“Ferrari’s Engine Roars, But Shares Stall Despite Hitting Earnings Targets”

Introduction

Ferrari, the iconic luxury sports car manufacturer, recently experienced a decline in its share value despite reporting earnings that aligned with Wall Street’s forecasts. This unexpected market reaction highlights the complexities of investor sentiment and market dynamics, where meeting expectations does not always translate into positive stock performance. The decline in Ferrari’s shares suggests that investors may have been anticipating stronger guidance or additional strategic insights beyond the earnings figures. As a brand synonymous with performance and exclusivity, Ferrari’s financial results are closely scrutinized, and any perceived lack of momentum or future growth potential can lead to swift market responses. This situation underscores the challenges faced by even the most prestigious companies in maintaining investor confidence amidst fluctuating market conditions.

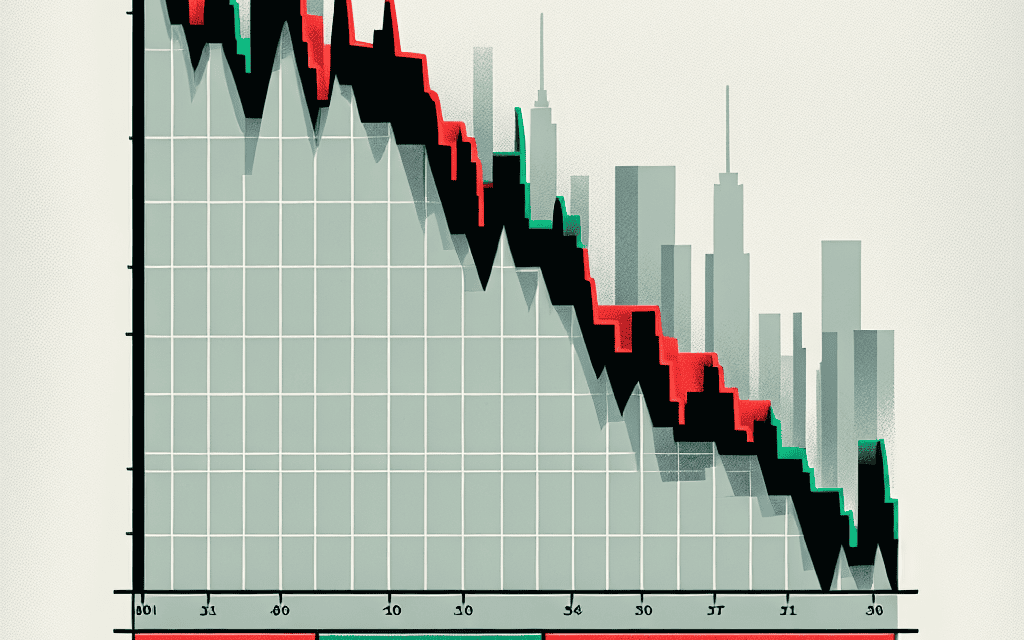

Analysis Of Ferrari’s Stock Performance Post-Earnings Announcement

Ferrari, the iconic luxury sports car manufacturer, recently released its quarterly earnings report, which met Wall Street’s expectations. Despite this alignment with forecasts, the company’s shares experienced a decline, prompting analysts and investors to delve deeper into the factors influencing this unexpected market reaction. Understanding the dynamics at play requires a comprehensive analysis of both the earnings report and the broader market context.

To begin with, Ferrari’s earnings report revealed a solid financial performance, with revenue and profit figures aligning closely with analysts’ predictions. The company reported steady sales growth, driven by strong demand for its high-performance vehicles and successful expansion into new markets. Additionally, Ferrari’s strategic initiatives, such as the introduction of hybrid models and limited-edition releases, have continued to bolster its brand appeal and customer base. These factors contributed to the company’s ability to meet Wall Street’s earnings forecasts, underscoring its operational resilience and market positioning.

However, despite these positive indicators, Ferrari’s stock performance post-earnings announcement suggests that investors may have been anticipating more than just meeting expectations. In the current financial landscape, where market participants often seek outperformance and signs of accelerated growth, merely meeting forecasts can sometimes be perceived as insufficient. This sentiment is particularly pronounced in the luxury automotive sector, where innovation and exclusivity are key drivers of investor confidence.

Moreover, the decline in Ferrari’s shares can also be attributed to broader market conditions and investor sentiment. The global economic environment remains fraught with uncertainties, including fluctuating interest rates, geopolitical tensions, and supply chain disruptions. These factors have collectively contributed to heightened market volatility, prompting investors to adopt a more cautious approach. In such a climate, even companies with strong fundamentals, like Ferrari, can experience stock price fluctuations that do not necessarily reflect their intrinsic value.

Furthermore, it is essential to consider the competitive landscape in which Ferrari operates. The luxury automotive market is witnessing increased competition from both traditional rivals and new entrants, particularly in the electric vehicle (EV) segment. Companies like Tesla and emerging EV manufacturers are capturing significant market share, challenging established players to innovate and adapt. While Ferrari has made strides in this area with its hybrid offerings, investors may be concerned about the pace of its transition to electrification and its ability to maintain its competitive edge.

In addition to these external factors, internal company dynamics may also play a role in shaping investor perceptions. Leadership changes, strategic shifts, or operational challenges can all influence market sentiment. Although Ferrari has demonstrated strong leadership and strategic clarity, any perceived uncertainties or deviations from its long-term vision could contribute to short-term stock volatility.

In conclusion, while Ferrari’s recent earnings report met Wall Street’s expectations, the subsequent decline in its share price highlights the complex interplay of factors influencing investor sentiment. From broader economic conditions and competitive pressures to internal company dynamics, a multitude of elements can impact stock performance. For investors and analysts, understanding these nuances is crucial in assessing Ferrari’s long-term prospects and navigating the ever-evolving landscape of the luxury automotive market. As the company continues to innovate and adapt, its ability to address these challenges will be pivotal in shaping its future trajectory and restoring investor confidence.

Factors Contributing To Ferrari’s Share Price Decline

Ferrari, the iconic luxury sports car manufacturer, recently experienced a decline in its share price despite meeting Wall Street’s earnings forecasts. This unexpected downturn has left investors and analysts pondering the underlying factors contributing to this phenomenon. While the company successfully aligned its financial performance with market expectations, several elements have collectively influenced the decline in its share price.

To begin with, the broader economic environment has played a significant role in shaping investor sentiment. Global economic uncertainties, including fluctuating interest rates and geopolitical tensions, have created a cautious atmosphere in the financial markets. Investors are increasingly wary of potential risks, leading to a more conservative approach to stock investments. Consequently, even companies like Ferrari, which have demonstrated robust financial health, are not immune to the ripple effects of these macroeconomic factors.

Moreover, the automotive industry is undergoing a transformative phase, with a pronounced shift towards electric vehicles (EVs) and sustainable technologies. While Ferrari has made strides in this direction by announcing plans to introduce hybrid and electric models, the transition is fraught with challenges. The company faces the dual task of maintaining its brand’s legacy of high-performance vehicles while adapting to the evolving demands of environmentally conscious consumers. This balancing act has raised concerns among investors about Ferrari’s ability to sustain its competitive edge in a rapidly changing market landscape.

In addition to these industry-wide challenges, Ferrari’s share price decline can also be attributed to specific company-related factors. For instance, the luxury car market is characterized by intense competition, with several high-end manufacturers vying for a share of the affluent customer base. Brands such as Lamborghini, Porsche, and Aston Martin are continuously innovating and expanding their product offerings, which intensifies the competitive pressure on Ferrari. This heightened competition necessitates substantial investments in research and development, marketing, and customer engagement, all of which can impact profit margins and investor confidence.

Furthermore, currency fluctuations have also played a part in Ferrari’s share price dynamics. As a global company with a significant portion of its sales generated outside its home market of Italy, Ferrari is exposed to the vagaries of foreign exchange rates. The strengthening of the euro against other major currencies can adversely affect the company’s revenue and profitability, as it makes Ferrari’s products more expensive for international buyers. This currency risk is an ongoing concern for investors, who closely monitor exchange rate trends and their potential impact on the company’s financial performance.

Lastly, it is essential to consider the role of market expectations and investor psychology in the context of Ferrari’s share price decline. In today’s fast-paced financial markets, investor reactions are often driven by short-term considerations and sentiment rather than long-term fundamentals. Even when a company meets earnings forecasts, any perceived lack of future growth prospects or strategic direction can lead to a negative market response. In Ferrari’s case, while the company has delivered on its current financial targets, investors may be seeking more clarity and assurance regarding its future trajectory, particularly in terms of innovation and sustainability.

In conclusion, Ferrari’s share price decline, despite meeting Wall Street’s earnings forecasts, can be attributed to a confluence of factors. The broader economic environment, industry-specific challenges, competitive pressures, currency fluctuations, and investor sentiment all play a role in shaping the company’s market performance. As Ferrari navigates these complexities, it will be crucial for the company to effectively communicate its strategic vision and adaptability to reassure investors and maintain its esteemed position in the luxury automotive sector.

Investor Sentiment And Market Reactions To Ferrari’s Earnings

Ferrari, the iconic luxury sports car manufacturer, recently reported its quarterly earnings, meeting Wall Street’s expectations. Despite this alignment with forecasts, the company’s shares experienced a decline, prompting a closer examination of investor sentiment and market reactions. This phenomenon underscores the complex dynamics that influence stock prices, which extend beyond mere financial performance.

To begin with, Ferrari’s earnings report revealed a robust financial position, with revenues and profits aligning with analysts’ predictions. The company has consistently demonstrated its ability to maintain strong sales figures, driven by its reputation for producing high-performance vehicles that appeal to a niche market of affluent consumers. However, meeting expectations, while generally positive, can sometimes lead to a paradoxical market response. Investors often anticipate not just meeting, but exceeding forecasts, and when a company merely aligns with predictions, it can lead to disappointment and a subsequent sell-off.

Moreover, the broader economic context plays a crucial role in shaping investor sentiment. In recent months, global economic uncertainties, including fluctuating interest rates and geopolitical tensions, have contributed to a cautious market environment. Investors are increasingly risk-averse, seeking stability and predictability in their portfolios. Consequently, even companies like Ferrari, which have a strong brand and consistent performance, are not immune to the effects of broader market apprehensions. This cautious sentiment can lead to a more conservative approach to investing, where even stable earnings are not enough to spur enthusiasm.

Additionally, the luxury automotive sector is facing its own set of challenges. The transition towards electric vehicles (EVs) is reshaping the industry, with companies investing heavily in new technologies to meet evolving consumer preferences and regulatory requirements. Ferrari, known for its powerful internal combustion engines, is navigating this transition carefully. While the company has announced plans to introduce hybrid and electric models, investors may harbor concerns about the pace and effectiveness of this shift. The uncertainty surrounding Ferrari’s adaptation to the EV landscape could contribute to the hesitancy observed in the market.

Furthermore, market reactions are often influenced by the actions and sentiments of institutional investors. These large entities, such as mutual funds and pension funds, wield significant influence over stock prices due to the volume of shares they control. Their investment decisions are guided by a myriad of factors, including macroeconomic trends, sectoral shifts, and company-specific developments. If institutional investors perceive potential risks or uncertainties, they may adjust their portfolios accordingly, leading to noticeable movements in stock prices.

In conclusion, the decline in Ferrari’s shares, despite meeting Wall Street’s earnings forecasts, highlights the multifaceted nature of investor sentiment and market reactions. While the company’s financial performance remains strong, broader economic uncertainties, industry-specific challenges, and the cautious stance of institutional investors contribute to the observed market dynamics. This scenario serves as a reminder that stock prices are not solely determined by earnings reports but are influenced by a complex interplay of factors that shape investor perceptions and decisions. As Ferrari continues to navigate these challenges, its ability to adapt and innovate will be crucial in maintaining investor confidence and achieving long-term success.

Comparing Ferrari’s Financial Results With Competitors

Ferrari, the iconic luxury sports car manufacturer, recently reported its financial results, which, despite meeting Wall Street’s earnings forecasts, led to a decline in its share price. This outcome has prompted analysts and investors to scrutinize the company’s performance in comparison to its competitors in the luxury automotive sector. Understanding the dynamics at play requires a closer examination of Ferrari’s financial results alongside those of its peers, such as Lamborghini, Porsche, and Aston Martin.

To begin with, Ferrari’s latest earnings report revealed a steady revenue stream, driven by strong demand for its high-performance vehicles. The company managed to meet Wall Street’s expectations, showcasing its ability to maintain profitability in a competitive market. However, the market’s reaction, as evidenced by the decline in share price, suggests that investors were perhaps anticipating more robust growth or additional strategic initiatives that could propel the company further ahead of its competitors.

In contrast, Lamborghini, another stalwart in the luxury sports car market, has been experiencing a period of rapid growth. The Italian automaker has reported significant increases in both sales and revenue, driven by the popularity of models such as the Urus SUV. Lamborghini’s ability to diversify its product lineup while maintaining its brand’s exclusivity has been a key factor in its recent success. This growth trajectory has not only bolstered investor confidence but also placed pressure on Ferrari to innovate and expand its offerings.

Similarly, Porsche has continued to perform well, leveraging its strong brand reputation and a diverse range of vehicles that appeal to both luxury and performance enthusiasts. The German automaker’s strategic focus on electric vehicles, exemplified by the success of the Taycan, has positioned it as a leader in the transition towards sustainable luxury mobility. Porsche’s ability to balance tradition with innovation has allowed it to capture a significant share of the market, further intensifying the competitive landscape for Ferrari.

Aston Martin, on the other hand, has faced its own set of challenges. The British luxury car manufacturer has been working to overcome financial difficulties and revitalize its brand. Recent efforts to introduce new models and partnerships, such as its collaboration with Mercedes-Benz, have shown promise. However, Aston Martin’s recovery is still in its early stages, and it remains to be seen whether these initiatives will translate into long-term success.

In light of these comparisons, Ferrari’s position in the luxury automotive market appears stable, yet it is clear that the company must navigate a rapidly evolving industry landscape. The decline in its share price, despite meeting earnings forecasts, underscores the heightened expectations from investors who are keenly observing how Ferrari will respond to the competitive pressures posed by its rivals. As the luxury automotive sector continues to evolve, driven by technological advancements and shifting consumer preferences, Ferrari’s ability to adapt and innovate will be crucial in maintaining its status as a leader in the industry.

In conclusion, while Ferrari’s financial results have met expectations, the market’s reaction highlights the importance of strategic growth and innovation in the luxury automotive sector. By comparing Ferrari’s performance with that of its competitors, it becomes evident that the company must continue to evolve and differentiate itself to remain at the forefront of the industry. As the landscape continues to shift, Ferrari’s future success will depend on its ability to balance tradition with innovation, ensuring that it remains a symbol of luxury and performance in the years to come.

The Impact Of Global Economic Trends On Ferrari’s Stock

Ferrari, the iconic luxury sports car manufacturer, recently experienced a decline in its stock value despite meeting Wall Street’s earnings forecasts. This unexpected downturn can be attributed to a confluence of global economic trends that have exerted pressure on the automotive industry as a whole. Understanding these broader economic factors is crucial to comprehending the challenges faced by Ferrari and similar companies in the current market environment.

To begin with, the global economic landscape has been marked by significant volatility, driven by factors such as fluctuating interest rates, geopolitical tensions, and supply chain disruptions. These elements have collectively contributed to a sense of uncertainty among investors, leading to cautious behavior in stock markets worldwide. For Ferrari, a company that relies heavily on consumer confidence and discretionary spending, this environment poses particular challenges. As interest rates rise, borrowing costs increase, potentially dampening consumer enthusiasm for high-end purchases like luxury vehicles.

Moreover, geopolitical tensions, particularly those involving major economies, have further complicated the situation. Trade disputes and tariffs can disrupt the flow of goods and materials, impacting production schedules and increasing costs. For a company like Ferrari, which prides itself on precision engineering and high-quality materials, any disruption in the supply chain can have significant repercussions. These challenges are compounded by the fact that Ferrari operates in a niche market where maintaining brand prestige and exclusivity is paramount.

In addition to these factors, the automotive industry is undergoing a transformative shift towards sustainability and electric vehicles. While Ferrari has made strides in this area by announcing plans to introduce hybrid and electric models, the transition requires substantial investment in research and development. This shift is not only a response to regulatory pressures but also a strategic move to align with changing consumer preferences. However, the costs associated with this transition can weigh heavily on a company’s financial performance, affecting investor sentiment.

Furthermore, the luxury car market is highly competitive, with numerous players vying for a share of the affluent consumer base. Brands like Lamborghini, Porsche, and Aston Martin are constantly innovating and expanding their offerings, which can dilute Ferrari’s market share. In such a competitive landscape, maintaining a unique value proposition is essential, yet challenging. This competitive pressure can influence stock performance as investors assess Ferrari’s ability to sustain its market position.

Despite these challenges, it is important to note that Ferrari’s fundamentals remain strong. The company has consistently demonstrated robust financial performance, driven by its strong brand equity and loyal customer base. Meeting Wall Street’s earnings forecasts is a testament to Ferrari’s operational efficiency and strategic foresight. However, the broader economic trends discussed earlier have overshadowed these positive aspects, leading to the recent decline in stock value.

In conclusion, while Ferrari’s recent stock decline may seem surprising given its solid earnings performance, it is a reflection of the complex interplay of global economic trends affecting the automotive industry. Rising interest rates, geopolitical tensions, supply chain disruptions, and the shift towards sustainable vehicles are all factors that have contributed to investor caution. As Ferrari navigates these challenges, its ability to adapt and innovate will be crucial in maintaining its position as a leader in the luxury automotive market. Understanding these dynamics provides valuable insight into the current state of Ferrari’s stock and the broader economic forces at play.

Future Outlook For Ferrari’s Market Position And Stock Value

Ferrari, the iconic luxury sports car manufacturer, recently experienced a decline in its share value despite meeting Wall Street’s earnings forecasts. This unexpected market reaction has prompted analysts and investors to scrutinize the company’s future outlook, particularly concerning its market position and stock value. As the automotive industry undergoes significant transformations, Ferrari’s ability to adapt and innovate will be crucial in maintaining its prestigious status and ensuring long-term growth.

To begin with, it is essential to understand the context in which Ferrari operates. The automotive industry is currently facing a paradigm shift, driven by the increasing demand for electric vehicles (EVs) and the growing emphasis on sustainability. Traditional automakers are under pressure to transition from internal combustion engines to more environmentally friendly alternatives. In this regard, Ferrari has been relatively slow to embrace the electric revolution, which may have contributed to the recent dip in its stock value. However, the company has announced plans to introduce its first fully electric model by 2025, signaling its commitment to evolving with industry trends.

Moreover, Ferrari’s brand strength and heritage remain unparalleled, providing a solid foundation for future growth. The company’s reputation for producing high-performance, luxury vehicles is a significant competitive advantage. This brand equity allows Ferrari to command premium pricing and maintain strong profit margins, even in a challenging market environment. Nevertheless, the company must balance its traditional brand values with the need to innovate and appeal to a new generation of environmentally conscious consumers.

In addition to its electric vehicle strategy, Ferrari’s expansion into new markets presents another avenue for growth. The company has been actively increasing its presence in emerging markets, particularly in Asia, where rising affluence is driving demand for luxury goods. By capitalizing on these opportunities, Ferrari can diversify its revenue streams and reduce its reliance on mature markets in Europe and North America. This geographic diversification is likely to enhance the company’s resilience against regional economic fluctuations and contribute to a more stable stock performance.

Furthermore, Ferrari’s commitment to technological innovation extends beyond electrification. The company is investing in advanced manufacturing techniques and digital technologies to enhance its production processes and improve operational efficiency. These initiatives are expected to yield cost savings and support Ferrari’s efforts to maintain its competitive edge in the luxury automotive segment. By leveraging technology, Ferrari can continue to deliver exceptional products that meet the evolving expectations of its discerning clientele.

Despite these positive developments, potential challenges remain on the horizon. The global economic landscape is fraught with uncertainties, including inflationary pressures, supply chain disruptions, and geopolitical tensions. These factors could impact consumer spending and, consequently, demand for luxury vehicles. Additionally, increased competition from both traditional automakers and new entrants in the EV space poses a threat to Ferrari’s market share. To navigate these challenges, Ferrari must remain agile and responsive to changing market dynamics.

In conclusion, while Ferrari’s recent share decline may have raised concerns among investors, the company’s long-term prospects remain promising. By embracing electrification, expanding into new markets, and leveraging technological advancements, Ferrari is well-positioned to sustain its market leadership and deliver value to shareholders. As the automotive industry continues to evolve, Ferrari’s ability to adapt and innovate will be key to securing its future market position and stock value.

Strategies For Investors In Light Of Ferrari’s Recent Stock Movements

Ferrari, the iconic luxury sports car manufacturer, recently experienced a decline in its stock value despite meeting Wall Street’s earnings forecasts. This unexpected movement in the market has left investors pondering the best strategies to navigate the current landscape. Understanding the underlying factors contributing to this decline is crucial for investors aiming to make informed decisions. While Ferrari’s financial performance met expectations, several external and internal factors may have influenced investor sentiment, leading to the stock’s downturn.

To begin with, the broader economic environment plays a significant role in shaping investor behavior. Global economic uncertainties, such as fluctuating interest rates, inflation concerns, and geopolitical tensions, can create a ripple effect across various industries, including the luxury automotive sector. Investors may be cautious about committing to stocks perceived as vulnerable to economic downturns, even if the company’s immediate financial health appears robust. Consequently, Ferrari’s stock decline could be partially attributed to these macroeconomic factors, prompting investors to reassess their portfolios.

Moreover, the automotive industry is undergoing a transformative phase, with a growing emphasis on sustainability and electric vehicles (EVs). While Ferrari has made strides in this direction, including plans to introduce hybrid and fully electric models, the transition poses challenges. Investors may be concerned about the pace at which Ferrari can adapt to these changes compared to its competitors. The pressure to innovate while maintaining the brand’s legacy of performance and luxury adds complexity to Ferrari’s strategic roadmap. As a result, some investors might adopt a wait-and-see approach, impacting the stock’s performance in the short term.

In light of these considerations, investors should adopt a multifaceted strategy when evaluating Ferrari’s stock. Diversification remains a fundamental principle, allowing investors to mitigate risks associated with industry-specific challenges. By spreading investments across different sectors and asset classes, investors can cushion their portfolios against potential downturns in the luxury automotive market. Additionally, keeping a close eye on Ferrari’s strategic initiatives, particularly in the realm of EVs and sustainability, can provide valuable insights into the company’s long-term growth prospects.

Furthermore, investors should consider the importance of staying informed about Ferrari’s competitive positioning. Analyzing how Ferrari stacks up against other luxury car manufacturers in terms of innovation, market share, and brand loyalty can offer a clearer picture of its potential trajectory. Engaging with industry reports, expert analyses, and company announcements can equip investors with the knowledge needed to make well-informed decisions.

Another critical aspect for investors is understanding the role of market sentiment and investor psychology. Stock prices are not solely determined by financial performance; they are also influenced by perceptions, expectations, and market trends. Recognizing the impact of these intangible factors can help investors navigate short-term volatility without losing sight of long-term objectives. Patience and a focus on fundamental analysis can be valuable tools in weathering periods of uncertainty.

In conclusion, while Ferrari’s recent stock decline may raise concerns, it also presents an opportunity for investors to reassess their strategies. By considering the broader economic context, industry trends, and Ferrari’s strategic initiatives, investors can position themselves to make informed decisions. Emphasizing diversification, staying informed, and understanding market sentiment are key components of a robust investment strategy in light of Ferrari’s recent stock movements. As the luxury automotive industry continues to evolve, investors who remain vigilant and adaptable will be better equipped to navigate the challenges and opportunities that lie ahead.

Q&A

1. **What caused Ferrari shares to decline despite meeting earnings forecasts?**

Investor concerns about future growth prospects or broader market conditions may have overshadowed the positive earnings report.

2. **Did Ferrari meet or exceed Wall Street’s earnings forecasts?**

Ferrari met Wall Street’s earnings forecasts.

3. **What are some potential reasons for investor concerns about Ferrari’s future growth?**

Potential reasons could include economic uncertainties, supply chain issues, or competition in the luxury car market.

4. **How did the broader market perform during the time of Ferrari’s share decline?**

The broader market may have been experiencing volatility or a downturn, affecting Ferrari’s share price.

5. **Were there any specific announcements from Ferrari that might have influenced the share decline?**

There might have been announcements regarding production challenges, changes in leadership, or strategic shifts that concerned investors.

6. **How did analysts react to Ferrari’s earnings report?**

Analysts might have maintained their ratings but expressed caution about future performance due to external factors.

7. **What is the long-term outlook for Ferrari according to market analysts?**

The long-term outlook could remain positive if Ferrari continues to innovate and expand its product line, despite short-term challenges.

Conclusion

Ferrari’s shares declined despite meeting Wall Street’s earnings forecasts, indicating that investors may have had higher expectations beyond the reported figures. This reaction could be attributed to concerns over future growth prospects, potential market saturation, or broader economic factors affecting luxury goods. The decline suggests that meeting forecasts alone may not be sufficient to satisfy investor sentiment, highlighting the importance of exceeding expectations and providing strong forward guidance to maintain or boost stock performance.