“Empowering Tomorrow: Microsoft’s Vision for Growth and Innovation in 2026”

Introduction

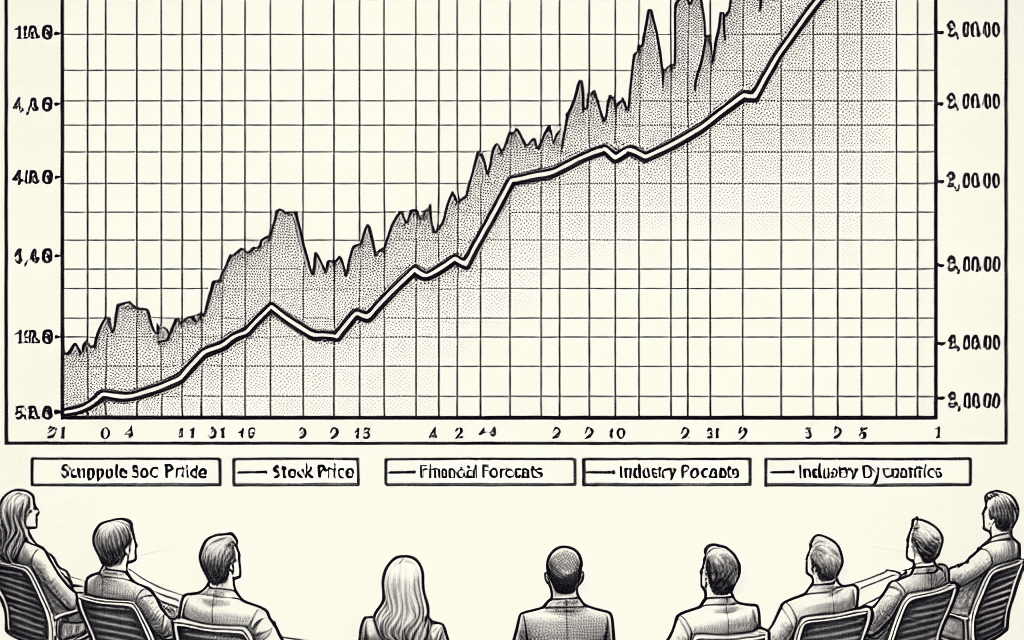

Title: Future Outlook: Microsoft’s Stock in Three Years

Introduction:

As one of the leading technology giants, Microsoft Corporation has consistently demonstrated robust financial performance and strategic innovation, making it a focal point for investors and market analysts. Over the past few years, the company has expanded its influence across various sectors, including cloud computing, artificial intelligence, and enterprise solutions. With a strong foundation and a forward-looking approach, the future outlook for Microsoft’s stock over the next three years is a subject of keen interest. This analysis aims to explore the potential trajectories of Microsoft’s stock, considering market trends, technological advancements, and strategic initiatives that could shape its financial landscape.

Impact Of AI Innovations On Microsoft’s Stock

In recent years, Microsoft has positioned itself as a formidable player in the technology sector, with its stock performance reflecting its strategic investments and innovations. As we look toward the future, particularly over the next three years, the impact of artificial intelligence (AI) innovations on Microsoft’s stock is a topic of considerable interest. The company’s commitment to AI is evident in its substantial investments and strategic acquisitions, which are likely to influence its stock trajectory significantly.

To begin with, Microsoft’s focus on AI is not a recent development. The company has been integrating AI into its products and services for several years, enhancing its cloud computing platform, Azure, with AI capabilities. This integration has allowed Microsoft to offer more sophisticated and efficient solutions to its enterprise clients, thereby increasing its competitive edge in the cloud market. As AI continues to evolve, Microsoft’s ability to leverage these advancements will be crucial in maintaining and potentially increasing its market share, which in turn could positively impact its stock value.

Moreover, Microsoft’s acquisition strategy has been instrumental in bolstering its AI capabilities. The purchase of companies like Nuance Communications, known for its speech recognition technology, underscores Microsoft’s intent to deepen its AI expertise. Such acquisitions not only expand Microsoft’s technological portfolio but also open new revenue streams, particularly in sectors like healthcare, where AI-driven solutions are increasingly in demand. As these technologies mature and become more integrated into Microsoft’s offerings, they are likely to contribute to revenue growth, thereby enhancing investor confidence and potentially driving up the stock price.

In addition to acquisitions, Microsoft’s internal research and development efforts play a pivotal role in its AI strategy. The company has been investing heavily in AI research, with initiatives aimed at advancing machine learning, natural language processing, and computer vision. These efforts are expected to yield innovative products and services that could redefine user experiences across various platforms. As these innovations are rolled out, they could attract a broader customer base, further solidifying Microsoft’s position in the tech industry and positively influencing its stock performance.

Furthermore, the broader economic and regulatory environment will also impact Microsoft’s AI-driven growth. As governments worldwide increasingly recognize the importance of AI, regulatory frameworks are being developed to ensure ethical and responsible AI use. Microsoft’s proactive approach to AI ethics and its collaboration with policymakers could position it favorably in this evolving landscape. By aligning its AI initiatives with regulatory expectations, Microsoft can mitigate potential risks and capitalize on opportunities, thereby maintaining investor trust and potentially boosting its stock value.

However, it is important to acknowledge the competitive landscape in which Microsoft operates. Other tech giants are also heavily investing in AI, which could pose challenges to Microsoft’s market dominance. Nevertheless, Microsoft’s established brand reputation, extensive customer base, and comprehensive suite of products and services provide it with a strong foundation to navigate these challenges effectively.

In conclusion, the impact of AI innovations on Microsoft’s stock over the next three years is poised to be significant. Through strategic acquisitions, robust research and development, and a proactive approach to regulatory challenges, Microsoft is well-positioned to harness the potential of AI. While competition remains fierce, the company’s strategic initiatives and market positioning suggest a promising outlook for its stock, making it a focal point for investors and industry observers alike.

Microsoft’s Cloud Computing Growth And Stock Projections

As we look toward the future of Microsoft’s stock over the next three years, it is essential to consider the pivotal role that cloud computing will play in shaping the company’s financial trajectory. Microsoft’s cloud computing division, Azure, has been a significant growth driver for the company, consistently reporting robust revenue increases. This growth is not only a testament to the increasing demand for cloud services but also to Microsoft’s strategic positioning in the market. As businesses worldwide continue to undergo digital transformation, the reliance on cloud infrastructure is expected to intensify, thereby providing a fertile ground for Azure’s expansion.

In recent years, Microsoft has made substantial investments in enhancing its cloud capabilities, focusing on artificial intelligence, machine learning, and data analytics. These investments are designed to cater to a broad spectrum of industries, from healthcare to finance, each seeking to leverage cloud technology for improved efficiency and innovation. As a result, Azure has emerged as a formidable competitor to other cloud giants, such as Amazon Web Services and Google Cloud. This competitive edge is likely to bolster Microsoft’s market share in the cloud sector, which, in turn, could positively influence its stock performance.

Moreover, Microsoft’s commitment to sustainability and its ambitious goal to be carbon negative by 2030 further enhance its appeal to environmentally conscious investors. The company’s efforts to integrate sustainable practices within its cloud operations not only align with global environmental goals but also position Microsoft as a leader in responsible corporate governance. This alignment is increasingly important to investors who prioritize environmental, social, and governance (ESG) criteria in their investment decisions. Consequently, Microsoft’s proactive stance on sustainability could attract a broader investor base, potentially driving up its stock value.

In addition to cloud computing, Microsoft’s diverse product portfolio, including its Office suite, LinkedIn, and gaming division, provides a stable revenue stream that complements its cloud growth. The integration of cloud services with these products creates a synergistic effect, enhancing user experience and fostering customer loyalty. This interconnected ecosystem is likely to contribute to sustained revenue growth, thereby supporting a positive outlook for Microsoft’s stock.

However, it is crucial to acknowledge potential challenges that could impact Microsoft’s stock projections. The cloud computing market is highly competitive, with rapid technological advancements and evolving customer needs. Microsoft must continuously innovate and adapt to maintain its competitive edge. Additionally, regulatory scrutiny and geopolitical tensions could pose risks to its global operations, potentially affecting investor confidence.

Despite these challenges, the overall outlook for Microsoft’s stock remains optimistic. Analysts predict that the company’s strategic focus on cloud computing, coupled with its commitment to innovation and sustainability, will drive significant growth over the next three years. As businesses increasingly adopt cloud solutions, Microsoft’s ability to deliver scalable, secure, and efficient services will be a key determinant of its success.

In conclusion, Microsoft’s cloud computing growth is poised to be a major catalyst for its stock performance in the coming years. By capitalizing on emerging technologies and maintaining a strong commitment to sustainability, Microsoft is well-positioned to navigate the dynamic landscape of the tech industry. As such, investors can anticipate a promising future for Microsoft’s stock, underpinned by its strategic initiatives and market leadership in cloud computing.

The Role Of Gaming In Microsoft’s Future Stock Performance

As we look toward the future of Microsoft’s stock performance over the next three years, the role of gaming emerges as a pivotal factor. Microsoft’s gaming division, primarily driven by Xbox and its associated services, has been a significant contributor to the company’s revenue stream. This sector’s influence on Microsoft’s stock is expected to grow, given the increasing global demand for interactive entertainment and the strategic moves the company is making within this space.

To begin with, Microsoft’s acquisition strategy has been a cornerstone of its gaming expansion. The purchase of ZeniMax Media, the parent company of Bethesda Softworks, in 2021 was a clear indication of Microsoft’s commitment to bolstering its gaming portfolio. This acquisition brought a wealth of popular franchises under the Xbox umbrella, enhancing the appeal of Microsoft’s gaming ecosystem. As the company continues to integrate these assets, the potential for increased revenue from game sales, subscriptions, and in-game purchases becomes more pronounced. This, in turn, could positively impact Microsoft’s stock performance as investors recognize the value of these strategic acquisitions.

Moreover, the growth of Xbox Game Pass, a subscription service offering access to a vast library of games, is another critical element in Microsoft’s gaming strategy. Game Pass has been described as the “Netflix of gaming,” and its subscriber base has been steadily increasing. The service not only provides a recurring revenue stream but also fosters customer loyalty and engagement. As Microsoft continues to expand the Game Pass library and enhance its offerings, the service is likely to attract even more subscribers, further solidifying its role as a revenue driver. This growth trajectory is expected to be a favorable factor for Microsoft’s stock, as it demonstrates the company’s ability to innovate and adapt to changing consumer preferences.

In addition to acquisitions and subscription services, Microsoft’s focus on cloud gaming through Xbox Cloud Gaming (formerly known as Project xCloud) is poised to play a significant role in its future stock performance. Cloud gaming allows users to stream games directly to their devices without the need for high-end hardware, making gaming more accessible to a broader audience. As internet infrastructure improves globally, the potential market for cloud gaming expands, offering Microsoft an opportunity to capture a larger share of the gaming market. The success of cloud gaming could serve as a catalyst for Microsoft’s stock, as it represents a new frontier in the gaming industry with substantial growth potential.

Furthermore, Microsoft’s commitment to cross-platform play and integration is another factor that could influence its stock performance. By enabling gamers to play across different devices and platforms, Microsoft is fostering a more inclusive and interconnected gaming community. This approach not only enhances the user experience but also positions Microsoft as a leader in the gaming industry, potentially attracting more users to its ecosystem. As the company continues to innovate and expand its gaming offerings, the positive impact on its stock performance could become increasingly evident.

In conclusion, the role of gaming in Microsoft’s future stock performance is multifaceted and significant. Through strategic acquisitions, the growth of subscription services like Xbox Game Pass, advancements in cloud gaming, and a commitment to cross-platform integration, Microsoft is well-positioned to capitalize on the evolving gaming landscape. As these initiatives unfold over the next three years, they are likely to play a crucial role in shaping the company’s stock trajectory, offering investors a compelling reason to consider Microsoft’s potential in the gaming sector.

Microsoft’s Strategic Acquisitions And Their Stock Implications

In recent years, Microsoft has strategically positioned itself as a dominant force in the technology sector through a series of calculated acquisitions. These acquisitions have not only expanded its portfolio but also fortified its competitive edge in various markets. As we look ahead to the next three years, the implications of these strategic moves on Microsoft’s stock are worth examining.

To begin with, Microsoft’s acquisition strategy has been focused on enhancing its capabilities in cloud computing, artificial intelligence, and gaming. The purchase of LinkedIn in 2016, for instance, was a significant step towards integrating social networking with professional services, thereby expanding Microsoft’s reach into the enterprise sector. This acquisition has continued to pay dividends, as LinkedIn’s user base and engagement metrics have steadily increased, contributing positively to Microsoft’s revenue streams. Moreover, the integration of LinkedIn’s data with Microsoft’s cloud services has created synergies that enhance the value proposition of its enterprise offerings.

Furthermore, Microsoft’s acquisition of GitHub in 2018 exemplifies its commitment to strengthening its developer ecosystem. By providing a platform for millions of developers worldwide, Microsoft has not only secured a foothold in the open-source community but also ensured a steady influx of innovation into its software development processes. This move is likely to bolster Microsoft’s cloud services, particularly Azure, as developers increasingly rely on GitHub for collaboration and project management. Consequently, this could lead to increased adoption of Azure, thereby positively impacting Microsoft’s stock performance.

In addition to these acquisitions, Microsoft’s foray into the gaming industry through the purchase of ZeniMax Media in 2020 has positioned it as a formidable player in the gaming sector. This acquisition brought popular franchises such as The Elder Scrolls and Fallout under Microsoft’s umbrella, significantly enhancing its gaming portfolio. As the gaming industry continues to grow, driven by advancements in technology and increasing consumer demand, Microsoft’s strategic positioning in this market is expected to yield substantial returns. The integration of ZeniMax’s offerings with Microsoft’s Xbox platform and Game Pass subscription service is likely to attract a larger user base, thereby boosting revenue and, in turn, stock value.

Moreover, Microsoft’s recent acquisition of Nuance Communications in 2021 underscores its focus on artificial intelligence and healthcare. By leveraging Nuance’s expertise in voice recognition and AI-driven solutions, Microsoft aims to enhance its cloud offerings, particularly in the healthcare sector. This move aligns with the growing trend of digital transformation in healthcare, where AI and cloud technologies are increasingly being adopted to improve patient care and operational efficiency. As Microsoft continues to innovate in this space, it is poised to capture a significant share of the healthcare technology market, which could have a positive impact on its stock performance.

In conclusion, Microsoft’s strategic acquisitions over the past few years have laid a solid foundation for future growth. By expanding its capabilities in cloud computing, gaming, and artificial intelligence, Microsoft has positioned itself to capitalize on emerging trends and market opportunities. As these acquisitions continue to integrate and mature, they are likely to drive revenue growth and enhance shareholder value. Therefore, over the next three years, Microsoft’s stock is expected to benefit from these strategic moves, making it a potentially attractive investment for those seeking exposure to the technology sector.

How Microsoft’s Sustainability Initiatives Could Affect Stock Value

As the world increasingly prioritizes sustainability, companies are under mounting pressure to adopt environmentally friendly practices. Microsoft, a leader in the technology sector, has been at the forefront of this movement, implementing a range of sustainability initiatives that could significantly impact its stock value over the next three years. Understanding the potential effects of these initiatives on Microsoft’s financial performance requires a closer examination of the company’s strategies and the broader market context.

To begin with, Microsoft’s commitment to sustainability is evident in its ambitious environmental goals. The company has pledged to become carbon negative by 2030, meaning it aims to remove more carbon from the atmosphere than it emits. This commitment extends to its entire supply chain, with plans to reduce emissions by more than half by 2030. Such initiatives not only demonstrate Microsoft’s dedication to environmental responsibility but also position the company as a leader in sustainable business practices. This leadership could enhance its brand reputation, attracting environmentally conscious investors and customers, which in turn could positively influence its stock value.

Moreover, Microsoft’s investment in renewable energy is another critical component of its sustainability strategy. The company has been actively purchasing renewable energy to power its data centers and operations, with a goal to shift to 100% renewable energy by 2025. This transition not only reduces operational costs in the long term but also mitigates risks associated with fluctuating energy prices and regulatory changes. As a result, Microsoft’s financial stability and predictability could improve, making its stock more attractive to investors seeking sustainable growth.

In addition to environmental initiatives, Microsoft’s focus on sustainable innovation is likely to play a crucial role in its future stock performance. The company is investing heavily in research and development to create technologies that enable other businesses to reduce their carbon footprints. For instance, Microsoft’s cloud services offer tools for energy efficiency and carbon tracking, which are increasingly in demand as companies strive to meet their own sustainability targets. By positioning itself as a provider of essential sustainability solutions, Microsoft could capture a larger market share, driving revenue growth and potentially boosting its stock value.

Furthermore, the regulatory landscape is evolving, with governments worldwide implementing stricter environmental regulations. Companies that proactively adopt sustainable practices are better positioned to navigate these changes, avoiding potential fines and compliance costs. Microsoft’s proactive approach not only reduces such risks but also aligns with the growing trend of environmental, social, and governance (ESG) investing. As more investors incorporate ESG criteria into their decision-making processes, companies like Microsoft that demonstrate strong sustainability credentials could see increased demand for their stock.

However, it is important to consider potential challenges that could affect Microsoft’s sustainability initiatives and, consequently, its stock value. The transition to sustainable practices requires significant upfront investment, which could impact short-term profitability. Additionally, the success of these initiatives depends on various external factors, such as technological advancements and global economic conditions. Therefore, while Microsoft’s sustainability efforts present promising opportunities, they also entail certain risks that investors should carefully evaluate.

In conclusion, Microsoft’s sustainability initiatives have the potential to significantly influence its stock value over the next three years. By enhancing its brand reputation, reducing operational costs, and capturing new market opportunities, the company is well-positioned to benefit from the growing emphasis on sustainability. However, investors must remain cognizant of the associated challenges and uncertainties. As the world continues to prioritize environmental responsibility, Microsoft’s commitment to sustainability could prove to be a key driver of its future financial performance.

The Influence Of Global Economic Trends On Microsoft’s Stock

As we look toward the future, the performance of Microsoft’s stock over the next three years will likely be influenced by a myriad of global economic trends. Understanding these trends is crucial for investors seeking to anticipate the potential trajectory of this technology giant’s market value. One of the most significant factors that could impact Microsoft’s stock is the ongoing evolution of the global economy, particularly in the context of technological advancements and digital transformation. As businesses worldwide continue to embrace digital solutions, Microsoft’s suite of products and services, including cloud computing, artificial intelligence, and enterprise software, positions the company to capitalize on this growing demand.

Moreover, the global economic landscape is increasingly shaped by geopolitical dynamics, which can have both direct and indirect effects on multinational corporations like Microsoft. Trade policies, international relations, and regulatory changes can influence market conditions and, consequently, stock performance. For instance, any shifts in trade agreements or tariffs between major economies could affect Microsoft’s supply chain and market access, thereby impacting its financial outlook. Additionally, regulatory scrutiny in different regions, particularly concerning data privacy and antitrust issues, could pose challenges that might affect investor confidence.

Another critical aspect to consider is the impact of macroeconomic indicators such as interest rates, inflation, and currency fluctuations. Central banks’ monetary policies, especially in major economies like the United States and the European Union, can influence borrowing costs and consumer spending, which in turn affect corporate earnings and stock valuations. For Microsoft, a company with significant international operations, currency exchange rates also play a vital role. Fluctuations in the value of the U.S. dollar relative to other currencies can impact the company’s revenue and profitability, as foreign earnings are translated back into dollars.

Furthermore, the global push towards sustainability and environmental responsibility is likely to shape Microsoft’s strategic initiatives and, by extension, its stock performance. As investors increasingly prioritize environmental, social, and governance (ESG) criteria, companies that demonstrate a commitment to sustainable practices may enjoy a competitive advantage. Microsoft’s efforts to achieve carbon neutrality and invest in renewable energy sources could enhance its reputation and attract ESG-focused investors, potentially boosting its stock value.

In addition to these economic and geopolitical factors, technological innovation remains a cornerstone of Microsoft’s growth strategy. The company’s ability to stay at the forefront of emerging technologies, such as quantum computing and the Internet of Things (IoT), will be pivotal in maintaining its competitive edge. As these technologies mature and become more integrated into various industries, Microsoft’s capacity to deliver cutting-edge solutions could drive revenue growth and positively influence its stock price.

In conclusion, while predicting the exact trajectory of Microsoft’s stock over the next three years is inherently uncertain, analyzing global economic trends provides valuable insights into potential influences on its performance. By considering factors such as digital transformation, geopolitical dynamics, macroeconomic indicators, sustainability initiatives, and technological innovation, investors can better understand the complex interplay of forces that may shape Microsoft’s financial future. As the global economy continues to evolve, Microsoft’s adaptability and strategic foresight will be key determinants of its success in navigating these challenges and opportunities.

Microsoft’s Expansion In Emerging Markets And Stock Forecast

As we look toward the future of Microsoft’s stock over the next three years, it is essential to consider the company’s strategic expansion into emerging markets and how this could influence its financial performance. Microsoft’s robust presence in developed markets has long been a cornerstone of its success, but the tech giant’s recent initiatives in emerging economies signal a new phase of growth that could significantly impact its stock valuation.

Emerging markets present a unique opportunity for Microsoft, as these regions are characterized by rapid economic growth, increasing internet penetration, and a burgeoning middle class with rising disposable incomes. Recognizing these trends, Microsoft has been actively investing in infrastructure, partnerships, and localized solutions to cater to the specific needs of these markets. For instance, the company’s efforts to provide affordable cloud services and digital tools tailored to local businesses and governments demonstrate its commitment to fostering digital transformation in these regions.

Moreover, Microsoft’s strategic partnerships with local companies and governments in emerging markets are pivotal in establishing a strong foothold. By collaborating with local entities, Microsoft not only gains valuable insights into regional market dynamics but also builds trust and credibility, which are crucial for long-term success. These partnerships often involve joint ventures, technology transfers, and skill development programs, all of which contribute to a more favorable business environment for Microsoft.

In addition to partnerships, Microsoft’s focus on innovation and technology adaptation plays a significant role in its expansion strategy. The company has been leveraging its expertise in artificial intelligence, cloud computing, and cybersecurity to develop solutions that address the unique challenges faced by emerging markets. For example, Microsoft’s Azure cloud platform has been instrumental in helping businesses in these regions enhance their operational efficiency and scalability. By providing cutting-edge technology solutions, Microsoft not only strengthens its competitive position but also creates new revenue streams that could positively impact its stock performance.

Furthermore, Microsoft’s commitment to sustainability and corporate social responsibility aligns well with the priorities of many emerging markets, where environmental and social issues are increasingly gaining attention. By investing in renewable energy projects and promoting digital inclusion, Microsoft not only enhances its brand image but also contributes to the sustainable development of these regions. This alignment with local values and priorities can lead to increased customer loyalty and market share, further bolstering Microsoft’s growth prospects.

As we consider the potential impact of these initiatives on Microsoft’s stock forecast, it is important to recognize the inherent risks associated with operating in emerging markets. Political instability, regulatory challenges, and economic volatility are factors that could pose significant obstacles to Microsoft’s expansion efforts. However, the company’s strong financial position, diversified product portfolio, and proven track record of navigating complex market environments provide a solid foundation for mitigating these risks.

In conclusion, Microsoft’s strategic expansion into emerging markets represents a promising avenue for growth that could positively influence its stock performance over the next three years. By leveraging its technological expertise, forming strategic partnerships, and aligning with local values, Microsoft is well-positioned to capitalize on the opportunities presented by these dynamic regions. While challenges remain, the company’s proactive approach and commitment to innovation suggest a favorable outlook for its stock, making it an attractive consideration for investors seeking long-term value.

Q&A

1. **Question:** What factors could influence Microsoft’s stock performance in the next three years?

**Answer:** Factors include technological advancements, market competition, economic conditions, regulatory changes, and Microsoft’s strategic initiatives in cloud computing, AI, and other emerging technologies.

2. **Question:** How might Microsoft’s investment in AI impact its stock price?

**Answer:** Successful AI integration and innovation could lead to increased revenue and market share, potentially boosting the stock price.

3. **Question:** What role does cloud computing play in Microsoft’s future stock outlook?

**Answer:** As a major growth driver, continued expansion and leadership in cloud services like Azure could positively impact Microsoft’s stock performance.

4. **Question:** Could geopolitical tensions affect Microsoft’s stock in the next three years?

**Answer:** Yes, geopolitical tensions could impact global operations, supply chains, and market access, potentially affecting stock performance.

5. **Question:** How important is Microsoft’s financial health to its future stock outlook?

**Answer:** Strong financial health, including revenue growth, profitability, and cash reserves, is crucial for sustaining investor confidence and stock performance.

6. **Question:** What impact could regulatory changes have on Microsoft’s stock?

**Answer:** Regulatory changes, especially in data privacy and antitrust laws, could pose challenges or opportunities, influencing stock volatility and long-term performance.

7. **Question:** How might Microsoft’s strategic partnerships influence its stock outlook?

**Answer:** Strategic partnerships can enhance product offerings, expand market reach, and drive innovation, potentially leading to positive stock performance.

Conclusion

Microsoft’s stock outlook over the next three years appears promising, driven by several key factors. The company’s continued investment in cloud computing, particularly through its Azure platform, positions it well to capitalize on the growing demand for cloud services. Additionally, Microsoft’s focus on artificial intelligence, productivity software, and gaming, including its Xbox ecosystem, provides diverse revenue streams. Strategic acquisitions and partnerships further enhance its competitive edge. However, potential risks include regulatory scrutiny and macroeconomic uncertainties. Overall, Microsoft’s strong financial health, innovation, and market leadership suggest a positive trajectory for its stock in the coming years.