“Retire in Comfort: $1.4M in IRAs and a Debt-Free Dream Home at 60!”

Introduction

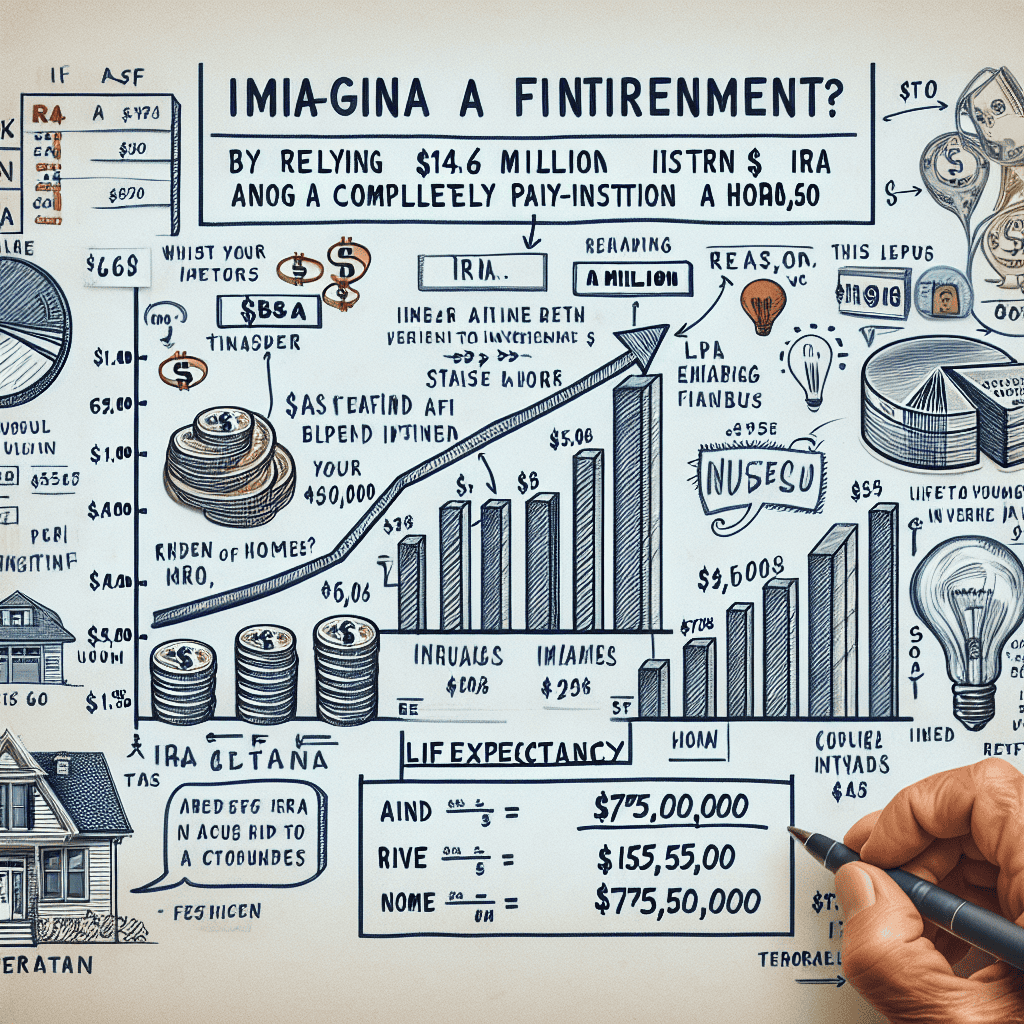

Retiring at 60 with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000 is a scenario that many individuals aspire to achieve. This financial position provides a solid foundation for a comfortable retirement, but it requires careful planning and consideration of various factors to ensure long-term financial security. Key considerations include estimating annual living expenses, understanding potential healthcare costs, evaluating investment strategies to sustain and grow retirement savings, and accounting for inflation and market volatility. Additionally, the absence of debt on the home offers flexibility, potentially allowing for downsizing or leveraging home equity if needed. By analyzing these elements, individuals can determine if retiring in two years is feasible and align their financial strategies to support a fulfilling retirement lifestyle.

Evaluating Financial Readiness for Retirement at 60

Retiring at the age of 60 is a dream for many, offering the promise of freedom and the opportunity to pursue personal interests without the constraints of a work schedule. For those with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, this dream may seem within reach. However, evaluating financial readiness for retirement involves more than just assessing assets; it requires a comprehensive understanding of expenses, income needs, and potential risks.

To begin with, the $1.4 million in IRAs represents a significant nest egg. Assuming a conservative withdrawal rate of 4%, this amount could potentially provide an annual income of $56,000. This figure, while substantial, must be weighed against anticipated living expenses. It is crucial to consider not only current expenses but also how these might change in retirement. For instance, while some costs such as commuting may decrease, others like healthcare could rise significantly. Therefore, a detailed budget that accounts for all potential expenses is essential.

In addition to the income from IRAs, the value of a debt-free home cannot be overlooked. While it does not directly contribute to liquid cash flow, it provides a substantial safety net. The home could be leveraged in several ways, such as downsizing to free up capital or utilizing a reverse mortgage to supplement income. However, these options should be carefully considered, as they may have long-term implications on financial security and estate planning.

Moreover, it is important to factor in Social Security benefits, which can significantly bolster retirement income. Although benefits can be claimed as early as age 62, delaying until full retirement age or even later can result in higher monthly payments. Therefore, understanding the optimal timing for claiming Social Security is a critical component of retirement planning.

While the financial assets and home equity present a promising picture, potential risks must also be addressed. Market volatility can impact the value of investments, and unexpected expenses, such as medical emergencies, can strain resources. To mitigate these risks, a diversified investment portfolio and an emergency fund are advisable. Additionally, considering long-term care insurance may provide peace of mind against unforeseen healthcare costs.

Inflation is another factor that can erode purchasing power over time. Even a modest inflation rate can significantly impact the real value of retirement savings over a couple of decades. Therefore, it is prudent to include investments that have the potential to outpace inflation, such as equities, within the portfolio.

Furthermore, tax implications should not be overlooked. Withdrawals from traditional IRAs are subject to income tax, which can affect net income. Strategic tax planning, possibly with the help of a financial advisor, can help optimize withdrawals and minimize tax liabilities.

In conclusion, retiring at 60 with $1.4 million in IRAs and a debt-free $750,000 home is indeed possible, but it requires careful planning and consideration of various factors. By thoroughly evaluating expenses, income sources, and potential risks, and by implementing strategies to address these elements, individuals can enhance their financial readiness for retirement. Ultimately, the key to a successful retirement lies in balancing current financial resources with future needs and uncertainties, ensuring a stable and fulfilling retirement journey.

Maximizing IRA Withdrawals for a Comfortable Retirement

Retirement planning is a multifaceted endeavor that requires careful consideration of various financial elements to ensure a comfortable and sustainable lifestyle. For individuals contemplating retirement at the age of 60, with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, the prospect appears promising. However, to maximize IRA withdrawals effectively, it is essential to adopt a strategic approach that balances income needs with long-term financial security.

To begin with, understanding the withdrawal strategies from IRAs is crucial. At age 60, individuals are eligible to make penalty-free withdrawals from their IRAs, although these withdrawals are subject to ordinary income tax. Therefore, it is advisable to develop a withdrawal plan that minimizes tax liabilities while ensuring sufficient income. One effective strategy is to withdraw funds in a manner that keeps the individual in a lower tax bracket, thereby reducing the overall tax burden. This can be achieved by carefully calculating the required annual income and adjusting withdrawals accordingly.

Moreover, it is important to consider the role of Social Security benefits in the retirement income plan. Although individuals can start receiving Social Security benefits as early as age 62, delaying benefits until a later age can result in higher monthly payments. Therefore, it may be beneficial to rely on IRA withdrawals initially and defer Social Security benefits to maximize future income. This approach not only enhances financial security but also provides a buffer against inflation and longevity risk.

In addition to managing withdrawals and Social Security benefits, it is essential to consider the investment strategy for the remaining IRA balance. A well-diversified portfolio that balances growth and income can help sustain the IRA’s value over time. While it is important to maintain a level of growth to combat inflation, it is equally crucial to ensure that the portfolio is not overly exposed to market volatility, which could jeopardize the retirement plan. Therefore, a balanced approach that includes a mix of equities, bonds, and other income-generating assets is recommended.

Furthermore, the value of a debt-free home should not be overlooked in the retirement planning process. While the primary residence is not a liquid asset, it represents a significant portion of the individual’s net worth. In the event of unexpected expenses or financial shortfalls, options such as a reverse mortgage or downsizing can provide additional financial flexibility. However, these decisions should be made with caution and ideally in consultation with a financial advisor to ensure they align with long-term retirement goals.

Additionally, healthcare costs are a critical consideration for retirees, particularly for those retiring before becoming eligible for Medicare at age 65. It is imperative to account for health insurance premiums and out-of-pocket medical expenses in the retirement budget. Exploring options such as private health insurance or marketplace plans can help bridge the gap until Medicare eligibility.

In conclusion, retiring at 60 with $1.4 million in IRAs and a debt-free $750,000 home is indeed possible, provided that a comprehensive and strategic approach is adopted. By carefully managing IRA withdrawals, considering the timing of Social Security benefits, maintaining a balanced investment portfolio, and planning for healthcare costs, individuals can maximize their retirement income and enjoy a comfortable and financially secure retirement. Engaging with a financial advisor can further enhance the effectiveness of these strategies, ensuring that all aspects of the retirement plan are aligned with personal goals and circumstances.

Strategies for Managing Retirement Expenses with $1.4 Million

Retirement planning is a multifaceted endeavor that requires careful consideration of various financial elements to ensure a comfortable and sustainable lifestyle. For individuals contemplating retirement in two years at the age of 60, with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, the prospect appears promising. However, it is essential to strategically manage retirement expenses to maintain financial stability throughout the retirement years.

To begin with, understanding the potential income streams from the $1.4 million in IRAs is crucial. Assuming a conservative withdrawal rate of 4% per annum, a widely recommended guideline for sustainable retirement income, this portfolio could generate approximately $56,000 annually. This figure serves as a foundational income source, but it is important to consider other potential income streams, such as Social Security benefits, which can supplement this amount. Although Social Security benefits can be claimed as early as age 62, delaying benefits until full retirement age or later can result in higher monthly payments, thus enhancing long-term financial security.

In addition to income planning, managing living expenses is a critical component of retirement strategy. A debt-free home provides a significant advantage, as it eliminates mortgage payments, thereby reducing monthly expenses. However, homeowners must still account for property taxes, insurance, maintenance, and potential renovations. Creating a detailed budget that encompasses these costs, along with other living expenses such as healthcare, utilities, and leisure activities, is essential for maintaining financial discipline.

Healthcare expenses, in particular, warrant careful attention, as they tend to increase with age. While Medicare eligibility begins at age 65, retirees must plan for healthcare coverage during the interim period. Options such as private health insurance or COBRA can bridge this gap, but they may come with substantial costs. Additionally, considering long-term care insurance can provide peace of mind and financial protection against unforeseen medical expenses.

Investment strategy also plays a pivotal role in managing retirement expenses. With a $1.4 million portfolio, it is advisable to adopt a diversified investment approach that balances growth and income. Allocating assets across various classes, such as stocks, bonds, and real estate, can mitigate risks and enhance returns. Moreover, regularly reviewing and adjusting the investment portfolio in response to market conditions and personal financial goals is essential for preserving capital and ensuring a steady income stream.

Furthermore, tax planning is an integral aspect of retirement expense management. Withdrawals from traditional IRAs are subject to income tax, which can significantly impact net income. Implementing tax-efficient withdrawal strategies, such as converting a portion of traditional IRAs to Roth IRAs, can minimize tax liabilities and maximize after-tax income. Consulting with a financial advisor or tax professional can provide valuable insights into optimizing tax strategies.

In conclusion, retiring at 60 with $1.4 million in IRAs and a debt-free home is indeed feasible, provided that a comprehensive and strategic approach is adopted. By carefully planning income streams, managing living and healthcare expenses, adopting a diversified investment strategy, and implementing effective tax planning, retirees can achieve financial security and enjoy a fulfilling retirement. As with any financial endeavor, ongoing evaluation and adjustment of the retirement plan are essential to adapt to changing circumstances and ensure long-term success.

The Role of a Debt-Free Home in Retirement Planning

Retirement planning is a multifaceted process that requires careful consideration of various financial elements. One significant component is the role of a debt-free home, which can substantially influence the feasibility of retiring comfortably. For individuals contemplating retirement in two years at the age of 60, with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, understanding how these assets interact is crucial.

A debt-free home provides a solid foundation for retirement planning, offering both financial security and flexibility. Without the burden of mortgage payments, retirees can allocate more of their income towards other essential expenses, such as healthcare, travel, or leisure activities. This financial freedom can significantly enhance the quality of life during retirement, allowing individuals to enjoy their golden years without the stress of ongoing debt obligations.

Moreover, a debt-free home serves as a valuable asset that can be leveraged if necessary. For instance, retirees can consider downsizing to a smaller, more manageable property, thereby freeing up additional funds to bolster their retirement savings. Alternatively, they might explore the option of a reverse mortgage, which allows homeowners to convert part of their home equity into cash without having to sell the property. This can provide a steady stream of income, supplementing withdrawals from IRAs and other retirement accounts.

In addition to providing financial flexibility, a debt-free home contributes to overall net worth, which is a critical factor in retirement planning. When combined with $1.4 million in IRAs, the total asset base becomes substantial, offering a robust financial cushion. This combination of assets can help mitigate the risks associated with market volatility and inflation, ensuring that retirees maintain their purchasing power over time.

However, it is essential to consider the potential challenges and limitations associated with relying on a debt-free home as part of a retirement strategy. While the home itself is a significant asset, it is not a liquid one. Accessing the equity tied up in the property may require selling or taking on additional financial products, which can involve costs and complexities. Therefore, it is crucial for retirees to have a comprehensive plan that includes a diversified portfolio of liquid assets to cover immediate and unforeseen expenses.

Furthermore, the cost of maintaining a home should not be overlooked. Property taxes, insurance, and maintenance expenses can add up, potentially impacting the overall retirement budget. Retirees should account for these costs in their financial planning to ensure they do not erode the benefits of owning a debt-free home.

In conclusion, a debt-free home plays a pivotal role in retirement planning, offering both security and flexibility. When combined with $1.4 million in IRAs, it creates a strong financial foundation that can support a comfortable retirement at age 60. However, it is essential to approach retirement planning holistically, considering both the benefits and limitations of homeownership. By doing so, individuals can develop a well-rounded strategy that maximizes their assets and ensures financial stability throughout their retirement years.

Balancing Lifestyle and Budget in Early Retirement

Retiring at the age of 60 is a dream for many, and with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, this aspiration seems within reach. However, achieving a comfortable and sustainable retirement requires careful planning and consideration of various factors. To begin with, understanding the potential income generated from the $1.4 million in IRAs is crucial. Assuming a conservative withdrawal rate of 4% per year, a common rule of thumb for retirees, this would provide an annual income of $56,000. While this amount may seem sufficient, it is essential to consider other sources of income, such as Social Security benefits, which may not be available immediately if retirement begins at 60. Therefore, bridging the gap until these benefits commence is a critical aspect of planning.

Moreover, the value of a debt-free home cannot be overstated. It not only provides a sense of financial security but also eliminates the burden of mortgage payments, allowing for more flexibility in budgeting. However, homeowners must still account for property taxes, insurance, maintenance, and potential homeowners association fees, which can add up over time. These expenses should be factored into the overall retirement budget to ensure they do not erode the available income.

In addition to financial considerations, lifestyle choices play a significant role in determining the feasibility of early retirement. Retirees must evaluate their desired lifestyle and how it aligns with their financial resources. For instance, if travel, hobbies, or other leisure activities are priorities, these costs should be incorporated into the budget. Conversely, a more modest lifestyle may allow for greater financial flexibility and the ability to stretch retirement savings further.

Healthcare is another critical factor that cannot be overlooked. Retiring before the age of 65 means that retirees are not yet eligible for Medicare, necessitating the need for private health insurance. This can be a significant expense, and it is vital to research and plan for these costs in advance. Additionally, considering long-term care insurance may be prudent to protect against unforeseen medical expenses that could deplete retirement savings.

Inflation is another element that can impact the sustainability of retirement funds. Over time, the purchasing power of money decreases, and retirees must ensure their investments are structured to outpace inflation. This may involve maintaining a diversified portfolio that includes a mix of stocks, bonds, and other assets to provide growth potential while managing risk.

Furthermore, it is advisable to consult with a financial advisor to develop a comprehensive retirement plan tailored to individual needs and circumstances. A professional can provide valuable insights into tax-efficient withdrawal strategies, investment allocations, and estate planning, ensuring that all aspects of retirement are addressed.

In conclusion, retiring at 60 with $1.4 million in IRAs and a debt-free $750,000 home is indeed possible, but it requires careful planning and consideration of various factors. By evaluating income sources, lifestyle choices, healthcare needs, and inflation, and seeking professional guidance, individuals can create a balanced retirement plan that aligns with their goals and ensures financial security throughout their retirement years.

Investment Strategies to Sustain Retirement Savings

Retiring at the age of 60 with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000 is an attractive prospect for many. However, ensuring that these assets can sustain a comfortable retirement requires careful planning and strategic investment. The key to a successful retirement strategy lies in balancing risk and reward, maintaining a diversified portfolio, and considering various income streams to support long-term financial stability.

To begin with, it is essential to assess the current financial landscape and understand the potential challenges that may arise during retirement. Inflation, healthcare costs, and market volatility are significant factors that can impact the longevity of retirement savings. Therefore, it is crucial to develop a comprehensive plan that addresses these concerns while maximizing the potential of the available assets.

One effective strategy is to maintain a diversified investment portfolio. Diversification helps mitigate risk by spreading investments across various asset classes, such as stocks, bonds, and real estate. This approach can provide a buffer against market fluctuations and ensure a steady income stream. For instance, allocating a portion of the IRAs to dividend-paying stocks can generate regular income, while investing in bonds can offer stability and preserve capital. Additionally, considering real estate investment trusts (REITs) can provide exposure to the real estate market without the need for direct property management.

Moreover, it is important to consider the sequence of withdrawals from retirement accounts. The order in which funds are withdrawn can significantly impact the overall tax liability and the longevity of the retirement savings. Typically, it is advisable to withdraw from taxable accounts first, followed by tax-deferred accounts like traditional IRAs, and finally, tax-free accounts such as Roth IRAs. This strategy can help minimize taxes and maximize the growth potential of the remaining assets.

In addition to investment strategies, exploring alternative income streams can further enhance financial security during retirement. For example, part-time work or consulting can provide additional income while allowing retirees to remain engaged and active. Furthermore, delaying Social Security benefits until the age of 70 can result in higher monthly payments, thereby increasing the overall retirement income.

Another critical aspect of sustaining retirement savings is managing expenses effectively. Creating a detailed budget that accounts for both essential and discretionary spending can help retirees maintain control over their finances. It is also prudent to set aside an emergency fund to cover unexpected expenses, such as medical emergencies or home repairs, without dipping into retirement savings.

Healthcare costs are a significant concern for retirees, and planning for these expenses is vital. Exploring options such as long-term care insurance or health savings accounts (HSAs) can provide a safety net and protect against the financial burden of medical expenses. Additionally, understanding Medicare coverage and supplemental insurance options can help retirees make informed decisions about their healthcare needs.

In conclusion, retiring at 60 with $1.4 million in IRAs and a debt-free $750,000 home is indeed possible with careful planning and strategic investment. By maintaining a diversified portfolio, optimizing withdrawal strategies, exploring alternative income streams, and managing expenses effectively, retirees can ensure their financial security and enjoy a comfortable retirement. As with any financial plan, it is advisable to consult with a financial advisor to tailor strategies to individual needs and circumstances, ensuring a well-rounded approach to sustaining retirement savings.

Understanding Healthcare Costs in Retirement Planning

Retirement planning is a multifaceted endeavor that requires careful consideration of various financial aspects, one of which is healthcare costs. As individuals approach retirement, understanding and preparing for these expenses becomes crucial, especially for those contemplating early retirement. For someone planning to retire in two years at the age of 60 with $1.4 million in Individual Retirement Accounts (IRAs) and a debt-free home valued at $750,000, assessing healthcare costs is an essential component of ensuring financial security throughout retirement.

Healthcare expenses in retirement can be substantial and often unpredictable. While Medicare provides a safety net for those aged 65 and older, individuals retiring at 60 will need to bridge the gap until they become eligible. This interim period can pose significant financial challenges, as private health insurance premiums for those in their early 60s can be notably high. Therefore, it is imperative to allocate a portion of retirement savings to cover these costs. One option is to explore the Health Insurance Marketplace for plans that may offer subsidies based on income, which could help mitigate expenses during this period.

Moreover, even after qualifying for Medicare, retirees should anticipate out-of-pocket costs that are not covered by the program. These can include premiums for Medicare Part B, which covers outpatient care, and Part D, which covers prescription drugs. Additionally, many retirees opt for supplemental insurance, such as Medigap or Medicare Advantage plans, to cover expenses not included in traditional Medicare. These additional policies can further strain retirement savings if not adequately planned for.

In light of these considerations, it is advisable for individuals with $1.4 million in IRAs to conduct a thorough analysis of their expected healthcare costs. This analysis should include not only premiums and out-of-pocket expenses but also potential long-term care needs. Long-term care insurance is another option to consider, as it can protect against the high costs associated with extended care services, which are not covered by Medicare. By incorporating these potential expenses into their retirement budget, individuals can better gauge the sustainability of their savings.

Furthermore, it is important to recognize that healthcare costs tend to rise with age, often outpacing inflation. This trend underscores the necessity of maintaining a diversified investment portfolio that can generate sufficient returns to keep pace with these increasing expenses. A well-balanced portfolio that includes a mix of equities and fixed-income investments can provide the growth needed to support healthcare costs over the long term.

In addition to financial planning, retirees should also consider lifestyle factors that can influence healthcare needs. Maintaining a healthy lifestyle through regular exercise, a balanced diet, and preventive care can help mitigate some healthcare costs. By prioritizing health and wellness, retirees may reduce the likelihood of incurring significant medical expenses, thereby preserving their financial resources.

In conclusion, while retiring at 60 with $1.4 million in IRAs and a debt-free home is a promising start, understanding and planning for healthcare costs is vital to ensuring a secure and comfortable retirement. By proactively addressing these expenses and incorporating them into a comprehensive retirement strategy, individuals can enhance their financial resilience and enjoy the peace of mind that comes with being well-prepared for the future.

Q&A

1. **Is $1.4 million in IRAs sufficient for retirement at 60?**

Yes, $1.4 million can be sufficient, depending on your annual expenses, lifestyle, and investment strategy.

2. **What withdrawal rate should be considered for a $1.4 million IRA?**

A common guideline is the 4% rule, suggesting $56,000 annually, but personal circumstances may require adjustments.

3. **How does being debt-free with a $750k home impact retirement readiness?**

Being debt-free reduces financial burdens, and the home can be a valuable asset for potential downsizing or reverse mortgage options.

4. **What are the key expenses to consider in retirement planning?**

Key expenses include healthcare, living expenses, taxes, travel, and any unforeseen costs.

5. **How can healthcare costs affect retirement plans?**

Healthcare can be a significant expense, especially before Medicare eligibility at 65, requiring careful planning.

6. **Should Social Security benefits be factored into retirement planning at 60?**

Yes, but consider the impact of early claiming on benefit amounts and overall retirement income.

7. **What investment strategies can help sustain a $1.4 million IRA?**

Diversified portfolios, risk management, and regular reviews can help sustain and grow retirement funds.

Conclusion

Retiring in 2 years at age 60 with $1.4 million in IRAs and a debt-free $750k home is possible, but it depends on several factors. These include your expected annual expenses, lifestyle choices, healthcare costs, inflation, investment returns, and any other sources of income such as Social Security or pensions. If your annual expenses are modest and your investments are managed prudently, the $1.4 million could provide a sustainable income. Additionally, owning a debt-free home adds financial security and potential downsizing options. However, careful financial planning and possibly consulting with a financial advisor are recommended to ensure that your retirement funds will last throughout your retirement years.