“Rising Rents, Rising Stakes: The Inflation Battle Reignites”

Introduction

The housing crisis, a persistent and multifaceted issue, is emerging as a significant threat to the ongoing battle against inflation. As housing costs continue to soar, driven by a combination of supply shortages, increased demand, and rising construction expenses, the economic landscape faces renewed pressures. This escalation in housing prices not only strains household budgets but also contributes to broader inflationary trends, complicating efforts by policymakers to stabilize the economy. The interplay between housing market dynamics and inflation underscores the urgent need for comprehensive strategies to address the root causes of the crisis, ensuring that the path to economic recovery is not derailed by unchecked inflationary forces.

Impact Of Housing Shortages On Inflation Rates

The housing crisis, a persistent issue in many parts of the world, is increasingly becoming a significant factor in the ongoing battle against inflation. As housing shortages intensify, the ripple effects on inflation rates are becoming more pronounced, posing challenges for policymakers and economic stakeholders alike. Understanding the intricate relationship between housing shortages and inflation is crucial for devising effective strategies to mitigate these economic pressures.

To begin with, housing shortages lead to increased demand for the limited available properties, driving up prices. This surge in housing costs contributes directly to inflation, as housing expenses constitute a significant portion of the consumer price index (CPI), a primary measure of inflation. When housing prices rise, they exert upward pressure on the CPI, thereby influencing overall inflation rates. Consequently, the housing market’s dynamics play a pivotal role in shaping inflationary trends, making it imperative to address housing shortages to stabilize inflation.

Moreover, the impact of housing shortages extends beyond direct price increases. As housing becomes more expensive, individuals and families allocate a larger share of their income to housing expenses, reducing their disposable income for other goods and services. This shift in spending patterns can lead to increased demand for certain goods, further exacerbating inflationary pressures. Additionally, higher housing costs can lead to increased wage demands, as workers seek to maintain their standard of living. This, in turn, can result in a wage-price spiral, where rising wages lead to higher production costs and, subsequently, higher prices for goods and services.

Furthermore, the construction industry, a critical component of the housing sector, is also affected by housing shortages. As demand for new housing units grows, the construction industry faces increased pressure to deliver more homes. However, supply chain disruptions, labor shortages, and rising material costs can hinder the industry’s ability to meet this demand. These challenges can lead to delays in construction projects and further exacerbate housing shortages, creating a feedback loop that perpetuates inflationary pressures.

In addition to these economic factors, housing shortages can have broader social implications that indirectly influence inflation. For instance, inadequate housing can lead to increased urbanization as people migrate to cities in search of better living conditions. This urban influx can strain existing infrastructure and services, leading to higher costs for utilities, transportation, and other essential services. As these costs rise, they contribute to the overall inflationary environment, complicating efforts to control inflation.

Addressing the housing crisis requires a multifaceted approach that involves both short-term and long-term strategies. In the short term, policymakers can implement measures to increase the supply of affordable housing, such as incentivizing the construction of new homes and streamlining regulatory processes. In the long term, comprehensive urban planning and investment in infrastructure are essential to accommodate growing populations and prevent future housing shortages.

In conclusion, the housing crisis is a critical factor in the ongoing battle against inflation. The interplay between housing shortages and inflation rates underscores the need for targeted interventions to stabilize the housing market and, by extension, the broader economy. By addressing the root causes of housing shortages and implementing effective policy measures, it is possible to mitigate the impact of housing on inflation and ensure economic stability in the face of this pressing challenge.

Government Policies To Address The Housing Crisis

The housing crisis, a persistent issue affecting economies worldwide, has recently intensified, threatening to reignite the battle against inflation. As housing costs soar, governments are under increasing pressure to implement effective policies to address this multifaceted problem. The interplay between housing affordability and inflation is complex, with rising housing costs contributing significantly to the overall inflation rate. Consequently, governments are exploring a range of strategies to mitigate the impact of the housing crisis on inflation and ensure economic stability.

One of the primary approaches governments are considering is increasing the supply of affordable housing. By incentivizing the construction of new homes, particularly in urban areas where demand is highest, policymakers aim to alleviate the pressure on housing markets. This can be achieved through tax incentives for developers, streamlined permitting processes, and the allocation of public land for housing projects. By boosting the supply of affordable housing, governments hope to stabilize prices and reduce the inflationary pressures associated with rising rents and home prices.

In addition to increasing supply, governments are also focusing on demand-side measures to address the housing crisis. These measures include providing financial assistance to first-time homebuyers and implementing rent control policies to protect tenants from exorbitant rent increases. Financial assistance programs, such as down payment grants or low-interest loans, can help lower-income individuals and families enter the housing market, thereby reducing the demand-supply imbalance. Rent control policies, while controversial, aim to provide immediate relief to renters facing rapidly escalating housing costs, thus curbing inflationary pressures in the rental market.

Moreover, governments are recognizing the importance of addressing the root causes of the housing crisis, such as income inequality and wage stagnation. By implementing policies that promote wage growth and improve job opportunities, particularly in high-demand areas, governments can enhance individuals’ purchasing power and reduce the financial strain associated with housing costs. This approach not only addresses the housing crisis but also contributes to broader economic stability by fostering a more equitable distribution of wealth.

Furthermore, governments are increasingly aware of the need to integrate housing policies with broader urban planning and infrastructure development strategies. By investing in public transportation, schools, and healthcare facilities, policymakers can create more livable and accessible communities, thereby reducing the pressure on housing markets in major urban centers. This holistic approach ensures that housing policies are not implemented in isolation but are part of a comprehensive strategy to enhance the quality of life for all citizens.

International collaboration is also emerging as a crucial component in addressing the housing crisis. By sharing best practices and learning from successful housing policies implemented in other countries, governments can develop more effective strategies tailored to their specific contexts. This exchange of knowledge and expertise can lead to innovative solutions that address both the supply and demand sides of the housing market, ultimately contributing to a more stable and sustainable economic environment.

In conclusion, the housing crisis poses a significant threat to economic stability by exacerbating inflationary pressures. However, through a combination of supply-side and demand-side measures, as well as addressing underlying economic issues, governments can mitigate the impact of the housing crisis on inflation. By adopting a comprehensive and collaborative approach, policymakers can ensure that housing remains affordable and accessible, thereby safeguarding economic stability and improving the quality of life for citizens.

The Role Of Interest Rates In The Housing Market

The housing market has long been a barometer of economic health, reflecting broader financial trends and influencing consumer behavior. In recent years, the interplay between interest rates and housing prices has become a focal point for economists and policymakers alike. As the housing crisis looms, there is growing concern that it could reignite the battle against inflation, a challenge that central banks have been grappling with for decades. Understanding the role of interest rates in the housing market is crucial to comprehending the potential implications of this crisis.

Interest rates, set by central banks, are a primary tool for regulating economic activity. When rates are low, borrowing becomes cheaper, encouraging individuals and businesses to take out loans for investment and consumption. This, in turn, stimulates economic growth. Conversely, high interest rates make borrowing more expensive, which can dampen spending and investment, thereby slowing down the economy. In the context of the housing market, interest rates directly affect mortgage rates, which are a critical factor in determining housing affordability.

Over the past decade, many countries have experienced historically low interest rates, a policy adopted to spur economic recovery following the global financial crisis. This environment of cheap borrowing costs has fueled a surge in housing demand, driving up property prices in many regions. However, as inflationary pressures began to mount, central banks were compelled to reconsider their monetary policies. The prospect of rising interest rates has introduced a new dynamic into the housing market, with potential repercussions for both buyers and sellers.

As interest rates increase, the cost of mortgages rises, which can lead to a decrease in housing affordability. Prospective homebuyers may find themselves priced out of the market, leading to a decline in demand. This, in turn, can exert downward pressure on housing prices, potentially resulting in a market correction. For current homeowners, particularly those with variable-rate mortgages, higher interest rates can translate into increased monthly payments, straining household budgets and potentially leading to higher default rates.

Moreover, the housing market is intricately linked to consumer confidence and spending. A downturn in housing prices can erode household wealth, as homes often represent a significant portion of personal assets. This wealth effect can influence consumer behavior, leading to reduced spending and investment, which can have broader economic implications. In this context, the housing crisis poses a significant risk to economic stability, with the potential to exacerbate inflationary pressures.

Policymakers face a delicate balancing act in addressing these challenges. On one hand, they must manage interest rates to control inflation and ensure economic stability. On the other hand, they must be mindful of the impact of these policies on the housing market and the broader economy. Striking the right balance is crucial to avoiding a scenario where efforts to curb inflation inadvertently trigger a housing market collapse.

In conclusion, the housing crisis underscores the complex relationship between interest rates and the housing market. As central banks navigate the intricacies of monetary policy, the potential for a revived inflation battle looms large. Understanding the role of interest rates in this context is essential for anticipating the challenges ahead and formulating effective policy responses. As the situation unfolds, it will be imperative for policymakers to remain vigilant and responsive to the evolving economic landscape.

How Rising Rent Prices Contribute To Inflation

The housing crisis, characterized by soaring rent prices, is emerging as a significant factor in the ongoing battle against inflation. As the cost of living continues to rise, the impact of escalating rent prices on inflation cannot be underestimated. This phenomenon is not only affecting individual households but also exerting pressure on the broader economy, complicating efforts to stabilize prices and maintain economic growth.

To understand how rising rent prices contribute to inflation, it is essential to consider the role of housing in the consumer price index (CPI), a key measure of inflation. Housing costs, including rent, constitute a substantial portion of the CPI, reflecting their importance in the average household’s budget. When rent prices increase, they directly influence the CPI, leading to higher reported inflation rates. This, in turn, affects monetary policy decisions, as central banks may be compelled to adjust interest rates to curb inflationary pressures.

Moreover, the housing market’s dynamics are intricately linked to supply and demand factors. A shortage of affordable housing options, driven by factors such as population growth, urbanization, and limited new construction, has intensified competition for available rental units. Consequently, landlords are able to command higher rents, further exacerbating the housing crisis. This upward pressure on rent prices not only affects current tenants but also poses challenges for prospective renters, who may find themselves priced out of desirable locations.

In addition to direct impacts on inflation, rising rent prices have broader economic implications. As households allocate a larger share of their income to housing costs, their disposable income for other goods and services diminishes. This shift in spending patterns can dampen consumer demand in other sectors, potentially slowing economic growth. Furthermore, higher rent burdens can lead to increased financial stress for families, resulting in higher default rates on loans and reduced savings, which can have long-term consequences for financial stability.

The interplay between rent prices and inflation is further complicated by regional disparities. In some areas, particularly major metropolitan centers, rent increases have been more pronounced due to heightened demand and limited supply. These regional variations can create uneven inflationary pressures across the country, posing challenges for policymakers tasked with implementing effective nationwide strategies.

Addressing the housing crisis and its contribution to inflation requires a multifaceted approach. Policymakers must prioritize increasing the supply of affordable housing through incentives for new construction and the development of innovative housing solutions. Additionally, measures to protect tenants from excessive rent hikes, such as rent control policies, can provide temporary relief while longer-term solutions are implemented. Collaboration between government entities, private developers, and community organizations is crucial to creating sustainable housing solutions that meet the needs of diverse populations.

In conclusion, the housing crisis, marked by rising rent prices, is a critical factor in the ongoing inflation battle. Its impact on the consumer price index, household budgets, and broader economic stability underscores the need for comprehensive strategies to address the root causes of the crisis. By increasing the supply of affordable housing and implementing protective measures for tenants, policymakers can mitigate the inflationary pressures stemming from the housing market and work towards a more stable economic future. As the housing crisis continues to evolve, its implications for inflation will remain a central concern for economists and policymakers alike.

Strategies For Affordable Housing Development

The housing crisis, a persistent issue affecting economies worldwide, has recently intensified, threatening to reignite the battle against inflation. As housing costs continue to soar, the need for effective strategies to develop affordable housing has become more urgent than ever. Addressing this crisis requires a multifaceted approach that balances economic, social, and environmental considerations. By exploring various strategies for affordable housing development, policymakers and stakeholders can work towards mitigating the impact of rising housing costs on inflation and ensuring that housing remains accessible to all.

One of the primary strategies for affordable housing development is the implementation of inclusive zoning policies. These policies mandate that a certain percentage of new housing developments be designated as affordable units. By integrating affordable housing into new developments, communities can promote socioeconomic diversity and prevent the displacement of low-income residents. Moreover, inclusive zoning can help alleviate the pressure on existing affordable housing stock, which is often insufficient to meet demand. However, it is crucial for policymakers to carefully design these policies to avoid unintended consequences, such as discouraging new development or increasing overall housing costs.

In addition to inclusive zoning, public-private partnerships (PPPs) have emerged as a vital tool in the development of affordable housing. By leveraging the resources and expertise of both the public and private sectors, PPPs can facilitate the construction of affordable housing units more efficiently and cost-effectively. These partnerships often involve government incentives, such as tax credits or subsidies, to encourage private developers to invest in affordable housing projects. Furthermore, PPPs can help streamline the development process by reducing bureaucratic hurdles and fostering collaboration between stakeholders. As a result, PPPs can play a significant role in expanding the supply of affordable housing and mitigating the inflationary pressures associated with rising housing costs.

Another critical strategy for affordable housing development is the utilization of innovative construction techniques and materials. Advances in technology have paved the way for more efficient and sustainable building practices, which can significantly reduce construction costs. For instance, modular construction and 3D printing have emerged as promising methods for rapidly producing affordable housing units at a lower cost. Additionally, the use of sustainable materials and energy-efficient designs can help reduce long-term operational costs for residents, further enhancing the affordability of these units. By embracing innovation in construction, developers can contribute to the creation of affordable housing that is both economically viable and environmentally responsible.

Moreover, addressing the housing crisis requires a comprehensive approach that considers the broader context of urban planning and infrastructure development. Investing in public transportation and community amenities can enhance the livability of affordable housing developments and reduce the overall cost of living for residents. By creating well-connected and vibrant communities, policymakers can ensure that affordable housing is not only accessible but also desirable. This holistic approach can help prevent the concentration of poverty and promote social cohesion, ultimately contributing to a more equitable and sustainable urban environment.

In conclusion, the housing crisis poses a significant threat to economic stability by exacerbating inflationary pressures. However, by implementing strategies such as inclusive zoning, public-private partnerships, innovative construction techniques, and comprehensive urban planning, stakeholders can work towards developing affordable housing solutions that address the root causes of the crisis. Through collaboration and innovation, it is possible to create a housing landscape that is both affordable and resilient, ensuring that all individuals have access to safe and secure housing in the face of economic challenges.

The Connection Between Housing Supply And Economic Stability

The intricate relationship between housing supply and economic stability has long been a subject of analysis for economists and policymakers alike. As the global economy grapples with the aftermath of the pandemic, the housing crisis has emerged as a formidable challenge, threatening to reignite the battle against inflation. Understanding this connection is crucial, as housing is not only a fundamental human need but also a significant driver of economic activity.

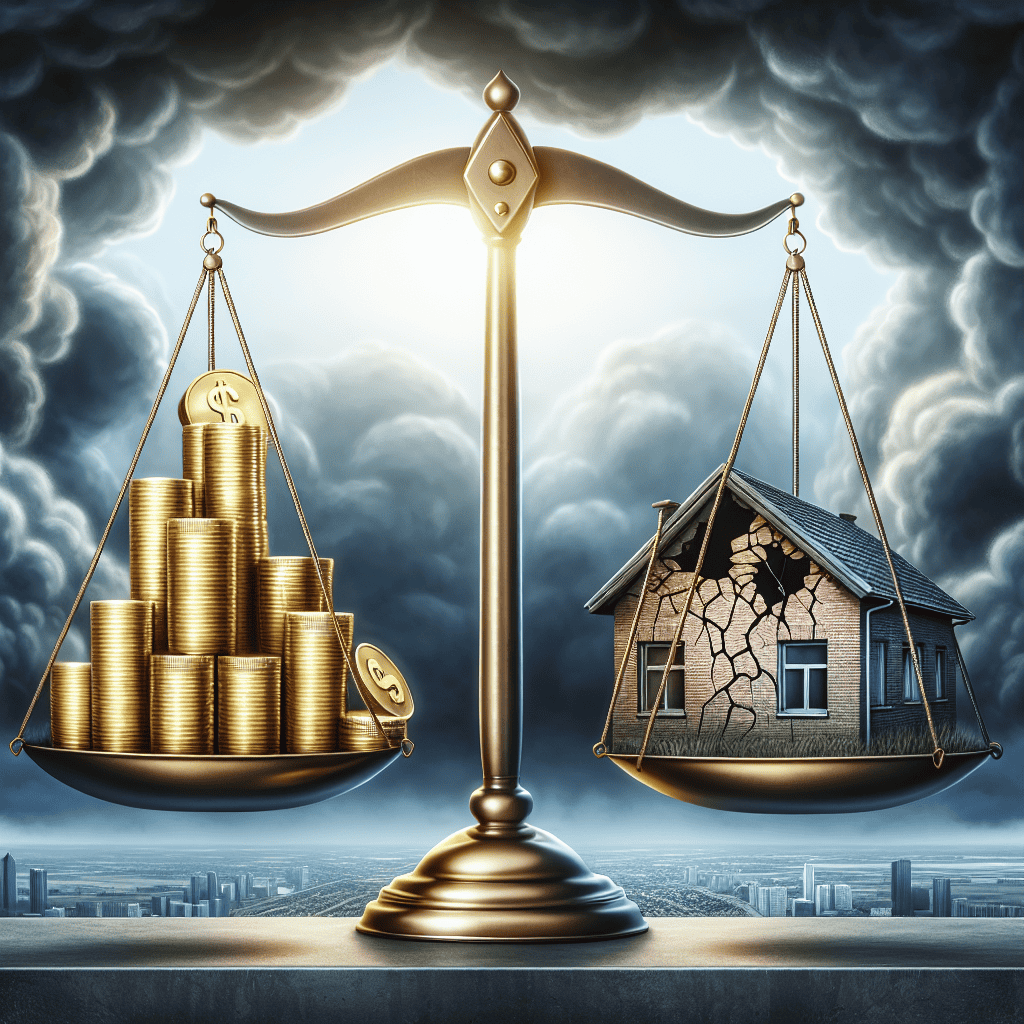

To begin with, the housing market plays a pivotal role in shaping economic stability. It influences consumer spending, employment, and overall economic growth. When housing supply fails to meet demand, prices inevitably rise, leading to increased costs for both renters and homeowners. This, in turn, can contribute to inflationary pressures, as housing costs constitute a substantial portion of the consumer price index. Consequently, a shortage in housing supply can exacerbate inflation, complicating efforts to maintain economic stability.

Moreover, the housing crisis has far-reaching implications for monetary policy. Central banks, tasked with controlling inflation, often rely on interest rate adjustments to manage economic fluctuations. However, when housing prices soar due to limited supply, central banks face a dilemma. Raising interest rates to curb inflation can inadvertently dampen economic growth, as higher borrowing costs may discourage investment and consumer spending. Conversely, maintaining low interest rates to stimulate growth can further inflate housing prices, creating a vicious cycle that is difficult to break.

In addition to its impact on inflation and monetary policy, the housing crisis also affects social and economic inequality. Limited housing supply disproportionately affects low- and middle-income households, who are more likely to experience housing insecurity and financial strain. As housing becomes increasingly unaffordable, these households may be forced to allocate a larger share of their income to housing costs, leaving less for other essential needs. This exacerbates existing inequalities and can hinder social mobility, as individuals and families struggle to build wealth and improve their economic standing.

Furthermore, the housing crisis has significant implications for labor markets. High housing costs can deter workers from relocating to areas with better job opportunities, leading to mismatches between labor supply and demand. This can result in inefficiencies in the labor market, as businesses may struggle to find qualified workers, while individuals remain unemployed or underemployed. Addressing the housing crisis is therefore essential not only for economic stability but also for ensuring a well-functioning labor market.

To mitigate the adverse effects of the housing crisis on economic stability, a multifaceted approach is required. Policymakers must prioritize increasing housing supply through measures such as incentivizing new construction, streamlining regulatory processes, and investing in affordable housing initiatives. Additionally, collaboration between government, private sector, and community organizations is essential to develop innovative solutions that address the diverse needs of different populations.

In conclusion, the housing crisis poses a significant threat to economic stability by exacerbating inflationary pressures, complicating monetary policy, and deepening social and economic inequalities. As such, it is imperative for policymakers to address the root causes of the crisis and implement strategies that promote a balanced and sustainable housing market. By doing so, they can help ensure that housing remains accessible and affordable for all, thereby safeguarding economic stability and fostering a more equitable society.

Long-Term Solutions To Prevent Future Housing Crises

The housing crisis, a persistent issue that has plagued economies worldwide, is once again threatening to reignite the battle against inflation. As housing costs continue to soar, the need for long-term solutions becomes increasingly urgent. Addressing this crisis requires a multifaceted approach that not only stabilizes the current market but also prevents future disruptions. To achieve this, policymakers and stakeholders must consider a range of strategies that encompass regulatory reforms, innovative construction techniques, and sustainable urban planning.

One of the primary drivers of the housing crisis is the imbalance between supply and demand. To mitigate this, governments must prioritize the development of affordable housing. This can be achieved through incentives for developers to build low-cost homes, as well as by streamlining the approval processes for new construction projects. By reducing bureaucratic hurdles, the time and cost associated with building new homes can be significantly decreased, thereby increasing the overall housing supply.

In addition to regulatory reforms, embracing innovative construction techniques can play a crucial role in addressing the housing shortage. Prefabricated and modular homes, for instance, offer a cost-effective and efficient alternative to traditional building methods. These techniques not only reduce construction time but also minimize waste, making them a more sustainable option. By investing in research and development of such technologies, governments can encourage their adoption and help alleviate the pressure on the housing market.

Furthermore, sustainable urban planning is essential in preventing future housing crises. As urban populations continue to grow, cities must be designed to accommodate this influx without compromising the quality of life for residents. This involves creating mixed-use developments that integrate residential, commercial, and recreational spaces, thereby reducing the need for long commutes and promoting a more balanced lifestyle. Additionally, investing in public transportation infrastructure can enhance connectivity and make suburban areas more accessible, thus expanding the available housing options.

Another critical aspect of addressing the housing crisis is ensuring that financial systems support sustainable homeownership. This involves implementing policies that prevent speculative investments and curb excessive borrowing. By promoting responsible lending practices and offering financial education programs, potential homeowners can be better equipped to make informed decisions, reducing the risk of defaults and foreclosures that can destabilize the housing market.

Moreover, collaboration between public and private sectors is vital in developing comprehensive solutions to the housing crisis. Public-private partnerships can facilitate the sharing of resources and expertise, leading to more effective and innovative approaches. For instance, governments can provide land or funding for affordable housing projects, while private developers bring in their construction and management expertise. Such collaborations can result in the creation of vibrant communities that cater to diverse needs and income levels.

In conclusion, the housing crisis poses a significant threat to economic stability and the fight against inflation. However, by implementing long-term solutions that address the root causes of the issue, it is possible to create a more resilient housing market. Through regulatory reforms, innovative construction techniques, sustainable urban planning, responsible financial practices, and public-private partnerships, we can not only stabilize the current situation but also prevent future crises. As we move forward, it is imperative that all stakeholders work together to ensure that housing remains accessible and affordable for all, thereby safeguarding economic prosperity and social well-being.

Q&A

1. **What is the housing crisis?**

The housing crisis refers to a situation where there is a significant shortage of affordable housing, leading to increased housing costs and financial strain on individuals and families.

2. **How does the housing crisis affect inflation?**

The housing crisis can contribute to inflation by driving up rental and home prices, which are significant components of the consumer price index, thereby increasing the overall cost of living.

3. **What factors are contributing to the current housing crisis?**

Factors include limited housing supply, increased demand, rising construction costs, and regulatory barriers that hinder new housing development.

4. **How might the housing crisis impact monetary policy?**

Central banks may need to adjust interest rates to manage inflationary pressures stemming from rising housing costs, potentially complicating efforts to stabilize the economy.

5. **What are potential solutions to the housing crisis?**

Solutions include increasing housing supply through new construction, implementing policies to make housing more affordable, and reforming zoning laws to allow for more diverse housing options.

6. **How does the housing crisis affect different socioeconomic groups?**

Lower-income and marginalized groups are disproportionately affected, as they spend a larger portion of their income on housing and have fewer resources to absorb rising costs.

7. **What role do government policies play in the housing crisis?**

Government policies can either exacerbate or alleviate the crisis through zoning regulations, tax incentives for developers, rent control measures, and funding for affordable housing projects.

Conclusion

The housing crisis poses a significant threat to reviving the battle against inflation. As housing costs rise, they contribute to overall inflationary pressures, affecting consumer spending and economic stability. The increased demand for housing, coupled with supply constraints, drives up prices, exacerbating affordability issues. This situation necessitates careful policy interventions to balance housing market dynamics and control inflation, ensuring economic growth without triggering further financial instability. Addressing the housing crisis is crucial to maintaining long-term economic health and preventing a resurgence of inflationary challenges.