“Unlocking Your Roth: Navigating the 5-Year Rule for a $900k Conversion”

Introduction

When considering a $900,000 Roth conversion, understanding the intricacies of tax implications and withdrawal rules is crucial. One common concern is the five-year rule, which dictates when converted funds can be accessed without penalties. This rule can significantly impact financial planning, especially for those nearing retirement or needing liquidity. Evaluating whether it’s necessary to wait five years before accessing converted funds involves analyzing the specifics of the Roth IRA regulations, potential penalties, and strategic financial goals. This introduction explores the considerations and strategies involved in navigating the five-year rule for a substantial Roth conversion.

Understanding the 5-Year Rule for Roth Conversions

When considering a Roth conversion, particularly one as substantial as $900,000, understanding the intricacies of the 5-year rule is crucial. This rule, often a source of confusion, plays a significant role in determining when you can access your converted funds without incurring penalties. To navigate this financial strategy effectively, it is essential to grasp the nuances of the 5-year rule and how it applies to Roth conversions.

The 5-year rule for Roth conversions is distinct from the 5-year rule for Roth IRA contributions. While both involve a five-year waiting period, they serve different purposes. For Roth conversions, the 5-year rule dictates that each conversion has its own separate 5-year clock. This means that if you convert traditional IRA funds to a Roth IRA, you must wait five years from the beginning of the year in which the conversion was made to withdraw the converted amount penalty-free, regardless of your age. This rule is designed to prevent individuals from using Roth conversions as a short-term tax avoidance strategy.

However, it is important to note that the 5-year rule for conversions only applies to the principal amount converted, not the earnings on those funds. Earnings on the converted amount are subject to a different set of rules. If you are under the age of 59½, withdrawing earnings before the 5-year period is up could result in a 10% early withdrawal penalty, in addition to income taxes on the earnings. Therefore, understanding the distinction between accessing converted amounts and earnings is vital for effective financial planning.

For those over 59½, the 5-year rule for conversions still applies, but the implications are less severe. While you can access the converted principal without penalty after five years, you can withdraw earnings tax-free if you meet the qualified distribution criteria. These criteria include having held any Roth IRA for at least five years and being over 59½, or meeting other specific conditions such as disability or first-time home purchase.

Given the complexity of these rules, it is advisable to plan Roth conversions strategically. If you anticipate needing access to the converted funds within five years, it may be prudent to stagger conversions over multiple years. This approach can help manage tax implications and ensure that you have penalty-free access to funds when needed. Additionally, consulting with a financial advisor can provide personalized guidance tailored to your unique financial situation.

Moreover, it is essential to consider the broader financial landscape when planning a Roth conversion. Factors such as current and future tax rates, retirement goals, and estate planning objectives should all be taken into account. A Roth conversion can offer significant tax advantages, particularly if you expect to be in a higher tax bracket in the future. However, the decision to convert should be made with a comprehensive understanding of both the immediate tax implications and the long-term benefits.

In conclusion, while the 5-year rule for Roth conversions may seem daunting, it is a manageable aspect of retirement planning with careful consideration and strategic planning. By understanding the rule’s application and implications, you can make informed decisions that align with your financial goals. Whether you choose to wait the full five years or employ a staggered conversion strategy, the key is to ensure that your approach is well-informed and aligned with your overall retirement objectives.

Strategies to Access Roth Funds Before 5 Years

When considering a substantial Roth conversion, such as a $900,000 transfer, understanding the nuances of accessing these funds is crucial. The Roth IRA is renowned for its tax-free growth and tax-free withdrawals in retirement, but it comes with specific rules that can impact your financial strategy. One of the most significant considerations is the five-year rule, which often raises questions about the accessibility of funds post-conversion. However, there are strategies to access Roth funds before the five-year period elapses, and understanding these can be beneficial for those who need flexibility.

The five-year rule for Roth conversions is designed to ensure that the tax advantages of a Roth IRA are used primarily for retirement savings. This rule stipulates that each conversion amount must remain in the Roth IRA for at least five years before it can be withdrawn tax-free. This is separate from the five-year rule that applies to Roth IRA contributions, which is based on the age of the account itself. For those who are under 59½, withdrawing converted amounts before the five-year period can result in a 10% early withdrawal penalty on the earnings, though the principal amount is not subject to this penalty.

Despite these restrictions, there are strategies to access Roth funds before the five-year period without incurring penalties. One such strategy involves utilizing the exceptions to the early withdrawal penalty. For instance, if you are over 59½, you can withdraw converted amounts without penalty, regardless of the five-year rule. Additionally, certain circumstances such as a first-time home purchase, qualified education expenses, or significant medical expenses can allow for penalty-free withdrawals. These exceptions provide a level of flexibility for those who may need to access their funds sooner than anticipated.

Another approach is to carefully plan the timing of your conversions. By staggering conversions over several years, you can create a laddering effect, where each conversion has its own five-year clock. This strategy allows you to access funds from earlier conversions while still adhering to the five-year rule for subsequent conversions. This method requires careful planning and a thorough understanding of your financial needs over time, but it can be an effective way to manage access to your Roth funds.

Moreover, it is essential to consider the tax implications of a large conversion. Converting $900,000 to a Roth IRA can significantly impact your tax bracket in the year of conversion. Therefore, it may be beneficial to spread the conversion over multiple years to mitigate the tax burden. This not only helps manage taxes but also aligns with the laddering strategy, providing more opportunities to access funds as needed.

In conclusion, while the five-year rule for Roth conversions may seem restrictive, there are viable strategies to access funds before this period ends. By understanding the exceptions to the penalty, planning conversions strategically, and considering the tax implications, you can effectively manage your Roth IRA to suit your financial needs. As with any significant financial decision, consulting with a financial advisor can provide personalized guidance tailored to your specific situation, ensuring that your Roth conversion aligns with your long-term financial goals.

Tax Implications of a $900k Roth Conversion

When considering a $900,000 Roth conversion, understanding the tax implications and the rules governing access to the converted funds is crucial. A Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA, which can offer significant tax advantages. However, this process is not without its complexities, particularly concerning the five-year rule, which often raises questions about when the converted funds can be accessed without penalty.

To begin with, a Roth IRA is an attractive retirement savings vehicle because it allows for tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you pay taxes on the money before it goes into the account. This upfront tax payment can be a significant consideration, especially when converting a substantial amount like $900,000. The conversion amount is added to your taxable income for the year, potentially pushing you into a higher tax bracket. Therefore, careful planning is essential to manage the tax burden effectively.

One of the primary concerns with a Roth conversion is the five-year rule, which stipulates that converted funds must remain in the Roth IRA for at least five years before they can be withdrawn without incurring a penalty. This rule is designed to prevent individuals from using Roth conversions as a short-term tax avoidance strategy. However, it is important to note that the five-year rule applies separately to each conversion. This means that if you perform multiple conversions over several years, each conversion will have its own five-year waiting period.

Despite the five-year rule, there are circumstances under which you can access your converted funds without penalty before the five-year period is up. For instance, if you are over the age of 59½, you can withdraw the converted amount without penalty, although the earnings on those conversions would still be subject to the five-year rule. Additionally, exceptions such as disability, first-time home purchase, or certain medical expenses may allow for penalty-free withdrawals.

Moreover, it is crucial to distinguish between the five-year rule for conversions and the five-year rule for contributions. The latter pertains to the tax-free withdrawal of earnings and begins with the first contribution to any Roth IRA. This rule is separate from the conversion rule and can add another layer of complexity to your retirement planning.

Given these considerations, it is advisable to consult with a financial advisor or tax professional before proceeding with a large Roth conversion. They can help you evaluate your current tax situation, project future tax implications, and develop a strategy that aligns with your long-term financial goals. Additionally, they can assist in determining whether it might be beneficial to spread the conversion over several years to mitigate the immediate tax impact.

In conclusion, while a $900,000 Roth conversion can offer significant tax advantages in the long run, it is essential to understand the associated rules and potential penalties. The five-year rule is a critical factor in determining when you can access your converted funds without penalty. By carefully planning and seeking professional guidance, you can navigate the complexities of a Roth conversion and make informed decisions that support your retirement objectives.

Benefits of a Roth Conversion for High-Net-Worth Individuals

For high-net-worth individuals, the decision to convert a traditional IRA to a Roth IRA is often driven by the potential for significant tax advantages and the strategic flexibility it offers in retirement planning. A Roth conversion involves paying taxes on the converted amount in the year of the conversion, but it allows for tax-free growth and withdrawals in the future. This can be particularly beneficial for those who anticipate being in a higher tax bracket during retirement or who wish to leave a tax-free inheritance to their heirs. However, one of the considerations that often arises in this context is the five-year rule, which can impact the timing and strategy of accessing the converted funds.

The five-year rule for Roth conversions stipulates that each conversion must be held in the Roth IRA for at least five years before the earnings can be withdrawn tax-free. This rule is separate from the five-year rule that applies to Roth IRA contributions, which is based on the date of the first contribution to any Roth IRA. For high-net-worth individuals planning a substantial conversion, such as a $900,000 Roth conversion, understanding this rule is crucial to avoid unexpected tax liabilities.

Despite the potential tax implications, the benefits of a Roth conversion can be substantial. For one, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, unlike traditional IRAs. This allows the account to grow tax-free for a longer period, which can be advantageous for those who do not need to draw on these funds immediately. Additionally, Roth IRAs can be an effective estate planning tool, as they can be passed on to heirs without the burden of income taxes, thereby preserving more wealth for future generations.

Moreover, a Roth conversion can provide a hedge against future tax rate increases. Given the uncertainty of future tax policies, locking in the current tax rate on the converted amount can be a prudent move. This is particularly relevant for high-net-worth individuals who may face higher taxes due to legislative changes aimed at increasing revenue from wealthier taxpayers.

However, the question remains: do you really need to wait five years for access to the converted funds? The answer depends on the specific circumstances and goals of the individual. If the primary objective is to maximize tax-free growth and minimize future tax liabilities, adhering to the five-year rule is advisable. On the other hand, if immediate access to the funds is necessary, it may be worth considering a partial conversion strategy or exploring other financial instruments that offer more liquidity.

In conclusion, while the five-year rule is an important consideration in the decision to undertake a Roth conversion, it should not overshadow the broader benefits that such a conversion can offer to high-net-worth individuals. By carefully evaluating their financial situation, tax implications, and long-term goals, individuals can make informed decisions that align with their retirement and estate planning objectives. Ultimately, the decision to convert should be guided by a comprehensive understanding of both the immediate and future financial landscape, ensuring that the benefits of a Roth conversion are fully realized.

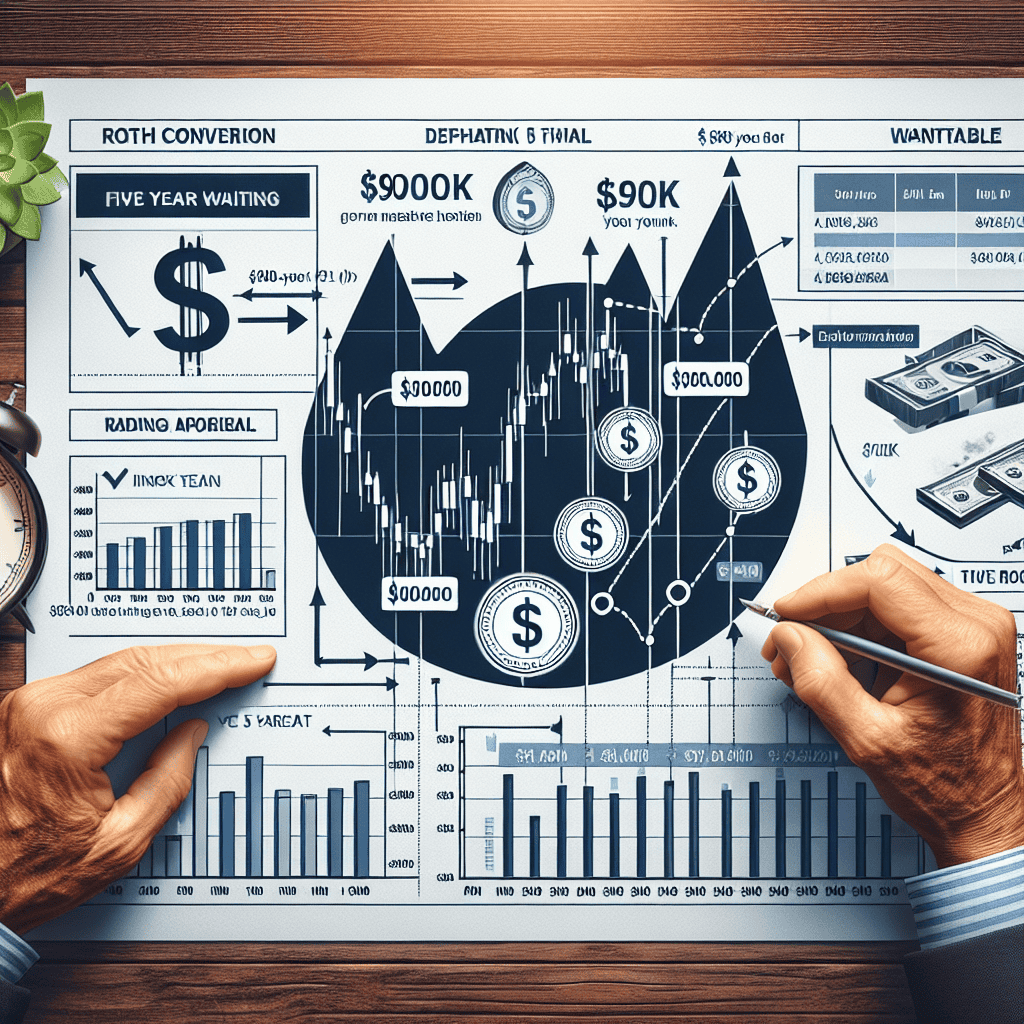

Comparing Roth Conversion Timelines and Penalties

When considering a Roth conversion, especially one as substantial as $900,000, understanding the timelines and potential penalties is crucial. A Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA, allowing for tax-free growth and withdrawals in retirement. However, the process is not without its complexities, particularly concerning the five-year rule, which often raises questions about accessibility and penalties.

The five-year rule is a critical component of Roth conversions, designed to prevent individuals from exploiting the tax-free withdrawal benefits of a Roth IRA immediately after conversion. Essentially, this rule mandates that converted funds must remain in the Roth IRA for at least five years before they can be withdrawn without incurring penalties. This stipulation applies to each conversion separately, meaning that if you convert funds in multiple years, each conversion has its own five-year timeline.

However, it is important to distinguish between the five-year rule for conversions and the five-year rule for contributions. The latter pertains to the initial five-year period starting with the first contribution to any Roth IRA, which determines when earnings can be withdrawn tax-free. In contrast, the five-year rule for conversions specifically addresses the penalty-free withdrawal of converted amounts, not the earnings on those amounts.

Despite the seemingly rigid nature of the five-year rule, there are exceptions that can mitigate potential penalties. For instance, if you are over the age of 59½, the 10% early withdrawal penalty does not apply to converted amounts, even if the five-year period has not been met. This exception provides a degree of flexibility for older individuals considering a Roth conversion, allowing them to access their funds without penalty, provided they adhere to other IRS guidelines.

Moreover, understanding the tax implications of a Roth conversion is essential. Converting $900,000 in a single year could significantly impact your tax bracket, resulting in a substantial tax bill. Therefore, it may be prudent to consider a phased approach, spreading the conversion over several years to manage the tax burden more effectively. This strategy not only helps in minimizing immediate tax liabilities but also aligns with the staggered nature of the five-year rule, as each conversion will have its own timeline.

In addition to tax considerations, evaluating your financial goals and retirement timeline is vital. If you anticipate needing access to the converted funds within five years, it may be worth exploring alternative strategies. For example, maintaining a portion of your retirement savings in a traditional IRA or 401(k) could provide the liquidity needed without triggering penalties.

Ultimately, the decision to proceed with a $900,000 Roth conversion should be informed by a comprehensive understanding of the five-year rule, potential penalties, and tax implications. Consulting with a financial advisor or tax professional can provide personalized guidance, ensuring that your conversion strategy aligns with your long-term financial objectives. By carefully weighing these factors, you can make an informed decision that maximizes the benefits of a Roth conversion while minimizing potential drawbacks.

Financial Planning Considerations for Large Roth Conversions

When considering a substantial Roth conversion, such as a $900,000 transfer, it is crucial to understand the financial planning implications and the rules governing access to the converted funds. A Roth conversion involves transferring assets from a traditional IRA or 401(k) into a Roth IRA, which can offer significant tax advantages. However, one of the primary concerns for individuals contemplating this move is the five-year rule, which dictates when the converted funds can be accessed without penalty.

The five-year rule is a critical component of Roth IRA conversions. It stipulates that each conversion amount must remain in the Roth IRA for at least five years before it can be withdrawn without incurring a 10% early withdrawal penalty. This rule is separate from the five-year rule that applies to Roth IRA contributions, which determines when earnings can be withdrawn tax-free. Therefore, understanding the nuances of these rules is essential for effective financial planning.

For those planning a large conversion, the five-year rule can seem daunting, especially if access to the funds is needed sooner. However, it is important to note that the five-year period begins on January 1 of the year in which the conversion is made, potentially shortening the wait time depending on when the conversion occurs. This timing aspect can be strategically used to minimize the waiting period.

Moreover, it is worth considering the tax implications of a large conversion. Converting $900,000 in a single year could push an individual into a higher tax bracket, resulting in a significant tax bill. To mitigate this, some financial advisors recommend spreading the conversion over several years, thereby managing the tax impact more effectively. This approach not only eases the immediate tax burden but also allows for more flexibility in accessing funds, as each conversion will have its own five-year timeline.

In addition to tax considerations, individuals should evaluate their current and future financial needs. If immediate access to funds is necessary, it may be prudent to convert only a portion of the assets, leaving some in a traditional IRA or 401(k) for liquidity. This strategy ensures that funds are available without penalty while still taking advantage of the long-term benefits of a Roth IRA.

Furthermore, it is essential to consider the overall financial goals and retirement plans. A Roth conversion can be a powerful tool for estate planning, as Roth IRAs do not require minimum distributions during the account holder’s lifetime, allowing the funds to grow tax-free for a longer period. This feature can be particularly advantageous for those looking to leave a legacy for heirs.

In conclusion, while the five-year rule may initially seem restrictive, careful planning and strategic timing can alleviate some of the concerns associated with accessing converted funds. By considering the tax implications, evaluating financial needs, and aligning the conversion with long-term goals, individuals can make informed decisions that enhance their financial well-being. Consulting with a financial advisor can provide personalized guidance, ensuring that the conversion aligns with both current circumstances and future aspirations.

Alternatives to Roth Conversions for Immediate Access

When considering a $900,000 Roth conversion, the allure of tax-free growth and withdrawals in retirement is undeniable. However, the five-year rule associated with Roth IRAs can be a significant concern for those seeking immediate access to their funds. This rule stipulates that for earnings to be withdrawn tax-free, the Roth IRA must be held for at least five years. While this waiting period may seem daunting, there are alternative strategies that can provide more immediate access to funds without incurring penalties.

One such alternative is the use of a traditional IRA or 401(k) with a strategy known as a “72(t) distribution.” This method allows for substantially equal periodic payments (SEPPs) to be taken from a retirement account before the age of 59½ without incurring the typical 10% early withdrawal penalty. By carefully calculating these distributions, individuals can access their funds while still maintaining a level of tax efficiency. However, it is crucial to adhere strictly to IRS guidelines, as any deviation can result in penalties and additional taxes.

Another option to consider is the use of a taxable brokerage account. While contributions to these accounts are made with after-tax dollars, they offer the advantage of no withdrawal restrictions. This flexibility can be particularly beneficial for those who anticipate needing access to their funds in the short term. Moreover, with strategic tax planning, such as tax-loss harvesting, individuals can potentially offset some of the tax liabilities associated with capital gains.

For those who are still employed, a loan from a 401(k) plan might be a viable solution. Many employer-sponsored retirement plans allow participants to borrow against their account balance, typically up to 50% or $50,000, whichever is less. This option provides immediate access to funds without triggering taxes or penalties, provided the loan is repaid within the specified timeframe. However, it is important to consider the potential impact on retirement savings growth, as borrowed funds are temporarily removed from the investment pool.

Additionally, health savings accounts (HSAs) can serve as a dual-purpose tool for both healthcare expenses and retirement savings. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. For those with high-deductible health plans, maximizing HSA contributions can provide a source of funds that can be accessed at any time for medical needs, thereby preserving other retirement assets.

Lastly, for individuals who are charitably inclined, a qualified charitable distribution (QCD) from a traditional IRA can be an effective way to meet required minimum distributions (RMDs) while supporting charitable causes. Although this does not provide direct access to funds for personal use, it can reduce taxable income and potentially lower the overall tax burden, thereby indirectly preserving other assets for immediate needs.

In conclusion, while the five-year rule for Roth conversions may initially seem restrictive, there are several alternative strategies that can provide more immediate access to funds. By exploring options such as 72(t) distributions, taxable brokerage accounts, 401(k) loans, health savings accounts, and qualified charitable distributions, individuals can tailor their financial strategies to meet both short-term liquidity needs and long-term retirement goals. Each option comes with its own set of considerations and potential trade-offs, making it essential to consult with a financial advisor to determine the most appropriate course of action based on individual circumstances.

Q&A

1. **What is a Roth conversion?**

A Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA, where future withdrawals can be tax-free.

2. **Why consider a Roth conversion?**

It can provide tax-free growth and withdrawals, potentially reducing future tax liabilities and offering estate planning benefits.

3. **What is the 5-year rule for Roth conversions?**

Each Roth conversion has its own 5-year waiting period before earnings can be withdrawn tax-free, starting January 1 of the conversion year.

4. **Does the 5-year rule apply to contributions?**

No, the 5-year rule applies to earnings on converted amounts, not to the principal amount converted.

5. **Are there exceptions to the 5-year rule?**

Yes, exceptions include reaching age 59½, disability, or using up to $10,000 for a first-time home purchase.

6. **What happens if you withdraw before 5 years?**

Withdrawing earnings before the 5-year period may result in taxes and a 10% penalty unless an exception applies.

7. **Is it necessary to wait 5 years for access to converted funds?**

No, you can access the converted principal at any time without penalty, but earnings are subject to the 5-year rule.

Conclusion

A $900k Roth conversion involves transferring funds from a traditional IRA to a Roth IRA, which can offer tax-free growth and withdrawals in retirement. However, the IRS imposes a five-year rule on Roth conversions, meaning that each converted amount must remain in the Roth IRA for at least five years before it can be withdrawn tax-free, regardless of the account holder’s age. This rule is separate from the five-year rule for Roth IRA contributions. If you withdraw converted funds before the five-year period and are under 59½, you may face a 10% penalty on the earnings. Therefore, if you anticipate needing access to these funds within five years, it may be prudent to reconsider the timing or amount of the conversion to avoid potential penalties.