“GE Aerospace’s Soaring Gains Face Turbulence: Boeing Connection Under Scrutiny.”

Introduction

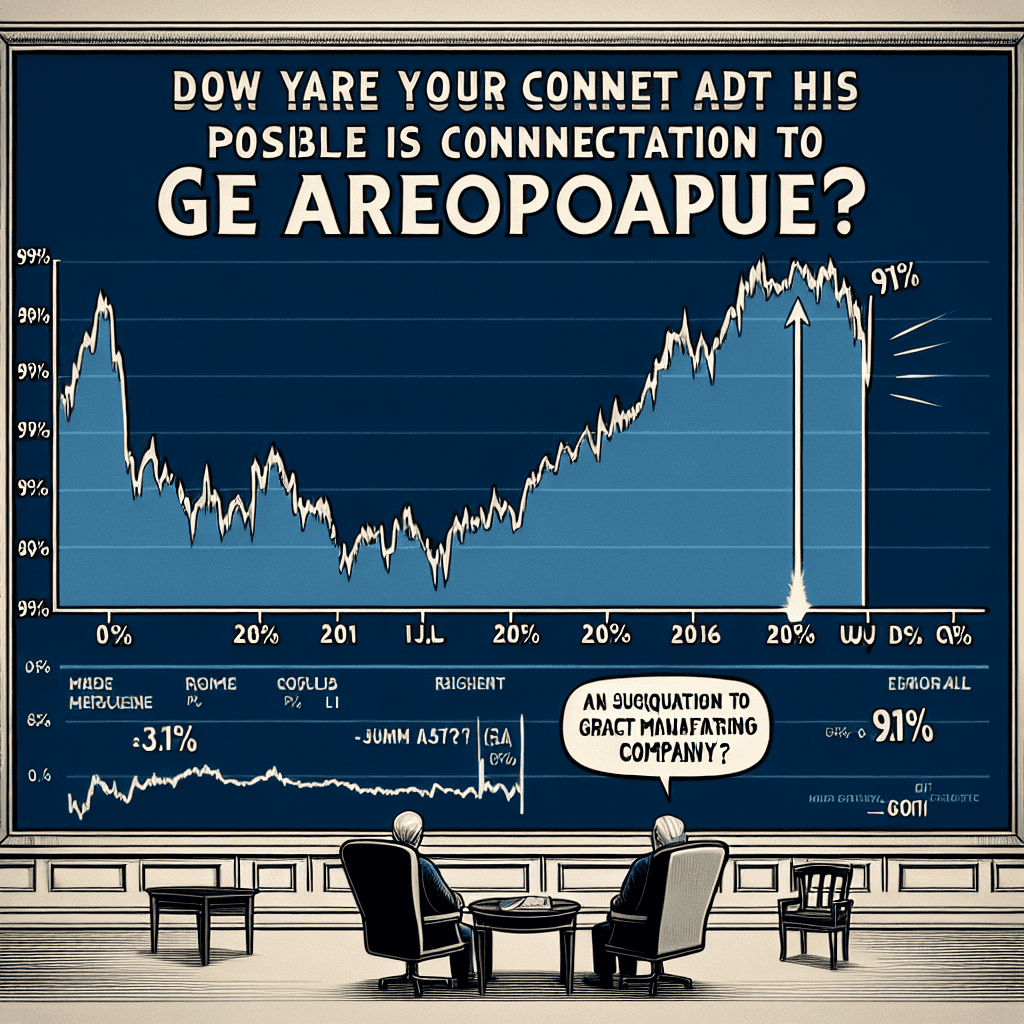

GE Aerospace recently experienced a significant 91% gain, which has since seen a decline following the release of its financial results. This fluctuation has sparked discussions among investors and analysts about the potential factors influencing this trend, with particular attention on its relationship with Boeing. As a major supplier of jet engines and components to Boeing, GE Aerospace’s performance is closely linked to the aerospace giant’s fortunes. The dip in GE Aerospace’s gains raises questions about whether it is directly tied to Boeing’s current market position, production challenges, or broader industry dynamics. Understanding the interplay between these two aerospace leaders is crucial for assessing the future trajectory of GE Aerospace’s financial performance.

Understanding GE Aerospace’s Recent Stock Performance: A Deep Dive

GE Aerospace has recently experienced a remarkable 91% gain in its stock performance, capturing the attention of investors and analysts alike. However, this impressive ascent was followed by a dip after the company’s latest financial results were released. This fluctuation has prompted questions about the underlying factors influencing GE Aerospace’s stock performance, particularly its relationship with Boeing, one of its key partners and customers. To understand the dynamics at play, it is essential to examine the broader context of GE Aerospace’s operations, its financial results, and its ties to Boeing.

Initially, GE Aerospace’s stock surge can be attributed to several factors, including a robust recovery in the aviation sector post-pandemic, increased demand for aircraft engines, and the company’s strategic initiatives aimed at enhancing operational efficiency. The aviation industry, having faced unprecedented challenges during the COVID-19 pandemic, has been on a path to recovery, with airlines ramping up operations and placing new orders for aircraft. This resurgence has directly benefited GE Aerospace, a leading manufacturer of jet engines, as airlines seek to modernize their fleets with more fuel-efficient and environmentally friendly options.

Moreover, GE Aerospace’s commitment to innovation and sustainability has positioned it favorably in the market. The company’s focus on developing next-generation engines that reduce carbon emissions aligns with the global push towards greener aviation solutions. This strategic direction not only enhances GE Aerospace’s competitive edge but also attracts environmentally conscious investors, further boosting its stock performance.

However, the recent dip in GE Aerospace’s stock following its financial results suggests that investors are reassessing their positions. While the company reported solid earnings, the results may not have fully met market expectations, leading to a recalibration of stock valuations. In such scenarios, it is common for stocks to experience short-term volatility as investors digest the implications of the financial data.

A critical aspect of GE Aerospace’s performance is its relationship with Boeing, a major player in the aerospace industry. Boeing is one of GE Aerospace’s largest customers, relying on its engines for various aircraft models. Consequently, any developments within Boeing can have a significant impact on GE Aerospace. For instance, production delays or changes in aircraft orders at Boeing could influence GE Aerospace’s revenue projections and, by extension, its stock performance.

Furthermore, Boeing’s own financial health and strategic decisions can indirectly affect GE Aerospace. If Boeing faces challenges such as regulatory scrutiny, supply chain disruptions, or shifts in market demand, these issues could ripple through to GE Aerospace. Investors, therefore, closely monitor Boeing’s performance and outlook when evaluating GE Aerospace’s stock.

In conclusion, while GE Aerospace’s recent stock performance has been impressive, the subsequent dip following its financial results highlights the complex interplay of factors influencing its valuation. The company’s strong position in the recovering aviation sector, coupled with its focus on innovation and sustainability, provides a solid foundation for future growth. However, its close ties to Boeing mean that any developments within the latter can have a profound impact on GE Aerospace. As such, investors must consider both the internal dynamics of GE Aerospace and the external factors related to Boeing when assessing the company’s stock performance. This nuanced understanding is crucial for making informed investment decisions in the ever-evolving aerospace industry.

The Impact of Boeing’s Challenges on GE Aerospace’s Financial Results

GE Aerospace, a prominent player in the aviation industry, recently experienced a significant 91% gain, which subsequently dipped following the release of its financial results. This fluctuation has prompted analysts and investors to question whether the challenges faced by Boeing, one of GE Aerospace’s key partners, have played a role in this financial performance. To understand the potential impact, it is essential to examine the intricate relationship between GE Aerospace and Boeing, as well as the broader context of the aviation industry.

GE Aerospace, a division of General Electric, is renowned for its production of jet engines and other aerospace components. A substantial portion of its business is tied to major aircraft manufacturers, with Boeing being one of its most significant clients. The two companies have a long-standing partnership, with GE Aerospace supplying engines for several Boeing aircraft models. Consequently, any challenges faced by Boeing can have a ripple effect on GE Aerospace’s financial health.

Boeing has encountered a series of challenges in recent years, ranging from production delays to regulatory scrutiny. The grounding of the 737 MAX fleet in 2019, following two fatal crashes, marked a significant setback for the company. Although the aircraft has since returned to service, the repercussions of this crisis continue to affect Boeing’s production schedules and financial performance. Additionally, the COVID-19 pandemic severely impacted the aviation industry, leading to reduced demand for new aircraft and further complicating Boeing’s recovery efforts.

Given this context, it is plausible that Boeing’s struggles have influenced GE Aerospace’s recent financial results. The dip in GE Aerospace’s gains following the release of its financial results may be partially attributed to the ongoing challenges faced by Boeing. As Boeing grapples with production delays and fluctuating demand, GE Aerospace may experience a corresponding impact on its order book and revenue streams. This interconnectedness underscores the importance of Boeing’s stability for GE Aerospace’s financial success.

However, it is crucial to consider other factors that may have contributed to GE Aerospace’s financial performance. The aviation industry as a whole is navigating a complex landscape, characterized by supply chain disruptions, fluctuating fuel prices, and evolving regulatory requirements. These factors can independently affect GE Aerospace’s operations and financial outcomes, irrespective of Boeing’s challenges. Moreover, GE Aerospace has been actively pursuing diversification strategies, expanding its portfolio to include digital solutions and sustainable aviation technologies. These initiatives may mitigate some of the adverse effects stemming from Boeing’s difficulties.

In conclusion, while Boeing’s challenges likely play a role in GE Aerospace’s recent financial performance, it is essential to recognize the multifaceted nature of the aviation industry. The intricate relationship between GE Aerospace and Boeing means that the latter’s struggles can have a direct impact on the former’s financial results. However, other industry-wide factors and GE Aerospace’s strategic initiatives also contribute to its financial outcomes. As the aviation industry continues to evolve, both companies will need to navigate these challenges collaboratively to ensure sustained growth and stability. Investors and analysts will undoubtedly keep a close eye on this dynamic relationship, as it remains a critical factor in assessing GE Aerospace’s future prospects.

Analyzing the Correlation Between GE Aerospace’s Gains and Boeing’s Market Position

GE Aerospace has recently experienced a remarkable 91% gain, capturing the attention of investors and market analysts alike. However, this impressive ascent faced a setback following the release of the company’s latest financial results. This development has sparked discussions about the potential correlation between GE Aerospace’s performance and Boeing’s market position. To understand this relationship, it is essential to delve into the dynamics of the aerospace industry and the interconnectedness of major players within it.

The aerospace sector is characterized by its complexity and the interdependence of its key participants. GE Aerospace, a prominent player in this field, is known for its production of jet engines and other critical components that are integral to the operations of major aircraft manufacturers, including Boeing. Consequently, the fortunes of GE Aerospace are often intertwined with those of its clients. When Boeing experiences fluctuations in its market position, it can have a ripple effect on its suppliers, including GE Aerospace.

Boeing, as one of the largest aerospace companies globally, wields significant influence over the industry. Its market position is shaped by various factors, including its order backlog, production rates, and the overall demand for commercial and defense aircraft. When Boeing faces challenges, such as production delays or reduced demand, it can lead to a decrease in orders for components from suppliers like GE Aerospace. This, in turn, can impact GE Aerospace’s financial performance and stock valuation.

The recent dip in GE Aerospace’s gains following its financial results may be partially attributed to Boeing’s current market conditions. Boeing has been navigating a complex landscape, dealing with issues such as supply chain disruptions and regulatory scrutiny. These challenges have affected its production schedules and delivery timelines, potentially leading to a slowdown in orders for GE Aerospace’s products. As a result, investors may have reacted to GE Aerospace’s financial results with caution, considering the broader context of Boeing’s market position.

Moreover, the aerospace industry is highly sensitive to macroeconomic factors, including global economic growth, fuel prices, and geopolitical tensions. These elements can influence airline profitability and, consequently, their investment in new aircraft. When airlines face financial constraints, they may delay or reduce orders for new planes, affecting both Boeing and its suppliers. This interconnectedness underscores the importance of monitoring not only individual company performance but also the broader industry trends.

While the correlation between GE Aerospace’s gains and Boeing’s market position is evident, it is crucial to recognize that other factors also play a role in shaping GE Aerospace’s financial outcomes. The company’s strategic initiatives, technological advancements, and operational efficiency are significant contributors to its success. GE Aerospace has been investing in research and development to enhance its product offerings and maintain a competitive edge. These efforts can mitigate some of the adverse effects stemming from external challenges.

In conclusion, the recent dip in GE Aerospace’s gains following its financial results highlights the intricate relationship between the company and Boeing’s market position. The aerospace industry’s interconnected nature means that fluctuations in one major player can reverberate throughout the sector. While Boeing’s challenges may have influenced GE Aerospace’s performance, it is essential to consider the broader context, including macroeconomic factors and the company’s internal strategies. As the aerospace industry continues to evolve, understanding these dynamics will be crucial for investors and stakeholders seeking to navigate this complex landscape.

GE Aerospace’s Strategic Moves Amidst Boeing’s Market Fluctuations

GE Aerospace has long been a significant player in the aviation industry, consistently demonstrating resilience and adaptability in the face of market fluctuations. Recently, the company experienced a remarkable 91% gain, a testament to its strategic initiatives and robust performance. However, this impressive surge was followed by a dip after the release of its latest financial results, prompting analysts and investors to question whether this downturn is linked to its close association with Boeing, one of its key partners.

To understand the dynamics at play, it is essential to consider the intricate relationship between GE Aerospace and Boeing. As a major supplier of aircraft engines and related technologies, GE Aerospace’s fortunes are closely tied to Boeing’s performance. The aviation giant has faced its own set of challenges in recent years, including production delays and regulatory scrutiny, which have inevitably impacted its suppliers. Consequently, any fluctuations in Boeing’s market position can have a ripple effect on GE Aerospace.

Despite these challenges, GE Aerospace has been proactive in implementing strategic measures to mitigate risks and capitalize on emerging opportunities. The company has invested heavily in research and development, focusing on innovative technologies that enhance fuel efficiency and reduce emissions. These advancements not only align with the industry’s growing emphasis on sustainability but also position GE Aerospace as a leader in next-generation aviation solutions. By prioritizing innovation, the company aims to strengthen its competitive edge and secure long-term growth.

Moreover, GE Aerospace has diversified its portfolio to reduce dependency on any single partner. By expanding its customer base and exploring new markets, the company seeks to cushion itself against potential downturns in specific segments. This strategic diversification is evident in its collaborations with other major aircraft manufacturers and its ventures into the burgeoning electric and hybrid propulsion sectors. Such initiatives underscore GE Aerospace’s commitment to adaptability and resilience in an ever-evolving industry landscape.

In addition to these strategic moves, GE Aerospace has also focused on operational efficiency to enhance profitability. Streamlining production processes and optimizing supply chain management have been key priorities, enabling the company to maintain cost competitiveness while delivering high-quality products. These efforts have not only bolstered financial performance but also reinforced GE Aerospace’s reputation as a reliable and efficient partner in the aviation sector.

While the recent dip in GE Aerospace’s gains may raise concerns, it is crucial to view this development within the broader context of the aviation industry’s cyclical nature. Market fluctuations are inherent in this sector, influenced by factors such as economic conditions, geopolitical tensions, and technological advancements. Therefore, short-term setbacks should not overshadow the company’s long-term strategic vision and its ability to navigate challenges effectively.

In conclusion, GE Aerospace’s recent performance, marked by a significant gain followed by a dip, reflects the complex interplay of factors influencing the aviation industry. While its close ties to Boeing may contribute to market volatility, GE Aerospace’s strategic initiatives, including innovation, diversification, and operational efficiency, position it well for sustained growth. As the company continues to adapt to changing market dynamics, it remains poised to capitalize on emerging opportunities and maintain its leadership in the aerospace sector.

Investor Reactions to GE Aerospace’s Earnings: A Focus on Boeing’s Influence

GE Aerospace recently reported a remarkable 91% gain, a figure that initially sent waves of optimism through the investment community. However, this enthusiasm was tempered following the release of their latest earnings report, which led to a dip in their stock value. Investors are now scrutinizing the potential factors behind this decline, with a particular focus on the company’s relationship with Boeing. Understanding the dynamics between GE Aerospace and Boeing is crucial, as the two companies have a long-standing partnership that significantly impacts GE’s financial performance.

To begin with, GE Aerospace’s impressive gains can be attributed to several factors, including increased demand for its products and services, as well as strategic initiatives aimed at enhancing operational efficiency. The company has been successful in capitalizing on the recovery of the aviation industry, which has been gradually rebounding from the disruptions caused by the COVID-19 pandemic. This recovery has led to a surge in orders for aircraft engines and related components, which are core offerings of GE Aerospace.

However, the recent dip in GE Aerospace’s stock following its earnings report has raised questions about the sustainability of its growth trajectory. One of the primary concerns among investors is the company’s exposure to Boeing, one of its largest customers. Boeing’s own financial health and production schedules have a direct impact on GE Aerospace’s revenue streams. Any fluctuations in Boeing’s operations, whether due to supply chain issues, regulatory challenges, or shifts in market demand, can have a ripple effect on GE Aerospace.

Moreover, Boeing has faced its own set of challenges in recent years, including the grounding of its 737 MAX aircraft and delays in the production of its 787 Dreamliner. These issues have, at times, led to reduced orders for GE Aerospace’s engines, thereby affecting its financial performance. Consequently, investors are keenly aware of the interconnectedness between the two companies and are closely monitoring Boeing’s progress in overcoming these hurdles.

In addition to Boeing’s influence, other external factors may also be contributing to the volatility in GE Aerospace’s stock. The global economic environment remains uncertain, with geopolitical tensions and fluctuating fuel prices posing potential risks to the aviation industry. These factors can impact airline profitability and, by extension, their willingness to invest in new aircraft and engines. As a result, GE Aerospace must navigate these challenges while maintaining its competitive edge in the market.

Despite these concerns, it is important to note that GE Aerospace has been proactive in addressing potential risks. The company has diversified its customer base and expanded its product offerings to mitigate its reliance on any single partner. Furthermore, GE Aerospace has invested in research and development to drive innovation and maintain its leadership position in the aerospace sector.

In conclusion, while the recent dip in GE Aerospace’s stock following its earnings report has prompted investor scrutiny, it is essential to consider the broader context of its relationship with Boeing and other external factors. The company’s long-term prospects remain promising, provided it continues to adapt to the evolving landscape of the aviation industry. Investors will undoubtedly keep a close watch on both GE Aerospace and Boeing, as their fortunes remain intertwined in the complex web of the global aerospace market.

The Role of Supply Chain Dynamics in GE Aerospace’s Financial Outcomes

GE Aerospace has recently experienced a remarkable 91% gain, a testament to its robust performance and strategic initiatives. However, this impressive ascent faced a slight dip following the release of its latest financial results. This fluctuation has prompted analysts and investors alike to ponder the potential connection between GE Aerospace’s financial outcomes and its relationship with Boeing, one of its key partners. To understand this dynamic, it is essential to delve into the intricacies of supply chain dynamics and their impact on GE Aerospace’s financial health.

The aerospace industry is inherently complex, characterized by intricate supply chains that involve numerous stakeholders, including manufacturers, suppliers, and customers. GE Aerospace, as a leading player in this sector, is no exception. Its financial performance is intricately linked to the efficiency and stability of its supply chain. Any disruptions or inefficiencies can have a cascading effect, influencing production schedules, delivery timelines, and ultimately, financial outcomes.

Boeing, as one of GE Aerospace’s major clients, plays a pivotal role in this supply chain ecosystem. The relationship between the two companies is symbiotic, with GE Aerospace supplying critical components such as engines for Boeing’s aircraft. Consequently, any fluctuations in Boeing’s production schedules or demand forecasts can directly impact GE Aerospace’s operations. For instance, if Boeing experiences delays in its production line, it may lead to a temporary reduction in orders for GE Aerospace, thereby affecting its revenue streams.

Moreover, the aerospace industry is currently navigating a challenging landscape marked by supply chain disruptions, partly due to the lingering effects of the COVID-19 pandemic. These disruptions have led to shortages of essential materials and components, causing delays and increased costs for manufacturers like GE Aerospace. In this context, the company’s ability to manage its supply chain effectively becomes crucial. Any missteps in this area can exacerbate financial volatility, as seen in the recent dip following the financial results.

Furthermore, the geopolitical climate and trade policies also play a significant role in shaping supply chain dynamics. Tariffs, trade restrictions, and diplomatic tensions can all influence the flow of goods and services across borders, impacting GE Aerospace’s ability to source materials and deliver products efficiently. In such a volatile environment, maintaining strong relationships with key partners like Boeing becomes even more critical. Collaborative efforts to mitigate risks and enhance supply chain resilience can help stabilize financial outcomes.

In addition to external factors, internal strategies also contribute to GE Aerospace’s financial performance. The company has been investing in digital technologies and process improvements to enhance supply chain visibility and agility. By leveraging data analytics and automation, GE Aerospace aims to optimize inventory management, reduce lead times, and improve overall operational efficiency. These initiatives are designed to mitigate the impact of supply chain disruptions and support sustainable financial growth.

In conclusion, while GE Aerospace’s recent financial dip may raise questions about its connection to Boeing, it is essential to consider the broader context of supply chain dynamics. The aerospace industry’s intricate supply chains, coupled with external challenges and internal strategies, play a significant role in shaping financial outcomes. As GE Aerospace continues to navigate this complex landscape, its ability to manage supply chain dynamics effectively will be crucial in sustaining its financial performance and capitalizing on future growth opportunities.

Future Prospects for GE Aerospace: Lessons from the Boeing Connection

GE Aerospace has long been a significant player in the aviation industry, and its recent 91% gain in stock value has drawn considerable attention from investors and analysts alike. However, this impressive surge experienced a slight dip following the release of the company’s latest financial results. This fluctuation has prompted questions about the underlying factors influencing GE Aerospace’s performance, particularly its intricate relationship with Boeing, one of its key partners and customers. Understanding this connection is crucial for assessing the future prospects of GE Aerospace and drawing valuable lessons for the industry.

To begin with, GE Aerospace’s fortunes are closely tied to the broader aviation market, where Boeing plays a pivotal role. As a major supplier of aircraft engines and related technologies, GE Aerospace’s business is significantly influenced by Boeing’s production schedules and order volumes. When Boeing experiences fluctuations in its operations, whether due to supply chain disruptions, regulatory challenges, or shifts in market demand, these changes inevitably ripple through to GE Aerospace. Consequently, any developments affecting Boeing can have a direct impact on GE Aerospace’s financial performance.

Moreover, the recent dip in GE Aerospace’s stock value following its financial results may be partially attributed to Boeing’s own challenges. Boeing has faced a series of hurdles in recent years, including the grounding of its 737 MAX aircraft and delays in the production of its 787 Dreamliner. These issues have not only affected Boeing’s bottom line but have also had a cascading effect on its suppliers, including GE Aerospace. As Boeing works to resolve these challenges and stabilize its production, GE Aerospace’s performance is likely to be influenced by the pace and success of these efforts.

In addition to the direct impact of Boeing’s operational challenges, GE Aerospace’s future prospects are also shaped by broader industry trends. The aviation sector is undergoing a transformation driven by technological advancements, environmental concerns, and changing consumer preferences. As airlines increasingly prioritize fuel efficiency and sustainability, there is a growing demand for next-generation aircraft engines that offer improved performance and reduced emissions. GE Aerospace is well-positioned to capitalize on this trend, given its focus on innovation and its track record of developing cutting-edge technologies.

Furthermore, the lessons from GE Aerospace’s relationship with Boeing extend beyond the immediate financial implications. This partnership underscores the importance of diversification and resilience in the aerospace industry. While strategic alliances with major players like Boeing can provide significant opportunities for growth, they also expose companies to risks associated with dependency on a single customer. For GE Aerospace, expanding its customer base and exploring new markets could mitigate these risks and enhance its long-term stability.

In conclusion, the recent dip in GE Aerospace’s stock value following its financial results highlights the complex interplay between the company and its key partner, Boeing. While Boeing’s challenges have undoubtedly influenced GE Aerospace’s performance, the future prospects for GE Aerospace remain promising, driven by industry trends and its commitment to innovation. By learning from its experiences with Boeing and embracing diversification, GE Aerospace can navigate the evolving landscape of the aviation industry and continue to thrive in the years to come.

Q&A

1. **What caused GE Aerospace’s 91% gain?**

GE Aerospace’s significant gain was primarily driven by strong financial performance, increased demand for its products, and positive market sentiment.

2. **Why did GE Aerospace’s stock dip after the results?**

The dip in GE Aerospace’s stock after the results could be attributed to profit-taking by investors, market volatility, or concerns about future growth prospects.

3. **How is GE Aerospace connected to Boeing?**

GE Aerospace supplies engines and other components to Boeing, making it a key partner in Boeing’s aircraft manufacturing process.

4. **Did Boeing’s performance impact GE Aerospace’s results?**

Yes, Boeing’s performance can impact GE Aerospace’s results, as any changes in Boeing’s production rates or order volumes can directly affect GE Aerospace’s revenue.

5. **What are the potential risks for GE Aerospace related to Boeing?**

Potential risks include dependency on Boeing’s production schedules, potential delays or cancellations of Boeing aircraft orders, and any financial or operational challenges faced by Boeing.

6. **How did the market react to GE Aerospace’s results?**

The market initially reacted positively to GE Aerospace’s results, but the subsequent dip suggests mixed investor sentiment or external market factors influencing the stock.

7. **What are analysts saying about GE Aerospace’s future prospects?**

Analysts generally remain optimistic about GE Aerospace’s future prospects, citing strong demand in the aerospace sector, but they also caution about potential risks related to supply chain issues and dependency on major clients like Boeing.

Conclusion

GE Aerospace’s 91% gain followed by a dip after results may be tied to its relationship with Boeing, as fluctuations in Boeing’s performance and order volumes can significantly impact GE Aerospace’s financial outcomes. The dip could reflect market reactions to Boeing’s challenges or changes in demand for aircraft engines, which GE supplies. Additionally, investor sentiment might be influenced by broader industry trends or specific developments in Boeing’s business, highlighting the interconnected nature of their operations.