“From Peaks to Valleys: Gold’s Glittering Descent”

Introduction

Gold prices have experienced a significant decline, retreating from their recent record highs to a notable two-week downturn. This shift in the precious metal’s market value comes amid a complex interplay of global economic factors, including fluctuating interest rates, currency strength, and investor sentiment. As gold traditionally serves as a safe-haven asset, its price movements are closely watched by investors and analysts alike, reflecting broader economic trends and uncertainties. The recent plummet marks a critical juncture for stakeholders, prompting a reevaluation of market strategies and future outlooks in the face of evolving financial landscapes.

Causes Of The Recent Decline In Gold Prices

The recent decline in gold prices, following a period of record highs, has captured the attention of investors and analysts alike. Understanding the causes behind this downturn requires a multifaceted examination of the global economic landscape, market dynamics, and investor behavior. Initially, the surge in gold prices was driven by a confluence of factors, including geopolitical tensions, inflationary pressures, and a weakening U.S. dollar. However, the subsequent decline can be attributed to several key developments that have shifted market sentiment and influenced investor decisions.

One of the primary factors contributing to the recent decline in gold prices is the strengthening of the U.S. dollar. As the dollar appreciates, gold, which is priced in dollars, becomes more expensive for foreign investors, thereby reducing demand. This inverse relationship between the dollar and gold is a well-established market dynamic, and recent economic data indicating a robust U.S. economy has bolstered the dollar’s value. Consequently, as the dollar gains strength, gold prices have experienced downward pressure.

In addition to currency fluctuations, changes in monetary policy have also played a significant role in the recent downturn of gold prices. Central banks, particularly the Federal Reserve, have signaled a shift towards tightening monetary policy in response to rising inflation. The prospect of higher interest rates diminishes the appeal of non-yielding assets like gold, as investors seek higher returns in interest-bearing instruments. This anticipation of rate hikes has led to a reallocation of assets, with investors moving away from gold and into other investment vehicles that offer better returns in a rising interest rate environment.

Moreover, the easing of geopolitical tensions has also contributed to the decline in gold prices. Earlier in the year, heightened geopolitical risks, such as conflicts in Eastern Europe and trade disputes, had driven investors towards safe-haven assets like gold. However, recent diplomatic efforts and negotiations have alleviated some of these concerns, reducing the demand for gold as a protective hedge against uncertainty. As geopolitical risks subside, investors are more inclined to explore riskier assets, further contributing to the decline in gold prices.

Furthermore, the recent downturn in gold prices can be linked to changes in investor sentiment and market psychology. During periods of economic uncertainty, gold is often perceived as a safe store of value. However, as confidence in the global economic recovery grows, investors are increasingly willing to take on more risk, shifting their focus towards equities and other growth-oriented investments. This shift in sentiment has led to a decrease in demand for gold, as investors seek to capitalize on potential gains in other markets.

Lastly, technical factors and market corrections have also played a role in the recent decline of gold prices. After reaching record highs, it is not uncommon for markets to experience corrections as investors take profits and reassess their positions. This natural ebb and flow of the market can lead to short-term fluctuations in prices, contributing to the observed downturn in gold.

In conclusion, the recent decline in gold prices from record highs can be attributed to a combination of factors, including a strengthening U.S. dollar, changes in monetary policy, easing geopolitical tensions, shifts in investor sentiment, and technical market corrections. As these elements continue to evolve, they will undoubtedly influence the future trajectory of gold prices, underscoring the importance of closely monitoring the interplay of these factors in the global economic landscape.

Impact Of Global Economic Factors On Gold Valuation

Gold prices, often seen as a barometer of economic stability, have recently experienced a significant downturn, plummeting from record highs to a two-week low. This decline in gold valuation can be attributed to a confluence of global economic factors that have collectively influenced investor sentiment and market dynamics. Understanding these factors is crucial for comprehending the current state of the gold market and its potential future trajectory.

To begin with, the strength of the U.S. dollar plays a pivotal role in the valuation of gold. As gold is typically priced in dollars, any appreciation in the currency tends to make gold more expensive for holders of other currencies, thereby dampening demand. Recently, the U.S. dollar has gained strength due to a combination of robust economic data and expectations of further interest rate hikes by the Federal Reserve. This monetary policy stance, aimed at curbing inflation, has inadvertently exerted downward pressure on gold prices as investors seek higher yields in dollar-denominated assets.

Moreover, geopolitical tensions, which often drive investors towards safe-haven assets like gold, have shown signs of easing in certain regions. For instance, diplomatic efforts in conflict zones and improved trade relations between major economies have reduced the immediate need for risk-averse investments. Consequently, the diminished geopolitical risk has led to a reallocation of assets away from gold, contributing to its recent price decline.

In addition to these factors, the global economic recovery from the COVID-19 pandemic has also influenced gold prices. As economies reopen and consumer confidence improves, there is a shift towards equities and other growth-oriented investments. This shift is further supported by the gradual stabilization of supply chains and increased industrial activity, which have bolstered economic growth prospects. As a result, the allure of gold as a hedge against economic uncertainty has somewhat diminished, leading to reduced demand and lower prices.

Furthermore, central banks around the world have been adjusting their gold reserves in response to changing economic conditions. Some central banks have opted to sell portions of their gold holdings to capitalize on previous high prices, thereby increasing supply in the market. This strategic move, aimed at diversifying reserves and managing national currencies, has contributed to the downward pressure on gold prices.

It is also important to consider the impact of inflation expectations on gold valuation. While gold is traditionally viewed as a hedge against inflation, recent data suggests that inflationary pressures may be moderating. This perception has led investors to reassess their portfolios, reducing their reliance on gold as an inflationary hedge. Consequently, the recalibration of inflation expectations has played a role in the recent decline in gold prices.

In conclusion, the recent downturn in gold prices from record highs can be attributed to a complex interplay of global economic factors. The strengthening U.S. dollar, easing geopolitical tensions, global economic recovery, central bank reserve adjustments, and shifting inflation expectations have all contributed to the current state of the gold market. As these factors continue to evolve, they will undoubtedly shape the future trajectory of gold prices, underscoring the importance of closely monitoring global economic developments for investors and policymakers alike.

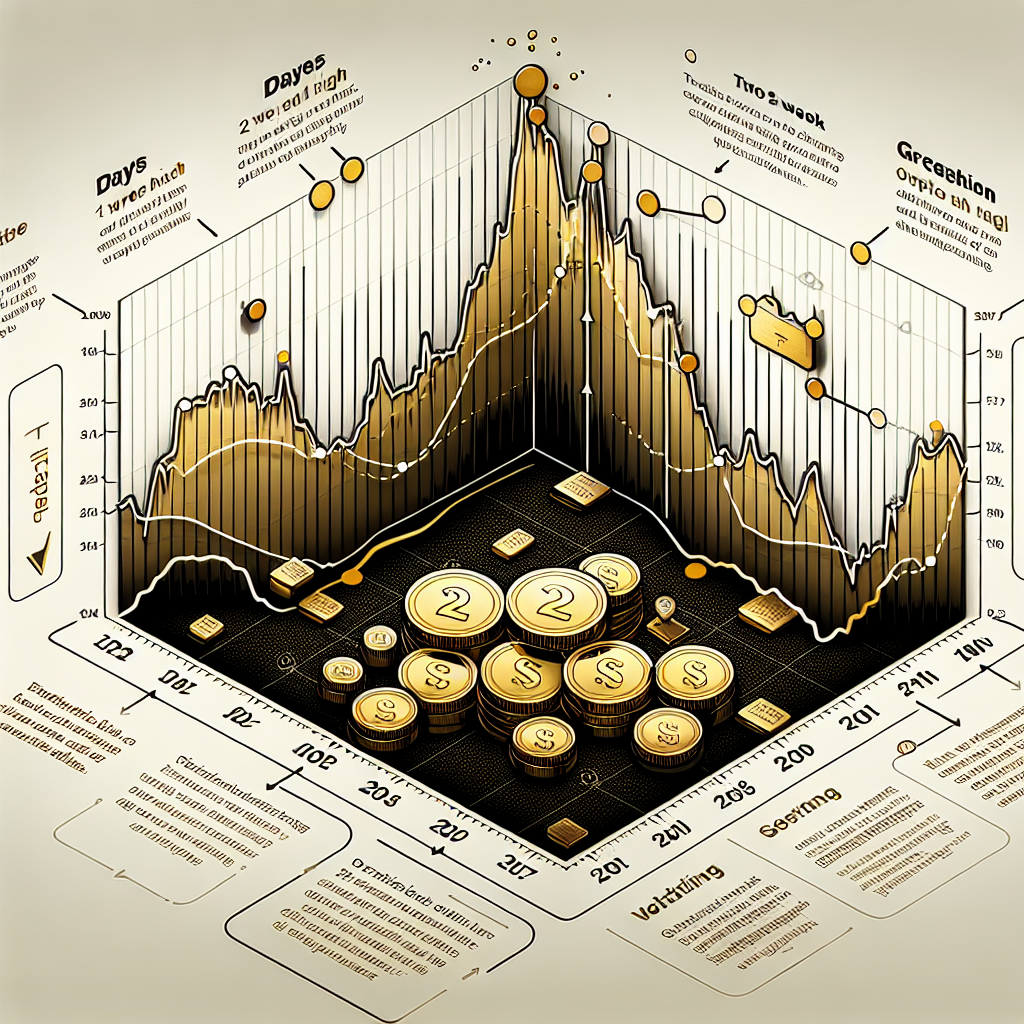

Historical Trends: Comparing Past Gold Price Fluctuations

Gold prices have long been a barometer of economic sentiment, often reflecting broader market trends and investor confidence. Historically, gold has been perceived as a safe haven during times of economic uncertainty, with its value typically rising when other assets falter. However, the recent plummet in gold prices from record highs to a two-week downturn has prompted analysts to revisit past fluctuations to better understand the current market dynamics.

To begin with, it is essential to consider the historical context of gold price movements. Over the decades, gold has experienced several significant peaks and troughs, each influenced by a unique set of economic and geopolitical factors. For instance, during the 1970s, gold prices surged due to high inflation and geopolitical tensions, reaching unprecedented levels by the end of the decade. Similarly, the 2008 financial crisis saw gold prices soar as investors sought refuge from volatile stock markets and uncertain economic conditions.

In contrast, the recent downturn in gold prices, following a period of record highs, can be attributed to a confluence of factors that differ from those of the past. Initially, the surge in gold prices was driven by a combination of pandemic-induced economic uncertainty, low interest rates, and expansive monetary policies implemented by central banks worldwide. These conditions created an environment where investors flocked to gold as a hedge against potential inflation and currency devaluation.

However, as the global economy began to recover and stabilize, the factors that once supported high gold prices started to wane. The rollout of vaccines and the gradual reopening of economies led to increased investor confidence in riskier assets, such as equities, thereby reducing the demand for gold. Additionally, central banks signaled a potential tightening of monetary policies, with some even beginning to raise interest rates. This shift in monetary policy expectations contributed to a stronger U.S. dollar, which typically inversely affects gold prices, as gold is priced in dollars.

Moreover, the recent downturn in gold prices can also be linked to profit-taking by investors who had previously capitalized on the metal’s record highs. As prices began to decline, some investors opted to lock in their gains, further exacerbating the downward trend. This behavior is not uncommon in the commodities market, where price corrections often follow periods of rapid appreciation.

When comparing the current situation to past fluctuations, it becomes evident that while the underlying causes may differ, the cyclical nature of gold prices remains consistent. Historically, gold has demonstrated resilience, often rebounding after periods of decline as new economic challenges emerge. This pattern suggests that while the current downturn may be concerning for some investors, it is not entirely unprecedented.

In conclusion, the recent plummet in gold prices from record highs to a two-week downturn can be understood within the broader context of historical trends. By examining past fluctuations, it becomes clear that gold’s value is influenced by a complex interplay of economic, geopolitical, and market factors. As such, while the current downturn may be unsettling, it is a reminder of the cyclical nature of commodities markets and the ever-evolving landscape of global economics. As investors navigate these changes, understanding historical trends can provide valuable insights into future price movements and potential opportunities within the gold market.

Investor Reactions To The Sudden Drop In Gold Prices

The recent downturn in gold prices has sent ripples through the investment community, prompting a range of reactions from seasoned investors and market analysts alike. After reaching record highs earlier this year, gold has experienced a significant decline over the past two weeks, leaving many to ponder the implications of this sudden shift. This unexpected drop has been attributed to a confluence of factors, including changes in global economic conditions, fluctuations in currency values, and shifts in investor sentiment. As a result, investors are now faced with the challenge of reassessing their strategies in light of these new market dynamics.

Initially, the surge in gold prices was driven by a combination of geopolitical tensions and economic uncertainties, which traditionally lead investors to seek the relative safety of precious metals. However, as these tensions began to ease and economic indicators showed signs of stabilization, the demand for gold started to wane. Concurrently, the strengthening of the U.S. dollar exerted additional downward pressure on gold prices, as a stronger dollar makes gold more expensive for holders of other currencies. This interplay of factors has created a complex environment for investors, who must now navigate the intricacies of a market in flux.

In response to the downturn, some investors have opted to liquidate their gold holdings, seeking to capitalize on the gains made during the previous price surge. This sell-off has further contributed to the decline in prices, as increased supply in the market exerts additional downward pressure. On the other hand, there are those who view the current dip as a buying opportunity, believing that gold’s long-term value proposition remains intact. These investors argue that the fundamental drivers of gold demand, such as inflation concerns and geopolitical risks, have not been entirely mitigated and could resurface, potentially driving prices higher in the future.

Moreover, institutional investors and hedge funds have also been closely monitoring the situation, adjusting their portfolios to reflect the changing market conditions. Some have diversified their holdings, reducing their exposure to gold while increasing investments in other asset classes that may offer more immediate returns. Others have taken a more cautious approach, maintaining their gold positions as a hedge against potential market volatility. This divergence in strategies underscores the uncertainty that currently pervades the market, as investors weigh the potential risks and rewards associated with gold investments.

In addition to individual and institutional investors, central banks around the world have also been affected by the recent fluctuations in gold prices. Many central banks hold significant gold reserves as part of their foreign exchange reserves, and changes in gold prices can impact the valuation of these reserves. As a result, central banks may adjust their monetary policies or reserve management strategies in response to the evolving market landscape.

In conclusion, the recent downturn in gold prices has elicited a wide range of reactions from investors, reflecting the complexity and uncertainty of the current market environment. While some have chosen to divest from gold, others remain steadfast in their belief in its long-term value. As the global economic landscape continues to evolve, investors will need to remain vigilant, adapting their strategies to navigate the challenges and opportunities that lie ahead. The coming months will likely provide further insights into the trajectory of gold prices and the broader implications for the investment community.

Future Predictions: Will Gold Prices Rebound?

Gold prices, which recently soared to unprecedented heights, have experienced a significant downturn over the past two weeks, leaving investors and market analysts speculating about the future trajectory of this precious metal. The recent decline in gold prices can be attributed to a confluence of factors, including shifts in global economic conditions, changes in investor sentiment, and fluctuations in currency values. As we delve into the potential future of gold prices, it is essential to consider these underlying influences and their possible implications.

To begin with, the global economic landscape plays a crucial role in determining the value of gold. Historically, gold has been perceived as a safe-haven asset, attracting investors during times of economic uncertainty. However, recent signs of economic stabilization and recovery in major economies have led to a shift in investor focus towards riskier assets, such as equities. This shift has contributed to the recent decline in gold prices, as investors seek higher returns in a recovering market. Moreover, central banks around the world have been adjusting their monetary policies, with some hinting at interest rate hikes. Higher interest rates tend to strengthen currencies, particularly the U.S. dollar, making gold less attractive as it becomes more expensive for holders of other currencies.

In addition to economic factors, geopolitical tensions and their resolution can also impact gold prices. For instance, the easing of certain geopolitical conflicts has reduced the immediate need for a safe-haven asset, further contributing to the decline in gold prices. However, it is important to note that geopolitical tensions are inherently unpredictable, and any resurgence could potentially drive gold prices upward once again. Therefore, while the current geopolitical climate may not favor a rebound in gold prices, the situation remains fluid and subject to change.

Furthermore, investor sentiment and market psychology play a significant role in the fluctuations of gold prices. The recent downturn may have been exacerbated by a shift in sentiment, as investors reassess their portfolios in light of changing economic conditions. However, sentiment can be volatile and is often influenced by external factors such as economic data releases, policy announcements, and global events. A sudden change in any of these factors could lead to a swift reversal in sentiment, potentially driving gold prices higher.

Looking ahead, the question of whether gold prices will rebound hinges on several key factors. Firstly, the trajectory of global economic recovery will be pivotal. Should economic growth falter or inflationary pressures rise, gold may regain its appeal as a hedge against uncertainty and inflation. Additionally, any unexpected geopolitical developments could reignite demand for gold as a safe-haven asset. Furthermore, central bank policies will continue to be closely monitored, as any deviation from expected interest rate paths could influence currency values and, consequently, gold prices.

In conclusion, while gold prices have experienced a notable downturn from their recent record highs, the future remains uncertain. The interplay of economic conditions, geopolitical developments, and investor sentiment will be critical in determining whether gold prices will rebound. Investors and analysts alike will need to remain vigilant, keeping a close eye on these factors as they navigate the complex landscape of the global economy and financial markets. As always, the inherent unpredictability of these elements underscores the importance of a diversified investment strategy, particularly in times of market volatility.

The Role Of Central Banks In Gold Price Movements

Gold prices have long been a barometer of economic stability, often reflecting broader financial trends and investor sentiment. Recently, gold prices have experienced a significant downturn, plummeting from record highs to a two-week low. This decline has sparked discussions about the various factors influencing gold prices, with central banks playing a pivotal role in these movements. Understanding the dynamics between central banks and gold prices is crucial for comprehending the recent fluctuations in the precious metal’s value.

Central banks are key players in the global financial system, wielding considerable influence over monetary policy and economic stability. Their actions, particularly regarding interest rates and currency reserves, can have profound effects on gold prices. When central banks adjust interest rates, they indirectly impact the attractiveness of gold as an investment. For instance, when interest rates are low, the opportunity cost of holding non-yielding assets like gold decreases, making it a more appealing option for investors seeking a safe haven. Conversely, rising interest rates can diminish gold’s allure, as investors may prefer assets that offer better returns.

Moreover, central banks themselves are significant holders of gold reserves, and their buying or selling activities can directly affect market dynamics. When central banks increase their gold reserves, it often signals confidence in the metal’s long-term value, potentially driving prices upward. Conversely, when they sell off gold, it can lead to a surplus in the market, exerting downward pressure on prices. The recent downturn in gold prices can be partially attributed to central banks’ strategic decisions regarding their reserves, as some have opted to reduce their holdings in response to changing economic conditions.

In addition to interest rates and reserve management, central banks’ monetary policies also play a crucial role in shaping gold prices. Quantitative easing, for example, involves the injection of liquidity into the economy, which can lead to inflationary pressures. In such scenarios, gold is often perceived as a hedge against inflation, prompting increased demand and higher prices. However, when central banks signal a tightening of monetary policy to combat inflation, it can lead to a strengthening of the currency, reducing the appeal of gold as an inflation hedge and contributing to price declines.

Furthermore, central banks’ actions are closely monitored by investors, who often react swiftly to any indications of policy shifts. This heightened sensitivity can lead to increased volatility in gold prices, as market participants adjust their positions based on anticipated changes in central bank strategies. The recent two-week downturn in gold prices may reflect such anticipatory behavior, as investors recalibrate their expectations in response to evolving central bank policies.

In conclusion, the role of central banks in gold price movements is multifaceted and significant. Their decisions regarding interest rates, reserve management, and monetary policy can have far-reaching implications for the precious metal’s value. As gold prices continue to fluctuate, understanding the interplay between central banks and market dynamics remains essential for investors and analysts alike. The recent decline from record highs to a two-week low underscores the importance of closely monitoring central bank actions and their potential impact on gold prices. As the global economic landscape evolves, the influence of central banks on gold will undoubtedly remain a critical factor in shaping the future trajectory of this enduring asset.

Strategies For Investors During A Gold Price Downturn

In the ever-fluctuating world of commodities, gold has long been regarded as a safe haven for investors, particularly during times of economic uncertainty. However, recent developments have seen gold prices plummet from record highs, leading to a two-week downturn that has left many investors questioning their strategies. As the market adjusts to these changes, it is crucial for investors to reassess their approaches and consider strategies that can help mitigate risks while capitalizing on potential opportunities.

To begin with, understanding the factors contributing to the recent decline in gold prices is essential. A combination of rising interest rates, a strengthening U.S. dollar, and improved economic indicators have collectively exerted downward pressure on gold. As interest rates increase, the opportunity cost of holding non-yielding assets like gold becomes less attractive, prompting investors to seek higher returns elsewhere. Additionally, a robust dollar makes gold more expensive for foreign investors, further dampening demand. In light of these dynamics, investors must remain vigilant and adaptable in their strategies.

One effective approach during a gold price downturn is diversification. By spreading investments across a range of asset classes, investors can reduce their exposure to the volatility of any single market. This strategy not only helps in managing risk but also provides opportunities to benefit from gains in other sectors. For instance, equities, bonds, and real estate may offer more stable returns during periods of declining gold prices. Moreover, diversification can be achieved within the commodities sector itself by investing in other precious metals such as silver or platinum, which may not be as adversely affected by the same economic factors.

Another strategy to consider is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This method allows investors to purchase more gold when prices are low and less when prices are high, effectively smoothing out the impact of market volatility over time. By maintaining a disciplined approach, investors can avoid the pitfalls of trying to time the market, which is notoriously difficult even for seasoned professionals.

Furthermore, investors should not overlook the importance of staying informed and conducting thorough research. Keeping abreast of global economic trends, geopolitical developments, and central bank policies can provide valuable insights into the factors influencing gold prices. By understanding these elements, investors can make more informed decisions and adjust their strategies accordingly. Additionally, consulting with financial advisors or utilizing investment tools and platforms can offer further guidance and support in navigating the complexities of the market.

In addition to these strategies, maintaining a long-term perspective is crucial. While short-term fluctuations in gold prices can be unsettling, it is important to remember that gold has historically maintained its value over the long run. By focusing on long-term goals and remaining patient, investors can weather temporary downturns and potentially benefit from future price recoveries.

In conclusion, the recent downturn in gold prices presents both challenges and opportunities for investors. By employing strategies such as diversification, dollar-cost averaging, staying informed, and maintaining a long-term perspective, investors can navigate this period of uncertainty with greater confidence. As the market continues to evolve, adaptability and informed decision-making will be key to successfully managing investments in gold and other assets.

Q&A

1. **What caused the recent plummet in gold prices?**

The recent plummet in gold prices was primarily caused by a stronger U.S. dollar, rising bond yields, and expectations of interest rate hikes by central banks.

2. **How much did gold prices fall from their record highs?**

Gold prices fell approximately 5-7% from their record highs during the two-week downturn.

3. **What were the record high prices of gold before the downturn?**

Before the downturn, gold prices reached record highs of around $2,070 per ounce.

4. **What external factors contributed to the decline in gold prices?**

External factors such as geopolitical tensions easing, reduced demand from major markets like China and India, and profit-taking by investors contributed to the decline.

5. **How did investor sentiment impact gold prices during the downturn?**

Investor sentiment shifted towards riskier assets as economic data suggested a stronger recovery, leading to reduced demand for gold as a safe-haven asset.

6. **What role did central bank policies play in the gold price downturn?**

Central bank policies, particularly the Federal Reserve’s indication of potential interest rate hikes, played a significant role in the downturn by increasing the opportunity cost of holding non-yielding assets like gold.

7. **What are analysts predicting for the future of gold prices following the downturn?**

Analysts are predicting that gold prices may stabilize or recover slightly in the short term, but the long-term outlook remains uncertain, depending on economic conditions and central bank actions.

Conclusion

Gold prices, after reaching record highs, have experienced a significant downturn over the past two weeks. This decline can be attributed to several factors, including a strengthening U.S. dollar, rising interest rates, and improved investor sentiment towards riskier assets. As the dollar appreciates, gold becomes more expensive for holders of other currencies, reducing its appeal. Additionally, higher interest rates increase the opportunity cost of holding non-yielding assets like gold. The shift in investor focus towards equities and other risk assets, driven by positive economic data and easing geopolitical tensions, has further contributed to the decrease in gold prices. This downturn highlights the volatility and sensitivity of gold to macroeconomic indicators and market sentiment, underscoring the importance of closely monitoring these factors for future price movements.