“Master Your Future: Crafting a Retirement Budget with $1.9 Million and $5,200 in Social Security”

Introduction

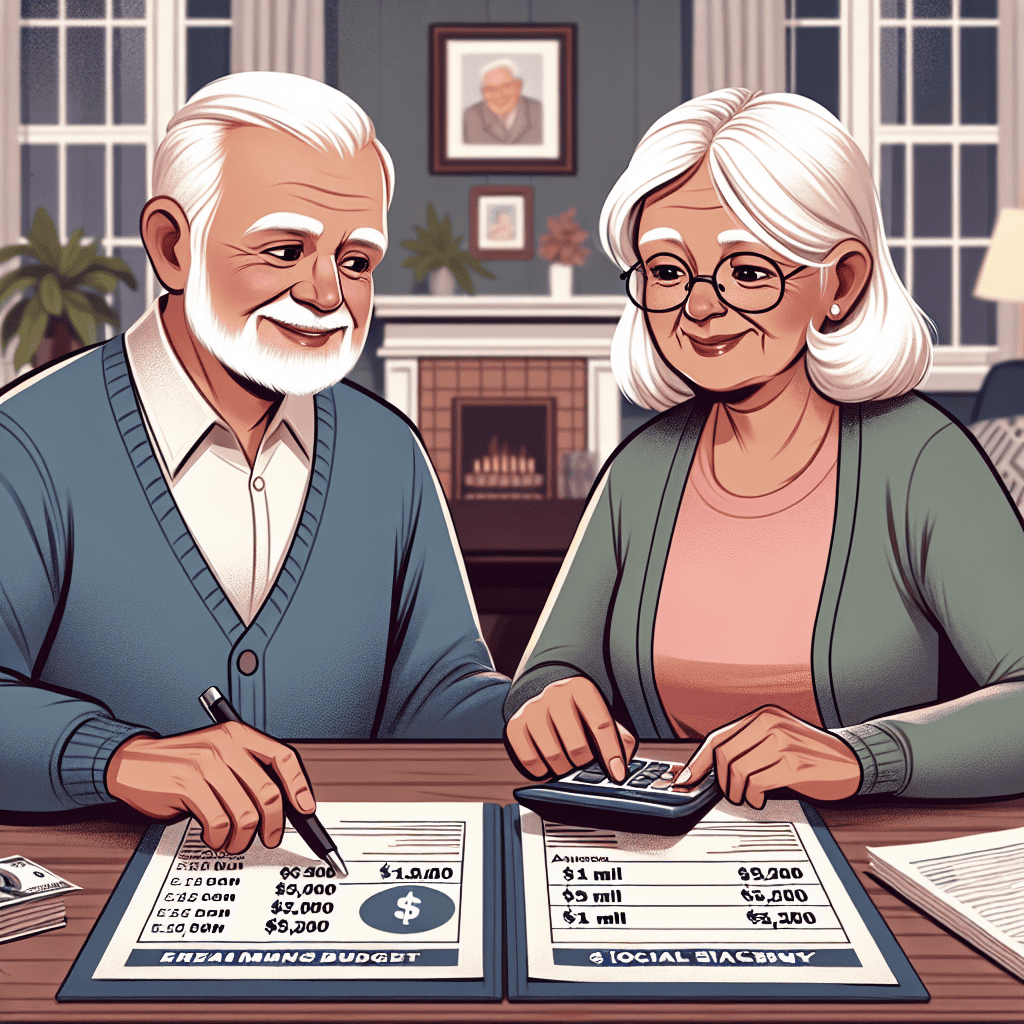

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires strategic planning to ensure financial security and a comfortable lifestyle. This process involves assessing your current financial situation, understanding your spending habits, and anticipating future expenses. By carefully evaluating your income sources and potential expenditures, you can create a sustainable budget that accommodates your desired lifestyle while safeguarding against unforeseen financial challenges. This approach not only helps in maintaining your standard of living but also ensures that your nest egg lasts throughout your retirement years.

Understanding Your Retirement Income Sources

Crafting a retirement budget is a crucial step in ensuring financial stability and peace of mind during your golden years. With a nest egg of $1.9 million and a monthly Social Security income of $5,200, you are well-positioned to enjoy a comfortable retirement. However, understanding your retirement income sources and how to effectively manage them is essential to maintaining your desired lifestyle.

To begin with, it is important to recognize the role of Social Security in your retirement plan. The $5,200 monthly benefit provides a reliable income stream that can cover a significant portion of your essential expenses. This predictable source of income can be particularly valuable in offsetting market volatility that may affect your investment portfolio. Therefore, it is advisable to allocate your Social Security benefits towards fixed costs such as housing, utilities, and healthcare. By doing so, you can ensure that your basic needs are met without having to dip into your investment savings.

In addition to Social Security, your $1.9 million retirement savings serve as a substantial financial resource. To maximize the longevity of this fund, it is crucial to adopt a strategic withdrawal plan. A common approach is the 4% rule, which suggests withdrawing 4% of your portfolio annually, adjusted for inflation. This method aims to provide a steady income while preserving the principal over a 30-year retirement period. However, it is important to remain flexible and adjust your withdrawal rate based on market conditions and personal circumstances.

Diversification of your investment portfolio is another key consideration. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can mitigate risk and enhance potential returns. It is also wise to periodically review and rebalance your portfolio to ensure it aligns with your risk tolerance and financial goals. Consulting with a financial advisor can provide valuable insights and help tailor your investment strategy to your specific needs.

Moreover, understanding the tax implications of your retirement income is essential for effective budgeting. While Social Security benefits may be partially taxable, withdrawals from tax-deferred accounts like traditional IRAs and 401(k)s are subject to ordinary income tax. Therefore, it is beneficial to explore tax-efficient withdrawal strategies, such as drawing from Roth accounts or utilizing tax-loss harvesting, to minimize your tax liability and maximize your net income.

Healthcare costs are another critical factor to consider in your retirement budget. As you age, medical expenses are likely to increase, making it imperative to plan for these costs. Medicare can cover a significant portion of your healthcare needs, but it is important to account for premiums, deductibles, and out-of-pocket expenses. Additionally, considering supplemental insurance or a health savings account can provide further financial protection.

Finally, it is important to periodically reassess your retirement budget and make adjustments as needed. Life circumstances, market conditions, and personal priorities can change over time, necessitating a flexible approach to financial planning. Regularly reviewing your budget and income sources can help ensure that you remain on track to achieve your retirement goals.

In conclusion, crafting a retirement budget with $1.9 million and $5,200 in Social Security requires a comprehensive understanding of your income sources and strategic financial management. By effectively allocating your resources, diversifying your investments, and planning for taxes and healthcare costs, you can enjoy a secure and fulfilling retirement.

Prioritizing Essential Expenses in Retirement

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires a strategic approach to ensure financial stability and peace of mind throughout one’s golden years. As retirees transition from a regular paycheck to relying on accumulated savings and Social Security, prioritizing essential expenses becomes paramount. This process begins with a thorough understanding of one’s financial landscape, including fixed and variable costs, to create a sustainable budget that aligns with long-term goals.

To begin with, it is crucial to identify and categorize essential expenses, which typically include housing, healthcare, food, transportation, and utilities. Housing often represents the largest expense in retirement, whether it involves maintaining a mortgage, paying rent, or covering property taxes and maintenance costs for a fully paid-off home. Given the substantial impact of housing on a retirement budget, retirees should consider downsizing or relocating to a more affordable area if necessary, thereby freeing up funds for other essential needs.

Healthcare is another critical component of retirement expenses, often underestimated by many retirees. With age, medical costs tend to rise, making it imperative to allocate a significant portion of the budget to health insurance premiums, out-of-pocket expenses, and potential long-term care needs. Utilizing Medicare and supplemental insurance plans can help mitigate these costs, but it is essential to plan for unexpected medical expenses that could arise.

In addition to housing and healthcare, food and transportation are fundamental necessities that require careful budgeting. While food costs can be managed through strategic shopping and meal planning, transportation expenses may vary depending on lifestyle choices. Retirees who prefer to travel or maintain multiple vehicles should account for these costs in their budget, while those who opt for a simpler lifestyle may find public transportation or a single vehicle sufficient.

Utilities, including electricity, water, and internet services, are also essential expenses that must be factored into the retirement budget. These costs can fluctuate based on location and usage, so retirees should monitor their consumption and explore energy-saving measures to reduce expenses. By prioritizing these essential expenses, retirees can ensure that their basic needs are met, allowing them to allocate remaining funds toward discretionary spending and leisure activities.

Once essential expenses are clearly defined and accounted for, retirees can focus on managing their $1.9 million in savings and $5,200 in monthly Social Security benefits to support their desired lifestyle. A prudent approach involves creating a diversified investment portfolio that balances growth and income, providing a steady stream of funds to supplement Social Security. Additionally, retirees should consider the impact of inflation on their purchasing power and adjust their budget accordingly to maintain their standard of living over time.

Furthermore, it is advisable to establish an emergency fund to cover unforeseen expenses, such as home repairs or medical emergencies, without disrupting the overall budget. This financial cushion can provide peace of mind and prevent the need to draw excessively from retirement savings during challenging times.

In conclusion, crafting a retirement budget with $1.9 million in savings and $5,200 in Social Security benefits requires careful planning and prioritization of essential expenses. By focusing on housing, healthcare, food, transportation, and utilities, retirees can create a sustainable financial plan that supports their needs and aspirations. Through strategic investment and prudent financial management, retirees can enjoy a fulfilling and secure retirement, free from the stress of financial uncertainty.

Strategies for Managing Healthcare Costs

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires careful planning, particularly when it comes to managing healthcare costs. As retirees transition from employer-sponsored health plans to Medicare, understanding the intricacies of healthcare expenses becomes crucial. With healthcare costs often being one of the most significant expenditures in retirement, strategic planning can help ensure financial stability and peace of mind.

To begin with, it is essential to recognize the components of Medicare and how they fit into your overall healthcare strategy. Medicare Part A, which covers hospital insurance, is typically premium-free for most retirees. However, Medicare Part B, which covers outpatient care, requires a monthly premium. Additionally, Medicare Part D, which covers prescription drugs, also involves separate premiums. Understanding these costs and how they fit into your budget is the first step in managing healthcare expenses effectively.

Moreover, considering supplemental insurance, such as Medigap or Medicare Advantage plans, can provide additional coverage and help mitigate out-of-pocket expenses. Medigap policies, for instance, can cover copayments, coinsurance, and deductibles that Medicare does not, offering a layer of financial protection. On the other hand, Medicare Advantage plans often include additional benefits like vision, dental, and hearing coverage, which can be advantageous depending on individual healthcare needs. Evaluating these options in the context of your overall budget is crucial for making informed decisions.

In addition to understanding Medicare and supplemental insurance options, it is important to anticipate potential long-term care needs. Long-term care insurance can be a valuable tool in managing the high costs associated with extended care services, such as nursing home care or in-home assistance. While premiums for long-term care insurance can be substantial, they may be a worthwhile investment to protect your retirement savings from being depleted by unforeseen healthcare expenses. Assessing your health history and family medical background can provide insights into the likelihood of needing long-term care, thereby informing your decision-making process.

Furthermore, maintaining a healthy lifestyle can play a significant role in managing healthcare costs during retirement. Regular exercise, a balanced diet, and routine medical check-ups can help prevent chronic conditions and reduce the need for costly medical interventions. By investing in your health, you not only enhance your quality of life but also potentially lower your healthcare expenses over time.

Another strategy to consider is setting aside a dedicated healthcare fund within your retirement savings. Allocating a portion of your $1.9 million specifically for healthcare expenses can provide a financial cushion and alleviate stress when unexpected medical costs arise. This fund can be adjusted annually based on changes in healthcare needs and costs, ensuring that you remain prepared for any eventuality.

Finally, staying informed about changes in healthcare policies and costs is vital. Healthcare regulations and Medicare policies can evolve, impacting coverage and expenses. By keeping abreast of these changes, you can adjust your budget and healthcare strategy accordingly, ensuring that you remain financially secure throughout your retirement years.

In conclusion, managing healthcare costs in retirement requires a multifaceted approach that includes understanding Medicare, considering supplemental insurance, planning for long-term care, maintaining a healthy lifestyle, and staying informed about policy changes. By integrating these strategies into your retirement budget, you can effectively manage healthcare expenses and enjoy a financially secure retirement.

Balancing Lifestyle Choices with Financial Realities

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires a careful balance between lifestyle aspirations and financial realities. As retirees transition from a regular paycheck to relying on accumulated savings and Social Security, it becomes crucial to develop a comprehensive financial plan that ensures long-term sustainability. The first step in this process involves assessing one’s current financial situation, including all sources of income and anticipated expenses. With $1.9 million in savings, retirees have a substantial nest egg to draw from, but prudent management is essential to ensure it lasts throughout retirement.

To begin with, understanding the role of Social Security is vital. The $5,200 monthly benefit provides a stable income stream, which can cover a significant portion of essential expenses such as housing, utilities, and groceries. However, it is important to recognize that Social Security alone may not be sufficient to maintain one’s desired lifestyle, especially when considering healthcare costs, travel, and leisure activities. Therefore, supplementing this income with withdrawals from the $1.9 million savings becomes necessary.

When planning withdrawals, retirees should consider the 4% rule, a widely accepted guideline suggesting that withdrawing 4% of retirement savings annually can help ensure that funds last for 30 years or more. Applying this rule to a $1.9 million portfolio results in an annual withdrawal of $76,000, or approximately $6,333 per month. Combined with Social Security, this provides a total monthly income of $11,533. However, it is crucial to adjust this rule based on individual circumstances, such as life expectancy, investment returns, and inflation.

Moreover, retirees should prioritize creating a detailed budget that categorizes expenses into essential and discretionary spending. Essential expenses include housing, healthcare, insurance, and food, while discretionary spending encompasses travel, entertainment, and hobbies. By distinguishing between these categories, retirees can identify areas where they may need to adjust their spending to align with their financial goals. For instance, if healthcare costs are higher than anticipated, it may be necessary to reduce discretionary spending to maintain financial stability.

In addition to budgeting, investment strategy plays a critical role in sustaining retirement savings. Retirees should consider a diversified portfolio that balances growth and income, taking into account their risk tolerance and time horizon. While equities can provide growth potential, fixed-income investments offer stability and income. Regularly reviewing and rebalancing the portfolio ensures that it remains aligned with changing market conditions and personal financial goals.

Furthermore, it is essential to plan for unexpected expenses and potential long-term care needs. Establishing an emergency fund and considering long-term care insurance can provide peace of mind and financial security. Additionally, retirees should remain informed about tax implications related to withdrawals and Social Security benefits, as effective tax planning can enhance the longevity of retirement savings.

In conclusion, crafting a retirement budget with $1.9 million in savings and $5,200 in Social Security benefits involves a delicate balance between lifestyle choices and financial realities. By understanding income sources, adhering to a disciplined withdrawal strategy, and maintaining a diversified investment portfolio, retirees can enjoy a fulfilling retirement while ensuring their financial resources endure. Through careful planning and regular reassessment, retirees can navigate the complexities of retirement with confidence and peace of mind.

Investment Strategies for a $1.9 Million Portfolio

Crafting a retirement budget with a $1.9 million portfolio and $5,200 in monthly Social Security benefits requires a strategic approach to ensure financial stability and longevity. As retirees transition from earning a regular income to relying on savings and benefits, it becomes crucial to develop an investment strategy that balances growth, income, and risk management. The first step in this process is to assess your financial goals and needs. Understanding your desired lifestyle, potential healthcare costs, and any legacy plans will help shape your investment strategy. With $1.9 million at your disposal, you have a substantial foundation to support a comfortable retirement, but careful planning is essential to maintain this wealth over the years.

Diversification is a key principle in managing a retirement portfolio. By spreading investments across various asset classes, you can mitigate risks and enhance potential returns. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and alternative investments. Stocks can provide growth potential, which is important for outpacing inflation over the long term. However, they also come with higher volatility, so it is advisable to balance them with more stable investments like bonds. Bonds can offer a steady income stream and are generally less volatile than stocks, making them a suitable choice for retirees seeking stability.

In addition to traditional asset classes, real estate can be an attractive option for retirees. Real estate investments can generate rental income and appreciate over time, providing both income and growth potential. However, it is important to consider the responsibilities and risks associated with property management. For those who prefer a more hands-off approach, real estate investment trusts (REITs) can offer exposure to the real estate market without the need to manage physical properties.

Another consideration in crafting a retirement budget is the role of alternative investments. These can include commodities, hedge funds, or private equity, which may offer diversification benefits and potential for higher returns. However, they often come with higher fees and less liquidity, so they should be approached with caution and typically represent a smaller portion of the overall portfolio.

As you structure your investment strategy, it is also important to consider the tax implications of your choices. Different types of accounts, such as traditional IRAs, Roth IRAs, and taxable accounts, have varying tax treatments. Understanding these differences can help you optimize your withdrawals and minimize tax liabilities. For instance, withdrawing from a Roth IRA can be tax-free, which might be advantageous in certain situations.

Moreover, it is essential to regularly review and adjust your investment strategy to reflect changes in the market and your personal circumstances. This might involve rebalancing your portfolio to maintain your desired asset allocation or adjusting your withdrawal strategy to ensure sustainability. Working with a financial advisor can provide valuable insights and help you navigate these complexities.

In conclusion, crafting a retirement budget with a $1.9 million portfolio and $5,200 in Social Security benefits involves a careful balance of growth, income, and risk management. By diversifying your investments, considering tax implications, and regularly reviewing your strategy, you can create a sustainable financial plan that supports your retirement goals. With thoughtful planning and prudent management, you can enjoy a secure and fulfilling retirement.

Maximizing Social Security Benefits

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires a strategic approach to ensure financial stability and longevity. As retirees transition from active employment to a more leisurely lifestyle, understanding how to maximize Social Security benefits becomes crucial. This process involves not only a thorough assessment of current financial resources but also a keen awareness of future financial needs and potential economic fluctuations.

To begin with, it is essential to recognize the role of Social Security benefits as a foundational component of retirement income. With $5,200 per month, these benefits provide a steady stream of income that can cover essential expenses such as housing, utilities, and healthcare. However, to maximize these benefits, retirees should consider the timing of their Social Security claims. Delaying benefits until reaching full retirement age, or even beyond, can result in increased monthly payments, thereby enhancing long-term financial security. This decision should be weighed against personal health considerations and life expectancy, as well as the need for immediate income.

In addition to optimizing Social Security benefits, retirees must carefully manage their $1.9 million in savings. This substantial nest egg offers significant flexibility, but it also requires prudent investment strategies to ensure it lasts throughout retirement. Diversifying investments across various asset classes, such as stocks, bonds, and real estate, can help mitigate risks and provide a balanced approach to growth and income. Moreover, retirees should consider the impact of inflation on their purchasing power and adjust their investment strategies accordingly to preserve the real value of their savings.

Furthermore, creating a comprehensive retirement budget is vital for aligning income with expenses. This budget should account for both fixed and variable costs, including discretionary spending on travel, hobbies, and other leisure activities. By establishing a clear understanding of monthly and annual expenses, retirees can better allocate their resources and avoid overspending. Additionally, it is advisable to set aside an emergency fund to cover unexpected expenses, such as medical emergencies or home repairs, which can otherwise disrupt financial plans.

Another important aspect of maximizing Social Security benefits is tax planning. Retirees should be aware of how their benefits and other sources of income are taxed, as this can significantly impact their net income. Consulting with a financial advisor or tax professional can provide valuable insights into strategies for minimizing tax liabilities, such as utilizing tax-advantaged accounts or strategically withdrawing from retirement accounts.

Moreover, healthcare costs are a significant consideration in retirement planning. With the potential for rising medical expenses, retirees should explore options for supplemental insurance coverage to complement Medicare. Long-term care insurance is another consideration, as it can protect against the high costs associated with extended care needs.

In conclusion, crafting a retirement budget with $1.9 million in savings and $5,200 in Social Security benefits involves a multifaceted approach that includes optimizing benefit timing, diversifying investments, creating a detailed budget, and implementing effective tax and healthcare strategies. By taking these steps, retirees can maximize their Social Security benefits and ensure a financially secure and fulfilling retirement. Through careful planning and informed decision-making, retirees can enjoy the peace of mind that comes with knowing their financial future is well-managed.

Planning for Inflation and Unexpected Expenses

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits requires careful planning, particularly when considering the impact of inflation and unexpected expenses. As retirees embark on this new chapter, it is crucial to develop a financial strategy that not only meets current needs but also anticipates future challenges. To begin with, understanding the role of inflation in eroding purchasing power is essential. Inflation, the gradual increase in prices over time, can significantly affect the value of savings. Even a modest inflation rate of 2% can diminish the purchasing power of a fixed income over the years. Therefore, retirees should consider investments that offer potential growth to outpace inflation. Diversifying the investment portfolio with a mix of stocks, bonds, and other assets can provide a hedge against inflation, ensuring that the retirement savings maintain their value over time.

In addition to inflation, unexpected expenses pose a significant risk to a retirement budget. Medical emergencies, home repairs, or other unforeseen costs can quickly deplete savings if not adequately planned for. To mitigate this risk, it is advisable to establish an emergency fund specifically for such contingencies. This fund should be easily accessible and contain enough to cover at least six months of living expenses. By setting aside a portion of the $1.9 million for emergencies, retirees can protect their long-term financial security.

Moreover, it is important to regularly review and adjust the retirement budget to reflect changes in personal circumstances and economic conditions. This involves monitoring spending habits and making necessary adjustments to ensure that expenses do not exceed income. Utilizing budgeting tools or consulting with a financial advisor can provide valuable insights and help maintain financial discipline. Additionally, retirees should consider the potential need for long-term care, which can be a significant expense. Long-term care insurance can be a prudent investment, offering peace of mind and financial protection against the high costs associated with extended care.

Furthermore, retirees should explore ways to maximize their Social Security benefits. Delaying the start of Social Security payments until reaching full retirement age or beyond can result in higher monthly benefits, providing a more substantial income stream. This strategy can be particularly beneficial for those with a longer life expectancy, as it increases the overall lifetime benefits received. Additionally, understanding the tax implications of Social Security and other retirement income is crucial. Proper tax planning can help minimize tax liabilities and maximize the net income available for living expenses.

Finally, maintaining a flexible mindset is vital when planning for retirement. Life is unpredictable, and circumstances can change rapidly. Being open to adjusting spending habits, exploring part-time work opportunities, or downsizing living arrangements can provide additional financial security and peace of mind. By proactively addressing the challenges posed by inflation and unexpected expenses, retirees can create a sustainable budget that supports a comfortable and fulfilling retirement lifestyle.

In conclusion, crafting a retirement budget with $1.9 million and $5,200 in Social Security requires a comprehensive approach that considers inflation, unexpected expenses, and potential changes in personal circumstances. By diversifying investments, establishing an emergency fund, maximizing Social Security benefits, and maintaining flexibility, retirees can navigate the complexities of retirement planning and enjoy financial stability throughout their golden years.

Q&A

1. **How much can I safely withdraw annually from a $1.9 million retirement portfolio?**

A common rule of thumb is the 4% rule, which suggests you can withdraw about $76,000 annually.

2. **What are the total annual funds available including Social Security?**

With $76,000 from the portfolio and $5,200 monthly from Social Security, the total is $138,400 annually.

3. **How should I allocate my retirement budget?**

Consider allocating 50% to needs (housing, healthcare), 30% to wants (travel, hobbies), and 20% to savings or unexpected expenses.

4. **What are some essential expenses to include in the budget?**

Housing, healthcare, utilities, groceries, insurance, and transportation are essential expenses.

5. **How can I manage healthcare costs in retirement?**

Consider Medicare plans, supplemental insurance, and setting aside funds for out-of-pocket expenses.

6. **What strategies can help reduce taxes on retirement income?**

Utilize tax-advantaged accounts, consider Roth conversions, and manage withdrawals to stay in lower tax brackets.

7. **How can I ensure my retirement budget remains sustainable?**

Regularly review and adjust your budget, monitor investment performance, and be prepared to reduce discretionary spending if necessary.

Conclusion

Crafting a retirement budget with $1.9 million in savings and $5,200 in monthly Social Security benefits involves strategic planning to ensure financial stability and longevity. The key is to balance withdrawals from savings with Social Security income to cover living expenses, healthcare, leisure, and unexpected costs. Assuming a conservative withdrawal rate of 3-4% from the $1.9 million, this could provide an additional $57,000 to $76,000 annually, supplementing the $62,400 from Social Security. Prioritizing essential expenses, maintaining an emergency fund, and considering inflation and healthcare costs are crucial. With disciplined budgeting and investment strategies, this financial setup can support a comfortable retirement lifestyle while preserving capital for future needs.