“Intel’s Leap: Matching Nvidia’s Momentum to Unlock CEO’s Stock Rewards”

Introduction

Intel’s stock performance has been under scrutiny as the company seeks to regain its competitive edge in the semiconductor industry. To secure the ambitious stock awards set for CEO Pat Gelsinger, Intel must achieve a significant surge in its stock price, akin to the remarkable rise experienced by Nvidia. This challenge underscores the pressure on Intel to innovate and execute its strategic initiatives effectively, as it aims to close the gap with industry leaders and deliver substantial returns to its shareholders. The company’s ability to navigate technological advancements and market dynamics will be crucial in determining whether it can replicate Nvidia’s success and meet the high expectations tied to its executive compensation plans.

Intel’s Strategic Moves to Boost Stock Performance

Intel Corporation, a stalwart in the semiconductor industry, finds itself at a pivotal juncture as it seeks to invigorate its stock performance. The company’s CEO, Pat Gelsinger, has been at the helm since February 2021, tasked with steering Intel through a rapidly evolving technological landscape. To align his interests with those of shareholders, Gelsinger’s compensation package includes substantial stock awards contingent upon significant improvements in Intel’s stock price. This strategy mirrors the remarkable surge experienced by Nvidia, a key competitor, whose stock has soared due to its strategic positioning in the burgeoning fields of artificial intelligence and data centers.

To achieve a similar trajectory, Intel has embarked on a series of strategic initiatives aimed at revitalizing its market position. Central to these efforts is the company’s ambitious IDM 2.0 strategy, which seeks to transform Intel into a major player in both chip design and manufacturing. By expanding its foundry services, Intel aims to capture a larger share of the semiconductor market, thereby driving revenue growth and enhancing shareholder value. This dual approach not only leverages Intel’s existing strengths but also positions it to compete more effectively with industry giants like Taiwan Semiconductor Manufacturing Company (TSMC).

Moreover, Intel is making significant investments in research and development to foster innovation and maintain its technological edge. The company is focusing on advancing its process technology, with plans to introduce new nodes that promise improved performance and energy efficiency. These advancements are crucial as Intel seeks to regain its leadership position in the semiconductor industry, particularly in the face of fierce competition from companies that have capitalized on the demand for cutting-edge chips.

In addition to technological advancements, Intel is also pursuing strategic partnerships and acquisitions to bolster its capabilities. Collaborations with other tech firms and the acquisition of complementary businesses are expected to enhance Intel’s product offerings and expand its market reach. These moves are designed to create synergies that will drive growth and, ultimately, contribute to a rise in the company’s stock price.

Furthermore, Intel is keenly aware of the growing importance of sustainability and environmental responsibility in today’s business landscape. The company has committed to reducing its carbon footprint and enhancing the sustainability of its operations. By prioritizing eco-friendly practices, Intel not only aligns itself with global sustainability goals but also appeals to environmentally conscious investors, potentially boosting its stock’s attractiveness.

While these strategic moves are promising, the path to achieving a stock surge akin to Nvidia’s is fraught with challenges. The semiconductor industry is characterized by rapid technological advancements and intense competition, requiring Intel to execute its strategies with precision and agility. Additionally, global supply chain disruptions and geopolitical tensions pose potential risks that could impact Intel’s operations and financial performance.

In conclusion, Intel’s quest to secure a stock surge similar to Nvidia’s is a multifaceted endeavor that hinges on successful execution of its strategic initiatives. By focusing on innovation, expanding its market presence, and embracing sustainability, Intel aims to enhance its stock performance and secure the CEO’s stock awards. As the company navigates this complex landscape, its ability to adapt and thrive will be crucial in determining its future success and its standing in the competitive semiconductor industry.

Comparing Intel and Nvidia: A Tale of Two Tech Giants

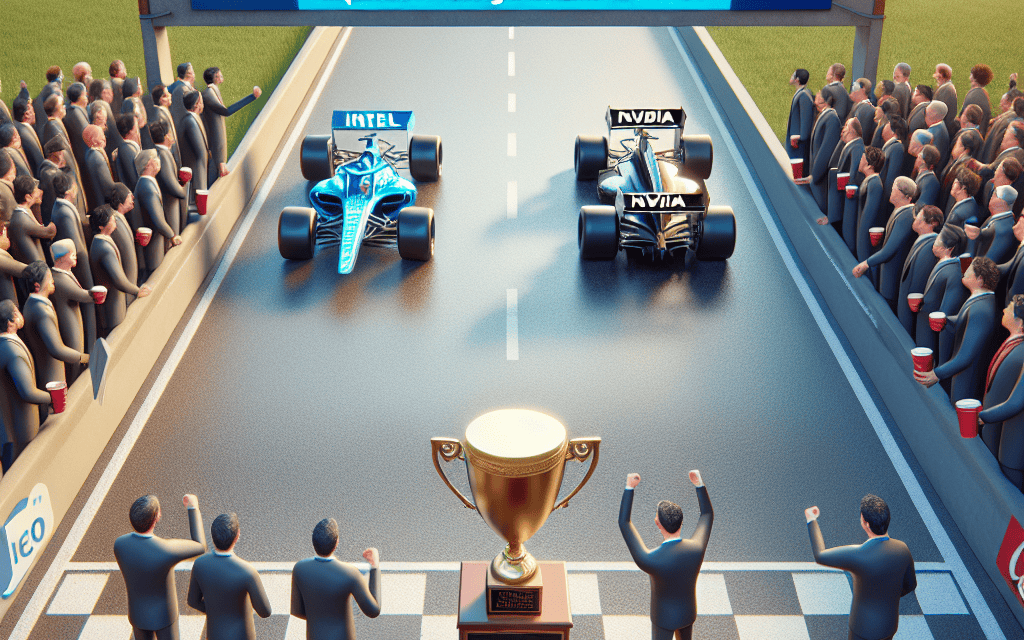

In the ever-evolving landscape of technology, Intel and Nvidia stand as two titans, each with its own unique trajectory and challenges. While both companies have made significant strides in the semiconductor industry, their recent performances in the stock market tell contrasting stories. Intel, once the undisputed leader in chip manufacturing, now finds itself in a position where it must emulate Nvidia’s recent success to secure substantial stock awards for its CEO. This situation underscores the broader dynamics at play within the tech sector and highlights the divergent paths these two companies have taken.

Intel, a company with a storied history, has been a cornerstone of the semiconductor industry for decades. However, in recent years, it has faced mounting pressure from competitors, including Nvidia, which has rapidly ascended to prominence. Nvidia’s rise can be attributed to its strategic focus on graphics processing units (GPUs) and its successful foray into artificial intelligence (AI) and data centers. This strategic pivot has not only bolstered Nvidia’s market position but also propelled its stock to new heights, rewarding its leadership with substantial stock awards.

In contrast, Intel has grappled with a series of challenges, including delays in its manufacturing processes and increased competition from both Nvidia and AMD. These hurdles have impacted its stock performance, leading to a situation where its CEO’s stock awards are contingent upon a significant surge in the company’s stock price. This requirement reflects the broader expectations placed on Intel to regain its competitive edge and deliver value to its shareholders.

To achieve a stock surge akin to Nvidia’s, Intel must navigate a complex landscape of technological innovation and market dynamics. One potential avenue for Intel is to capitalize on its strengths in central processing units (CPUs) while simultaneously expanding its presence in emerging markets such as AI and autonomous vehicles. By leveraging its existing expertise and investing in cutting-edge technologies, Intel can position itself as a formidable competitor in these high-growth areas.

Moreover, Intel’s recent strategic initiatives, including its focus on advanced manufacturing processes and partnerships with key industry players, signal a commitment to regaining its leadership position. These efforts, if executed effectively, could serve as catalysts for a stock resurgence, aligning with the company’s long-term vision and the expectations of its stakeholders.

However, it is important to recognize that the path to achieving a stock surge similar to Nvidia’s is fraught with challenges. The semiconductor industry is characterized by rapid technological advancements and intense competition, requiring companies to continuously innovate and adapt. Intel must not only address its current operational challenges but also anticipate future trends and disruptions to maintain its relevance in the market.

In conclusion, the contrasting stock performances of Intel and Nvidia highlight the divergent strategies and challenges faced by these two tech giants. While Nvidia’s strategic focus on GPUs and AI has propelled its stock to new heights, Intel must navigate a complex landscape to achieve a similar surge. By leveraging its strengths, investing in innovation, and addressing operational challenges, Intel has the potential to secure the stock awards for its CEO and reaffirm its position as a leader in the semiconductor industry. The journey ahead is undoubtedly challenging, but with strategic foresight and execution, Intel can aspire to emulate Nvidia’s success and deliver value to its shareholders.

The Role of Leadership in Intel’s Market Position

In the ever-evolving landscape of the semiconductor industry, leadership plays a pivotal role in shaping a company’s market position. Intel, a stalwart in the field, has been navigating a challenging environment marked by fierce competition and rapid technological advancements. At the helm of this iconic company is CEO Pat Gelsinger, whose leadership is crucial in steering Intel towards a future of innovation and growth. However, the stakes are high, as Gelsinger’s stock awards are contingent upon Intel achieving a surge in its stock performance akin to that of its rival, Nvidia.

To understand the significance of this requirement, it is essential to consider the broader context of the semiconductor market. Nvidia has set a formidable benchmark with its impressive stock performance, driven by its strategic focus on artificial intelligence and graphics processing units. This has not only elevated Nvidia’s market capitalization but also positioned it as a leader in cutting-edge technology. Consequently, Intel faces the challenge of replicating such success to meet the conditions tied to Gelsinger’s stock awards.

Leadership, in this context, is not merely about maintaining the status quo but rather about driving transformative change. Gelsinger’s vision for Intel involves a comprehensive strategy that encompasses innovation, strategic partnerships, and a renewed focus on manufacturing capabilities. By investing in advanced process technologies and expanding its foundry services, Intel aims to regain its competitive edge and capture a larger share of the market. This ambitious plan requires not only substantial financial investment but also a cultural shift within the organization to foster agility and creativity.

Moreover, the role of leadership extends beyond internal strategies to encompass external collaborations. Gelsinger has emphasized the importance of forging alliances with other technology companies to leverage synergies and accelerate innovation. By collaborating with industry leaders, Intel can tap into new markets and enhance its product offerings, thereby strengthening its market position. This approach underscores the significance of leadership in navigating complex ecosystems and capitalizing on emerging opportunities.

In addition to strategic initiatives, effective leadership is characterized by the ability to inspire and motivate a diverse workforce. Gelsinger’s leadership style is marked by transparency and a commitment to fostering an inclusive culture. By empowering employees and encouraging open communication, he aims to harness the collective potential of Intel’s talent pool. This focus on human capital is crucial, as it enables the company to adapt to changing market dynamics and drive sustainable growth.

Furthermore, leadership in the semiconductor industry requires a keen understanding of global trends and geopolitical factors. The ongoing supply chain disruptions and trade tensions have underscored the need for resilience and adaptability. Gelsinger’s leadership involves navigating these challenges while ensuring that Intel remains at the forefront of technological innovation. By prioritizing supply chain diversification and investing in domestic manufacturing capabilities, Intel aims to mitigate risks and enhance its competitive position.

In conclusion, the role of leadership in Intel’s market position is multifaceted and dynamic. As the company strives to achieve a stock performance surge similar to Nvidia’s, Gelsinger’s leadership will be instrumental in driving strategic initiatives, fostering innovation, and navigating external challenges. By aligning internal capabilities with external opportunities, Intel can secure its place as a leader in the semiconductor industry and fulfill the conditions tied to its CEO’s stock awards.

Analyzing Intel’s Financial Health and Growth Potential

Intel Corporation, a stalwart in the semiconductor industry, has been navigating a challenging landscape marked by rapid technological advancements and fierce competition. The company’s financial health and growth potential are under scrutiny, particularly in light of the ambitious stock awards tied to the performance of its CEO, Pat Gelsinger. To secure these awards, Intel’s stock would need to experience a surge akin to that of Nvidia, a formidable competitor that has recently seen its stock soar due to its strategic positioning in the burgeoning fields of artificial intelligence and data centers.

Intel’s current financial standing reflects a company in transition. While it remains a dominant player in the PC and server markets, it faces significant pressure to innovate and expand into new areas. The company’s revenue streams have been relatively stable, but growth has been modest compared to the explosive gains seen by some of its competitors. This stagnation is partly due to Intel’s delayed entry into the advanced chip manufacturing processes that companies like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung have already mastered. Consequently, Intel has been investing heavily in research and development to catch up and regain its competitive edge.

The strategic initiatives undertaken by Intel under Gelsinger’s leadership are crucial to understanding its growth potential. Gelsinger has emphasized the importance of expanding Intel’s manufacturing capabilities, with plans to build new fabrication plants in the United States and Europe. This move is not only aimed at increasing production capacity but also at reducing reliance on Asian manufacturers, thereby addressing geopolitical risks. Furthermore, Intel’s foray into the foundry business, where it manufactures chips for other companies, represents a significant shift in its business model. This diversification could open new revenue streams and position Intel as a key player in the global semiconductor supply chain.

However, for Intel to achieve a stock surge similar to Nvidia’s, it must demonstrate substantial progress in these strategic areas. Nvidia’s success has been largely driven by its dominance in the graphics processing unit (GPU) market, which has become essential for AI and machine learning applications. Intel, on the other hand, is still in the early stages of developing its GPU offerings. To compete effectively, Intel must accelerate its innovation cycle and deliver products that meet the evolving demands of the tech industry.

Moreover, Intel’s ability to capitalize on emerging trends such as AI, 5G, and the Internet of Things (IoT) will be pivotal. These technologies are expected to drive significant growth in the semiconductor sector, and Intel’s investments in these areas could yield substantial returns if executed successfully. The company’s recent acquisitions and partnerships indicate a strategic focus on these high-growth markets, but tangible results are necessary to convince investors of its long-term potential.

In conclusion, while Intel’s financial health remains robust, its growth potential hinges on the successful execution of its strategic initiatives. The company must overcome significant challenges to achieve a stock performance that would secure Gelsinger’s stock awards. By focusing on innovation, expanding its manufacturing capabilities, and capitalizing on emerging technologies, Intel has the opportunity to revitalize its growth trajectory. However, the path to achieving a surge similar to Nvidia’s is fraught with challenges, requiring a concerted effort to navigate the complexities of the semiconductor industry and deliver value to shareholders.

The Impact of Technological Innovation on Intel’s Stock

Intel Corporation, a stalwart in the semiconductor industry, has long been a cornerstone of technological innovation. However, in recent years, the company has faced mounting pressure to keep pace with its competitors, particularly Nvidia, which has seen its stock soar due to its advancements in artificial intelligence and graphics processing units. For Intel to secure the ambitious stock awards set for its CEO, Pat Gelsinger, the company must achieve a similar surge in its stock performance. This challenge underscores the critical role that technological innovation plays in influencing stock valuations and investor confidence.

To understand the dynamics at play, it is essential to consider the broader context of the semiconductor industry. The demand for semiconductors has been on an upward trajectory, driven by the proliferation of digital devices, the expansion of cloud computing, and the burgeoning field of artificial intelligence. Companies that can innovate rapidly and deliver cutting-edge technology are well-positioned to capitalize on these trends. Nvidia, for instance, has successfully leveraged its expertise in GPU technology to become a leader in AI and machine learning, resulting in a significant appreciation of its stock value.

In contrast, Intel has faced challenges in maintaining its competitive edge. The company has experienced delays in the rollout of its next-generation chips and has struggled to transition from its traditional focus on central processing units (CPUs) to more diversified offerings. These hurdles have contributed to a stagnation in its stock performance, prompting the need for a strategic pivot. Under the leadership of Pat Gelsinger, Intel has embarked on an ambitious plan to revitalize its product lineup and regain its position as an industry leader.

Central to this strategy is Intel’s commitment to advancing its manufacturing capabilities. The company has announced substantial investments in new fabrication facilities, aiming to enhance its production capacity and reduce reliance on external foundries. By doing so, Intel seeks to regain control over its supply chain and improve its ability to deliver innovative products to market. This move is expected to bolster investor confidence and, if successful, could lead to a significant uptick in the company’s stock price.

Moreover, Intel is focusing on expanding its presence in high-growth areas such as AI, 5G, and autonomous vehicles. By diversifying its product offerings and tapping into these emerging markets, Intel aims to capture new revenue streams and drive long-term growth. The company’s recent acquisitions and partnerships in these domains reflect its commitment to staying at the forefront of technological innovation.

However, achieving a stock surge akin to Nvidia’s requires more than just strategic investments and product diversification. Intel must also address the perception challenges it faces in the market. Building investor trust and demonstrating a consistent track record of innovation will be crucial in convincing stakeholders of the company’s potential for growth. Transparent communication of its progress and milestones will play a vital role in shaping market sentiment.

In conclusion, the path to securing the CEO’s stock awards is intricately linked to Intel’s ability to innovate and adapt in a rapidly evolving industry. By focusing on manufacturing excellence, expanding into high-growth sectors, and effectively communicating its vision, Intel has the potential to achieve the stock performance necessary to meet its ambitious goals. As the company navigates this transformative period, the impact of technological innovation on its stock will be a critical determinant of its success.

Investor Sentiment and Intel’s Future Prospects

Investor sentiment towards Intel has been a topic of considerable discussion, particularly in light of the ambitious stock awards tied to the performance of its CEO, Pat Gelsinger. The semiconductor giant, once a dominant force in the industry, now finds itself in a challenging position, striving to regain its competitive edge. To achieve this, Intel must emulate the remarkable surge experienced by Nvidia, a company that has set a high benchmark in the tech sector. This task, however, is fraught with complexities, given the rapidly evolving landscape of the semiconductor industry.

Intel’s current predicament can be traced back to a series of strategic missteps and intensified competition. While Nvidia has capitalized on the burgeoning demand for graphics processing units (GPUs) and artificial intelligence (AI) technologies, Intel has struggled to keep pace. The company’s delay in transitioning to advanced manufacturing processes has further exacerbated its challenges, allowing competitors to seize market share. Consequently, investor confidence has waned, reflected in the company’s stock performance, which has lagged behind its peers.

To restore investor confidence and secure the stock awards for its CEO, Intel must embark on a transformative journey. This involves not only technological advancements but also strategic realignments. The company has already initiated several measures under Gelsinger’s leadership, including a renewed focus on manufacturing capabilities and a commitment to reclaiming its position as a leader in semiconductor innovation. These efforts are crucial, as they aim to address the core issues that have hindered Intel’s growth.

Moreover, Intel’s strategic pivot towards becoming a major player in the foundry business is a significant step in the right direction. By investing in new manufacturing facilities and expanding its capacity to produce chips for other companies, Intel aims to diversify its revenue streams and reduce its reliance on traditional markets. This move is expected to not only enhance its financial performance but also position the company as a key player in the global semiconductor supply chain.

However, achieving a surge similar to Nvidia’s requires more than just strategic initiatives. It necessitates a cultural shift within the organization, fostering an environment that encourages innovation and agility. Intel must leverage its vast resources and talent pool to drive breakthroughs in areas such as AI, machine learning, and quantum computing. By doing so, the company can create new growth opportunities and capture the imagination of investors.

Furthermore, effective communication with stakeholders is paramount. Intel must articulate a clear and compelling vision for its future, outlining how it plans to navigate the challenges and capitalize on emerging trends. Transparent communication will not only build trust with investors but also galvanize support for the company’s long-term objectives.

In conclusion, while Intel faces an uphill battle to achieve a stock surge akin to Nvidia’s, it is not an insurmountable task. By executing a well-rounded strategy that encompasses technological innovation, strategic realignment, and effective stakeholder engagement, Intel can revitalize investor sentiment and secure the stock awards for its CEO. The road ahead is undoubtedly challenging, but with determination and strategic foresight, Intel has the potential to reclaim its position as a leader in the semiconductor industry.

Challenges and Opportunities for Intel in the Semiconductor Industry

Intel Corporation, a stalwart in the semiconductor industry, faces a complex landscape of challenges and opportunities as it seeks to regain its competitive edge. The company’s CEO, Pat Gelsinger, has been at the helm since February 2021, tasked with steering Intel through a transformative period. A significant aspect of his compensation package is tied to the performance of Intel’s stock, which must experience a surge akin to that of Nvidia’s recent meteoric rise to secure his stock awards. This requirement underscores the pressing need for Intel to navigate the current industry dynamics effectively.

The semiconductor industry is characterized by rapid technological advancements and fierce competition. Intel, once the undisputed leader in microprocessor manufacturing, has seen its dominance challenged by companies like AMD and Nvidia. These competitors have capitalized on Intel’s delays in transitioning to smaller, more efficient manufacturing processes. Consequently, Intel’s market share has eroded, and its stock performance has lagged behind that of its rivals. To address these challenges, Intel has embarked on an ambitious strategy to revitalize its manufacturing capabilities and product offerings.

Central to Intel’s strategy is the IDM 2.0 initiative, which aims to reestablish the company as a leader in semiconductor manufacturing. This initiative involves significant investments in expanding Intel’s manufacturing capacity, including the construction of new fabrication plants in the United States and Europe. By doing so, Intel hopes to regain control over its supply chain and reduce its reliance on external foundries. Moreover, this move aligns with broader geopolitical trends, as governments worldwide seek to bolster domestic semiconductor production to mitigate supply chain vulnerabilities.

In addition to bolstering its manufacturing capabilities, Intel is focusing on innovation to regain its competitive edge. The company is investing heavily in research and development to accelerate the transition to advanced process nodes and develop cutting-edge technologies. For instance, Intel is exploring new architectures and packaging technologies to enhance the performance and efficiency of its chips. These efforts are crucial for Intel to compete effectively in high-growth markets such as artificial intelligence, data centers, and autonomous vehicles.

However, Intel’s path to resurgence is fraught with challenges. The semiconductor industry is highly capital-intensive, and Intel’s ambitious plans require substantial financial resources. The company must balance these investments with the need to deliver returns to shareholders, a task made more difficult by the volatile nature of the industry. Furthermore, Intel faces intense competition from companies that have already established strong footholds in emerging markets. Nvidia, for example, has become a dominant player in the AI and gaming sectors, leveraging its expertise in graphics processing units to capture significant market share.

Despite these challenges, Intel’s opportunities are significant. The global demand for semiconductors continues to grow, driven by trends such as the proliferation of connected devices, the expansion of cloud computing, and the rise of artificial intelligence. Intel’s strong brand recognition and extensive customer base provide a solid foundation for growth. Additionally, the company’s strategic partnerships and collaborations with industry leaders position it well to capitalize on emerging opportunities.

In conclusion, Intel’s journey to secure a stock performance surge similar to Nvidia’s is emblematic of the broader challenges and opportunities facing the company in the semiconductor industry. By focusing on manufacturing excellence, innovation, and strategic investments, Intel aims to reclaim its leadership position and deliver value to shareholders. The coming years will be pivotal for Intel as it navigates this complex landscape, striving to achieve the growth necessary to fulfill its CEO’s stock award requirements and secure its future in the ever-evolving semiconductor industry.

Q&A

1. **What is the context of Intel’s stock performance?**

Intel’s stock performance has been under scrutiny as it seeks to recover and compete with industry leaders like Nvidia.

2. **Why is a surge in Intel’s stock important for the CEO?**

A significant increase in Intel’s stock price is necessary for the CEO to secure certain stock-based compensation awards.

3. **How does Nvidia’s stock performance compare to Intel’s?**

Nvidia has experienced a substantial surge in its stock price, driven by its leadership in AI and graphics processing technologies.

4. **What are the challenges Intel faces in achieving a stock surge?**

Intel faces challenges such as increased competition, technological advancements, and market perception.

5. **What strategies might Intel employ to boost its stock price?**

Intel may focus on innovation, strategic partnerships, and expanding its market presence to drive stock performance.

6. **What role does market perception play in Intel’s stock performance?**

Market perception significantly impacts investor confidence and can influence stock price movements.

7. **What are the potential outcomes if Intel’s stock does not surge?**

If Intel’s stock does not surge, the CEO may not receive certain stock awards, and the company might face increased pressure from investors.

Conclusion

Intel’s CEO stock awards are contingent upon the company’s stock performance reaching certain milestones, similar to the impressive surge experienced by Nvidia. For Intel to achieve this, it would require a significant increase in its stock value, driven by factors such as innovation, market expansion, and competitive positioning in the semiconductor industry. Achieving such a surge would not only secure the CEO’s stock awards but also signal strong investor confidence and potential long-term growth for the company.