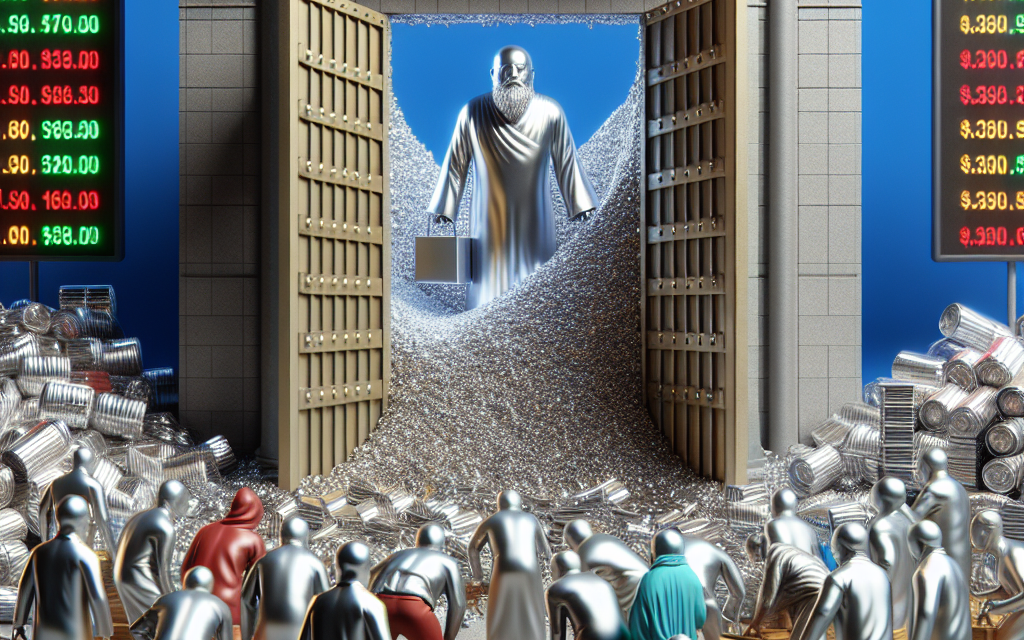

“China’s Export Curbs: Shaking the Aluminum Market and Spiking Prices Worldwide.”

Introduction

In recent months, China’s imposition of export restrictions has significantly disrupted the global aluminum market, leading to volatility in prices and supply chain uncertainties. As one of the world’s largest producers and exporters of aluminum, China’s policy shift has sent ripples across international markets, affecting industries reliant on this critical metal. The restrictions, aimed at conserving energy and reducing carbon emissions, have resulted in decreased aluminum exports, prompting concerns among manufacturers and traders about potential shortages and increased costs. This development underscores the intricate balance between environmental policy and global trade dynamics, highlighting the far-reaching impact of national regulations on international commodity markets.

Impact Of China’s Export Restrictions On Global Aluminum Supply Chain

China’s recent imposition of export restrictions on aluminum has sent ripples through the global supply chain, causing significant disruptions and price fluctuations. As the world’s largest producer and exporter of aluminum, China’s policy shift has profound implications for industries reliant on this versatile metal. The restrictions, primarily aimed at curbing energy consumption and reducing carbon emissions, have inadvertently created a ripple effect that extends far beyond its borders.

To understand the impact of these restrictions, it is essential to consider China’s dominant position in the aluminum market. Accounting for more than half of the world’s aluminum production, China plays a pivotal role in determining global supply and pricing dynamics. Consequently, any policy changes within China have immediate and far-reaching consequences for international markets. The recent export restrictions have led to a tightening of supply, which in turn has driven up prices, affecting manufacturers and consumers worldwide.

The rationale behind China’s decision to impose these restrictions is rooted in its commitment to achieving carbon neutrality by 2060. Aluminum production is an energy-intensive process, and China has been under increasing pressure to reduce its carbon footprint. By limiting exports, the Chinese government aims to control domestic production levels and encourage more sustainable practices within its borders. However, this well-intentioned move has inadvertently strained the global supply chain, highlighting the interconnectedness of modern economies.

As a result of these restrictions, countries heavily reliant on Chinese aluminum imports are now grappling with supply shortages. Industries such as automotive, aerospace, and construction, which depend on aluminum for its lightweight and durable properties, are particularly vulnerable. Manufacturers are facing increased costs as they scramble to secure alternative sources of aluminum, often at higher prices. This situation is exacerbated by the fact that other major aluminum-producing countries, such as Russia and India, are unable to fill the gap left by China’s reduced exports.

Moreover, the impact of China’s export restrictions extends beyond immediate supply shortages and price hikes. It has also prompted a reevaluation of global supply chain strategies. Companies are now considering diversifying their sources of aluminum to mitigate the risks associated with over-reliance on a single supplier. This shift could lead to increased investments in aluminum production facilities in other regions, potentially reshaping the global aluminum market in the long term.

In addition to supply chain adjustments, the current situation has sparked discussions about the need for greater sustainability in aluminum production. As countries and companies strive to reduce their carbon footprints, there is a growing emphasis on developing more energy-efficient and environmentally friendly production methods. This could drive innovation in recycling technologies and the use of alternative materials, further influencing the future landscape of the aluminum industry.

In conclusion, China’s export restrictions on aluminum have underscored the intricate web of dependencies that characterize the global supply chain. While the immediate effects are evident in supply shortages and rising prices, the long-term implications could lead to significant shifts in production strategies and sustainability practices. As the world navigates these challenges, the aluminum market will likely continue to evolve, shaped by the dual imperatives of economic resilience and environmental responsibility.

How China’s Policy Shifts Are Reshaping The Aluminum Market

China’s recent imposition of export restrictions on aluminum has sent ripples through the global market, causing significant disruptions and price fluctuations. As the world’s largest producer and consumer of aluminum, China’s policy shifts hold substantial sway over the international aluminum landscape. The decision to tighten export controls is primarily driven by the Chinese government’s commitment to reducing carbon emissions and achieving its environmental goals. This move aligns with China’s broader strategy to transition towards a more sustainable and environmentally friendly industrial sector. However, the implications of these restrictions extend far beyond China’s borders, affecting global supply chains and market dynamics.

The immediate impact of China’s export restrictions has been a noticeable increase in aluminum prices. With China accounting for more than half of the world’s aluminum production, any reduction in its export capacity creates a supply-demand imbalance. This imbalance has led to heightened competition among international buyers, driving prices upward. Consequently, industries reliant on aluminum, such as automotive, construction, and packaging, are experiencing increased production costs. These industries are now compelled to reassess their sourcing strategies and explore alternative suppliers to mitigate the impact of rising prices.

Moreover, China’s policy shift has prompted other aluminum-producing countries to adjust their production and export strategies. Nations such as Russia, India, and Canada, which are significant players in the aluminum market, are now presented with opportunities to fill the supply gap left by China. These countries are likely to ramp up their production and export activities to capitalize on the increased demand. However, this transition is not without challenges, as it requires substantial investments in infrastructure and technology to meet the quality and quantity demands of the global market.

In addition to affecting supply and demand dynamics, China’s export restrictions are also reshaping the competitive landscape of the aluminum industry. Companies that have traditionally relied on Chinese aluminum are now seeking to diversify their supply chains to reduce dependency on a single source. This shift is fostering innovation and collaboration among industry players as they explore new technologies and materials to enhance efficiency and sustainability. Furthermore, the restrictions are encouraging the development of recycling initiatives and the use of secondary aluminum, which is less energy-intensive to produce and aligns with global sustainability goals.

While China’s export restrictions pose challenges, they also present opportunities for the global aluminum market to evolve and adapt. The current situation underscores the importance of resilience and flexibility in supply chain management. Companies that can swiftly adjust to these changes are likely to gain a competitive edge in the evolving market landscape. Additionally, the emphasis on sustainability and environmental responsibility is expected to drive long-term growth and innovation in the industry.

In conclusion, China’s export restrictions on aluminum are reshaping the global market in profound ways. The resulting price fluctuations and supply chain disruptions highlight the interconnectedness of the global economy and the significant influence of policy decisions on international trade. As the world navigates these changes, the aluminum industry is poised for transformation, with new opportunities emerging for those willing to adapt and innovate. The ongoing developments in this sector will undoubtedly have far-reaching implications for industries and economies worldwide, underscoring the need for strategic planning and collaboration in addressing the challenges and opportunities that lie ahead.

Analyzing The Economic Consequences Of China’s Aluminum Export Limits

China’s recent imposition of export restrictions on aluminum has sent ripples through the global market, causing significant disruptions and price fluctuations. As the world’s largest producer and exporter of aluminum, China’s policy shift has profound implications for international trade and economic stability. The decision to limit exports is primarily driven by the Chinese government’s intent to prioritize domestic consumption and reduce carbon emissions, aligning with its broader environmental goals. However, this move has sparked a series of economic consequences that extend far beyond China’s borders.

To begin with, the immediate impact of China’s export restrictions is evident in the sharp increase in aluminum prices. As supply tightens, prices have surged, affecting industries reliant on this versatile metal. Aluminum is a critical component in various sectors, including automotive, aerospace, construction, and electronics. Consequently, the price hike has led to increased production costs, which are likely to be passed on to consumers, thereby contributing to inflationary pressures in many economies. This situation is exacerbated by the fact that alternative sources of aluminum are limited, as other major producers like Russia and India cannot fully compensate for the shortfall created by China’s reduced exports.

Moreover, the restrictions have prompted a reevaluation of supply chain strategies among global manufacturers. Companies are now compelled to seek alternative suppliers or invest in recycling and innovation to mitigate the impact of the aluminum shortage. This shift not only incurs additional costs but also requires time and resources to implement effectively. In the long term, these adjustments may lead to a more diversified and resilient supply chain, but the transition period is fraught with challenges and uncertainties.

In addition to affecting prices and supply chains, China’s export restrictions have geopolitical implications. Countries heavily dependent on Chinese aluminum imports are now exploring new trade partnerships and alliances to secure their supply needs. This realignment of trade relationships could alter the dynamics of global economic power, as nations seek to reduce their reliance on China and enhance their strategic autonomy. Furthermore, the restrictions may prompt other countries to impose similar measures on their exports, potentially leading to a wave of protectionism that could hinder global trade and economic growth.

On the environmental front, China’s decision to limit aluminum exports is part of its broader strategy to reduce carbon emissions and transition to a more sustainable economy. Aluminum production is energy-intensive and contributes significantly to greenhouse gas emissions. By curbing exports, China aims to control domestic production levels and encourage the adoption of cleaner technologies. While this is a positive step towards environmental sustainability, it also underscores the complex interplay between economic and environmental objectives. Balancing these priorities remains a formidable challenge for policymakers worldwide.

In conclusion, China’s aluminum export restrictions have set off a chain reaction of economic consequences that are reshaping the global market. The immediate effects are seen in rising prices and disrupted supply chains, while the longer-term implications involve shifts in trade relationships and geopolitical dynamics. As countries navigate these challenges, the need for innovative solutions and international cooperation becomes increasingly apparent. Ultimately, the situation highlights the interconnectedness of the global economy and the delicate balance between economic growth and environmental sustainability.

Strategies For Businesses To Navigate Aluminum Price Volatility

In recent months, China’s decision to impose export restrictions on aluminum has sent ripples through the global market, creating a wave of uncertainty and price volatility. As the world’s largest producer of aluminum, China’s policies significantly influence global supply chains, and businesses worldwide are now grappling with the implications of these restrictions. To navigate this challenging landscape, companies must adopt strategic approaches to mitigate risks associated with fluctuating aluminum prices.

Firstly, businesses should consider diversifying their supply sources. Relying heavily on a single supplier or country can expose companies to significant risks, especially when geopolitical or economic factors disrupt supply chains. By establishing relationships with multiple suppliers across different regions, businesses can reduce their dependency on any one source and ensure a more stable supply of aluminum. This diversification strategy not only helps in managing price volatility but also enhances the resilience of the supply chain against unforeseen disruptions.

In addition to diversifying supply sources, companies can also explore the use of financial instruments such as futures contracts and options to hedge against price fluctuations. These financial tools allow businesses to lock in prices for future purchases, providing a degree of certainty in budgeting and financial planning. By effectively utilizing these instruments, companies can protect themselves from sudden price spikes and maintain more predictable cost structures. However, it is crucial for businesses to thoroughly understand these financial products and seek expert advice to implement them effectively.

Moreover, investing in technology and innovation can play a pivotal role in navigating aluminum price volatility. By adopting advanced manufacturing techniques and materials science innovations, companies can improve the efficiency of aluminum usage and reduce waste. For instance, lightweighting initiatives in the automotive and aerospace industries not only decrease material costs but also enhance product performance. Additionally, exploring alternative materials that can substitute aluminum in certain applications may provide further cost savings and reduce exposure to price fluctuations.

Furthermore, fostering strong relationships with suppliers is essential in times of market uncertainty. Open communication and collaboration with suppliers can lead to mutually beneficial arrangements, such as long-term contracts with fixed pricing or volume commitments. These agreements can provide stability and predictability for both parties, allowing businesses to plan more effectively. Building trust and maintaining transparent communication channels with suppliers can also facilitate quicker responses to market changes and enable more agile decision-making.

Another strategy involves closely monitoring market trends and staying informed about geopolitical developments that could impact aluminum prices. By keeping abreast of industry news and economic indicators, businesses can anticipate potential disruptions and adjust their strategies accordingly. This proactive approach allows companies to make informed decisions and seize opportunities that may arise from market fluctuations.

Finally, businesses should consider enhancing their internal risk management frameworks to better cope with aluminum price volatility. This involves conducting regular risk assessments, scenario planning, and stress testing to identify vulnerabilities and develop contingency plans. By integrating risk management into their overall business strategy, companies can build resilience and ensure long-term sustainability in a volatile market environment.

In conclusion, China’s export restrictions on aluminum have underscored the importance of strategic planning and risk management for businesses operating in the global market. By diversifying supply sources, utilizing financial instruments, investing in technology, fostering supplier relationships, monitoring market trends, and enhancing risk management frameworks, companies can effectively navigate the challenges posed by aluminum price volatility. These strategies not only mitigate risks but also position businesses to capitalize on opportunities in an ever-evolving market landscape.

The Role Of Geopolitics In China’s Aluminum Export Decisions

China’s recent decision to impose export restrictions on aluminum has sent ripples through the global market, underscoring the significant role geopolitics plays in shaping trade dynamics. As the world’s largest producer and exporter of aluminum, China’s policies have far-reaching implications, affecting not only prices but also the strategic calculations of other nations. The move to restrict exports is not merely an economic decision but is deeply intertwined with geopolitical considerations, reflecting China’s broader strategic objectives on the global stage.

To understand the impact of these restrictions, it is essential to consider the geopolitical landscape in which China operates. The nation has been navigating a complex web of international relations, marked by trade tensions, technological competition, and regional security concerns. In this context, aluminum, a critical material for industries ranging from automotive to aerospace, becomes a tool of strategic leverage. By controlling the flow of this vital resource, China can exert influence over countries that rely heavily on its aluminum exports, thereby enhancing its geopolitical clout.

Moreover, China’s export restrictions can be seen as a response to external pressures, particularly from Western countries. In recent years, there has been a concerted effort by the United States and its allies to reduce dependency on Chinese materials, driven by concerns over supply chain vulnerabilities and national security. By limiting aluminum exports, China may be signaling its willingness to use economic means to counterbalance these efforts, asserting its position as a dominant player in the global market.

The implications of China’s export restrictions are multifaceted. On one hand, they have led to a surge in aluminum prices, as supply constraints create uncertainty and drive up costs. This price volatility poses challenges for industries worldwide, which must now grapple with increased production costs and potential disruptions in supply chains. On the other hand, the restrictions have prompted other countries to reassess their own strategies, potentially accelerating efforts to diversify sources of aluminum and invest in domestic production capabilities.

In addition to economic impacts, China’s export decisions have diplomatic ramifications. Countries affected by the restrictions may seek to engage in dialogue with China to negotiate more favorable terms or explore alternative trade partnerships. This could lead to a realignment of alliances and trade networks, as nations strive to secure stable and reliable access to essential materials. Furthermore, China’s actions may prompt international bodies to revisit trade agreements and regulations, aiming to address the challenges posed by such unilateral decisions.

As the situation unfolds, it is crucial to recognize that China’s export restrictions are not an isolated incident but part of a broader pattern of using economic tools to achieve geopolitical objectives. This approach reflects a strategic calculus that prioritizes long-term gains over short-term economic considerations, highlighting the intricate interplay between trade and geopolitics. For policymakers and industry leaders, understanding this dynamic is essential to navigating the complexities of the global aluminum market and mitigating the risks associated with geopolitical tensions.

In conclusion, China’s decision to impose export restrictions on aluminum underscores the profound influence of geopolitics on trade. As nations grapple with the consequences of these actions, it becomes increasingly clear that economic policies cannot be divorced from their geopolitical context. By examining the motivations and implications of China’s export decisions, stakeholders can better anticipate future developments and adapt to the evolving landscape of global trade.

Long-term Implications Of China’s Export Restrictions On The Aluminum Industry

China’s recent imposition of export restrictions on aluminum has sent ripples through the global market, raising concerns about the long-term implications for the aluminum industry. As the world’s largest producer and exporter of aluminum, China’s policy shift is poised to reshape the dynamics of supply and demand, with far-reaching consequences for producers, consumers, and economies worldwide. Understanding these implications requires a comprehensive examination of the factors driving China’s decision and the potential outcomes for the global aluminum market.

To begin with, China’s export restrictions are primarily motivated by its desire to reduce carbon emissions and promote sustainable development. The aluminum industry is notoriously energy-intensive, and China has been under increasing pressure to meet its environmental commitments. By curbing exports, China aims to limit domestic production, thereby reducing its carbon footprint. This move aligns with the country’s broader strategy to transition towards a greener economy. However, while these environmental goals are commendable, they introduce significant challenges for the global aluminum supply chain.

In the short term, China’s export restrictions have already led to a tightening of supply, driving up aluminum prices. This price surge is particularly concerning for industries heavily reliant on aluminum, such as automotive, aerospace, and construction. As these sectors grapple with increased costs, the ripple effects are likely to be felt across the global economy. Companies may face difficult decisions regarding pricing strategies, potentially passing on higher costs to consumers or absorbing them at the expense of profit margins. Consequently, the immediate impact of China’s policy is a heightened sense of uncertainty and volatility in the aluminum market.

Looking beyond the immediate effects, the long-term implications of China’s export restrictions are multifaceted. One potential outcome is the acceleration of efforts to diversify sources of aluminum supply. Countries heavily dependent on Chinese aluminum may seek to bolster domestic production or explore alternative suppliers. This shift could lead to increased investment in aluminum production facilities outside of China, fostering competition and innovation within the industry. However, establishing new production capacities is a time-consuming and capital-intensive process, and it remains to be seen whether other countries can effectively fill the void left by China’s reduced exports.

Moreover, China’s policy may catalyze advancements in aluminum recycling and the development of alternative materials. As industries face supply constraints and rising costs, there is likely to be a renewed focus on sustainability and resource efficiency. Recycling aluminum not only reduces the demand for primary production but also aligns with global efforts to minimize environmental impact. Additionally, research into alternative materials that can substitute for aluminum in various applications may gain momentum, potentially leading to breakthroughs that reshape the industry’s landscape.

In conclusion, China’s export restrictions on aluminum present a complex set of challenges and opportunities for the global aluminum industry. While the immediate impact is characterized by supply constraints and rising prices, the long-term implications are likely to be more nuanced. The industry’s response will be shaped by efforts to diversify supply sources, enhance recycling capabilities, and explore alternative materials. As stakeholders navigate this evolving landscape, collaboration and innovation will be key to ensuring a resilient and sustainable future for the aluminum industry. Ultimately, the global response to China’s policy will determine the trajectory of the aluminum market in the years to come.

Alternative Sources For Aluminum Amid China’s Export Constraints

China’s recent imposition of export restrictions on aluminum has sent ripples through the global market, prompting industry stakeholders to seek alternative sources to mitigate potential supply chain disruptions. As the world’s largest producer and exporter of aluminum, China’s policy shift has significant implications for industries reliant on this versatile metal. Consequently, countries and companies are exploring various strategies to secure a stable supply of aluminum, thereby ensuring the continuity of their operations.

One of the primary responses to China’s export constraints is the diversification of supply sources. Countries such as India, Russia, and Canada, which are also significant aluminum producers, are poised to fill the gap left by China’s reduced exports. India, in particular, has been ramping up its aluminum production capabilities, leveraging its abundant bauxite reserves and expanding its smelting capacity. This strategic move not only positions India as a key player in the global aluminum market but also provides a viable alternative for countries seeking to reduce their dependence on Chinese aluminum.

In addition to diversifying supply sources, there is a growing emphasis on recycling and the circular economy as a means to alleviate the pressure on primary aluminum production. Recycling aluminum is significantly less energy-intensive than producing new aluminum from raw materials, making it an attractive option both economically and environmentally. As a result, industries are increasingly investing in recycling infrastructure and technologies to enhance their capacity to process scrap aluminum. This shift not only helps in meeting the immediate demand but also contributes to long-term sustainability goals.

Furthermore, technological advancements in aluminum production are being explored to optimize efficiency and reduce reliance on traditional supply chains. Innovations such as inert anode technology, which reduces carbon emissions during the smelting process, are gaining traction. These advancements not only address environmental concerns but also offer the potential to increase production capacity in regions outside of China. By investing in such technologies, countries can enhance their self-sufficiency and resilience in the face of market fluctuations.

Moreover, strategic partnerships and trade agreements are being pursued to secure aluminum supplies. Countries are engaging in bilateral and multilateral negotiations to establish favorable trade terms and ensure a steady flow of aluminum. These agreements often include provisions for technology transfer and joint ventures, which can further bolster domestic production capabilities. By fostering international cooperation, countries can mitigate the risks associated with supply chain disruptions and create a more balanced global aluminum market.

While these strategies offer promising solutions, they also underscore the complexity of the global aluminum market and the challenges of reducing dependency on a single dominant supplier. The transition to alternative sources requires significant investment, time, and coordination among various stakeholders. However, the current situation presents an opportunity for countries to reassess their supply chain strategies and build more resilient and diversified networks.

In conclusion, China’s export restrictions on aluminum have catalyzed a global search for alternative sources, prompting countries to diversify their supply chains, invest in recycling, adopt new technologies, and forge strategic partnerships. These efforts not only aim to address immediate supply challenges but also contribute to a more sustainable and balanced global aluminum market. As the situation continues to evolve, the ability to adapt and innovate will be crucial in navigating the complexities of the aluminum industry and ensuring its long-term stability.

Q&A

1. **What are China’s export restrictions on aluminum?**

China has implemented export restrictions on certain aluminum products, including imposing tariffs and quotas, to control the outflow of raw materials and prioritize domestic industries.

2. **Why did China impose these export restrictions?**

The restrictions aim to ensure sufficient domestic supply, support local manufacturers, and enhance China’s strategic control over critical materials amid global supply chain tensions.

3. **How have these restrictions affected the global aluminum market?**

The restrictions have led to reduced global supply, causing disruptions in the aluminum market, increased prices, and heightened competition among international buyers.

4. **Which industries are most impacted by the aluminum export restrictions?**

Industries heavily reliant on aluminum, such as automotive, aerospace, and construction, are significantly impacted due to increased costs and supply chain challenges.

5. **What are the potential long-term effects of these restrictions on the global market?**

Long-term effects may include shifts in global supply chains, increased investment in alternative sources or materials, and potential trade tensions between China and other countries.

6. **How have other countries responded to China’s export restrictions?**

Some countries have sought to negotiate with China for exemptions, while others are exploring alternative suppliers or increasing domestic production to mitigate the impact.

7. **What impact have these restrictions had on aluminum prices?**

The restrictions have contributed to a rise in aluminum prices due to decreased supply and increased demand, affecting both producers and consumers globally.

Conclusion

China’s export restrictions on aluminum have significantly disrupted the global market, leading to increased prices and supply chain challenges. As one of the world’s largest producers and exporters of aluminum, China’s policy changes have created a ripple effect, impacting industries reliant on this critical metal. The restrictions have intensified competition for available supplies, driving up costs for manufacturers and potentially leading to increased prices for consumers. This situation underscores the interconnectedness of global trade and the substantial influence that policy decisions in one country can have on international markets. As stakeholders navigate these disruptions, there may be a push for diversification of supply sources and increased investment in alternative materials or technologies to mitigate future risks.