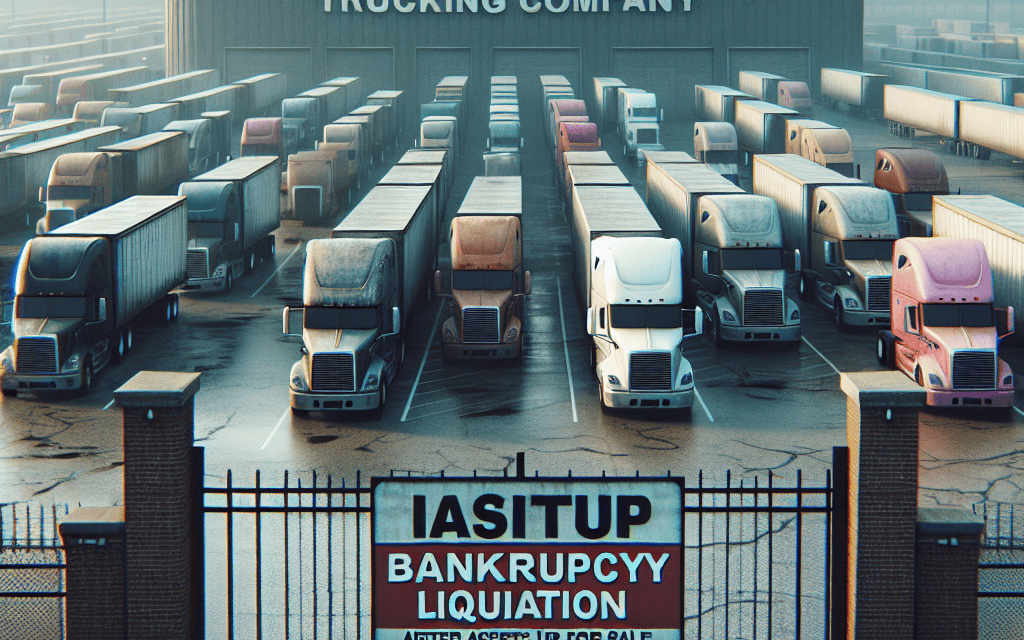

“Illinois Trucking Firm Hits the Brakes: Seeks Bankruptcy Liquidation After Closure”

Introduction

Illinois-based trucking company, once a key player in the regional transportation sector, has filed for bankruptcy liquidation following its recent closure. The firm, which had been operational for several decades, cited financial difficulties exacerbated by rising operational costs, regulatory challenges, and a competitive market landscape as primary reasons for its downfall. The decision to seek liquidation marks the end of an era for the company, which had built a reputation for reliable freight services across the Midwest. The bankruptcy filing aims to address outstanding debts and obligations, providing a structured process for asset distribution among creditors. This development highlights the ongoing challenges faced by the trucking industry, including fluctuating fuel prices and evolving logistics demands.

Impact Of Bankruptcy On Illinois Trucking Industry

The recent announcement of an Illinois trucking firm seeking bankruptcy liquidation has sent ripples through the state’s trucking industry, highlighting the broader challenges faced by the sector. This development underscores the financial vulnerabilities that many trucking companies encounter, particularly in a market that is increasingly competitive and fraught with economic uncertainties. As the firm moves towards liquidation, the implications for the local economy and the trucking industry at large are significant, warranting a closer examination of the factors contributing to this outcome and the potential repercussions.

Firstly, the closure of the Illinois trucking firm is emblematic of the financial pressures that have been mounting within the industry. Rising operational costs, including fuel prices, maintenance expenses, and regulatory compliance, have placed a considerable strain on trucking companies. These costs, coupled with fluctuating demand for freight services, have created a challenging environment for firms striving to maintain profitability. In this context, the decision to seek bankruptcy liquidation reflects an inability to sustain operations amidst these financial burdens.

Moreover, the impact of this bankruptcy extends beyond the immediate financial concerns of the firm itself. The closure of a trucking company can have a cascading effect on the local economy, affecting not only the employees who face job losses but also the businesses and industries that rely on trucking services for the transportation of goods. The disruption in logistics and supply chains can lead to delays and increased costs for businesses, ultimately affecting consumers as well. This interconnectedness highlights the critical role that trucking firms play in the broader economic landscape.

In addition to the economic implications, the bankruptcy of the Illinois trucking firm raises questions about the structural challenges within the industry. The trucking sector is characterized by intense competition, with numerous small and medium-sized enterprises vying for market share. This competitive pressure can lead to price wars, further squeezing profit margins and making it difficult for companies to invest in necessary upgrades and innovations. As a result, firms that are unable to adapt to changing market conditions may find themselves at a disadvantage, as evidenced by the recent bankruptcy filing.

Furthermore, the situation underscores the importance of strategic planning and financial management within the trucking industry. Companies must navigate a complex array of factors, including regulatory changes, technological advancements, and shifting consumer preferences. Those that can effectively manage these challenges are more likely to achieve long-term sustainability. However, for firms that lack the resources or expertise to do so, the risk of financial distress remains high.

In conclusion, the bankruptcy liquidation of the Illinois trucking firm serves as a stark reminder of the vulnerabilities that exist within the trucking industry. While the immediate impact is felt by the firm and its stakeholders, the broader implications for the industry and the economy cannot be overlooked. As the sector continues to evolve, it is imperative for trucking companies to adopt strategies that enhance resilience and adaptability. By doing so, they can better position themselves to navigate the complexities of the market and contribute to a more stable and robust economic environment.

Reasons Behind The Closure Of Illinois Trucking Firm

The recent announcement of an Illinois trucking firm seeking bankruptcy liquidation has sent ripples through the transportation industry, raising questions about the underlying reasons for its closure. This development underscores the multifaceted challenges that trucking companies face in today’s economic landscape. To understand the factors contributing to this unfortunate outcome, it is essential to examine the broader context in which the firm operated, as well as the specific challenges it encountered.

Firstly, the trucking industry has been grappling with a series of economic pressures that have intensified over recent years. Rising fuel costs have been a significant burden, as they directly impact operational expenses. For many trucking firms, fuel constitutes a substantial portion of their overall costs, and fluctuations in fuel prices can severely affect profitability. In the case of the Illinois trucking firm, sustained high fuel prices likely strained its financial resources, making it difficult to maintain competitive pricing while covering operational costs.

Moreover, the industry has been experiencing a persistent shortage of qualified drivers, which has exacerbated operational challenges. The demand for freight transportation has been on the rise, yet the supply of drivers has not kept pace. This shortage has forced companies to increase wages and offer additional incentives to attract and retain drivers, further inflating operational costs. The Illinois firm, like many others, may have struggled to balance these increased labor costs with the need to remain competitive in a crowded market.

In addition to these economic pressures, regulatory changes have also played a role in shaping the operational landscape for trucking companies. Stricter regulations regarding emissions and safety standards have necessitated significant investments in fleet upgrades and compliance measures. While these regulations are crucial for ensuring environmental sustainability and safety, they also impose additional financial burdens on companies, particularly smaller firms with limited capital reserves. The Illinois trucking firm may have found it challenging to meet these regulatory demands while maintaining financial stability.

Furthermore, the firm faced intense competition from both established players and new entrants in the market. The trucking industry is characterized by thin profit margins, and companies must continuously innovate and optimize their operations to stay ahead. Larger firms often benefit from economies of scale, allowing them to offer more competitive pricing and absorb market fluctuations more effectively. For smaller firms, like the one in Illinois, competing against such giants can be daunting, especially when compounded by the aforementioned economic and regulatory pressures.

Additionally, the advent of technology and digital platforms has transformed the logistics and transportation sector. While these innovations offer opportunities for increased efficiency and improved customer service, they also require significant investment in technology infrastructure and training. Companies that fail to adapt to these technological advancements risk falling behind. The Illinois trucking firm may have struggled to keep pace with these changes, further contributing to its financial difficulties.

In conclusion, the closure of the Illinois trucking firm seeking bankruptcy liquidation is a reflection of the complex interplay of economic, regulatory, and competitive challenges facing the industry. Rising fuel costs, driver shortages, regulatory compliance, intense competition, and technological advancements have collectively created a challenging environment for trucking companies. While these factors are not insurmountable, they require strategic planning, adaptability, and investment to navigate successfully. The case of the Illinois firm serves as a poignant reminder of the need for resilience and innovation in an ever-evolving industry landscape.

Legal Process Of Bankruptcy Liquidation For Trucking Companies

In the complex world of business, the trucking industry stands as a vital component of the supply chain, ensuring the seamless movement of goods across vast distances. However, like any other sector, it is not immune to financial challenges. Recently, an Illinois-based trucking firm has found itself at the crossroads of financial distress, seeking bankruptcy liquidation following its closure. This development underscores the intricate legal process that trucking companies must navigate when facing insolvency.

Bankruptcy liquidation, often referred to as Chapter 7 bankruptcy, is a legal procedure that allows a company to wind down its operations and distribute its remaining assets to creditors. For trucking companies, this process can be particularly intricate due to the nature of their assets, which often include a fleet of vehicles, equipment, and real estate. The decision to pursue liquidation typically follows an exhaustive evaluation of the company’s financial health, where it becomes evident that reorganization or continued operation is not feasible.

The initial step in the bankruptcy liquidation process involves the filing of a petition with the bankruptcy court. This petition serves as a formal declaration of the company’s insolvency and initiates the legal proceedings. Once the petition is filed, an automatic stay is enacted, halting all collection activities by creditors. This provides the company with temporary relief from financial pressures, allowing it to focus on the orderly liquidation of its assets.

Subsequently, a trustee is appointed by the court to oversee the liquidation process. The trustee’s primary responsibility is to manage the sale of the company’s assets and ensure that the proceeds are distributed equitably among creditors. In the context of a trucking firm, this often involves the appraisal and sale of trucks, trailers, and other equipment. The trustee must also address any outstanding contracts or leases, which may require negotiation or termination.

Throughout the liquidation process, transparency and adherence to legal protocols are paramount. The trustee is required to provide regular reports to the court, detailing the progress of asset sales and the distribution of funds. Creditors are also given the opportunity to file claims against the company’s estate, asserting their right to a portion of the liquidation proceeds. The priority of these claims is determined by bankruptcy law, with secured creditors typically receiving precedence over unsecured creditors.

As the liquidation progresses, the trucking company must also address any regulatory obligations. This may include the cancellation of permits and licenses, as well as the resolution of any environmental or safety issues related to its operations. Compliance with these requirements is essential to avoid potential legal complications that could arise during or after the liquidation process.

Ultimately, the goal of bankruptcy liquidation is to maximize the value of the company’s assets for the benefit of its creditors. However, it also marks the end of the company’s operations, resulting in the loss of jobs and the cessation of services. For the Illinois trucking firm in question, this outcome reflects the harsh realities of financial insolvency and the challenges faced by businesses in a competitive and often volatile industry.

In conclusion, the bankruptcy liquidation of a trucking company involves a multifaceted legal process that requires careful management and adherence to established protocols. While it provides a mechanism for addressing insolvency, it also highlights the broader economic and social impacts of business closures. As such, it serves as a reminder of the importance of financial prudence and strategic planning in the ever-evolving landscape of the trucking industry.

Economic Consequences Of Trucking Firm Closures In Illinois

The recent announcement of an Illinois trucking firm seeking bankruptcy liquidation following its closure has sent ripples through the local economy, highlighting the broader economic consequences of such events. The trucking industry, a vital component of the American supply chain, plays a crucial role in the transportation of goods across the nation. When a firm within this sector shutters its operations, the effects are felt not only by the employees and stakeholders directly involved but also by the communities and industries that rely on its services.

Firstly, the immediate impact of a trucking firm’s closure is the loss of jobs. Employees, ranging from drivers to administrative staff, find themselves suddenly unemployed, which can lead to financial instability for many families. This loss of income affects local economies as consumer spending decreases, leading to a potential downturn in business for local retailers and service providers. Moreover, the ripple effect extends to suppliers and contractors who depended on the trucking firm for their business, potentially leading to further job losses and financial strain.

In addition to the direct impact on employment, the closure of a trucking firm can disrupt supply chains. Businesses that relied on the firm for the transportation of goods may face delays and increased costs as they scramble to find alternative logistics solutions. This disruption can be particularly challenging for industries that operate on tight schedules or rely on just-in-time delivery systems. Consequently, the increased costs and logistical challenges can lead to higher prices for consumers, further exacerbating the economic impact.

Furthermore, the bankruptcy liquidation process itself can have significant economic implications. As the firm’s assets are sold off to pay creditors, there is often a devaluation of these assets, which can result in financial losses for investors and lenders. This devaluation can also affect the broader market, as it may lead to a decrease in confidence among investors in the trucking industry or related sectors. Additionally, the legal and administrative costs associated with the bankruptcy process can be substantial, further diminishing the financial returns for creditors and stakeholders.

The closure of a trucking firm also has implications for state and local governments. With the loss of jobs and decreased business activity, there is a corresponding reduction in tax revenues. This decline in revenue can strain public services and infrastructure, particularly in communities that are heavily reliant on the trucking industry. Moreover, governments may face increased demand for social services, such as unemployment benefits and job retraining programs, as they work to support displaced workers.

In light of these economic consequences, it is crucial for policymakers and industry leaders to consider strategies to mitigate the impact of trucking firm closures. This may include providing support for affected workers through job placement and retraining programs, as well as fostering a business environment that encourages innovation and resilience within the trucking industry. Additionally, efforts to strengthen supply chain networks and improve infrastructure can help reduce the vulnerability of businesses and communities to such disruptions.

In conclusion, the closure of an Illinois trucking firm seeking bankruptcy liquidation underscores the far-reaching economic consequences of such events. From job losses and supply chain disruptions to decreased tax revenues and market confidence, the impact is felt across multiple levels of the economy. As the industry continues to navigate challenges, it is imperative to address these issues proactively to ensure the stability and resilience of both the trucking sector and the broader economy.

Future Prospects For Employees Of Bankrupt Trucking Firms

The recent announcement of an Illinois trucking firm seeking bankruptcy liquidation after its closure has sent ripples through the industry, raising concerns about the future prospects for employees affected by such developments. As the trucking industry grapples with economic fluctuations, regulatory changes, and evolving market demands, the closure of a firm can have profound implications for its workforce. Employees of bankrupt trucking firms often face a challenging transition, as they must navigate the uncertainties of unemployment while seeking new opportunities in a competitive job market.

In the immediate aftermath of a firm’s closure, employees are confronted with the daunting task of securing alternative employment. The trucking industry, while vast, is not immune to the broader economic conditions that influence job availability. Consequently, displaced workers may find themselves competing for a limited number of positions, particularly in regions where the industry is already saturated. However, the demand for skilled drivers and logistics professionals remains relatively robust, offering a glimmer of hope for those seeking to re-enter the workforce.

To enhance their employability, former employees of bankrupt trucking firms may consider pursuing additional training or certifications. The industry is increasingly embracing technological advancements, such as telematics and automated systems, which require a workforce adept in these new tools. By acquiring relevant skills, individuals can position themselves as valuable assets to potential employers, thereby improving their chances of securing stable employment. Moreover, some states offer workforce development programs specifically designed to assist displaced workers in acquiring new skills and transitioning to different sectors.

Networking also plays a crucial role in the job search process. Former employees are encouraged to leverage professional networks, industry associations, and social media platforms to connect with potential employers and stay informed about job openings. Engaging with industry events and forums can provide valuable insights into emerging trends and opportunities, enabling individuals to make informed decisions about their career paths. Additionally, maintaining relationships with former colleagues and supervisors can lead to referrals and recommendations, which are often instrumental in securing new positions.

While the immediate focus for many employees is finding new employment, it is equally important to consider long-term career prospects. The trucking industry is undergoing significant transformations, driven by technological innovations and shifting consumer preferences. As a result, there is a growing demand for professionals who can adapt to these changes and contribute to the industry’s evolution. Employees who embrace lifelong learning and remain open to new opportunities are more likely to thrive in this dynamic environment.

Furthermore, the closure of a trucking firm can serve as a catalyst for some individuals to explore entrepreneurial ventures. With experience and industry knowledge, former employees may choose to establish their own businesses, whether in logistics, freight brokerage, or related fields. While entrepreneurship entails its own set of challenges, it also offers the potential for greater autonomy and financial rewards.

In conclusion, the closure of an Illinois trucking firm and its subsequent bankruptcy liquidation present significant challenges for its employees. However, by proactively seeking new opportunities, acquiring relevant skills, and leveraging professional networks, displaced workers can navigate this transition and secure a brighter future. As the trucking industry continues to evolve, those who remain adaptable and forward-thinking will be well-positioned to capitalize on emerging trends and opportunities, ensuring their long-term success in a competitive landscape.

Lessons Learned From The Illinois Trucking Firm’s Bankruptcy

The recent bankruptcy liquidation of an Illinois trucking firm has sent ripples through the transportation industry, offering a sobering reminder of the challenges that can beset even well-established companies. As the firm shutters its operations, stakeholders and industry observers are left to ponder the lessons that can be gleaned from this unfortunate turn of events. The closure underscores the importance of adaptability, financial prudence, and strategic foresight in navigating the complex landscape of the trucking industry.

One of the primary lessons from the firm’s bankruptcy is the critical need for adaptability in an ever-evolving market. The trucking industry is subject to a myriad of external pressures, including fluctuating fuel prices, regulatory changes, and technological advancements. Companies that fail to adapt to these changes risk obsolescence. In this case, the Illinois firm may have struggled to keep pace with industry innovations, such as the integration of digital logistics platforms and the shift towards more sustainable practices. By not embracing these changes, the firm potentially lost its competitive edge, highlighting the necessity for companies to remain agile and forward-thinking.

Moreover, the financial challenges faced by the firm illuminate the importance of maintaining robust financial health. The trucking industry is capital-intensive, with significant investments required for fleet maintenance, fuel, and labor costs. Effective financial management is crucial to ensure liquidity and operational stability. The firm’s bankruptcy suggests that it may have encountered cash flow issues or unsustainable debt levels, which ultimately led to its downfall. This serves as a cautionary tale for other companies to prioritize financial discipline, regularly assess their financial strategies, and be prepared to make difficult decisions to safeguard their fiscal health.

In addition to financial prudence, strategic foresight is essential for long-term success. The Illinois firm’s closure may have been precipitated by a lack of strategic planning or an inability to anticipate market trends. In a competitive industry, companies must continuously evaluate their business models and explore new opportunities for growth. This includes diversifying service offerings, expanding into new markets, and investing in technology to enhance operational efficiency. By failing to adopt a proactive approach, the firm may have missed opportunities to pivot or innovate, ultimately contributing to its demise.

Furthermore, the firm’s bankruptcy highlights the significance of effective leadership and governance. Strong leadership is vital in steering a company through turbulent times and making informed decisions that align with the organization’s long-term vision. The challenges faced by the Illinois firm may have been exacerbated by leadership shortcomings, whether in strategic decision-making or in fostering a resilient organizational culture. This underscores the need for companies to cultivate leaders who possess the skills and foresight to navigate complex challenges and drive sustainable growth.

In conclusion, the bankruptcy liquidation of the Illinois trucking firm serves as a poignant reminder of the multifaceted challenges that companies in the transportation industry must navigate. By examining the factors that contributed to the firm’s closure, industry stakeholders can glean valuable insights into the importance of adaptability, financial prudence, strategic foresight, and effective leadership. As the industry continues to evolve, these lessons will be crucial for companies seeking to thrive in an increasingly competitive and dynamic environment.

Strategies For Financial Recovery In The Trucking Sector

In the ever-evolving landscape of the trucking industry, financial stability remains a critical concern for many companies. The recent closure and subsequent bankruptcy liquidation filing of an Illinois trucking firm underscores the challenges faced by businesses in this sector. As the industry grapples with fluctuating fuel prices, regulatory changes, and economic uncertainties, it becomes imperative for trucking companies to adopt effective strategies for financial recovery and sustainability.

One of the primary strategies for financial recovery in the trucking sector is cost management. Companies must meticulously analyze their operational expenses to identify areas where costs can be reduced without compromising service quality. This involves scrutinizing fuel consumption, maintenance expenses, and administrative overheads. By implementing fuel-efficient practices and investing in technology that optimizes route planning, trucking firms can significantly cut down on fuel costs, which often constitute a substantial portion of their expenditures.

Moreover, diversifying revenue streams can provide a buffer against economic downturns. Trucking companies can explore opportunities beyond traditional freight services, such as offering logistics consulting or expanding into warehousing and distribution. By broadening their service offerings, firms can tap into new markets and reduce their reliance on a single source of income. This diversification not only enhances financial resilience but also positions companies to capitalize on emerging trends in the logistics industry.

In addition to cost management and revenue diversification, leveraging technology is crucial for financial recovery. The adoption of advanced telematics systems and data analytics can provide valuable insights into fleet performance and operational efficiency. By harnessing these technologies, trucking companies can make informed decisions that enhance productivity and reduce unnecessary expenditures. Furthermore, investing in automation and digital platforms can streamline administrative processes, leading to cost savings and improved customer service.

Another vital aspect of financial recovery is maintaining strong relationships with stakeholders. Open communication with creditors, suppliers, and customers can facilitate negotiations for more favorable terms and conditions. Building trust and demonstrating a commitment to financial responsibility can lead to extended credit lines or renegotiated contracts, providing much-needed liquidity during challenging times. Additionally, fostering a positive company culture and investing in employee training can enhance workforce morale and productivity, contributing to overall financial health.

While these strategies are essential, it is equally important for trucking companies to remain adaptable and forward-thinking. The industry is subject to rapid changes, driven by technological advancements and shifting consumer demands. Companies must stay informed about industry trends and be willing to pivot their business models to align with new opportunities. This proactive approach can help firms anticipate challenges and position themselves for long-term success.

In conclusion, the closure of the Illinois trucking firm serves as a stark reminder of the financial vulnerabilities that can beset companies in the trucking sector. However, by implementing effective cost management practices, diversifying revenue streams, leveraging technology, and maintaining strong stakeholder relationships, trucking companies can navigate financial challenges and achieve sustainable recovery. As the industry continues to evolve, adaptability and strategic planning will be key to ensuring the financial resilience and growth of trucking firms in the future.

Q&A

1. **What is the name of the Illinois trucking firm seeking bankruptcy liquidation?**

– The name of the firm is not specified in the provided context.

2. **Why is the Illinois trucking firm seeking bankruptcy liquidation?**

– The firm is seeking bankruptcy liquidation due to financial difficulties that led to its closure.

3. **When did the Illinois trucking firm close its operations?**

– The specific date of closure is not provided in the context.

4. **What type of bankruptcy is the Illinois trucking firm filing for?**

– The firm is filing for bankruptcy liquidation, which typically refers to Chapter 7 bankruptcy.

5. **How has the closure of the Illinois trucking firm affected its employees?**

– The closure likely resulted in job losses for the firm’s employees, though specific details are not provided.

6. **What impact does the bankruptcy of the Illinois trucking firm have on its creditors?**

– Creditors may face financial losses as they might not recover the full amounts owed to them.

7. **Are there any legal proceedings associated with the bankruptcy of the Illinois trucking firm?**

– Bankruptcy filings typically involve legal proceedings, but specific details about any ongoing cases are not provided.

Conclusion

The Illinois trucking firm’s decision to seek bankruptcy liquidation following its closure highlights the significant challenges faced by the transportation industry, including fluctuating fuel costs, regulatory pressures, and competitive market dynamics. This move underscores the financial difficulties that can arise from operational inefficiencies and market volatility, ultimately leading to the cessation of business operations. The liquidation process will aim to address outstanding debts and obligations, providing a structured resolution for creditors and stakeholders. This case serves as a reminder of the importance of strategic financial management and adaptability in sustaining business viability within the trucking sector.