“Gold Shines Brighter: Surpassing $2,700, A New Era of Wealth”

Introduction

Gold prices have reached unprecedented heights, surging to a record high and stabilizing above $2,700 per ounce. This remarkable ascent reflects a confluence of global economic factors, including heightened geopolitical tensions, inflationary pressures, and shifts in monetary policy. Investors, seeking safe-haven assets amidst market volatility, have driven demand for gold, pushing its value to new peaks. The precious metal’s performance underscores its enduring appeal as a store of value and a hedge against economic uncertainty, capturing the attention of market analysts and investors worldwide. As gold maintains its elevated position, the implications for global markets and investment strategies continue to unfold.

Factors Driving Gold’s Surge to Record Highs

Gold has long been regarded as a safe haven asset, a reliable store of value in times of economic uncertainty. Recently, it has surged to record highs, stabilizing above $2,700 per ounce, a development that has captured the attention of investors and analysts worldwide. Several factors have contributed to this remarkable rise, each playing a crucial role in driving gold’s ascent to unprecedented levels.

To begin with, the global economic landscape has been marked by significant volatility and uncertainty. The lingering effects of the COVID-19 pandemic, coupled with geopolitical tensions and trade disputes, have created an environment where traditional financial markets are fraught with risk. In such times, investors often turn to gold as a hedge against potential downturns, seeking the stability and security it offers. This increased demand has naturally pushed prices higher, as more investors flock to the precious metal to safeguard their wealth.

Moreover, inflationary pressures have been mounting across the globe, further fueling gold’s appeal. Central banks in major economies have implemented expansive monetary policies, including low interest rates and quantitative easing measures, to stimulate growth. While these policies have been effective in supporting economic recovery, they have also led to concerns about rising inflation. As the purchasing power of fiat currencies diminishes, gold becomes an attractive alternative, preserving value over time. Consequently, the fear of inflation has driven more investors to allocate a portion of their portfolios to gold, contributing to its price surge.

In addition to these macroeconomic factors, currency fluctuations have also played a significant role in gold’s ascent. The U.S. dollar, traditionally seen as a benchmark for global trade, has experienced periods of weakness due to various economic and political factors. A weaker dollar makes gold, which is priced in dollars, more affordable for investors using other currencies. This dynamic has further bolstered demand, as international buyers take advantage of favorable exchange rates to acquire gold, thereby driving up its price.

Furthermore, central banks themselves have been active participants in the gold market, adding to their reserves in recent years. Countries such as China, Russia, and India have been steadily increasing their gold holdings as part of a strategy to diversify their foreign exchange reserves. This trend reflects a growing recognition of gold’s enduring value and its role as a stabilizing force in national economies. The sustained purchases by central banks have provided additional support to gold prices, reinforcing its upward trajectory.

Lastly, technological advancements and innovations in the financial sector have made gold more accessible to a broader range of investors. The proliferation of exchange-traded funds (ETFs) and digital platforms has simplified the process of buying and selling gold, attracting a new generation of investors who may not have considered the precious metal in the past. This increased accessibility has expanded the market for gold, contributing to its sustained demand and price growth.

In conclusion, the surge in gold prices to record highs above $2,700 per ounce is the result of a confluence of factors. Economic uncertainty, inflationary pressures, currency fluctuations, central bank activities, and technological advancements have all played pivotal roles in driving demand for gold. As these dynamics continue to evolve, gold is likely to remain a focal point for investors seeking stability and security in an ever-changing global landscape.

The Economic Implications of Gold Stabilizing Above $2,700

The recent surge in gold prices, stabilizing above $2,700 per ounce, has captured the attention of investors, economists, and policymakers worldwide. This unprecedented rise in gold’s value is not merely a reflection of market speculation but rather a complex interplay of global economic factors. As gold continues to hold its ground at these record levels, it is essential to explore the broader economic implications of this phenomenon.

To begin with, gold has long been considered a safe-haven asset, a status that becomes particularly pronounced during times of economic uncertainty. The current stabilization of gold prices above $2,700 per ounce can be attributed to a confluence of factors, including geopolitical tensions, inflationary pressures, and fluctuating currency values. In times of geopolitical instability, investors often flock to gold as a means of preserving wealth, thereby driving up demand and, consequently, prices. This trend is evident in the current global landscape, where ongoing conflicts and diplomatic tensions have heightened the appeal of gold as a secure investment.

Moreover, inflationary pressures have played a significant role in the recent surge in gold prices. As central banks around the world grapple with rising inflation rates, the purchasing power of fiat currencies diminishes, prompting investors to seek refuge in assets that can retain value over time. Gold, with its historical reputation as a hedge against inflation, naturally becomes an attractive option. The stabilization of gold prices above $2,700 per ounce suggests that investors are increasingly concerned about the long-term impact of inflation on their portfolios, leading to sustained demand for the precious metal.

In addition to these factors, the fluctuating values of major currencies have also contributed to the rise in gold prices. The strength or weakness of currencies such as the US dollar can significantly influence gold’s value, as it is typically priced in dollars. When the dollar weakens, gold becomes cheaper for investors holding other currencies, thereby boosting demand. Conversely, a strong dollar can suppress gold prices. The current stabilization of gold above $2,700 per ounce indicates a complex interplay between currency dynamics and investor sentiment, reflecting broader economic uncertainties.

The implications of gold’s stabilization at these record levels extend beyond individual investment portfolios. For central banks, which hold significant reserves of gold, the increase in gold prices can enhance their balance sheets, providing a buffer against economic volatility. This, in turn, can influence monetary policy decisions, as central banks may adjust interest rates or engage in other measures to manage inflation and economic growth.

Furthermore, the mining industry stands to benefit from sustained high gold prices. Mining companies may experience increased profitability, which could lead to expanded operations and investment in exploration and development. This potential growth in the mining sector could have positive ripple effects on employment and economic activity in regions where gold mining is a significant industry.

In conclusion, the stabilization of gold prices above $2,700 per ounce is a multifaceted development with far-reaching economic implications. It reflects a confluence of geopolitical tensions, inflationary pressures, and currency fluctuations, all of which contribute to gold’s enduring appeal as a safe-haven asset. As investors, central banks, and industries navigate this new economic landscape, the sustained high value of gold will undoubtedly continue to shape financial strategies and policy decisions in the months and years to come.

How Investors Can Capitalize on Gold’s Record-Breaking Performance

As gold prices surge to unprecedented heights, stabilizing above $2,700 per ounce, investors are presented with a unique opportunity to capitalize on this record-breaking performance. The allure of gold as a safe-haven asset has been magnified by recent economic uncertainties, geopolitical tensions, and inflationary pressures, all of which have contributed to its meteoric rise. Consequently, understanding how to effectively invest in gold during this period of heightened interest is crucial for those looking to diversify their portfolios and hedge against potential market volatility.

To begin with, it is essential to recognize the various avenues available for investing in gold. Physical gold, such as bullion and coins, remains a popular choice for many investors due to its tangible nature and historical significance. However, purchasing and storing physical gold can involve additional costs and logistical considerations. Therefore, investors might also consider gold exchange-traded funds (ETFs), which offer a more convenient and liquid means of gaining exposure to gold prices without the need for physical storage. These funds track the price of gold and can be bought and sold on major stock exchanges, providing a flexible option for both short-term and long-term investors.

In addition to ETFs, gold mining stocks present another viable investment opportunity. By investing in companies that extract and produce gold, investors can potentially benefit from both the rising price of gold and the operational efficiencies of the mining companies themselves. However, it is important to conduct thorough research and due diligence when selecting mining stocks, as factors such as management expertise, geopolitical risks, and production costs can significantly impact their performance.

Moreover, gold futures and options offer more sophisticated investors the ability to speculate on the future price movements of gold. These financial instruments can provide substantial leverage, allowing investors to control a large amount of gold with a relatively small initial investment. Nevertheless, the complexity and inherent risks associated with futures and options trading necessitate a comprehensive understanding of the market and a well-defined risk management strategy.

As investors navigate the current gold market, it is also important to consider the broader economic context. The ongoing concerns about inflation, driven by expansive monetary policies and supply chain disruptions, have heightened the appeal of gold as a hedge against currency devaluation. Furthermore, geopolitical tensions, such as trade disputes and regional conflicts, continue to contribute to market uncertainty, reinforcing gold’s status as a safe-haven asset. By keeping abreast of these macroeconomic factors, investors can make more informed decisions about their gold investments.

In conclusion, the record-breaking performance of gold presents a compelling opportunity for investors seeking to enhance their portfolios. By exploring various investment vehicles, such as physical gold, ETFs, mining stocks, and futures, investors can tailor their strategies to align with their risk tolerance and investment objectives. Additionally, maintaining an awareness of the broader economic landscape will enable investors to capitalize on gold’s enduring appeal as a store of value and a hedge against uncertainty. As gold continues to stabilize above $2,700 per ounce, those who strategically position themselves in this market may find themselves well-rewarded in the long run.

Comparing Gold’s Current Surge to Historical Highs

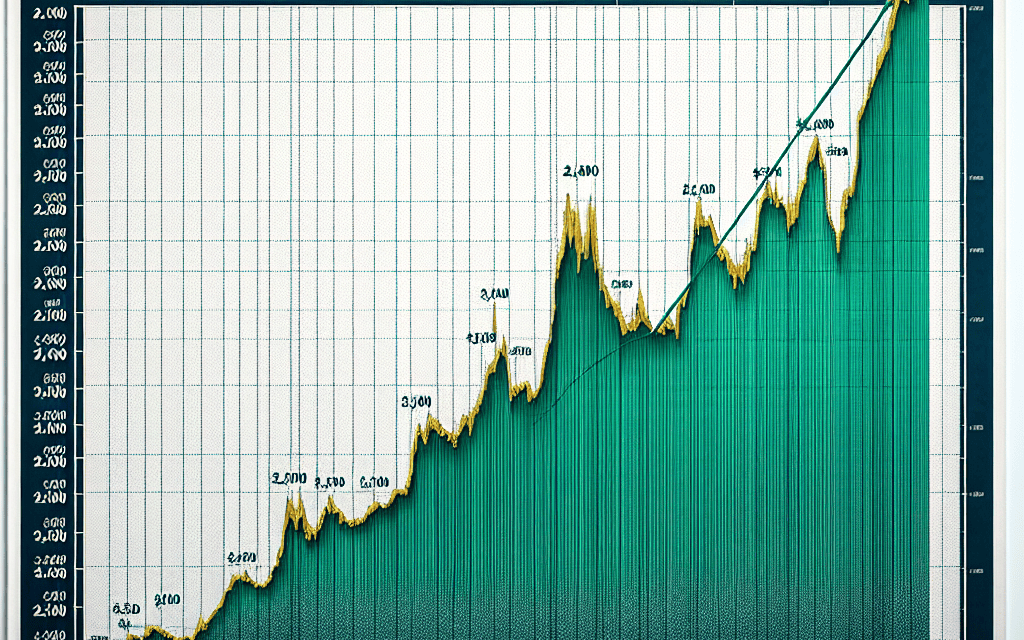

Gold has long been regarded as a safe haven for investors, particularly during times of economic uncertainty. Its recent surge to a record high, stabilizing above $2,700 per ounce, has captured the attention of market analysts and investors alike. To understand the significance of this development, it is essential to compare gold’s current performance with its historical highs, examining the factors that have driven its value in the past and those influencing it today.

Historically, gold has experienced several notable surges, often coinciding with periods of financial instability or geopolitical tension. For instance, during the late 1970s, gold prices soared as a result of high inflation, political unrest, and a weakening U.S. dollar. The price of gold reached an unprecedented peak in January 1980, driven by the Iranian Revolution and the Soviet invasion of Afghanistan, which heightened global uncertainty. Similarly, the 2008 financial crisis saw gold prices climb as investors sought refuge from volatile stock markets and declining currencies.

In comparing these historical surges to the current situation, it is evident that some underlying factors remain consistent. Economic uncertainty continues to play a pivotal role in driving gold prices upward. Today, concerns about inflation, exacerbated by expansive fiscal policies and supply chain disruptions, have prompted investors to seek the stability that gold offers. Additionally, geopolitical tensions, such as those involving major global powers, contribute to the perception of gold as a reliable store of value.

However, there are also distinct differences between past and present circumstances. The current surge in gold prices is occurring in an era characterized by unprecedented technological advancements and a rapidly evolving financial landscape. The rise of digital currencies and the increasing interest in blockchain technology have introduced new dynamics to the market. While some investors view cryptocurrencies as a potential alternative to gold, others remain skeptical, preferring the tangible and time-tested nature of precious metals.

Moreover, central banks around the world have played a more active role in recent years, with many increasing their gold reserves as a hedge against economic instability. This trend has contributed to the sustained demand for gold, further supporting its price. In contrast, during previous surges, central banks were often net sellers of gold, which sometimes tempered price increases.

Another factor to consider is the impact of global economic policies. In the past, gold price surges were often linked to specific regional events or crises. Today, the interconnectedness of global economies means that policy decisions in one part of the world can have far-reaching effects. For example, monetary policy shifts by major central banks, such as the Federal Reserve or the European Central Bank, can influence investor sentiment and drive demand for gold on a global scale.

In conclusion, while gold’s current surge to record highs shares some similarities with historical trends, it is also shaped by unique contemporary factors. The interplay of economic uncertainty, geopolitical tensions, technological advancements, and global policy decisions creates a complex environment that continues to bolster gold’s appeal as a safe haven asset. As investors navigate this landscape, the enduring allure of gold remains evident, underscoring its role as a cornerstone of financial security in an ever-changing world.

The Role of Central Banks in Gold’s Price Stability

Gold has long been regarded as a safe haven asset, a status that has been reinforced by its recent surge to a record high, stabilizing above $2,700 per ounce. This remarkable ascent in gold prices can be attributed to a confluence of factors, with central banks playing a pivotal role in influencing its price stability. As global economic uncertainties persist, central banks have increasingly turned to gold as a means of diversifying their reserves and safeguarding against potential financial crises. This strategic shift has had a profound impact on the dynamics of the gold market.

To understand the role of central banks in gold’s price stability, it is essential to consider their dual function as both buyers and holders of gold. Central banks, particularly in emerging markets, have been augmenting their gold reserves as a hedge against currency volatility and geopolitical risks. This trend has been driven by a desire to reduce reliance on the U.S. dollar and to enhance financial resilience. Consequently, the sustained demand from central banks has provided a solid foundation for gold prices, contributing to their upward trajectory.

Moreover, central banks’ monetary policies have indirectly influenced gold’s appeal as an investment. In recent years, the adoption of ultra-loose monetary policies, characterized by low or negative interest rates, has diminished the opportunity cost of holding non-yielding assets like gold. As a result, investors have increasingly turned to gold as a store of value, further bolstering its price. The interplay between central banks’ monetary policies and investor behavior underscores the intricate relationship between macroeconomic factors and gold’s market dynamics.

In addition to their role as buyers, central banks also act as custodians of significant gold reserves. This custodial function has implications for market stability, as central banks’ decisions regarding the management of these reserves can influence market sentiment. For instance, announcements of gold sales or purchases by central banks can trigger market reactions, affecting prices in the short term. However, central banks have generally adopted a cautious approach to managing their gold reserves, recognizing the potential impact of their actions on market stability.

Furthermore, central banks’ communication strategies play a crucial role in shaping market expectations and perceptions. By signaling their intentions regarding gold reserves, central banks can influence investor sentiment and contribute to price stability. Transparent communication helps mitigate market volatility and fosters confidence among market participants. This aspect of central bank policy underscores the importance of clear and consistent messaging in maintaining stability in the gold market.

While central banks have been instrumental in supporting gold’s price stability, it is important to acknowledge the broader macroeconomic context in which these dynamics unfold. Factors such as inflationary pressures, geopolitical tensions, and shifts in global trade patterns also exert significant influence on gold prices. Central banks, therefore, operate within a complex and interconnected global financial system, where their actions are both a response to and a driver of broader economic trends.

In conclusion, the role of central banks in gold’s price stability is multifaceted, encompassing their functions as buyers, custodians, and communicators. Their strategic decisions and policies have a profound impact on the gold market, contributing to its recent surge and stabilization above $2,700 per ounce. As global economic uncertainties persist, the actions of central banks will continue to be a key determinant of gold’s trajectory, underscoring their pivotal role in shaping the future of this precious metal.

Gold’s Impact on Global Markets and Currencies

The recent surge in gold prices, reaching a record high and stabilizing above $2,700 per ounce, has sent ripples through global markets and currencies, prompting a reevaluation of economic strategies worldwide. This unprecedented rise in gold’s value can be attributed to a confluence of factors, including geopolitical tensions, inflationary pressures, and shifts in monetary policy. As investors seek safe havens amidst economic uncertainty, gold’s allure as a stable asset has intensified, influencing both market dynamics and currency valuations.

To begin with, the geopolitical landscape has played a significant role in gold’s ascent. Heightened tensions in various regions, coupled with trade disputes and political instability, have driven investors to seek refuge in gold. Historically, gold has been perceived as a hedge against geopolitical risk, and its current trajectory underscores this enduring belief. As nations grapple with diplomatic challenges, the demand for gold as a protective asset has surged, further propelling its price upward.

Moreover, inflationary pressures have significantly contributed to gold’s recent performance. With central banks around the world implementing expansive monetary policies to counteract economic slowdowns, concerns about inflation have mounted. The injection of liquidity into the global economy, while necessary to stimulate growth, has raised fears of currency devaluation. In this context, gold emerges as a reliable store of value, immune to the erosive effects of inflation. Consequently, investors have flocked to gold, driving its price to unprecedented levels.

In addition to these factors, shifts in monetary policy have also played a crucial role in gold’s rise. Central banks, particularly in developed economies, have signaled a cautious approach to interest rate hikes, prioritizing economic recovery over immediate inflation control. This dovish stance has weakened currencies, particularly the U.S. dollar, which traditionally moves inversely to gold prices. As the dollar depreciates, gold becomes more attractive to investors, further fueling its upward momentum.

The impact of gold’s surge extends beyond market dynamics, influencing currency valuations across the globe. As gold prices climb, currencies of gold-exporting nations have experienced appreciation, bolstered by increased revenues from gold sales. Conversely, countries heavily reliant on gold imports have faced currency depreciation, as the cost of acquiring gold has risen. This shift in currency valuations has prompted central banks to reassess their foreign exchange strategies, balancing the need to stabilize their currencies with the imperative to support economic growth.

Furthermore, the record-high gold prices have implications for global trade balances. Nations with substantial gold reserves find themselves in a favorable position, as the value of their holdings appreciates. This newfound wealth can be leveraged to bolster economic resilience, fund infrastructure projects, or reduce national debt. On the other hand, countries with limited gold reserves may face challenges in maintaining trade equilibrium, as the cost of importing gold strains their financial resources.

In conclusion, the surge in gold prices to record highs above $2,700 per ounce has had a profound impact on global markets and currencies. Driven by geopolitical tensions, inflationary pressures, and shifts in monetary policy, gold’s ascent reflects its enduring status as a safe haven asset. As investors navigate an uncertain economic landscape, the influence of gold on market dynamics and currency valuations is likely to persist, shaping economic strategies and trade balances worldwide. This development underscores the intricate interplay between precious metals and the broader financial ecosystem, highlighting the need for adaptive and forward-thinking economic policies.

Future Predictions: Will Gold Maintain Its Record High?

The recent surge in gold prices, reaching a record high and stabilizing above $2,700 per ounce, has captured the attention of investors and analysts worldwide. This unprecedented rise prompts a critical examination of whether gold will maintain its elevated status or if market dynamics will lead to a correction. To understand the future trajectory of gold prices, it is essential to consider the factors that have contributed to this historic peak and the potential influences that could sustain or alter this trend.

Firstly, the global economic landscape has played a significant role in driving gold prices to their current heights. Economic uncertainty, fueled by geopolitical tensions, inflationary pressures, and fluctuating currency values, has led investors to seek safe-haven assets. Gold, traditionally viewed as a hedge against inflation and currency devaluation, has naturally benefited from this shift in investment strategy. As central banks around the world continue to grapple with inflation, the demand for gold as a protective asset is likely to persist, supporting its high price.

Moreover, the monetary policies of major economies have further bolstered gold’s appeal. With interest rates remaining relatively low, the opportunity cost of holding non-yielding assets like gold diminishes, making it an attractive option for preserving wealth. Additionally, central banks themselves have been active buyers of gold, diversifying their reserves away from traditional currencies. This institutional demand adds another layer of support to gold prices, suggesting that the current levels may be sustainable in the near term.

However, it is crucial to acknowledge the potential challenges that could impact gold’s ability to maintain its record high. One such factor is the possibility of a stronger-than-expected economic recovery. Should global economies rebound more robustly, investor confidence in riskier assets could increase, leading to a shift away from gold. Furthermore, any significant changes in monetary policy, such as interest rate hikes by central banks, could alter the investment landscape, making gold less attractive compared to interest-bearing assets.

In addition to economic factors, technological advancements and market innovations could also influence gold’s future. The rise of digital currencies and blockchain technology presents both opportunities and challenges for traditional assets like gold. While some investors may view cryptocurrencies as a modern alternative to gold, others argue that the tangible nature and historical significance of gold provide a level of security that digital assets cannot match. The interplay between these emerging technologies and traditional investment vehicles will be a key area to watch in determining gold’s long-term prospects.

Furthermore, geopolitical developments will continue to play a pivotal role in shaping gold’s future. Any escalation in global tensions or conflicts could drive investors towards safe-haven assets, reinforcing gold’s position at its current high. Conversely, diplomatic resolutions and stability could reduce the perceived need for protective investments, potentially leading to a price adjustment.

In conclusion, while gold’s recent surge to a record high above $2,700 per ounce is supported by a confluence of economic, monetary, and geopolitical factors, its future trajectory remains subject to a complex interplay of influences. Investors and analysts must remain vigilant, considering both traditional and emerging factors that could impact gold’s status. As the global landscape continues to evolve, the question of whether gold will maintain its record high remains open, with the potential for both sustained strength and market corrections.

Q&A

1. **What caused the recent surge in gold prices?**

The recent surge in gold prices was driven by increased geopolitical tensions, economic uncertainty, and a weaker U.S. dollar, prompting investors to seek safe-haven assets.

2. **How does inflation impact gold prices?**

Inflation erodes the purchasing power of fiat currencies, leading investors to buy gold as a hedge against inflation, which can drive up gold prices.

3. **What role do central banks play in gold price movements?**

Central banks influence gold prices through their monetary policies, such as interest rate adjustments and gold reserve management, which can affect investor confidence and demand for gold.

4. **How does the demand from emerging markets affect gold prices?**

Increased demand from emerging markets, particularly for jewelry and investment purposes, can drive up gold prices due to higher consumption and limited supply.

5. **What is the impact of mining production on gold prices?**

Limited or declining mining production can constrain supply, potentially leading to higher gold prices if demand remains strong.

6. **How do interest rates influence gold prices?**

Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors and potentially increasing its price.

7. **What are the potential risks to the stability of gold prices above $2,700 per ounce?**

Potential risks include a stronger U.S. dollar, rising interest rates, reduced geopolitical tensions, and increased mining output, all of which could lead to a decrease in gold prices.

Conclusion

The surge in gold prices to a record high, stabilizing above $2,700 per ounce, reflects a confluence of factors including heightened geopolitical tensions, economic uncertainty, and inflationary pressures driving investors towards safe-haven assets. This price level indicates strong market confidence in gold as a store of value amidst volatile financial markets. The stabilization above this threshold suggests sustained demand and potential for further price appreciation, contingent on ongoing global economic conditions and investor sentiment.