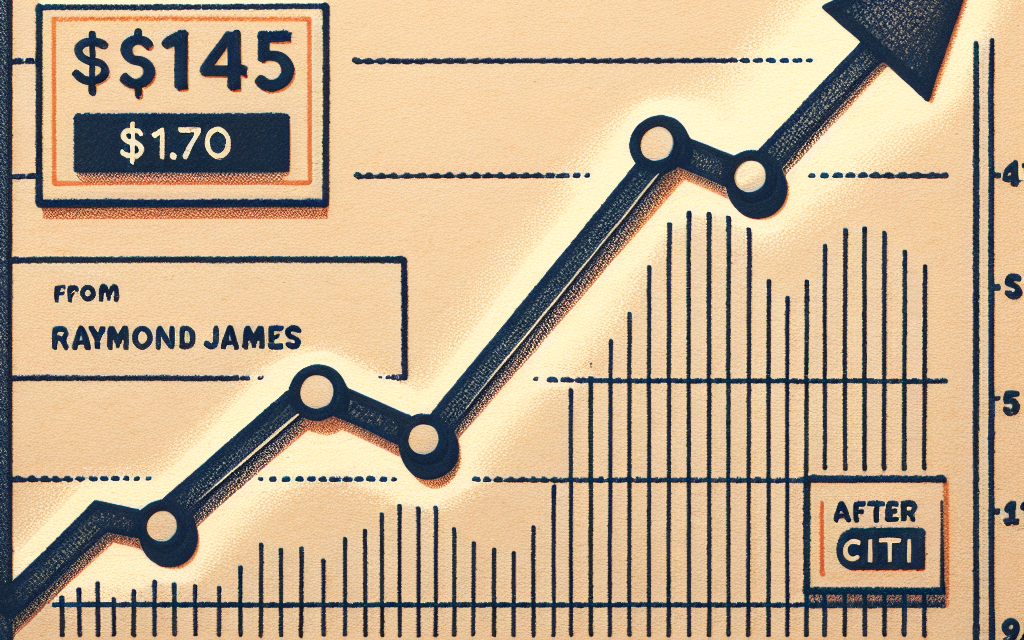

“Raymond James Soars: Citi Raises Price Target to $170!”

Introduction

Citi has raised its price target for Raymond James to $170, up from the previous target of $145. This adjustment reflects Citi’s positive outlook on the company’s performance and growth potential in the financial services sector. The increase in the price target is based on a thorough analysis of Raymond James’ financial metrics, market position, and anticipated future earnings, indicating confidence in the firm’s ability to navigate market challenges and capitalize on emerging opportunities.

Citi’s Upgrade: Analyzing the New Price Target for Raymond James

Citi has recently announced an increase in its price target for Raymond James, raising it from $145 to $170. This adjustment reflects a positive outlook on the financial services firm, which has demonstrated resilience and adaptability in a competitive market. The decision by Citi analysts to revise the price target is based on a comprehensive analysis of Raymond James’ financial performance, market positioning, and growth potential.

In recent quarters, Raymond James has shown robust earnings growth, driven by a combination of strong client demand and effective management strategies. The firm has successfully navigated the complexities of the financial landscape, capitalizing on opportunities in wealth management and capital markets. This adaptability has not only bolstered its revenue streams but has also enhanced its reputation among investors and clients alike. As a result, Citi’s analysts have recognized the firm’s ability to maintain a strong performance trajectory, prompting the upward revision of the price target.

Moreover, the broader economic environment has played a significant role in shaping Citi’s assessment. With interest rates remaining relatively stable and the economy showing signs of recovery, financial institutions like Raymond James are well-positioned to benefit from increased client activity and investment flows. The firm’s diversified business model, which includes wealth management, investment banking, and asset management, allows it to mitigate risks associated with market volatility. This diversification is a key factor that has contributed to Citi’s confidence in Raymond James’ future performance.

Additionally, the firm has made strategic investments in technology and infrastructure, enhancing its operational efficiency and client service capabilities. These investments are expected to yield long-term benefits, enabling Raymond James to attract and retain clients in an increasingly digital world. As financial services continue to evolve, firms that prioritize innovation and client engagement are likely to gain a competitive edge. Citi’s analysts have taken note of these developments, further justifying the increase in the price target.

Furthermore, the competitive landscape within the financial services sector cannot be overlooked. Raymond James has established itself as a formidable player, consistently outperforming many of its peers. The firm’s commitment to client-centric solutions and its strong brand reputation have positioned it favorably in the eyes of investors. As other firms struggle to adapt to changing market conditions, Raymond James’ proactive approach has set it apart, reinforcing Citi’s positive outlook.

In conclusion, Citi’s decision to raise the price target for Raymond James from $145 to $170 is a reflection of the firm’s strong financial performance, strategic initiatives, and favorable market conditions. The increase underscores the confidence that analysts have in Raymond James’ ability to navigate the complexities of the financial landscape while continuing to deliver value to its clients and shareholders. As the firm moves forward, it will be essential to monitor its progress and the broader economic factors that may influence its trajectory. However, the current outlook suggests that Raymond James is well-equipped to capitalize on emerging opportunities, making it a compelling prospect for investors.

Impact of Citi’s Price Target Increase on Raymond James Stock

Citi’s recent decision to increase its price target for Raymond James from $145 to $170 has significant implications for the financial services firm and its investors. This upward revision reflects Citi’s positive outlook on Raymond James’ performance, driven by a combination of strong fundamentals and favorable market conditions. As analysts and investors digest this news, it is essential to consider the potential impact on Raymond James’ stock price and overall market perception.

Firstly, an increase in the price target often serves as a signal of confidence from analysts regarding a company’s future performance. In this case, Citi’s adjustment suggests that the firm anticipates continued growth and profitability for Raymond James. This optimistic outlook may encourage both current and prospective investors to reassess their positions in the stock. As a result, we could see an influx of buying activity, which would likely drive the stock price higher in the short term. The market tends to react positively to such news, as it reinforces the belief that the company is on a solid growth trajectory.

Moreover, the increase in the price target can also enhance Raymond James’ credibility within the financial sector. When a reputable institution like Citi raises its expectations for a company’s stock, it can attract attention from institutional investors who may have previously been hesitant to invest. This newfound interest can lead to increased trading volume and liquidity, further bolstering the stock’s performance. Consequently, as more investors become aware of the positive sentiment surrounding Raymond James, the stock may experience upward momentum, creating a self-reinforcing cycle of demand.

In addition to the immediate effects on stock price, Citi’s price target increase may also have longer-term implications for Raymond James’ strategic initiatives. With a higher valuation in mind, the company may feel more empowered to pursue growth opportunities, such as acquisitions or investments in technology and infrastructure. This could enhance its competitive position in the market, allowing it to better serve clients and expand its offerings. As Raymond James continues to innovate and adapt to changing market dynamics, the potential for sustained growth becomes increasingly plausible.

Furthermore, the broader economic environment plays a crucial role in shaping investor sentiment. As interest rates stabilize and economic indicators show signs of recovery, financial services firms like Raymond James stand to benefit from increased client activity and investment flows. Citi’s revised price target aligns with this positive economic backdrop, suggesting that the firm is well-positioned to capitalize on emerging opportunities. This alignment may further bolster investor confidence, as they perceive Raymond James as a resilient player in a recovering market.

In conclusion, Citi’s decision to raise its price target for Raymond James from $145 to $170 is a significant development that could have far-reaching effects on the company’s stock performance and market perception. The increase signals confidence in Raymond James’ growth potential, which may attract new investors and enhance the firm’s credibility. Additionally, it could empower the company to pursue strategic initiatives that further solidify its competitive position. As the market responds to this news, the interplay between investor sentiment, economic conditions, and Raymond James’ strategic direction will be critical in determining the stock’s trajectory in the coming months.

Key Factors Behind Citi’s Decision to Raise Raymond James Price Target

Citi’s recent decision to raise the price target for Raymond James from $145 to $170 reflects a strategic assessment of the financial services firm’s growth potential and market positioning. This adjustment is not merely a numerical revision; it is rooted in a comprehensive analysis of various factors that indicate a promising trajectory for Raymond James. One of the primary considerations influencing Citi’s decision is the robust performance of the firm in the face of a challenging economic environment. Despite fluctuations in the market, Raymond James has demonstrated resilience, showcasing its ability to adapt and thrive. This adaptability is particularly evident in its wealth management segment, which has consistently attracted new clients and retained existing ones, thereby bolstering its revenue streams.

Moreover, the firm’s diversified business model plays a crucial role in its stability and growth prospects. By operating across multiple segments, including investment banking, asset management, and capital markets, Raymond James mitigates risks associated with reliance on any single revenue source. This diversification not only enhances the firm’s overall financial health but also positions it favorably against competitors who may be more vulnerable to market volatility. As Citi analysts evaluated these dynamics, they recognized that the firm’s strategic initiatives, such as expanding its footprint in key markets and enhancing its technological capabilities, further solidify its competitive edge.

In addition to these operational strengths, the macroeconomic landscape has also shifted in ways that favor Raymond James. With interest rates stabilizing and economic indicators suggesting a gradual recovery, the environment for financial services is becoming increasingly conducive to growth. Citi’s analysts noted that as consumer confidence rises, so too does the demand for investment and wealth management services. This trend is expected to benefit Raymond James significantly, as it is well-positioned to capture a larger share of the market. Furthermore, the firm’s commitment to providing personalized client service and innovative financial solutions aligns well with the evolving preferences of investors, particularly younger demographics who prioritize tailored advice and digital engagement.

Another key factor that contributed to Citi’s revised price target is the anticipated growth in earnings per share (EPS) for Raymond James. Analysts project that the firm will continue to experience strong earnings growth driven by both organic expansion and strategic acquisitions. This expectation is underpinned by the firm’s historical performance, which has consistently outpaced industry averages. As such, Citi’s analysts believe that the upward revision of the price target reflects not only the current performance but also the future potential of Raymond James as it capitalizes on emerging opportunities in the financial services sector.

In conclusion, Citi’s decision to increase the price target for Raymond James to $170 is a reflection of a multifaceted analysis that considers the firm’s operational strengths, market positioning, and favorable economic conditions. By recognizing the resilience and adaptability of Raymond James, along with its diversified business model and growth potential, Citi has positioned itself to provide investors with a more optimistic outlook on the firm’s future. As the financial landscape continues to evolve, Raymond James appears well-equipped to navigate the challenges and seize the opportunities that lie ahead, making it a compelling prospect for investors.

Market Reactions to Citi’s Revised Price Target for Raymond James

Citi’s recent decision to raise its price target for Raymond James from $145 to $170 has sparked considerable interest in the financial markets, prompting a range of reactions from investors and analysts alike. This adjustment reflects Citi’s positive outlook on Raymond James’ performance, driven by a combination of strong earnings potential and favorable market conditions. As investors digest this news, it is essential to understand the implications of such a revision and how it may influence market sentiment.

The increase in the price target signifies Citi’s confidence in Raymond James’ ability to navigate the current economic landscape effectively. Analysts at Citi have pointed to several key factors that underpin this optimistic assessment. For instance, the firm has demonstrated resilience in its wealth management and capital markets segments, which have been bolstered by a robust demand for financial advisory services. This demand is particularly noteworthy in the context of ongoing market volatility, as clients increasingly seek guidance to optimize their investment strategies. Consequently, the enhanced price target reflects not only the firm’s historical performance but also its potential for future growth.

Moreover, the broader economic environment plays a crucial role in shaping investor perceptions. With interest rates remaining relatively low and the stock market showing signs of recovery, financial institutions like Raymond James are well-positioned to capitalize on these favorable conditions. As a result, the upward revision of the price target aligns with a growing consensus among analysts that the financial sector is poised for a rebound. This sentiment is further reinforced by Raymond James’ strategic initiatives aimed at expanding its market share and enhancing operational efficiency.

In light of Citi’s revised price target, market reactions have been largely positive. Investors have responded with enthusiasm, as evidenced by a noticeable uptick in Raymond James’ stock price following the announcement. This surge reflects a broader trend in which investors are increasingly willing to embrace equities in the financial sector, driven by the prospect of higher returns. Additionally, the positive sentiment surrounding Raymond James may encourage other analysts to reassess their own price targets, potentially leading to a ripple effect across the industry.

However, it is essential to approach this optimism with a degree of caution. While Citi’s revised price target is undoubtedly a vote of confidence, market dynamics can be unpredictable. Factors such as geopolitical tensions, regulatory changes, and shifts in consumer behavior could impact Raymond James’ performance in unforeseen ways. Therefore, investors are advised to remain vigilant and consider a range of scenarios when evaluating their investment strategies.

In conclusion, Citi’s decision to increase the price target for Raymond James from $145 to $170 has generated significant interest and positive market reactions. This revision underscores the firm’s strong performance and potential for growth in a favorable economic environment. As investors respond to this news, it is crucial to remain aware of the broader market dynamics that could influence future performance. Ultimately, while the revised price target reflects a positive outlook, prudent investors will continue to monitor developments closely, ensuring that their strategies remain aligned with the evolving landscape of the financial markets.

Comparing Citi’s Price Target with Other Analysts’ Predictions for Raymond James

Citi’s recent decision to raise its price target for Raymond James from $145 to $170 has sparked considerable interest among investors and analysts alike. This adjustment reflects Citi’s confidence in Raymond James’ growth potential and its ability to navigate the complexities of the financial services landscape. As investors seek to understand the implications of this revised target, it is essential to compare Citi’s outlook with those of other analysts who cover Raymond James.

To begin with, it is important to note that Citi’s new price target represents a significant endorsement of Raymond James’ business model and strategic initiatives. Analysts at other firms have also expressed optimism about the company’s prospects, albeit with varying price targets. For instance, some analysts have set their targets in the range of $150 to $160, indicating a more conservative approach compared to Citi’s bullish stance. This divergence in price targets can be attributed to differing assessments of market conditions, competitive pressures, and the overall economic environment.

Moreover, while Citi’s target suggests a robust upside potential, it is crucial to consider the broader consensus among analysts. The average price target for Raymond James, as compiled from various research reports, hovers around $155. This average reflects a more tempered view, taking into account potential risks that could impact the company’s performance. Analysts who maintain a cautious outlook often cite factors such as regulatory challenges, market volatility, and the potential for economic downturns as reasons for their conservative estimates.

In addition to the varying price targets, analysts also differ in their ratings for Raymond James. While Citi has maintained a positive rating, other firms have issued hold or neutral ratings, suggesting that they believe the stock is fairly valued at current levels. This disparity in ratings highlights the complexity of the financial services sector and the challenges analysts face in making predictions. As such, investors should consider these differing perspectives when evaluating their investment strategies.

Furthermore, it is essential to recognize that price targets are not static; they evolve as new information becomes available. For instance, if Raymond James were to report stronger-than-expected earnings or announce a strategic acquisition, it could prompt analysts to revise their targets upward. Conversely, any negative developments, such as regulatory scrutiny or disappointing financial results, could lead to downward revisions. Therefore, while Citi’s increased price target is a positive signal, it is vital for investors to remain vigilant and responsive to changing market dynamics.

In conclusion, Citi’s decision to raise its price target for Raymond James to $170 underscores a strong belief in the company’s future growth. However, this optimistic outlook must be viewed in the context of other analysts’ predictions, which vary in both price targets and ratings. As investors navigate this landscape, they should consider the broader consensus while remaining aware of the inherent uncertainties in the financial markets. Ultimately, a well-rounded approach that incorporates multiple viewpoints will enable investors to make informed decisions regarding their investments in Raymond James.

Implications of Citi’s Price Target Change for Investors in Raymond James

Citi’s recent decision to increase its price target for Raymond James from $145 to $170 carries significant implications for investors in the financial services sector. This upward revision reflects a positive outlook on the company’s performance and suggests that analysts at Citi have identified strong growth potential within Raymond James. As investors seek to navigate the complexities of the market, understanding the factors behind this price target change is crucial for making informed decisions.

Firstly, the increase in the price target indicates a growing confidence in Raymond James’ ability to generate revenue and manage expenses effectively. Analysts often base their price targets on a combination of financial metrics, market conditions, and company-specific developments. In this case, Citi’s adjustment may be influenced by recent earnings reports that showcase robust financial health, including increased net income and a solid return on equity. Such indicators not only bolster investor confidence but also suggest that the company is well-positioned to capitalize on favorable market trends.

Moreover, the financial services industry is currently experiencing a period of transformation, driven by technological advancements and changing consumer preferences. Raymond James has been proactive in adapting to these shifts, investing in digital platforms and enhancing its service offerings. This strategic focus on innovation is likely to resonate with investors, as it positions the company to attract a broader client base and improve operational efficiency. Consequently, Citi’s revised price target may reflect an acknowledgment of these strategic initiatives, which could lead to sustained growth in the coming years.

In addition to operational improvements, the broader economic environment plays a pivotal role in shaping investor sentiment. With interest rates fluctuating and inflationary pressures persisting, financial institutions are navigating a complex landscape. However, Raymond James has demonstrated resilience in such conditions, leveraging its diversified business model to mitigate risks. This adaptability is essential for maintaining investor trust, and Citi’s price target adjustment may signal that analysts believe the company will continue to thrive despite external challenges.

Furthermore, the increase in the price target could attract new investors who are seeking opportunities in the financial sector. As the market becomes more competitive, a higher price target often serves as a signal of potential upside, prompting both institutional and retail investors to reassess their portfolios. This influx of interest can lead to increased trading volume and potentially drive the stock price higher, creating a positive feedback loop that benefits existing shareholders.

It is also important to consider the implications of this price target change on Raymond James’ management and strategic direction. A higher price target may encourage the company’s leadership to pursue aggressive growth strategies, including mergers and acquisitions or further investments in technology. Such initiatives could enhance the company’s market position and create additional value for shareholders. Therefore, investors should remain vigilant and monitor how management responds to this positive analyst sentiment.

In conclusion, Citi’s decision to raise its price target for Raymond James from $145 to $170 reflects a strong belief in the company’s growth potential and operational resilience. For investors, this change serves as a critical indicator of market confidence and may influence their investment strategies moving forward. By understanding the underlying factors driving this adjustment, investors can better position themselves to capitalize on the opportunities that lie ahead in the evolving financial landscape.

Future Outlook for Raymond James Following Citi’s Price Target Adjustment

Citi’s recent adjustment of the price target for Raymond James from $145 to $170 marks a significant shift in the financial outlook for the firm, reflecting a growing confidence in its operational performance and market positioning. This upward revision not only underscores the potential for enhanced shareholder value but also indicates a broader recognition of the company’s strategic initiatives and resilience in a competitive landscape. As investors and analysts digest this news, it is essential to consider the implications of this price target adjustment on Raymond James’ future prospects.

One of the primary factors contributing to Citi’s revised price target is the robust performance of Raymond James in recent quarters. The firm has demonstrated a consistent ability to generate strong revenue growth, driven by its diverse business segments, including wealth management, capital markets, and asset management. This diversification has allowed Raymond James to mitigate risks associated with market volatility, thereby enhancing its overall stability. Furthermore, the firm’s commitment to investing in technology and innovation has positioned it well to capitalize on emerging trends in the financial services industry, such as digital transformation and client-centric solutions.

In addition to its operational strengths, Raymond James has also benefited from favorable market conditions. The ongoing recovery in the economy, coupled with rising interest rates, has created a conducive environment for financial institutions. As clients seek guidance in navigating these changes, Raymond James’ experienced advisors are well-equipped to provide tailored solutions, thereby reinforcing client loyalty and driving further growth. This positive momentum is likely to continue, as the firm remains focused on expanding its client base and enhancing its service offerings.

Moreover, the strategic acquisitions made by Raymond James in recent years have played a crucial role in bolstering its market position. By integrating complementary businesses, the firm has not only expanded its geographic reach but also enhanced its capabilities in key areas such as investment banking and wealth management. These acquisitions have proven to be accretive to earnings, further justifying Citi’s optimistic outlook. As Raymond James continues to pursue growth opportunities, it is expected that these strategic moves will yield significant returns, contributing to the overall increase in the price target.

Looking ahead, the outlook for Raymond James appears promising, particularly in light of the firm’s proactive approach to addressing potential challenges. The financial services industry is not without its uncertainties, including regulatory changes and economic fluctuations. However, Raymond James has demonstrated a remarkable ability to adapt to evolving market conditions. By maintaining a strong capital position and a disciplined risk management framework, the firm is well-prepared to navigate any headwinds that may arise.

In conclusion, Citi’s decision to raise the price target for Raymond James reflects a positive assessment of the firm’s future prospects. With its strong operational performance, strategic acquisitions, and commitment to innovation, Raymond James is poised for continued growth in the coming years. As the firm capitalizes on favorable market conditions and enhances its service offerings, investors can remain optimistic about the potential for increased shareholder value. Ultimately, this price target adjustment serves as a testament to the confidence in Raymond James’ ability to thrive in an ever-evolving financial landscape.

Q&A

1. **What is the new price target set by Citi for Raymond James?**

– $170

2. **What was the previous price target for Raymond James before the increase?**

– $145

3. **What is the reason for Citi’s increase in the price target?**

– The increase is likely based on improved financial performance or market conditions, though specific reasons may vary.

4. **How does this price target change reflect on Raymond James’ stock performance?**

– It suggests a positive outlook and potential for growth in the stock’s value.

5. **What does a price target indicate for investors?**

– It provides a forecast of the stock’s expected price movement and can guide investment decisions.

6. **Is a price target of $170 considered bullish or bearish?**

– It is considered bullish, indicating optimism about the company’s future performance.

7. **When was the price target increase announced?**

– The specific date of the announcement would need to be referenced from the original report or news source.

Conclusion

Citi’s increase of Raymond James’ price target to $170 from $145 reflects a positive outlook on the company’s performance and growth potential, indicating confidence in its financial stability and market position. This adjustment suggests that analysts anticipate stronger earnings or favorable market conditions that could drive the stock’s value higher.