“Skyrocketing Prices Dim the Luster: China’s Gold Demand Plummets as Jewelry Buyers Recoil”

Introduction

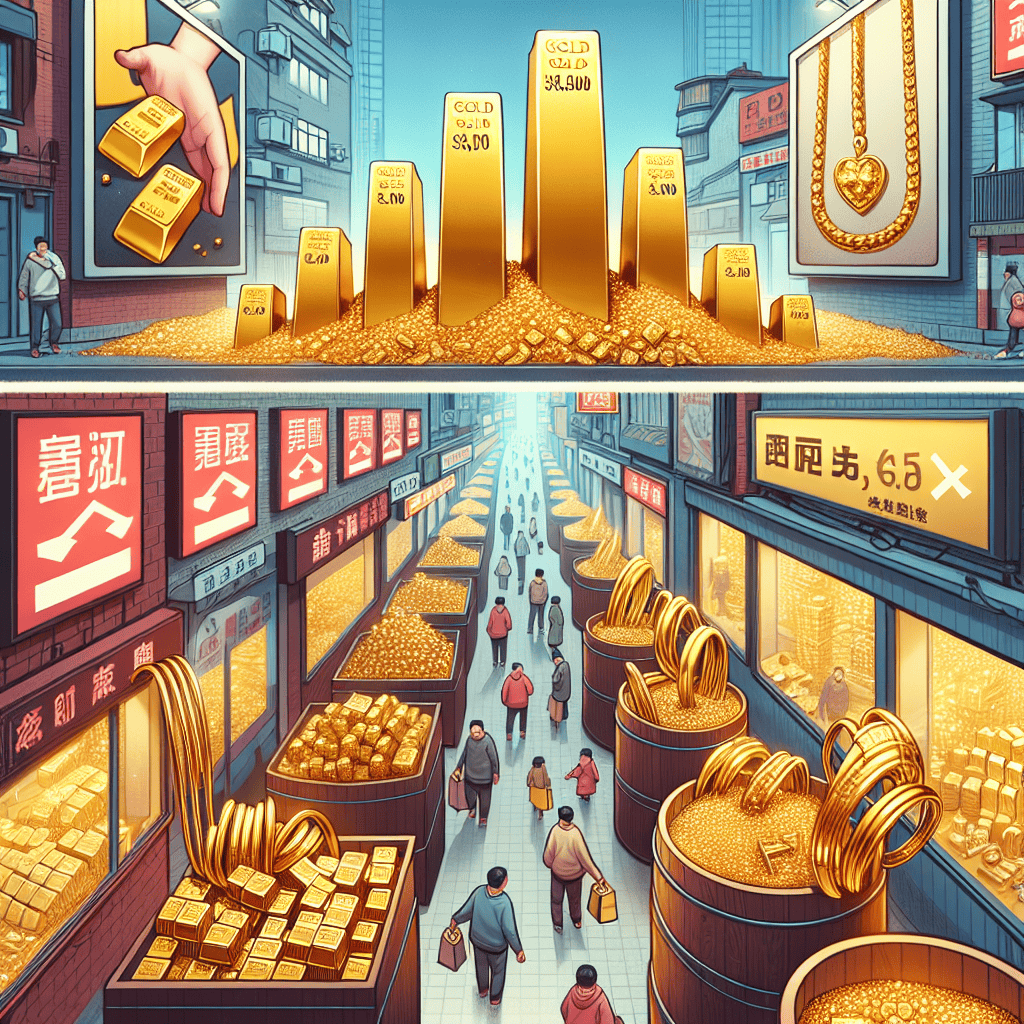

In recent months, China’s gold demand has experienced a significant decline, primarily driven by soaring prices that have deterred consumers from purchasing jewelry. As one of the world’s largest markets for gold, China’s shift in consumer behavior has raised concerns among industry analysts and stakeholders. The escalating costs have made gold jewelry less accessible to the average consumer, leading to a noticeable drop in sales. This trend reflects broader economic challenges and shifts in consumer priorities, as individuals opt for more affordable alternatives or delay purchases in response to the financial pressures exerted by the high price of gold. The situation underscores the delicate balance between market prices and consumer demand, highlighting the impact of economic fluctuations on luxury goods consumption.

Impact Of Rising Gold Prices On Chinese Consumer Behavior

The recent decline in gold demand in China has become a focal point of discussion among economists and market analysts, as the traditionally robust market for gold jewelry in the country faces significant challenges. This downturn is primarily attributed to the soaring prices of gold, which have discouraged consumers from making purchases. As the world’s largest consumer of gold, China’s shifting buying patterns have profound implications not only for the domestic market but also for global gold trends.

To understand the impact of rising gold prices on Chinese consumer behavior, it is essential to consider the cultural and economic factors that traditionally drive gold purchases in China. Gold has long been regarded as a symbol of wealth and prosperity in Chinese culture, often given as gifts during weddings, festivals, and other significant life events. However, as gold prices have surged, consumers are increasingly hesitant to invest in such luxury items. This hesitation is compounded by broader economic uncertainties, including fluctuating stock markets and concerns over economic growth, which have made consumers more cautious about discretionary spending.

Moreover, the high prices have led to a shift in consumer preferences, with many opting for alternative forms of investment or luxury goods. For instance, younger consumers, who are more price-sensitive and less attached to traditional symbols of wealth, are turning to other forms of jewelry or luxury items that offer better value for money. This demographic shift is significant, as it suggests a potential long-term change in consumer behavior that could persist even if gold prices stabilize.

In addition to changing consumer preferences, the impact of rising gold prices is also evident in the retail sector. Jewelry retailers in China are experiencing decreased foot traffic and lower sales volumes, prompting some to diversify their product offerings to include more affordable options or to focus on other precious metals. This strategic pivot is necessary to maintain profitability in a challenging market environment, but it also reflects the broader trend of adaptation within the industry.

Furthermore, the decline in gold demand in China has implications for the global gold market. As one of the largest importers of gold, any significant change in Chinese demand can influence global prices and market dynamics. The current situation has led to increased volatility in gold prices, as investors and traders react to the shifting landscape. This volatility is further exacerbated by geopolitical tensions and economic uncertainties worldwide, which continue to influence investor sentiment and market behavior.

In conclusion, the sharp drop in gold demand in China due to high prices is a multifaceted issue that highlights the complex interplay between cultural traditions, economic conditions, and consumer behavior. As consumers become more cautious and selective in their spending, the jewelry industry must adapt to these changes to remain competitive. Meanwhile, the global gold market must contend with the ripple effects of China’s shifting demand, which could have lasting implications for prices and market stability. As the situation continues to evolve, stakeholders across the industry will need to closely monitor these trends and adjust their strategies accordingly to navigate the challenges and opportunities that lie ahead.

Economic Factors Influencing Gold Demand In China

In recent years, the dynamics of gold demand in China have undergone significant changes, primarily influenced by fluctuating economic factors. One of the most notable shifts has been the sharp decline in gold demand, particularly in the jewelry sector, as high prices have increasingly discouraged purchases. This trend is emblematic of broader economic forces at play, reflecting both domestic and international influences on consumer behavior and market conditions.

To begin with, the surge in gold prices has been a critical factor in dampening consumer enthusiasm for gold jewelry in China. Traditionally, gold has held a significant cultural and economic value in Chinese society, often seen as a symbol of wealth and prosperity. However, as prices have soared, the affordability of gold jewelry has come into question for many consumers. This price sensitivity is particularly pronounced among younger generations, who are more inclined to allocate their disposable income towards experiences and technology rather than traditional luxury items. Consequently, the high cost of gold has led to a noticeable shift in consumer preferences, with many opting for alternative materials or postponing purchases altogether.

Moreover, the economic landscape in China has been marked by a series of challenges that have further influenced gold demand. The country’s economic growth has shown signs of slowing, with various sectors experiencing reduced momentum. This deceleration has had a ripple effect on consumer confidence, leading to more cautious spending habits. In such an environment, discretionary spending on luxury items like gold jewelry tends to decline, as consumers prioritize essential goods and services. Additionally, the Chinese government’s efforts to rebalance the economy towards domestic consumption and away from investment-driven growth have also played a role in shaping consumer behavior, as individuals adjust to new economic realities.

In addition to domestic factors, global economic conditions have also impacted gold demand in China. The international gold market is highly sensitive to geopolitical tensions, currency fluctuations, and changes in interest rates. For instance, the strengthening of the US dollar has made gold more expensive for buyers using other currencies, including the Chinese yuan. This currency dynamic has further exacerbated the impact of high gold prices on Chinese consumers, making gold jewelry even less accessible. Furthermore, global economic uncertainties, such as trade tensions and the ongoing effects of the COVID-19 pandemic, have contributed to market volatility, influencing both investor sentiment and consumer confidence.

Despite these challenges, it is important to note that gold continues to hold intrinsic value for many Chinese consumers, particularly as a form of investment. While jewelry demand may have waned, there remains a robust interest in gold as a financial asset. This is evident in the sustained demand for gold bars and coins, which are often viewed as a hedge against inflation and economic instability. As such, while the jewelry sector may be experiencing a downturn, the overall demand for gold in China remains multifaceted, driven by a complex interplay of cultural, economic, and financial factors.

In conclusion, the sharp drop in gold demand for jewelry in China can be attributed to a confluence of high prices and broader economic influences. As consumers navigate an evolving economic landscape, their purchasing decisions reflect both immediate financial considerations and long-term cultural values. Understanding these dynamics is crucial for stakeholders in the gold market, as they adapt to changing consumer preferences and anticipate future trends in demand.

Alternatives To Gold Jewelry In The Chinese Market

In recent years, the Chinese market has witnessed a significant shift in consumer preferences, particularly in the realm of jewelry. As gold prices have soared, many consumers have been deterred from purchasing traditional gold jewelry, prompting a search for alternative options. This trend is not only reshaping the jewelry industry but also influencing broader consumer behavior in China. Understanding the factors driving this change and the alternatives gaining popularity can provide valuable insights into the evolving market dynamics.

One of the primary reasons for the decline in gold jewelry demand is the substantial increase in gold prices. As gold becomes more expensive, consumers are increasingly reluctant to invest in such high-cost items, especially when economic uncertainties loom. This has led to a growing interest in more affordable alternatives that offer both aesthetic appeal and value for money. Consequently, materials such as silver, platinum, and even high-quality stainless steel are gaining traction among consumers seeking stylish yet cost-effective options.

Silver, in particular, has emerged as a popular choice due to its affordability and versatility. It offers a similar luster to gold but at a fraction of the price, making it an attractive option for those who wish to maintain a sense of luxury without the hefty price tag. Moreover, silver’s malleability allows for intricate designs, catering to consumers’ desire for unique and personalized pieces. This shift towards silver is also supported by a growing appreciation for minimalist and contemporary designs, which often feature silver as a primary material.

In addition to silver, platinum is also gaining favor among Chinese consumers. Known for its durability and rarity, platinum is often perceived as a symbol of prestige and exclusivity. Although it is more expensive than silver, it remains a more affordable alternative to gold. Its hypoallergenic properties further enhance its appeal, particularly among consumers with sensitive skin. As a result, platinum is increasingly being used in engagement rings and other fine jewelry pieces, offering a blend of elegance and practicality.

Beyond traditional metals, the Chinese market is also witnessing a rise in the popularity of alternative materials such as titanium and tungsten. These materials are celebrated for their strength and modern aesthetic, appealing to a younger demographic that values innovation and individuality. Titanium, for instance, is lightweight yet incredibly strong, making it ideal for everyday wear. Tungsten, on the other hand, is known for its scratch-resistant properties, ensuring longevity and resilience. These characteristics make both materials attractive options for consumers seeking durable and contemporary jewelry.

Furthermore, the growing trend of sustainable and ethical consumption is influencing jewelry choices in China. Consumers are increasingly aware of the environmental and social impacts of their purchases, leading to a preference for brands that prioritize sustainability. This has paved the way for the rise of lab-grown diamonds and gemstones, which offer an ethical alternative to mined stones. These lab-grown options are not only environmentally friendly but also more affordable, allowing consumers to enjoy the beauty of gemstones without compromising their values.

In conclusion, the sharp decline in gold demand in China due to high prices has catalyzed a shift towards alternative jewelry options. As consumers seek more affordable, sustainable, and innovative choices, materials such as silver, platinum, titanium, and lab-grown gemstones are gaining popularity. This evolving landscape presents both challenges and opportunities for the jewelry industry, as it adapts to meet the changing preferences of Chinese consumers. As these trends continue to unfold, they will undoubtedly shape the future of jewelry consumption in China and beyond.

Historical Trends In Gold Demand And Pricing In China

The historical trends in gold demand and pricing in China have long been a subject of interest for economists and market analysts alike. As one of the world’s largest consumers of gold, China’s market dynamics significantly influence global gold prices. Traditionally, gold has held a special place in Chinese culture, symbolizing wealth, prosperity, and good fortune. This cultural affinity has historically driven robust demand for gold jewelry, particularly during festive seasons and significant life events such as weddings. However, recent developments indicate a sharp decline in gold demand within China, primarily attributed to soaring prices that have discouraged jewelry purchases.

To understand the current scenario, it is essential to examine the historical context of gold demand in China. Over the past few decades, China’s rapid economic growth and rising middle class have fueled an increase in disposable income, leading to a surge in gold consumption. The Chinese market has been characterized by a strong preference for physical gold, with jewelry accounting for a substantial portion of the demand. This trend was further bolstered by the perception of gold as a safe-haven asset, particularly during times of economic uncertainty.

However, the landscape began to shift as global economic conditions evolved. In recent years, geopolitical tensions, fluctuating currency values, and economic slowdowns have contributed to volatility in gold prices. As prices soared, the cost of gold jewelry became prohibitive for many consumers, leading to a noticeable decline in demand. This trend is particularly evident in urban areas, where consumers are more sensitive to price changes and have access to a wider range of investment options.

Moreover, the Chinese government’s efforts to curb excessive spending and promote economic stability have also played a role in shaping gold demand. Policies aimed at reducing luxury consumption and encouraging savings have led to a more cautious approach among consumers. Consequently, the allure of gold as a status symbol has diminished, further impacting jewelry sales.

In addition to these economic factors, changing consumer preferences have also contributed to the decline in gold demand. Younger generations in China are increasingly favoring alternative forms of investment, such as stocks and real estate, over traditional assets like gold. This shift in investment behavior reflects a broader trend towards diversification and a desire for higher returns.

Despite these challenges, it is important to note that gold still holds significant cultural and economic value in China. While demand for jewelry may have waned, other sectors, such as technology and finance, continue to drive gold consumption. The use of gold in electronic devices and as a component in financial products underscores its enduring relevance in the modern economy.

In conclusion, the sharp drop in gold demand in China due to high prices discouraging jewelry purchases is a multifaceted issue influenced by historical trends, economic conditions, and evolving consumer preferences. While the current scenario presents challenges for the gold market, it also highlights the need for adaptability and innovation. As China continues to navigate its economic landscape, the future of gold demand will likely be shaped by a complex interplay of cultural, economic, and technological factors. Understanding these dynamics is crucial for stakeholders seeking to navigate the ever-changing landscape of the global gold market.

Strategies For Jewelers To Adapt To High Gold Prices

The recent decline in gold demand in China, primarily driven by soaring prices, has posed significant challenges for jewelers operating in the region. As consumers become increasingly hesitant to purchase gold jewelry due to its elevated cost, jewelers must explore innovative strategies to adapt to this shifting market landscape. To remain competitive and sustain their businesses, jewelers can consider several approaches that not only address the immediate impact of high gold prices but also position them for long-term success.

One effective strategy is to diversify product offerings by incorporating alternative materials into jewelry designs. By blending gold with less expensive metals such as silver or copper, jewelers can create pieces that maintain the allure of gold while offering more affordable options to consumers. This approach not only reduces the overall cost of the jewelry but also appeals to a broader audience seeking unique and contemporary designs. Additionally, jewelers can explore the use of gemstones and other embellishments to enhance the aesthetic appeal of their products, thereby shifting the focus from the gold content to the overall design and craftsmanship.

Moreover, jewelers can capitalize on the growing trend of personalized and custom-made jewelry. By offering bespoke services, they can cater to consumers’ desire for unique and meaningful pieces that reflect their individual tastes and preferences. This personalized approach not only adds value to the jewelry but also fosters a deeper emotional connection between the consumer and the product, making it less susceptible to fluctuations in gold prices. Furthermore, jewelers can leverage digital platforms and social media to showcase their custom offerings, reaching a wider audience and engaging with potential customers in a more interactive and personalized manner.

In addition to product diversification and customization, jewelers can also focus on enhancing the overall customer experience. By investing in customer service and creating a welcoming and informative shopping environment, jewelers can differentiate themselves from competitors and build lasting relationships with their clientele. Offering educational workshops or seminars on jewelry care, design trends, or the history of gold can also add value to the customer experience, positioning the jeweler as a trusted authority in the field.

Another viable strategy is to explore strategic partnerships and collaborations with other brands or designers. By aligning with complementary businesses, jewelers can expand their reach and tap into new customer segments. Collaborations can also lead to the creation of exclusive collections that generate buzz and excitement, drawing attention away from the high cost of gold and towards the unique value proposition of the partnership.

Finally, jewelers should consider implementing sustainable practices in their operations. As consumers become more environmentally conscious, there is a growing demand for ethically sourced and sustainably produced jewelry. By adopting sustainable practices, such as using recycled gold or supporting fair-trade initiatives, jewelers can appeal to this conscientious consumer base and differentiate themselves in a crowded market.

In conclusion, while the sharp drop in gold demand in China due to high prices presents significant challenges for jewelers, it also offers an opportunity to innovate and adapt. By diversifying product offerings, embracing customization, enhancing customer experiences, exploring strategic partnerships, and adopting sustainable practices, jewelers can not only navigate the current market conditions but also position themselves for future growth and success. Through these strategies, they can continue to captivate consumers and maintain their relevance in an ever-evolving industry.

The Role Of Cultural Preferences In Gold Purchases In China

In recent years, the dynamics of gold demand in China have undergone significant changes, influenced by a variety of factors, including cultural preferences and economic conditions. Traditionally, gold has held a prominent place in Chinese culture, symbolizing wealth, prosperity, and good fortune. It is often gifted during significant life events such as weddings and births, and it plays a crucial role in various cultural and religious ceremonies. However, the recent sharp decline in gold demand in China can be attributed to the soaring prices of this precious metal, which have discouraged many consumers from purchasing gold jewelry.

To understand the impact of cultural preferences on gold purchases in China, it is essential to consider the historical context. Gold has been revered in Chinese society for centuries, not only as a form of adornment but also as a reliable store of value. This cultural affinity for gold has traditionally driven strong demand, particularly in the form of jewelry. However, as global economic conditions have shifted, so too have the purchasing behaviors of Chinese consumers. The recent surge in gold prices has made it increasingly difficult for many individuals to justify the expense of gold jewelry, leading to a noticeable decline in demand.

Moreover, the younger generation in China is exhibiting different preferences compared to their predecessors. While gold remains a symbol of status and success, younger consumers are increasingly drawn to alternative forms of investment and adornment. The rise of digital currencies and other investment vehicles has provided new avenues for wealth accumulation, which do not carry the same cultural significance as gold. Additionally, the influence of Western fashion trends has introduced a preference for more contemporary and diverse styles of jewelry, which do not necessarily include gold.

Despite these shifts, it is important to recognize that cultural preferences still play a significant role in shaping gold demand in China. For instance, during the Lunar New Year and other traditional festivals, gold jewelry and ornaments continue to be popular gifts, reflecting the enduring cultural significance of gold. However, the frequency and scale of such purchases have been affected by the high prices, prompting consumers to seek more affordable alternatives or to purchase gold in smaller quantities.

Furthermore, the economic landscape in China has also contributed to the changing patterns of gold demand. As the country experiences economic fluctuations, consumers are becoming more cautious with their spending. The high cost of living and the need to prioritize essential expenses have led many to reconsider discretionary purchases, including luxury items such as gold jewelry. This economic prudence is further compounded by the uncertainty surrounding global markets, which has made consumers more hesitant to invest in gold at elevated prices.

In conclusion, while cultural preferences continue to influence gold purchases in China, the recent decline in demand can be largely attributed to the high prices that have discouraged jewelry purchases. The interplay between traditional values and modern economic realities has created a complex landscape for gold demand in China. As consumers navigate these changes, it remains to be seen how cultural preferences will evolve and how they will continue to shape the market for gold in the future. Nonetheless, the enduring cultural significance of gold suggests that it will remain an important part of Chinese society, albeit with adaptations to contemporary economic conditions.

Future Predictions For Gold Demand In China Amid Price Fluctuations

The recent decline in gold demand in China, primarily driven by elevated prices, has raised questions about the future trajectory of the market in the world’s largest consumer of the precious metal. As prices soar, consumers are increasingly hesitant to invest in gold jewelry, traditionally a staple of Chinese cultural and economic life. This shift in consumer behavior is not only a reflection of current market conditions but also a harbinger of potential long-term changes in the gold market dynamics within China.

To understand the future predictions for gold demand in China, it is essential to consider the factors contributing to the current decline. High gold prices have made it less accessible for average consumers, who are now prioritizing essential expenditures over luxury items. This trend is particularly evident among younger generations, who are more inclined to spend on technology and experiences rather than traditional symbols of wealth. Consequently, the jewelry sector, which accounts for a significant portion of gold consumption in China, has experienced a notable downturn.

Moreover, the economic landscape in China is undergoing significant transformations. As the country shifts towards a consumption-driven economy, the emphasis on gold as a store of value may diminish. This transition is further compounded by the increasing popularity of alternative investment options, such as real estate and digital currencies, which offer potentially higher returns. As a result, gold’s appeal as a safe-haven asset is being challenged, leading to a reevaluation of its role in personal and institutional portfolios.

Despite these challenges, it is important to recognize that gold has historically been a resilient asset, often rebounding in times of economic uncertainty. The Chinese market is no exception, and several factors could potentially revive demand in the future. For instance, any geopolitical tensions or economic instability could prompt a renewed interest in gold as a hedge against risk. Additionally, cultural factors, such as the traditional gifting of gold during weddings and festivals, may continue to support baseline demand, albeit at a reduced level.

Furthermore, the Chinese government’s policies could play a pivotal role in shaping future gold demand. Should the government decide to implement measures to stabilize or boost the economy, such as monetary easing or fiscal stimulus, disposable incomes could rise, potentially leading to increased consumer spending on luxury goods, including gold jewelry. Additionally, any initiatives aimed at promoting gold as a strategic reserve could influence both public perception and institutional demand.

In light of these considerations, the future of gold demand in China is likely to be characterized by a complex interplay of economic, cultural, and policy-driven factors. While high prices currently deter purchases, the inherent value and historical significance of gold cannot be easily dismissed. As such, stakeholders in the gold market should remain vigilant, monitoring both domestic and international developments that could impact demand.

In conclusion, while the current decline in gold demand in China due to high prices presents challenges, it also offers an opportunity to reassess and adapt strategies to align with evolving consumer preferences and economic conditions. By understanding the multifaceted nature of the market, industry participants can better anticipate future trends and position themselves to capitalize on potential opportunities as they arise.

Q&A

1. **Question:** What is the primary reason for the drop in gold demand in China?

**Answer:** The primary reason for the drop in gold demand in China is high prices discouraging jewelry purchases.

2. **Question:** How have high gold prices affected consumer behavior in China?

**Answer:** High gold prices have discouraged consumers from purchasing gold jewelry, leading to a decrease in demand.

3. **Question:** Which sector of the gold market in China is most affected by the high prices?

**Answer:** The jewelry sector of the gold market in China is most affected by the high prices.

4. **Question:** Are there any other factors contributing to the decline in gold demand in China besides high prices?

**Answer:** The primary factor mentioned is high prices; other factors are not specified in the context provided.

5. **Question:** How might the drop in gold demand impact the global gold market?

**Answer:** A drop in gold demand in China, one of the largest markets, could lead to a decrease in global gold prices and affect global market dynamics.

6. **Question:** What could potentially reverse the trend of declining gold demand in China?

**Answer:** A decrease in gold prices or an increase in consumer purchasing power could potentially reverse the trend of declining gold demand.

7. **Question:** How significant is China’s role in the global gold market?

**Answer:** China plays a significant role in the global gold market as one of the largest consumers and importers of gold.

Conclusion

The sharp decline in gold demand in China, primarily driven by elevated prices, has significantly impacted the jewelry sector. As consumers face higher costs, their purchasing behavior shifts, leading to reduced consumption of gold jewelry. This trend not only affects domestic retailers and manufacturers but also has broader implications for the global gold market, potentially influencing prices and trade dynamics. The situation underscores the sensitivity of consumer demand to price fluctuations and highlights the need for the industry to adapt to changing economic conditions and consumer preferences.