“Strategic Shifts: Japan and China Rebalance Portfolios Amid U.S. Political Uncertainty”

Introduction

In the lead-up to Donald Trump’s presidential victory in 2016, both Japan and China, two of the largest foreign holders of U.S. Treasury securities, began reducing their holdings. This sell-off was driven by a combination of factors, including economic strategies, currency stabilization efforts, and market uncertainties surrounding the potential impact of Trump’s economic policies. As the U.S. election approached, concerns over possible shifts in trade relations and fiscal policies under a Trump administration prompted these nations to reassess their investment strategies, leading to a notable decrease in their U.S. Treasury holdings. This move highlighted the interconnectedness of global financial markets and the influence of geopolitical events on investment decisions.

Impact Of Japan And China Selling US Treasuries On Global Markets

In recent years, the global financial landscape has been marked by significant shifts, one of which is the decision by Japan and China to sell off substantial portions of their holdings in U.S. Treasuries. This move, occurring in the lead-up to Donald Trump’s presidential victory, has had profound implications for global markets. To understand the impact of this sell-off, it is essential to consider the motivations behind these actions and the subsequent ripple effects across international financial systems.

Japan and China, as two of the largest foreign holders of U.S. debt, have traditionally played a crucial role in stabilizing the U.S. Treasury market. Their decision to reduce their holdings was driven by a combination of economic and geopolitical factors. For Japan, the need to address domestic economic challenges, such as deflationary pressures and an aging population, necessitated a reallocation of resources. Meanwhile, China faced its own set of economic hurdles, including a slowing growth rate and the need to manage its currency more effectively. Additionally, both nations were likely influenced by the uncertainty surrounding U.S. economic policies under a potential Trump administration, which promised significant changes in trade and fiscal policies.

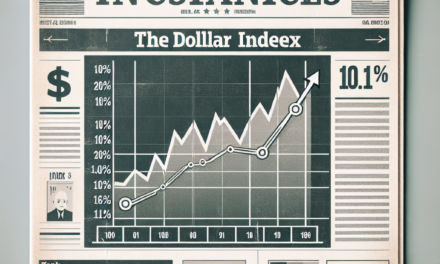

The sell-off of U.S. Treasuries by these two economic powerhouses had immediate and far-reaching consequences. Firstly, it exerted upward pressure on U.S. Treasury yields. As Japan and China reduced their holdings, the demand for these securities decreased, leading to a rise in yields. Higher yields, in turn, increased borrowing costs for the U.S. government, potentially complicating efforts to finance fiscal initiatives. Moreover, the increase in yields had a cascading effect on global interest rates, influencing borrowing costs for other nations and impacting global investment strategies.

Furthermore, the actions of Japan and China contributed to heightened volatility in currency markets. As these countries sold off U.S. Treasuries, they converted their holdings into other currencies, leading to fluctuations in exchange rates. This volatility posed challenges for multinational corporations and investors, who had to navigate an increasingly unpredictable currency environment. Additionally, the sell-off raised concerns about the stability of the U.S. dollar as the world’s primary reserve currency, prompting discussions about the need for diversification in global reserves.

In response to these developments, central banks and financial institutions around the world were compelled to reassess their strategies. Many central banks, particularly those in emerging markets, faced pressure to adjust their monetary policies to mitigate the impact of rising U.S. yields and currency volatility. This often involved interventions in foreign exchange markets and adjustments to interest rates, which had further implications for global economic stability.

In conclusion, the decision by Japan and China to sell off U.S. Treasuries ahead of Donald Trump’s presidential win had significant repercussions for global markets. By influencing U.S. Treasury yields, currency volatility, and central bank policies, this move underscored the interconnectedness of the global financial system. As nations continue to navigate the complexities of international finance, the actions of major economic players like Japan and China will undoubtedly remain a focal point for policymakers and investors alike. The evolving dynamics of these relationships will shape the future of global markets, highlighting the importance of strategic foresight and adaptability in an ever-changing economic landscape.

Reasons Behind Japan And China’s Decision To Sell US Treasuries

In the months leading up to Donald Trump’s unexpected victory in the 2016 U.S. presidential election, both Japan and China made significant moves in the global financial markets by selling off substantial amounts of U.S. Treasuries. This decision, while seemingly abrupt, was influenced by a confluence of economic, political, and strategic factors that prompted these two major holders of U.S. debt to reassess their positions.

To begin with, the economic landscape at the time was marked by uncertainty and volatility, which played a crucial role in Japan and China’s decision-making process. The global economy was still grappling with the aftershocks of the 2008 financial crisis, and the recovery was uneven across different regions. In this context, the U.S. Federal Reserve had begun signaling a shift towards tightening monetary policy, with potential interest rate hikes on the horizon. For countries like Japan and China, which held large reserves of U.S. Treasuries, the prospect of rising interest rates posed a risk to the value of their investments. Selling off Treasuries was a strategic move to mitigate potential losses from declining bond prices as interest rates increased.

Moreover, the political climate in the United States added another layer of complexity to the decision. The 2016 presidential election was one of the most contentious in recent history, with Donald Trump emerging as a polarizing figure whose policy proposals were often unpredictable. His rhetoric on trade, particularly with China, raised concerns about the future of U.S.-China economic relations. Fearing potential trade wars or shifts in trade policies that could adversely affect their economies, both Japan and China sought to reduce their exposure to U.S. debt as a precautionary measure.

In addition to these economic and political considerations, strategic factors also influenced the sell-off. For China, in particular, the decision to reduce its holdings of U.S. Treasuries was part of a broader strategy to manage its foreign exchange reserves and stabilize its currency, the yuan. By selling U.S. Treasuries, China aimed to support the yuan and prevent excessive depreciation, which could have triggered capital outflows and further destabilized its economy. Japan, on the other hand, was dealing with its own set of challenges, including a stagnant economy and deflationary pressures. Selling U.S. Treasuries provided Japan with liquidity that could be used to support domestic economic initiatives and address fiscal concerns.

Furthermore, the geopolitical dynamics between the United States and these Asian powers cannot be overlooked. The U.S. Treasuries market has long been a tool of economic diplomacy, and by adjusting their holdings, Japan and China were sending subtle signals to the U.S. about their economic priorities and concerns. This maneuvering was not just about financial returns but also about maintaining leverage and influence in a rapidly changing global order.

In conclusion, the decision by Japan and China to sell off U.S. Treasuries ahead of Donald Trump’s election victory was driven by a complex interplay of economic, political, and strategic factors. As these nations navigated an uncertain global environment, their actions reflected a cautious approach to safeguarding their economic interests while adapting to potential shifts in U.S. policy. This episode underscores the intricate connections between global financial markets and international relations, highlighting the delicate balance that countries must maintain in an interconnected world.

Historical Context: Japan And China’s US Treasury Holdings

In the years leading up to Donald Trump’s unexpected victory in the 2016 U.S. presidential election, global financial markets were already experiencing significant shifts. Among these changes was the notable sell-off of U.S. Treasury securities by two of the largest foreign holders: Japan and China. This move, while seemingly abrupt, was rooted in a complex interplay of economic strategies, geopolitical considerations, and market dynamics that had been evolving over time.

Historically, both Japan and China have been major players in the U.S. Treasury market, holding substantial amounts of American debt as part of their foreign exchange reserves. This strategy has been driven by a combination of factors, including the need to stabilize their own currencies, manage trade surpluses, and ensure liquidity in times of economic uncertainty. However, as the global economic landscape began to shift in the mid-2010s, both nations found themselves reassessing their positions.

One of the primary catalysts for this reassessment was the changing monetary policy in the United States. The Federal Reserve’s decision to gradually raise interest rates after years of maintaining them at near-zero levels had significant implications for global investors. Higher interest rates typically lead to a decrease in the value of existing bonds, prompting investors to reconsider their holdings. For Japan and China, this meant that the returns on U.S. Treasuries were becoming less attractive, especially when weighed against the potential risks.

Moreover, the geopolitical climate was becoming increasingly complex. Tensions between the United States and China were escalating, fueled by trade disputes and broader strategic rivalries. In this context, China’s decision to reduce its holdings of U.S. Treasuries can be seen as a strategic maneuver to diversify its foreign exchange reserves and reduce its economic reliance on the United States. Similarly, Japan, while maintaining a strong alliance with the U.S., was also looking to balance its economic interests amid a rapidly changing global environment.

As the 2016 U.S. presidential election approached, uncertainty loomed large over the markets. The prospect of a Trump presidency introduced a new layer of unpredictability, given his campaign rhetoric on trade policies and international relations. This uncertainty likely contributed to the decision by Japan and China to further reduce their U.S. Treasury holdings, as they sought to mitigate potential risks associated with a shift in U.S. economic policy.

In addition to these strategic considerations, domestic factors also played a role. Both Japan and China were grappling with their own economic challenges, necessitating a reevaluation of their investment strategies. For Japan, the need to address deflationary pressures and stimulate economic growth was paramount. Meanwhile, China was focused on managing its economic transition from an export-driven model to one more reliant on domestic consumption.

In conclusion, the sell-off of U.S. Treasuries by Japan and China ahead of Donald Trump’s election victory was not an isolated event but rather the culmination of a series of interconnected factors. These included shifts in U.S. monetary policy, geopolitical tensions, and domestic economic priorities. As such, this period serves as a poignant reminder of the intricate and often unpredictable nature of global financial markets, where decisions made by major economic players can have far-reaching implications.

Economic Implications For The US Of Reduced Treasury Holdings By Japan And China

In recent years, the global economic landscape has been marked by significant shifts, one of which is the reduction of U.S. Treasury holdings by major foreign investors, notably Japan and China. This trend has garnered attention, particularly in the context of the political climate surrounding Donald Trump’s presidential win. As the two largest foreign holders of U.S. debt, Japan and China’s decisions to sell off U.S. Treasuries carry substantial implications for the American economy.

To understand the economic implications of this sell-off, it is essential to first consider the role of U.S. Treasuries in the global financial system. U.S. Treasuries are considered one of the safest investments, providing a reliable store of value and a source of liquidity for countries with large foreign exchange reserves. Consequently, they have been a cornerstone of international financial portfolios. However, when major holders like Japan and China reduce their holdings, it signals a shift in confidence and strategy that can reverberate through the global economy.

One immediate effect of Japan and China’s sell-off is the potential for increased volatility in the U.S. bond market. As these countries divest from U.S. Treasuries, the supply of available bonds in the market increases, which can lead to a decrease in bond prices and a corresponding rise in yields. Higher yields, in turn, translate to increased borrowing costs for the U.S. government. This scenario poses a challenge for fiscal policy, as it could lead to higher interest payments on the national debt, thereby constraining the government’s ability to finance other initiatives.

Moreover, the reduction in foreign holdings of U.S. Treasuries could have broader implications for the U.S. dollar’s status as the world’s primary reserve currency. A significant sell-off might prompt other countries to reassess their reliance on the dollar, potentially leading to a diversification of reserves into other currencies or assets. Such a shift could weaken the dollar’s value, affecting international trade dynamics and the purchasing power of American consumers.

In addition to these financial implications, the geopolitical context cannot be overlooked. The decision by Japan and China to reduce their U.S. Treasury holdings may reflect broader strategic considerations. For China, in particular, this move could be part of a strategy to assert greater economic independence and reduce vulnerability to U.S. economic policies. Similarly, Japan’s actions might be influenced by domestic economic priorities and a desire to manage its own fiscal challenges.

While the sell-off of U.S. Treasuries by Japan and China presents challenges, it also offers opportunities for the U.S. economy. For instance, it could encourage domestic investors to step in and fill the gap, potentially leading to a more balanced and resilient financial system. Additionally, the situation might prompt policymakers to address underlying economic issues, such as fiscal deficits and trade imbalances, thereby strengthening the long-term foundations of the U.S. economy.

In conclusion, the reduction of U.S. Treasury holdings by Japan and China ahead of Donald Trump’s presidential win is a development with far-reaching economic implications. It underscores the interconnectedness of global financial markets and the delicate balance of economic and geopolitical interests. As the U.S. navigates this evolving landscape, it will be crucial to monitor these trends and adapt strategies to ensure economic stability and growth in an increasingly complex world.

How Japan And China’s Actions Reflect Their Economic Strategies

In the months leading up to Donald Trump’s unexpected victory in the 2016 U.S. presidential election, both Japan and China made significant moves in the global financial markets by selling off substantial amounts of U.S. Treasuries. This strategic decision by two of the largest foreign holders of U.S. debt reflects not only their economic strategies but also their anticipation of potential shifts in the global economic landscape. Understanding the motivations behind these actions requires a closer examination of the economic strategies employed by Japan and China, as well as the broader implications for international financial markets.

Japan and China, as major players in the global economy, have long held significant portions of U.S. Treasuries as part of their foreign exchange reserves. These holdings serve as a means of stabilizing their own currencies and economies, providing a buffer against economic volatility. However, the decision to sell off these assets ahead of the U.S. election suggests a calculated response to anticipated changes in U.S. economic policy under a potential Trump administration. Trump’s campaign rhetoric, which included promises of renegotiating trade deals and imposing tariffs on Chinese goods, likely contributed to concerns about increased economic protectionism and its impact on global trade dynamics.

For Japan, the sale of U.S. Treasuries can be seen as part of a broader strategy to manage its own economic challenges. With a stagnant economy and persistent deflationary pressures, Japan has been focused on stimulating growth through monetary easing and fiscal policies. By reducing its holdings of U.S. debt, Japan may have sought to reallocate resources towards domestic investments or to support its own currency, the yen, in the face of potential market volatility. This move aligns with Japan’s ongoing efforts to revitalize its economy and maintain financial stability.

Similarly, China’s decision to sell U.S. Treasuries reflects its strategic approach to managing its vast foreign exchange reserves and addressing domestic economic concerns. As the world’s second-largest economy, China has been navigating a complex economic transition, shifting from an export-driven model to one focused on domestic consumption and innovation. The sale of U.S. Treasuries could be interpreted as a means of diversifying its reserves and reducing reliance on U.S. assets, thereby mitigating risks associated with potential U.S. policy changes. Additionally, this move may have been aimed at stabilizing the Chinese yuan, which faced depreciation pressures amid capital outflows and economic uncertainties.

The actions of Japan and China in selling off U.S. Treasuries ahead of Trump’s win underscore the interconnectedness of global financial markets and the importance of strategic foresight in economic planning. These decisions highlight the delicate balance that countries must maintain between managing their own economic priorities and responding to external geopolitical developments. As the world continues to grapple with evolving economic challenges, the strategies employed by Japan and China serve as a reminder of the complexities involved in navigating the global financial landscape.

In conclusion, the sell-off of U.S. Treasuries by Japan and China prior to the 2016 U.S. presidential election reflects their proactive approach to economic strategy and risk management. By carefully considering the potential implications of a Trump presidency, both countries demonstrated their commitment to safeguarding their economic interests while adapting to an ever-changing global environment. This episode serves as a testament to the intricate interplay between national economic policies and international financial markets, highlighting the need for vigilance and adaptability in an increasingly interconnected world.

Potential Consequences For US-Japan And US-China Relations

In the months leading up to Donald Trump’s unexpected victory in the 2016 U.S. presidential election, both Japan and China, two of the largest foreign holders of U.S. Treasuries, began to significantly reduce their holdings. This strategic financial maneuver has sparked considerable debate among economists and policymakers regarding its potential implications for U.S.-Japan and U.S.-China relations. As these two Asian economic powerhouses adjusted their portfolios, the move was seen as a response to the growing uncertainty surrounding the U.S. political landscape and its potential impact on global markets.

Japan and China, traditionally significant investors in U.S. government debt, have historically used their holdings as a means of stabilizing their own currencies and economies. However, the sell-off of U.S. Treasuries by these nations was perceived as a signal of their apprehension about the future direction of U.S. economic policy under a Trump administration. This development raised questions about the future of economic cooperation and diplomatic relations between the United States and these key Asian partners.

The reduction in U.S. Treasury holdings by Japan and China could have several potential consequences for bilateral relations. For one, it may lead to increased volatility in the bond markets, as the withdrawal of such substantial investments could drive up interest rates. Higher interest rates, in turn, could have a ripple effect on the U.S. economy, potentially slowing down growth and affecting trade relations. This scenario could strain the economic ties between the United States and these countries, as higher borrowing costs might lead to reduced investment and trade flows.

Moreover, the sell-off could be interpreted as a strategic move by Japan and China to assert their economic independence and reduce their reliance on the U.S. dollar. This shift could signal a broader trend of diversification in their foreign exchange reserves, potentially leading to a reevaluation of their economic strategies and partnerships. Such a development might prompt the United States to reconsider its own economic policies and diplomatic strategies in the Asia-Pacific region, as it seeks to maintain its influence and foster stable relations with these key players.

Furthermore, the decision by Japan and China to sell off U.S. Treasuries may also reflect broader geopolitical considerations. As the Trump administration signaled a shift towards more protectionist trade policies and a reevaluation of existing trade agreements, both Japan and China may have felt compelled to reassess their economic ties with the United States. This reassessment could lead to a recalibration of their diplomatic strategies, potentially resulting in a more cautious approach to future negotiations and collaborations.

In conclusion, the sell-off of U.S. Treasuries by Japan and China ahead of Trump’s election victory underscores the complex interplay between economic and political factors in shaping international relations. As these nations navigate the uncertainties of a changing global landscape, their actions may have far-reaching implications for U.S.-Japan and U.S.-China relations. The evolving dynamics of these relationships will likely require careful management and strategic foresight to ensure that economic cooperation and diplomatic engagement continue to thrive in an increasingly interconnected world. As such, policymakers on all sides must remain vigilant and adaptable, ready to address the challenges and opportunities that lie ahead in this new era of international relations.

Analysis Of Market Reactions To Japan And China’s Treasury Sell-Off

In the months leading up to Donald Trump’s unexpected victory in the 2016 U.S. presidential election, a notable shift occurred in the global financial landscape as Japan and China, two of the largest foreign holders of U.S. Treasury securities, began to sell off significant portions of their holdings. This move, which initially raised eyebrows among market analysts, was driven by a confluence of economic and geopolitical factors that underscored the complex interplay between international relations and financial markets.

To begin with, it is essential to understand the motivations behind Japan and China’s decision to reduce their U.S. Treasury holdings. For China, the sell-off was partly a response to domestic economic pressures. Faced with a slowing economy and capital outflows, Chinese authorities sought to stabilize the yuan by selling U.S. Treasuries to support their currency. This strategy was aimed at curbing the depreciation of the yuan and maintaining investor confidence in China’s economic stability. Meanwhile, Japan’s actions were influenced by its own economic challenges, including a persistent struggle with deflation and the need to manage its monetary policy effectively. By selling U.S. Treasuries, Japan aimed to adjust its foreign exchange reserves and address domestic financial concerns.

As these two economic powerhouses began to offload their U.S. Treasury holdings, the market reaction was swift and multifaceted. Initially, the sell-off exerted upward pressure on U.S. Treasury yields, as increased supply in the market typically leads to a decrease in bond prices and a corresponding rise in yields. This development was closely monitored by investors, who were already on edge due to the uncertainty surrounding the U.S. presidential election. The prospect of higher yields made U.S. Treasuries more attractive to other investors, thereby mitigating some of the immediate impacts of the sell-off.

Moreover, the actions of Japan and China were interpreted by some market participants as a signal of their concerns about the future direction of U.S. economic policy under a potential Trump administration. Trump’s campaign rhetoric, which included promises of protectionist trade policies and a more aggressive stance towards China, added an element of geopolitical risk to the equation. Consequently, the sell-off was seen not only as a response to domestic economic conditions but also as a preemptive measure to hedge against potential volatility in U.S.-China relations.

In the broader context of global financial markets, the sell-off by Japan and China highlighted the interconnectedness of national economies and the ripple effects that can result from shifts in policy and sentiment. It underscored the importance of understanding the motivations and strategies of major international players, as their actions can have far-reaching implications for global financial stability. Furthermore, the episode served as a reminder of the delicate balance that countries must maintain between managing their domestic economic priorities and navigating the complexities of international finance.

In conclusion, the decision by Japan and China to sell off U.S. Treasuries ahead of Trump’s election victory was a multifaceted move driven by both domestic economic considerations and geopolitical uncertainties. The market reactions to this sell-off illustrated the intricate dynamics at play in the global financial system, where actions taken by major economies can reverberate across borders and influence investor behavior worldwide. As such, this episode remains a pertinent example of the challenges and opportunities inherent in the interconnected world of international finance.

Q&A

1. **Why did Japan and China sell off US Treasuries ahead of Trump’s win?**

Japan and China sold off US Treasuries due to concerns over potential economic policy changes and market volatility associated with the uncertainty of Trump’s presidential campaign.

2. **How did the sell-off of US Treasuries by Japan and China impact the market?**

The sell-off led to increased yields on US Treasuries as prices fell, reflecting investor concerns and a shift in global capital flows.

3. **What were the economic concerns related to Trump’s potential presidency?**

Concerns included possible trade tensions, changes in fiscal policy, and uncertainty over international relations, which could affect global economic stability.

4. **How significant was the sell-off by Japan and China in terms of US Treasury holdings?**

Both countries are among the largest foreign holders of US Treasuries, so their sell-off was significant and closely watched by global markets.

5. **What was the reaction of the US government to the sell-off?**

The US government monitored the situation but did not take immediate action, as fluctuations in foreign holdings of Treasuries are common.

6. **Did the sell-off have any long-term effects on US-China or US-Japan relations?**

While it added to existing economic tensions, the sell-off did not have a major long-term impact on diplomatic relations, which are influenced by a broader set of issues.

7. **What strategies did investors adopt in response to the sell-off?**

Investors sought safer assets, diversified their portfolios, and closely monitored policy announcements from the incoming Trump administration.

Conclusion

In the lead-up to Donald Trump’s presidential victory in 2016, both Japan and China, two of the largest foreign holders of U.S. Treasuries, began selling off these assets. This move was likely driven by a combination of factors, including concerns over potential shifts in U.S. economic policy under a Trump administration, expectations of rising interest rates, and the need to stabilize their own currencies. The sell-off highlighted the interconnectedness of global financial markets and the potential for geopolitical events to influence investment strategies. It also underscored the delicate balance countries must maintain between holding foreign reserves and addressing domestic economic challenges. Overall, the actions of Japan and China during this period reflected a cautious approach to managing economic uncertainty and mitigating risks associated with significant political changes in the United States.