“From Silicon Dreams to Market Realities: Watch Your Nvidia IPO Investment Soar!”

Introduction

Investing in Nvidia during its initial public offering (IPO) in 1999 could have been a remarkably lucrative decision, given the company’s impressive growth trajectory over the years. Nvidia, a leader in graphics processing technology, has seen its stock price soar as it expanded its influence beyond gaming into areas like artificial intelligence, data centers, and autonomous vehicles. Initially priced at $12 per share, Nvidia’s stock has experienced significant appreciation, driven by its innovative product offerings and strategic market positioning. This growth reflects the company’s ability to capitalize on emerging technology trends and its commitment to research and development. As a result, early investors who held onto their shares have witnessed substantial returns, underscoring the potential long-term benefits of investing in pioneering tech companies.

Understanding The Nvidia IPO: A Historical Overview

Nvidia Corporation, a name synonymous with cutting-edge graphics technology and artificial intelligence, has become a titan in the tech industry. To understand the remarkable growth of an investment in Nvidia since its initial public offering (IPO), it is essential to delve into the historical context of the company’s market debut and subsequent evolution. Nvidia went public on January 22, 1999, at a time when the technology sector was experiencing rapid expansion and the dot-com bubble was nearing its peak. The IPO was priced at $12 per share, and the company raised approximately $42 million, a modest sum by today’s standards but significant for a company that was then primarily known for its graphics processing units (GPUs).

In the years following its IPO, Nvidia’s growth trajectory was influenced by several key factors. Initially, the company’s focus on developing high-performance GPUs for gaming and professional visualization applications allowed it to carve out a niche in a burgeoning market. As the demand for more sophisticated graphics in video games and professional applications grew, Nvidia’s innovative products gained traction, leading to increased revenue and market share. This period of growth was further bolstered by the company’s strategic decision to expand its product offerings beyond gaming, venturing into areas such as data centers, artificial intelligence, and autonomous vehicles.

Transitioning into the mid-2000s, Nvidia’s stock experienced fluctuations, reflecting broader market trends and the company’s own strategic shifts. However, the introduction of the CUDA platform in 2006 marked a turning point. CUDA enabled developers to harness the parallel processing power of Nvidia’s GPUs for a wide range of applications beyond graphics, including scientific research and machine learning. This innovation positioned Nvidia as a leader in the emerging field of general-purpose GPU computing, setting the stage for future growth.

As the 2010s unfolded, Nvidia’s stock began to reflect the company’s expanding influence in the tech industry. The rise of artificial intelligence and machine learning created new opportunities for Nvidia’s GPU technology, which was ideally suited for the computational demands of these fields. Consequently, Nvidia’s stock price soared, driven by strong financial performance and strategic partnerships with major tech companies. By the end of the decade, Nvidia had firmly established itself as a key player in the AI revolution, with its GPUs powering everything from data centers to self-driving cars.

For investors who participated in Nvidia’s IPO, the returns have been nothing short of extraordinary. A $1,000 investment in Nvidia at the time of its IPO would have grown exponentially, as the company’s stock price increased by thousands of percentage points over the years. This remarkable growth can be attributed to Nvidia’s ability to adapt to changing market dynamics, its commitment to innovation, and its strategic expansion into new and lucrative markets.

In conclusion, Nvidia’s journey from its IPO to its current status as a tech powerhouse is a testament to the company’s visionary leadership and relentless pursuit of technological advancement. For those who invested in Nvidia at its inception, the rewards have been substantial, underscoring the potential of investing in companies that are at the forefront of technological innovation. As Nvidia continues to push the boundaries of what is possible with its cutting-edge technology, its story serves as an inspiring example of how strategic foresight and innovation can drive long-term success in the ever-evolving tech landscape.

The Growth Trajectory Of Nvidia: Key Milestones

Nvidia Corporation, a name synonymous with cutting-edge graphics technology, has experienced a remarkable growth trajectory since its initial public offering (IPO) in 1999. For investors who participated in Nvidia’s IPO, the journey has been nothing short of extraordinary. Understanding the key milestones in Nvidia’s growth provides insight into how an initial investment in the company would have appreciated over time.

When Nvidia went public on January 22, 1999, it was priced at $12 per share. The company was primarily known for its graphics processing units (GPUs), which were gaining traction in the burgeoning video game industry. At the time, few could have predicted the transformative impact Nvidia would have on various sectors, from gaming to artificial intelligence. However, the company’s strategic vision and technological innovations soon began to pay dividends.

In the early 2000s, Nvidia’s growth was fueled by the increasing demand for high-performance graphics in personal computers and gaming consoles. The launch of the GeForce series in 1999 marked a significant milestone, establishing Nvidia as a leader in the GPU market. This period saw Nvidia’s stock price steadily climb, reflecting its growing dominance in the industry. By 2007, Nvidia’s shares had appreciated significantly, driven by the widespread adoption of its technology in gaming and professional visualization.

The next major milestone came with the rise of parallel computing and the introduction of Nvidia’s CUDA platform in 2006. CUDA enabled developers to harness the power of GPUs for general-purpose computing, opening new avenues for Nvidia’s technology beyond graphics. This innovation positioned Nvidia at the forefront of the high-performance computing revolution, further boosting its stock value. As industries such as scientific research, finance, and healthcare began to leverage GPU acceleration, Nvidia’s market presence expanded, and its shares continued to rise.

The 2010s marked a transformative decade for Nvidia, as the company capitalized on the growing interest in artificial intelligence (AI) and machine learning. Nvidia’s GPUs became the de facto standard for AI research and development, thanks to their unparalleled processing capabilities. The launch of the Pascal architecture in 2016 and the Volta architecture in 2017 underscored Nvidia’s commitment to advancing AI technology. These innovations not only solidified Nvidia’s leadership in AI but also contributed to a substantial increase in its stock price.

Moreover, Nvidia’s strategic acquisitions, such as the purchase of Mellanox Technologies in 2020, further bolstered its position in the data center market. This move was instrumental in diversifying Nvidia’s revenue streams and enhancing its growth prospects. As a result, Nvidia’s shares experienced exponential growth, rewarding long-term investors with substantial returns.

In recent years, Nvidia has continued to push the boundaries of technology with its advancements in AI, autonomous vehicles, and the metaverse. The company’s focus on these emerging fields has kept it at the cutting edge of innovation, ensuring sustained growth and investor confidence. Consequently, an initial investment in Nvidia’s IPO would have grown exponentially, reflecting the company’s remarkable journey from a graphics card manufacturer to a global technology powerhouse.

In conclusion, Nvidia’s growth trajectory is a testament to its ability to adapt and innovate in a rapidly evolving technological landscape. The key milestones in its history highlight the strategic decisions and technological breakthroughs that have driven its success. For those who invested in Nvidia’s IPO, the journey has been a rewarding one, underscoring the potential of visionary companies to deliver exceptional returns over time.

Nvidia’s Market Performance: Year-By-Year Analysis

Nvidia Corporation, a leading player in the technology sector, has consistently demonstrated remarkable growth since its initial public offering (IPO) in 1999. For investors who participated in Nvidia’s IPO, the journey has been nothing short of extraordinary. To understand the trajectory of Nvidia’s market performance, it is essential to examine its year-by-year growth and the factors that contributed to its success.

In 1999, Nvidia went public at a price of $12 per share, marking the beginning of its journey as a publicly traded company. The late 1990s and early 2000s were characterized by the dot-com boom, which saw a surge in technology stocks. Nvidia, with its innovative graphics processing units (GPUs), quickly gained traction in the market. By the end of 2000, Nvidia’s stock had already appreciated significantly, driven by the increasing demand for high-performance graphics in gaming and professional applications.

As the years progressed, Nvidia continued to capitalize on its technological advancements. The mid-2000s saw the company expanding its product line and solidifying its position as a leader in the GPU market. This period was marked by the introduction of the GeForce series, which became a staple for gamers and professionals alike. Consequently, Nvidia’s stock price experienced steady growth, reflecting the company’s robust financial performance and market dominance.

Transitioning into the late 2000s and early 2010s, Nvidia faced new challenges and opportunities. The rise of mobile computing and the increasing importance of energy-efficient technologies prompted Nvidia to innovate further. The company’s foray into mobile processors with the Tegra line and its focus on energy-efficient GPUs for data centers and artificial intelligence (AI) applications opened new revenue streams. These strategic moves were pivotal in sustaining Nvidia’s growth trajectory, as evidenced by the consistent appreciation of its stock price during this period.

The mid-2010s marked a transformative phase for Nvidia, as the company began to leverage its expertise in GPUs to tap into emerging markets such as AI, machine learning, and autonomous vehicles. Nvidia’s GPUs became integral to AI research and development, leading to partnerships with major tech companies and research institutions. This strategic pivot not only diversified Nvidia’s revenue base but also positioned it as a key player in the AI revolution. Consequently, Nvidia’s stock experienced exponential growth, rewarding long-term investors with substantial returns.

As we move into the late 2010s and early 2020s, Nvidia’s market performance continued to impress. The company’s acquisition of Mellanox Technologies in 2020 further strengthened its position in the data center market, while its ongoing innovations in AI and gaming kept it at the forefront of technological advancements. The global shift towards digitalization, accelerated by the COVID-19 pandemic, further boosted demand for Nvidia’s products, resulting in record-breaking financial results and a corresponding surge in its stock price.

In conclusion, an investment in Nvidia’s IPO would have yielded remarkable returns over the years, driven by the company’s relentless pursuit of innovation and strategic market positioning. From its early days as a GPU manufacturer to its current status as a leader in AI and data center technologies, Nvidia’s journey exemplifies the potential for growth in the technology sector. As the company continues to explore new frontiers, investors remain optimistic about its future prospects, underscoring the enduring appeal of Nvidia as a formidable player in the global technology landscape.

The Impact Of Technological Advancements On Nvidia’s Stock

When Nvidia Corporation went public on January 22, 1999, it marked the beginning of a journey that would see the company become a dominant force in the technology sector. At the time of its initial public offering (IPO), Nvidia’s stock was priced at $12 per share. For those who invested in Nvidia at its IPO, the subsequent years have demonstrated the profound impact of technological advancements on the company’s stock performance.

Initially, Nvidia was primarily known for its graphics processing units (GPUs), which were primarily used in personal computers for gaming and graphic design. However, as technology evolved, so did the applications for Nvidia’s products. The company’s ability to adapt and innovate in response to these changes has been a significant factor in its stock’s growth. For instance, the rise of artificial intelligence (AI) and machine learning has created new opportunities for Nvidia’s GPUs, which are well-suited for the parallel processing required by these technologies. This shift has not only expanded Nvidia’s market but also increased investor confidence, driving up the stock price.

Moreover, the explosion of data and the need for more powerful computing solutions have further propelled Nvidia’s growth. The company’s GPUs have become integral to data centers, where they are used to accelerate workloads and improve efficiency. This diversification into data centers has provided Nvidia with a robust revenue stream, contributing to its stock’s upward trajectory. As a result, investors who recognized the potential of Nvidia’s technology early on have seen substantial returns on their initial investments.

In addition to AI and data centers, Nvidia has also capitalized on the burgeoning fields of autonomous vehicles and virtual reality. The company’s technology is at the forefront of these industries, providing the computational power necessary for advancements in self-driving cars and immersive virtual experiences. These emerging markets have not only expanded Nvidia’s reach but have also reinforced its position as a leader in technological innovation. Consequently, the anticipation of future growth in these areas has further bolstered investor sentiment and stock performance.

Furthermore, Nvidia’s strategic acquisitions have played a crucial role in its success. By acquiring companies that complement its core business, Nvidia has been able to enhance its product offerings and enter new markets. These acquisitions have not only strengthened Nvidia’s competitive edge but have also contributed to its stock’s appreciation over time. Investors who have held onto their shares have benefited from the company’s strategic vision and execution.

It is also important to consider the broader market trends that have influenced Nvidia’s stock. The increasing demand for high-performance computing, driven by the proliferation of digital content and the Internet of Things (IoT), has created a favorable environment for Nvidia’s growth. As more devices become interconnected and reliant on advanced computing capabilities, Nvidia’s products are likely to remain in high demand, further supporting its stock’s long-term growth potential.

In conclusion, the impact of technological advancements on Nvidia’s stock has been profound. From its early days as a GPU manufacturer to its current status as a leader in AI, data centers, and emerging technologies, Nvidia has consistently adapted to and capitalized on technological trends. For those who invested in Nvidia at its IPO, the company’s ability to innovate and expand into new markets has resulted in significant returns. As technology continues to evolve, Nvidia’s stock is poised to benefit from the ongoing demand for cutting-edge computing solutions.

Comparing Nvidia’s Growth With Other Tech Giants

When Nvidia Corporation went public on January 22, 1999, it marked the beginning of a remarkable journey in the technology sector. At the time of its initial public offering (IPO), Nvidia’s shares were priced at $12 each. For investors who recognized the potential of this innovative company, the decision to invest in Nvidia proved to be a lucrative one. Over the years, Nvidia has not only established itself as a leader in the graphics processing unit (GPU) market but has also expanded its influence into various other technological domains, including artificial intelligence, data centers, and autonomous vehicles. To understand the magnitude of Nvidia’s growth, it is insightful to compare it with other tech giants that have also made significant strides in the industry.

In the late 1990s, the technology sector was burgeoning with opportunities, and companies like Apple, Amazon, and Microsoft were also making waves. However, Nvidia’s focus on GPUs set it apart, as these components became increasingly essential for gaming, professional visualization, and high-performance computing. As the demand for advanced graphics and computing power grew, so did Nvidia’s market value. By 2023, Nvidia’s stock price had soared, reflecting a compounded annual growth rate that outpaced many of its contemporaries. This impressive growth trajectory can be attributed to Nvidia’s strategic investments in research and development, as well as its ability to adapt to emerging trends in technology.

Comparatively, Apple, which went public in 1980, has also experienced substantial growth, driven by its innovative consumer electronics and ecosystem. While Apple’s growth has been fueled by its ability to create and dominate new product categories, Nvidia’s success has been largely driven by its technological advancements and strategic partnerships. Similarly, Amazon, which had its IPO in 1997, has grown exponentially by revolutionizing e-commerce and cloud computing. Although Amazon’s growth strategy differs from Nvidia’s, both companies have demonstrated the importance of diversification and innovation in achieving long-term success.

Microsoft, another tech giant that went public in 1986, has maintained its position as a leader in software and cloud services. While Microsoft has consistently expanded its product offerings, Nvidia’s growth has been more focused on leveraging its core competencies in GPU technology to enter new markets. This strategic focus has allowed Nvidia to capitalize on the growing demand for AI and machine learning applications, further solidifying its position in the tech industry.

In comparing Nvidia’s growth with these tech giants, it is evident that each company has carved its own path to success. Nvidia’s ability to anticipate and respond to technological shifts has been a key factor in its impressive market performance. Moreover, the company’s commitment to innovation and strategic expansion has enabled it to maintain a competitive edge in a rapidly evolving industry.

For investors who participated in Nvidia’s IPO, the journey has been nothing short of extraordinary. The company’s growth not only highlights the potential of investing in technology but also underscores the importance of identifying companies with a clear vision and the ability to execute it effectively. As Nvidia continues to explore new frontiers in technology, its growth story serves as a testament to the power of innovation and strategic foresight in shaping the future of the tech industry.

The Role Of Market Trends In Nvidia’s Stock Appreciation

When Nvidia Corporation went public on January 22, 1999, it marked the beginning of a journey that would see the company transform from a niche graphics card manufacturer into a dominant force in the technology sector. Investors who participated in Nvidia’s initial public offering (IPO) have witnessed remarkable growth in their investments, driven by a confluence of market trends and strategic business decisions. Understanding the role of these market trends is crucial to appreciating how Nvidia’s stock has appreciated over time.

Initially, Nvidia’s growth was fueled by the burgeoning demand for graphics processing units (GPUs) in the gaming industry. As video games became more sophisticated, the need for advanced graphics technology increased, positioning Nvidia as a key player in this rapidly expanding market. The company’s ability to innovate and deliver high-performance GPUs allowed it to capture a significant share of the gaming market, which in turn contributed to the steady appreciation of its stock.

However, the gaming industry was just the beginning. As technology evolved, so did the applications for Nvidia’s products. The rise of artificial intelligence (AI) and machine learning opened new avenues for growth. Nvidia’s GPUs, known for their parallel processing capabilities, became essential for AI research and development. This shift in market trends significantly boosted Nvidia’s stock, as investors recognized the potential for GPUs to power the next wave of technological advancements.

Moreover, the explosion of data-driven industries further propelled Nvidia’s stock appreciation. The demand for data centers and cloud computing services surged, and Nvidia’s GPUs were increasingly used to accelerate data processing tasks. This trend was particularly evident in sectors such as autonomous vehicles, healthcare, and finance, where large-scale data analysis is crucial. As these industries continued to expand, so did the demand for Nvidia’s technology, driving up the company’s stock value.

In addition to these market trends, Nvidia’s strategic acquisitions and partnerships played a pivotal role in its stock appreciation. By acquiring companies with complementary technologies and forming alliances with industry leaders, Nvidia was able to expand its product offerings and enter new markets. These strategic moves not only diversified Nvidia’s revenue streams but also enhanced its competitive position, further boosting investor confidence and stock performance.

Furthermore, Nvidia’s commitment to research and development has been instrumental in maintaining its technological edge. By consistently investing in innovation, Nvidia has been able to stay ahead of competitors and adapt to changing market dynamics. This focus on R&D has resulted in a steady stream of cutting-edge products, reinforcing Nvidia’s reputation as a leader in the tech industry and contributing to the long-term appreciation of its stock.

In conclusion, the growth of an Nvidia IPO investment over time can be attributed to a combination of market trends and strategic initiatives. From its early days in the gaming industry to its current role in AI and data-driven sectors, Nvidia has successfully capitalized on emerging opportunities. The company’s ability to innovate, adapt, and expand has been key to its stock appreciation, making it a compelling case study for investors seeking to understand the impact of market trends on stock performance. As Nvidia continues to navigate the ever-evolving technology landscape, its stock remains a testament to the power of strategic foresight and market responsiveness.

Lessons Learned From Nvidia’s Investment Journey

Investing in the stock market has always been a venture filled with both promise and peril, and Nvidia’s journey from its initial public offering (IPO) to its current status as a tech giant offers a compelling case study. When Nvidia went public on January 22, 1999, it was a relatively small player in the burgeoning field of graphics processing units (GPUs). Priced at $12 per share, the IPO raised approximately $42 million, a modest sum by today’s standards. However, those who recognized the potential of Nvidia’s technology and invested in its IPO have witnessed remarkable growth over the years.

To understand the magnitude of this growth, it is essential to consider the technological advancements and market dynamics that have propelled Nvidia forward. Initially, Nvidia’s GPUs were primarily used for rendering graphics in video games, a niche market at the time. However, as the demand for high-quality graphics surged, Nvidia’s products became indispensable to gamers and developers alike. This growing demand laid the foundation for Nvidia’s expansion into other sectors, such as data centers, artificial intelligence, and autonomous vehicles.

Over the years, Nvidia’s strategic decisions have played a crucial role in its success. The company’s focus on innovation and its ability to anticipate market trends have allowed it to stay ahead of competitors. For instance, Nvidia’s early investment in AI and machine learning technologies positioned it as a leader in these fields, long before they became mainstream. This foresight has not only diversified Nvidia’s revenue streams but also solidified its reputation as a pioneer in cutting-edge technology.

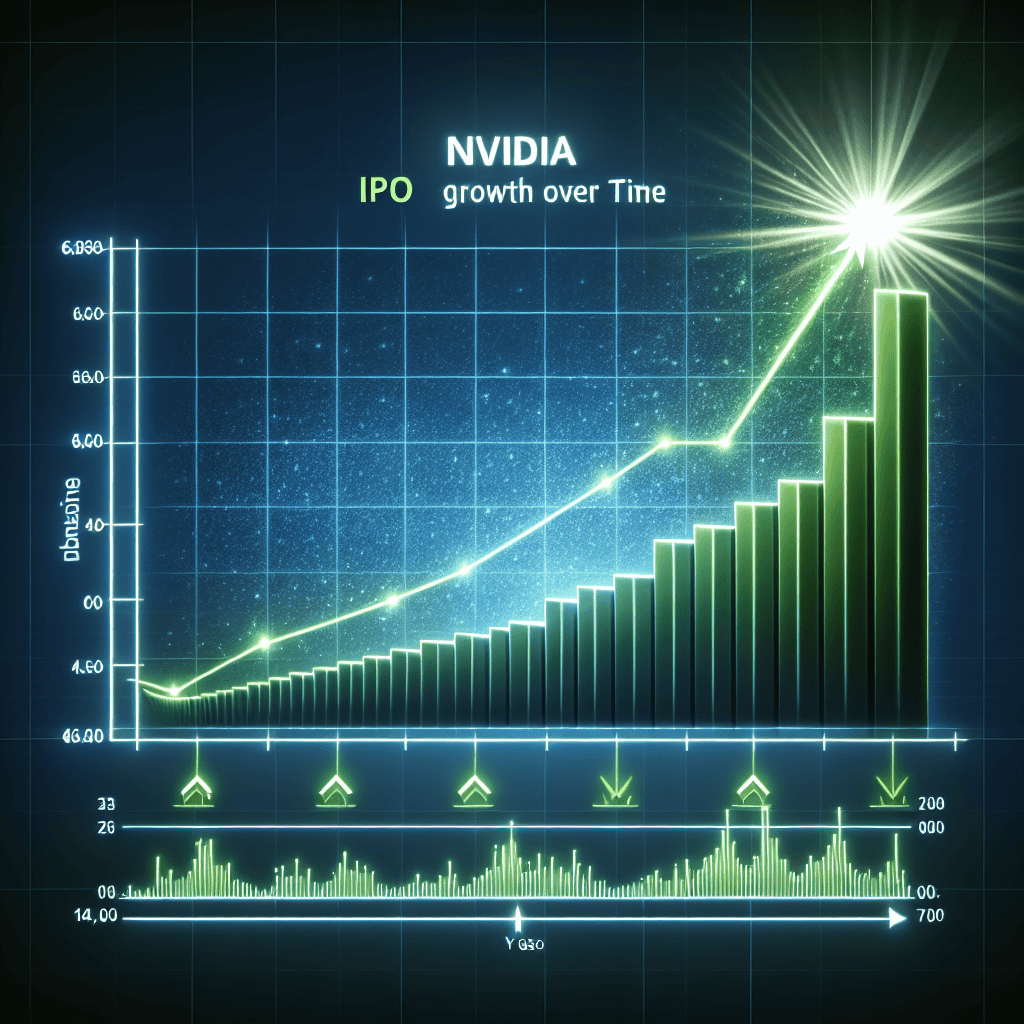

As Nvidia’s influence expanded, so did its stock price. Investors who held onto their shares from the IPO have seen their investments grow exponentially. By 2023, Nvidia’s stock price had soared to over $400 per share, representing a staggering increase of more than 3,000% from its IPO price. This remarkable growth underscores the importance of patience and long-term vision in investing. Those who believed in Nvidia’s potential and weathered the market’s ups and downs have been handsomely rewarded.

Moreover, Nvidia’s journey offers valuable lessons about the importance of diversification and adaptability. The company’s ability to pivot from a gaming-centric focus to a broader technological scope has been instrumental in its sustained growth. This adaptability has allowed Nvidia to capitalize on emerging trends and mitigate risks associated with market fluctuations. For investors, this highlights the significance of choosing companies that demonstrate both innovation and flexibility.

In addition to strategic foresight, Nvidia’s commitment to research and development has been a driving force behind its success. By consistently investing in new technologies and improving existing products, Nvidia has maintained its competitive edge. This dedication to advancement not only enhances the company’s market position but also instills confidence in its investors.

In conclusion, Nvidia’s investment journey from its IPO to its current status as a tech powerhouse offers a wealth of insights for investors. The company’s remarkable growth trajectory underscores the potential rewards of investing in innovative and adaptable companies. Furthermore, Nvidia’s story highlights the importance of patience, strategic foresight, and a commitment to continuous improvement. As investors reflect on Nvidia’s journey, they can glean valuable lessons that may guide their future investment decisions, ultimately contributing to their own financial success.

Q&A

1. **What was the IPO price of Nvidia?**

Nvidia’s IPO price was $12 per share when it went public on January 22, 1999.

2. **How did Nvidia’s stock perform in the first year after its IPO?**

In the first year after its IPO, Nvidia’s stock saw significant growth, closing at around $40 per share by the end of 1999, more than tripling its initial offering price.

3. **What was the impact of the dot-com bubble on Nvidia’s stock?**

During the dot-com bubble burst in the early 2000s, Nvidia’s stock experienced volatility but managed to recover relatively quickly compared to many other tech companies, maintaining a strong growth trajectory.

4. **How did Nvidia’s stock perform during the 2008 financial crisis?**

Nvidia’s stock, like many others, was affected by the 2008 financial crisis, experiencing a significant drop. However, it rebounded in the following years as the company continued to innovate and expand its product offerings.

5. **What role did Nvidia’s focus on GPUs play in its stock growth?**

Nvidia’s focus on developing high-performance GPUs for gaming, data centers, and AI applications has been a major driver of its stock growth, particularly in the 2010s and beyond, as demand for these technologies surged.

6. **How has Nvidia’s stock performed in the 2020s?**

In the 2020s, Nvidia’s stock has seen substantial growth, driven by its leadership in AI, gaming, and data center markets, as well as strategic acquisitions and partnerships.

7. **What would be the approximate return on investment if you had invested in Nvidia at its IPO?**

If you had invested in Nvidia at its IPO price of $12 per share, your investment would have grown significantly, with the stock price reaching over $400 per share by 2023, representing a substantial return on investment.

Conclusion

Investing in Nvidia’s IPO in 1999 would have yielded substantial returns over time. Initially priced at $12 per share, Nvidia has experienced significant growth due to its leadership in graphics processing units (GPUs) and expansion into data centers, AI, and autonomous vehicles. Adjusted for stock splits, the IPO price was effectively $0.75 per share. By October 2023, Nvidia’s stock price has surged, reflecting its pivotal role in the tech industry and strong financial performance. This growth trajectory highlights the potential for substantial long-term gains from early investments in innovative technology companies.