“From Modest Beginnings to Millionaire Status: The 20-Year Stock Success Story”

Introduction

In the world of investing, few stories capture the imagination quite like those of extraordinary returns achieved over time. One such remarkable tale is that of a single stock that turned a modest $10,000 investment into nearly $5.6 million over the span of two decades. This transformation is not just a testament to the power of compound growth and strategic investment but also highlights the potential of identifying and holding onto high-growth opportunities in the stock market. By examining the factors that contributed to this phenomenal growth, investors can glean valuable insights into the dynamics of long-term wealth creation and the importance of patience, research, and timing in the pursuit of financial success.

The Power Of Long-Term Investing: A Case Study

In the realm of investing, the allure of quick profits often overshadows the profound benefits of a long-term strategy. However, the story of one particular stock, which transformed an initial investment of $10,000 into nearly $5.6 million over two decades, serves as a compelling testament to the power of patience and strategic foresight. This remarkable journey underscores the potential of long-term investing, illustrating how time, compounded growth, and a steadfast approach can yield extraordinary results.

To begin with, the stock in question belongs to a company that, over the years, has demonstrated consistent growth and innovation. This company, which started as a small player in its industry, gradually expanded its market share through strategic acquisitions and a relentless focus on research and development. As a result, it was able to introduce groundbreaking products that not only captured consumer interest but also set new industry standards. This continuous cycle of innovation and adaptation played a crucial role in driving the company’s stock price upward, rewarding those investors who had the foresight to hold onto their shares.

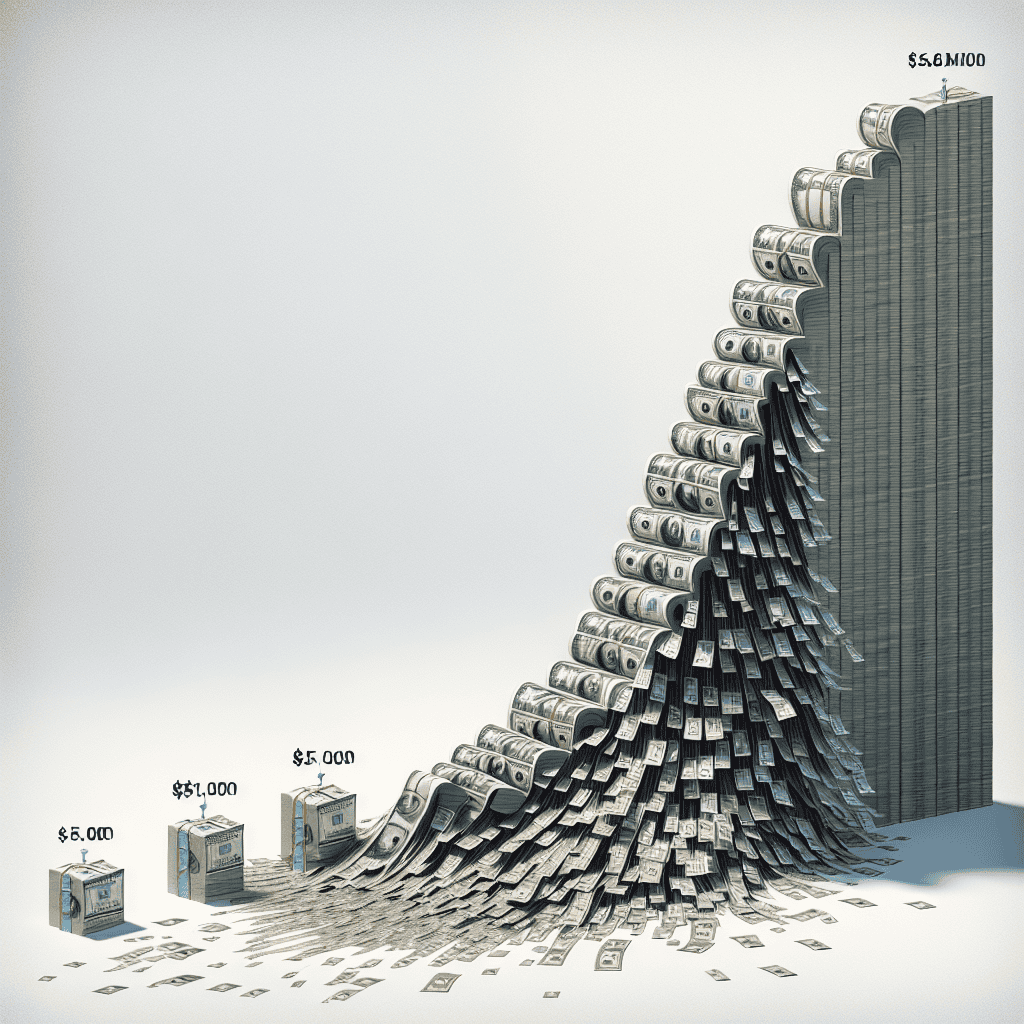

Moreover, the power of compounding cannot be overstated in this context. Compounding, often described as the eighth wonder of the world, allows investors to earn returns on their initial investment as well as on the accumulated returns from previous periods. Over two decades, this effect can lead to exponential growth, as evidenced by the transformation of $10,000 into nearly $5.6 million. By reinvesting dividends and maintaining a long-term perspective, investors can harness the full potential of compounding, turning modest investments into substantial wealth over time.

In addition to compounding, the importance of emotional discipline in long-term investing cannot be ignored. The stock market is inherently volatile, with prices fluctuating due to a myriad of factors, including economic indicators, geopolitical events, and market sentiment. During periods of market turbulence, it is easy for investors to succumb to fear and make impulsive decisions that could jeopardize their long-term goals. However, those who remain committed to their investment strategy, resisting the urge to react to short-term market movements, are often rewarded with significant gains. This case study exemplifies how maintaining emotional discipline and focusing on the bigger picture can lead to remarkable financial outcomes.

Furthermore, diversification played a pivotal role in mitigating risks associated with this investment. While the stock in question delivered exceptional returns, it is important to recognize that investing in a single company carries inherent risks. By diversifying their portfolio across various sectors and asset classes, investors can reduce the impact of any single investment’s poor performance on their overall portfolio. This approach not only enhances the potential for returns but also provides a safety net during market downturns.

In conclusion, the transformation of $10,000 into nearly $5.6 million over two decades through a single stock serves as a powerful illustration of the benefits of long-term investing. By focusing on companies with strong growth potential, harnessing the power of compounding, maintaining emotional discipline, and diversifying their portfolios, investors can achieve substantial financial success. This case study reinforces the notion that patience and strategic foresight are invaluable assets in the world of investing, offering a roadmap for those seeking to build wealth over the long term.

Understanding Compound Interest: The Key To Wealth

Compound interest is often heralded as one of the most powerful forces in finance, capable of transforming modest investments into substantial wealth over time. This principle is vividly illustrated by the remarkable journey of a single stock that turned an initial investment of $10,000 into nearly $5.6 million over the course of two decades. Understanding how compound interest works is crucial for anyone looking to harness its potential for wealth accumulation.

At its core, compound interest is the process by which an investment grows exponentially as the interest earned on the initial principal and the accumulated interest from previous periods is reinvested. This creates a snowball effect, where the investment base grows larger and larger, leading to increasingly significant returns. The power of compounding is often underestimated, yet it is the very mechanism that can lead to extraordinary financial outcomes, as demonstrated by this stock’s performance.

To appreciate the magnitude of this transformation, consider the annualized return required to achieve such growth. The stock in question delivered an average annual return of approximately 35%, a figure that far exceeds the historical average return of the broader stock market. This exceptional performance underscores the importance of selecting investments with strong growth potential and the ability to sustain that growth over time. However, it is also a reminder that such opportunities are rare and often come with higher levels of risk.

The journey from $10,000 to nearly $5.6 million was not without its challenges. The stock market is inherently volatile, and even the most successful stocks experience periods of decline. Investors who held onto this stock through market fluctuations demonstrated a key principle of successful investing: patience. By maintaining a long-term perspective and resisting the urge to react to short-term market movements, these investors allowed the power of compound interest to work its magic.

Moreover, this example highlights the importance of time in the compounding process. The longer an investment is allowed to compound, the more pronounced the effects become. In this case, a 20-year time horizon was instrumental in achieving such impressive results. This serves as a valuable lesson for investors: starting early and allowing investments to grow over time can significantly enhance wealth accumulation.

While the story of this stock is extraordinary, it is important to recognize that not all investments will yield such dramatic results. Diversification remains a fundamental strategy to mitigate risk and enhance the potential for returns. By spreading investments across a variety of asset classes and sectors, investors can reduce the impact of any single investment’s poor performance on their overall portfolio.

In conclusion, the transformation of $10,000 into nearly $5.6 million through the power of compound interest is a testament to the potential of long-term investing. By understanding and leveraging the principles of compounding, investors can unlock opportunities for wealth creation that may seem unimaginable at first glance. While the journey requires patience, discipline, and a willingness to embrace risk, the rewards can be substantial. As this remarkable example demonstrates, compound interest is indeed a key to unlocking financial success.

The Role Of Market Trends In Stock Growth

In the world of investing, the allure of transforming a modest sum into a substantial fortune is a dream many aspire to achieve. The story of how one stock turned a $10,000 investment into nearly $5.6 million over two decades is a testament to the power of market trends and their role in stock growth. Understanding these trends is crucial for investors seeking to replicate such success, as they provide insights into the forces that drive stock prices upward over time.

To begin with, market trends are influenced by a myriad of factors, including technological advancements, consumer behavior shifts, and macroeconomic changes. In the case of the stock in question, its remarkable growth can be attributed to its alignment with several key trends that emerged over the past twenty years. For instance, the rise of digital technology and the internet revolutionized industries, creating new opportunities for companies that were quick to adapt. This particular stock, belonging to a tech giant, capitalized on the burgeoning demand for digital solutions, positioning itself as a leader in innovation and capturing a significant market share.

Moreover, the company’s ability to anticipate and respond to consumer needs played a pivotal role in its growth trajectory. As consumer preferences evolved, driven by the increasing reliance on technology in everyday life, the company consistently introduced products and services that resonated with its audience. This adaptability not only solidified its market position but also fostered brand loyalty, further propelling its stock value. Consequently, investors who recognized these trends early on and invested in the company reaped substantial rewards as the stock price soared.

In addition to technological and consumer trends, macroeconomic factors also significantly impacted the stock’s growth. Over the past two decades, periods of economic expansion provided a favorable environment for businesses to thrive. Low interest rates, for instance, facilitated access to capital, enabling companies to invest in research and development, expand operations, and pursue strategic acquisitions. The company in question adeptly leveraged these conditions to fuel its growth, thereby enhancing its stock performance.

Furthermore, globalization played a crucial role in expanding the company’s reach and revenue potential. By tapping into international markets, the company diversified its income streams and mitigated risks associated with domestic market fluctuations. This global presence not only contributed to its financial stability but also attracted a broader investor base, driving up demand for its stock.

While market trends undeniably played a significant role in the stock’s growth, it is essential to acknowledge the importance of sound management and strategic decision-making. The company’s leadership demonstrated foresight and agility, navigating challenges and capitalizing on opportunities as they arose. This strategic acumen, combined with a keen understanding of market dynamics, enabled the company to maintain its competitive edge and deliver consistent value to shareholders.

In conclusion, the transformation of a $10,000 investment into nearly $5.6 million over two decades underscores the profound impact of market trends on stock growth. By aligning with technological advancements, adapting to consumer preferences, and leveraging favorable macroeconomic conditions, the company achieved remarkable success. For investors, this story serves as a powerful reminder of the importance of staying attuned to market trends and making informed investment decisions. As the market continues to evolve, those who can identify and capitalize on emerging trends will be well-positioned to achieve similar financial success.

Identifying High-Growth Stocks: Lessons From A Success Story

In the world of investing, identifying high-growth stocks can be akin to finding a needle in a haystack. However, the rewards for those who succeed can be monumental. A prime example of this is the remarkable journey of a single stock that transformed an initial investment of $10,000 into nearly $5.6 million over the span of two decades. This success story not only highlights the potential of high-growth stocks but also offers valuable lessons for investors seeking similar opportunities.

The stock in question is none other than Amazon.com, Inc. Founded by Jeff Bezos in 1994, Amazon began as an online bookstore and quickly expanded its offerings to become the e-commerce giant we know today. In 1997, Amazon went public with an initial public offering (IPO) price of $18 per share. Those who recognized the company’s potential and invested $10,000 at the time of its IPO would have seen their investment grow exponentially, thanks to Amazon’s relentless innovation and expansion into new markets.

One of the key lessons from Amazon’s success is the importance of identifying companies with visionary leadership. Jeff Bezos’s foresight and willingness to take risks played a crucial role in Amazon’s growth. He consistently prioritized long-term gains over short-term profits, reinvesting earnings into the business to fuel its expansion. This approach allowed Amazon to diversify its product offerings and enter new industries, such as cloud computing with Amazon Web Services (AWS), which has become a significant revenue driver for the company.

Moreover, Amazon’s ability to adapt to changing market conditions and consumer preferences underscores the importance of flexibility in a high-growth stock. The company’s continuous innovation, from the introduction of Amazon Prime to the development of Alexa and other smart devices, demonstrates its commitment to staying ahead of the curve. This adaptability has enabled Amazon to maintain its competitive edge and capture a substantial share of the market.

Another critical factor in Amazon’s success is its focus on customer experience. By prioritizing customer satisfaction and convenience, Amazon has built a loyal customer base that continues to drive its growth. The company’s emphasis on fast shipping, competitive pricing, and a vast selection of products has set a high standard for the e-commerce industry and contributed to its sustained success.

For investors seeking to identify high-growth stocks, Amazon’s story offers several valuable insights. First, it is essential to look for companies with strong leadership and a clear vision for the future. Leaders who are willing to take calculated risks and prioritize long-term growth can significantly impact a company’s trajectory. Additionally, investors should seek out companies that demonstrate adaptability and a commitment to innovation, as these qualities can help businesses navigate changing market dynamics and maintain their competitive advantage.

Furthermore, a focus on customer experience can be a strong indicator of a company’s potential for growth. Companies that prioritize customer satisfaction and continuously strive to improve their offerings are more likely to build a loyal customer base and achieve long-term success.

In conclusion, the transformation of a $10,000 investment into nearly $5.6 million through Amazon’s stock is a testament to the power of high-growth stocks. By learning from Amazon’s success, investors can better position themselves to identify similar opportunities and potentially achieve substantial returns. While the journey to finding the next Amazon may be challenging, the rewards for those who succeed can be truly transformative.

Risk Management: Balancing Potential And Pitfalls

Investing in the stock market has long been heralded as a pathway to wealth, yet it is fraught with risks that can deter even the most intrepid investors. The story of how one stock transformed a modest $10,000 investment into nearly $5.6 million over two decades serves as a compelling case study in the delicate art of risk management. This remarkable financial journey underscores the importance of balancing potential rewards with inherent pitfalls, a task that requires both strategic foresight and disciplined execution.

To begin with, the stock in question belonged to a company that, at the time of the initial investment, was relatively unknown but possessed significant growth potential. The investor, recognizing the company’s innovative approach and market potential, decided to take a calculated risk. This decision was not made lightly; it was the result of thorough research and a deep understanding of the industry landscape. By identifying key indicators of future success, such as a strong management team and a unique value proposition, the investor was able to make an informed decision that would eventually yield extraordinary returns.

However, the journey from $10,000 to $5.6 million was not without its challenges. The stock market is inherently volatile, and the company faced numerous obstacles along the way, including economic downturns, competitive pressures, and regulatory changes. Each of these factors had the potential to derail the company’s growth trajectory, and by extension, the investor’s financial aspirations. It is here that the principles of risk management played a crucial role. By diversifying their portfolio and maintaining a long-term perspective, the investor was able to mitigate some of the risks associated with holding a single stock. This approach allowed them to weather short-term fluctuations and remain focused on the company’s long-term potential.

Moreover, the investor’s success was not solely due to their initial stock selection. Continuous monitoring and periodic reassessment of the investment were essential components of their strategy. By staying informed about the company’s performance and the broader market environment, the investor was able to make timely decisions, such as adjusting their holdings or reinvesting dividends, to maximize returns. This proactive approach exemplifies the dynamic nature of risk management, where adaptability and vigilance are key to capitalizing on opportunities while minimizing exposure to potential losses.

In addition to strategic decision-making, emotional discipline played a significant role in the investor’s success. The stock market can evoke strong emotions, from the euphoria of soaring prices to the despair of sudden declines. By maintaining a level-headed approach and resisting the urge to make impulsive decisions based on short-term market movements, the investor was able to stay the course and achieve their long-term financial goals. This emotional resilience is a testament to the importance of psychological fortitude in effective risk management.

In conclusion, the transformation of a $10,000 investment into nearly $5.6 million over two decades is a testament to the power of strategic risk management. By carefully balancing potential rewards with the pitfalls inherent in the stock market, the investor was able to achieve extraordinary financial success. This story serves as a valuable lesson for all investors, highlighting the importance of thorough research, diversification, continuous monitoring, and emotional discipline in navigating the complex world of stock market investing.

The Impact Of Economic Cycles On Stock Performance

Investing in the stock market has long been a favored strategy for building wealth, but the journey is often fraught with volatility and uncertainty. The impact of economic cycles on stock performance is a critical factor that investors must consider. Over the past two decades, one particular stock has demonstrated the profound influence of these cycles, transforming a modest $10,000 investment into nearly $5.6 million. This remarkable growth underscores the importance of understanding economic cycles and their effects on stock performance.

Economic cycles, characterized by periods of expansion and contraction, significantly influence the stock market. During expansion phases, characterized by rising GDP, low unemployment, and increased consumer spending, stocks generally perform well. Companies experience higher revenues and profits, which often leads to increased stock prices. Conversely, during contraction phases, marked by economic slowdown, rising unemployment, and reduced consumer spending, stock performance tends to suffer. Investors often react to these conditions by selling off stocks, leading to declining prices.

The stock in question, which has seen its value skyrocket over the past two decades, serves as a prime example of how economic cycles can impact stock performance. During periods of economic expansion, this company capitalized on increased consumer demand and favorable market conditions, resulting in substantial growth. Its ability to innovate and adapt to changing market dynamics allowed it to maintain a competitive edge, further boosting its stock price.

However, the journey was not without challenges. During economic downturns, the company faced significant obstacles, including reduced consumer spending and increased competition. Yet, its resilience and strategic decision-making enabled it to weather these storms. By focusing on cost management, diversifying its product offerings, and expanding into new markets, the company mitigated the adverse effects of economic contractions. This adaptability not only preserved its market position but also set the stage for future growth once the economy rebounded.

Moreover, the company’s success highlights the importance of a long-term investment strategy. Investors who remained committed to their investment, despite short-term market fluctuations, reaped substantial rewards. This underscores the value of patience and the ability to look beyond immediate economic conditions. By maintaining a long-term perspective, investors can better navigate the ups and downs of economic cycles and capitalize on the eventual recovery and growth phases.

Additionally, this case illustrates the significance of thorough research and analysis when selecting stocks. Understanding a company’s fundamentals, including its financial health, competitive position, and growth potential, is crucial. Investors who conducted diligent research and recognized the company’s potential were better positioned to benefit from its impressive performance over the years.

In conclusion, the transformation of a $10,000 investment into nearly $5.6 million over two decades is a testament to the profound impact of economic cycles on stock performance. By understanding these cycles and adopting a long-term investment strategy, investors can navigate the complexities of the stock market and achieve significant financial gains. This case serves as a powerful reminder of the importance of resilience, adaptability, and informed decision-making in the ever-changing landscape of economic cycles. As investors continue to seek opportunities in the stock market, these lessons remain as relevant as ever, guiding them toward potential success in the face of economic uncertainty.

The Psychology Of Holding: Patience As An Investment Strategy

In the world of investing, the allure of quick profits often overshadows the virtues of patience and long-term strategy. However, the story of how one stock transformed a modest $10,000 investment into nearly $5.6 million over two decades serves as a compelling testament to the power of holding. This remarkable journey underscores the psychological fortitude required to maintain an investment through market fluctuations, economic downturns, and the ever-present temptation to sell.

The stock in question, which has become emblematic of long-term success, is none other than Amazon. When Amazon went public in 1997, it was a fledgling online bookstore with an uncertain future. Yet, those who recognized its potential and invested $10,000 at its initial public offering have seen their investment grow exponentially. This transformation did not occur overnight; rather, it was the result of steadfast patience and a belief in the company’s vision.

To understand the psychology of holding, one must first appreciate the emotional challenges that accompany long-term investing. Market volatility can provoke anxiety, leading investors to question their decisions. During periods of economic uncertainty, the instinct to cut losses and sell can be overwhelming. However, successful long-term investors cultivate a mindset that prioritizes future potential over immediate gains. This requires a disciplined approach, resisting the urge to react impulsively to short-term market movements.

Moreover, the concept of compounding plays a crucial role in the success of long-term investments. Compounding, often described as the eighth wonder of the world, allows investors to earn returns not only on their initial investment but also on the accumulated gains from previous years. This exponential growth is most effective over extended periods, reinforcing the importance of patience. In the case of Amazon, the company’s consistent innovation and expansion into new markets fueled its growth, rewarding those who held their shares with substantial returns.

Another psychological aspect of holding is the ability to maintain conviction in the face of skepticism. Throughout its history, Amazon faced numerous challenges and criticisms, from doubts about its profitability to concerns over its aggressive expansion strategies. Investors who remained steadfast in their belief in Amazon’s long-term potential were ultimately vindicated. This highlights the importance of conducting thorough research and having a clear understanding of a company’s fundamentals before committing to a long-term investment.

Furthermore, the story of Amazon’s meteoric rise illustrates the significance of diversification within a portfolio. While holding a single stock can yield extraordinary returns, it also carries inherent risks. Diversification mitigates these risks by spreading investments across various assets, industries, and geographies. This strategy not only protects against potential losses but also provides peace of mind, allowing investors to hold their positions with greater confidence.

In conclusion, the transformation of a $10,000 investment into nearly $5.6 million through Amazon exemplifies the profound impact of patience as an investment strategy. The psychological resilience required to hold through market turbulence, coupled with the power of compounding and diversification, underscores the potential rewards of a long-term approach. As investors navigate the complexities of the financial markets, embracing the psychology of holding can serve as a guiding principle, fostering a mindset that prioritizes enduring success over fleeting gains.

Q&A

1. **What stock achieved this transformation?**

Monster Beverage Corporation (MNST).

2. **What was the initial investment amount?**

$10,000.

3. **Over how many years did this transformation occur?**

Approximately 20 years.

4. **What was the final value of the investment?**

Nearly $5.6 million.

5. **What was the primary factor contributing to this growth?**

The explosive growth in the energy drink market and Monster’s strong brand presence.

6. **What was a key strategy used by the company to achieve this growth?**

Aggressive marketing and expansion into international markets.

7. **What lesson can investors learn from this stock’s performance?**

Investing in companies with strong growth potential and market demand can yield significant long-term returns.

Conclusion

Investing in a single stock that appreciates significantly over time can yield substantial returns, as demonstrated by the transformation of $10,000 into nearly $5.6 million over two decades. This remarkable growth is typically driven by a combination of factors, including the company’s consistent revenue and profit growth, innovative product development, effective management, and favorable market conditions. Additionally, the power of compounding, reinvestment of dividends, and a long-term investment horizon play crucial roles in maximizing returns. However, such success stories also underscore the inherent risks of stock market investments, emphasizing the importance of thorough research, diversification, and a well-considered investment strategy to mitigate potential losses.