“Unveiling Insights: Navigating the Depths of KKR & Co. Inc.”

Introduction

KKR & Co. Inc., a global investment firm, has established itself as a formidable player in the financial industry through its diverse portfolio and strategic investment approach. Founded in 1976 by Henry Kravis, George Roberts, and Jerome Kohlberg, KKR has evolved from a pioneering private equity firm into a multifaceted asset management company. With a focus on private equity, energy, infrastructure, real estate, and credit, KKR leverages its extensive industry expertise and global network to identify and capitalize on investment opportunities. The firm’s commitment to value creation and sustainable growth is reflected in its robust performance and ability to adapt to changing market dynamics. Through an in-depth analysis of KKR & Co. Inc., one can gain insights into its investment strategies, financial performance, and the factors contributing to its enduring success in the competitive landscape of global finance.

Historical Growth Trajectory of KKR & Co. Inc.

KKR & Co. Inc., a global investment firm renowned for its private equity prowess, has carved a significant niche in the financial world since its inception. The firm’s historical growth trajectory is a testament to its strategic acumen and adaptability in an ever-evolving market landscape. Founded in 1976 by Henry Kravis, George Roberts, and Jerome Kohlberg, KKR initially focused on leveraged buyouts, a strategy that would become synonymous with its name. The firm’s early years were marked by a series of high-profile acquisitions, which not only solidified its reputation but also set the stage for its future expansion.

As the 1980s unfolded, KKR’s aggressive acquisition strategy reached new heights with the landmark buyout of RJR Nabisco in 1989. This deal, valued at $31.4 billion, was the largest of its kind at the time and underscored KKR’s ability to orchestrate complex financial transactions. The RJR Nabisco buyout became emblematic of the era’s corporate raiding culture, yet it also highlighted KKR’s innovative approach to financing and deal structuring. This period of rapid growth and high-stakes deals established KKR as a formidable player in the private equity sector.

Transitioning into the 1990s, KKR began to diversify its investment portfolio, recognizing the need to adapt to changing market conditions. The firm expanded its focus beyond leveraged buyouts, venturing into growth capital, infrastructure, and real estate investments. This strategic diversification allowed KKR to mitigate risks associated with market volatility and economic downturns. Moreover, it enabled the firm to capitalize on emerging opportunities across various sectors, thereby enhancing its overall growth trajectory.

The turn of the millennium marked another pivotal phase in KKR’s evolution. The firm embraced globalization, extending its reach into Europe and Asia. By establishing a presence in these regions, KKR tapped into new markets and broadened its investment horizons. This global expansion was complemented by the firm’s commitment to innovation and technology, as it sought to leverage data analytics and digital tools to enhance its investment strategies. Consequently, KKR’s ability to adapt to technological advancements further bolstered its competitive edge.

In the years following the 2008 financial crisis, KKR demonstrated resilience and strategic foresight. The firm capitalized on distressed assets and undervalued opportunities, positioning itself for sustained growth in a recovering economy. Additionally, KKR’s decision to go public in 2010 marked a significant milestone, providing the firm with greater access to capital and enhancing its transparency and governance. This move not only reinforced KKR’s commitment to growth but also underscored its adaptability in navigating the complexities of the financial landscape.

As KKR entered the 2020s, it continued to evolve, focusing on environmental, social, and governance (ESG) criteria in its investment decisions. This shift reflects a broader industry trend towards sustainable investing and underscores KKR’s commitment to responsible corporate citizenship. By integrating ESG considerations into its investment framework, KKR aims to create long-term value for its stakeholders while addressing pressing global challenges.

In conclusion, the historical growth trajectory of KKR & Co. Inc. is characterized by strategic diversification, global expansion, and a commitment to innovation. From its early leveraged buyouts to its current focus on sustainable investing, KKR has consistently demonstrated an ability to adapt and thrive in a dynamic financial environment. As the firm continues to navigate the complexities of the modern market, its rich history serves as a foundation for future success.

Strategic Investment Approaches of KKR & Co. Inc.

KKR & Co. Inc., a global investment firm renowned for its strategic investment approaches, has consistently demonstrated its prowess in navigating the complex landscape of private equity and alternative asset management. Founded in 1976 by Henry Kravis, George Roberts, and Jerome Kohlberg, KKR has evolved into a formidable entity, managing a diverse portfolio that spans multiple sectors and geographies. The firm’s strategic investment approaches are characterized by a meticulous blend of deep industry expertise, rigorous due diligence, and a long-term value creation mindset.

One of the cornerstones of KKR’s investment strategy is its focus on operational improvement. Unlike traditional investment firms that may prioritize short-term financial gains, KKR emphasizes enhancing the operational efficiencies of its portfolio companies. This approach involves deploying a team of seasoned industry experts who work closely with management teams to identify areas for improvement, implement best practices, and drive sustainable growth. By fostering a culture of collaboration and innovation, KKR ensures that its investments are not only financially successful but also operationally robust.

Moreover, KKR’s strategic investment approach is underscored by its commitment to environmental, social, and governance (ESG) principles. Recognizing the growing importance of sustainable investing, KKR has integrated ESG considerations into its investment process. This commitment is reflected in the firm’s efforts to invest in companies that demonstrate strong ESG performance and to actively engage with portfolio companies to improve their ESG practices. By aligning its investment strategies with broader societal goals, KKR not only mitigates risks but also capitalizes on opportunities that arise from the global shift towards sustainability.

In addition to its focus on operational improvement and ESG integration, KKR’s investment strategy is distinguished by its global reach and sectoral diversity. The firm has established a strong presence in key markets across North America, Europe, Asia, and other regions, enabling it to capitalize on local market dynamics and emerging trends. This global footprint is complemented by a diversified investment portfolio that spans various sectors, including technology, healthcare, consumer goods, and infrastructure. By maintaining a balanced and diversified portfolio, KKR is well-positioned to weather economic fluctuations and capture growth opportunities across different industries.

Furthermore, KKR’s strategic investment approaches are supported by its robust capital-raising capabilities. The firm has a proven track record of attracting capital from a wide range of investors, including pension funds, sovereign wealth funds, and high-net-worth individuals. This strong capital base provides KKR with the financial flexibility to pursue large-scale investments and execute complex transactions. Additionally, KKR’s ability to leverage its extensive network of relationships with industry leaders, policymakers, and other stakeholders enhances its capacity to identify and execute attractive investment opportunities.

In conclusion, KKR & Co. Inc.’s strategic investment approaches are characterized by a focus on operational improvement, ESG integration, global reach, sectoral diversity, and robust capital-raising capabilities. These elements collectively enable KKR to navigate the complexities of the investment landscape and deliver long-term value to its stakeholders. As the firm continues to adapt to evolving market conditions and emerging trends, its commitment to strategic and sustainable investing remains unwavering, positioning it as a leader in the global investment arena.

Key Leadership and Management Strategies at KKR & Co. Inc.

KKR & Co. Inc., a global investment firm renowned for its private equity prowess, has long been a beacon of strategic leadership and innovative management practices. At the heart of KKR’s success lies a robust leadership framework that emphasizes adaptability, foresight, and a commitment to stakeholder value. The firm’s leadership strategies are deeply rooted in its ability to anticipate market trends and respond with agility, ensuring sustained growth and competitive advantage.

One of the key elements of KKR’s leadership strategy is its focus on cultivating a culture of ownership among its employees. By aligning the interests of its workforce with those of the firm, KKR fosters an environment where employees are motivated to think and act like owners. This is achieved through a combination of equity-based compensation and a decentralized decision-making process that empowers teams to take initiative and drive results. Consequently, this approach not only enhances employee engagement but also ensures that decision-making is closely aligned with the firm’s long-term objectives.

Moreover, KKR’s leadership places a strong emphasis on diversity and inclusion as a strategic priority. Recognizing that diverse teams are more innovative and better equipped to tackle complex challenges, KKR has implemented a range of initiatives aimed at promoting diversity across all levels of the organization. These initiatives include targeted recruitment efforts, mentorship programs, and leadership development opportunities designed to nurture a diverse pipeline of talent. By fostering an inclusive culture, KKR not only enhances its ability to attract top talent but also strengthens its capacity to deliver superior investment performance.

In addition to its internal leadership strategies, KKR is also known for its proactive approach to stakeholder engagement. The firm understands that building strong relationships with stakeholders, including investors, portfolio companies, and the communities in which it operates, is crucial to its long-term success. To this end, KKR has developed a comprehensive stakeholder engagement framework that emphasizes transparency, accountability, and collaboration. This framework includes regular communication with stakeholders, the integration of environmental, social, and governance (ESG) considerations into investment decisions, and active participation in industry initiatives aimed at promoting sustainable business practices.

Furthermore, KKR’s management strategies are characterized by a disciplined approach to investment and risk management. The firm employs a rigorous due diligence process to identify investment opportunities that align with its strategic objectives and risk appetite. This process is supported by a team of experienced professionals who bring deep industry expertise and a global perspective to the table. Once an investment is made, KKR takes an active role in managing its portfolio companies, working closely with management teams to drive operational improvements and create value. This hands-on approach not only enhances the performance of portfolio companies but also mitigates risk and maximizes returns for investors.

In conclusion, KKR & Co. Inc.’s leadership and management strategies are a testament to the firm’s commitment to excellence and innovation. By fostering a culture of ownership, promoting diversity and inclusion, engaging proactively with stakeholders, and employing a disciplined approach to investment and risk management, KKR has positioned itself as a leader in the global investment landscape. As the firm continues to navigate an ever-evolving market environment, its strategic focus on adaptability and stakeholder value will undoubtedly remain central to its ongoing success.

Financial Performance and Market Position of KKR & Co. Inc.

KKR & Co. Inc., a global investment firm renowned for its private equity operations, has consistently demonstrated robust financial performance and a formidable market position. Founded in 1976, the firm has evolved into a diversified asset manager with a broad spectrum of investment strategies, including private equity, energy, infrastructure, real estate, and credit. This diversification has been instrumental in KKR’s ability to navigate the complexities of the financial markets and maintain its competitive edge.

In recent years, KKR’s financial performance has been marked by significant growth in assets under management (AUM). As of the latest fiscal reports, the firm’s AUM has surpassed $500 billion, reflecting a compound annual growth rate that underscores its strategic acquisitions and organic growth initiatives. This impressive growth trajectory can be attributed to KKR’s adeptness at identifying lucrative investment opportunities and its disciplined approach to capital allocation. Moreover, the firm’s ability to generate substantial returns for its investors has bolstered its reputation and attracted a diverse clientele, ranging from institutional investors to high-net-worth individuals.

Transitioning to its market position, KKR has established itself as a leader in the private equity sector. The firm’s extensive experience and deep industry knowledge have enabled it to execute complex transactions and drive value creation across its portfolio companies. KKR’s investment philosophy, which emphasizes operational improvements and strategic growth initiatives, has been pivotal in enhancing the performance of its portfolio companies. This approach not only maximizes returns but also mitigates risks, thereby ensuring sustainable growth.

Furthermore, KKR’s commitment to innovation and adaptability has reinforced its market position. The firm has been proactive in embracing emerging trends, such as environmental, social, and governance (ESG) considerations, which have become increasingly important to investors. By integrating ESG factors into its investment process, KKR not only aligns with investor expectations but also contributes to the long-term sustainability of its investments. This forward-thinking approach has positioned KKR as a responsible and forward-looking investment firm, further enhancing its appeal to a broad range of stakeholders.

In addition to its private equity prowess, KKR’s expansion into other asset classes has diversified its revenue streams and reduced its reliance on any single market segment. The firm’s credit and real estate divisions, for instance, have experienced substantial growth, driven by strategic acquisitions and the development of innovative investment products. This diversification strategy has not only enhanced KKR’s financial resilience but also provided it with a competitive advantage in an increasingly dynamic market environment.

Moreover, KKR’s global footprint has been a key factor in its sustained success. With offices in major financial centers around the world, the firm has the ability to leverage local market insights and establish strong relationships with regional stakeholders. This global presence enables KKR to capitalize on cross-border investment opportunities and navigate the complexities of international markets with agility and precision.

In conclusion, KKR & Co. Inc.’s financial performance and market position are a testament to its strategic vision, operational excellence, and commitment to innovation. The firm’s ability to adapt to changing market dynamics, coupled with its diversified investment approach, has ensured its continued success and leadership in the global investment landscape. As KKR continues to evolve and expand its capabilities, it remains well-positioned to deliver value to its investors and stakeholders, reinforcing its status as a preeminent force in the financial industry.

KKR & Co. Inc.’s Role in Global Private Equity Markets

KKR & Co. Inc., a prominent player in the global private equity markets, has consistently demonstrated its prowess in navigating the complex landscape of investment management. Founded in 1976 by Henry Kravis, George Roberts, and Jerome Kohlberg, KKR has evolved into a formidable force, influencing the dynamics of private equity with its strategic investments and innovative approaches. As we delve into KKR’s role in the global private equity markets, it is essential to understand the firm’s foundational strategies and how they have adapted to the ever-changing economic environment.

Initially, KKR gained recognition for pioneering the leveraged buyout (LBO) model, a strategy that involves acquiring companies primarily through borrowed funds. This approach allowed KKR to acquire significant stakes in companies with relatively small equity investments, thereby maximizing potential returns. Over the years, KKR’s adeptness at executing LBOs has been instrumental in its growth, enabling the firm to amass a diverse portfolio across various sectors, including technology, healthcare, and consumer goods. This diversification not only mitigates risk but also positions KKR to capitalize on emerging market trends.

Moreover, KKR’s global reach is a testament to its strategic foresight and adaptability. With offices in major financial hubs such as New York, London, and Hong Kong, KKR has established a robust international presence, allowing it to tap into regional markets and identify lucrative investment opportunities. This global footprint is complemented by KKR’s deep industry expertise, which is leveraged to drive value creation in its portfolio companies. By implementing operational improvements, strategic realignments, and financial restructuring, KKR enhances the performance of its investments, ultimately delivering superior returns to its investors.

In addition to its traditional private equity operations, KKR has expanded its investment strategies to include infrastructure, real estate, and credit markets. This diversification reflects KKR’s commitment to adapting to the evolving needs of its clients and the broader market environment. By broadening its investment scope, KKR not only enhances its growth potential but also fortifies its resilience against market volatility. This strategic expansion underscores KKR’s role as a versatile and forward-thinking player in the global private equity arena.

Furthermore, KKR’s emphasis on environmental, social, and governance (ESG) factors highlights its dedication to responsible investing. Recognizing the growing importance of sustainability in investment decisions, KKR integrates ESG considerations into its investment processes, thereby aligning its objectives with the broader societal shift towards sustainable development. This commitment to ESG principles not only enhances KKR’s reputation but also positions it as a leader in promoting ethical investment practices within the private equity industry.

As we consider KKR’s impact on the global private equity markets, it is evident that the firm’s strategic acumen, global reach, and commitment to innovation have been pivotal in shaping its success. By continuously adapting to market dynamics and embracing new investment opportunities, KKR remains at the forefront of the private equity landscape. Looking ahead, KKR’s ability to navigate economic uncertainties and capitalize on emerging trends will be crucial in maintaining its influential role in the global investment community. In conclusion, KKR & Co. Inc.’s enduring legacy in the private equity markets is a testament to its strategic vision, operational excellence, and unwavering commitment to delivering value to its stakeholders.

Impact of KKR & Co. Inc.’s Investments on Industry Sectors

KKR & Co. Inc., a global investment firm renowned for its strategic acumen and financial prowess, has long been a pivotal player in shaping various industry sectors through its investments. The firm’s influence extends across a multitude of industries, including technology, healthcare, energy, and consumer goods, among others. By leveraging its extensive resources and expertise, KKR has consistently demonstrated an ability to drive growth and innovation within these sectors, thereby leaving a lasting impact on the global economic landscape.

To begin with, KKR’s investments in the technology sector have been particularly transformative. The firm has strategically targeted companies that are at the forefront of technological innovation, thereby facilitating advancements that have ripple effects across the industry. For instance, KKR’s investment in cybersecurity firms has not only bolstered the growth of these companies but also enhanced the overall security infrastructure of the digital economy. This, in turn, has instilled greater confidence among businesses and consumers alike, fostering an environment conducive to further technological advancements.

Moreover, KKR’s influence in the healthcare sector is equally noteworthy. By investing in companies that focus on cutting-edge medical research and healthcare delivery, KKR has played a crucial role in advancing medical technologies and improving patient outcomes. The firm’s commitment to this sector is evident in its support for initiatives that aim to make healthcare more accessible and affordable. Consequently, KKR’s investments have contributed to the development of innovative healthcare solutions that address some of the most pressing challenges faced by the industry today.

In addition to technology and healthcare, KKR’s investments in the energy sector have also been significant. Recognizing the global shift towards sustainable energy solutions, KKR has strategically invested in companies that are pioneering renewable energy technologies. These investments have not only accelerated the transition to cleaner energy sources but have also spurred economic growth by creating new jobs and opportunities within the sector. Furthermore, KKR’s focus on sustainability aligns with the broader global agenda of reducing carbon emissions and combating climate change, thereby underscoring the firm’s commitment to responsible investing.

The consumer goods sector has also benefited from KKR’s investment strategy. By identifying and investing in companies with strong growth potential, KKR has facilitated the expansion of consumer brands into new markets, thereby driving economic growth and enhancing consumer choice. The firm’s approach often involves working closely with management teams to optimize operations and implement strategic initiatives that enhance brand value and market presence. As a result, KKR’s investments have not only strengthened individual companies but have also contributed to the overall dynamism of the consumer goods industry.

In conclusion, KKR & Co. Inc.’s investments have had a profound impact on various industry sectors, driving innovation, growth, and sustainability. Through its strategic investments, KKR has not only enhanced the capabilities of individual companies but has also contributed to broader economic and societal advancements. As the firm continues to identify and capitalize on emerging opportunities, its influence on the global economic landscape is likely to persist, shaping the future of industries and setting new benchmarks for investment excellence.

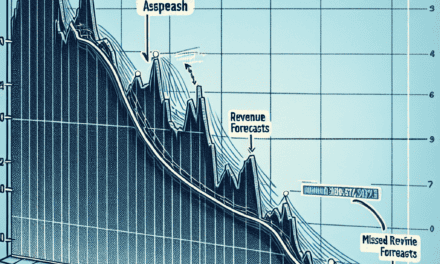

Future Outlook and Challenges for KKR & Co. Inc

KKR & Co. Inc., a global investment firm renowned for its private equity prowess, stands at a pivotal juncture as it navigates the complexities of the modern financial landscape. The future outlook for KKR is shaped by a confluence of factors, including evolving market dynamics, regulatory changes, and the firm’s strategic initiatives. As the firm continues to expand its global footprint, it faces both opportunities and challenges that will define its trajectory in the coming years.

One of the primary drivers of KKR’s future growth is its ability to adapt to shifting market conditions. The firm has demonstrated a keen aptitude for identifying lucrative investment opportunities across various sectors, including technology, healthcare, and infrastructure. By leveraging its extensive network and deep industry expertise, KKR is well-positioned to capitalize on emerging trends and innovations. However, the firm must remain vigilant in its risk assessment and management practices, as the global economic environment remains fraught with uncertainties, such as geopolitical tensions and fluctuating interest rates.

In addition to market dynamics, regulatory changes present both challenges and opportunities for KKR. The firm operates in a highly regulated industry, and compliance with evolving regulations is paramount. As governments worldwide implement stricter financial regulations to enhance transparency and accountability, KKR must ensure that its operations align with these new standards. While regulatory compliance can be resource-intensive, it also offers KKR the opportunity to differentiate itself as a responsible and ethical investment firm, thereby enhancing its reputation and attracting more investors.

Furthermore, KKR’s strategic initiatives play a crucial role in shaping its future outlook. The firm has been actively diversifying its investment portfolio to reduce reliance on traditional private equity. By expanding into areas such as credit, real estate, and infrastructure, KKR aims to create a more balanced and resilient portfolio that can withstand market volatility. This diversification strategy not only mitigates risk but also opens up new revenue streams, thereby enhancing the firm’s long-term growth prospects.

Moreover, KKR’s commitment to environmental, social, and governance (ESG) principles is increasingly becoming a focal point of its investment strategy. As investors and stakeholders place greater emphasis on sustainable and responsible investing, KKR’s integration of ESG considerations into its decision-making processes positions the firm to meet these evolving expectations. By prioritizing ESG factors, KKR not only contributes to positive societal outcomes but also enhances its appeal to a broader range of investors who are keen on aligning their investments with their values.

Despite these promising prospects, KKR faces several challenges that could impact its future performance. The competitive landscape in the investment industry is intensifying, with numerous firms vying for the same opportunities. To maintain its competitive edge, KKR must continue to innovate and differentiate itself through unique value propositions and superior execution. Additionally, the firm must navigate the complexities of global expansion, which entails understanding diverse cultural, legal, and economic environments.

In conclusion, KKR & Co. Inc. is poised for a dynamic future, driven by its strategic initiatives, adaptability to market changes, and commitment to ESG principles. While challenges such as regulatory compliance and competitive pressures persist, KKR’s proactive approach and robust investment strategies position it well to navigate these hurdles. As the firm continues to evolve and expand its global presence, its ability to balance risk and opportunity will be crucial in shaping its long-term success.

Q&A

1. **What is KKR & Co. Inc.?**

KKR & Co. Inc. is a global investment firm that

Conclusion

KKR & Co. Inc. is a leading global investment firm known for its expertise in private equity, credit, and real assets. The firm has demonstrated a strong track record of generating substantial returns for its investors through strategic acquisitions, operational improvements, and market expansion. KKR’s diversified portfolio and global presence enable it to capitalize on various market opportunities and mitigate risks. The firm’s focus on long-term value creation, coupled with its robust investment strategies and experienced management team, positions it well for sustained growth and competitive advantage in the financial industry.