“Unlock Steady Growth with High-Yield Dividend Stocks: Your Path to Financial Freedom”

Introduction

Investing in high-yield dividend stocks can be a compelling strategy for those seeking a steady stream of income and potential capital appreciation. These stocks, often from well-established companies with a history of stable earnings, offer attractive dividend yields that can enhance total returns, especially in a low-interest-rate environment. By focusing on companies with strong fundamentals, sustainable payout ratios, and a track record of consistent dividend payments, investors can build a resilient portfolio that not only provides regular income but also has the potential for long-term growth. In this introduction, I will highlight some of the irresistible high-yield dividend stocks that I am continuously investing in, emphasizing their appeal and the strategic role they play in my investment approach.

Understanding The Appeal Of High-Yield Dividend Stocks

High-yield dividend stocks have long been a cornerstone for investors seeking both income and growth. These stocks, which offer dividends significantly higher than the average yield of the broader market, present an attractive proposition for those looking to generate a steady stream of income while also benefiting from potential capital appreciation. The allure of high-yield dividend stocks lies in their ability to provide a reliable income stream, which can be particularly appealing in a low-interest-rate environment where traditional fixed-income investments may not offer sufficient returns. Moreover, these stocks often belong to well-established companies with a history of stable earnings and cash flow, further enhancing their appeal to risk-averse investors.

One of the primary reasons investors are drawn to high-yield dividend stocks is the potential for compounding returns. By reinvesting dividends, investors can purchase additional shares, thereby increasing their future dividend income and capitalizing on the power of compounding over time. This strategy can significantly enhance total returns, especially when dividends are reinvested in companies with a track record of increasing their payouts. Furthermore, high-yield dividend stocks can serve as a hedge against inflation. As the cost of living rises, the purchasing power of fixed-income investments can erode. However, companies that consistently increase their dividends can help offset inflationary pressures, providing investors with a growing income stream that maintains its real value over time.

In addition to income generation and inflation protection, high-yield dividend stocks can also offer a measure of stability in volatile markets. Companies that pay substantial dividends are often mature businesses with established market positions and predictable cash flows. These characteristics can make them less susceptible to market fluctuations compared to growth-oriented stocks, which may be more sensitive to economic cycles and investor sentiment. As a result, high-yield dividend stocks can provide a buffer during market downturns, helping to preserve capital and reduce portfolio volatility.

However, it is essential to approach high-yield dividend stocks with a discerning eye. Not all high yields are created equal, and an unusually high dividend yield may be a red flag indicating underlying financial distress or an unsustainable payout ratio. Therefore, investors should conduct thorough due diligence, examining a company’s financial health, dividend history, and payout ratio to ensure that the dividend is both sustainable and supported by strong fundamentals. Additionally, diversification is crucial when investing in high-yield dividend stocks. By spreading investments across various sectors and industries, investors can mitigate the risk associated with individual companies and enhance the overall resilience of their portfolios.

In conclusion, the appeal of high-yield dividend stocks is multifaceted, offering income generation, inflation protection, and potential stability in turbulent markets. By carefully selecting companies with solid financials and a history of consistent dividend payments, investors can harness the benefits of these stocks while minimizing associated risks. As with any investment strategy, it is important to maintain a balanced approach, incorporating high-yield dividend stocks as part of a diversified portfolio tailored to individual financial goals and risk tolerance. Through prudent selection and strategic reinvestment, high-yield dividend stocks can play a vital role in achieving long-term financial success.

Top High-Yield Dividend Stocks For Long-Term Growth

In the ever-evolving landscape of investment opportunities, high-yield dividend stocks have consistently emerged as a compelling choice for investors seeking both income and long-term growth. These stocks, known for their ability to provide regular income through dividends, also offer the potential for capital appreciation, making them an attractive option for those looking to build a robust investment portfolio. As we delve into the realm of high-yield dividend stocks, it becomes evident that certain companies stand out due to their strong financial performance, sustainable dividend policies, and promising growth prospects.

One of the primary reasons investors are drawn to high-yield dividend stocks is the stability they offer in uncertain market conditions. Companies that consistently pay dividends often have established business models and generate steady cash flows, which can provide a cushion against market volatility. This stability is particularly appealing to long-term investors who prioritize preserving capital while seeking growth. Moreover, the compounding effect of reinvested dividends can significantly enhance total returns over time, further solidifying the appeal of these stocks.

Transitioning to specific examples, several high-yield dividend stocks have garnered attention for their impressive track records and future potential. For instance, utility companies are often favored for their reliable dividend payouts. These companies operate in a regulated environment, ensuring a steady demand for their services, which translates into consistent revenue streams. As a result, they can maintain and even increase their dividend payments, making them a staple in many income-focused portfolios.

In addition to utilities, the real estate sector offers intriguing opportunities for high-yield dividend investors. Real Estate Investment Trusts (REITs) are particularly noteworthy due to their unique structure, which requires them to distribute a significant portion of their income as dividends. This characteristic, combined with the potential for property value appreciation, makes REITs an attractive option for those seeking both income and growth. Furthermore, the diversification benefits of investing in real estate can help mitigate risks associated with other asset classes.

Another sector that deserves attention is the telecommunications industry. Companies in this space often boast substantial cash flows and have a history of returning capital to shareholders through dividends. As the demand for connectivity continues to rise, driven by technological advancements and increased data consumption, telecommunications companies are well-positioned to sustain and grow their dividend payments. This potential for growth, coupled with their high-yield nature, makes them a compelling choice for long-term investors.

While the allure of high-yield dividend stocks is undeniable, it is crucial for investors to conduct thorough research and due diligence before committing capital. Evaluating a company’s financial health, dividend history, and growth prospects is essential to ensure that the dividends are sustainable and that the company can weather economic downturns. Additionally, diversification across sectors and geographies can further enhance the resilience of a dividend-focused portfolio.

In conclusion, high-yield dividend stocks offer a unique blend of income and growth potential, making them an attractive option for long-term investors. By carefully selecting companies with strong fundamentals and sustainable dividend policies, investors can build a portfolio that not only provides regular income but also capital appreciation over time. As the investment landscape continues to evolve, these stocks remain a cornerstone for those seeking to achieve financial stability and growth in the years to come.

Strategies For Identifying Irresistible Dividend Stocks

Investing in high-yield dividend stocks is a strategy that has long attracted both novice and seasoned investors alike. The allure of receiving regular income, coupled with the potential for capital appreciation, makes dividend stocks an attractive component of a diversified investment portfolio. However, identifying irresistible dividend stocks requires a strategic approach that balances yield with sustainability and growth potential. To begin with, one must understand the importance of a company’s dividend yield, which is a key indicator of the income an investor can expect relative to the stock’s price. A high dividend yield can be enticing, but it is crucial to ensure that the yield is sustainable. This involves examining the company’s payout ratio, which indicates the proportion of earnings paid out as dividends. A payout ratio that is too high may suggest that the company is overextending itself, potentially jeopardizing future dividend payments.

In addition to the payout ratio, evaluating the company’s financial health is paramount. This includes analyzing the balance sheet for indicators such as debt levels and cash flow. Companies with strong cash flow and manageable debt are more likely to maintain and even increase their dividend payments over time. Furthermore, it is essential to consider the company’s earnings growth potential. A company that consistently grows its earnings is more likely to increase its dividends, providing investors with a growing income stream. This growth potential can often be gauged by examining industry trends and the company’s competitive position within its sector.

Moreover, diversification across sectors can mitigate risks associated with investing in dividend stocks. Different sectors react differently to economic cycles, and by spreading investments across various industries, investors can reduce the impact of sector-specific downturns on their dividend income. For instance, while utility companies are known for their stable dividends, technology companies may offer higher growth potential. Balancing investments across these sectors can provide both stability and growth in a dividend portfolio.

Another critical factor to consider is the company’s dividend history. A track record of consistent or increasing dividend payments is a positive indicator of a company’s commitment to returning value to shareholders. Companies that have weathered economic downturns while maintaining their dividends demonstrate resilience and reliability, making them attractive candidates for long-term investment. Additionally, it is beneficial to stay informed about macroeconomic factors that could impact dividend stocks. Interest rates, inflation, and economic growth can all influence dividend yields and stock prices. For example, rising interest rates may lead to higher yields on bonds, making dividend stocks less attractive in comparison. Therefore, keeping abreast of economic indicators can help investors make informed decisions about their dividend stock investments.

Finally, while high-yield dividend stocks can be an excellent source of income, it is important to approach them with a long-term perspective. Market fluctuations can impact stock prices in the short term, but a focus on the underlying fundamentals of the companies can provide reassurance and stability. By employing a strategic approach that considers yield sustainability, financial health, earnings growth, diversification, dividend history, and macroeconomic factors, investors can identify irresistible high-yield dividend stocks that offer both income and growth potential. This disciplined strategy not only enhances the likelihood of achieving financial goals but also contributes to a more resilient and rewarding investment experience.

Balancing Risk And Reward In High-Yield Investments

Investing in high-yield dividend stocks can be an enticing strategy for those seeking to balance risk and reward in their investment portfolios. These stocks offer the potential for substantial income through dividends, which can be particularly appealing in a low-interest-rate environment. However, it is crucial to approach high-yield investments with a discerning eye, as the promise of high returns often comes with increased risk. By carefully selecting stocks with sustainable dividends and strong financial health, investors can mitigate some of these risks while enjoying the benefits of regular income.

One of the primary considerations when investing in high-yield dividend stocks is the sustainability of the dividend itself. A high dividend yield may initially appear attractive, but it is essential to assess whether the company can maintain or grow its dividend over time. This involves examining the company’s payout ratio, which is the proportion of earnings paid out as dividends. A lower payout ratio suggests that the company retains more of its earnings for reinvestment or to weather economic downturns, thereby enhancing the sustainability of its dividend. Additionally, evaluating the company’s cash flow and debt levels can provide further insight into its ability to sustain dividend payments.

Moreover, the financial health of the company is a critical factor in determining the viability of a high-yield investment. Companies with strong balance sheets, characterized by manageable debt levels and robust cash reserves, are better positioned to maintain their dividend payments even in challenging economic conditions. Furthermore, a company with a history of consistent earnings growth is more likely to continue generating the cash flow necessary to support its dividend. Therefore, conducting thorough due diligence on a company’s financial statements and growth prospects is imperative for investors seeking to balance risk and reward in high-yield dividend stocks.

In addition to financial metrics, it is important to consider the industry in which the company operates. Certain sectors, such as utilities and consumer staples, are traditionally known for their stable cash flows and resilience during economic downturns, making them attractive options for dividend investors. These industries often provide essential goods and services, ensuring a steady demand regardless of economic conditions. Consequently, companies within these sectors may offer more reliable dividend payments compared to those in more cyclical industries, such as technology or consumer discretionary.

Furthermore, diversification plays a vital role in managing risk within a high-yield dividend portfolio. By spreading investments across various sectors and geographies, investors can reduce their exposure to any single company or industry-specific risk. This approach not only helps to mitigate potential losses but also enhances the potential for income generation from multiple sources. Diversification, therefore, serves as a crucial tool in balancing the risk and reward associated with high-yield dividend stocks.

In conclusion, while high-yield dividend stocks can offer attractive income opportunities, they require careful consideration and analysis to ensure a balanced approach to risk and reward. By focusing on dividend sustainability, financial health, industry stability, and diversification, investors can construct a portfolio that maximizes income potential while minimizing exposure to undue risk. As with any investment strategy, it is essential to remain vigilant and adaptable, continuously monitoring market conditions and company performance to make informed decisions. Through this disciplined approach, high-yield dividend stocks can become a valuable component of a well-rounded investment portfolio.

The Role Of Dividend Stocks In A Diversified Portfolio

Dividend stocks play a crucial role in a diversified investment portfolio, offering a blend of income generation and potential capital appreciation. As an investor, the allure of high-yield dividend stocks is undeniable, providing a steady stream of income that can be reinvested or used to meet financial obligations. This consistent income stream is particularly appealing in volatile markets, where price fluctuations can unsettle even the most seasoned investors. By incorporating dividend stocks into a diversified portfolio, investors can achieve a balance between risk and reward, enhancing overall portfolio stability.

One of the primary benefits of dividend stocks is their ability to generate passive income. Unlike growth stocks, which reinvest profits to fuel expansion, dividend stocks distribute a portion of their earnings to shareholders. This distribution can be particularly advantageous for retirees or those seeking a reliable income source. Moreover, high-yield dividend stocks often belong to well-established companies with a history of profitability, providing an added layer of security. These companies, often referred to as “dividend aristocrats,” have demonstrated resilience through various economic cycles, making them a dependable choice for long-term investors.

In addition to income generation, dividend stocks contribute to portfolio diversification. By investing in a mix of dividend-paying companies across different sectors, investors can mitigate risks associated with market volatility. For instance, while technology stocks may experience rapid growth, they are also susceptible to significant downturns. Conversely, sectors such as utilities or consumer staples, known for their stable dividend payouts, can offer a buffer during economic downturns. This sectoral diversification ensures that an investor’s portfolio is not overly reliant on the performance of a single industry, thereby reducing overall risk.

Furthermore, the reinvestment of dividends can significantly enhance portfolio growth over time. By opting for a dividend reinvestment plan (DRIP), investors can purchase additional shares using the dividends received, compounding their returns. This strategy not only increases the number of shares owned but also amplifies future dividend payouts, creating a snowball effect that can substantially boost long-term wealth. The power of compounding, when combined with the stability of dividend stocks, makes for a formidable investment strategy.

However, it is essential to approach high-yield dividend stocks with a discerning eye. While the promise of high yields is enticing, it is crucial to assess the sustainability of these dividends. Companies offering exceptionally high yields may be doing so at the expense of their financial health, potentially leading to dividend cuts in the future. Therefore, conducting thorough research and evaluating a company’s financial statements, payout ratios, and historical dividend performance is imperative. This due diligence ensures that the selected dividend stocks align with an investor’s risk tolerance and financial goals.

In conclusion, high-yield dividend stocks are an integral component of a diversified portfolio, offering a blend of income, growth, and risk mitigation. By carefully selecting and continuously investing in these stocks, investors can enjoy the benefits of a steady income stream while enhancing their portfolio’s resilience against market fluctuations. As with any investment strategy, a balanced approach, grounded in research and diversification, is key to achieving long-term financial success.

How To Reinvest Dividends For Maximum Returns

Reinvesting dividends is a strategy that can significantly enhance the returns on high-yield dividend stocks, making it an attractive option for investors seeking to maximize their investment potential. By reinvesting dividends, investors can take advantage of the power of compounding, which allows their investment to grow exponentially over time. This approach not only increases the number of shares owned but also amplifies the potential for future dividend payments, creating a virtuous cycle of growth and income.

To begin with, it is essential to understand the mechanics of dividend reinvestment. When a company pays dividends, investors have the option to receive these payments in cash or to reinvest them in additional shares of the company’s stock. Many brokerage firms offer Dividend Reinvestment Plans (DRIPs), which automate this process, allowing dividends to be reinvested seamlessly. This automation is particularly beneficial for investors who prefer a hands-off approach, as it ensures that dividends are consistently reinvested without the need for manual intervention.

Moreover, reinvesting dividends can be particularly advantageous in a tax-advantaged account, such as an Individual Retirement Account (IRA) or a 401(k). In these accounts, dividends can be reinvested without immediate tax implications, allowing the investment to grow unhindered by tax liabilities. This tax efficiency can significantly boost the long-term returns of a dividend-focused portfolio, making it a compelling strategy for retirement planning.

In addition to the tax benefits, reinvesting dividends can also help mitigate the impact of market volatility. By consistently purchasing additional shares, investors can take advantage of dollar-cost averaging, which involves buying more shares when prices are low and fewer shares when prices are high. This approach can reduce the average cost per share over time, potentially enhancing returns and reducing risk. Furthermore, by focusing on high-quality, high-yield dividend stocks, investors can benefit from a steady stream of income, even during periods of market turbulence.

Another critical aspect of maximizing returns through dividend reinvestment is selecting the right stocks. High-yield dividend stocks are often found in sectors such as utilities, real estate, and consumer staples, which tend to offer stable and predictable cash flows. However, it is crucial to conduct thorough research and due diligence to ensure that the companies selected have a strong track record of dividend payments and the financial health to sustain them. Evaluating factors such as payout ratios, earnings growth, and debt levels can provide valuable insights into a company’s ability to maintain and grow its dividend over time.

Furthermore, diversification is a key consideration when building a dividend-focused portfolio. By investing in a diverse range of high-yield stocks across different sectors and geographies, investors can reduce the risk associated with individual companies and market fluctuations. This diversification can provide a more stable income stream and enhance the overall resilience of the portfolio.

In conclusion, reinvesting dividends is a powerful strategy for maximizing returns on high-yield dividend stocks. By leveraging the benefits of compounding, tax efficiency, and dollar-cost averaging, investors can significantly enhance their long-term investment outcomes. However, it is essential to carefully select high-quality stocks and maintain a diversified portfolio to mitigate risks and ensure sustainable growth. Through disciplined reinvestment and strategic stock selection, investors can harness the full potential of high-yield dividend stocks to achieve their financial goals.

Analyzing Market Trends To Enhance Dividend Stock Selection

In the ever-evolving landscape of financial markets, the pursuit of high-yield dividend stocks remains a compelling strategy for investors seeking both income and growth. As market dynamics shift, analyzing trends becomes crucial in enhancing the selection of dividend stocks that promise not only attractive yields but also sustainable returns. The allure of high-yield dividend stocks lies in their ability to provide a steady income stream, which is particularly appealing in times of economic uncertainty. However, the challenge lies in identifying stocks that can maintain their dividend payouts over the long term. This necessitates a thorough analysis of market trends, company fundamentals, and broader economic indicators.

To begin with, understanding macroeconomic trends is essential. Interest rates, inflation, and economic growth are key factors that influence dividend yields. For instance, in a low-interest-rate environment, high-yield dividend stocks become more attractive as they offer better returns compared to traditional fixed-income securities. Conversely, rising interest rates may lead to increased borrowing costs for companies, potentially impacting their ability to sustain dividend payments. Therefore, keeping a close eye on central bank policies and economic forecasts can provide valuable insights into the future performance of dividend stocks.

Moreover, sector-specific trends play a significant role in dividend stock selection. Certain sectors, such as utilities, consumer staples, and real estate, are traditionally known for their stable dividend payouts. These sectors often exhibit less volatility and are considered defensive, making them attractive to dividend investors. However, it is important to assess the current market conditions and potential disruptions within these sectors. For example, the transition towards renewable energy sources may impact traditional utility companies, necessitating a reevaluation of their long-term dividend sustainability.

In addition to macroeconomic and sectoral analysis, evaluating company-specific factors is paramount. A company’s financial health, earnings stability, and cash flow generation are critical indicators of its ability to maintain and grow dividend payments. Companies with strong balance sheets, low debt levels, and consistent cash flow are better positioned to weather economic downturns and continue rewarding shareholders. Furthermore, management’s commitment to returning capital to shareholders through dividends is a positive signal. Analyzing historical dividend growth rates and payout ratios can provide insights into a company’s dividend policy and its potential for future increases.

Transitioning from analysis to action, diversification is a prudent strategy when investing in high-yield dividend stocks. By spreading investments across different sectors and geographies, investors can mitigate risks associated with individual companies or market segments. This approach not only enhances the stability of the income stream but also provides exposure to various growth opportunities. Additionally, reinvesting dividends can compound returns over time, further enhancing the overall investment performance.

In conclusion, the selection of high-yield dividend stocks requires a comprehensive analysis of market trends, economic indicators, and company fundamentals. By understanding the interplay between these factors, investors can make informed decisions that align with their financial goals. While the pursuit of high yields is enticing, it is equally important to prioritize sustainability and long-term growth. As market conditions continue to evolve, staying informed and adaptable will be key to successfully navigating the world of dividend investing. Through diligent research and strategic diversification, investors can build a resilient portfolio that not only generates income but also stands the test of time.

Q&A

1. **Question:** What is a high-yield dividend stock?

**Answer:** A high-yield dividend stock is a stock that offers a dividend yield significantly higher than the average yield of the broader market, providing investors with substantial income.

2. **Question:** Why are high-yield dividend stocks attractive to investors?

**Answer:** They are attractive because they provide a steady income stream, potential for capital appreciation, and can be a hedge against inflation.

3. **Question:** What is one example of an irresistible high-yield dividend stock?

**Answer:** An example could be AT&T Inc. (T), known for its consistent high dividend yield.

4. **Question:** What is a key risk associated with high-yield dividend stocks?

**Answer:** A key risk is the potential for dividend cuts if the company faces financial difficulties, which can lead to a decrease in stock price.

5. **Question:** How can investors assess the sustainability of a high-yield dividend?

**Answer:** Investors can assess sustainability by examining the company’s payout ratio, cash flow, and earnings stability.

6. **Question:** What sector often features high-yield dividend stocks?

**Answer:** The utilities sector often features high-yield dividend stocks due to its stable cash flows and regulated nature.

7. **Question:** How does reinvesting dividends impact long-term returns?

**Answer:** Reinvesting dividends can significantly enhance long-term returns through the power of compounding, as dividends are used to purchase additional shares, leading to more dividends.

Conclusion

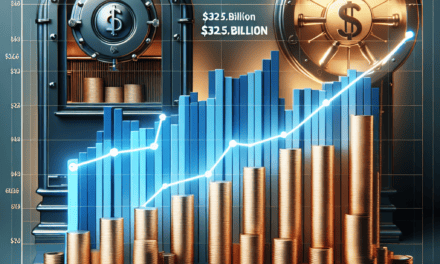

Investing in irresistible high-yield dividend stocks can be a strategic approach for generating consistent income and potential capital appreciation. These stocks often belong to well-established companies with strong financials and a history of stable or growing dividend payouts. By continuously investing in such stocks, investors can benefit from compounding returns, hedge against inflation, and potentially achieve financial goals over the long term. However, it’s crucial to conduct thorough research and consider factors such as dividend sustainability, company performance, and market conditions to mitigate risks and ensure a balanced investment portfolio.