“Skyward Shifts: Boeing’s Bold Move Reshapes the Future for Trio Titans”

Introduction

Boeing’s major announcement has sent ripples across the aerospace and defense industry, significantly impacting three key companies: Airbus, Lockheed Martin, and General Electric. As Boeing unveils its latest strategic initiative, Airbus faces intensified competition, potentially reshaping market dynamics and influencing its future product development and sales strategies. Lockheed Martin, a major player in defense contracting, may experience shifts in its collaborative ventures and supply chain logistics, as Boeing’s announcement could alter defense procurement priorities and partnerships. Meanwhile, General Electric, a crucial supplier of aircraft engines and components, stands to be directly affected by changes in Boeing’s production plans, potentially influencing its manufacturing output and financial forecasts. This announcement not only highlights Boeing’s strategic direction but also underscores the interconnected nature of the aerospace industry, where the actions of one major player can have far-reaching consequences for others.

Impact On Airbus: Competitive Dynamics And Market Share

Boeing’s recent major announcement has sent ripples through the aerospace industry, particularly affecting its primary competitor, Airbus. As Boeing unveils its latest strategic initiatives, the competitive dynamics between these two aviation giants are poised for significant shifts. This development is not only crucial for Boeing and Airbus but also for the broader market, as it influences market share, innovation, and customer preferences.

To begin with, Boeing’s announcement, which includes the launch of a new aircraft model and advancements in sustainable aviation technology, directly challenges Airbus’s market position. Historically, Airbus and Boeing have been locked in a duopoly, each vying for dominance in the commercial aircraft sector. Boeing’s new aircraft, designed to be more fuel-efficient and environmentally friendly, aims to capture a growing segment of the market that prioritizes sustainability. This move is likely to compel Airbus to accelerate its own efforts in developing eco-friendly technologies, thereby intensifying the competition between the two companies.

Moreover, Boeing’s strategic focus on sustainability aligns with the increasing demand from airlines for greener solutions, driven by regulatory pressures and consumer expectations. As a result, Airbus may need to reassess its current product offerings and innovation pipeline to ensure it remains competitive. This could involve ramping up research and development efforts or forming strategic partnerships to enhance its technological capabilities. Consequently, the competitive dynamics between Boeing and Airbus are expected to become more pronounced, with each company striving to outpace the other in delivering cutting-edge, sustainable solutions.

In addition to technological advancements, Boeing’s announcement also has implications for market share. The introduction of a new aircraft model provides Boeing with an opportunity to capture a larger share of the market, particularly in regions where demand for new, efficient aircraft is surging. This is especially pertinent in emerging markets, where airlines are expanding their fleets to accommodate growing passenger numbers. Airbus, therefore, faces the challenge of defending its market share by ensuring its offerings are equally appealing and competitive.

Furthermore, Boeing’s announcement may influence customer preferences, as airlines evaluate the benefits of adopting the latest technologies. Airlines are increasingly prioritizing operational efficiency and cost-effectiveness, and Boeing’s new aircraft promises to deliver on these fronts. This could lead to a shift in customer loyalty, with some airlines opting to switch from Airbus to Boeing if the latter’s offerings better align with their strategic goals. In response, Airbus will need to reinforce its value proposition, emphasizing the unique benefits of its aircraft and services to retain its customer base.

In conclusion, Boeing’s major announcement is set to reshape the competitive landscape of the aerospace industry, with significant implications for Airbus. The introduction of new, sustainable aircraft models by Boeing challenges Airbus to enhance its technological capabilities and defend its market share. As both companies vie for dominance, the competitive dynamics between them are likely to intensify, driving innovation and influencing customer preferences. Ultimately, this development underscores the importance of agility and foresight in the aerospace sector, as companies navigate an evolving market landscape characterized by technological advancements and shifting consumer demands.

Supply Chain Shifts: Effects On Spirit AeroSystems

Boeing’s recent major announcement has sent ripples through the aerospace industry, particularly affecting its supply chain dynamics. Among the companies most impacted by this development is Spirit AeroSystems, a key supplier and partner in Boeing’s production ecosystem. As Boeing adjusts its strategies and operations, the implications for Spirit AeroSystems are multifaceted, influencing not only their production processes but also their financial outlook and strategic planning.

To begin with, Boeing’s announcement, which involves a shift in production rates and a renewed focus on certain aircraft models, directly affects Spirit AeroSystems’ manufacturing operations. As a primary supplier of fuselage sections, wing components, and other critical parts for Boeing’s commercial aircraft, Spirit AeroSystems must recalibrate its production schedules to align with Boeing’s revised plans. This alignment is crucial to maintaining efficiency and meeting delivery timelines, which are essential for both companies’ operational success. Consequently, Spirit AeroSystems may need to adjust its workforce levels, manage inventory differently, and potentially invest in new technologies or processes to meet the changing demands.

Moreover, the financial implications for Spirit AeroSystems cannot be understated. Boeing’s production adjustments could lead to fluctuations in order volumes, impacting Spirit AeroSystems’ revenue streams. A decrease in production rates for certain aircraft models might result in reduced orders for Spirit AeroSystems, necessitating a reevaluation of their financial forecasts and cost management strategies. Conversely, an increase in demand for other models could present opportunities for growth, provided Spirit AeroSystems can scale its operations effectively. This financial uncertainty requires Spirit AeroSystems to maintain a flexible and responsive approach to budgeting and resource allocation.

In addition to operational and financial considerations, Boeing’s announcement also prompts Spirit AeroSystems to reassess its strategic positioning within the aerospace supply chain. As Boeing emphasizes certain aircraft models, Spirit AeroSystems must ensure that it remains a competitive and indispensable partner. This may involve enhancing its capabilities in areas such as innovation, quality assurance, and sustainability. By doing so, Spirit AeroSystems can strengthen its value proposition to Boeing and other potential clients, securing its role as a leading supplier in the industry.

Furthermore, the broader implications of Boeing’s announcement extend to Spirit AeroSystems’ relationships with other suppliers and partners. As the aerospace supply chain is highly interconnected, changes in Boeing’s production strategy may lead to shifts in collaboration and competition among suppliers. Spirit AeroSystems must navigate these dynamics carefully, fostering strong partnerships while also exploring new opportunities for collaboration and diversification. This strategic agility will be crucial in adapting to the evolving landscape of the aerospace industry.

In conclusion, Boeing’s major announcement has significant ramifications for Spirit AeroSystems, influencing its production processes, financial outlook, and strategic direction. As the company adapts to these changes, it must remain agile and proactive, leveraging its strengths while addressing potential challenges. By aligning closely with Boeing’s evolving needs and maintaining a focus on innovation and quality, Spirit AeroSystems can continue to thrive in the competitive aerospace supply chain. This period of transition presents both challenges and opportunities, and Spirit AeroSystems’ ability to navigate this landscape will be pivotal in shaping its future success.

Financial Implications For General Electric: Engine Manufacturing

Boeing’s recent major announcement has sent ripples through the aerospace industry, with significant financial implications for several key players, including General Electric (GE). As a leading manufacturer of aircraft engines, GE stands at the forefront of those affected by Boeing’s strategic decisions. The announcement, which outlines Boeing’s plans to ramp up production of its next-generation aircraft, directly influences GE’s engine manufacturing operations. This development is poised to reshape the financial landscape for GE, as well as for other companies intricately linked to Boeing’s supply chain.

To begin with, Boeing’s decision to increase production rates for its new aircraft models translates into a heightened demand for engines, a core component supplied by GE. This surge in demand is expected to bolster GE’s revenue streams, as the company is a primary supplier of engines for Boeing’s commercial aircraft. Consequently, GE’s engine manufacturing division is likely to experience a significant uptick in orders, which could lead to increased production capacity and potentially higher profit margins. This positive outlook is further reinforced by the long-term nature of aircraft manufacturing contracts, which often span several years and provide a stable revenue base for suppliers like GE.

Moreover, the financial implications for GE extend beyond immediate revenue gains. The increased production of Boeing aircraft necessitates advancements in engine technology to meet evolving efficiency and environmental standards. GE, renowned for its innovation in engine design, is well-positioned to capitalize on this opportunity. By investing in research and development, GE can enhance its competitive edge, offering more efficient and environmentally friendly engines that align with Boeing’s sustainability goals. This strategic alignment not only strengthens GE’s partnership with Boeing but also enhances its reputation in the broader aerospace market, potentially attracting new clients and contracts.

In addition to the direct impact on GE’s engine manufacturing, Boeing’s announcement also influences the broader supply chain dynamics. As Boeing accelerates its production schedule, the demand for raw materials and components is expected to rise. This scenario presents both challenges and opportunities for GE. On one hand, GE must ensure a steady supply of high-quality materials to meet production targets, which may require renegotiating terms with existing suppliers or seeking new partnerships. On the other hand, the increased demand for engines could lead to economies of scale, reducing per-unit production costs and improving overall profitability.

Furthermore, Boeing’s strategic shift has implications for GE’s workforce and operational efficiency. To meet the anticipated increase in engine orders, GE may need to expand its workforce, invest in employee training, and optimize its manufacturing processes. These efforts, while initially requiring capital investment, are likely to yield long-term benefits by enhancing productivity and ensuring timely delivery of engines to Boeing. Additionally, GE’s commitment to operational excellence could serve as a model for other companies in the aerospace sector, reinforcing its leadership position in the industry.

In conclusion, Boeing’s major announcement heralds a period of significant financial implications for General Electric, particularly in its engine manufacturing division. The increased demand for aircraft engines presents a lucrative opportunity for GE to boost its revenue, advance its technological capabilities, and strengthen its position in the aerospace market. By strategically navigating the challenges and opportunities presented by Boeing’s production plans, GE can not only enhance its financial performance but also solidify its role as a key player in the global aerospace industry.

Stock Market Reactions: Investor Sentiment And Trends

Boeing’s recent major announcement has sent ripples through the stock market, significantly impacting investor sentiment and trends, particularly concerning three key companies: Airbus, General Electric, and Spirit AeroSystems. As Boeing unveiled its strategic plans to ramp up production and introduce new aircraft models, the market’s response was swift, reflecting both optimism and caution among investors.

To begin with, Airbus, Boeing’s primary competitor, experienced a notable shift in its stock performance following the announcement. Investors, anticipating increased competition in the aerospace sector, initially reacted with apprehension. However, as the details of Boeing’s plans became clearer, the sentiment gradually shifted. The announcement underscored the robust demand for commercial aircraft, suggesting a healthy market environment that could benefit both Boeing and Airbus. Consequently, Airbus’s stock saw a moderate uptick as investors recalibrated their expectations, recognizing that Boeing’s expansion could also drive innovation and growth across the industry.

Meanwhile, General Electric, a major supplier of aircraft engines to Boeing, witnessed a more direct impact on its stock. Boeing’s commitment to increasing production rates signaled a potential surge in demand for GE’s engines, which are integral to many of Boeing’s aircraft. This prospect of heightened demand buoyed investor confidence in General Electric, leading to a positive reaction in its stock price. Moreover, the announcement reinforced the long-standing partnership between Boeing and GE, further solidifying investor trust in GE’s future revenue streams. As a result, the market’s response was largely favorable, with analysts projecting a promising outlook for GE in the wake of Boeing’s strategic initiatives.

In contrast, Spirit AeroSystems, a key supplier of fuselage components to Boeing, faced a more complex reaction from the market. While the announcement initially sparked enthusiasm due to the anticipated increase in production orders, concerns about supply chain constraints and production capacity soon tempered investor optimism. Spirit AeroSystems has been grappling with challenges related to labor shortages and material costs, which could potentially hinder its ability to meet Boeing’s heightened demands. Consequently, the company’s stock experienced volatility as investors weighed the potential benefits against the operational risks. Nevertheless, the long-term prospects remain positive, as Spirit AeroSystems is poised to benefit from Boeing’s growth trajectory, provided it can effectively navigate the current challenges.

In summary, Boeing’s major announcement has had a multifaceted impact on the stock market, influencing investor sentiment and trends across the aerospace sector. While Airbus, General Electric, and Spirit AeroSystems each experienced distinct reactions, the overarching theme is one of cautious optimism. The announcement has highlighted the dynamic nature of the aerospace industry, where competition and collaboration coexist, driving innovation and growth. As investors continue to assess the implications of Boeing’s strategic plans, the focus will likely remain on the interplay between market demand, supply chain dynamics, and the ability of these companies to adapt to evolving industry conditions. Ultimately, Boeing’s announcement serves as a catalyst for change, prompting stakeholders to reevaluate their positions and strategies in a rapidly shifting landscape.

Technological Advancements: Opportunities For Raytheon Technologies

Boeing’s recent major announcement has sent ripples across the aerospace and defense industries, with significant implications for several key players, including Raytheon Technologies. As Boeing unveils its plans to accelerate the development of next-generation aircraft, the focus on technological advancements presents a myriad of opportunities for companies deeply embedded in the aerospace supply chain. Raytheon Technologies, a prominent player in this sector, stands to benefit considerably from Boeing’s strategic shift, alongside other industry giants such as General Electric and Northrop Grumman.

To begin with, Boeing’s commitment to innovation and advanced technology aligns seamlessly with Raytheon Technologies’ core competencies. Raytheon, known for its cutting-edge avionics and defense systems, is well-positioned to capitalize on Boeing’s increased demand for sophisticated components. As Boeing seeks to integrate more advanced avionics systems into its new aircraft models, Raytheon’s expertise in this domain becomes invaluable. The company’s ability to deliver state-of-the-art radar, communication, and navigation systems will likely see heightened demand, fostering a closer collaboration between the two aerospace titans.

Moreover, Boeing’s announcement underscores a broader industry trend towards sustainability and efficiency, which further amplifies opportunities for Raytheon Technologies. As the aerospace sector grapples with the imperative to reduce carbon emissions, Boeing’s focus on developing more fuel-efficient aircraft opens doors for Raytheon’s innovative propulsion technologies. The company’s advancements in electric and hybrid propulsion systems are particularly relevant, as they align with Boeing’s objectives to create environmentally friendly aircraft. This synergy not only enhances Raytheon’s market position but also contributes to the industry’s collective efforts to achieve sustainability goals.

In addition to Raytheon Technologies, General Electric (GE) is another company poised to benefit from Boeing’s strategic direction. GE, a longstanding partner of Boeing, is renowned for its advanced jet engines. With Boeing’s emphasis on next-generation aircraft, the demand for GE’s high-performance engines is expected to surge. The collaboration between Boeing and GE in developing engines that offer improved fuel efficiency and reduced emissions is likely to intensify, driving innovation and technological advancements in the aerospace sector. This partnership not only strengthens GE’s market presence but also reinforces its role as a key contributor to the industry’s evolution.

Furthermore, Northrop Grumman, a leader in aerospace and defense technology, stands to gain from Boeing’s announcement as well. Northrop Grumman’s expertise in autonomous systems and cybersecurity solutions aligns with Boeing’s vision of integrating cutting-edge technologies into its aircraft. As Boeing explores the potential of autonomous flight and enhanced cybersecurity measures, Northrop Grumman’s capabilities become increasingly relevant. The collaboration between these two companies could lead to groundbreaking advancements in aircraft autonomy and security, setting new standards for the industry.

In conclusion, Boeing’s major announcement marks a pivotal moment for the aerospace and defense industries, with significant implications for companies like Raytheon Technologies, General Electric, and Northrop Grumman. The focus on technological advancements and sustainability presents a wealth of opportunities for these companies to leverage their expertise and drive innovation. As Boeing embarks on its journey to develop next-generation aircraft, the collaborative efforts with its partners will undoubtedly shape the future of aviation, fostering a new era of technological progress and environmental responsibility. Through strategic partnerships and a shared commitment to innovation, these companies are poised to play a crucial role in the industry’s transformation, paving the way for a more advanced and sustainable aerospace landscape.

Regulatory Considerations: Compliance And Industry Standards

Boeing’s recent major announcement has sent ripples through the aerospace industry, particularly affecting three key companies that are closely tied to its operations. As Boeing navigates the complex landscape of regulatory considerations, compliance, and industry standards, these companies must also adapt to the evolving environment. The announcement, which centers on Boeing’s commitment to enhancing safety protocols and adopting new technologies, underscores the importance of regulatory compliance in maintaining industry standards. This development has significant implications for its partners and competitors alike.

Firstly, one of the companies most directly impacted by Boeing’s announcement is Raytheon Technologies. As a major supplier of aerospace systems and components, Raytheon is intricately linked to Boeing’s supply chain. The emphasis on heightened safety measures and compliance with stringent industry standards means that Raytheon must ensure its products meet these new requirements. This could involve revisiting existing manufacturing processes, investing in advanced technologies, and enhancing quality control measures. By aligning its operations with Boeing’s updated standards, Raytheon not only maintains its business relationship but also strengthens its position as a leader in the aerospace sector.

Moreover, General Electric (GE) Aviation, another significant player in the aerospace industry, is also affected by Boeing’s strategic shift. GE Aviation, which provides jet engines for Boeing’s commercial aircraft, must now consider how these regulatory changes influence engine design and performance. The focus on compliance and safety standards necessitates a reevaluation of engine technologies to ensure they meet the new criteria. This may lead to increased research and development efforts, as well as collaboration with Boeing to align on safety protocols. Consequently, GE Aviation’s proactive approach to adapting its products and processes will be crucial in maintaining its competitive edge and fulfilling its commitments to Boeing.

In addition to suppliers, Boeing’s announcement also impacts its competitors, such as Airbus. As Boeing raises the bar for safety and compliance, Airbus must assess how these changes affect its own operations and market positioning. The aerospace industry is highly competitive, and any advancements in safety and technology by one major player can influence the entire sector. Airbus may need to evaluate its current compliance strategies and consider adopting similar measures to ensure it remains competitive. This could involve investing in new technologies, enhancing safety protocols, and engaging with regulatory bodies to stay ahead of industry standards. By doing so, Airbus can continue to offer products that meet or exceed the expectations set by Boeing’s announcement.

Furthermore, the broader implications of Boeing’s announcement extend beyond these individual companies. The aerospace industry as a whole is subject to rigorous regulatory oversight, and any changes in compliance standards can have a cascading effect. Companies must remain vigilant and adaptable, ensuring that their operations align with evolving regulations. This requires ongoing collaboration with regulatory bodies, investment in research and development, and a commitment to continuous improvement. By prioritizing compliance and industry standards, companies can not only meet regulatory requirements but also enhance their reputation and customer trust.

In conclusion, Boeing’s major announcement has significant ramifications for Raytheon Technologies, GE Aviation, and Airbus, as well as the broader aerospace industry. The focus on regulatory considerations, compliance, and industry standards necessitates a proactive approach from these companies to adapt to the changing landscape. By aligning their operations with Boeing’s updated standards, these companies can maintain their competitive positions and contribute to the overall advancement of the aerospace sector.

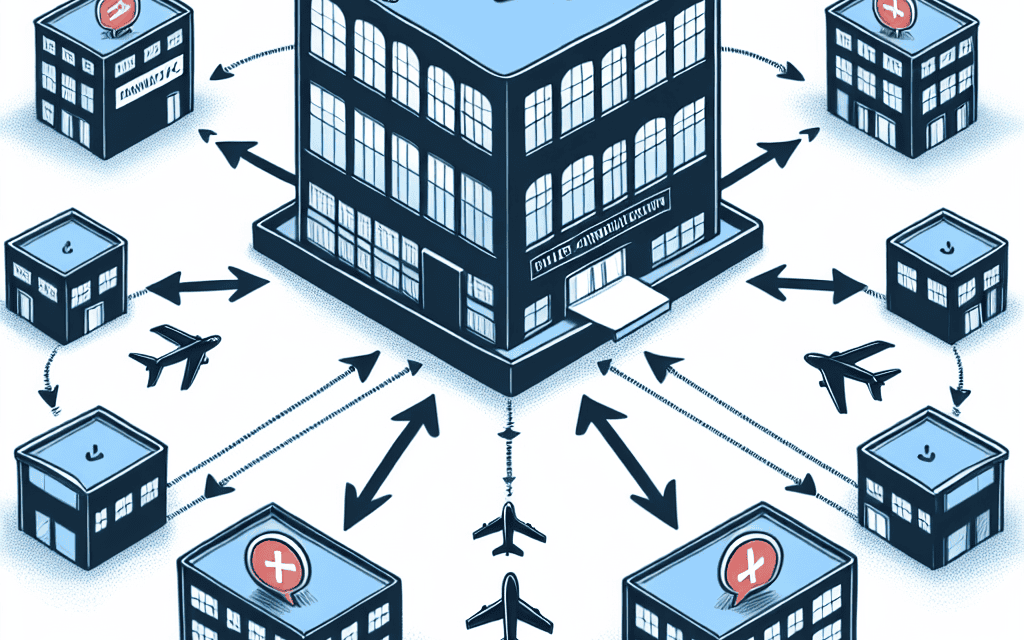

Strategic Partnerships: Collaborations And Joint Ventures

Boeing’s recent major announcement has sent ripples through the aerospace industry, particularly affecting three key companies with which it has strategic partnerships. This development underscores the importance of collaborations and joint ventures in navigating the complexities of modern aerospace challenges. As Boeing continues to innovate and expand its capabilities, the implications for its partners are both significant and multifaceted.

Firstly, the announcement has a profound impact on General Electric (GE), a long-standing partner of Boeing. GE, known for its advanced jet engines, has been a crucial supplier for Boeing’s commercial aircraft. The new strategic direction outlined by Boeing emphasizes a shift towards more fuel-efficient and environmentally friendly technologies. Consequently, GE is poised to benefit from increased demand for its next-generation engines that align with these sustainability goals. This collaboration not only strengthens GE’s market position but also reinforces its commitment to developing cutting-edge propulsion systems. As Boeing prioritizes eco-friendly solutions, GE’s role becomes even more pivotal, driving innovation and setting new industry standards.

In addition to GE, the announcement significantly affects Spirit AeroSystems, a company that specializes in manufacturing aerostructures. Spirit AeroSystems has been a vital partner in producing key components for Boeing’s aircraft, including fuselages and wing assemblies. With Boeing’s renewed focus on enhancing production efficiency and reducing costs, Spirit AeroSystems is expected to play an integral role in achieving these objectives. The partnership is likely to evolve, with both companies working closely to streamline manufacturing processes and implement advanced materials. This collaboration not only enhances Spirit AeroSystems’ operational capabilities but also positions it as a leader in the aerostructures market, capable of meeting the demands of a rapidly changing industry.

Furthermore, the announcement has implications for Honeywell Aerospace, another significant partner of Boeing. Honeywell provides a range of aerospace products and services, including avionics and auxiliary power units. As Boeing seeks to integrate more advanced digital technologies into its aircraft, Honeywell’s expertise in avionics and connectivity solutions becomes increasingly valuable. The partnership is expected to deepen, with a focus on developing innovative systems that enhance aircraft performance and passenger experience. This collaboration not only strengthens Honeywell’s position in the aerospace sector but also accelerates the adoption of digital technologies across the industry.

In light of Boeing’s announcement, these strategic partnerships highlight the importance of collaboration in addressing the challenges and opportunities within the aerospace industry. By working together, Boeing and its partners can leverage their respective strengths to drive innovation and achieve common goals. The synergies created through these collaborations not only benefit the companies involved but also contribute to the advancement of the aerospace sector as a whole.

Moreover, these partnerships underscore the interconnected nature of the aerospace industry, where the success of one company often hinges on the contributions of others. As Boeing continues to navigate its strategic priorities, the role of its partners becomes increasingly critical. Through joint ventures and collaborative efforts, these companies can collectively push the boundaries of what is possible, setting new benchmarks for performance, efficiency, and sustainability.

In conclusion, Boeing’s major announcement serves as a catalyst for strengthening its strategic partnerships with GE, Spirit AeroSystems, and Honeywell Aerospace. These collaborations are instrumental in driving innovation and achieving the ambitious goals set forth by Boeing. As the aerospace industry continues to evolve, the importance of strategic partnerships cannot be overstated, as they provide the foundation for future growth and success.

Q&A

1. **Question:** What was Boeing’s major announcement?

**Answer:** Boeing announced a significant increase in production rates for its 737 MAX aircraft.

2. **Question:** How does this announcement impact Spirit AeroSystems?

**Answer:** Spirit AeroSystems, which manufactures fuselages for the 737 MAX, is likely to see increased demand and production, potentially boosting its revenue and operational scale.

3. **Question:** What effect does Boeing’s announcement have on General Electric (GE)?

**Answer:** General Electric, through its joint venture CFM International, supplies engines for the 737 MAX, so increased production could lead to higher engine orders and sales for GE.

4. **Question:** How might this announcement affect Southwest Airlines?

**Answer:** As a major customer of the 737 MAX, Southwest Airlines could benefit from increased availability of aircraft, supporting its fleet expansion and operational efficiency.

5. **Question:** What are the potential risks for Spirit AeroSystems due to Boeing’s announcement?

**Answer:** The risks include potential supply chain challenges and the need to ramp up production capacity, which could strain resources and affect delivery timelines.

6. **Question:** How could Boeing’s announcement influence the stock prices of these companies?

**Answer:** The announcement could positively impact the stock prices of Spirit AeroSystems and GE due to anticipated increased demand, while Southwest Airlines might see improved investor confidence in its growth prospects.

7. **Question:** What strategic moves might these companies consider following Boeing’s announcement?

**Answer:** Spirit AeroSystems might invest in expanding production capabilities, GE could focus on optimizing engine production, and Southwest Airlines might strategize on fleet expansion and route optimization.

Conclusion

Boeing’s major announcement significantly impacts three key companies: its suppliers, competitors, and airline customers. For suppliers, the announcement could mean increased demand for parts and components, leading to potential revenue growth and the need for scaling operations. Competitors might face heightened pressure to innovate and improve their offerings to maintain market share, potentially leading to strategic shifts or partnerships. Airline customers could benefit from new aircraft models or technologies, enhancing their operational efficiency and passenger experience, but they may also need to adjust their fleet strategies and financial planning to accommodate new purchases or upgrades. Overall, Boeing’s announcement is likely to ripple through the aerospace industry, influencing strategic decisions and market dynamics for these companies.