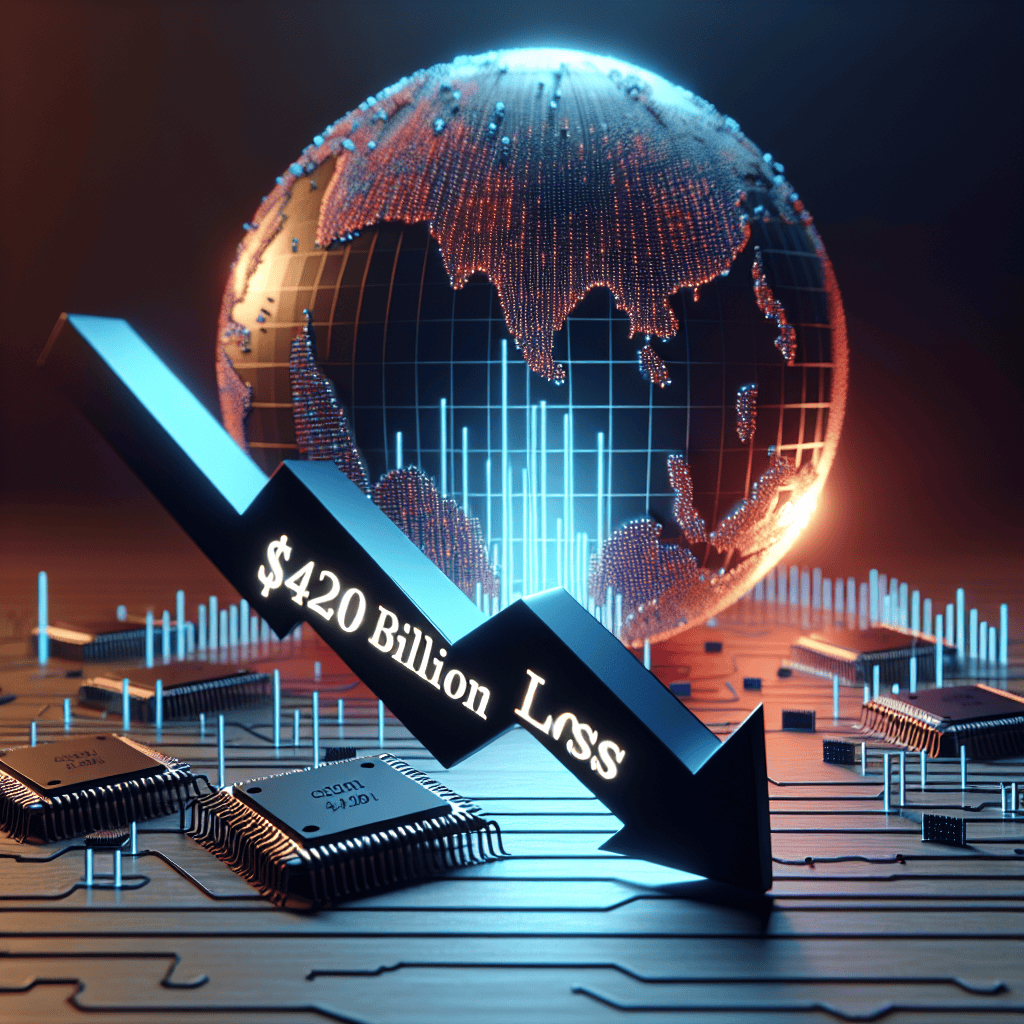

“Global Chip Stocks Tumble: $420 Billion Wiped Out Following ASML Sales Warning”

Introduction

Global chip stocks experienced a significant decline, erasing approximately $420 billion in market value, following a sales warning from ASML Holding NV, a leading supplier of semiconductor manufacturing equipment. ASML’s cautionary outlook raised concerns about a potential slowdown in the semiconductor industry, which has been grappling with fluctuating demand and supply chain disruptions. The warning reverberated across the sector, impacting major chipmakers and technology companies reliant on semiconductor components. This development underscores the fragility of the global chip market and highlights the broader economic implications of shifts within the technology supply chain.

Impact Of ASML Sales Warning On Global Chip Market

The global semiconductor industry, a cornerstone of modern technology, recently faced a significant jolt as chip stocks collectively shed $420 billion in market value. This dramatic decline was precipitated by a sales warning from ASML Holding NV, a key player in the semiconductor manufacturing equipment sector. ASML’s announcement has sent ripples across the global chip market, highlighting the interconnectedness of the industry and the potential vulnerabilities that can arise from shifts in market expectations.

ASML, a Dutch company, is renowned for its advanced lithography machines, which are essential for producing the latest generation of microchips. These machines are critical for the fabrication of semiconductors used in a wide array of products, from smartphones to data centers. Therefore, any indication of reduced sales or production from ASML can have far-reaching implications for the entire semiconductor supply chain. The company’s recent warning about a slowdown in sales growth has raised concerns about the future demand for its cutting-edge equipment, which in turn has led to a reevaluation of the growth prospects for the semiconductor industry as a whole.

The impact of ASML’s sales warning is not confined to the company itself. It has triggered a broader reassessment of the semiconductor market, affecting major chip manufacturers and suppliers worldwide. Companies such as Intel, TSMC, and Samsung, which rely heavily on ASML’s technology, have seen their stock prices fluctuate as investors digest the potential implications of a slowdown in ASML’s sales. This reaction underscores the pivotal role that ASML plays in the semiconductor ecosystem and the sensitivity of the market to any changes in its outlook.

Moreover, the sales warning comes at a time when the semiconductor industry is already grappling with a series of challenges. Supply chain disruptions, geopolitical tensions, and fluctuating demand patterns have all contributed to an environment of uncertainty. ASML’s announcement adds another layer of complexity to this landscape, prompting stakeholders to reconsider their strategies and forecasts. The potential for reduced sales growth at ASML raises questions about the broader demand for semiconductors, particularly in key sectors such as consumer electronics and automotive, which have been major drivers of chip demand in recent years.

In addition to the immediate financial impact, ASML’s sales warning may also have longer-term implications for innovation and technological advancement within the semiconductor industry. ASML’s lithography machines are at the forefront of enabling smaller, more powerful, and more efficient chips. A slowdown in the adoption of these machines could potentially delay the development and deployment of next-generation technologies, affecting industries that depend on cutting-edge semiconductor solutions.

In conclusion, the $420 billion decline in global chip stocks following ASML’s sales warning serves as a stark reminder of the semiconductor industry’s intricate interdependencies and the potential for significant market shifts based on the performance and outlook of key players. As the industry navigates this period of uncertainty, stakeholders will need to closely monitor developments and adapt to the evolving landscape. The situation underscores the importance of resilience and adaptability in an industry that is both a driver of technological progress and a barometer of global economic health.

Analyzing The $420 Billion Decline In Chip Stocks

The recent announcement by ASML, a leading supplier of semiconductor manufacturing equipment, has sent ripples through the global chip market, resulting in a staggering $420 billion decline in chip stocks. This development has raised concerns among investors and industry analysts, prompting a closer examination of the factors contributing to this significant market shift. ASML’s warning about its sales forecast has been a pivotal factor in this decline, as the company plays a crucial role in the semiconductor supply chain. As a key supplier of photolithography machines, which are essential for producing advanced microchips, any indication of reduced sales or demand from ASML can have far-reaching implications for the entire semiconductor industry. Consequently, the company’s announcement has led to a reassessment of growth prospects across the sector.

The semiconductor industry has been experiencing a period of unprecedented growth, driven by the increasing demand for chips in various applications, from consumer electronics to automotive and industrial sectors. However, this rapid expansion has also exposed vulnerabilities in the supply chain, as manufacturers struggle to keep up with the surging demand. ASML’s sales warning has highlighted these vulnerabilities, suggesting that the industry may face challenges in sustaining its growth trajectory. In addition to supply chain concerns, geopolitical tensions have also played a role in the decline of chip stocks. The ongoing trade disputes between major economies, particularly the United States and China, have created an environment of uncertainty for semiconductor companies. These tensions have led to disruptions in the supply chain, as well as increased scrutiny and regulation of technology exports. As a result, investors are becoming increasingly cautious, leading to a sell-off in chip stocks.

Moreover, the global economic outlook has added another layer of complexity to the situation. With concerns about inflation and potential interest rate hikes by central banks, there is growing apprehension about the impact on consumer spending and overall economic growth. This uncertainty has further dampened investor sentiment, contributing to the decline in chip stocks. Despite these challenges, it is important to recognize that the semiconductor industry remains a critical component of the global economy. The demand for chips is expected to continue growing in the long term, driven by advancements in technology and the increasing digitization of various sectors. However, the current market conditions underscore the need for companies to adapt and innovate in order to navigate the evolving landscape.

In response to the recent decline, industry leaders are likely to focus on strengthening their supply chains and exploring new markets to mitigate risks. Additionally, governments and policymakers may play a role in supporting the industry through strategic investments and initiatives aimed at enhancing domestic semiconductor capabilities. As the industry grapples with these challenges, collaboration and innovation will be key to ensuring its resilience and continued growth. In conclusion, the $420 billion decline in global chip stocks following ASML’s sales warning serves as a stark reminder of the complexities and interdependencies within the semiconductor industry. While the current market conditions present significant challenges, they also offer opportunities for companies to reassess their strategies and position themselves for future success. By addressing supply chain vulnerabilities, navigating geopolitical tensions, and adapting to changing economic conditions, the industry can continue to thrive and drive technological advancements that shape the future.

ASML’s Role In The Semiconductor Industry

ASML Holding NV, a pivotal player in the semiconductor industry, recently issued a sales warning that sent ripples across global chip stocks, resulting in a staggering $420 billion decrease in market value. This development underscores the critical role ASML plays in the semiconductor supply chain and highlights the interconnectedness of the global technology market. As the leading supplier of photolithography machines, ASML’s technology is indispensable for the production of advanced microchips, which are the backbone of modern electronic devices. Consequently, any fluctuations in ASML’s business outlook can have far-reaching implications for the entire semiconductor industry.

The semiconductor industry is characterized by its complexity and the intricate interdependencies among various stakeholders. ASML’s photolithography machines are essential for the fabrication of cutting-edge chips, enabling manufacturers to produce smaller, more powerful, and energy-efficient semiconductors. These chips are integral to a wide array of applications, from consumer electronics and automotive systems to telecommunications and data centers. Therefore, ASML’s sales projections serve as a barometer for the health of the semiconductor sector, influencing investor sentiment and market dynamics.

The recent sales warning from ASML can be attributed to several factors, including geopolitical tensions, supply chain disruptions, and fluctuating demand patterns. Geopolitical tensions, particularly between major economies, have led to increased scrutiny and export controls on semiconductor technologies, affecting ASML’s ability to conduct business seamlessly across borders. Additionally, the global supply chain has been under strain due to the lingering effects of the COVID-19 pandemic, which has caused delays in the production and delivery of critical components. These challenges have compounded the uncertainty surrounding ASML’s sales outlook, prompting a reassessment of growth prospects within the industry.

Moreover, the semiconductor market is experiencing shifts in demand as industries adapt to evolving technological trends. The rise of artificial intelligence, the Internet of Things, and 5G technology has spurred demand for advanced chips, yet this demand is not uniform across all sectors. While some segments are witnessing robust growth, others are facing headwinds due to economic slowdowns and changing consumer preferences. ASML’s sales warning reflects these nuanced demand dynamics, signaling potential adjustments in production and investment strategies among chip manufacturers.

In response to ASML’s announcement, investors have reacted by reevaluating their positions in semiconductor stocks, leading to a significant decline in market valuations. This reaction highlights the sensitivity of the market to ASML’s performance and the broader implications for the technology sector. As a bellwether for the semiconductor industry, ASML’s sales projections are closely monitored by analysts and investors alike, serving as a key indicator of future trends and opportunities.

Looking ahead, the semiconductor industry must navigate a complex landscape marked by technological advancements, geopolitical challenges, and evolving market demands. ASML’s role as a technology leader and enabler of innovation remains crucial, and its ability to adapt to changing conditions will be instrumental in shaping the industry’s trajectory. As stakeholders assess the implications of ASML’s sales warning, there is a renewed focus on fostering resilience and agility within the semiconductor supply chain to mitigate risks and capitalize on emerging opportunities. In this context, ASML’s strategic decisions and technological innovations will continue to play a pivotal role in driving the future of the semiconductor industry.

Future Projections For Chip Stocks Post-ASML Warning

The recent announcement from ASML, a leading supplier of semiconductor manufacturing equipment, has sent ripples through the global chip market, resulting in a staggering $420 billion reduction in chip stocks. This development has raised concerns about the future trajectory of the semiconductor industry, which has been a critical driver of technological advancement and economic growth. As we delve into the potential future projections for chip stocks following ASML’s sales warning, it is essential to consider the multifaceted factors that could influence the market’s direction.

To begin with, ASML’s warning highlights the intricate supply chain dynamics that underpin the semiconductor industry. The company’s announcement was primarily driven by a slowdown in demand from key markets, including consumer electronics and data centers. This deceleration can be attributed to a combination of factors, such as the global economic uncertainty, inflationary pressures, and geopolitical tensions, which have collectively dampened consumer and business spending. Consequently, the reduced demand for semiconductors has led to a reassessment of production and inventory levels across the industry, thereby impacting stock valuations.

Moreover, the semiconductor industry is inherently cyclical, characterized by periods of rapid growth followed by phases of consolidation. The current downturn, as signaled by ASML, may be indicative of a broader cyclical adjustment. However, it is crucial to recognize that such cycles are not uncommon and often pave the way for future innovation and expansion. In this context, companies that can navigate the current challenges by optimizing their operations and investing in research and development are likely to emerge stronger in the long run.

In addition to cyclical factors, technological advancements continue to play a pivotal role in shaping the semiconductor landscape. The ongoing transition towards advanced technologies, such as artificial intelligence, 5G, and the Internet of Things, is expected to drive substantial demand for semiconductors in the coming years. These technologies require increasingly sophisticated chips, which in turn necessitate cutting-edge manufacturing equipment. Therefore, while the short-term outlook may appear uncertain, the long-term prospects for the semiconductor industry remain robust, underpinned by the relentless pace of technological progress.

Furthermore, government policies and initiatives are poised to influence the future of chip stocks. In recent years, several countries have recognized the strategic importance of the semiconductor industry and have implemented measures to bolster domestic production capabilities. For instance, the United States and the European Union have announced significant investments aimed at reducing reliance on foreign suppliers and enhancing supply chain resilience. Such initiatives are likely to create new opportunities for semiconductor companies, potentially offsetting some of the current market challenges.

In conclusion, while ASML’s sales warning has undoubtedly cast a shadow over the global chip market, it is essential to adopt a balanced perspective when considering future projections for chip stocks. The current downturn, driven by a confluence of economic, cyclical, and geopolitical factors, presents both challenges and opportunities for industry players. By focusing on innovation, operational efficiency, and strategic investments, semiconductor companies can position themselves to capitalize on the long-term growth potential of the industry. As the world continues to embrace digital transformation, the demand for semiconductors is expected to remain a critical driver of technological and economic progress, offering a promising outlook for the future.

Investor Reactions To The ASML Sales Forecast

The recent announcement from ASML, a leading supplier of semiconductor manufacturing equipment, has sent ripples through the global financial markets, particularly impacting the semiconductor sector. ASML’s sales warning has led to a significant decline in chip stocks, with an estimated $420 billion wiped off their market value. This development has prompted a range of reactions from investors, who are now reassessing their positions in the semiconductor industry. The warning from ASML, which cited a slowdown in demand for its advanced lithography machines, has raised concerns about the broader health of the semiconductor market. These machines are crucial for producing the latest generation of microchips, and any indication of reduced demand can have far-reaching implications. Consequently, investors are now grappling with the potential ramifications of this slowdown, not only for ASML but also for other companies within the semiconductor supply chain.

In light of ASML’s announcement, investors are re-evaluating their strategies, with many opting to reduce their exposure to semiconductor stocks. This cautious approach is driven by fears that the slowdown in demand could be indicative of a broader cyclical downturn in the industry. Historically, the semiconductor market has been characterized by periods of rapid growth followed by sharp contractions, and investors are wary of being caught on the wrong side of such a cycle. Moreover, the semiconductor industry is highly interconnected, with companies relying on each other for components and technology. A slowdown in one segment can quickly cascade through the entire supply chain, amplifying the impact on stock prices. This interconnectedness has heightened investor concerns, as they consider the potential for a domino effect that could further depress valuations across the sector.

Despite these concerns, some investors see the current situation as an opportunity to buy into the semiconductor market at a discount. They argue that the long-term growth prospects for the industry remain robust, driven by ongoing advancements in technology and increasing demand for chips in various sectors, including automotive, telecommunications, and consumer electronics. These investors believe that the current downturn is a temporary blip in an otherwise upward trajectory and are positioning themselves to capitalize on future growth. Furthermore, the semiconductor industry is poised to benefit from several emerging trends, such as the proliferation of artificial intelligence, the expansion of 5G networks, and the growing adoption of electric vehicles. These trends are expected to drive significant demand for advanced chips, providing a strong foundation for future growth. As a result, some investors are maintaining a bullish outlook, confident that the industry’s long-term potential outweighs the short-term challenges.

In conclusion, ASML’s sales warning has undoubtedly shaken investor confidence in the semiconductor sector, leading to a substantial decline in chip stocks. However, the investor reactions have been mixed, with some adopting a cautious stance while others see potential opportunities amidst the uncertainty. As the market continues to digest the implications of ASML’s announcement, it remains to be seen how the semiconductor industry will navigate this challenging period. Ultimately, the sector’s ability to adapt to changing market dynamics and capitalize on emerging trends will be crucial in determining its future trajectory. Investors will be closely monitoring developments in the coming months, as they seek to balance the risks and rewards associated with the ever-evolving semiconductor landscape.

The Broader Economic Implications Of Chip Stock Volatility

The recent announcement by ASML, a leading supplier of semiconductor manufacturing equipment, has sent ripples through the global financial markets, resulting in a staggering $420 billion reduction in the value of chip stocks. This development underscores the inherent volatility within the semiconductor industry, a sector that has become increasingly pivotal to the global economy. As the world becomes more reliant on technology, the implications of such fluctuations extend far beyond the immediate financial losses, affecting various facets of economic stability and growth.

To begin with, the semiconductor industry is a cornerstone of modern technology, powering everything from smartphones and computers to automobiles and industrial machinery. Consequently, any disruption in this sector can have a cascading effect on numerous industries. The warning from ASML, which cited potential slowdowns in sales, has raised concerns about the supply chain’s ability to meet the ever-growing demand for chips. This apprehension is not unfounded, as the semiconductor industry has already been grappling with supply chain disruptions due to geopolitical tensions and the lingering effects of the COVID-19 pandemic. Therefore, the recent dip in chip stocks could exacerbate these challenges, leading to potential delays in production and innovation across various sectors.

Moreover, the volatility in chip stocks can have significant implications for global trade. Semiconductors are a critical component of international commerce, with countries like the United States, China, South Korea, and Taiwan playing pivotal roles in their production and distribution. A decline in chip stock values can lead to shifts in trade balances, affecting the economic relationships between these nations. For instance, countries heavily reliant on semiconductor exports may experience a decrease in trade surpluses, while those dependent on imports could face increased costs. This dynamic can further strain international relations, particularly in an era where technological supremacy is closely linked to national security.

In addition to trade implications, the volatility in chip stocks can influence monetary policy decisions. Central banks around the world closely monitor stock market trends as indicators of economic health. A significant drop in chip stocks could signal broader economic instability, prompting central banks to adjust interest rates or implement other monetary measures to stabilize the economy. Such interventions, while necessary, can have far-reaching consequences, affecting everything from consumer borrowing costs to business investment decisions.

Furthermore, the impact of chip stock volatility extends to the realm of employment. The semiconductor industry is a major employer, providing jobs to millions of people worldwide. A downturn in the industry could lead to job losses, not only within semiconductor companies but also in related sectors such as electronics manufacturing and technology services. This potential rise in unemployment could, in turn, reduce consumer spending, further dampening economic growth.

In conclusion, the $420 billion reduction in global chip stocks following ASML’s sales warning highlights the interconnectedness of the semiconductor industry with the broader economy. While the immediate financial losses are significant, the broader economic implications are equally concerning. From supply chain disruptions and trade imbalances to monetary policy adjustments and employment challenges, the volatility in chip stocks serves as a reminder of the critical role semiconductors play in the global economic landscape. As such, stakeholders across industries and governments must remain vigilant and proactive in addressing the challenges posed by this volatility to ensure sustained economic growth and stability.

Strategies For Navigating The Semiconductor Market Downturn

The recent announcement by ASML, a leading supplier of semiconductor manufacturing equipment, has sent ripples through the global semiconductor market, leading to a staggering $420 billion reduction in chip stocks. This development has raised concerns among investors and industry stakeholders, prompting a reevaluation of strategies to navigate the downturn. As the semiconductor industry grapples with this unexpected challenge, it becomes imperative to explore effective strategies that can mitigate risks and capitalize on potential opportunities.

To begin with, understanding the root causes of the downturn is crucial. ASML’s sales warning is indicative of broader market dynamics, including supply chain disruptions, fluctuating demand, and geopolitical tensions. These factors have collectively contributed to a volatile market environment, necessitating a strategic approach to investment and operations. Consequently, companies must prioritize agility and adaptability, ensuring they can respond swiftly to changing market conditions.

One effective strategy is diversification. By expanding their product portfolios and exploring new markets, semiconductor companies can reduce their reliance on a single revenue stream. This approach not only mitigates risks associated with market fluctuations but also opens up avenues for growth. For instance, companies can explore opportunities in emerging technologies such as artificial intelligence, the Internet of Things, and renewable energy, which continue to drive demand for semiconductors despite the current downturn.

In addition to diversification, investing in research and development (R&D) is paramount. The semiconductor industry is inherently driven by innovation, and companies that prioritize R&D are better positioned to weather market downturns. By developing cutting-edge technologies and improving manufacturing processes, companies can enhance their competitive edge and capture a larger market share. Moreover, R&D investments can lead to the creation of proprietary technologies, providing a buffer against market volatility.

Furthermore, strategic partnerships and collaborations can play a pivotal role in navigating the downturn. By forming alliances with other industry players, companies can pool resources, share risks, and leverage each other’s strengths. These partnerships can facilitate access to new markets, enhance supply chain resilience, and foster innovation. For example, collaborations between semiconductor manufacturers and technology firms can lead to the development of integrated solutions that address specific industry needs.

Another critical aspect to consider is supply chain optimization. The semiconductor industry is highly susceptible to supply chain disruptions, as evidenced by recent global events. Companies must therefore focus on building resilient supply chains that can withstand external shocks. This can be achieved through strategies such as diversifying suppliers, investing in local manufacturing capabilities, and implementing advanced supply chain technologies. By enhancing supply chain resilience, companies can ensure continuity of operations and maintain customer satisfaction.

Lastly, maintaining a strong financial position is essential for navigating the downturn. Companies should focus on prudent financial management, including cost optimization, cash flow management, and strategic investments. By maintaining a healthy balance sheet, companies can weather short-term challenges and position themselves for long-term success.

In conclusion, the recent downturn in the semiconductor market, triggered by ASML’s sales warning, underscores the need for strategic foresight and adaptability. By embracing diversification, investing in R&D, forming strategic partnerships, optimizing supply chains, and maintaining financial resilience, companies can navigate the current challenges and emerge stronger. As the semiconductor industry continues to evolve, these strategies will be instrumental in driving sustainable growth and ensuring long-term success.

Q&A

1. **What caused the decline in global chip stocks?**

The decline was triggered by a sales warning from ASML, a major supplier in the semiconductor industry.

2. **How much value was wiped off global chip stocks?**

Approximately $420 billion was wiped off global chip stocks.

3. **Who is ASML?**

ASML is a Dutch company that supplies photolithography machines used in the production of semiconductors.

4. **Why is ASML’s sales warning significant?**

ASML’s sales warning is significant because it indicates potential slowdowns in the semiconductor industry, affecting major chip manufacturers and their stock prices.

5. **Which sectors are most affected by the decline in chip stocks?**

Technology and electronics sectors, which heavily rely on semiconductors, are most affected.

6. **What are the broader implications of the decline in chip stocks?**

The decline could lead to reduced investment in semiconductor production and impact industries dependent on chip technology.

7. **How might this affect consumers?**

Consumers might experience higher prices or shortages in electronic devices and products that rely on semiconductors.

Conclusion

The recent sales warning from ASML, a key player in the semiconductor industry, has led to a significant decline in global chip stocks, erasing approximately $420 billion in market value. This downturn reflects investor concerns about potential slowdowns in semiconductor demand and broader market uncertainties. ASML’s warning may signal challenges in the supply chain or shifts in technology demand, impacting major chip manufacturers and related industries. The substantial market reaction underscores the critical role of semiconductor companies in the global economy and highlights the sensitivity of tech markets to changes in industry forecasts and performance.