“Navigating Uncertainty: How Bond Market Turmoil Reflects Investors’ Evolving Views on Trump.”

Introduction

The recent turmoil in the bond market has prompted a reevaluation of investor sentiment towards former President Donald Trump and his potential impact on the economy. As market volatility escalates, investors are increasingly scrutinizing the implications of Trump’s policies and rhetoric on fiscal stability, interest rates, and overall market confidence. This shift in perspective reflects a broader concern about the intersection of political dynamics and economic performance, as stakeholders seek to navigate the uncertainties of a changing political landscape. Understanding these evolving attitudes is crucial for assessing future market trends and investment strategies in an environment marked by both opportunity and risk.

Investor Sentiment: The Impact of Trump’s Policies on Bond Markets

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their perspectives on former President Donald Trump and the potential implications of his policies on financial markets. This shift in sentiment is not merely a reaction to the immediate fluctuations in bond prices but also reflects a deeper analysis of the economic landscape shaped by Trump’s administration. As investors navigate this complex environment, understanding the interplay between political decisions and market dynamics becomes increasingly crucial.

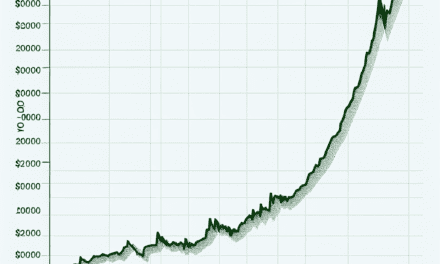

Historically, Trump’s policies have elicited mixed reactions from investors, particularly in the bond market. His administration’s focus on tax cuts and deregulation initially spurred optimism, leading to a surge in economic growth and a corresponding rise in bond yields. However, as the implications of these policies unfolded, concerns about inflation and fiscal sustainability began to surface. The bond market, sensitive to interest rate changes and inflation expectations, reacted accordingly, leading to increased volatility. This backdrop has prompted investors to reconsider their long-term strategies in light of potential future policies that could emerge from Trump’s influence.

Moreover, the recent turmoil in the bond market has been exacerbated by broader economic factors, including rising inflation rates and shifts in Federal Reserve policy. As the central bank signals its intent to combat inflation through interest rate hikes, investors are left grappling with the potential consequences of these actions on bond prices. In this context, Trump’s past rhetoric and policy proposals regarding fiscal stimulus and infrastructure spending have resurfaced in discussions among market participants. Investors are weighing the likelihood of a return to Trump’s economic agenda and its potential impact on inflation and interest rates.

Transitioning from past policies to future implications, it is essential to consider how investor sentiment is evolving in response to the current political climate. The recent midterm elections and ongoing discussions about the 2024 presidential race have reignited interest in Trump’s potential candidacy. As speculation mounts, investors are increasingly focused on how a Trump-led administration might approach economic policy, particularly in relation to fiscal discipline and regulatory frameworks. This uncertainty has led to a cautious approach among bond investors, who are keenly aware of the historical volatility associated with Trump’s presidency.

Furthermore, the bond market’s reaction to geopolitical events and domestic policy changes cannot be overlooked. Investors are acutely aware that Trump’s foreign policy decisions, particularly regarding trade and international relations, can have far-reaching implications for the U.S. economy. As tensions rise globally, the potential for economic disruption becomes a critical consideration for bond investors. Consequently, the interplay between Trump’s policies and global economic conditions adds another layer of complexity to investor sentiment.

In conclusion, the recent turmoil in the bond market has prompted a reevaluation of investor perspectives on Donald Trump’s policies and their potential implications for the economy. As market participants navigate this uncertain landscape, they are increasingly aware of the intricate relationship between political decisions and financial outcomes. The evolving sentiment reflects a broader understanding that the impact of Trump’s policies extends beyond immediate market reactions, influencing long-term investment strategies and economic forecasts. As investors continue to monitor developments in the political arena, their insights will undoubtedly shape the future trajectory of the bond market and the broader economy.

Analyzing Market Reactions: Trump’s Influence on Investor Confidence

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their perspectives on various political figures, notably former President Donald Trump. This shift in sentiment can be attributed to a confluence of factors, including economic indicators, geopolitical tensions, and the evolving political landscape. As investors navigate these complexities, it becomes increasingly clear that Trump’s influence on investor confidence is multifaceted and deeply intertwined with broader market dynamics.

To begin with, the bond market is often viewed as a barometer of investor sentiment, reflecting expectations about future economic conditions. When uncertainty looms, as it has in recent times, investors typically flock to safer assets, such as government bonds. However, the recent volatility has revealed a more nuanced reaction to Trump’s potential candidacy in the upcoming elections. While some investors express concern over his unpredictable policy decisions, others see opportunities for growth, particularly in sectors that may benefit from his pro-business stance. This dichotomy illustrates the complexity of investor sentiment, as confidence can be swayed by both fear and optimism.

Moreover, the economic landscape has played a crucial role in shaping investor perceptions. Inflationary pressures, rising interest rates, and supply chain disruptions have created a challenging environment for fixed-income securities. In this context, Trump’s previous tenure is often scrutinized, with investors weighing the potential implications of his return to power. For instance, his administration’s tax cuts and deregulation efforts are viewed favorably by some, who argue that such policies could stimulate economic growth and, consequently, bolster bond yields. Conversely, others remain wary, citing concerns over fiscal irresponsibility and the potential for increased volatility in financial markets.

Transitioning to the geopolitical arena, Trump’s foreign policy decisions have also left a lasting impact on investor confidence. His approach to trade relations, particularly with China, has been a focal point of discussion. Investors are acutely aware that any shift in trade policy could have far-reaching consequences for global supply chains and economic stability. As tensions between the U.S. and other nations continue to simmer, the prospect of Trump’s return to the White House raises questions about the future of international relations and its implications for the bond market. Consequently, investors are left to grapple with the uncertainty surrounding potential policy shifts and their effects on market stability.

Furthermore, the political landscape itself is evolving, with the upcoming elections serving as a critical juncture for investors. As candidates position themselves for the primaries, the rhetoric surrounding economic policies and fiscal responsibility is becoming increasingly pronounced. Investors are closely monitoring these developments, as they seek to gauge the potential impact on market conditions. Trump’s ability to galvanize support among his base, coupled with his controversial style, adds another layer of complexity to the equation. As a result, investor confidence is not only influenced by economic indicators but also by the broader political narrative that unfolds in the lead-up to the elections.

In conclusion, the recent turmoil in the bond market has prompted a reevaluation of investor perspectives on Trump and his potential influence on future economic conditions. As investors navigate the intricate interplay of economic indicators, geopolitical tensions, and political dynamics, it becomes evident that their confidence is shaped by a myriad of factors. Ultimately, understanding these shifting perspectives is essential for navigating the complexities of the current financial landscape, as investors seek to position themselves strategically in an ever-evolving market environment.

The Role of Economic Indicators in Shaping Investor Views on Trump

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their perspectives on various political figures, including former President Donald Trump. This reassessment is largely influenced by a range of economic indicators that serve as barometers for the overall health of the economy. As these indicators fluctuate, they not only reflect current economic conditions but also shape investor sentiment regarding political leadership and policy direction.

To begin with, inflation rates have emerged as a critical economic indicator that directly impacts investor confidence. As inflation rises, the purchasing power of consumers diminishes, leading to concerns about economic stability. Investors often look to political leaders to implement policies that can mitigate inflationary pressures. In this context, Trump’s previous administration’s approach to fiscal policy and trade has come under scrutiny. While some investors may recall the tax cuts and deregulation efforts that characterized his presidency as beneficial for economic growth, others are now questioning whether such policies could lead to unsustainable inflation in the long run. This dichotomy illustrates how economic indicators can influence perceptions of political figures, as investors weigh the potential benefits of past policies against current economic realities.

Moreover, employment figures play a pivotal role in shaping investor views. The unemployment rate is a key indicator of economic health, and fluctuations in this metric can lead to significant shifts in investor sentiment. During Trump’s presidency, the unemployment rate reached historic lows, which many investors viewed as a testament to his economic policies. However, as recent data has shown a rise in unemployment claims, investors are becoming increasingly cautious. This shift in the labor market raises questions about the effectiveness of current economic strategies and the potential for a return to Trump’s policies, which some believe could reignite job growth. Consequently, the interplay between employment data and investor sentiment underscores the importance of economic indicators in evaluating political leadership.

In addition to inflation and employment, interest rates are another crucial economic indicator that influences investor perspectives. The Federal Reserve’s decisions regarding interest rates can have profound implications for the bond market and overall economic activity. As interest rates rise, bond prices typically fall, leading to increased volatility in the market. Investors are acutely aware of how Trump’s policies may have influenced the Fed’s approach during his presidency, particularly regarding the balance between stimulating growth and controlling inflation. As the current economic landscape evolves, investors are left to ponder whether a return to Trump’s leadership would result in a more favorable environment for interest rates or exacerbate existing challenges.

Furthermore, geopolitical factors and trade relations also play a significant role in shaping investor views on Trump. Economic indicators such as trade balances and tariffs can influence market stability and investor confidence. During Trump’s tenure, his administration’s focus on renegotiating trade agreements and imposing tariffs was met with mixed reactions. While some investors appreciated the emphasis on American manufacturing, others expressed concern about potential trade wars and their impact on global supply chains. As current economic indicators reflect ongoing trade tensions, investors are reevaluating the implications of Trump’s policies on future trade relations and their potential effects on the economy.

In conclusion, the recent turmoil in the bond market has prompted investors to reconsider their perspectives on Donald Trump, driven largely by a variety of economic indicators. As inflation, employment, interest rates, and trade relations fluctuate, they serve as critical touchpoints for investors assessing the potential impact of political leadership on economic stability. This dynamic interplay between economic indicators and investor sentiment highlights the complex relationship between politics and finance, underscoring the importance of informed decision-making in an ever-evolving economic landscape.

Shifts in Investment Strategies Amidst Trump’s Political Landscape

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their strategies in light of the evolving political landscape shaped by former President Donald Trump. As the political climate remains volatile, characterized by ongoing investigations and the potential for a 2024 presidential run, investors are increasingly aware of how these factors can influence economic stability and market performance. This awareness has led to a notable shift in investment strategies, as market participants seek to navigate the uncertainties that accompany Trump’s political maneuvers.

One of the most immediate impacts of Trump’s political activities has been the fluctuation in interest rates, which are closely tied to investor sentiment and economic forecasts. As Trump continues to dominate headlines, concerns about his influence on fiscal policy and regulatory frameworks have prompted investors to adopt a more cautious approach. This caution is reflected in a growing preference for safer assets, such as government bonds, which are perceived as more stable during periods of political uncertainty. Consequently, the demand for these securities has surged, driving down yields and altering the dynamics of the bond market.

Moreover, the shifting perspectives on Trump have also led to a reevaluation of risk tolerance among investors. In the past, many viewed Trump’s policies as pro-business, fostering an environment conducive to growth and investment. However, as political tensions escalate and the potential for divisive policies looms, investors are increasingly weighing the risks associated with a Trump-led administration. This has resulted in a more diversified investment approach, with many reallocating their portfolios to include a mix of equities, commodities, and alternative investments that can provide a hedge against potential market volatility.

In addition to altering asset allocation, the current political climate has prompted investors to pay closer attention to sector-specific dynamics. For instance, industries that are heavily influenced by regulatory changes, such as healthcare and energy, have become focal points for investors seeking to capitalize on or mitigate risks associated with Trump’s policies. As a result, sectors that may benefit from a Trump presidency, such as defense and infrastructure, have seen increased investment, while those that could be adversely affected, like renewable energy, have faced scrutiny. This sector rotation reflects a broader trend of investors becoming more strategic in their decision-making, driven by the anticipation of how political developments may impact various industries.

Furthermore, the uncertainty surrounding Trump’s potential candidacy for the 2024 election has led to increased volatility in the markets. Investors are acutely aware that the political landscape can shift rapidly, and as such, they are adopting more agile investment strategies. This agility is characterized by a willingness to pivot quickly in response to new information, whether it be related to Trump’s legal challenges or shifts in public opinion. As a result, many investors are employing tactical asset allocation strategies, allowing them to respond to market movements and political developments in real-time.

In conclusion, the recent turmoil in the bond market has catalyzed a significant shift in investment strategies as investors grapple with the implications of Trump’s political landscape. By prioritizing safety, diversifying portfolios, focusing on sector-specific dynamics, and adopting agile strategies, market participants are striving to navigate the complexities of an uncertain political environment. As the situation continues to evolve, it is clear that investors will remain vigilant, adapting their approaches to align with the ever-changing political and economic landscape.

Bond Market Volatility: Lessons Learned from Trump’s Presidency

The recent turmoil in the bond market has prompted investors to reassess their perspectives on former President Donald Trump and the implications of his policies during his administration. As the financial landscape continues to evolve, it is essential to reflect on the lessons learned from the bond market’s volatility, particularly in the context of Trump’s presidency. The bond market, often viewed as a barometer of economic stability, has experienced significant fluctuations, influenced by a myriad of factors, including fiscal policies, interest rates, and geopolitical tensions.

During Trump’s tenure, the bond market was characterized by a series of dramatic shifts, largely driven by his administration’s approach to taxation, trade, and regulatory reforms. For instance, the implementation of substantial tax cuts aimed at stimulating economic growth initially led to a surge in bond yields, as investors anticipated increased government borrowing to finance the deficit. This expectation, coupled with a robust economy, resulted in a temporary decline in bond prices. However, as the long-term implications of these policies became clearer, the market began to exhibit signs of instability, prompting investors to reconsider their strategies.

Moreover, Trump’s unpredictable foreign policy decisions, particularly regarding trade relations with key partners such as China, added another layer of complexity to the bond market. The imposition of tariffs and the subsequent trade war created uncertainty, leading to fluctuations in investor confidence. As tensions escalated, the bond market reacted with increased volatility, reflecting concerns over potential economic repercussions. This environment of uncertainty served as a reminder of the interconnectedness of global markets and the importance of geopolitical stability in maintaining investor confidence.

In addition to these factors, the Federal Reserve’s response to Trump’s economic policies played a crucial role in shaping bond market dynamics. The central bank’s decisions regarding interest rates were often influenced by the administration’s fiscal strategies, leading to a delicate balancing act. For instance, while the Fed initially raised rates in response to perceived economic growth, it later faced pressure to adjust its stance as signs of economic slowdown emerged. This back-and-forth created an atmosphere of unpredictability, further contributing to bond market volatility.

As investors reflect on these experiences, it becomes evident that the lessons learned from Trump’s presidency extend beyond mere market fluctuations. The importance of adaptability and foresight in investment strategies has never been more pronounced. Investors are now more acutely aware of the potential for rapid changes in market conditions, driven by political developments and policy shifts. Consequently, a more cautious approach to risk management has emerged, with many investors diversifying their portfolios to mitigate exposure to unforeseen events.

Furthermore, the recent bond market turmoil has underscored the significance of understanding the broader economic context in which investments are made. As the political landscape continues to evolve, investors must remain vigilant and informed about the potential implications of policy changes. This awareness will be crucial in navigating future market fluctuations, particularly as the nation approaches another election cycle.

In conclusion, the bond market’s volatility during Trump’s presidency has provided valuable insights for investors. By examining the interplay between political decisions and market dynamics, investors can better prepare for the uncertainties that lie ahead. As perspectives shift and new challenges emerge, the lessons learned from this period will undoubtedly shape investment strategies for years to come.

The Future of Investment: How Trump’s Actions Shape Market Trends

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their strategies and outlooks. Central to this reevaluation is the evolving perception of former President Donald Trump and his potential influence on future economic policies. As the political landscape shifts, investors are increasingly aware of how Trump’s actions and rhetoric can shape market trends, particularly in the context of fiscal policy, trade relations, and regulatory frameworks.

To begin with, Trump’s approach to fiscal policy has historically been characterized by tax cuts and increased government spending. These measures initially spurred economic growth, leading to a bullish sentiment in the markets. However, as inflationary pressures have mounted, the sustainability of such policies has come under scrutiny. Investors are now weighing the implications of potential future tax reforms and spending initiatives that could emerge from a Trump-led administration. The uncertainty surrounding these policies has led to fluctuations in bond yields, as market participants attempt to gauge the long-term impact on interest rates and inflation.

Moreover, Trump’s stance on trade has also played a pivotal role in shaping investor sentiment. His administration’s focus on protectionist measures and renegotiation of trade agreements created a volatile environment for global markets. As investors navigate the complexities of international trade relations, they are increasingly concerned about the potential for renewed tariffs or trade wars. Such developments could have far-reaching consequences for corporate earnings and economic growth, prompting investors to adjust their portfolios accordingly. Consequently, the bond market has reacted to these uncertainties, with shifts in demand for government securities reflecting a cautious approach to risk.

In addition to fiscal and trade policies, Trump’s regulatory agenda has been a significant factor influencing market dynamics. His administration’s efforts to roll back regulations across various sectors, including energy and finance, were initially welcomed by investors seeking a more business-friendly environment. However, the potential for regulatory changes under a future Trump administration raises questions about the stability of these gains. Investors are now considering how shifts in regulatory frameworks could impact sectors such as healthcare, technology, and environmental sustainability. This ongoing evaluation has led to increased volatility in bond markets, as investors seek to anticipate the implications of potential policy changes.

Furthermore, the psychological aspect of Trump’s influence on the market cannot be overlooked. His ability to sway public opinion and market sentiment through social media and public statements has created an environment where investor confidence can shift rapidly. As a result, market participants are increasingly attuned to Trump’s communications, often reacting to his remarks with immediate changes in trading behavior. This phenomenon underscores the importance of understanding the interplay between political rhetoric and market movements, as investors strive to navigate the complexities of an ever-changing landscape.

In conclusion, the future of investment is intricately linked to the actions and decisions of political figures like Donald Trump. As investors grapple with the implications of his potential return to power, they must remain vigilant in monitoring fiscal policies, trade relations, and regulatory changes. The recent turmoil in the bond market serves as a reminder of the interconnectedness of politics and finance, highlighting the need for a nuanced understanding of how political developments can shape market trends. Ultimately, as investors adapt to these shifting perspectives, they will continue to seek strategies that mitigate risk while capitalizing on opportunities in an uncertain environment.

Navigating Uncertainty: Investor Strategies in Response to Trump’s Leadership

In recent months, the bond market has experienced significant turmoil, prompting investors to reassess their strategies in light of the evolving political landscape under former President Donald Trump. As uncertainty looms over economic policies and geopolitical relations, investors are increasingly compelled to navigate the complexities of a market influenced by Trump’s leadership style and rhetoric. This shift in perspective is not merely a reaction to immediate events but reflects a broader understanding of how political dynamics can impact financial markets.

One of the primary concerns for investors has been the potential for increased volatility stemming from Trump’s unpredictable approach to governance. His administration’s past decisions, such as trade tariffs and regulatory rollbacks, have had profound implications for various sectors, leading investors to adopt a more cautious stance. Consequently, many are diversifying their portfolios to mitigate risks associated with potential policy shifts. This diversification often includes reallocating assets into safer investments, such as government bonds or commodities, which tend to perform better during periods of uncertainty.

Moreover, the bond market’s recent fluctuations have underscored the importance of interest rates in shaping investment strategies. As the Federal Reserve navigates its monetary policy in response to inflationary pressures and economic recovery, investors are closely monitoring how Trump’s influence might affect these decisions. For instance, if Trump were to regain political prominence, his historical inclination towards aggressive fiscal policies could lead to expectations of rising inflation, prompting investors to adjust their bond holdings accordingly. In this context, many are considering shorter-duration bonds to reduce exposure to interest rate risk, thereby enhancing their ability to respond to rapid market changes.

In addition to adjusting their asset allocations, investors are also paying closer attention to the broader economic indicators that could signal shifts in market sentiment. The interplay between Trump’s leadership and key economic metrics, such as employment rates and consumer confidence, is critical in shaping investor outlooks. As a result, many are adopting a more analytical approach, utilizing data-driven insights to inform their investment decisions. This trend reflects a growing recognition that understanding the political landscape is essential for anticipating market movements.

Furthermore, the rise of alternative investment strategies has become increasingly prominent as investors seek to capitalize on the uncertainties associated with Trump’s leadership. Hedge funds and private equity firms, for instance, are exploring opportunities in distressed assets or sectors that may benefit from potential policy changes. This proactive approach allows investors to position themselves advantageously in a rapidly changing environment, highlighting the importance of agility in investment strategies.

As the political climate continues to evolve, the implications for the bond market and broader financial landscape remain uncertain. Investors are acutely aware that Trump’s leadership could lead to both opportunities and challenges, necessitating a balanced approach to risk management. By staying informed and adaptable, they can better navigate the complexities of the market while positioning themselves for potential gains.

In conclusion, the recent turmoil in the bond market has prompted a reevaluation of investment strategies in response to Trump’s leadership. As investors grapple with uncertainty, they are increasingly focusing on diversification, interest rate dynamics, economic indicators, and alternative investment opportunities. This multifaceted approach underscores the necessity of remaining vigilant and responsive to the ever-changing political and economic landscape, ultimately shaping the future of investment strategies in a world influenced by Trump’s distinctive leadership style.

Q&A

1. **Question:** How have investors’ perspectives on Trump changed in light of recent bond market turmoil?

**Answer:** Investors have become more cautious, viewing Trump’s policies as potentially destabilizing for the economy, leading to increased volatility in the bond market.

2. **Question:** What specific events related to Trump have influenced bond market reactions?

**Answer:** Events such as changes in fiscal policy, trade negotiations, and political controversies have contributed to uncertainty, prompting shifts in investor sentiment.

3. **Question:** How does Trump’s economic policy impact bond yields?

**Answer:** Investors may anticipate higher inflation or increased government spending under Trump, leading to rising bond yields as they demand higher returns for perceived risks.

4. **Question:** What role does political stability play in investor confidence regarding Trump?

**Answer:** Political instability or uncertainty surrounding Trump’s administration can lead to decreased investor confidence, resulting in sell-offs in the bond market.

5. **Question:** How have interest rates been affected by investors’ views on Trump?

**Answer:** Expectations of aggressive fiscal policies under Trump can lead to speculation about rising interest rates, influencing bond prices negatively.

6. **Question:** Are there specific sectors that have been more affected by investors’ shifting views on Trump?

**Answer:** Sectors such as infrastructure, healthcare, and defense may experience more volatility as investors react to Trump’s policy announcements and their implications.

7. **Question:** What long-term implications could these shifting perspectives have on the bond market?

**Answer:** Prolonged uncertainty regarding Trump’s policies could lead to sustained volatility in the bond market, affecting investment strategies and risk assessments for the foreseeable future.

Conclusion

Investors’ shifting perspectives on Trump, as reflected in the recent bond market turmoil, indicate a growing uncertainty regarding his potential return to power and its implications for economic policy. The volatility in bond markets suggests that investors are recalibrating their expectations about fiscal and monetary stability, influenced by Trump’s past policies and rhetoric. This shift highlights a broader concern about the impact of political dynamics on market performance, emphasizing the need for investors to remain vigilant in assessing how political developments may affect economic conditions and investment strategies moving forward.