encouraging investment. However, recent economic data has painted a more resilient picture of the global economy, leading central banks to adopt a more cautious stance on rate cuts. This shift in expectations has prompted a reassessment of asset valuations, resulting in downward pressure on stock prices.

Moreover, the rise in bond yields further compounds the challenges faced by equity markets. As yields climb, the relative attractiveness of stocks diminishes, particularly for income-focused investors who may opt for the perceived safety and steady returns of fixed-income securities. The increase in yields is partly driven by the same economic resilience that has tempered rate-cut expectations. Stronger-than-expected economic indicators, such as robust employment figures and steady consumer spending, suggest that inflationary pressures may persist, prompting investors to demand higher yields as compensation for potential future rate hikes.

In addition to these macroeconomic factors, geopolitical tensions and trade uncertainties continue to weigh on investor confidence. Ongoing negotiations and disputes between major economies have introduced an element of unpredictability, which can exacerbate market volatility. Investors are keenly aware that any escalation in trade conflicts could disrupt global supply chains and dampen economic growth, further complicating the outlook for corporate earnings and stock valuations.

Transitioning to the corporate sector, earnings reports have been a mixed bag, with some companies exceeding expectations while others have issued cautious guidance. This divergence in performance underscores the challenges faced by businesses in navigating an environment characterized by shifting consumer preferences, technological disruptions, and regulatory changes. As companies strive to adapt, investors are closely monitoring their ability to maintain profitability and growth in the face of these headwinds.

Furthermore, the interplay between fiscal policy and market dynamics cannot be overlooked. Government spending initiatives and tax policies play a crucial role in shaping economic conditions and influencing investor behavior. As policymakers grapple with balancing fiscal stimulus and budgetary constraints, their decisions will inevitably impact market sentiment and the trajectory of both stock indexes and bond yields.

In conclusion, the recent decline in major stock indexes and the concurrent rise in bond yields reflect a complex interplay of economic indicators, policy expectations, and geopolitical factors. As investors navigate this evolving landscape, they must remain vigilant and adaptable, recognizing that market conditions can shift rapidly in response to new information. By staying informed and considering a broad range of factors, market participants can better position themselves to manage risk and capitalize on opportunities in this dynamic environment.

Investor Sentiment: Navigating A Market With Fewer Rate-Cut Expectations

Investor sentiment has been notably affected by the recent developments in the financial markets, where indexes have experienced a decline and yields have climbed, largely due to diminished prospects for rate cuts. This shift in market dynamics has prompted investors to reassess their strategies and expectations, as the economic landscape continues to evolve. The interplay between these factors is crucial in understanding the current market environment and its implications for future investment decisions.

To begin with, the decline in indexes can be attributed to a combination of factors, including concerns over economic growth and the Federal Reserve’s monetary policy stance. As economic indicators have shown mixed signals, investors have become increasingly cautious, leading to a pullback in equity markets. The anticipation of slower economic growth has further exacerbated this trend, as market participants weigh the potential impact on corporate earnings and overall market performance. Consequently, this has led to a more risk-averse approach among investors, who are now seeking safer assets to preserve capital.

Simultaneously, the rise in yields has been driven by changing expectations regarding interest rate cuts. Initially, there was optimism that the Federal Reserve might implement rate cuts to stimulate economic growth. However, recent statements from Fed officials have suggested a more hawkish stance, indicating that rate cuts may not be forthcoming in the near term. This shift in expectations has resulted in an upward movement in bond yields, as investors adjust their portfolios to reflect the likelihood of a prolonged period of higher interest rates. The increase in yields has also been influenced by inflationary pressures, which have persisted despite efforts to contain them.

In light of these developments, investor sentiment has become more cautious, as market participants navigate a landscape with fewer rate-cut expectations. The prospect of sustained higher interest rates has prompted a reevaluation of investment strategies, with a focus on balancing risk and return. Investors are now considering the implications of higher borrowing costs on corporate profitability and consumer spending, which could potentially dampen economic growth. Moreover, the increased cost of capital may lead to a reassessment of valuations, particularly in sectors that are sensitive to interest rate changes.

As investors adapt to this evolving environment, diversification has emerged as a key strategy to mitigate risk. By spreading investments across various asset classes, investors can reduce their exposure to market volatility and enhance their potential for returns. Additionally, a focus on quality investments, such as companies with strong balance sheets and stable cash flows, can provide a buffer against economic uncertainties. Furthermore, the importance of maintaining a long-term perspective cannot be overstated, as short-term market fluctuations may not necessarily reflect the underlying fundamentals.

In conclusion, the current market environment, characterized by declining indexes and rising yields amid diminished rate-cut prospects, presents both challenges and opportunities for investors. As they navigate this complex landscape, a prudent approach that emphasizes diversification, quality investments, and a long-term outlook can help mitigate risks and capitalize on potential opportunities. By staying informed and adaptable, investors can better position themselves to weather the uncertainties and achieve their financial objectives in an ever-changing market.

The Relationship Between Bond Yields And Equity Markets

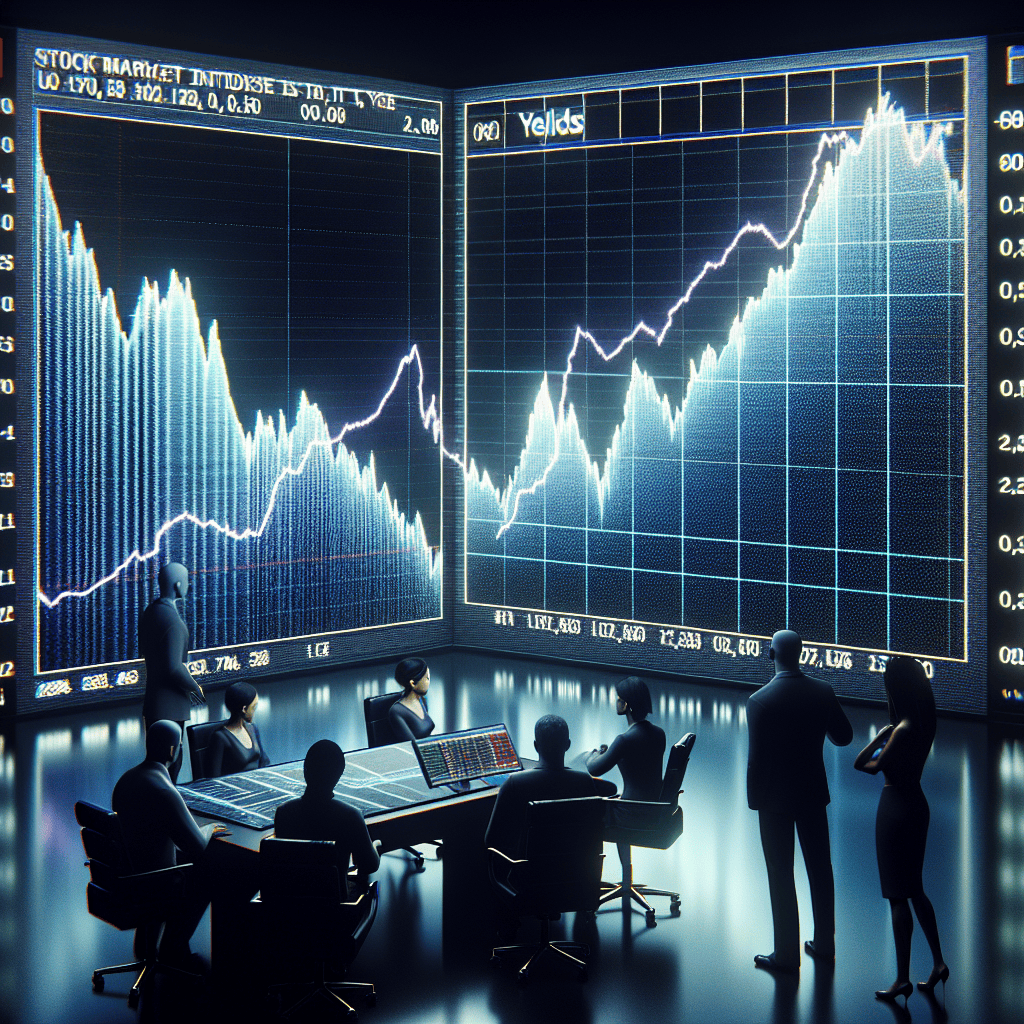

In recent weeks, financial markets have been characterized by a notable decline in equity indexes alongside a concurrent rise in bond yields, a phenomenon that has captured the attention of investors and analysts alike. This dynamic interplay between bond yields and equity markets is rooted in the fundamental principles of finance and economics, where shifts in interest rates and yield expectations can significantly influence investor behavior and market valuations. As bond yields climb, the cost of borrowing increases, which can have a dampening effect on corporate profits and, by extension, equity valuations. This inverse relationship is particularly pronounced in periods when the prospects for interest rate cuts appear diminished, as is currently the case.

The Federal Reserve’s monetary policy plays a pivotal role in shaping market expectations, and recent signals from the central bank suggest a more cautious approach to rate cuts than previously anticipated. This shift in outlook has led to a recalibration of investor expectations, with many now bracing for a prolonged period of elevated interest rates. As a result, bond yields have risen, reflecting the market’s adjustment to the new interest rate environment. Higher yields on government bonds, often considered a risk-free benchmark, make equities less attractive on a relative basis, as investors can achieve comparable returns with lower risk by investing in bonds.

Moreover, the rise in bond yields has implications for the valuation of equities, particularly those in sectors that are sensitive to interest rate changes, such as technology and real estate. These sectors often rely on borrowing to finance growth and expansion, and higher interest rates can increase their cost of capital, thereby compressing profit margins and reducing future cash flow projections. Consequently, investors may reassess the growth prospects of companies within these sectors, leading to a revaluation of their stock prices.

In addition to the direct impact on corporate profitability, rising bond yields can also influence investor sentiment and risk appetite. As yields climb, the opportunity cost of holding equities increases, prompting some investors to reallocate their portfolios in favor of fixed-income securities. This shift in asset allocation can exert downward pressure on equity markets, as demand for stocks wanes in favor of bonds. Furthermore, the heightened uncertainty surrounding future interest rate movements can exacerbate market volatility, as investors grapple with the implications of a potentially prolonged period of higher borrowing costs.

Despite these challenges, it is important to recognize that the relationship between bond yields and equity markets is not always straightforward. While rising yields can pose headwinds for equities, they can also signal confidence in the underlying strength of the economy. In such scenarios, robust economic growth can offset the negative impact of higher interest rates, as increased consumer spending and business investment drive corporate earnings higher. Therefore, the broader economic context is crucial in determining the ultimate impact of rising bond yields on equity markets.

In conclusion, the recent decline in equity indexes and the rise in bond yields underscore the complex interplay between interest rates and market dynamics. As investors navigate this evolving landscape, understanding the relationship between bond yields and equity markets is essential for making informed investment decisions. While the diminished prospects for rate cuts have introduced new challenges, they also present opportunities for those who can adeptly manage risk and capitalize on shifting market conditions. As always, a nuanced approach that considers both macroeconomic trends and individual company fundamentals will be key to navigating the current market environment.

Strategies For Investors In A High-Yield Environment

In the current financial landscape, investors are navigating a complex environment characterized by declining indexes and climbing yields, driven by diminished prospects for rate cuts. This scenario presents both challenges and opportunities, necessitating strategic adjustments to investment portfolios. As central banks signal a more cautious approach to monetary easing, the implications for various asset classes become increasingly significant. Consequently, investors must reassess their strategies to optimize returns while managing risks in this high-yield environment.

To begin with, understanding the dynamics of bond markets is crucial. As yields rise, bond prices typically fall, which can negatively impact fixed-income portfolios. However, this environment also offers the potential for higher income from new bond investments. Investors might consider diversifying their bond holdings by incorporating a mix of short-duration bonds, which are less sensitive to interest rate fluctuations, and high-yield bonds, which offer attractive returns but come with increased risk. Additionally, inflation-linked bonds can provide a hedge against rising prices, preserving purchasing power over time.

Equities, on the other hand, present a different set of considerations. While higher yields can exert downward pressure on stock valuations, certain sectors may benefit from the current economic conditions. For instance, financial stocks, particularly banks, often perform well in rising interest rate environments due to improved net interest margins. Similarly, energy and commodity-related sectors may experience tailwinds from inflationary pressures and global supply chain disruptions. Investors should focus on companies with strong balance sheets and pricing power, as these attributes can help sustain profitability amid economic uncertainties.

Moreover, dividend-paying stocks can be an attractive option for income-seeking investors. Companies with a history of stable and growing dividends may offer a reliable income stream, which can be particularly appealing when bond yields are volatile. It is essential, however, to conduct thorough due diligence to ensure that these companies have the financial strength to maintain their dividend payouts in challenging economic conditions.

In addition to traditional asset classes, alternative investments can play a vital role in portfolio diversification. Real estate investment trusts (REITs), for example, can provide exposure to income-generating properties, offering both yield and potential capital appreciation. Similarly, infrastructure investments, which often come with long-term contracts and inflation-linked revenues, can serve as a stable income source. Private equity and hedge funds may also offer opportunities for enhanced returns, albeit with higher risk and less liquidity.

Furthermore, investors should not overlook the importance of maintaining a well-balanced and diversified portfolio. Asset allocation remains a critical component of investment strategy, helping to mitigate risks associated with market volatility. By spreading investments across various asset classes, sectors, and geographies, investors can reduce the impact of adverse market movements on their overall portfolio performance.

In conclusion, the current high-yield environment, marked by declining indexes and rising yields, requires investors to adopt a proactive and informed approach to portfolio management. By carefully evaluating the opportunities and risks associated with different asset classes, and by maintaining a diversified investment strategy, investors can position themselves to navigate the challenges and capitalize on the opportunities presented by this evolving financial landscape. As always, staying informed and adaptable will be key to achieving long-term investment success in these uncertain times.

Economic Indicators Influencing Rate-Cut Prospects

In recent weeks, the financial markets have been characterized by a notable decline in major indexes, accompanied by a rise in bond yields. This shift in market dynamics can be attributed to a confluence of economic indicators that have collectively diminished the prospects of imminent rate cuts by central banks. As investors and analysts closely monitor these developments, it becomes imperative to understand the underlying factors influencing this trend.

To begin with, inflationary pressures have remained persistently high, defying earlier expectations of a more rapid decline. Consumer price indices across several major economies have shown that inflation is not abating as quickly as anticipated. This has led central banks to adopt a more cautious stance, prioritizing inflation control over economic stimulus. Consequently, the likelihood of rate cuts has diminished, as monetary authorities remain vigilant in their efforts to anchor inflation expectations.

Moreover, labor market conditions have continued to exhibit resilience, further complicating the case for rate cuts. Unemployment rates in many developed economies have remained at historically low levels, and wage growth has shown signs of acceleration. This robust labor market performance suggests that the economy is not in immediate need of monetary easing to spur job creation. Instead, central banks are wary of fueling inflationary pressures through premature rate cuts, which could exacerbate wage-price spirals.

In addition to inflation and labor market dynamics, global economic growth prospects have also played a pivotal role in shaping rate-cut expectations. While there are pockets of weakness, particularly in certain emerging markets, the overall global growth outlook has been relatively stable. This has been supported by resilient consumer spending and a gradual recovery in supply chains. As a result, central banks are less inclined to cut rates aggressively, as the need for immediate economic stimulus appears less pressing.

Furthermore, geopolitical tensions and uncertainties have added another layer of complexity to the rate-cut calculus. Trade disputes, political instability, and other geopolitical risks have the potential to disrupt economic activity and financial markets. However, central banks are cautious about using rate cuts as a tool to mitigate these risks, as such measures may not effectively address the underlying issues. Instead, they are likely to adopt a wait-and-see approach, assessing the impact of geopolitical developments on economic fundamentals before making any decisive policy moves.

As bond yields climb in response to these diminished rate-cut prospects, investors are recalibrating their portfolios to reflect the changing interest rate environment. Higher yields on government bonds have made them more attractive relative to equities, leading to a reallocation of assets and contributing to the decline in major stock indexes. This shift underscores the interconnectedness of financial markets and the importance of interest rate expectations in shaping investment decisions.

In conclusion, the recent decline in indexes and the rise in yields can be attributed to a complex interplay of economic indicators that have reduced the likelihood of near-term rate cuts. Persistent inflation, robust labor markets, stable global growth prospects, and geopolitical uncertainties have all contributed to this evolving landscape. As central banks navigate these challenges, market participants will continue to closely monitor economic data and policy signals, seeking to anticipate the future trajectory of interest rates and their implications for financial markets.

Historical Context: Market Reactions To Changing Rate Expectations

In the ever-evolving landscape of financial markets, the interplay between interest rates and market indices has long been a focal point for investors and analysts alike. Historically, changes in interest rate expectations have had profound impacts on market behavior, often dictating the flow of capital and influencing investor sentiment. As we delve into the current scenario where indexes are declining and yields are climbing, it is essential to understand the historical context of market reactions to shifting rate expectations.

Traditionally, the prospect of interest rate cuts has been met with enthusiasm by equity markets. Lower rates generally reduce the cost of borrowing, thereby encouraging investment and consumption, which in turn can stimulate economic growth. This environment typically leads to higher corporate earnings, making equities more attractive. Conversely, the anticipation of rate hikes often results in a more cautious market stance, as higher borrowing costs can dampen economic activity and squeeze corporate profit margins. However, the current market dynamics present a nuanced picture, as diminished prospects for rate cuts are contributing to a decline in indexes while yields are on the rise.

To comprehend this phenomenon, it is crucial to consider the broader economic backdrop. In recent years, central banks worldwide have adopted accommodative monetary policies to counteract economic slowdowns and foster recovery. This has led to an extended period of low interest rates, which has been a boon for equity markets. However, as inflationary pressures mount and economic indicators suggest a more robust recovery, central banks are signaling a shift towards tightening monetary policy. This shift is reflected in the climbing yields, as bond markets adjust to the anticipated changes in interest rates.

The relationship between bond yields and equity markets is complex and multifaceted. Rising yields often indicate expectations of higher inflation and stronger economic growth, which can be positive for equities in the long run. However, in the short term, higher yields can lead to increased volatility and downward pressure on stock prices. This is because higher yields make fixed-income investments more attractive relative to equities, prompting a reallocation of assets. Additionally, higher borrowing costs can weigh on corporate profitability, further dampening investor enthusiasm for stocks.

Moreover, the current market environment is characterized by heightened uncertainty, as investors grapple with the implications of potential policy shifts. The diminished prospects for rate cuts suggest that central banks are prioritizing inflation control over economic stimulus, which could lead to a recalibration of market expectations. This uncertainty is exacerbated by geopolitical tensions and supply chain disruptions, which add layers of complexity to the investment landscape.

In light of these factors, it is evident that the historical context of market reactions to changing rate expectations provides valuable insights into the current market dynamics. While the prospect of diminished rate cuts is contributing to declining indexes and climbing yields, it is important to recognize that markets are inherently forward-looking. As such, investors must remain vigilant and adaptable, considering both the immediate impacts and the long-term implications of monetary policy shifts.

In conclusion, the intricate relationship between interest rates, market indices, and yields underscores the importance of understanding historical market reactions to changing rate expectations. As the current scenario unfolds, investors must navigate a complex and uncertain environment, balancing the challenges and opportunities presented by evolving monetary policies. Through careful analysis and strategic decision-making, market participants can better position themselves to weather the fluctuations and capitalize on potential growth opportunities.

Q&A

1. **What caused the decline in market indexes?**

Market indexes declined due to investor concerns over diminished prospects for rate cuts by central banks.

2. **Which indexes were affected by the decline?**

Major indexes such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite were affected.

3. **Why are rate-cut prospects diminished?**

Rate-cut prospects are diminished due to stronger-than-expected economic data and persistent inflationary pressures.

4. **How did bond yields react to the market update?**

Bond yields climbed as investors adjusted their expectations for future interest rate movements.

5. **What sectors were most impacted by the index decline?**

Interest rate-sensitive sectors, such as technology and real estate, were most impacted by the index decline.

6. **How did the Federal Reserve’s stance influence the market?**

The Federal Reserve’s indication of a more prolonged period of higher interest rates influenced the market’s reaction.

7. **What are investors focusing on amid these market changes?**

Investors are focusing on upcoming economic data releases and central bank communications for further guidance on interest rate policies.

Conclusion

In conclusion, the recent market update indicates a decline in indexes alongside a rise in yields, primarily driven by reduced expectations for rate cuts. This shift suggests that investors are adjusting their strategies in response to a potentially prolonged period of higher interest rates, reflecting concerns about inflationary pressures and central bank policies. The market’s reaction underscores the sensitivity of financial markets to monetary policy signals and the ongoing balancing act between growth and inflation.