“Iovance Biotherapeutics: Soaring to New Heights on Market Momentum!”

Introduction

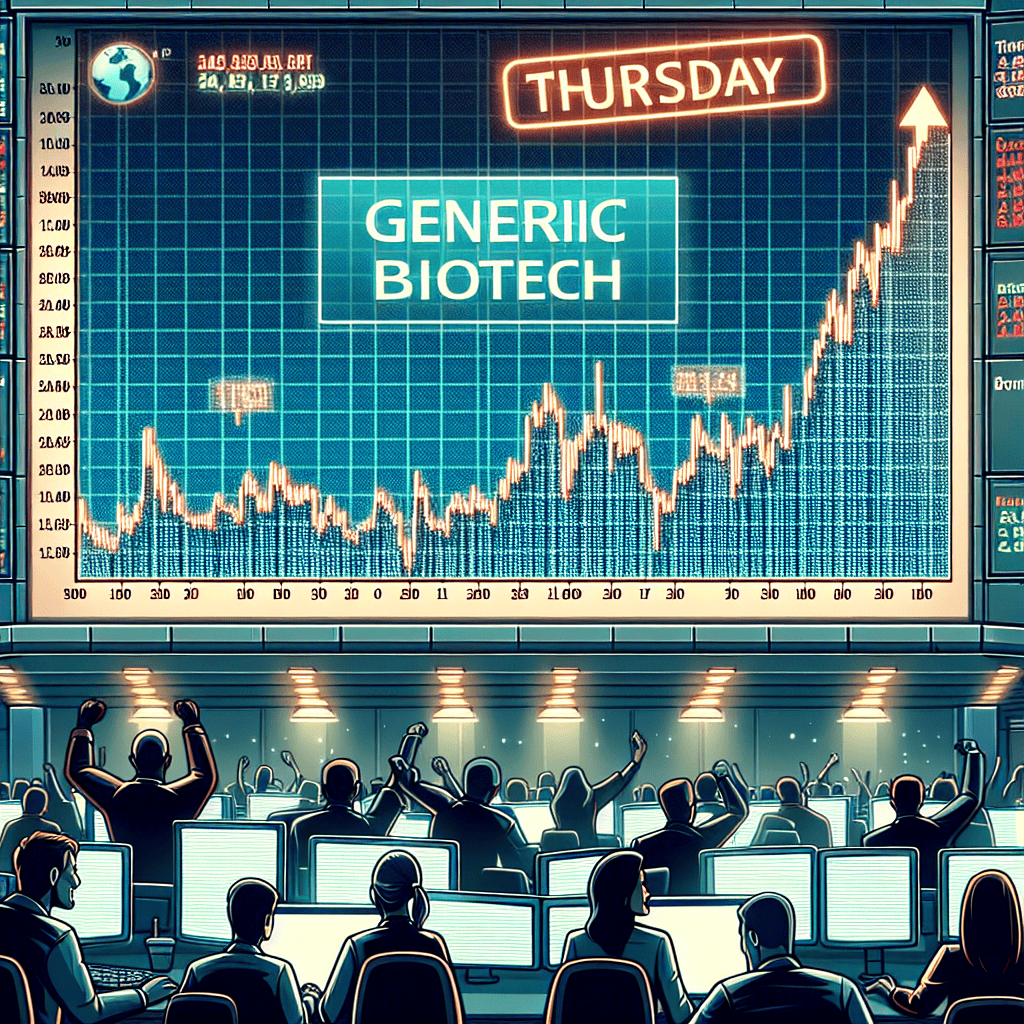

Iovance Biotherapeutics experienced a significant surge in its stock price on Thursday, capturing the attention of investors and market analysts. The biotechnology company, known for its pioneering work in developing novel cancer immunotherapies, saw its shares rise sharply following positive developments related to its clinical trials and regulatory progress. This upward momentum reflects growing investor confidence in Iovance’s potential to bring innovative treatments to market, particularly in the field of tumor-infiltrating lymphocyte (TIL) therapy. The stock’s performance underscores the market’s optimistic outlook on the company’s strategic initiatives and its role in advancing cancer treatment options.

Impact Of Iovance Biotherapeutics’ Recent Stock Surge

Iovance Biotherapeutics, a company at the forefront of developing innovative cancer immunotherapies, experienced a significant surge in its stock price on Thursday. This remarkable increase has captured the attention of investors and analysts alike, prompting a closer examination of the factors contributing to this upward trajectory and the potential implications for the company’s future.

To begin with, the surge in Iovance Biotherapeutics’ stock can be attributed to several key developments. Notably, the company recently announced promising clinical trial results for its lead product candidate, lifileucel, a tumor-infiltrating lymphocyte (TIL) therapy designed to treat patients with advanced melanoma. These results demonstrated a substantial improvement in patient outcomes, including higher response rates and prolonged survival, compared to existing treatment options. Consequently, this positive data has bolstered investor confidence in the company’s ability to bring a groundbreaking therapy to market, thereby driving up the stock price.

Moreover, the company’s strategic partnerships and collaborations have played a crucial role in enhancing its market position. Iovance Biotherapeutics has established alliances with leading research institutions and pharmaceutical companies, facilitating the exchange of knowledge and resources necessary for the advancement of its pipeline. These collaborations not only provide access to cutting-edge technologies but also help mitigate the risks associated with drug development. As a result, investors perceive Iovance as a well-positioned player in the competitive landscape of cancer immunotherapy, further contributing to the stock’s upward momentum.

In addition to clinical and strategic factors, the broader market environment has also influenced Iovance Biotherapeutics’ stock performance. The biotechnology sector has witnessed a resurgence of interest from investors, driven by a renewed focus on innovative therapies and personalized medicine. This trend has been fueled by advancements in genomic research and a growing understanding of the immune system’s role in combating cancer. Consequently, companies like Iovance, which are at the cutting edge of these developments, are attracting significant attention and investment, thereby benefiting from favorable market conditions.

However, it is essential to consider the potential challenges and risks that may impact Iovance Biotherapeutics’ future trajectory. Despite the promising clinical data, the path to regulatory approval is fraught with uncertainties. The company must navigate complex regulatory processes and demonstrate the safety and efficacy of its therapies to secure approval from health authorities. Additionally, the competitive landscape in cancer immunotherapy is rapidly evolving, with numerous companies vying for market share. Iovance must continue to innovate and differentiate its offerings to maintain its competitive edge.

Furthermore, the financial implications of bringing a novel therapy to market cannot be overlooked. The costs associated with clinical trials, manufacturing, and commercialization are substantial, necessitating careful financial management and strategic planning. While the recent stock surge provides a favorable financial position, Iovance must ensure sustainable growth and profitability in the long term.

In conclusion, the recent surge in Iovance Biotherapeutics’ stock reflects a confluence of positive clinical developments, strategic partnerships, and favorable market conditions. While the company is well-positioned to capitalize on these opportunities, it must remain vigilant in addressing potential challenges and risks. As Iovance continues to advance its pipeline and pursue regulatory approvals, its ability to navigate the complexities of the biotechnology landscape will be crucial in determining its future success. Investors and stakeholders will undoubtedly be watching closely as the company strives to bring its innovative therapies to patients in need.

Key Factors Driving Iovance Biotherapeutics’ Stock Performance

Iovance Biotherapeutics experienced a significant surge in its stock price on Thursday, capturing the attention of investors and analysts alike. This remarkable performance can be attributed to several key factors that have collectively bolstered investor confidence in the company’s future prospects. Understanding these factors provides valuable insights into the dynamics driving Iovance Biotherapeutics’ stock performance.

To begin with, one of the primary catalysts for the stock’s upward trajectory is the company’s recent advancements in its clinical pipeline. Iovance Biotherapeutics has been at the forefront of developing innovative cancer therapies, particularly in the field of tumor-infiltrating lymphocyte (TIL) therapy. The company’s lead product candidate, lifileucel, has shown promising results in clinical trials for the treatment of metastatic melanoma. Recent data presented at a major oncology conference highlighted the therapy’s efficacy and safety profile, which has significantly boosted investor optimism. As a result, the positive clinical outcomes have reinforced the market’s belief in the potential of Iovance’s therapies to address unmet medical needs in oncology.

In addition to clinical progress, regulatory developments have played a crucial role in driving the stock’s performance. Iovance Biotherapeutics has been actively engaged with regulatory authorities to advance its product candidates towards commercialization. The company recently announced that it had submitted a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for lifileucel. This submission marks a significant milestone in the company’s journey towards bringing its innovative therapies to market. The anticipation of a favorable regulatory decision has further fueled investor enthusiasm, as it could pave the way for Iovance to capture a substantial share of the oncology market.

Moreover, strategic partnerships and collaborations have also contributed to the positive sentiment surrounding Iovance Biotherapeutics. The company has entered into several key alliances with leading pharmaceutical and biotechnology firms to enhance its research and development capabilities. These partnerships not only provide access to additional resources and expertise but also validate the potential of Iovance’s technology platform. By leveraging these collaborations, Iovance is well-positioned to accelerate the development of its pipeline and expand its reach in the competitive landscape of cancer therapeutics.

Furthermore, the broader market environment has been conducive to the stock’s performance. The biotechnology sector has witnessed increased investor interest, driven by a growing recognition of the importance of innovative therapies in addressing complex diseases. As a result, companies with promising pipelines and strong clinical data, such as Iovance Biotherapeutics, have garnered significant attention from institutional and retail investors alike. This heightened interest has translated into increased trading volumes and upward pressure on the stock price.

In conclusion, the impressive surge in Iovance Biotherapeutics’ stock on Thursday can be attributed to a confluence of factors, including clinical advancements, regulatory progress, strategic partnerships, and a favorable market environment. As the company continues to make strides in its mission to develop transformative cancer therapies, investor confidence remains robust. While challenges and uncertainties persist in the biotechnology sector, Iovance Biotherapeutics’ recent achievements have positioned it as a compelling player in the field, with the potential to deliver significant value to patients and shareholders alike.

Investor Reactions To Iovance Biotherapeutics’ Market Movement

On Thursday, Iovance Biotherapeutics experienced a significant surge in its stock price, capturing the attention of investors and market analysts alike. This remarkable movement in the market can be attributed to a confluence of factors that have collectively bolstered investor confidence in the company’s future prospects. As the trading day unfolded, it became evident that the enthusiasm surrounding Iovance Biotherapeutics was not merely a fleeting phenomenon but rather a reflection of deeper market dynamics and investor sentiment.

To begin with, the primary catalyst for the stock’s upward trajectory was the announcement of promising clinical trial results. Iovance Biotherapeutics, a company specializing in the development of innovative cancer immunotherapies, revealed data from its latest trials that demonstrated significant efficacy in treating certain types of cancer. This news was met with optimism from the investment community, as it underscored the potential of Iovance’s therapies to address unmet medical needs and improve patient outcomes. Consequently, investors were quick to react, driving up the stock price as they anticipated future growth and revenue opportunities for the company.

Moreover, the broader context of the biotechnology sector played a crucial role in amplifying the positive sentiment surrounding Iovance Biotherapeutics. In recent months, there has been a resurgence of interest in biotech stocks, driven by advancements in medical research and a growing recognition of the sector’s potential to revolutionize healthcare. This renewed focus on biotechnology has created a favorable environment for companies like Iovance, which are at the forefront of developing cutting-edge treatments. As a result, investors have been more inclined to allocate capital to biotech firms, further fueling the upward momentum of Iovance’s stock.

In addition to the clinical trial results and sector-wide trends, strategic partnerships and collaborations have also contributed to the heightened investor interest in Iovance Biotherapeutics. The company has been proactive in forging alliances with leading research institutions and pharmaceutical companies, thereby enhancing its capabilities and expanding its reach in the market. These partnerships not only provide Iovance with access to valuable resources and expertise but also serve as a validation of its scientific approach and potential for success. Consequently, investors have viewed these collaborations as a positive indicator of the company’s long-term viability and growth prospects.

Furthermore, the financial health of Iovance Biotherapeutics has been a reassuring factor for investors. The company has demonstrated prudent fiscal management, maintaining a strong balance sheet and securing funding to support its research and development initiatives. This financial stability has instilled confidence among investors, who are increasingly seeking companies with solid foundations and the ability to weather market fluctuations. As a result, Iovance’s robust financial position has been instrumental in attracting investor interest and contributing to the stock’s impressive performance.

In conclusion, the surge in Iovance Biotherapeutics’ stock on Thursday can be attributed to a combination of promising clinical trial results, favorable sector dynamics, strategic partnerships, and sound financial management. These factors have collectively reinforced investor confidence in the company’s potential to deliver innovative cancer therapies and achieve sustainable growth. As the market continues to evolve, it will be interesting to observe how Iovance Biotherapeutics capitalizes on these opportunities and navigates the challenges that lie ahead. For now, the company’s stock performance serves as a testament to the optimism and enthusiasm that investors have for its future prospects.

Analyzing Iovance Biotherapeutics’ Financial Health Post-Stock Rise

Iovance Biotherapeutics, a company at the forefront of developing innovative cancer immunotherapies, experienced a significant surge in its stock price on Thursday. This remarkable increase has drawn the attention of investors and analysts alike, prompting a closer examination of the company’s financial health in the wake of this stock market activity. Understanding the factors contributing to this rise and the implications for Iovance’s financial stability is crucial for stakeholders and potential investors.

To begin with, the recent stock surge can be attributed to several key developments within the company. Notably, Iovance has made substantial progress in its clinical trials, particularly with its lead product candidate, lifileucel. This therapy, designed to treat metastatic melanoma, has shown promising results in recent studies, bolstering investor confidence. Furthermore, the company has been actively expanding its pipeline, exploring the potential of tumor-infiltrating lymphocyte (TIL) therapy in other cancer types. These advancements have not only enhanced the company’s growth prospects but have also positioned it as a leader in the field of cell therapy.

In addition to clinical progress, Iovance’s financial health is supported by a robust balance sheet. The company has successfully raised capital through various funding rounds, ensuring it has the necessary resources to continue its research and development efforts. This financial stability is further reinforced by strategic partnerships and collaborations with other industry players, which provide additional funding and expertise. As a result, Iovance is well-equipped to navigate the challenges of bringing innovative therapies to market.

Moreover, the company’s management team has demonstrated a strong commitment to fiscal responsibility. By carefully managing expenses and prioritizing investments in high-potential projects, Iovance has maintained a healthy cash flow. This prudent financial management is crucial, especially in the biotechnology sector, where the path to commercialization can be lengthy and costly. Consequently, Iovance’s ability to sustain its operations without compromising its long-term vision is a positive indicator of its financial health.

However, it is important to consider the potential risks associated with investing in Iovance Biotherapeutics. The biotechnology industry is inherently volatile, with stock prices often subject to fluctuations based on clinical trial outcomes, regulatory approvals, and market competition. While Iovance has made significant strides, the success of its therapies is not guaranteed, and setbacks in clinical development could impact its financial performance. Therefore, investors should remain vigilant and consider these factors when evaluating the company’s financial health.

In conclusion, Iovance Biotherapeutics’ recent stock surge reflects the company’s promising advancements in cancer immunotherapy and its solid financial foundation. The progress in clinical trials, coupled with strategic partnerships and sound financial management, underscores Iovance’s potential for growth and innovation. Nevertheless, the inherent risks of the biotechnology sector necessitate a cautious approach for investors. By carefully assessing the company’s financial health and staying informed about industry developments, stakeholders can make informed decisions regarding their investment in Iovance Biotherapeutics. As the company continues to advance its pipeline and explore new therapeutic avenues, its financial health will remain a critical factor in determining its long-term success.

Future Prospects For Iovance Biotherapeutics After Stock Increase

Iovance Biotherapeutics experienced a significant surge in its stock price on Thursday, capturing the attention of investors and analysts alike. This remarkable increase has prompted discussions about the future prospects of the company, which specializes in the development of innovative cancer immunotherapies. As the market reacts to this upward trend, it is essential to examine the factors contributing to the stock’s rise and consider the potential implications for Iovance Biotherapeutics moving forward.

To begin with, the recent stock surge can be attributed to positive developments in Iovance’s clinical trials and regulatory progress. The company has been making strides in advancing its pipeline of tumor-infiltrating lymphocyte (TIL) therapies, which are designed to harness the body’s immune system to target and destroy cancer cells. Notably, Iovance has reported encouraging results from its ongoing trials, demonstrating the efficacy and safety of its lead product candidate, lifileucel, in treating patients with advanced melanoma. These promising outcomes have bolstered investor confidence, as they suggest that Iovance is on the cusp of achieving significant milestones in its quest to bring novel cancer treatments to market.

Moreover, the company’s recent interactions with regulatory authorities have further fueled optimism. Iovance has been actively engaging with the U.S. Food and Drug Administration (FDA) to secure approval for lifileucel, and recent updates indicate that the regulatory pathway is progressing favorably. The potential approval of lifileucel would mark a pivotal moment for Iovance, as it would not only validate the company’s TIL technology but also open the door to commercial opportunities in the lucrative oncology market. Consequently, investors are closely monitoring these developments, anticipating that regulatory success could translate into substantial revenue growth for the company.

In addition to clinical and regulatory advancements, strategic partnerships and collaborations have also played a crucial role in shaping Iovance’s future prospects. The company has been proactive in forging alliances with leading research institutions and biopharmaceutical companies to enhance its scientific capabilities and expand its therapeutic portfolio. These collaborations have enabled Iovance to access cutting-edge technologies and expertise, thereby strengthening its position in the competitive landscape of cancer immunotherapy. As a result, the company is well-positioned to capitalize on emerging opportunities and drive innovation in the field.

Furthermore, the broader market dynamics in the biotechnology sector have contributed to the positive sentiment surrounding Iovance Biotherapeutics. The growing demand for effective cancer treatments, coupled with advancements in immunotherapy, has created a favorable environment for companies like Iovance that are at the forefront of developing next-generation therapies. Investors are increasingly recognizing the potential of immuno-oncology to revolutionize cancer care, and Iovance’s focus on TIL therapies aligns with this trend. Consequently, the company’s stock is benefiting from the heightened interest in this promising area of research.

In conclusion, the recent surge in Iovance Biotherapeutics’ stock price reflects a confluence of factors, including positive clinical trial results, regulatory progress, strategic partnerships, and favorable market conditions. As the company continues to advance its pipeline and navigate the regulatory landscape, it is poised to capitalize on the growing demand for innovative cancer treatments. While challenges remain, the future prospects for Iovance Biotherapeutics appear promising, and investors will be keenly watching for further developments that could drive the company’s growth and success in the years to come.

Comparing Iovance Biotherapeutics’ Stock With Industry Peers

On Thursday, Iovance Biotherapeutics experienced a significant surge in its stock price, capturing the attention of investors and analysts alike. This upward movement in Iovance’s stock prompts a closer examination of how the company compares with its industry peers. To understand the dynamics at play, it is essential to consider the broader context of the biotechnology sector, which is characterized by rapid innovation, regulatory challenges, and intense competition. Within this landscape, Iovance Biotherapeutics has carved out a niche for itself, focusing on the development of novel cancer immunotherapies, particularly tumor-infiltrating lymphocyte (TIL) therapies.

In comparison to its industry peers, Iovance’s recent stock performance can be attributed to several key factors. Firstly, the company’s progress in clinical trials has been a significant driver of investor confidence. Positive trial results not only validate the efficacy of Iovance’s therapies but also enhance its competitive position in the market. This is particularly important in the biotechnology sector, where clinical success can make or break a company’s prospects. Moreover, Iovance’s focus on TIL therapies sets it apart from other companies that may be pursuing different approaches to cancer treatment, such as CAR-T cell therapies or monoclonal antibodies.

Furthermore, Iovance’s strategic partnerships and collaborations have bolstered its standing in the industry. By aligning with established pharmaceutical companies and research institutions, Iovance has been able to leverage additional resources and expertise, thereby accelerating its development timelines. This collaborative approach is a common strategy among biotechnology firms, as it allows them to mitigate risks and share the burden of high research and development costs. In contrast, some of Iovance’s peers may choose to go it alone, which can be a double-edged sword; while it allows for greater control over the development process, it also exposes the company to higher financial risks.

Another aspect to consider is the regulatory environment, which plays a crucial role in shaping the fortunes of biotechnology companies. Iovance’s ability to navigate the complex regulatory landscape effectively has been a contributing factor to its recent stock surge. Securing approvals from regulatory bodies such as the U.S. Food and Drug Administration (FDA) is a critical milestone for any biotech firm, as it paves the way for commercialization and revenue generation. In this regard, Iovance’s proactive engagement with regulators and its commitment to meeting stringent safety and efficacy standards have set it apart from some of its peers who may face delays or setbacks in their approval processes.

Additionally, market sentiment and investor perception are influential factors in the stock performance of biotechnology companies. Iovance’s recent achievements have likely enhanced its reputation among investors, leading to increased demand for its shares. This is in contrast to some of its peers who may be struggling with negative perceptions due to clinical trial failures or financial instability. It is worth noting that the biotechnology sector is inherently volatile, with stock prices often subject to rapid fluctuations based on news flow and market speculation.

In conclusion, Iovance Biotherapeutics’ stock surge on Thursday can be attributed to a combination of successful clinical progress, strategic partnerships, effective regulatory navigation, and positive market sentiment. When compared to its industry peers, Iovance’s focused approach and strategic initiatives have positioned it favorably within the competitive biotechnology landscape. As the company continues to advance its pipeline and achieve key milestones, it will be interesting to observe how it maintains its momentum and navigates the challenges that lie ahead.

Strategic Developments Behind Iovance Biotherapeutics’ Stock Growth

Iovance Biotherapeutics, a pioneering company in the field of cell therapy, experienced a significant surge in its stock price on Thursday, capturing the attention of investors and analysts alike. This remarkable growth can be attributed to a series of strategic developments that have positioned the company favorably within the competitive biotechnology landscape. As the market continues to evolve, understanding the factors driving Iovance’s recent success provides valuable insights into the company’s future potential.

To begin with, one of the primary catalysts for the stock’s upward trajectory is the progress in Iovance’s clinical pipeline. The company has been at the forefront of developing tumor-infiltrating lymphocyte (TIL) therapies, which harness the power of a patient’s own immune cells to combat cancer. Recent updates from ongoing clinical trials have demonstrated promising efficacy and safety profiles, particularly in treating advanced melanoma and cervical cancer. These positive results have not only bolstered investor confidence but have also underscored the potential of TIL therapies to address unmet medical needs.

Moreover, Iovance’s strategic partnerships and collaborations have played a crucial role in enhancing its market position. By aligning with leading research institutions and pharmaceutical companies, Iovance has been able to leverage external expertise and resources to accelerate the development of its therapies. These collaborations have facilitated the exchange of knowledge and technology, thereby strengthening the company’s research and development capabilities. As a result, Iovance is well-equipped to navigate the complexities of the regulatory landscape and bring its innovative treatments to market more efficiently.

In addition to clinical advancements and strategic alliances, Iovance’s robust financial health has contributed to its stock’s impressive performance. The company has successfully secured funding through various channels, including public offerings and private investments. This financial stability has enabled Iovance to invest in state-of-the-art manufacturing facilities and expand its operational infrastructure. By ensuring a reliable supply chain and production capacity, the company is poised to meet the anticipated demand for its therapies upon regulatory approval.

Furthermore, the broader market dynamics have also played a role in Iovance’s stock appreciation. The biotechnology sector has witnessed increased interest from investors seeking opportunities in innovative and high-growth areas. As a leader in cell therapy, Iovance is well-positioned to capitalize on this trend, attracting both institutional and retail investors. The growing recognition of the potential of cell-based therapies to revolutionize cancer treatment has further fueled optimism around Iovance’s prospects.

While the recent stock surge is undoubtedly a positive development, it is essential to consider the potential challenges that lie ahead. The biotechnology industry is inherently risky, with regulatory hurdles and competitive pressures posing significant threats. However, Iovance’s strategic focus on innovation, collaboration, and financial prudence provides a solid foundation to navigate these challenges effectively.

In conclusion, Iovance Biotherapeutics’ stock surge on Thursday is a testament to the company’s strategic developments and its commitment to advancing cell therapy. Through clinical progress, strategic partnerships, financial stability, and favorable market dynamics, Iovance has positioned itself as a formidable player in the biotechnology sector. As the company continues to innovate and expand its capabilities, it remains well-equipped to deliver transformative therapies that have the potential to improve patient outcomes and drive long-term value for shareholders.

Q&A

1. **What caused Iovance Biotherapeutics stock to soar on Thursday?**

The stock surged due to positive news or developments related to their cancer therapies, such as promising clinical trial results or regulatory advancements.

2. **What is Iovance Biotherapeutics known for?**

Iovance Biotherapeutics is known for developing cell therapies, particularly tumor-infiltrating lymphocyte (TIL) therapies for cancer treatment.

3. **How did the stock market react to the news about Iovance Biotherapeutics?**

The stock market reacted positively, with a significant increase in the stock price and trading volume.

4. **What are tumor-infiltrating lymphocyte (TIL) therapies?**

TIL therapies involve extracting immune cells from a patient’s tumor, expanding them in a lab, and reinfusing them to help the immune system attack cancer.

5. **What specific news or event triggered the stock surge?**

The surge was likely triggered by a specific announcement, such as successful trial results, a partnership, or regulatory approval.

6. **How did analysts respond to the stock surge?**

Analysts may have upgraded their ratings or price targets for Iovance Biotherapeutics, reflecting increased confidence in the company’s prospects.

7. **What impact did the stock surge have on Iovance Biotherapeutics’ market capitalization?**

The stock surge increased the company’s market capitalization, reflecting higher investor valuation and confidence.

Conclusion

Iovance Biotherapeutics’ stock experienced a significant surge on Thursday, likely driven by positive developments or announcements related to its pipeline, regulatory progress, or financial performance. Such a rise in stock price often reflects increased investor confidence and optimism about the company’s future prospects. However, investors should remain cautious and consider broader market conditions and company fundamentals before making investment decisions.