“Revitalize Hong Kong: Easing Housing and Spirits for a Thriving Tomorrow”

Introduction

Hong Kong is set to implement significant policy changes aimed at stimulating economic growth, including the relaxation of housing regulations and a reduction in liquor taxes. These measures are part of a broader strategy to enhance the city’s competitiveness and attract both local and international investment. By easing housing rules, the government seeks to address affordability issues and increase the availability of residential properties, thereby encouraging more people to live and work in the city. Simultaneously, the cut in liquor taxes is designed to boost the hospitality and tourism sectors, making Hong Kong a more attractive destination for visitors and businesses alike. These initiatives reflect Hong Kong’s commitment to revitalizing its economy and maintaining its status as a leading global financial hub.

Impact Of Relaxed Housing Rules On Hong Kong’s Real Estate Market

The recent announcement by Hong Kong to relax housing rules and cut liquor tax marks a significant shift in the city’s economic strategy, aiming to stimulate growth and address pressing issues within its real estate market. This policy change is expected to have a profound impact on Hong Kong’s real estate sector, which has long been characterized by high property prices and limited housing availability. By easing housing regulations, the government seeks to increase the supply of residential units, thereby making housing more accessible and affordable for its residents.

One of the primary effects of relaxed housing rules is the potential increase in housing supply. By streamlining the approval process for new developments and reducing bureaucratic hurdles, developers are likely to be encouraged to undertake more projects. This could lead to a surge in construction activities, ultimately resulting in a greater number of housing units entering the market. As supply begins to meet demand, property prices may stabilize or even decrease, offering relief to prospective homebuyers who have been priced out of the market for years.

Moreover, the relaxation of housing rules could attract foreign investment into Hong Kong’s real estate sector. Investors, both local and international, are often deterred by stringent regulations and lengthy approval processes. By creating a more investor-friendly environment, Hong Kong could see an influx of capital, which would not only boost the real estate market but also contribute to the overall economic growth of the city. This increased investment could lead to the development of more diverse housing options, catering to different segments of the population and further enhancing the city’s appeal as a global financial hub.

In addition to increasing housing supply, the relaxed rules may also encourage innovation in the real estate sector. Developers might explore new construction technologies and sustainable building practices to differentiate their projects in a more competitive market. This could lead to the creation of environmentally friendly and energy-efficient housing, aligning with global trends towards sustainability. Consequently, Hong Kong could position itself as a leader in green urban development, attracting environmentally conscious investors and residents.

However, it is important to consider potential challenges that may arise from these policy changes. While increasing housing supply is a positive step, it must be accompanied by adequate infrastructure development to support the growing population. This includes ensuring access to transportation, healthcare, and education facilities. Without these complementary developments, the benefits of increased housing supply may be undermined by congestion and a decline in the quality of life.

Furthermore, while the reduction in liquor tax is aimed at boosting the hospitality sector, it may have indirect effects on the real estate market. A thriving hospitality industry could increase demand for commercial real estate, as businesses seek to capitalize on the anticipated growth in tourism and leisure activities. This, in turn, could lead to a rise in property values in areas with a high concentration of hospitality venues.

In conclusion, the relaxation of housing rules in Hong Kong represents a strategic move to address longstanding issues in the real estate market and stimulate economic growth. By increasing housing supply, attracting investment, and encouraging innovation, these policy changes have the potential to transform the city’s real estate landscape. However, careful planning and infrastructure development are essential to ensure that the benefits are fully realized and that Hong Kong remains a vibrant and livable city for its residents.

How Cutting Liquor Tax Could Boost Hong Kong’s Hospitality Industry

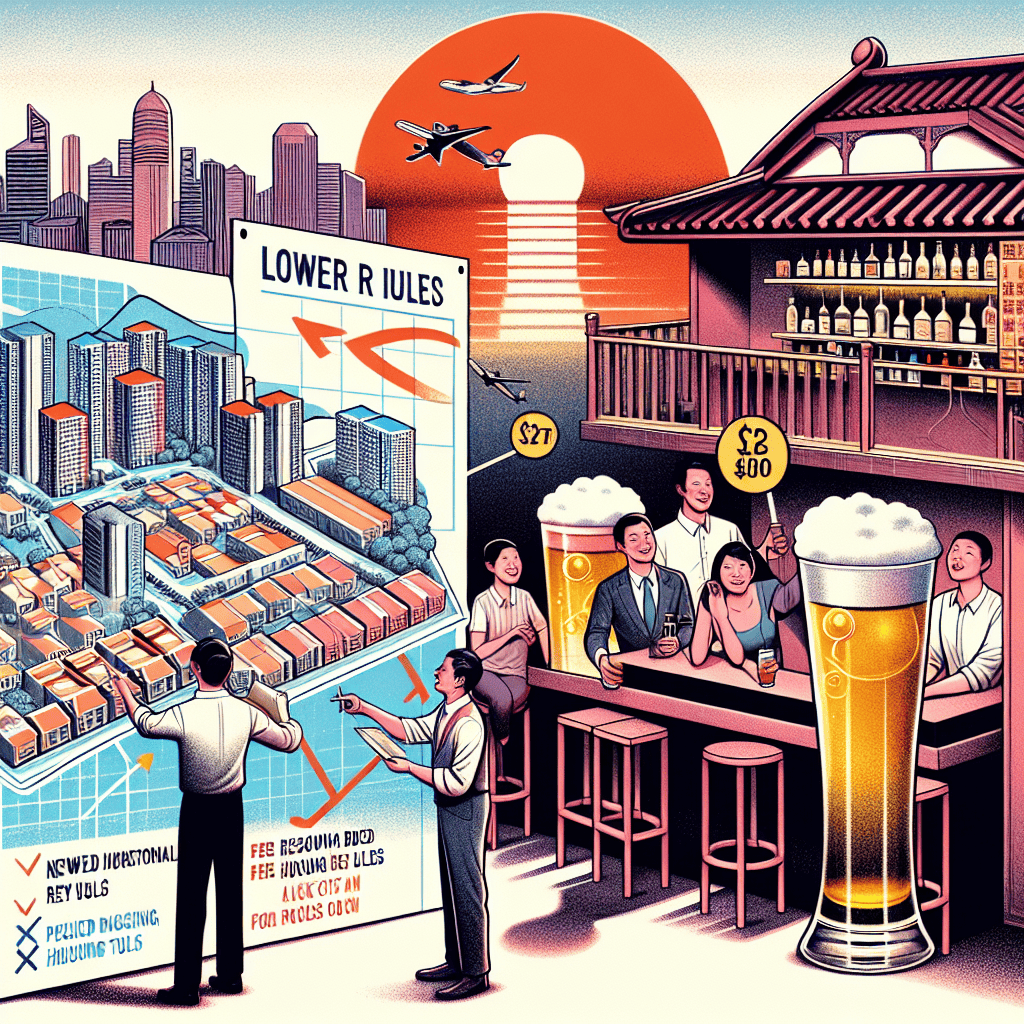

In a strategic move to invigorate its economy, Hong Kong has announced plans to relax housing rules and cut liquor taxes, aiming to stimulate growth and enhance its appeal as a global business hub. The decision to reduce liquor taxes is particularly significant for the hospitality industry, which has faced numerous challenges in recent years. By lowering these taxes, the government seeks to provide a much-needed boost to this sector, potentially leading to a ripple effect of economic benefits.

The hospitality industry in Hong Kong, like many around the world, has been severely impacted by the global pandemic. Restrictions on travel and social gatherings have led to a decline in business for restaurants, bars, and hotels. In this context, the reduction of liquor taxes is a strategic measure designed to alleviate some of the financial burdens faced by these establishments. By decreasing the cost of alcoholic beverages, the government hopes to encourage increased consumer spending, thereby driving higher revenues for businesses within the sector.

Moreover, the reduction in liquor taxes could enhance Hong Kong’s competitiveness as a destination for international tourists and business travelers. Lower prices on alcoholic beverages may attract more visitors, who often consider the cost of dining and entertainment when choosing travel destinations. This, in turn, could lead to increased occupancy rates in hotels and higher patronage in restaurants and bars, further stimulating the local economy.

In addition to attracting tourists, the tax cut could also foster a more vibrant nightlife scene, which is an integral part of Hong Kong’s cultural identity. A thriving nightlife not only appeals to visitors but also enhances the quality of life for residents, making the city a more attractive place to live and work. This could have positive implications for other sectors as well, such as real estate, as a lively urban environment often correlates with higher property values and increased demand for housing.

Furthermore, the decision to cut liquor taxes aligns with broader efforts to support small and medium-sized enterprises (SMEs) within the hospitality industry. Many of these businesses operate on thin margins and have been disproportionately affected by economic downturns. By reducing operational costs through lower taxes, the government provides these SMEs with a better chance of survival and growth. This support is crucial, as SMEs are a vital component of Hong Kong’s economy, contributing significantly to employment and innovation.

While the reduction in liquor taxes presents numerous opportunities, it is also important to consider potential challenges. For instance, there may be concerns about the social implications of increased alcohol consumption. To address this, the government could implement complementary measures, such as promoting responsible drinking and enhancing public awareness campaigns about the risks associated with excessive alcohol consumption.

In conclusion, the decision to cut liquor taxes in Hong Kong represents a calculated effort to revitalize the hospitality industry and stimulate economic growth. By making alcoholic beverages more affordable, the government aims to boost consumer spending, attract tourists, and support local businesses. While challenges remain, the potential benefits of this policy are significant, offering a pathway to recovery and prosperity for one of Hong Kong’s most dynamic sectors. As the city navigates its post-pandemic future, such measures will be crucial in ensuring its continued status as a leading global destination for business and leisure.

The Economic Implications Of Hong Kong’s New Growth Strategy

Hong Kong’s recent decision to relax housing rules and cut liquor taxes marks a significant shift in its economic strategy, aimed at revitalizing growth and enhancing its competitive edge in the global market. This move comes at a time when the city is grappling with economic challenges, including a sluggish property market and the need to attract international talent and investment. By easing housing regulations, the government seeks to address the pressing issue of housing affordability, which has long been a concern for residents and expatriates alike. The high cost of living in Hong Kong has often been cited as a deterrent for skilled professionals considering relocation to the city. Therefore, by making housing more accessible, the government hopes to create a more attractive environment for both local and international talent, thereby fostering a more dynamic workforce.

In tandem with housing reforms, the reduction in liquor taxes is another strategic move designed to stimulate economic activity. The hospitality and tourism sectors, which have been severely impacted by the global pandemic, stand to benefit significantly from this tax cut. Lower liquor taxes are expected to reduce costs for businesses, potentially leading to lower prices for consumers and increased spending in bars, restaurants, and hotels. This, in turn, could boost employment within these sectors, providing a much-needed lift to the local economy. Moreover, the tax reduction may enhance Hong Kong’s appeal as a tourist destination, drawing visitors who are eager to experience the city’s vibrant nightlife and culinary scene.

Furthermore, these policy changes reflect a broader effort by Hong Kong to diversify its economic base and reduce its reliance on traditional industries such as finance and real estate. By creating a more favorable environment for businesses and residents, the government aims to encourage innovation and entrepreneurship, paving the way for new industries to flourish. This diversification is crucial for ensuring long-term economic stability and resilience, particularly in the face of global uncertainties and shifting economic landscapes.

However, while these measures are poised to stimulate growth, they also present certain challenges and considerations. For instance, the relaxation of housing rules may lead to increased demand for property, potentially driving up prices in the short term. It is essential for the government to carefully monitor the housing market and implement complementary policies to prevent speculative activities that could undermine affordability goals. Similarly, while the reduction in liquor taxes is likely to benefit the hospitality sector, it is important to consider the potential social implications, such as increased alcohol consumption and its associated health risks.

In conclusion, Hong Kong’s new growth strategy, characterized by relaxed housing rules and reduced liquor taxes, represents a proactive approach to addressing current economic challenges and positioning the city for future success. By fostering a more inclusive and dynamic economic environment, these measures have the potential to attract talent, stimulate business activity, and enhance Hong Kong’s global competitiveness. Nevertheless, it is crucial for policymakers to remain vigilant and responsive to the evolving economic landscape, ensuring that these initiatives yield sustainable and equitable benefits for all stakeholders. As Hong Kong embarks on this new chapter, the careful balancing of growth ambitions with social and economic considerations will be key to achieving its long-term objectives.

Housing Affordability In Hong Kong: A New Era?

Hong Kong, a city renowned for its towering skyscrapers and vibrant economy, has long grappled with the challenge of housing affordability. As one of the most densely populated urban areas in the world, the demand for housing has consistently outstripped supply, leading to soaring property prices and a significant portion of the population being priced out of the market. In a bid to address these pressing issues and stimulate economic growth, the Hong Kong government has announced plans to relax housing rules and cut liquor taxes, marking a potential new era for housing affordability in the city.

The decision to relax housing regulations is a strategic move aimed at increasing the supply of residential units. By easing restrictions on land use and development, the government hopes to encourage more construction projects, thereby alleviating the housing shortage. This initiative is expected to not only make housing more accessible to the average citizen but also to attract foreign investment, as more developers may be enticed to enter the market. Furthermore, by streamlining the approval process for new developments, the government aims to expedite the construction of affordable housing units, which could lead to a more balanced real estate market in the long term.

In tandem with these housing reforms, the government has also announced a reduction in liquor taxes. This measure is designed to boost the hospitality and tourism sectors, which have been significantly impacted by global economic uncertainties and the lingering effects of the COVID-19 pandemic. By lowering the cost of alcoholic beverages, the government hopes to stimulate consumer spending and attract more tourists, thereby providing a much-needed boost to local businesses. This, in turn, could have a positive ripple effect on the broader economy, creating more jobs and increasing disposable income, which could further enhance the affordability of housing.

While these initiatives are promising, they are not without their challenges. Critics argue that simply increasing the supply of housing may not be sufficient to address the root causes of unaffordability. Issues such as income inequality and the speculative nature of the real estate market must also be addressed to ensure that the benefits of these reforms are felt by all segments of society. Moreover, there are concerns about the potential environmental impact of increased construction, as well as the need to preserve the unique cultural and historical heritage of Hong Kong amidst rapid urban development.

Nevertheless, the government’s proactive approach signals a commitment to tackling the housing crisis head-on. By adopting a multifaceted strategy that includes both regulatory reforms and economic incentives, Hong Kong is taking significant steps towards creating a more equitable and sustainable urban environment. As these policies are implemented, it will be crucial for the government to engage with stakeholders, including developers, community groups, and environmental organizations, to ensure that the needs and concerns of all parties are addressed.

In conclusion, the relaxation of housing rules and the reduction of liquor taxes represent a bold attempt by the Hong Kong government to revitalize its economy and improve housing affordability. While challenges remain, these measures could pave the way for a new era in which more residents can enjoy the benefits of living in one of the world’s most dynamic cities. As Hong Kong navigates this complex landscape, the success of these initiatives will depend on careful planning, collaboration, and a commitment to sustainable development.

The Role Of Tax Policy In Hong Kong’s Economic Recovery

In recent years, Hong Kong has faced a series of economic challenges, prompting policymakers to explore various strategies to stimulate growth and recovery. Among the measures under consideration are the relaxation of housing rules and a reduction in liquor taxes, both of which are intended to invigorate the local economy. These policy adjustments are part of a broader effort to leverage tax policy as a tool for economic revitalization, reflecting a strategic shift in how the government seeks to address the city’s financial hurdles.

The decision to relax housing rules is particularly significant given Hong Kong’s longstanding reputation for having one of the most expensive real estate markets in the world. By easing these regulations, the government aims to increase the supply of housing, thereby making it more affordable for residents. This move is expected to stimulate the construction industry, create jobs, and ultimately contribute to economic growth. Moreover, by making housing more accessible, the government hopes to attract and retain talent, which is crucial for maintaining Hong Kong’s status as a global financial hub.

In tandem with housing reforms, the proposed reduction in liquor taxes is another strategic move to boost economic activity. The hospitality and entertainment sectors, which have been severely impacted by the pandemic, stand to benefit significantly from this tax cut. By lowering the cost of liquor, the government aims to encourage consumer spending in bars, restaurants, and other venues, thereby supporting businesses that have struggled to stay afloat. This measure is also expected to enhance Hong Kong’s appeal as a tourist destination, drawing visitors who contribute to the local economy.

These policy changes underscore the critical role of tax policy in shaping economic outcomes. By adjusting tax rates and regulations, governments can influence consumer behavior, business investment, and overall economic activity. In Hong Kong’s case, the focus on housing and liquor taxes reflects a targeted approach to addressing specific sectors that have the potential to drive broader economic recovery. However, it is important to consider the potential trade-offs and challenges associated with these measures.

For instance, while relaxing housing rules may increase supply and reduce prices, it could also lead to concerns about overdevelopment and environmental sustainability. Balancing the need for economic growth with the preservation of Hong Kong’s unique urban landscape will require careful planning and oversight. Similarly, while reducing liquor taxes may boost the hospitality sector, it could also raise public health concerns related to alcohol consumption. Policymakers will need to weigh these factors carefully to ensure that the benefits of tax policy adjustments are maximized while minimizing potential drawbacks.

In conclusion, Hong Kong’s decision to relax housing rules and cut liquor taxes represents a strategic use of tax policy to foster economic recovery. By targeting key sectors with the potential for growth, the government aims to stimulate job creation, attract talent, and enhance the city’s global competitiveness. As these measures are implemented, it will be crucial to monitor their impact and make necessary adjustments to ensure that Hong Kong’s economic recovery is both robust and sustainable. Through thoughtful and adaptive tax policy, Hong Kong can navigate its current challenges and lay the groundwork for a prosperous future.

Comparing Hong Kong’s Housing Policies With Other Global Cities

Hong Kong’s recent decision to relax housing rules and cut liquor taxes marks a significant shift in its approach to fostering economic growth and addressing housing challenges. This move is part of a broader strategy to enhance the city’s competitiveness and livability. To better understand the implications of these changes, it is useful to compare Hong Kong’s housing policies with those of other global cities facing similar challenges.

Hong Kong has long been known for its sky-high property prices and limited housing supply, issues that have been exacerbated by its dense population and geographical constraints. The government’s decision to relax housing rules aims to alleviate some of these pressures by encouraging the development of more affordable housing options. This approach is not unique to Hong Kong; many global cities have implemented similar measures to tackle housing affordability.

For instance, Singapore, another densely populated city-state, has successfully implemented policies to control property prices and increase housing supply. The Singaporean government plays a proactive role in the housing market, with the Housing and Development Board (HDB) providing affordable public housing to a significant portion of the population. By maintaining a steady supply of public housing and implementing cooling measures such as additional buyer’s stamp duties, Singapore has managed to keep its property market relatively stable.

Similarly, cities like Tokyo have adopted innovative zoning and land-use policies to increase housing supply. Tokyo’s flexible zoning laws allow for mixed-use developments and higher-density housing, which have contributed to a more dynamic and affordable housing market. This approach contrasts with the more rigid zoning regulations often seen in Western cities, where restrictive land-use policies can limit housing supply and drive up prices.

In contrast, cities like London and New York have struggled with housing affordability due to a combination of high demand and limited supply. Both cities have implemented various measures to address these issues, such as affordable housing mandates and incentives for developers to build more housing units. However, these efforts have often been hampered by bureaucratic hurdles and local opposition, highlighting the challenges of balancing development with community interests.

Hong Kong’s decision to cut liquor taxes is another strategic move aimed at boosting economic growth. By reducing the cost of alcohol, the government hopes to stimulate the hospitality and tourism sectors, which have been hit hard by the global pandemic. This approach mirrors similar strategies employed by other cities seeking to revitalize their economies. For example, cities like Dublin and Berlin have leveraged their vibrant nightlife scenes to attract tourists and boost local businesses, contributing to their economic recovery.

In conclusion, Hong Kong’s recent policy changes reflect a broader trend among global cities to address housing affordability and stimulate economic growth. By relaxing housing rules and cutting liquor taxes, Hong Kong aims to enhance its competitiveness and livability in an increasingly interconnected world. While each city faces unique challenges, the experiences of cities like Singapore, Tokyo, London, and New York offer valuable insights into the potential benefits and pitfalls of various policy approaches. As Hong Kong moves forward with these initiatives, it will be crucial to monitor their impact and adapt strategies as needed to ensure sustainable growth and improved quality of life for its residents.

The Future Of Hong Kong’s Urban Development Post-Policy Changes

Hong Kong, a city renowned for its towering skyscrapers and vibrant economy, is poised to undergo significant changes in its urban development landscape. The government has announced plans to relax housing rules and cut liquor taxes as part of a broader strategy to stimulate economic growth and enhance the city’s global competitiveness. These policy changes are expected to have far-reaching implications for the future of Hong Kong’s urban development, influencing both the real estate market and the broader economic environment.

The decision to relax housing rules comes in response to the persistent challenges of housing affordability and supply shortages that have long plagued the city. By easing regulations, the government aims to encourage the construction of more residential units, thereby increasing the housing supply and alleviating pressure on property prices. This move is anticipated to attract both local and international developers, fostering a more dynamic real estate market. Moreover, the increased availability of housing could make Hong Kong a more attractive destination for expatriates and skilled professionals, further bolstering the city’s economic growth.

In tandem with the relaxation of housing rules, the government has also announced a reduction in liquor taxes. This measure is intended to invigorate the hospitality and tourism sectors, which have been adversely affected by global economic uncertainties and the lingering impacts of the COVID-19 pandemic. By lowering the cost of alcoholic beverages, the government hopes to stimulate consumer spending and attract more tourists, thereby revitalizing these crucial sectors. This policy change is expected to benefit not only bars and restaurants but also the broader service industry, creating a ripple effect that could lead to increased employment opportunities and economic activity.

The intersection of these policy changes with Hong Kong’s urban development is particularly noteworthy. As the city seeks to expand its housing stock, there will likely be a surge in construction projects, necessitating careful urban planning to ensure sustainable growth. The government will need to balance the demand for new housing with the preservation of green spaces and the maintenance of infrastructure. This presents an opportunity for innovative urban design solutions that prioritize environmental sustainability and enhance the quality of life for residents.

Furthermore, the reduction in liquor taxes could lead to a transformation in the city’s social and cultural landscape. With more vibrant nightlife and dining options, Hong Kong could strengthen its reputation as a global hub for entertainment and leisure. This, in turn, could attract a diverse array of international visitors and investors, contributing to the city’s cultural richness and economic vitality.

In conclusion, the relaxation of housing rules and the reduction of liquor taxes represent significant policy shifts that are poised to shape the future of Hong Kong’s urban development. These changes reflect the government’s commitment to addressing pressing economic challenges while positioning the city for long-term growth and prosperity. As Hong Kong navigates this new chapter, it will be crucial for policymakers, developers, and the community to collaborate in creating a sustainable and inclusive urban environment that meets the needs of its residents and enhances its global standing. Through strategic planning and innovative solutions, Hong Kong can continue to thrive as a dynamic and resilient metropolis in the years to come.

Q&A

1. **What is the main goal of Hong Kong’s new policy changes?**

The main goal is to stimulate economic growth and attract talent and investment.

2. **What specific housing rule changes are being proposed?**

The government plans to relax property cooling measures, such as reducing stamp duties for non-resident buyers and easing mortgage restrictions.

3. **How will the liquor tax be adjusted?**

The liquor tax will be reduced or potentially eliminated to boost the hospitality and tourism sectors.

4. **Why is Hong Kong focusing on these particular sectors?**

These sectors are targeted to enhance competitiveness, attract international talent, and revitalize the economy post-pandemic.

5. **What impact is expected from the relaxation of housing rules?**

It is expected to increase property market activity, attract foreign buyers, and make housing more accessible.

6. **How might the reduction in liquor tax affect local businesses?**

It could lower costs for bars and restaurants, increase consumer spending, and attract more tourists.

7. **What are the potential risks of these policy changes?**

Potential risks include overheating the property market and reducing government revenue from taxes.

Conclusion

Hong Kong’s decision to relax housing rules and cut liquor taxes is a strategic move aimed at stimulating economic growth and enhancing its competitiveness as a global financial hub. By easing housing regulations, the government seeks to address affordability issues, attract talent, and encourage investment in the real estate sector. The reduction in liquor taxes is likely intended to boost the hospitality and tourism industries, which have been significantly impacted by global economic challenges. These measures reflect Hong Kong’s proactive approach to revitalizing its economy and maintaining its status as a dynamic, attractive destination for businesses and individuals alike.