“Unlock Steady Income: Discover UPS and 7 High-Yield Dividend Stocks with 4%+ Returns!”

Introduction

High-yield dividend stocks are a popular choice for investors seeking a steady income stream and potential capital appreciation. Among these, United Parcel Service (UPS) and several other companies stand out for offering dividend yields of 4% or more. These stocks are particularly attractive in a low-interest-rate environment, providing a reliable source of income that can outpace inflation. UPS, a leader in the logistics and delivery industry, is known for its robust dividend policy, supported by strong cash flow and a resilient business model. Alongside UPS, other high-yield dividend stocks span various sectors, including utilities, telecommunications, and consumer goods, each offering unique advantages and risks. These companies not only provide attractive yields but also possess the potential for long-term growth, making them appealing to both income-focused and growth-oriented investors.

Understanding High-Yield Dividend Stocks: A Beginner’s Guide

High-yield dividend stocks have long been a cornerstone for investors seeking a steady income stream, particularly in volatile market conditions. These stocks, characterized by their ability to offer dividend yields of 4% or more, provide an attractive option for those looking to balance risk and reward. Among the notable high-yield dividend stocks is United Parcel Service (UPS), a company that has consistently demonstrated its commitment to returning value to shareholders. However, UPS is not alone in this endeavor; there are several other companies that also offer compelling dividend yields, making them worthy of consideration for any income-focused portfolio.

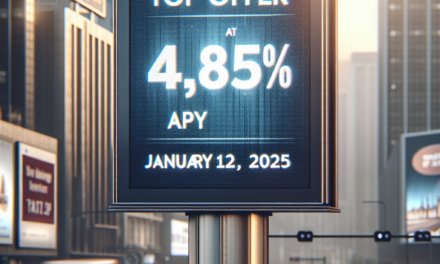

To understand the appeal of high-yield dividend stocks, it is essential to grasp the basic concept of dividend yield. This metric is calculated by dividing the annual dividend payment by the stock’s current price, expressed as a percentage. A higher yield indicates a greater return on investment in terms of dividends, which can be particularly appealing in a low-interest-rate environment. However, it is crucial to consider the sustainability of these dividends. Companies with high yields may face financial challenges that could jeopardize future payments, so investors must conduct thorough research to ensure the stability of the dividend.

UPS, a leader in the logistics and package delivery industry, exemplifies a company with a robust dividend policy. Its strong cash flow and strategic market position enable it to offer a dividend yield that exceeds 4%, making it an attractive option for income-seeking investors. The company’s ability to adapt to changing market dynamics, such as the rise of e-commerce, further solidifies its potential as a reliable dividend payer. Moreover, UPS’s commitment to innovation and efficiency ensures that it remains competitive, thereby supporting its capacity to maintain and potentially increase its dividend over time.

In addition to UPS, there are other high-yield dividend stocks that merit attention. These include companies from diverse sectors, each offering unique advantages and challenges. For instance, telecommunications giants often provide substantial dividends due to their stable cash flows and essential services. Similarly, utility companies, known for their consistent demand and regulated pricing, frequently offer attractive yields. Real estate investment trusts (REITs) also stand out, as they are required by law to distribute a significant portion of their income as dividends, resulting in higher yields for investors.

While high-yield dividend stocks can enhance a portfolio’s income potential, it is important to approach them with a discerning eye. Investors should evaluate the financial health of the company, its payout ratio, and its historical dividend performance. A high payout ratio, which indicates the proportion of earnings paid out as dividends, may signal potential risks if the company faces earnings pressure. Additionally, understanding the industry dynamics and the company’s competitive position can provide insights into the sustainability of its dividend.

In conclusion, high-yield dividend stocks like UPS and others offering 4% or more returns present a compelling opportunity for investors seeking income. By carefully assessing the financial stability and growth prospects of these companies, investors can build a diversified portfolio that not only provides regular income but also has the potential for capital appreciation. As with any investment strategy, due diligence and a long-term perspective are key to successfully navigating the world of high-yield dividend stocks.

Analyzing UPS: A Reliable High-Yield Dividend Stock

United Parcel Service (UPS) stands out as a reliable high-yield dividend stock, offering investors a compelling opportunity to secure substantial returns. As a cornerstone in the logistics and delivery industry, UPS has consistently demonstrated its ability to generate robust cash flows, which in turn supports its attractive dividend yield. Currently, UPS offers a dividend yield exceeding 4%, making it an appealing choice for income-focused investors seeking stability and growth potential.

The company’s strong market position is underpinned by its extensive global network and comprehensive service offerings, which include package delivery, freight forwarding, and supply chain management solutions. This diversified portfolio not only enhances UPS’s revenue streams but also mitigates risks associated with economic fluctuations. Moreover, the company’s strategic investments in technology and infrastructure have bolstered its operational efficiency, enabling it to maintain competitive advantage in a rapidly evolving industry.

In addition to its operational strengths, UPS’s financial health further solidifies its status as a reliable dividend stock. The company boasts a solid balance sheet, characterized by manageable debt levels and ample liquidity. This financial stability provides UPS with the flexibility to navigate economic uncertainties while continuing to reward shareholders through consistent dividend payments. Furthermore, UPS’s commitment to returning capital to shareholders is evident in its history of dividend growth, which reflects management’s confidence in the company’s long-term prospects.

Transitioning to the broader context of high-yield dividend stocks, UPS is not alone in offering attractive returns. Several other companies also present compelling opportunities for investors seeking income-generating assets. For instance, telecommunications giant AT&T, with its substantial dividend yield, remains a popular choice among dividend investors. Similarly, energy sector stalwart Chevron offers a high yield, supported by its strong cash flow generation and disciplined capital allocation.

Moreover, real estate investment trusts (REITs) such as Realty Income and Simon Property Group provide investors with exposure to the real estate market while delivering impressive dividend yields. These companies benefit from stable rental income and have demonstrated resilience in the face of economic challenges. Additionally, consumer staples companies like Altria and Philip Morris International offer high yields, driven by their strong brand portfolios and consistent demand for their products.

While these companies each have unique attributes that contribute to their high-yield status, they share common characteristics that make them appealing to dividend investors. These include strong cash flow generation, disciplined financial management, and a commitment to returning capital to shareholders. By focusing on these attributes, investors can identify high-yield dividend stocks that offer both income and potential for capital appreciation.

In conclusion, UPS exemplifies the qualities of a reliable high-yield dividend stock, with its strong market position, financial stability, and commitment to shareholder returns. As part of a diversified portfolio, UPS and other high-yield dividend stocks can provide investors with a steady income stream and potential for long-term growth. By carefully analyzing these opportunities, investors can enhance their portfolios and achieve their financial objectives.

Top 7 High-Yield Dividend Stocks Offering 4%+ Returns

Investors seeking stable income streams often turn to high-yield dividend stocks, which can provide a reliable source of returns even in volatile market conditions. Among these, United Parcel Service (UPS) stands out as a prominent choice, offering a robust dividend yield that appeals to income-focused investors. However, UPS is not alone in this category. There are several other companies that also offer dividend yields exceeding 4%, making them attractive options for those looking to bolster their portfolios with consistent income.

UPS, a leader in the logistics and package delivery industry, has consistently demonstrated its ability to generate substantial cash flow, which supports its generous dividend policy. The company’s strategic investments in technology and infrastructure have not only enhanced operational efficiency but also ensured a steady growth trajectory. This, in turn, has allowed UPS to maintain a high dividend yield, making it a compelling choice for investors seeking both income and growth potential.

In addition to UPS, there are other noteworthy companies that offer high-yield dividends. For instance, telecommunications giant AT&T has long been a favorite among dividend investors. Despite facing challenges in the rapidly evolving telecom landscape, AT&T has managed to sustain its dividend payouts, thanks to its extensive network infrastructure and diversified business model. The company’s commitment to returning value to shareholders is evident in its consistent dividend payments, which continue to attract income-seeking investors.

Similarly, energy sector stalwart Chevron is another high-yield dividend stock worth considering. As one of the world’s largest integrated energy companies, Chevron benefits from its global presence and diversified operations. The company’s strong balance sheet and disciplined capital management have enabled it to weather industry downturns while maintaining attractive dividend yields. For investors looking for exposure to the energy sector with the added benefit of high dividends, Chevron presents a viable option.

Moreover, the real estate investment trust (REIT) sector offers several high-yield opportunities. Realty Income Corporation, often referred to as “The Monthly Dividend Company,” is renowned for its consistent monthly dividend payments. With a diversified portfolio of commercial properties and a focus on long-term leases, Realty Income has established a track record of reliable income generation. This stability, coupled with its attractive dividend yield, makes it a popular choice among income-focused investors.

Another REIT worth mentioning is Simon Property Group, a leading player in the retail real estate space. Despite the challenges faced by the retail sector, Simon Property Group has demonstrated resilience through strategic acquisitions and a focus on premium properties. The company’s ability to adapt to changing market dynamics while maintaining a strong dividend yield underscores its appeal to investors seeking high-yield opportunities in the real estate sector.

Furthermore, the utility sector offers its share of high-yield dividend stocks, with companies like Duke Energy standing out. As a major utility provider, Duke Energy benefits from stable cash flows and a regulated business model, which supports its ability to pay consistent dividends. The company’s focus on renewable energy and infrastructure investments positions it well for future growth, making it an attractive option for income-oriented investors.

In conclusion, high-yield dividend stocks such as UPS, AT&T, Chevron, Realty Income Corporation, Simon Property Group, and Duke Energy offer compelling opportunities for investors seeking reliable income streams. These companies, each with their unique strengths and market positions, provide a diverse range of options for those looking to enhance their portfolios with stable, high-yielding investments. As always, investors should conduct thorough research and consider their individual financial goals before making investment decisions.

The Benefits of Investing in High-Yield Dividend Stocks

Investing in high-yield dividend stocks can be a strategic approach for those seeking to enhance their income streams while also benefiting from potential capital appreciation. High-yield dividend stocks, such as UPS and others offering returns of 4% or more, present a compelling opportunity for investors looking to balance risk and reward. These stocks are particularly attractive in a low-interest-rate environment, where traditional fixed-income investments may not provide sufficient returns to meet financial goals. By focusing on companies with a strong track record of dividend payments, investors can enjoy a steady income stream, which can be especially beneficial during periods of market volatility.

One of the primary benefits of investing in high-yield dividend stocks is the potential for regular income. Companies like UPS, known for their robust business models and consistent cash flow, often distribute a portion of their earnings to shareholders in the form of dividends. This regular income can be reinvested to purchase additional shares, thereby compounding returns over time, or it can be used to meet immediate financial needs. Moreover, dividends can provide a cushion against market downturns, as they offer a return on investment even when stock prices are fluctuating.

In addition to providing income, high-yield dividend stocks can also contribute to portfolio diversification. By including a mix of dividend-paying stocks from various sectors, investors can reduce their exposure to market volatility and economic cycles. For instance, while UPS operates in the logistics and transportation sector, other high-yield dividend stocks may be found in industries such as utilities, telecommunications, and consumer goods. This diversification can help mitigate risks associated with investing in a single sector or company, thereby enhancing the overall stability of an investment portfolio.

Furthermore, companies that consistently pay high dividends often exhibit strong financial health and stability. These firms typically have a history of generating reliable cash flows and maintaining disciplined capital allocation strategies. As a result, they are often better positioned to weather economic downturns and continue paying dividends even during challenging times. This financial resilience can be reassuring for investors, as it suggests a lower likelihood of dividend cuts or suspensions, which can negatively impact income streams.

Another advantage of high-yield dividend stocks is their potential for capital appreciation. While the primary focus of dividend investing is income generation, many high-yield stocks also offer the possibility of price appreciation over the long term. Companies that prioritize returning capital to shareholders through dividends often demonstrate strong operational performance and growth prospects. As these companies expand and increase their earnings, their stock prices may rise, providing investors with capital gains in addition to dividend income.

Moreover, high-yield dividend stocks can be an effective hedge against inflation. As the cost of living rises, the purchasing power of fixed-income investments may erode. However, companies that regularly increase their dividend payouts can help offset the impact of inflation by providing a growing income stream. This ability to maintain or increase dividends over time is a key consideration for investors seeking to preserve their wealth in real terms.

In conclusion, high-yield dividend stocks like UPS and others offering 4% or more returns present a valuable opportunity for investors seeking income, diversification, and potential growth. By carefully selecting companies with strong financial health and a commitment to returning capital to shareholders, investors can build a resilient portfolio that meets their financial objectives while navigating the complexities of the market.

Risks and Rewards: Navigating High-Yield Dividend Investments

Investing in high-yield dividend stocks can be an attractive strategy for those seeking a steady income stream, particularly in a low-interest-rate environment. Companies like UPS and others offering dividends of 4% or more present enticing opportunities for investors. However, while the allure of high returns is undeniable, it is crucial to understand the inherent risks and rewards associated with these investments. By carefully navigating the landscape of high-yield dividend stocks, investors can potentially enhance their portfolios while mitigating potential downsides.

To begin with, high-yield dividend stocks are often appealing because they provide a regular income stream, which can be particularly beneficial for retirees or those looking to supplement their income. Companies like UPS, known for their robust business models and consistent cash flow, can offer a sense of security to investors. Moreover, these dividends can be reinvested to purchase additional shares, thereby compounding returns over time. This reinvestment strategy can significantly boost the overall yield of an investment portfolio, making high-yield dividend stocks a compelling choice for long-term growth.

However, it is essential to recognize that high-yield dividend stocks are not without risks. One of the primary concerns is the sustainability of the dividend itself. A high yield may sometimes indicate that a company’s stock price has fallen, possibly due to underlying business challenges. In such cases, the dividend may be at risk of being cut if the company cannot maintain its payout ratio. Therefore, investors must conduct thorough due diligence, examining the company’s financial health, earnings stability, and cash flow to assess the sustainability of its dividends.

Furthermore, high-yield dividend stocks can be sensitive to interest rate changes. As interest rates rise, the relative attractiveness of dividend stocks may diminish, leading to potential price volatility. Investors should be mindful of the broader economic environment and interest rate trends when considering these investments. Diversification across different sectors and industries can help mitigate some of these risks, ensuring that a portfolio is not overly exposed to any single economic factor.

In addition to these considerations, it is important to evaluate the growth potential of the underlying companies. While high-yield dividend stocks provide immediate income, their long-term success depends on the company’s ability to grow its earnings and dividends over time. Companies with strong competitive advantages, such as UPS, which benefits from a global logistics network, are better positioned to sustain and potentially increase their dividends. Investors should look for companies with a track record of dividend growth, as this can be a positive indicator of future performance.

In conclusion, high-yield dividend stocks like UPS and others offering 4% or more returns can be a valuable addition to an investment portfolio, providing both income and potential for capital appreciation. However, investors must carefully weigh the risks and rewards, considering factors such as dividend sustainability, interest rate sensitivity, and growth potential. By conducting thorough research and maintaining a diversified portfolio, investors can navigate the complexities of high-yield dividend investments and potentially achieve their financial goals. As with any investment strategy, a balanced approach that aligns with individual risk tolerance and financial objectives is essential for long-term success.

How to Evaluate High-Yield Dividend Stocks for Long-Term Growth

When evaluating high-yield dividend stocks for long-term growth, investors must consider several critical factors to ensure that their investments not only provide substantial income but also appreciate over time. High-yield dividend stocks, such as UPS and others offering returns of 4% or more, can be attractive to income-focused investors. However, it is essential to look beyond the yield percentage and assess the sustainability and growth potential of these dividends.

To begin with, the financial health of a company is paramount. A robust balance sheet with manageable debt levels and strong cash flow is indicative of a company’s ability to sustain and potentially increase its dividend payouts. For instance, companies like UPS, which have a history of stable earnings and cash flow, are often better positioned to maintain their dividend payments even during economic downturns. Therefore, examining financial statements and understanding key metrics such as the debt-to-equity ratio and free cash flow is crucial.

Moreover, the payout ratio is another vital metric to consider. This ratio, which measures the proportion of earnings paid out as dividends, can provide insights into the sustainability of a company’s dividend policy. A lower payout ratio suggests that a company retains a significant portion of its earnings for reinvestment or as a buffer against future uncertainties, thereby enhancing its ability to sustain dividends. Conversely, a high payout ratio may indicate that a company is distributing most of its earnings, which could be unsustainable if earnings decline.

In addition to financial metrics, the competitive position and industry dynamics of a company play a significant role in its long-term growth prospects. Companies operating in industries with high barriers to entry, strong brand recognition, and a competitive edge are more likely to experience stable growth. For example, UPS benefits from its extensive logistics network and global reach, which provide it with a competitive advantage in the transportation and logistics industry. Evaluating the competitive landscape and understanding the company’s strategic positioning can offer valuable insights into its growth potential.

Furthermore, management’s track record and commitment to returning value to shareholders are essential considerations. Companies with a history of consistent dividend increases demonstrate a commitment to rewarding shareholders and often reflect confidence in their future earnings potential. Analyzing past dividend growth rates and management’s communication regarding future dividend policies can help investors gauge the likelihood of continued dividend growth.

Additionally, macroeconomic factors and industry trends can impact the performance of high-yield dividend stocks. Economic conditions, interest rates, and regulatory changes can influence a company’s profitability and, consequently, its ability to pay dividends. Staying informed about these external factors and understanding their potential impact on specific industries can aid investors in making informed decisions.

In conclusion, while high-yield dividend stocks like UPS and others offering 4%+ returns can be appealing for their income potential, a comprehensive evaluation is necessary to ensure long-term growth. By considering financial health, payout ratios, competitive positioning, management’s track record, and macroeconomic factors, investors can better assess the sustainability and growth prospects of these investments. Through diligent analysis and a focus on quality, investors can identify high-yield dividend stocks that not only provide attractive returns but also contribute to a resilient and growing investment portfolio.

Diversifying Your Portfolio with High-Yield Dividend Stocks

In the ever-evolving landscape of investment opportunities, high-yield dividend stocks have emerged as a compelling option for investors seeking both income and growth. These stocks, known for their ability to provide substantial dividend returns, offer a dual advantage: they generate a steady income stream while also possessing the potential for capital appreciation. Among the myriad of choices available, United Parcel Service (UPS) and seven other notable companies stand out, each offering dividend yields exceeding 4%. This makes them attractive options for those looking to diversify their portfolios with reliable income-generating assets.

To begin with, United Parcel Service (UPS) has long been a stalwart in the logistics and delivery sector. Its robust business model, characterized by a vast global network and efficient operations, has enabled it to consistently deliver strong financial performance. This, in turn, has allowed UPS to offer a dividend yield that exceeds 4%, making it a prime candidate for income-focused investors. The company’s commitment to returning value to shareholders is evident in its consistent dividend payouts, which are supported by its solid cash flow generation.

Transitioning to other high-yield dividend stocks, we find that the energy sector also presents lucrative opportunities. Companies such as Chevron and ExxonMobil have historically been reliable dividend payers, thanks to their substantial cash reserves and strategic investments in energy production. Despite the volatility often associated with the energy market, these companies have managed to maintain attractive dividend yields, providing investors with a buffer against market fluctuations. Their ability to adapt to changing market dynamics, coupled with a focus on sustainable energy initiatives, further enhances their appeal as long-term investments.

In addition to the energy sector, the telecommunications industry offers promising high-yield dividend stocks. AT&T, for instance, has been a consistent performer in this regard. The company’s extensive network infrastructure and diverse service offerings have enabled it to generate stable revenues, which support its generous dividend payouts. As the demand for connectivity continues to rise, AT&T’s strategic investments in 5G technology and broadband expansion are likely to bolster its financial position, ensuring the sustainability of its dividends.

Moreover, the consumer goods sector is not to be overlooked when considering high-yield dividend stocks. Procter & Gamble, a leader in this space, has a long-standing reputation for delivering reliable dividends. Its diverse portfolio of trusted brands and its ability to adapt to consumer trends have contributed to its financial resilience. This stability is reflected in its consistent dividend payments, which offer investors a dependable income stream.

Furthermore, the financial sector also presents viable options for dividend-seeking investors. Companies like JPMorgan Chase and Bank of America have demonstrated their ability to navigate economic cycles while maintaining strong dividend yields. Their robust capital positions and prudent risk management practices have enabled them to weather financial storms, making them attractive choices for those seeking stability and income.

In conclusion, diversifying a portfolio with high-yield dividend stocks such as UPS and others offering 4%+ returns can be a prudent strategy for investors aiming to balance income generation with growth potential. By carefully selecting stocks from various sectors, investors can mitigate risks and enhance their portfolios’ overall resilience. As these companies continue to adapt to market changes and prioritize shareholder returns, they remain valuable components of a well-rounded investment strategy.

Q&A

1. **What is a high-yield dividend stock?**

A high-yield dividend stock is a stock that offers a dividend yield significantly higher than the average yield of the market, typically above 4%.

2. **Why are high-yield dividend stocks attractive to investors?**

They provide a steady income stream, which can be particularly appealing during periods of market volatility or low interest rates.

3. **What is the dividend yield of UPS?**

As of the latest data, UPS offers a dividend yield of approximately 4%.

4. **Name another high-yield dividend stock besides UPS.**

AT&T is another example of a high-yield dividend stock, often offering yields above 4%.

5. **What are the risks associated with high-yield dividend stocks?**

They may be riskier due to potential financial instability of the company, leading to dividend cuts or stock price declines.

6. **How can investors assess the sustainability of a high dividend yield?**

Investors can look at the payout ratio, company earnings, cash flow, and historical dividend payment consistency.

7. **What sectors often have high-yield dividend stocks?**

Utilities, telecommunications, and real estate investment trusts (REITs) are sectors commonly associated with high-yield dividend stocks.

Conclusion

High-yield dividend stocks, such as UPS and others offering returns of 4% or more, present an attractive opportunity for income-focused investors seeking stable and potentially growing income streams. These stocks typically belong to well-established companies with strong cash flows and a commitment to returning capital to shareholders. While they offer the potential for higher income, investors should also consider the associated risks, such as market volatility and company-specific challenges, which could impact dividend sustainability. Diversification across sectors and thorough research into each company’s financial health and dividend history are crucial for mitigating risks. Overall, high-yield dividend stocks can be a valuable component of a balanced investment portfolio, providing both income and potential for capital appreciation.