“Citigroup’s Profits Dented: Navigating the Storm of Credit Losses and Bad Loan Allowances.”

Introduction

In a recent financial disclosure, Citigroup reported a significant impact on its profitability due to rising credit losses and increased allowances for bad loans. The banking giant, which is a key player in the global financial sector, has faced mounting challenges as economic uncertainties and market volatilities have led to a deterioration in credit quality. This has necessitated a substantial increase in provisions to cover potential loan defaults, thereby affecting the company’s bottom line. The situation underscores the broader pressures facing financial institutions as they navigate a complex landscape marked by fluctuating interest rates, geopolitical tensions, and evolving regulatory requirements. As Citigroup grapples with these headwinds, its financial performance reflects the broader economic environment and the ongoing need for strategic adjustments to mitigate risk and sustain growth.

Impact Of Credit Losses On Citigroup’s Profit Margins

Citigroup, one of the leading financial institutions globally, has recently reported a notable impact on its profit margins due to rising credit losses and increased allowances for bad loans. This development underscores the challenges faced by major banks in navigating the complexities of the current economic landscape. As the global economy grapples with uncertainties, including fluctuating interest rates and geopolitical tensions, financial institutions like Citigroup are compelled to reassess their risk management strategies and financial forecasts.

The increase in credit losses is a significant factor contributing to the pressure on Citigroup’s profit margins. Credit losses occur when borrowers fail to meet their debt obligations, leading to a direct hit on the bank’s financial health. In recent quarters, Citigroup has observed a rise in delinquency rates, particularly in consumer lending segments such as credit cards and personal loans. This trend is partly attributed to the economic aftershocks of the pandemic, which have left many consumers struggling to maintain their financial stability. Consequently, Citigroup has had to allocate more resources to cover potential defaults, thereby affecting its profitability.

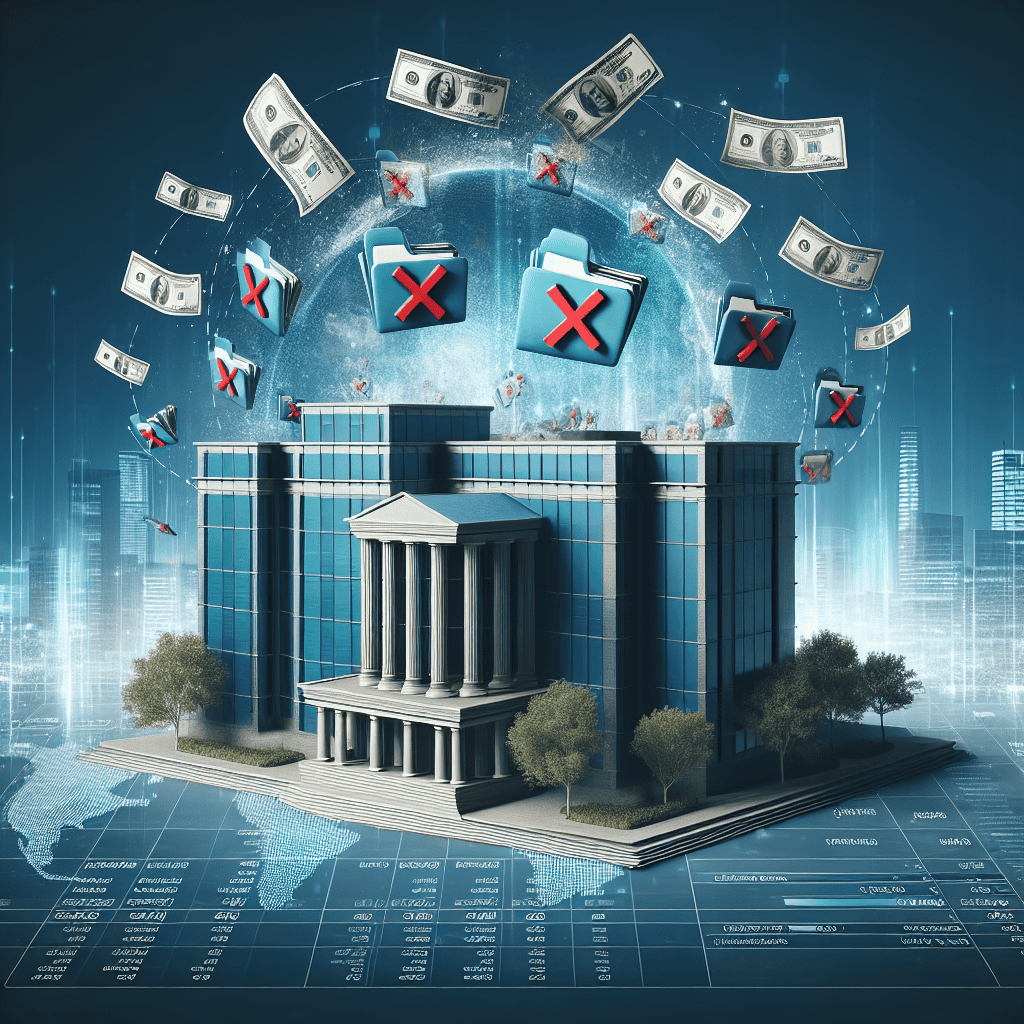

In tandem with rising credit losses, Citigroup has also increased its allowances for bad loans. Allowances for bad loans are provisions set aside by banks to cover potential future losses from non-performing assets. This prudent approach is essential for maintaining financial resilience, especially in uncertain times. However, the need to bolster these allowances inevitably impacts the bank’s bottom line. By setting aside more capital to cover potential loan defaults, Citigroup is effectively reducing the funds available for other profit-generating activities, such as investments and lending.

Moreover, the decision to increase allowances for bad loans reflects Citigroup’s cautious outlook on the economic environment. With inflationary pressures and interest rate hikes posing additional challenges, the bank is preparing for potential headwinds that could further strain borrowers’ ability to repay their debts. This proactive stance, while necessary for long-term stability, underscores the delicate balance that financial institutions must strike between risk management and profitability.

Furthermore, the impact of credit losses and allowances for bad loans on Citigroup’s profit margins is not an isolated phenomenon. It is indicative of broader trends affecting the banking sector as a whole. Many financial institutions are facing similar challenges, as they navigate a landscape marked by economic volatility and evolving regulatory requirements. In response, banks are increasingly focusing on enhancing their risk assessment frameworks and leveraging technology to better predict and mitigate potential credit risks.

In conclusion, the hit to Citigroup’s profit margins due to credit losses and allowances for bad loans highlights the intricate interplay between economic conditions and financial performance. As the bank continues to adapt to the evolving landscape, it remains committed to maintaining a robust risk management strategy to safeguard its financial health. While the current challenges are significant, they also present an opportunity for Citigroup to refine its operations and emerge more resilient in the face of future uncertainties. As the global economy continues to evolve, the bank’s ability to navigate these complexities will be crucial in determining its long-term success and stability.

Understanding Citigroup’s Allowances For Bad Loans

Citigroup, one of the leading financial institutions globally, has recently reported a decline in profits, primarily attributed to increased credit losses and allowances for bad loans. This development has sparked considerable interest among investors and analysts, prompting a closer examination of the factors contributing to this financial outcome. Understanding the intricacies of Citigroup’s allowances for bad loans is essential to grasp the broader implications for the bank’s financial health and future prospects.

To begin with, allowances for bad loans, also known as loan loss provisions, are funds that banks set aside to cover potential losses from defaulted loans. These provisions are a critical component of a bank’s risk management strategy, as they help cushion the impact of borrowers failing to meet their financial obligations. In the case of Citigroup, the increase in these allowances indicates a more cautious approach in response to the current economic environment, which has been marked by uncertainty and volatility.

The rise in credit losses can be attributed to several factors, including economic slowdowns, rising interest rates, and geopolitical tensions. These elements have collectively contributed to a challenging landscape for borrowers, leading to an uptick in loan defaults. Consequently, Citigroup has had to adjust its financial strategies to mitigate potential risks, resulting in higher allowances for bad loans. This proactive measure, while impacting short-term profitability, is aimed at safeguarding the bank’s long-term stability.

Moreover, the increase in allowances for bad loans reflects Citigroup’s adherence to regulatory requirements and accounting standards. Financial institutions are mandated to maintain adequate reserves to cover potential loan losses, ensuring they remain solvent even in adverse conditions. By bolstering its provisions, Citigroup demonstrates its commitment to maintaining a robust financial position, thereby instilling confidence among stakeholders.

In addition to regulatory compliance, Citigroup’s decision to increase its loan loss provisions is also influenced by its internal risk assessment processes. The bank employs sophisticated models and analytics to evaluate the creditworthiness of its borrowers and the likelihood of default. These assessments are continually updated to reflect changing economic conditions, enabling Citigroup to make informed decisions regarding its allowances for bad loans.

While the increase in credit losses and allowances for bad loans has undoubtedly impacted Citigroup’s profitability, it is important to consider the broader context. The banking sector as a whole is navigating a complex environment, characterized by evolving regulatory landscapes and shifting market dynamics. In this context, Citigroup’s approach can be seen as a prudent measure to ensure resilience and adaptability in the face of uncertainty.

Furthermore, it is worth noting that Citigroup’s financial performance is not solely determined by its loan loss provisions. The bank continues to generate revenue from diverse sources, including investment banking, wealth management, and global markets. These segments provide a buffer against potential losses in the lending business, underscoring the importance of a diversified business model.

In conclusion, Citigroup’s increased allowances for bad loans, while impacting short-term profits, reflect a strategic response to the current economic challenges. By prioritizing risk management and regulatory compliance, the bank aims to fortify its financial position and navigate the complexities of the global financial landscape. As the economic environment continues to evolve, Citigroup’s approach will likely serve as a benchmark for other financial institutions seeking to balance profitability with prudent risk management.

Strategies Citigroup Is Implementing To Mitigate Credit Losses

Citigroup, one of the leading financial institutions globally, has recently faced significant challenges due to increased credit losses and allowances for bad loans. This situation has prompted the bank to implement a series of strategic measures aimed at mitigating these financial setbacks. As the economic landscape continues to evolve, Citigroup is focusing on a multi-faceted approach to address the underlying issues contributing to credit losses, while also strengthening its overall financial health.

To begin with, Citigroup is enhancing its risk management framework. By refining its credit risk assessment processes, the bank aims to identify potential problem areas earlier and more accurately. This involves leveraging advanced data analytics and machine learning technologies to better predict borrower behavior and potential defaults. By doing so, Citigroup can take preemptive actions to mitigate risks before they materialize into significant losses. Furthermore, the bank is investing in training programs for its risk management teams to ensure they are equipped with the latest tools and knowledge to navigate the complexities of the current financial environment.

In addition to improving risk assessment, Citigroup is also focusing on diversifying its loan portfolio. By spreading its credit exposure across various sectors and geographies, the bank aims to reduce its vulnerability to sector-specific downturns or regional economic challenges. This diversification strategy not only helps in managing risk but also opens up new opportunities for growth in emerging markets. Citigroup is actively seeking to expand its presence in regions with strong economic potential, thereby balancing its portfolio with a mix of stable and high-growth assets.

Moreover, Citigroup is strengthening its capital reserves to better absorb potential losses. By maintaining a robust capital buffer, the bank can ensure it remains resilient in the face of economic uncertainties. This involves not only adhering to regulatory capital requirements but also setting aside additional reserves as a precautionary measure. Citigroup’s proactive approach in this regard demonstrates its commitment to maintaining financial stability and protecting its stakeholders’ interests.

Another critical aspect of Citigroup’s strategy is enhancing its customer engagement and support mechanisms. By working closely with borrowers, the bank aims to provide tailored solutions that can help clients navigate financial difficulties. This includes offering loan restructuring options, flexible repayment plans, and financial counseling services. By fostering strong relationships with its customers, Citigroup can better understand their needs and challenges, thereby reducing the likelihood of defaults and enhancing customer loyalty.

Furthermore, Citigroup is actively collaborating with regulatory bodies and industry peers to stay ahead of emerging risks and trends. By participating in industry forums and working groups, the bank can share insights and best practices, while also gaining valuable perspectives from other financial institutions. This collaborative approach not only helps Citigroup refine its strategies but also contributes to the overall stability and resilience of the financial system.

In conclusion, Citigroup is implementing a comprehensive set of strategies to mitigate credit losses and allowances for bad loans. By enhancing risk management, diversifying its loan portfolio, strengthening capital reserves, improving customer engagement, and collaborating with industry stakeholders, the bank is taking decisive steps to address current challenges and position itself for sustainable growth. As the financial landscape continues to evolve, Citigroup’s proactive and adaptive approach will be crucial in navigating future uncertainties and maintaining its status as a leading global financial institution.

Analyzing The Financial Health Of Citigroup Amid Rising Bad Loans

Citigroup, one of the leading financial institutions globally, has recently reported a decline in its profit margins, primarily attributed to rising credit losses and increased allowances for bad loans. This development has sparked considerable interest among investors and analysts, prompting a closer examination of the bank’s financial health amid a challenging economic landscape. As the global economy grapples with uncertainties, Citigroup’s financial performance offers a lens through which the broader banking sector’s resilience can be assessed.

To begin with, the increase in credit losses is a significant factor impacting Citigroup’s profitability. Credit losses occur when borrowers fail to meet their debt obligations, leading to a direct hit on the bank’s earnings. In recent quarters, Citigroup has experienced a noticeable uptick in such losses, reflecting broader economic challenges that have affected borrowers’ ability to repay loans. This trend is not isolated to Citigroup alone; rather, it mirrors a wider phenomenon observed across the banking industry as financial institutions navigate the complexities of a post-pandemic recovery, inflationary pressures, and geopolitical tensions.

In response to the rising credit losses, Citigroup has prudently increased its allowances for bad loans. These allowances serve as a financial buffer, enabling the bank to absorb potential future losses without severely impacting its capital base. By setting aside a portion of its earnings to cover anticipated loan defaults, Citigroup demonstrates a proactive approach to risk management. This strategy, while impacting short-term profitability, underscores the bank’s commitment to maintaining financial stability and safeguarding shareholder interests in the long run.

Moreover, the decision to bolster allowances for bad loans is indicative of Citigroup’s cautious outlook on the economic environment. The bank’s management has likely considered various macroeconomic indicators, such as unemployment rates, consumer spending patterns, and interest rate fluctuations, to assess the potential risks to its loan portfolio. By aligning its financial strategy with these indicators, Citigroup aims to mitigate the adverse effects of economic volatility and ensure its continued operational resilience.

Transitioning to the broader implications of Citigroup’s financial performance, it is essential to consider the impact on investor sentiment and market perception. The bank’s decision to increase allowances for bad loans, while prudent, may raise concerns among investors regarding the quality of its loan portfolio and the potential for further credit deterioration. Consequently, Citigroup’s stock performance may experience fluctuations as market participants digest these developments and adjust their expectations accordingly.

Furthermore, Citigroup’s financial health is closely monitored by regulatory authorities, who play a crucial role in ensuring the stability of the banking system. Regulators may view the bank’s increased allowances as a positive step towards maintaining adequate capital levels and safeguarding against systemic risks. This perspective aligns with the broader regulatory emphasis on promoting transparency and accountability within the financial sector.

In conclusion, Citigroup’s recent profit decline, driven by rising credit losses and increased allowances for bad loans, highlights the challenges faced by financial institutions in a complex economic environment. While these developments may pose short-term challenges, Citigroup’s proactive approach to risk management and its commitment to financial stability position it well for navigating future uncertainties. As the bank continues to adapt to evolving market conditions, its financial health will remain a focal point for investors, regulators, and industry observers alike, offering valuable insights into the resilience of the global banking sector.

The Role Of Economic Conditions In Citigroup’s Credit Losses

Citigroup, one of the leading financial institutions globally, has recently reported a decline in profits, primarily attributed to increased credit losses and allowances for bad loans. This development underscores the intricate relationship between economic conditions and the financial health of major banking entities. As economic conditions fluctuate, they invariably impact the credit landscape, influencing both the ability of borrowers to repay loans and the bank’s strategies in managing potential defaults.

In periods of economic expansion, consumers and businesses generally experience improved financial stability, leading to a lower incidence of loan defaults. However, during economic downturns, the opposite tends to occur. Unemployment rates may rise, consumer spending can decrease, and businesses might face reduced revenues, all of which contribute to a higher likelihood of loan defaults. Citigroup’s recent financial performance reflects these dynamics, as the bank has had to increase its provisions for credit losses in response to the current economic environment.

The global economy has faced numerous challenges in recent years, including the lingering effects of the COVID-19 pandemic, geopolitical tensions, and inflationary pressures. These factors have collectively contributed to an uncertain economic climate, prompting financial institutions like Citigroup to adopt a more cautious approach. By setting aside greater allowances for bad loans, Citigroup aims to mitigate potential risks associated with borrowers’ inability to meet their financial obligations.

Moreover, the role of interest rates cannot be overlooked when examining Citigroup’s credit losses. Central banks worldwide have adjusted interest rates in response to inflationary trends and economic growth forecasts. Higher interest rates, while intended to curb inflation, can also increase the cost of borrowing for consumers and businesses. This, in turn, may lead to a higher incidence of loan defaults, as borrowers struggle to manage increased debt servicing costs. Citigroup’s increased credit loss provisions reflect an anticipation of these challenges, as the bank seeks to safeguard its financial stability amidst a volatile interest rate environment.

In addition to macroeconomic factors, Citigroup’s internal risk management strategies play a crucial role in determining its exposure to credit losses. The bank’s ability to accurately assess the creditworthiness of its borrowers and adjust its lending practices accordingly is vital in minimizing potential defaults. By employing sophisticated risk assessment models and continuously monitoring economic indicators, Citigroup endeavors to strike a balance between maintaining profitability and managing risk.

Furthermore, regulatory frameworks and government policies also influence Citigroup’s approach to credit losses. Financial regulations often require banks to maintain certain capital reserves to cover potential loan defaults, ensuring that they remain solvent even in adverse economic conditions. Citigroup’s increased allowances for bad loans align with these regulatory requirements, demonstrating the bank’s commitment to maintaining a robust financial position.

In conclusion, Citigroup’s recent profit decline, driven by heightened credit losses and allowances for bad loans, highlights the significant impact of economic conditions on the banking sector. As the global economy continues to navigate a complex landscape, financial institutions must remain vigilant in their risk management practices. By understanding the interplay between economic factors, interest rates, and regulatory requirements, Citigroup can better position itself to weather future economic challenges while safeguarding its financial health. This proactive approach not only ensures the bank’s stability but also reinforces its ability to support its customers and contribute to broader economic growth.

How Citigroup’s Profitability Is Affected By Loan Loss Provisions

Citigroup, one of the leading financial institutions globally, has recently reported a decline in its profitability, primarily attributed to increased credit losses and allowances for bad loans. This development underscores the intricate relationship between a bank’s financial health and its management of credit risk. As economic conditions fluctuate, banks like Citigroup must navigate the challenges posed by borrowers’ ability to repay loans, which directly impacts their bottom line.

To understand how Citigroup’s profitability is affected by loan loss provisions, it is essential to first consider the nature of these provisions. Loan loss provisions are funds that banks set aside to cover potential losses from defaulted loans. These provisions are a critical component of a bank’s risk management strategy, serving as a buffer against economic uncertainties. However, they also represent a cost to the bank, as setting aside these funds reduces the capital available for other profitable ventures.

In recent quarters, Citigroup has experienced an uptick in credit losses, prompting the bank to increase its loan loss provisions. This increase is partly due to a challenging economic environment characterized by rising interest rates and inflationary pressures, which have strained the financial capacity of both individual and corporate borrowers. As borrowers face difficulties in meeting their debt obligations, the likelihood of loan defaults rises, necessitating higher provisions.

Moreover, regulatory requirements also play a significant role in shaping Citigroup’s approach to loan loss provisions. Financial regulators mandate that banks maintain adequate reserves to safeguard against potential credit losses, ensuring the stability of the financial system. Consequently, Citigroup must balance regulatory compliance with its profitability objectives, a task that becomes more complex in volatile economic conditions.

The impact of increased loan loss provisions on Citigroup’s profitability is multifaceted. On one hand, these provisions are essential for maintaining the bank’s financial stability and protecting it from unexpected credit losses. On the other hand, they directly reduce the bank’s net income, as funds allocated for provisions are not available for revenue-generating activities. This trade-off highlights the delicate balance that banks must strike between risk management and profit maximization.

Furthermore, the rise in credit losses and loan loss provisions can also affect investor confidence in Citigroup. Investors closely monitor a bank’s financial performance, and a decline in profitability may lead to concerns about the bank’s ability to manage credit risk effectively. This, in turn, can influence the bank’s stock price and its overall market valuation.

In response to these challenges, Citigroup is likely to adopt a multifaceted strategy aimed at mitigating credit risk while enhancing profitability. This may involve tightening lending standards, diversifying its loan portfolio, and investing in advanced risk assessment technologies. By doing so, Citigroup can better anticipate potential credit issues and adjust its provisions accordingly, thereby minimizing the impact on its financial performance.

In conclusion, Citigroup’s profitability is intricately linked to its management of loan loss provisions. As economic conditions evolve, the bank must navigate the complexities of credit risk management while striving to maintain its financial health. By balancing regulatory requirements, risk management, and profit objectives, Citigroup can position itself to weather economic uncertainties and sustain its long-term growth.

Future Outlook For Citigroup In Managing Credit Risks And Profitability

Citigroup, one of the leading financial institutions globally, has recently faced challenges that have impacted its profitability, primarily due to credit losses and allowances for bad loans. As the financial landscape continues to evolve, the future outlook for Citigroup in managing credit risks and maintaining profitability is a topic of significant interest to investors, analysts, and stakeholders. Understanding the strategies that Citigroup might employ to navigate these challenges is crucial for assessing its potential for sustained growth and stability.

To begin with, the increase in credit losses and the need for allowances for bad loans can be attributed to several factors, including economic uncertainties and shifts in consumer behavior. These elements have led to a rise in default rates, compelling Citigroup to set aside more substantial reserves to cover potential losses. This prudent approach, while impacting short-term profitability, is essential for safeguarding the bank’s financial health in the long run. As Citigroup looks to the future, it will likely continue to refine its risk management strategies to better anticipate and mitigate such credit risks.

One potential avenue for Citigroup to enhance its credit risk management is through the adoption of advanced data analytics and artificial intelligence. By leveraging these technologies, Citigroup can improve its ability to assess the creditworthiness of borrowers more accurately and in real-time. This proactive approach not only aids in identifying potential risks before they materialize but also allows for more tailored lending solutions that align with the risk profiles of individual clients. Consequently, this could lead to a reduction in default rates and a more robust loan portfolio.

Moreover, Citigroup’s global presence offers a unique advantage in diversifying its credit risk. By operating in various markets, the bank can spread its exposure across different economic environments, thereby reducing the impact of localized economic downturns. This geographical diversification, coupled with a focus on expanding into emerging markets with high growth potential, could provide Citigroup with new revenue streams and offset losses in more mature markets. However, this strategy requires careful consideration of the unique risks associated with each market, including regulatory challenges and currency fluctuations.

In addition to these strategies, Citigroup’s commitment to maintaining a strong capital position is vital for its future outlook. By ensuring that it has adequate capital reserves, the bank can absorb potential losses without compromising its operational capabilities. This financial resilience not only instills confidence among investors and clients but also positions Citigroup to take advantage of growth opportunities as they arise.

Furthermore, Citigroup’s focus on enhancing its digital banking capabilities is another critical component of its strategy to manage credit risks and drive profitability. By investing in digital platforms, Citigroup can offer more efficient and accessible services to its clients, thereby improving customer satisfaction and loyalty. This digital transformation also enables the bank to streamline its operations, reduce costs, and enhance its competitive edge in an increasingly digital financial landscape.

In conclusion, while Citigroup faces challenges related to credit losses and allowances for bad loans, its future outlook remains promising, provided it continues to adapt and innovate. By leveraging technology, diversifying its market presence, maintaining a strong capital position, and enhancing its digital capabilities, Citigroup can effectively manage credit risks and sustain profitability. As the financial environment continues to change, Citigroup’s ability to navigate these complexities will be crucial in securing its position as a leading global financial institution.

Q&A

1. **What caused Citigroup’s profit to be hit?**

Citigroup’s profit was impacted by increased credit losses and higher allowances for bad loans.

2. **How did credit losses affect Citigroup’s financial performance?**

Credit losses led to a reduction in net income as the bank had to set aside more funds to cover potential defaults.

3. **What are allowances for bad loans?**

Allowances for bad loans are reserves that banks set aside to cover potential losses from loans that may not be repaid.

4. **Why did Citigroup increase its allowances for bad loans?**

Citigroup increased its allowances due to a rise in delinquent accounts and a more cautious economic outlook.

5. **How do credit losses and allowances impact a bank’s profitability?**

They reduce profitability by increasing expenses, as more funds are allocated to cover potential loan defaults.

6. **What sectors contributed to the rise in credit losses for Citigroup?**

The rise in credit losses was primarily seen in consumer lending and certain commercial sectors.

7. **What measures might Citigroup take in response to increased credit losses?**

Citigroup might tighten lending standards, increase monitoring of at-risk accounts, and adjust its financial forecasts.

Conclusion

Citigroup’s profit has been adversely affected by increased credit losses and the need to set aside greater allowances for bad loans. This financial strain reflects a challenging economic environment where borrowers are struggling to meet their obligations, prompting the bank to bolster its reserves to cover potential defaults. The impact on Citigroup’s profitability underscores the importance of prudent risk management and the need for strategic adjustments to navigate the evolving credit landscape.