“Strategic Vision Over Higher Valuation: Fuji Soft Partners with KKR”

Introduction

In a strategic move that has captured the attention of the financial world, Fuji Soft, a prominent player in the technology services sector, has opted to align with global investment firm KKR, despite receiving a higher bid from rival private equity giant Bain Capital. This decision underscores Fuji Soft’s confidence in KKR’s strategic vision and partnership potential, prioritizing long-term growth and operational synergy over immediate financial gain. The choice highlights the intricate dynamics of corporate acquisitions, where factors beyond monetary value, such as strategic alignment, cultural fit, and future growth prospects, play a crucial role in shaping pivotal business decisions.

Strategic Reasons Behind Fuji Soft’s Decision to Partner with KKR

In a surprising turn of events, Fuji Soft, a prominent player in the Japanese IT services industry, has opted to partner with global investment firm KKR, despite receiving a higher bid from Bain Capital. This decision has sparked considerable interest and speculation within the business community, prompting a closer examination of the strategic reasons behind Fuji Soft’s choice. While financial considerations often dominate such decisions, Fuji Soft’s preference for KKR over Bain Capital underscores the importance of strategic alignment and long-term vision in corporate partnerships.

To begin with, Fuji Soft’s decision to align with KKR can be attributed to the latter’s extensive experience and proven track record in the technology sector. KKR has a history of successful investments in technology companies, which likely provided Fuji Soft with confidence in KKR’s ability to support its growth ambitions. This experience is not merely a matter of financial backing; it also encompasses strategic guidance and industry insights that can be invaluable for a company looking to expand its footprint in a competitive market. By choosing KKR, Fuji Soft is likely prioritizing the qualitative benefits of a partnership that extends beyond immediate financial gain.

Moreover, KKR’s global network and resources present a compelling advantage for Fuji Soft as it seeks to enhance its international presence. In today’s interconnected world, having access to a global platform can significantly accelerate a company’s growth trajectory. KKR’s extensive network of portfolio companies and industry contacts can facilitate new business opportunities and partnerships for Fuji Soft, enabling it to tap into new markets and customer segments. This strategic consideration may have outweighed the allure of a higher bid from Bain Capital, as Fuji Soft looks to position itself as a global leader in IT services.

In addition to these factors, the cultural fit between Fuji Soft and KKR may have played a crucial role in the decision-making process. Successful partnerships often hinge on shared values and a mutual understanding of business objectives. KKR’s approach to investment, which emphasizes collaboration and long-term value creation, may have resonated with Fuji Soft’s corporate philosophy. This alignment can foster a more harmonious and productive partnership, ultimately benefiting both parties in the long run. By choosing KKR, Fuji Soft is likely prioritizing a partnership that aligns with its corporate ethos and strategic goals.

Furthermore, the decision to partner with KKR may also reflect Fuji Soft’s desire for stability and continuity. In an industry characterized by rapid technological advancements and shifting market dynamics, having a stable and supportive partner can provide a sense of security and confidence. KKR’s reputation for being a patient and committed investor may have appealed to Fuji Soft, which is likely seeking a partner that will support its long-term vision rather than focusing solely on short-term financial returns. This strategic consideration underscores the importance of trust and reliability in corporate partnerships.

In conclusion, Fuji Soft’s decision to choose KKR over Bain Capital, despite the latter’s higher bid, highlights the multifaceted nature of strategic partnerships. By prioritizing factors such as industry expertise, global reach, cultural fit, and stability, Fuji Soft is positioning itself for sustainable growth and success in the competitive IT services landscape. This decision serves as a reminder that in the world of business, strategic alignment and long-term vision often take precedence over immediate financial gains.

Analyzing the Implications of Fuji Soft’s Choice for the Tech Industry

In a surprising turn of events, Fuji Soft, a prominent player in the technology sector, has opted to accept a buyout offer from KKR, a leading global investment firm, despite receiving a higher bid from Bain Capital. This decision has sparked considerable discussion within the tech industry, as stakeholders and analysts alike seek to understand the implications of Fuji Soft’s choice. The move underscores the complex dynamics at play in corporate acquisitions, where financial considerations are often weighed alongside strategic alignments and long-term visions.

To begin with, Fuji Soft’s decision to favor KKR over Bain Capital, despite the latter’s more lucrative offer, suggests that the company values strategic compatibility and future growth potential over immediate financial gain. KKR’s reputation for fostering innovation and supporting long-term growth strategies may have been a decisive factor in Fuji Soft’s choice. This decision highlights the importance of aligning with partners who share a similar vision and can provide the necessary resources and expertise to navigate the rapidly evolving tech landscape.

Moreover, this development reflects a broader trend within the technology industry, where companies are increasingly prioritizing strategic partnerships over purely financial transactions. As the tech sector becomes more competitive and complex, firms are recognizing the need for alliances that can offer more than just capital. They are seeking partners who can provide strategic guidance, industry insights, and access to a broader network of resources. In this context, KKR’s extensive experience in the tech industry and its track record of successful investments may have given it an edge over Bain Capital.

Furthermore, Fuji Soft’s decision could have significant implications for the tech industry as a whole. By choosing KKR, Fuji Soft is setting a precedent for other companies considering similar buyouts. This move may encourage other tech firms to prioritize strategic alignment and long-term growth potential when evaluating potential partners. As a result, investment firms may need to adapt their strategies to remain competitive, focusing not only on financial offers but also on demonstrating their ability to add value beyond capital infusion.

In addition, this decision may influence the dynamics of future mergers and acquisitions within the tech sector. As companies become more discerning in their choice of partners, investment firms may face increased pressure to differentiate themselves through their strategic capabilities and industry expertise. This shift could lead to a more collaborative approach to mergers and acquisitions, where both parties work closely to achieve shared objectives and drive innovation.

In conclusion, Fuji Soft’s choice to accept KKR’s offer over Bain Capital’s higher bid is a testament to the evolving priorities within the tech industry. It underscores the growing importance of strategic alignment and long-term growth potential in corporate acquisitions. As the tech landscape continues to evolve, companies and investment firms alike will need to adapt to these changing dynamics, prioritizing partnerships that offer more than just financial gain. This development not only sets a precedent for future transactions but also highlights the need for a more nuanced approach to mergers and acquisitions in the tech sector. As such, it will be interesting to observe how this decision influences the strategies of other companies and investment firms in the coming years.

The Role of Corporate Culture in Fuji Soft’s Selection of KKR

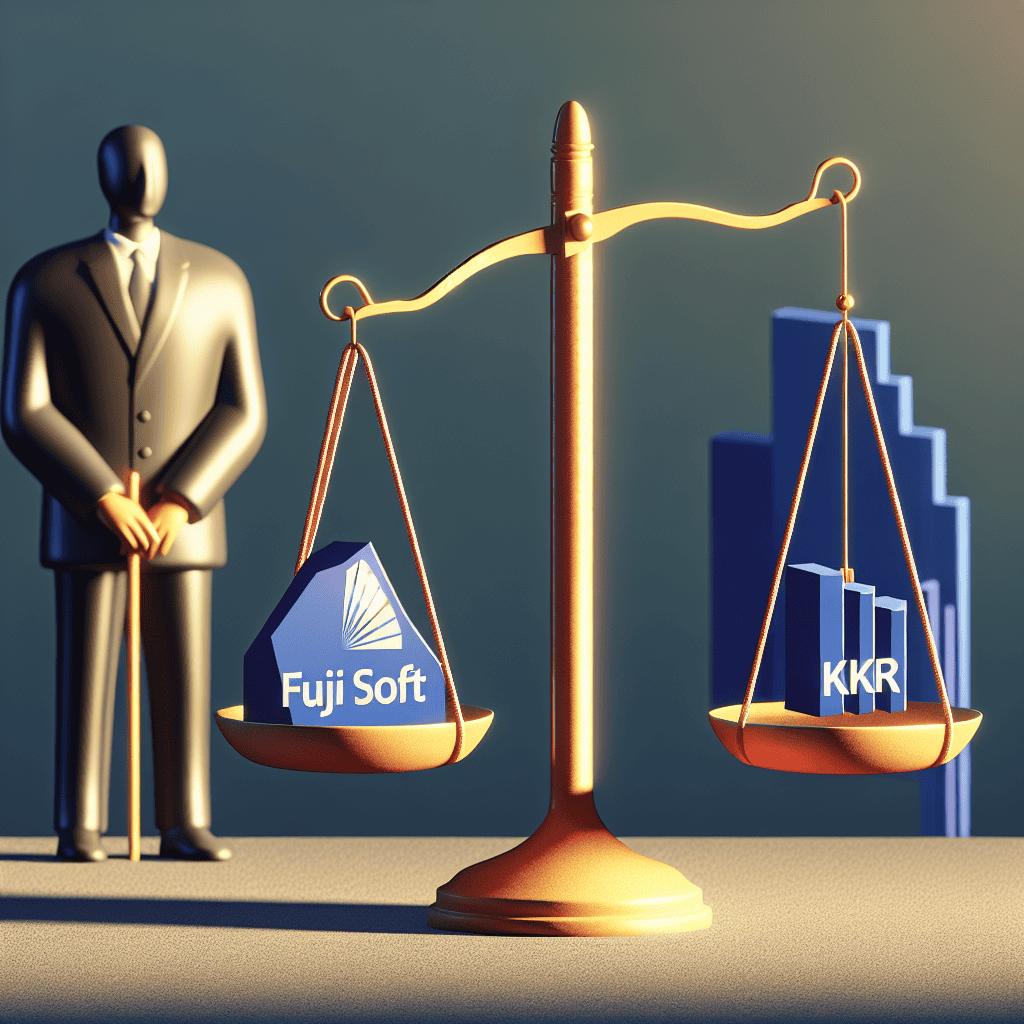

In the intricate world of corporate acquisitions, the decision-making process often extends beyond mere financial considerations. This was exemplified in the recent decision by Fuji Soft, a prominent Japanese IT services company, to accept a buyout offer from KKR, a global investment firm, despite a higher bid from Bain Capital. At first glance, this choice might seem counterintuitive, especially in a business environment where maximizing shareholder value is typically paramount. However, a deeper examination reveals that Fuji Soft’s decision was significantly influenced by the alignment of corporate culture and values, underscoring the critical role these elements play in strategic business decisions.

Corporate culture, often described as the shared values, beliefs, and practices within an organization, can be a decisive factor in mergers and acquisitions. For Fuji Soft, a company with a long-standing reputation for innovation and employee-centric policies, the cultural fit with KKR was a pivotal consideration. KKR’s approach to investment, which emphasizes long-term growth and sustainable business practices, resonated with Fuji Soft’s own corporate ethos. This alignment was seen as essential for ensuring a smooth transition and continued success post-acquisition, as it promised to preserve the core values that have been integral to Fuji Soft’s identity and operational philosophy.

Moreover, the decision to choose KKR over Bain Capital, despite the latter’s higher financial offer, highlights the importance Fuji Soft places on maintaining its organizational culture. Bain Capital, while a respected player in the investment landscape, is often perceived as more aggressive in its pursuit of financial returns. This approach, although potentially lucrative, might have necessitated significant changes to Fuji Soft’s operational model and corporate culture, potentially disrupting the harmony and stability that have been cultivated over the years. By opting for KKR, Fuji Soft demonstrated a preference for a partner that not only understands but also values its cultural framework, thereby ensuring that the company’s legacy and employee morale remain intact.

Furthermore, the decision underscores a broader trend in the corporate world where intangible assets, such as culture and employee satisfaction, are increasingly recognized as critical components of a company’s value proposition. In an era where talent retention and innovation are key drivers of competitive advantage, maintaining a strong and cohesive corporate culture can be as important as financial metrics. Fuji Soft’s choice reflects an understanding that a harmonious cultural integration can lead to more sustainable long-term growth, as it fosters an environment where employees are motivated and aligned with the company’s strategic objectives.

In addition, the selection of KKR can be seen as a strategic move to leverage the firm’s global expertise and resources while maintaining Fuji Soft’s unique cultural identity. KKR’s track record of successful partnerships with companies across various industries suggests that it is well-equipped to support Fuji Soft’s ambitions for international expansion and technological advancement. This partnership is expected to enhance Fuji Soft’s competitive position in the global market, while simultaneously preserving the cultural elements that have been instrumental in its domestic success.

In conclusion, Fuji Soft’s decision to choose KKR over Bain Capital, despite the latter’s higher bid, illustrates the profound impact of corporate culture on strategic business decisions. By prioritizing cultural alignment and long-term growth over immediate financial gain, Fuji Soft has set a precedent for how companies can navigate the complexities of mergers and acquisitions in a way that honors their core values and ensures sustainable success. This case serves as a reminder that in the ever-evolving business landscape, the intangible aspects of a company can be just as crucial as the tangible ones in determining its future trajectory.

Financial Considerations: Why Fuji Soft Opted for KKR Despite Bain’s Higher Bid

In the intricate world of corporate acquisitions, decisions are often influenced by a multitude of factors beyond the mere financial figures presented in a bid. Such is the case with Fuji Soft’s recent decision to accept a buyout offer from KKR, despite a higher bid from Bain Capital. This choice underscores the complexity of financial considerations that companies must navigate when determining the most suitable partner for their future growth and stability.

At first glance, Bain Capital’s higher bid might seem like the more attractive option for Fuji Soft, promising immediate financial gain. However, the decision to partner with KKR was not solely based on the monetary value of the offer. Instead, it was a strategic move that took into account a broader spectrum of financial and operational considerations. One of the primary factors influencing Fuji Soft’s decision was the alignment of long-term strategic goals. KKR’s proposal was perceived as more closely aligned with Fuji Soft’s vision for future growth and expansion. This alignment is crucial for ensuring that the partnership will foster an environment conducive to achieving the company’s objectives, rather than merely providing a short-term financial boost.

Moreover, KKR’s reputation and track record in managing and growing technology companies played a significant role in Fuji Soft’s decision-making process. The private equity firm’s extensive experience in the tech sector provided Fuji Soft with confidence that KKR would be a partner capable of offering not just capital, but also valuable industry insights and operational expertise. This expertise is essential for navigating the rapidly evolving technology landscape, where innovation and adaptability are key to maintaining a competitive edge.

In addition to strategic alignment and industry expertise, the cultural fit between the two organizations was another critical factor. Successful mergers and acquisitions often hinge on the compatibility of corporate cultures, which can significantly impact the integration process and the overall success of the partnership. Fuji Soft likely assessed that KKR’s corporate culture and values were more in harmony with its own, thereby reducing the risk of potential conflicts and facilitating a smoother transition.

Furthermore, the structure of KKR’s offer may have included more favorable terms beyond the headline financial figure. These terms could encompass aspects such as the retention of key management personnel, commitments to invest in research and development, or assurances regarding the preservation of Fuji Soft’s brand identity and operational autonomy. Such considerations are vital for ensuring that the company’s core strengths and competitive advantages are not compromised in the pursuit of financial gain.

Finally, the decision to choose KKR over Bain Capital may also reflect a strategic assessment of the broader market environment and competitive landscape. By selecting a partner with a proven ability to navigate complex market dynamics, Fuji Soft positions itself to better withstand external pressures and capitalize on emerging opportunities. This forward-looking approach demonstrates a commitment to sustainable growth and long-term value creation, rather than focusing solely on immediate financial returns.

In conclusion, Fuji Soft’s decision to accept KKR’s offer over Bain Capital’s higher bid highlights the multifaceted nature of financial considerations in corporate acquisitions. By prioritizing strategic alignment, industry expertise, cultural fit, and favorable terms, Fuji Soft has chosen a partner that it believes will best support its long-term objectives and enhance its competitive position in the technology sector.

The Impact of Fuji Soft’s Decision on Future Mergers and Acquisitions

In the ever-evolving landscape of mergers and acquisitions, the recent decision by Fuji Soft to accept a bid from KKR, despite a higher offer from Bain Capital, has sparked considerable discussion among industry analysts and stakeholders. This decision underscores the complex dynamics that often influence corporate transactions, extending beyond mere financial considerations. As companies navigate the intricate web of strategic partnerships, the implications of Fuji Soft’s choice may reverberate through future mergers and acquisitions, offering valuable insights into the priorities and strategies that drive such decisions.

Fuji Soft’s decision to align with KKR, a global investment firm with a robust track record in technology investments, highlights the importance of strategic alignment and long-term vision in the decision-making process. While Bain Capital’s offer was financially more attractive, Fuji Soft’s preference for KKR suggests a prioritization of strategic fit over immediate financial gain. This move indicates a growing trend where companies are increasingly valuing the qualitative aspects of a partnership, such as shared vision, cultural compatibility, and potential for innovation, over purely quantitative metrics.

Moreover, this decision reflects a broader shift in the mergers and acquisitions landscape, where companies are becoming more discerning in their choice of partners. The emphasis is gradually shifting from short-term financial benefits to long-term strategic growth. This trend is particularly pronounced in the technology sector, where rapid innovation and the need for agility necessitate partnerships that can offer more than just capital. By choosing KKR, Fuji Soft is likely positioning itself to leverage KKR’s expertise and network in the technology domain, which could prove instrumental in driving future growth and innovation.

Furthermore, Fuji Soft’s decision may influence other companies contemplating similar transactions. As businesses observe the outcomes of this partnership, they may be encouraged to adopt a more holistic approach when evaluating potential mergers and acquisitions. This could lead to a paradigm shift where the focus is not solely on the highest bid but rather on the overall strategic value that a partnership can bring. Consequently, investment firms may need to adapt their strategies, emphasizing not only their financial prowess but also their ability to offer strategic value and alignment with the target company’s long-term goals.

In addition, this development could have implications for the competitive dynamics within the investment community. As firms vie for attractive acquisition targets, the ability to demonstrate strategic alignment and value creation beyond financial metrics may become a key differentiator. This could lead to a more nuanced approach to deal-making, where investment firms are compelled to showcase their unique strengths and capabilities in fostering growth and innovation.

In conclusion, Fuji Soft’s decision to choose KKR over Bain Capital’s higher bid serves as a poignant reminder of the evolving priorities in the mergers and acquisitions arena. As companies increasingly prioritize strategic alignment and long-term growth potential, the criteria for evaluating potential partners are becoming more sophisticated. This shift not only influences the strategies of companies seeking acquisitions but also reshapes the competitive landscape for investment firms. As the business world continues to evolve, the lessons gleaned from Fuji Soft’s decision may well inform the future of mergers and acquisitions, guiding companies toward partnerships that offer enduring value and strategic synergy.

How KKR’s Vision Aligns with Fuji Soft’s Long-Term Goals

In a strategic move that has captured the attention of industry analysts and investors alike, Fuji Soft has opted to partner with KKR, a global investment firm, despite receiving a higher bid from Bain Capital. This decision underscores the importance of aligning with a partner whose vision and strategic approach resonate with the long-term goals of the company. While Bain Capital’s offer was financially more attractive, Fuji Soft’s choice reflects a deeper consideration of how KKR’s values and strategic direction align with its own aspirations for sustainable growth and innovation.

Fuji Soft, a prominent player in the technology and software development sector, has long been committed to fostering innovation and maintaining a competitive edge in a rapidly evolving market. The decision to align with KKR is rooted in the investment firm’s proven track record of nurturing growth in technology companies. KKR’s approach is characterized by a focus on long-term value creation, which is particularly appealing to Fuji Soft as it seeks to expand its market presence and enhance its technological capabilities. This alignment of vision is crucial for Fuji Soft, as it aims to leverage KKR’s expertise and resources to drive innovation and achieve sustainable growth.

Moreover, KKR’s emphasis on strategic partnerships and collaborative growth models resonates with Fuji Soft’s own business philosophy. The investment firm is known for its ability to forge strong relationships with portfolio companies, providing not just capital but also strategic guidance and operational support. This collaborative approach is expected to empower Fuji Soft to explore new markets, develop cutting-edge technologies, and enhance its service offerings. By choosing KKR, Fuji Soft is positioning itself to benefit from a partnership that goes beyond financial investment, focusing instead on strategic alignment and shared goals.

In addition to strategic alignment, KKR’s commitment to environmental, social, and governance (ESG) principles played a significant role in Fuji Soft’s decision-making process. As companies across the globe increasingly prioritize sustainability and corporate responsibility, Fuji Soft is no exception. The alignment with KKR, which has demonstrated a strong commitment to ESG initiatives, allows Fuji Soft to further its own sustainability goals. This partnership is expected to facilitate the integration of sustainable practices into Fuji Soft’s operations, enhancing its reputation as a socially responsible company and appealing to a growing base of environmentally conscious consumers and investors.

Furthermore, KKR’s global reach and extensive network offer Fuji Soft the opportunity to expand its footprint in international markets. This is particularly important as Fuji Soft seeks to capitalize on emerging opportunities in the global technology landscape. KKR’s experience in navigating complex international markets and its ability to provide strategic insights into global trends are invaluable assets that Fuji Soft can leverage to achieve its expansion goals. By aligning with KKR, Fuji Soft is poised to enhance its competitive position on the global stage, driving growth and innovation in new and existing markets.

In conclusion, Fuji Soft’s decision to choose KKR over Bain Capital, despite the latter’s higher bid, highlights the importance of strategic alignment and shared vision in corporate partnerships. By prioritizing long-term growth, innovation, and sustainability, Fuji Soft is positioning itself for success in an increasingly competitive and dynamic industry. The partnership with KKR is expected to provide the strategic support and resources necessary to achieve these goals, ensuring that Fuji Soft remains at the forefront of technological advancement and market leadership.

Lessons Learned from Fuji Soft’s Decision-Making Process in Choosing KKR

In the intricate world of corporate acquisitions, the decision-making process often involves a complex interplay of financial, strategic, and cultural considerations. The recent decision by Fuji Soft to choose KKR over Bain Capital, despite the latter’s higher bid, offers a compelling case study in the nuanced factors that influence such critical choices. This decision underscores the importance of evaluating not just the financial aspects of a deal, but also the strategic alignment and long-term vision shared between the parties involved.

At first glance, it might seem counterintuitive for Fuji Soft to opt for KKR when Bain Capital presented a more lucrative financial offer. However, this decision highlights the significance of strategic fit over immediate financial gain. Fuji Soft, a prominent player in the software and IT services industry, likely prioritized KKR’s alignment with its long-term goals and values. This choice reflects a broader trend in corporate acquisitions where companies increasingly value partners who understand their business model and can contribute to sustainable growth.

Moreover, the decision to partner with KKR may have been influenced by the private equity firm’s reputation and track record in the technology sector. KKR’s extensive experience and successful history of nurturing technology companies could have provided Fuji Soft with the confidence that their future growth and innovation would be supported. This aspect of the decision-making process emphasizes the importance of trust and credibility in choosing a partner, as these elements can significantly impact the success of the partnership.

In addition to strategic alignment and reputation, cultural compatibility often plays a crucial role in such decisions. The integration of two companies can be fraught with challenges if there is a mismatch in corporate cultures. Fuji Soft’s choice of KKR might suggest that the two entities share a similar corporate ethos, which could facilitate smoother integration and collaboration. This consideration is vital, as cultural clashes can lead to disruptions and inefficiencies that undermine the potential benefits of an acquisition.

Furthermore, the decision-making process likely involved a thorough assessment of the potential risks and benefits associated with each bidder. While Bain Capital’s higher bid might have offered immediate financial advantages, Fuji Soft may have perceived KKR’s proposal as offering a more balanced approach to risk management. This perspective underscores the importance of a comprehensive evaluation of all aspects of a deal, beyond just the financial terms.

In conclusion, Fuji Soft’s decision to choose KKR over Bain Capital, despite the latter’s higher bid, provides valuable insights into the multifaceted nature of corporate acquisition decisions. It illustrates that while financial considerations are undoubtedly important, they are not the sole determinants of a successful partnership. Strategic alignment, reputation, cultural compatibility, and risk management are equally critical factors that can influence the outcome of such decisions. As companies navigate the complexities of mergers and acquisitions, the lessons learned from Fuji Soft’s decision-making process serve as a reminder of the importance of a holistic approach that considers both immediate and long-term objectives. This case study reinforces the idea that in the world of corporate acquisitions, the right partner is often the one who shares a vision for the future, rather than simply offering the highest bid.

Q&A

1. **What is the main event?**

Fuji Soft has chosen to accept an acquisition offer from KKR, despite a higher bid from Bain Capital.

2. **Who are the main parties involved?**

The main parties involved are Fuji Soft, KKR, and Bain Capital.

3. **Why did Fuji Soft choose KKR over Bain?**

Specific reasons for Fuji Soft’s choice may include strategic alignment, trust, or other non-financial considerations, though the exact rationale was not detailed.

4. **What was Bain Capital’s offer?**

Bain Capital made a higher financial bid than KKR for the acquisition of Fuji Soft.

5. **What industry does Fuji Soft operate in?**

Fuji Soft operates in the technology and software industry.

6. **What is KKR known for?**

KKR is a global investment firm known for private equity investments.

7. **What could be the implications of this decision?**

The decision could impact Fuji Soft’s future strategic direction, market position, and shareholder value, depending on how KKR manages the acquisition.

Conclusion

Fuji Soft’s decision to choose KKR over Bain Capital, despite Bain’s higher bid, likely reflects strategic considerations beyond immediate financial gain. This choice may indicate Fuji Soft’s preference for KKR’s long-term vision, alignment with corporate values, or confidence in KKR’s ability to enhance operational efficiencies and drive sustainable growth. Additionally, KKR’s reputation, industry expertise, and potential synergies with Fuji Soft’s existing operations might have outweighed the financial allure of Bain’s higher offer. Ultimately, Fuji Soft’s decision underscores the importance of strategic alignment and future prospects in corporate acquisitions, beyond just the monetary aspects of a bid.