“Unlocking Insights: Navigating Success with Regions Financial Corp.”

Introduction

The financial analysis of Regions Financial Corp. provides a comprehensive examination of the company’s financial health, performance, and strategic positioning within the banking industry. This report delves into key financial metrics, including revenue growth, profitability ratios, asset quality, and capital adequacy, to assess the company’s operational efficiency and market competitiveness. By analyzing historical data and recent financial statements, the report aims to offer insights into Regions Financial Corp.’s financial stability and potential for future growth. Additionally, the analysis considers external factors such as economic conditions, regulatory changes, and industry trends that may impact the company’s financial outlook. Through this detailed evaluation, stakeholders can gain a clearer understanding of Regions Financial Corp.’s financial standing and make informed decisions regarding investment and strategic planning.

Overview Of Regions Financial Corp.’s Recent Performance

Regions Financial Corp., a prominent player in the banking sector, has recently released its financial performance report, offering valuable insights into its operational efficacy and market positioning. The report highlights several key metrics that underscore the company’s financial health and strategic direction. To begin with, Regions Financial Corp. has demonstrated a robust growth trajectory in its net income, which is a critical indicator of profitability. This growth can be attributed to a combination of increased revenue streams and effective cost management strategies. The bank’s ability to enhance its revenue is largely due to its diversified portfolio of financial services, which includes retail banking, commercial banking, and wealth management. By leveraging these diverse offerings, Regions Financial Corp. has successfully tapped into various customer segments, thereby broadening its revenue base.

Moreover, the company’s focus on digital transformation has played a pivotal role in its recent performance. In an era where digital banking is becoming increasingly prevalent, Regions Financial Corp. has invested significantly in technology to enhance customer experience and operational efficiency. This strategic investment has not only improved customer satisfaction but also reduced operational costs, contributing to the overall profitability of the company. Furthermore, the bank’s commitment to innovation is evident in its adoption of advanced analytics and artificial intelligence, which have streamlined processes and improved decision-making capabilities.

In addition to revenue growth and digital transformation, Regions Financial Corp.’s strong capital position is another highlight of its recent performance. The bank has maintained a healthy capital adequacy ratio, which is crucial for absorbing potential losses and ensuring financial stability. This strong capital base has enabled the company to pursue growth opportunities while maintaining a prudent risk management approach. The bank’s risk management framework is comprehensive, encompassing credit risk, market risk, and operational risk, thereby safeguarding its financial health in a volatile economic environment.

Transitioning to the bank’s asset quality, Regions Financial Corp. has reported a commendable improvement in this area. The reduction in non-performing assets is indicative of the bank’s effective credit risk management practices. By maintaining stringent underwriting standards and closely monitoring its loan portfolio, the bank has minimized the incidence of loan defaults, thereby enhancing asset quality. This improvement not only strengthens the bank’s balance sheet but also boosts investor confidence.

Furthermore, Regions Financial Corp.’s commitment to sustainability and corporate responsibility is noteworthy. The bank has integrated environmental, social, and governance (ESG) considerations into its business strategy, reflecting its dedication to sustainable growth. This approach not only aligns with the growing demand for responsible banking practices but also positions the company favorably in the eyes of socially conscious investors.

In conclusion, Regions Financial Corp.’s recent performance report paints a picture of a company that is not only financially sound but also strategically agile. Through a combination of revenue growth, digital innovation, strong capital management, improved asset quality, and a commitment to sustainability, the bank has positioned itself for continued success in the competitive banking landscape. As the financial sector continues to evolve, Regions Financial Corp.’s proactive approach and strategic initiatives are likely to drive its future growth and enhance its market standing.

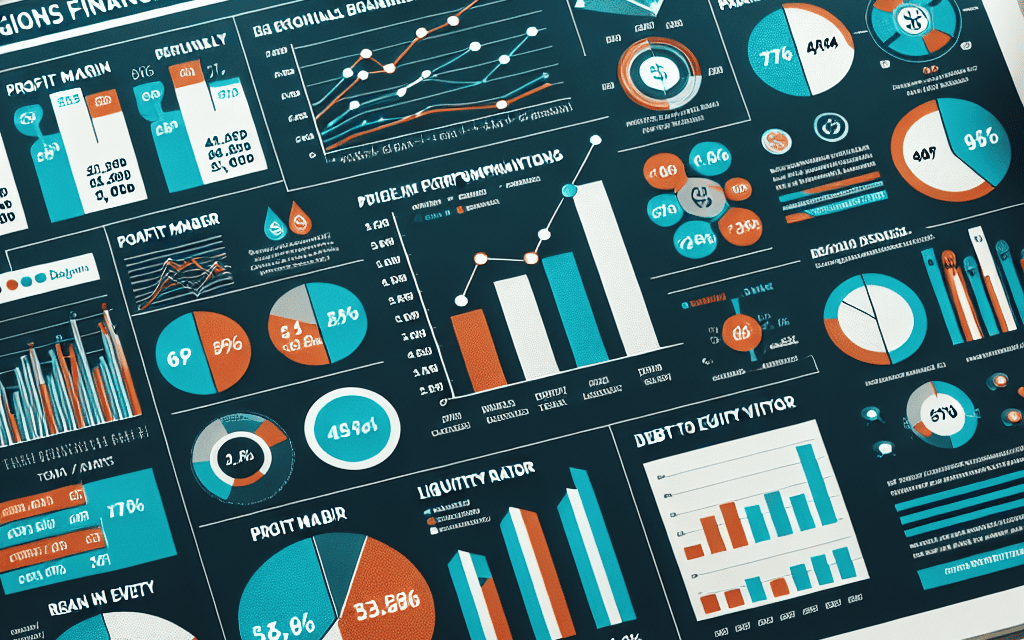

Key Financial Metrics In Regions Financial Corp.’s Report

Regions Financial Corp., a prominent player in the banking sector, recently released its financial report, offering a comprehensive overview of its performance through key financial metrics. This report provides valuable insights into the company’s financial health, operational efficiency, and strategic direction. By examining these metrics, stakeholders can better understand the company’s current standing and future prospects.

To begin with, the net income of Regions Financial Corp. serves as a fundamental indicator of its profitability. The report highlights a steady increase in net income, reflecting the company’s ability to generate profit from its core banking operations. This growth can be attributed to a combination of factors, including effective cost management, strategic investments, and a focus on expanding its customer base. Furthermore, the company’s net interest margin, which measures the difference between interest income generated and interest paid out, has shown resilience despite fluctuating market conditions. This stability underscores the company’s adeptness in managing interest rate risks and optimizing its asset-liability mix.

In addition to profitability, the efficiency ratio is another critical metric that sheds light on the company’s operational efficiency. Regions Financial Corp. has demonstrated a commendable efficiency ratio, indicating that it effectively controls its operating expenses relative to its revenue. This efficiency is a testament to the company’s commitment to streamlining operations and leveraging technology to enhance productivity. As a result, Regions Financial Corp. is well-positioned to maintain its competitive edge in an increasingly digital banking landscape.

Moreover, the report delves into the company’s asset quality, which is crucial for assessing its risk management capabilities. The non-performing assets ratio, a key measure of asset quality, has remained low, suggesting that Regions Financial Corp. has maintained a prudent approach to lending. This conservative lending strategy not only safeguards the company’s financial stability but also enhances investor confidence. Additionally, the allowance for loan losses, which acts as a buffer against potential loan defaults, is adequately provisioned, further reinforcing the company’s robust risk management framework.

Capital adequacy is another vital aspect covered in the report, with Regions Financial Corp. maintaining a strong capital position. The company’s capital ratios, including the Common Equity Tier 1 (CET1) ratio, exceed regulatory requirements, providing a solid foundation for future growth and resilience against economic uncertainties. This strong capital base enables the company to pursue strategic initiatives, such as mergers and acquisitions, while also returning value to shareholders through dividends and share buybacks.

Transitioning to the company’s strategic initiatives, the report highlights Regions Financial Corp.’s focus on digital transformation and customer-centric innovations. By investing in digital platforms and enhancing customer experience, the company aims to capture new market opportunities and drive long-term growth. This strategic emphasis on technology not only aligns with evolving consumer preferences but also positions the company to navigate the challenges posed by fintech disruptors.

In conclusion, the financial report of Regions Financial Corp. presents a positive outlook, characterized by strong profitability, operational efficiency, and prudent risk management. The company’s robust capital position and strategic focus on digital transformation further underscore its commitment to sustainable growth. As Regions Financial Corp. continues to adapt to the dynamic banking landscape, these key financial metrics will serve as essential benchmarks for evaluating its ongoing performance and strategic direction.

Analyzing Regions Financial Corp.’s Revenue Streams

Regions Financial Corp., a prominent player in the banking sector, has consistently demonstrated a robust financial performance, largely attributed to its diverse revenue streams. Understanding these revenue streams is crucial for investors and stakeholders who seek to evaluate the company’s financial health and future prospects. The primary sources of revenue for Regions Financial Corp. include interest income, non-interest income, and fee-based services, each contributing significantly to the company’s overall financial stability.

Interest income remains a cornerstone of Regions Financial Corp.’s revenue, primarily generated through loans and advances extended to individuals and businesses. This income stream is heavily influenced by prevailing interest rates and the company’s ability to manage its loan portfolio effectively. In recent years, Regions Financial Corp. has strategically diversified its loan offerings, catering to a wide range of customers, from small businesses to large corporations. This diversification not only mitigates risk but also enhances the company’s ability to capitalize on varying economic conditions. Moreover, the bank’s prudent risk management practices ensure a healthy balance between loan growth and credit quality, thereby sustaining a steady flow of interest income.

In addition to interest income, non-interest income plays a vital role in bolstering Regions Financial Corp.’s revenue. This category encompasses a variety of sources, including service charges on deposit accounts, wealth management fees, and income from trading activities. The bank’s focus on expanding its wealth management services has been particularly noteworthy, as it aligns with the growing demand for personalized financial advisory services. By leveraging its extensive network of financial advisors and investment professionals, Regions Financial Corp. has successfully tapped into this lucrative market, thereby enhancing its non-interest income. Furthermore, the bank’s trading activities, although subject to market fluctuations, provide an additional revenue stream that complements its core banking operations.

Fee-based services also contribute significantly to Regions Financial Corp.’s revenue, reflecting the bank’s commitment to offering a comprehensive suite of financial products and services. These fees are derived from various activities, such as transaction processing, card services, and mortgage origination. The bank’s investment in digital banking platforms has facilitated the seamless delivery of these services, thereby attracting a tech-savvy customer base and driving fee income growth. Additionally, Regions Financial Corp.’s strategic partnerships with fintech companies have enabled it to enhance its service offerings, further solidifying its position in the competitive banking landscape.

As Regions Financial Corp. continues to navigate the complexities of the financial industry, its diverse revenue streams provide a solid foundation for sustained growth. The interplay between interest income, non-interest income, and fee-based services not only ensures financial resilience but also positions the bank to capitalize on emerging opportunities. By maintaining a balanced approach to revenue generation, Regions Financial Corp. is well-equipped to adapt to changing market dynamics and regulatory environments. In conclusion, a comprehensive analysis of Regions Financial Corp.’s revenue streams reveals a well-rounded financial institution that is poised for continued success in the ever-evolving banking sector.

Impact Of Economic Trends On Regions Financial Corp.

In recent years, the financial landscape has been subject to significant shifts, influenced by a myriad of economic trends that have had a profound impact on banking institutions, including Regions Financial Corp. As a prominent player in the financial services sector, Regions Financial Corp. has navigated these changes with strategic foresight, adapting to both challenges and opportunities presented by the evolving economic environment. Understanding the impact of these trends is crucial for stakeholders and investors who seek to comprehend the company’s performance and future prospects.

To begin with, the interest rate environment has been a pivotal factor affecting Regions Financial Corp. Like many financial institutions, Regions’ profitability is closely tied to interest rate fluctuations. In periods of rising interest rates, banks generally benefit from an expanded net interest margin, as the difference between the interest earned on loans and the interest paid on deposits widens. Conversely, a low-interest-rate environment can compress these margins, posing challenges to revenue growth. Over the past few years, the Federal Reserve’s monetary policy has oscillated between tightening and easing, compelling Regions Financial Corp. to continuously adjust its strategies to maintain profitability.

Moreover, the economic growth trajectory has played a significant role in shaping Regions Financial Corp.’s operations. Economic expansion typically leads to increased consumer and business confidence, resulting in higher demand for loans and financial services. This, in turn, can drive revenue growth for banks. However, economic downturns or periods of uncertainty can lead to reduced borrowing and heightened credit risk, necessitating a cautious approach to lending. Regions Financial Corp. has demonstrated resilience by maintaining a diversified loan portfolio and implementing robust risk management practices to mitigate potential adverse effects during economic slowdowns.

In addition to interest rates and economic growth, regulatory changes have also influenced Regions Financial Corp.’s strategic direction. The financial industry is heavily regulated, and compliance with evolving regulations is essential for maintaining operational integrity and avoiding legal pitfalls. Over the years, regulatory bodies have introduced measures aimed at enhancing financial stability and consumer protection. While these regulations can impose additional compliance costs, they also present opportunities for banks like Regions Financial Corp. to differentiate themselves through strong governance and ethical practices.

Furthermore, technological advancements have reshaped the financial services landscape, presenting both challenges and opportunities for Regions Financial Corp. The rise of digital banking and fintech innovations has transformed customer expectations, necessitating investments in technology to enhance service delivery and operational efficiency. Regions Financial Corp. has embraced digital transformation by investing in cutting-edge technologies to improve customer experience and streamline internal processes. This strategic focus on technology not only helps in retaining existing customers but also attracts a tech-savvy clientele, thereby expanding the bank’s market reach.

Lastly, demographic shifts and changing consumer preferences have also impacted Regions Financial Corp. As the population becomes more diverse and technologically inclined, there is a growing demand for personalized and convenient banking solutions. Regions Financial Corp. has responded by tailoring its products and services to meet the evolving needs of its customer base, ensuring that it remains competitive in a dynamic market.

In conclusion, the impact of economic trends on Regions Financial Corp. is multifaceted, encompassing interest rate dynamics, economic growth patterns, regulatory changes, technological advancements, and demographic shifts. By strategically navigating these trends, Regions Financial Corp. has positioned itself to capitalize on opportunities while mitigating risks, thereby ensuring its continued success in an ever-changing financial landscape.

Regions Financial Corp.’s Strategic Initiatives And Their Outcomes

Regions Financial Corp., a prominent player in the banking sector, has consistently demonstrated a commitment to strategic initiatives aimed at enhancing its operational efficiency and market presence. Over recent years, the company has embarked on a series of well-calibrated strategies designed to bolster its financial performance and shareholder value. These initiatives have not only underscored Regions Financial Corp.’s adaptability in a dynamic economic landscape but have also yielded tangible outcomes that merit closer examination.

To begin with, Regions Financial Corp. has placed a significant emphasis on digital transformation, recognizing the pivotal role technology plays in modern banking. By investing in advanced digital platforms, the company has sought to streamline its operations and improve customer experience. This strategic pivot towards digitalization has enabled Regions Financial Corp. to offer more personalized and efficient services, thereby attracting a broader customer base. The outcomes of this initiative are evident in the increased adoption of digital banking services among its clientele, which has, in turn, contributed to a reduction in operational costs and an improvement in profit margins.

In addition to digital transformation, Regions Financial Corp. has also focused on expanding its footprint through strategic acquisitions and partnerships. By identifying and integrating complementary businesses, the company has been able to diversify its product offerings and enter new markets. This expansion strategy has not only enhanced Regions Financial Corp.’s competitive edge but has also provided a buffer against market volatility. The successful integration of acquired entities has resulted in synergies that have positively impacted the company’s bottom line, as evidenced by the steady growth in its revenue streams.

Moreover, Regions Financial Corp. has demonstrated a strong commitment to sustainability and corporate responsibility, recognizing the growing importance of environmental, social, and governance (ESG) factors in investment decisions. By embedding sustainability into its core operations, the company has not only aligned itself with global best practices but has also attracted a new segment of environmentally conscious investors. The outcomes of this initiative are reflected in the enhanced reputation and brand loyalty that Regions Financial Corp. enjoys, as well as in the increased interest from ESG-focused funds.

Furthermore, the company has prioritized risk management as a cornerstone of its strategic initiatives. In an era marked by economic uncertainties and regulatory changes, Regions Financial Corp. has implemented robust risk management frameworks to safeguard its assets and ensure compliance. This proactive approach to risk management has enabled the company to maintain a strong financial position, even in challenging times, thereby instilling confidence among its stakeholders.

In conclusion, Regions Financial Corp.’s strategic initiatives have been instrumental in driving its growth and success. Through digital transformation, strategic acquisitions, a commitment to sustainability, and rigorous risk management, the company has positioned itself as a resilient and forward-thinking entity in the financial sector. The outcomes of these initiatives are not only reflected in the company’s financial performance but also in its enhanced market reputation and stakeholder trust. As Regions Financial Corp. continues to navigate the complexities of the banking industry, its strategic initiatives will undoubtedly play a crucial role in shaping its future trajectory.

Comparative Analysis: Regions Financial Corp. Vs. Competitors

In the realm of financial services, understanding the competitive landscape is crucial for stakeholders aiming to make informed decisions. Regions Financial Corp., a prominent player in the banking sector, offers a compelling case study when compared to its competitors. By examining key financial metrics and strategic initiatives, we can gain insights into how Regions Financial Corp. positions itself within the industry.

To begin with, Regions Financial Corp. has consistently demonstrated robust financial performance, which is evident in its revenue growth and profitability metrics. When compared to its peers, such as Wells Fargo, Bank of America, and PNC Financial Services, Regions Financial Corp. exhibits a competitive edge in certain areas. For instance, its return on equity (ROE) is often a focal point for investors, as it reflects the company’s ability to generate profits from shareholders’ equity. Regions Financial Corp. has maintained a commendable ROE, often surpassing industry averages, which underscores its operational efficiency and effective management practices.

Moreover, the company’s net interest margin (NIM) is another critical indicator of its financial health. Regions Financial Corp. has managed to sustain a favorable NIM, which is indicative of its adeptness in managing interest rate risks and optimizing its asset-liability mix. This performance is particularly noteworthy when juxtaposed with competitors who may face challenges in maintaining similar margins due to fluctuating interest rates and economic conditions.

In addition to these financial metrics, Regions Financial Corp.’s strategic initiatives further distinguish it from its competitors. The company has been proactive in embracing digital transformation, investing in technology to enhance customer experience and streamline operations. This forward-thinking approach not only improves operational efficiency but also positions Regions Financial Corp. as a leader in innovation within the banking sector. In contrast, some competitors have been slower to adopt such technologies, potentially hindering their ability to meet evolving customer expectations.

Furthermore, Regions Financial Corp.’s commitment to sustainability and corporate responsibility is another aspect that sets it apart. The company has implemented various initiatives aimed at reducing its environmental footprint and promoting social equity. These efforts resonate with a growing segment of consumers and investors who prioritize environmental, social, and governance (ESG) factors in their decision-making processes. While competitors are also making strides in this area, Regions Financial Corp.’s comprehensive approach and transparent reporting provide it with a competitive advantage.

However, it is essential to acknowledge the challenges that Regions Financial Corp. faces in this competitive landscape. Regulatory pressures, economic uncertainties, and the ever-present threat of cyberattacks are issues that all financial institutions must navigate. Regions Financial Corp. must continue to adapt and innovate to maintain its competitive position and address these challenges effectively.

In conclusion, Regions Financial Corp. stands out in the financial services industry through its strong financial performance, strategic initiatives, and commitment to sustainability. By maintaining a focus on innovation and operational efficiency, the company not only competes effectively with its peers but also sets a benchmark for others to follow. As the industry continues to evolve, Regions Financial Corp.’s ability to adapt and thrive will be crucial in sustaining its competitive edge. Through careful analysis and strategic foresight, the company is well-positioned to navigate the complexities of the financial landscape and deliver value to its stakeholders.

Future Outlook For Regions Financial Corp. Based On Current Data

Regions Financial Corp., a prominent player in the banking sector, has demonstrated resilience and adaptability in the face of evolving market conditions. As we delve into the future outlook for this financial institution, it is essential to consider the current data and trends that may influence its trajectory. The company’s recent performance, strategic initiatives, and the broader economic environment all play pivotal roles in shaping its future prospects.

To begin with, Regions Financial Corp. has shown a commendable ability to maintain stability in its financial metrics. The company’s balance sheet remains robust, characterized by a healthy capital position and strong liquidity. This financial strength provides a solid foundation for future growth and positions the company well to navigate potential economic uncertainties. Moreover, Regions Financial has consistently demonstrated prudent risk management practices, which are crucial in safeguarding its assets and ensuring long-term sustainability.

In addition to its financial stability, Regions Financial has been proactive in embracing technological advancements to enhance its service offerings. The digital transformation initiatives undertaken by the company have not only improved operational efficiency but also enriched customer experience. By investing in digital banking platforms and innovative financial solutions, Regions Financial is well-positioned to meet the evolving needs of its clientele. This strategic focus on technology is likely to drive customer engagement and retention, thereby contributing to the company’s future growth.

Furthermore, the economic landscape presents both challenges and opportunities for Regions Financial. On one hand, the potential for rising interest rates could impact the company’s net interest margin, a critical component of its profitability. However, Regions Financial’s diversified revenue streams, including non-interest income from fee-based services, provide a buffer against interest rate fluctuations. This diversification strategy is instrumental in mitigating risks and ensuring a steady revenue flow.

On the other hand, the broader economic recovery presents opportunities for expansion and increased lending activity. As economic conditions improve, consumer confidence and business investments are likely to rise, leading to greater demand for financial services. Regions Financial, with its extensive network and comprehensive product offerings, is well-equipped to capitalize on these opportunities. The company’s focus on expanding its market presence and deepening customer relationships will be key drivers of growth in this context.

Moreover, Regions Financial’s commitment to sustainability and corporate responsibility is increasingly becoming a differentiating factor in the financial industry. The company’s efforts to integrate environmental, social, and governance (ESG) considerations into its business operations resonate with the growing emphasis on sustainable finance. By aligning its strategies with ESG principles, Regions Financial not only enhances its reputation but also attracts socially conscious investors and customers. This alignment with global sustainability trends is likely to bolster the company’s long-term prospects.

In conclusion, the future outlook for Regions Financial Corp. appears promising, underpinned by its strong financial position, strategic focus on technology, and adaptability to changing economic conditions. While challenges such as interest rate fluctuations remain, the company’s diversified revenue streams and commitment to sustainability provide a solid foundation for growth. As Regions Financial continues to navigate the dynamic financial landscape, its ability to leverage opportunities and mitigate risks will be crucial in shaping its future success.

Q&A

1. **What is Regions Financial Corp.?**

Regions Financial Corp. is a financial services company headquartered in Birmingham, Alabama, providing retail and commercial banking, trust, securities brokerage, mortgage, and insurance products and services.

2. **What are the key financial metrics to analyze in Regions Financial Corp.’s report?**

Key financial metrics include net income, earnings per share (EPS), return on equity (ROE), net interest margin, loan growth, deposit growth, and non-performing assets.

3. **How does Regions Financial Corp. generate revenue?**

Regions Financial Corp. generates revenue primarily through interest income from loans and securities, as well as non-interest income from fees and services such as wealth management and insurance.

4. **What is the significance of the net interest margin for Regions Financial Corp.?**

The net interest margin measures the difference between the interest income generated and the amount of interest paid out to lenders, relative to the amount of their interest-earning assets. It is a key indicator of profitability for banks.

5. **How does Regions Financial Corp. manage risk?**

Regions Financial Corp. manages risk through a comprehensive risk management framework that includes credit risk assessment, market risk management, operational risk controls, and compliance with regulatory requirements.

6. **What are the recent trends in Regions Financial Corp.’s loan and deposit growth?**

Recent trends in loan and deposit growth can be assessed by examining quarterly or annual reports, which typically highlight changes in loan portfolios, deposit balances, and the overall economic environment affecting these metrics.

7. **What challenges does Regions Financial Corp. face in the current financial environment?**

Challenges may include interest rate fluctuations, regulatory changes, economic downturns, competition from other financial institutions, and technological advancements impacting traditional banking models.

Conclusion

Regions Financial Corp. has demonstrated a stable financial performance, characterized by consistent revenue growth and effective cost management. The company’s strategic focus on expanding its digital banking services and enhancing customer experience has contributed to its competitive positioning in the financial sector. Despite facing challenges such as fluctuating interest rates and regulatory pressures, Regions Financial has maintained a strong capital base and asset quality. The company’s prudent risk management practices and diversified revenue streams position it well for future growth. Overall, Regions Financial Corp. appears to be in a solid financial position, with potential for continued success in the evolving banking landscape.