“DJT Stock Faces Choppy Waters: Trading Halted Amid Election Uncertainty”

Introduction

DJT Stock Experiences Turbulence and Temporary Trading Halt Amid Election Uncertainty

In a dramatic turn of events, DJT stock has faced significant volatility, culminating in a temporary trading halt as election-related uncertainties grip the market. Investors have been on edge as the political landscape shifts, causing fluctuations in stock prices and prompting regulatory bodies to intervene. The halt, intended to stabilize trading and prevent further market disruption, underscores the heightened sensitivity of financial markets to political developments. As stakeholders await clarity on the election outcome, the situation highlights the intricate interplay between politics and market dynamics, with potential long-term implications for investors and the broader economy.

Impact Of Election Uncertainty On DJT Stock Performance

The performance of DJT stock has recently been subject to significant volatility, largely attributed to the prevailing uncertainty surrounding the upcoming election. This turbulence has not only affected investor sentiment but also led to a temporary trading halt, underscoring the profound impact political events can have on financial markets. As investors grapple with the potential outcomes of the election, the stock’s fluctuations reflect broader concerns about economic policies, regulatory changes, and geopolitical dynamics that could emerge from the electoral process.

Initially, DJT stock had been on a steady upward trajectory, buoyed by strong quarterly earnings and optimistic forecasts for future growth. However, as the election date approached, the market began to exhibit signs of anxiety. Investors, wary of the potential for significant policy shifts, started to reassess their portfolios, leading to increased selling pressure on DJT stock. This shift in market sentiment was further exacerbated by conflicting polls and debates that highlighted stark differences in economic strategies between the candidates.

In response to the mounting uncertainty, DJT stock experienced heightened volatility, with sharp price swings becoming a daily occurrence. This volatility was not isolated to DJT alone; rather, it was indicative of a broader trend affecting various sectors, particularly those sensitive to regulatory changes and international trade policies. As a result, market analysts began to issue warnings about the potential for further disruptions, advising investors to brace for continued instability until a clearer picture of the election outcome emerged.

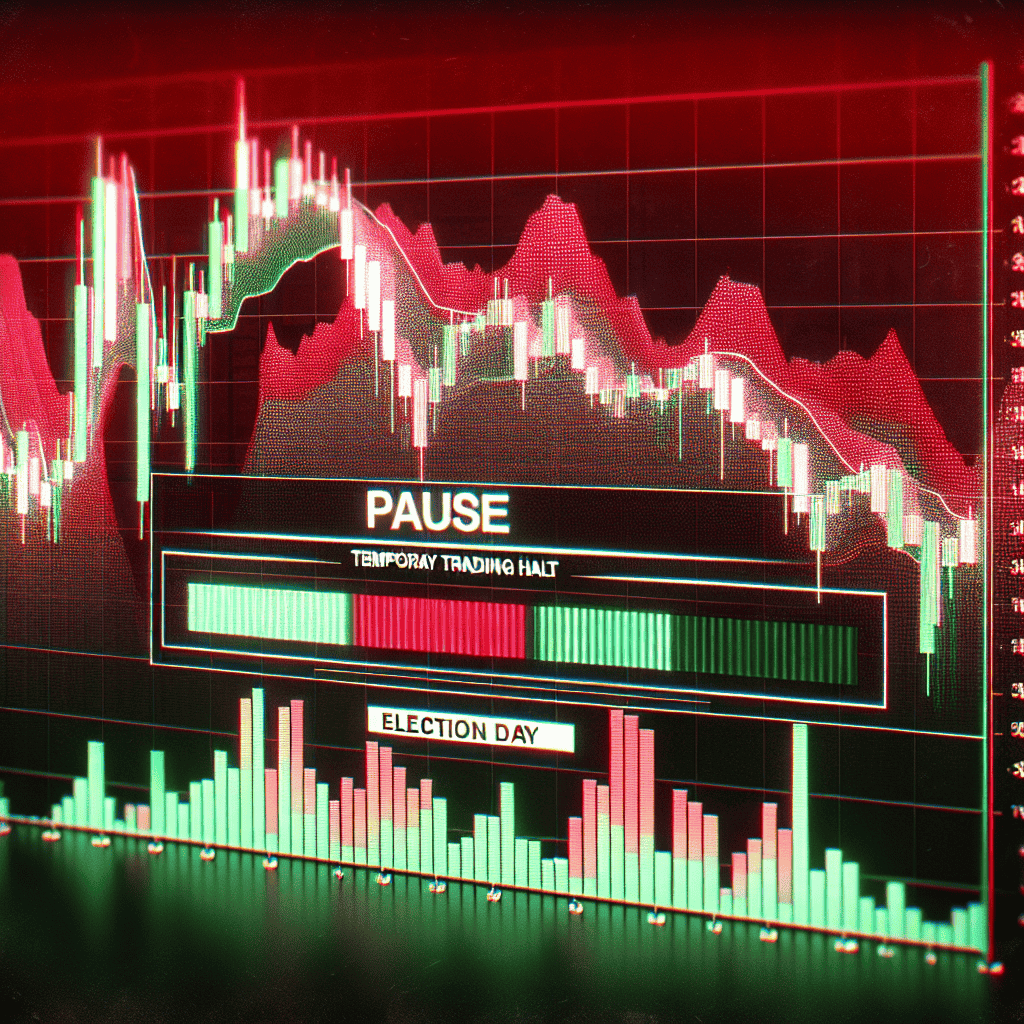

The situation reached a critical point when DJT stock experienced a sudden and dramatic drop in value, triggering a temporary trading halt. This halt, implemented as a protective measure by the stock exchange, was designed to prevent panic selling and allow investors time to digest the unfolding events. While such halts are not uncommon during periods of extreme market stress, they serve as a stark reminder of the interconnectedness between political developments and financial markets.

Following the trading halt, DJT stock saw a modest recovery, as some investors viewed the dip as a buying opportunity. However, the underlying uncertainty remained, with market participants closely monitoring any developments that could provide clarity on the election’s outcome. In the interim, financial advisors have been advocating for a cautious approach, emphasizing the importance of diversification and risk management in navigating the current market environment.

Looking ahead, the performance of DJT stock will likely continue to be influenced by election-related developments. As the political landscape evolves, investors will be keenly attuned to any indications of policy direction, particularly in areas such as taxation, trade, and infrastructure spending. These factors will play a crucial role in shaping market expectations and, consequently, the trajectory of DJT stock.

In conclusion, the recent turbulence experienced by DJT stock serves as a poignant illustration of the impact election uncertainty can have on financial markets. While the temporary trading halt provided a momentary respite, the broader challenges posed by the electoral process remain. As investors navigate this complex landscape, the interplay between political developments and market dynamics will continue to be a focal point, underscoring the need for vigilance and adaptability in investment strategies.

Analyzing The Temporary Trading Halt Of DJT Stock

The recent turbulence experienced by DJT stock has captured the attention of investors and analysts alike, as the market grapples with the implications of election uncertainty. This volatility culminated in a temporary trading halt, a move that underscores the broader market’s sensitivity to political developments. Understanding the factors that led to this halt requires a closer examination of the interplay between political events and market dynamics.

To begin with, the stock market is inherently sensitive to political events, as they can significantly influence investor sentiment and economic forecasts. In the case of DJT stock, the uncertainty surrounding the upcoming election has created a climate of apprehension among investors. This apprehension is not unfounded, as elections can lead to shifts in policy that directly impact corporate profitability and market conditions. Consequently, investors often react to election-related news with heightened caution, leading to increased volatility in stock prices.

Moreover, the temporary trading halt of DJT stock can be attributed to the mechanisms in place to maintain market stability. Trading halts are regulatory tools used by exchanges to prevent panic selling and to provide a cooling-off period during periods of extreme volatility. In this instance, the halt was triggered by a rapid decline in DJT stock’s price, which exceeded the thresholds set by the exchange. By pausing trading, the exchange aimed to allow investors to digest the unfolding political developments and make more informed decisions, thereby reducing the risk of irrational market behavior.

In addition to the immediate impact of the trading halt, it is essential to consider the broader implications for DJT stock and the market as a whole. The halt serves as a reminder of the interconnectedness between political events and financial markets, highlighting the need for investors to remain vigilant and adaptable. As the election approaches, market participants will likely continue to monitor political developments closely, adjusting their strategies in response to new information.

Furthermore, the temporary trading halt of DJT stock underscores the importance of diversification in investment portfolios. By spreading investments across a range of asset classes and sectors, investors can mitigate the risks associated with political uncertainty and market volatility. This approach not only helps to protect against potential losses but also positions investors to capitalize on opportunities that may arise in the aftermath of the election.

In conclusion, the turbulence experienced by DJT stock and the subsequent trading halt serve as a poignant illustration of the complex relationship between political events and market dynamics. As investors navigate this period of uncertainty, it is crucial to remain informed and adaptable, recognizing the potential for both risks and opportunities. By understanding the factors that led to the trading halt and considering the broader implications for the market, investors can better position themselves to weather the storm and emerge stronger in the long run. As the election draws nearer, the focus will undoubtedly remain on political developments, with market participants keenly attuned to any signals that may influence the trajectory of DJT stock and the broader market landscape.

Investor Reactions To DJT Stock Volatility

The recent turbulence in DJT stock has captured the attention of investors and market analysts alike, as the company experienced a temporary trading halt amid growing election uncertainty. This development has sparked a range of reactions from investors, who are now grappling with the implications of political instability on their portfolios. As the election season unfolds, the volatility in DJT stock serves as a microcosm of the broader market sentiment, reflecting the intricate interplay between politics and financial markets.

To begin with, the temporary trading halt in DJT stock was triggered by a sudden and significant drop in its price, which prompted regulatory bodies to intervene. Such halts are designed to prevent panic selling and provide a cooling-off period for investors to reassess their positions. In this case, the halt was a response to heightened concerns over the potential impact of election outcomes on the company’s future prospects. As a result, investors were left in a state of uncertainty, unsure of how to navigate the choppy waters of the current market environment.

In light of these developments, investor reactions have been varied, with some opting to adopt a cautious approach while others see potential opportunities amid the chaos. On one hand, risk-averse investors have chosen to reduce their exposure to DJT stock, seeking refuge in more stable assets until the political landscape becomes clearer. This flight to safety is a common strategy during periods of uncertainty, as investors aim to preserve capital and minimize potential losses.

Conversely, more adventurous investors view the current volatility as an opportunity to capitalize on potential price fluctuations. These individuals are often driven by the belief that market overreactions can create attractive entry points for long-term gains. By purchasing DJT stock at a lower price, they hope to benefit from a potential rebound once the election dust settles and market conditions stabilize. This contrarian approach, while risky, underscores the diverse strategies employed by investors in response to market volatility.

Moreover, the broader implications of election uncertainty on financial markets cannot be overlooked. Historically, elections have been known to introduce a degree of unpredictability, as investors attempt to gauge the potential policy shifts that may arise from a change in leadership. In this context, DJT stock’s recent volatility is emblematic of the wider market sentiment, as investors weigh the potential ramifications of election outcomes on various sectors and industries.

In addition to individual investor strategies, institutional investors and fund managers are also closely monitoring the situation. These entities often have a more comprehensive view of market dynamics and may adjust their portfolios accordingly to mitigate risks associated with political uncertainty. Their actions can have a significant impact on market trends, as large-scale buying or selling can influence stock prices and investor sentiment.

In conclusion, the turbulence experienced by DJT stock amid election uncertainty highlights the complex relationship between politics and financial markets. Investor reactions have been diverse, reflecting a range of strategies aimed at navigating the current volatility. As the election season progresses, market participants will continue to closely monitor developments, seeking to balance risk and opportunity in an ever-changing landscape. Ultimately, the ability to adapt to these challenges will be crucial for investors looking to safeguard their portfolios and capitalize on potential market movements.

Historical Context: Election Cycles And Stock Market Fluctuations

The relationship between election cycles and stock market fluctuations has long been a subject of interest for economists, investors, and policymakers alike. Historically, the stock market tends to exhibit increased volatility during election years, as investors grapple with the uncertainty surrounding potential policy changes and their implications for economic growth. This phenomenon is particularly pronounced in the United States, where the political landscape can significantly influence market dynamics. The recent turbulence experienced by DJT Stock, culminating in a temporary trading halt, serves as a contemporary example of this historical trend.

To understand the current situation, it is essential to consider the broader historical context. Traditionally, election years are characterized by heightened market sensitivity to political developments. Investors often react to the perceived likelihood of different candidates winning and the anticipated impact of their policies on various sectors. For instance, a candidate favoring increased regulation might cause apprehension in industries such as finance and energy, while one advocating for tax cuts could boost investor confidence in consumer-driven sectors. This interplay between political expectations and market reactions underscores the complex relationship between elections and stock market behavior.

In the case of DJT Stock, the recent volatility can be attributed to the heightened uncertainty surrounding the upcoming election. As the political climate becomes increasingly polarized, investors are left to speculate on the potential outcomes and their ramifications for the business environment. This uncertainty is further exacerbated by the proliferation of conflicting information and the rapid dissemination of news through digital platforms, which can amplify market reactions. Consequently, DJT Stock has experienced significant price swings, reflecting the broader market’s struggle to navigate the uncertain political landscape.

The temporary trading halt imposed on DJT Stock is a measure designed to stabilize the market and prevent excessive volatility. Trading halts are not uncommon during periods of heightened uncertainty, serving as a mechanism to allow investors to digest new information and make more informed decisions. By pausing trading, regulators aim to mitigate the risk of panic selling and provide a buffer against erratic market behavior. In this context, the halt on DJT Stock can be seen as a prudent step to maintain market integrity and protect investors from undue risk.

While the immediate impact of election-related uncertainty on DJT Stock is evident, it is important to consider the potential long-term implications. Historically, markets tend to stabilize once election outcomes are determined and policy directions become clearer. This pattern suggests that the current turbulence may be temporary, with DJT Stock likely to recover as political uncertainties are resolved. However, the extent and speed of this recovery will depend on various factors, including the nature of the election results and the subsequent policy environment.

In conclusion, the recent turbulence experienced by DJT Stock amid election uncertainty is emblematic of the broader historical trend of market fluctuations during election cycles. The interplay between political developments and investor sentiment underscores the complex dynamics at play, with temporary trading halts serving as a tool to manage volatility. As the election approaches, investors will continue to closely monitor the political landscape, seeking clarity and stability in an inherently uncertain environment. Ultimately, the resolution of these uncertainties will play a crucial role in shaping the future trajectory of DJT Stock and the broader market.

Strategies For Navigating Stock Market Uncertainty During Elections

Navigating the stock market during periods of political uncertainty, such as an election, requires a strategic approach to mitigate risks and capitalize on potential opportunities. The recent turbulence experienced by DJT stock, which led to a temporary trading halt, underscores the importance of having a well-thought-out strategy in place. Investors often face heightened volatility during election cycles, as markets react to the potential implications of policy changes and shifts in political power. Therefore, understanding how to manage investments during these times is crucial for maintaining portfolio stability and achieving long-term financial goals.

One effective strategy for navigating stock market uncertainty during elections is diversification. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of volatility on their portfolios. Diversification helps to balance the risks associated with any single investment or market segment, thereby providing a buffer against unexpected market movements. For instance, while DJT stock may experience fluctuations due to election-related news, a diversified portfolio containing bonds, international stocks, and other asset classes can help offset potential losses.

In addition to diversification, maintaining a long-term perspective is essential when dealing with market uncertainty. Elections are temporary events, and while they can cause short-term market disruptions, the long-term trajectory of the market is often driven by broader economic factors. Investors should focus on their long-term financial objectives and avoid making impulsive decisions based on short-term market movements. By keeping a steady course and adhering to a well-defined investment plan, investors can weather the storm of election-related volatility and emerge with their portfolios intact.

Moreover, staying informed about the political landscape and potential policy changes is vital for making informed investment decisions. Understanding the platforms and proposed policies of different candidates can provide insights into which sectors or industries might be affected by the election outcome. For example, if a candidate is advocating for increased infrastructure spending, investors might consider increasing their exposure to construction and materials stocks. Conversely, if there is uncertainty surrounding healthcare policy, it may be prudent to reassess investments in that sector. By staying informed, investors can make strategic adjustments to their portfolios in anticipation of potential market shifts.

Another important consideration is the use of hedging strategies to protect against downside risk. Options and futures contracts can be employed to hedge against potential losses in specific stocks or sectors. While these instruments can be complex and may not be suitable for all investors, they offer a way to manage risk during periods of heightened uncertainty. Consulting with a financial advisor or investment professional can help investors determine whether hedging strategies are appropriate for their individual circumstances.

Finally, maintaining liquidity is crucial during uncertain times. Having access to cash or cash-equivalent assets allows investors to take advantage of buying opportunities that may arise during market downturns. Additionally, liquidity provides a safety net in case of unexpected expenses or financial needs. By ensuring that a portion of their portfolio is easily accessible, investors can remain flexible and responsive to changing market conditions.

In conclusion, navigating stock market uncertainty during elections requires a combination of diversification, long-term perspective, informed decision-making, hedging strategies, and liquidity management. By implementing these strategies, investors can better position themselves to withstand the volatility associated with political events and continue working towards their financial objectives. As demonstrated by the recent fluctuations in DJT stock, having a robust strategy in place is essential for successfully navigating the complexities of the stock market during election cycles.

Expert Opinions On DJT Stock’s Future Amid Political Turmoil

The recent turbulence experienced by DJT stock has captured the attention of investors and analysts alike, as the company finds itself at the intersection of financial markets and political uncertainty. The temporary trading halt imposed on DJT stock has only added to the intrigue, prompting a flurry of expert opinions on its future trajectory. As the political landscape remains in flux, the implications for DJT stock are multifaceted, with experts weighing in on both the immediate and long-term prospects.

To begin with, the temporary trading halt was a precautionary measure taken in response to heightened volatility, a common practice in financial markets to prevent panic selling and to allow investors to reassess their positions. This move, while unsettling to some, is not unprecedented and serves as a reminder of the inherent risks associated with political events. The uncertainty surrounding the upcoming election has undoubtedly contributed to this volatility, as investors grapple with the potential outcomes and their implications for the broader market.

In light of these developments, financial analysts have been keen to offer their insights into the future of DJT stock. Some experts argue that the current volatility presents a buying opportunity for those with a long-term investment horizon. They point to the company’s strong fundamentals and its ability to weather previous political storms as indicators of its resilience. Moreover, they suggest that once the political dust settles, DJT stock could experience a rebound, driven by renewed investor confidence and a clearer economic outlook.

Conversely, other analysts urge caution, highlighting the potential for prolonged political turmoil to weigh on DJT stock’s performance. They emphasize the importance of considering the broader macroeconomic environment, which could be adversely affected by policy changes and regulatory shifts. In this context, they advise investors to adopt a more conservative approach, perhaps by diversifying their portfolios to mitigate risk.

Furthermore, the role of market sentiment cannot be overlooked in assessing DJT stock’s future. Investor psychology plays a crucial role in driving stock prices, and the current climate of uncertainty can exacerbate emotional decision-making. As such, experts recommend that investors remain vigilant and avoid making impulsive decisions based on short-term market movements. Instead, they advocate for a disciplined investment strategy, grounded in thorough research and a clear understanding of one’s risk tolerance.

In addition to these considerations, the potential impact of external factors, such as global economic conditions and geopolitical tensions, should not be underestimated. These elements can further complicate the outlook for DJT stock, as they introduce additional layers of uncertainty. Consequently, experts stress the importance of staying informed about both domestic and international developments, as these can have far-reaching implications for financial markets.

In conclusion, the future of DJT stock amid political turmoil is a topic of considerable debate among experts. While some see the current volatility as an opportunity, others advise caution in light of the myriad uncertainties that lie ahead. Ultimately, the key to navigating this complex landscape lies in maintaining a balanced perspective, informed by a comprehensive understanding of the factors at play. As the election approaches and the political situation evolves, investors will need to remain adaptable, ready to respond to new information and adjust their strategies accordingly.

Lessons Learned From DJT Stock’s Recent Market Turbulence

The recent turbulence experienced by DJT stock has provided a wealth of lessons for investors and market analysts alike. As the stock market reacted to the uncertainty surrounding the upcoming election, DJT stock became a focal point of volatility, leading to a temporary trading halt. This situation underscores the intricate relationship between political events and market dynamics, offering valuable insights into how external factors can influence investor behavior and stock performance.

Initially, the volatility in DJT stock was driven by heightened uncertainty regarding the election outcome. Investors, wary of potential policy shifts and economic implications, began to reassess their portfolios, leading to increased trading activity. This surge in trading volume, coupled with fluctuating stock prices, prompted regulatory bodies to implement a temporary trading halt. Such measures are designed to prevent excessive volatility and provide a cooling-off period for investors to digest information and make more informed decisions. This incident highlights the importance of regulatory mechanisms in maintaining market stability during periods of heightened uncertainty.

Moreover, the DJT stock turbulence serves as a reminder of the critical role that investor sentiment plays in market movements. In times of uncertainty, emotions such as fear and speculation can drive market behavior, often leading to exaggerated price swings. Investors, therefore, must remain vigilant and avoid making impulsive decisions based on short-term market fluctuations. Instead, a focus on long-term investment strategies and a thorough understanding of market fundamentals can help mitigate the impact of temporary volatility.

Additionally, the situation with DJT stock illustrates the significance of diversification in investment portfolios. By spreading investments across various asset classes and sectors, investors can reduce their exposure to specific risks associated with individual stocks or market events. Diversification acts as a buffer against volatility, ensuring that the impact of adverse movements in one stock or sector is minimized. This approach not only helps in managing risk but also enhances the potential for stable returns over time.

Furthermore, the temporary trading halt of DJT stock underscores the importance of staying informed about market regulations and trading protocols. Investors should be aware of the mechanisms in place to address market volatility and understand how these measures can affect their trading activities. By staying informed, investors can better navigate periods of uncertainty and make strategic decisions that align with their investment goals.

In conclusion, the recent turbulence experienced by DJT stock amid election uncertainty offers several lessons for investors. It highlights the intricate relationship between political events and market dynamics, emphasizing the need for regulatory mechanisms to maintain stability. Additionally, it underscores the importance of investor sentiment, diversification, and staying informed about market regulations. By learning from these lessons, investors can better prepare for future market uncertainties and enhance their ability to make informed investment decisions. As the market continues to evolve, these insights will remain invaluable in navigating the complexities of stock market investing.

Q&A

1. **What caused the turbulence in DJT stock?**

The turbulence in DJT stock was caused by uncertainty surrounding the election results.

2. **What action was taken in response to the stock’s volatility?**

A temporary trading halt was implemented to stabilize the market and address the volatility.

3. **How did investors react to the election uncertainty?**

Investors reacted with caution and concern, leading to increased volatility in the stock market.

4. **What is a trading halt?**

A trading halt is a temporary suspension of trading for a particular stock or the entire market to prevent panic selling and allow for the dissemination of important information.

5. **How long did the trading halt last for DJT stock?**

The duration of the trading halt can vary, but it typically lasts for a few minutes to several hours, depending on the situation.

6. **What impact did the trading halt have on the market?**

The trading halt helped to calm the market, allowing investors to reassess the situation and make more informed decisions.

7. **What are potential future implications for DJT stock amid ongoing election uncertainty?**

Ongoing election uncertainty could lead to continued volatility in DJT stock, affecting investor confidence and market stability.

Conclusion

DJT stock experienced significant volatility and a temporary trading halt due to heightened uncertainty surrounding the election. This turbulence reflects investor concerns about potential policy changes and market instability, leading to increased caution and reactive trading behaviors. The temporary halt was implemented to stabilize the market and prevent excessive fluctuations, highlighting the sensitivity of financial markets to political events. As the election outcome becomes clearer, it is expected that market conditions will stabilize, allowing for a more predictable trading environment.