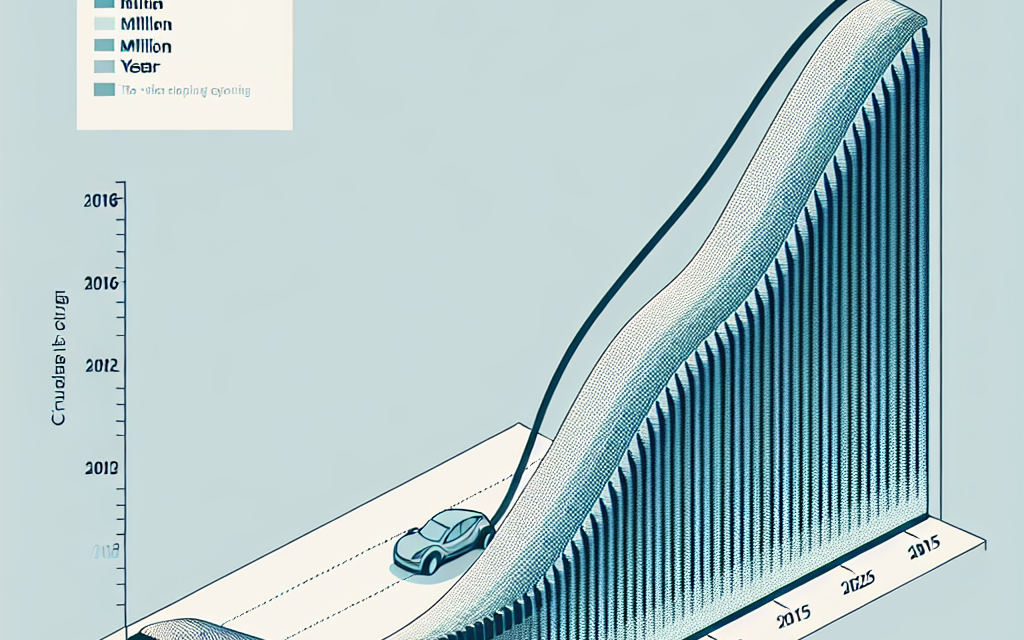

“China’s Electric Vehicle Exports: A Slowdown Ahead by 2025.”

Introduction

China’s electric vehicle (EV) exports, which have surged in recent years due to increasing global demand and competitive pricing, are projected to experience a slowdown by 2025. This anticipated deceleration is influenced by several factors, including tightening regulations in key markets, rising competition from domestic manufacturers in other countries, and potential shifts in consumer preferences. As the global EV landscape evolves, China’s dominance in the export market may face challenges, prompting a reevaluation of strategies among Chinese automakers. The interplay of these dynamics will significantly shape the future of China’s EV export trajectory.

China’s Electric Vehicle Export Trends

China has emerged as a dominant player in the global electric vehicle (EV) market, significantly influencing export trends over the past few years. The rapid growth of the Chinese EV industry can be attributed to a combination of government policies, technological advancements, and a burgeoning domestic market. However, as we look toward the future, particularly the year 2025, there are indications that the momentum of China’s EV exports may begin to slow down. This anticipated deceleration is influenced by several interrelated factors that merit careful consideration.

To begin with, the Chinese government has played a pivotal role in fostering the growth of the EV sector through substantial subsidies and incentives aimed at both manufacturers and consumers. These policies have not only stimulated domestic demand but have also positioned Chinese manufacturers as competitive players in international markets. Nevertheless, as the government gradually reduces these subsidies in response to the maturing market, the cost structure for manufacturers may shift, potentially impacting their pricing strategies and export capabilities. Consequently, this transition could lead to a decrease in the competitiveness of Chinese EVs abroad, particularly in regions where consumers are sensitive to price fluctuations.

Moreover, the global landscape for electric vehicles is evolving rapidly. As countries around the world ramp up their own EV production capabilities, competition is intensifying. Notably, European and American manufacturers are increasingly investing in electric vehicle technology and infrastructure, aiming to capture a larger share of the market. This surge in competition may pose challenges for Chinese exports, as consumers in key markets may gravitate toward locally produced vehicles that align with their preferences and values. As a result, the unique selling propositions that Chinese manufacturers have relied upon may become less effective, leading to a potential decline in export volumes.

In addition to competitive pressures, supply chain dynamics are also expected to play a crucial role in shaping China’s EV export trends. The COVID-19 pandemic has exposed vulnerabilities in global supply chains, particularly in the semiconductor industry, which is vital for EV production. As manufacturers worldwide strive to secure their supply chains, any disruptions or shortages could hinder the ability of Chinese companies to meet export demands. Furthermore, as countries increasingly prioritize local sourcing and production, the reliance on Chinese components may diminish, further constraining export opportunities.

Another factor to consider is the evolving regulatory landscape surrounding electric vehicles. As environmental concerns gain prominence, governments are implementing stricter emissions regulations and sustainability standards. While Chinese manufacturers have made significant strides in developing cleaner technologies, compliance with varying international standards can be complex and costly. This regulatory burden may deter some manufacturers from pursuing aggressive export strategies, thereby contributing to a slowdown in overall export growth.

In conclusion, while China’s electric vehicle industry has experienced remarkable growth and has established itself as a key player in the global market, the outlook for exports by 2025 appears to be shifting. The combination of reduced government support, increasing competition from international manufacturers, supply chain vulnerabilities, and evolving regulatory requirements suggests that the pace of Chinese EV exports may not sustain its previous trajectory. As the global market continues to evolve, stakeholders within the Chinese EV sector will need to adapt strategically to navigate these challenges and capitalize on emerging opportunities.

Factors Influencing EV Export Slowdown

As the global automotive landscape continues to evolve, China’s electric vehicle (EV) exports are anticipated to experience a notable slowdown by 2025. Several interrelated factors contribute to this expected deceleration, each playing a crucial role in shaping the future of China’s position in the international EV market. Understanding these influences is essential for stakeholders, policymakers, and industry analysts alike.

One of the primary factors affecting the slowdown is the increasing competition from other countries. As nations around the world ramp up their efforts to transition to electric mobility, countries such as the United States, Germany, and Japan are investing heavily in their own EV manufacturing capabilities. This surge in competition not only threatens China’s market share but also compels Chinese manufacturers to innovate continuously and improve their product offerings. Consequently, the pressure to maintain competitiveness may divert resources and focus away from export activities, leading to a potential decline in the volume of vehicles shipped abroad.

In addition to external competition, domestic market dynamics are also influencing China’s EV export trajectory. The Chinese government has implemented various policies aimed at promoting the adoption of electric vehicles within its borders. As a result, domestic demand for EVs is expected to rise significantly, driven by incentives such as subsidies, tax breaks, and investments in charging infrastructure. This growing domestic market may lead manufacturers to prioritize local sales over exports, as they seek to capitalize on the increasing consumer interest and government support. Consequently, the shift in focus towards domestic consumption could further contribute to a slowdown in export growth.

Moreover, supply chain challenges are another critical factor impacting China’s EV export potential. The global semiconductor shortage, which has plagued various industries, including automotive, has highlighted the vulnerabilities within supply chains. As manufacturers grapple with sourcing essential components, the ability to produce and export vehicles efficiently is compromised. This situation is exacerbated by geopolitical tensions and trade disputes, which can disrupt supply chains and create uncertainty for manufacturers. As a result, the cumulative effect of these challenges may hinder the capacity of Chinese EV producers to meet export demands, thereby contributing to a slowdown.

Furthermore, regulatory changes in key markets can also play a significant role in shaping China’s EV export landscape. As countries implement stricter emissions standards and safety regulations, Chinese manufacturers may face increased barriers to entry in these markets. Compliance with varying regulations can be both time-consuming and costly, potentially discouraging exports. Additionally, as consumer preferences evolve, there may be a growing demand for vehicles that align with local tastes and standards, further complicating the export process for Chinese manufacturers.

Lastly, the global economic environment cannot be overlooked when considering the factors influencing China’s EV export slowdown. Economic fluctuations, such as inflation and changes in consumer spending patterns, can impact the overall demand for vehicles, including electric models. A downturn in the global economy may lead to reduced consumer confidence and spending, which could adversely affect the demand for Chinese EVs abroad.

In conclusion, the anticipated slowdown in China’s electric vehicle exports by 2025 is influenced by a confluence of factors, including rising international competition, shifting domestic priorities, supply chain challenges, regulatory hurdles, and broader economic conditions. As these elements interact, they will shape the future of China’s EV industry and its role in the global market, necessitating strategic adaptations from manufacturers and policymakers alike.

Impact of Global Market Competition

As the global automotive landscape continues to evolve, the competition in the electric vehicle (EV) sector is intensifying, particularly for China, which has emerged as a dominant player in the market. However, projections indicate that China’s electric vehicle exports may experience a slowdown by 2025, primarily due to the increasing competition from other countries. This shift is not merely a reflection of market dynamics but also highlights the broader implications of global economic trends and technological advancements.

To begin with, the rise of electric vehicles has prompted numerous countries to invest heavily in their domestic EV industries. Nations such as the United States, Germany, and several others in Europe are ramping up their production capabilities, aiming to capture a larger share of the global market. This surge in competition is expected to challenge China’s current export dominance. As these countries enhance their technological capabilities and innovate in battery production and vehicle design, they are likely to offer consumers more choices, which could divert attention away from Chinese manufacturers.

Moreover, the geopolitical landscape plays a significant role in shaping the future of EV exports. Trade tensions and regulatory barriers can hinder China’s ability to penetrate certain markets. For instance, tariffs imposed by the United States on Chinese goods have already created obstacles for Chinese automakers seeking to expand their presence in North America. As countries adopt more stringent regulations regarding emissions and safety standards, Chinese manufacturers may find it increasingly difficult to comply with these requirements, further complicating their export strategies.

In addition to external competition and regulatory challenges, the domestic market in China itself is becoming increasingly saturated. With a growing number of local manufacturers entering the EV space, the competition within China is fierce. This saturation could lead to a scenario where companies focus more on domestic sales rather than exporting their vehicles abroad. As a result, the emphasis on local markets may inadvertently contribute to a decline in export volumes, as manufacturers prioritize meeting domestic demand over international expansion.

Furthermore, consumer preferences are shifting as well. As awareness of environmental issues grows, consumers are becoming more discerning about the brands they choose. This trend is particularly evident in markets outside of China, where consumers may favor local brands that align with their values and preferences. Consequently, Chinese manufacturers may struggle to establish brand loyalty in foreign markets, which could further impede their export ambitions.

In light of these factors, it is essential to consider the long-term implications for China’s electric vehicle industry. While the country has made significant strides in becoming a leader in EV production, the anticipated slowdown in exports by 2025 may necessitate a strategic reevaluation. Chinese manufacturers may need to invest in research and development to enhance their technological edge, as well as explore partnerships and collaborations with foreign companies to bolster their global presence.

In conclusion, the impact of global market competition on China’s electric vehicle exports is multifaceted and complex. As other countries ramp up their efforts to establish themselves in the EV sector, Chinese manufacturers face a myriad of challenges that could hinder their export growth. The interplay of domestic market saturation, evolving consumer preferences, and geopolitical factors will undoubtedly shape the future trajectory of China’s electric vehicle industry. As the landscape continues to shift, it remains to be seen how Chinese manufacturers will adapt to these changes and maintain their competitive edge in an increasingly crowded marketplace.

Government Policies Affecting Exports

As the global automotive landscape continues to evolve, China’s electric vehicle (EV) exports are poised to experience a significant slowdown by 2025, largely influenced by government policies. The Chinese government has been a driving force behind the rapid growth of the EV market, implementing a range of incentives and regulations aimed at promoting domestic production and consumption. However, as the market matures, these policies are expected to shift, potentially impacting the export dynamics of Chinese electric vehicles.

One of the primary factors contributing to the anticipated slowdown in exports is the Chinese government’s focus on fostering a robust domestic market. In recent years, the government has introduced various subsidies and incentives to encourage consumers to purchase electric vehicles, thereby boosting local demand. While this strategy has successfully increased domestic sales, it has also led to a reduction in the surplus of vehicles available for export. As the government continues to prioritize local consumption, manufacturers may find themselves with less capacity to allocate vehicles for international markets.

Moreover, the Chinese government is increasingly emphasizing the importance of technological innovation and quality standards within the EV sector. As part of this initiative, stricter regulations are being implemented to ensure that vehicles meet specific safety and environmental standards. While these measures are essential for enhancing the overall quality of Chinese electric vehicles, they may inadvertently create barriers for exports. Manufacturers may face challenges in adapting their production processes to comply with these new regulations, which could lead to delays and increased costs, ultimately affecting their competitiveness in the global market.

In addition to domestic market focus and regulatory changes, geopolitical tensions and trade policies are also playing a crucial role in shaping the future of China’s EV exports. As countries around the world reassess their trade relationships, tariffs and trade barriers may be imposed, complicating the export landscape for Chinese manufacturers. For instance, the ongoing trade disputes between China and the United States have already resulted in heightened scrutiny of Chinese products, including electric vehicles. This scrutiny could lead to increased tariffs or restrictions, making it more challenging for Chinese manufacturers to penetrate key markets.

Furthermore, as other countries ramp up their own EV production capabilities, competition in the global market is expected to intensify. Nations such as the United States and various European countries are investing heavily in their domestic EV industries, aiming to reduce reliance on foreign imports. This shift not only poses a challenge for Chinese manufacturers but also reflects a broader trend of localization in the automotive sector. As countries strive for self-sufficiency in EV production, the demand for Chinese exports may diminish, further contributing to the anticipated slowdown.

In conclusion, while China’s electric vehicle industry has experienced remarkable growth in recent years, a combination of government policies, regulatory changes, geopolitical factors, and increasing global competition is expected to slow down exports by 2025. As the Chinese government continues to prioritize domestic consumption and technological advancement, manufacturers may find themselves navigating a more complex landscape that could limit their ability to compete internationally. Consequently, the future of China’s electric vehicle exports will likely depend on how effectively manufacturers can adapt to these evolving conditions while maintaining their competitive edge in an increasingly crowded global market.

Technological Advancements in EV Production

As the global automotive industry continues to evolve, technological advancements in electric vehicle (EV) production play a pivotal role in shaping market dynamics. In recent years, China has emerged as a dominant player in the EV sector, leveraging its robust manufacturing capabilities and innovative technologies. However, as we look toward 2025, it is anticipated that the pace of China’s EV exports may experience a slowdown, influenced by various factors, including the maturation of technology and shifting market demands.

One of the key drivers of China’s initial success in EV production has been its significant investment in research and development. Chinese manufacturers have made substantial strides in battery technology, which is critical for enhancing the performance and range of electric vehicles. Innovations such as solid-state batteries and advancements in lithium-ion technology have not only improved energy density but also reduced charging times, making EVs more appealing to consumers. Nevertheless, as these technologies become more widely adopted, the competitive edge that China once held may begin to diminish, leading to a more level playing field among global manufacturers.

Moreover, the integration of artificial intelligence and automation in the production process has transformed the efficiency of EV manufacturing. Chinese companies have increasingly adopted smart manufacturing techniques, utilizing robotics and data analytics to streamline operations and reduce costs. This shift has allowed manufacturers to scale production rapidly, meeting the surging demand for electric vehicles both domestically and internationally. However, as other countries also invest in similar technologies, the unique advantage that China has enjoyed may start to wane, contributing to a potential slowdown in export growth.

In addition to technological advancements, regulatory changes and environmental considerations are also influencing the landscape of EV production. The Chinese government has implemented stringent emissions standards and incentives to promote the adoption of electric vehicles. While these policies have spurred domestic growth, they may also lead to increased scrutiny of exports. As international markets become more discerning regarding environmental impacts, Chinese manufacturers may face challenges in meeting diverse regulatory requirements, which could hinder their ability to export vehicles at the same pace as before.

Furthermore, the global supply chain dynamics are shifting, particularly in the wake of the COVID-19 pandemic. Disruptions in the supply chain have highlighted vulnerabilities in reliance on specific materials, such as lithium and cobalt, which are essential for battery production. As countries seek to secure their own supply chains and reduce dependency on foreign sources, Chinese manufacturers may encounter obstacles in sourcing critical components. This could lead to increased production costs and delays, ultimately affecting the volume of exports.

As we approach 2025, the interplay of these factors suggests that while China will continue to be a significant player in the EV market, the rapid growth of its exports may not sustain its previous trajectory. The maturation of technology, coupled with evolving regulatory landscapes and supply chain challenges, indicates a period of adjustment for Chinese manufacturers. Consequently, the focus may shift from aggressive export strategies to enhancing domestic capabilities and fostering innovation. In this context, the future of China’s electric vehicle exports will likely be characterized by a more measured approach, emphasizing quality and sustainability over sheer volume. As the global market for electric vehicles continues to expand, the ability of Chinese manufacturers to adapt to these changes will be crucial in determining their position in the international arena.

Consumer Demand Shifts in Key Markets

As the global automotive landscape continues to evolve, consumer demand in key markets is undergoing significant shifts, particularly concerning electric vehicles (EVs). This transformation is poised to impact China’s electric vehicle exports, which are expected to slow down by 2025. Understanding these changes requires an examination of the factors influencing consumer preferences and the broader implications for the automotive industry.

In recent years, the demand for electric vehicles has surged, driven by a growing awareness of environmental issues and the need for sustainable transportation solutions. However, as markets mature, consumer preferences are beginning to diversify. For instance, in Europe, where EV adoption has been robust, consumers are increasingly seeking vehicles that not only offer eco-friendly features but also align with their lifestyle choices. This shift is prompting manufacturers to innovate and adapt their offerings, focusing on aspects such as design, performance, and technology integration. Consequently, Chinese manufacturers, who have been at the forefront of EV production, may find themselves needing to recalibrate their strategies to meet these evolving consumer expectations.

Moreover, the competitive landscape is intensifying as traditional automakers ramp up their electric vehicle offerings. Established brands in Europe and North America are investing heavily in EV technology, aiming to capture market share and retain customer loyalty. This influx of competition is likely to challenge Chinese manufacturers, who have enjoyed a relatively unchallenged position in certain markets. As consumers become more discerning, they may gravitate towards brands with a long-standing reputation for quality and reliability, potentially impacting the demand for Chinese-made electric vehicles.

In addition to competition, regulatory changes in key markets are also influencing consumer behavior. Governments around the world are implementing stricter emissions regulations and offering incentives for electric vehicle purchases. However, these policies are not uniform, and variations in incentives can lead to fluctuations in consumer demand. For instance, if a country reduces its subsidies for electric vehicles, potential buyers may delay their purchases or opt for alternative fuel vehicles. Such regulatory shifts can create uncertainty in the market, making it challenging for Chinese manufacturers to predict future demand accurately.

Furthermore, the economic landscape plays a crucial role in shaping consumer preferences. Economic downturns or fluctuations can lead to a reassessment of spending priorities, with consumers potentially opting for more affordable options rather than premium electric vehicles. In this context, the price sensitivity of consumers becomes a critical factor. Chinese manufacturers, known for their competitive pricing, may find that their traditional advantages are eroded as consumers weigh the total cost of ownership against the benefits of investing in more established brands.

As we look ahead to 2025, it is clear that the interplay of these factors will significantly influence China’s electric vehicle exports. The anticipated slowdown is not merely a reflection of reduced demand but rather a complex response to shifting consumer preferences, increased competition, regulatory changes, and economic conditions. In this dynamic environment, Chinese manufacturers will need to remain agile, adapting their strategies to align with the evolving landscape of consumer demand. By doing so, they can position themselves to navigate the challenges ahead while continuing to contribute to the global transition towards sustainable transportation. Ultimately, the ability to understand and respond to these shifts will be crucial for maintaining competitiveness in an increasingly crowded market.

Future Projections for China’s EV Industry

As the global automotive landscape continues to evolve, China’s electric vehicle (EV) industry stands at a pivotal juncture, with projections indicating a potential slowdown in exports by 2025. This anticipated deceleration can be attributed to a confluence of factors, including market saturation, increased competition, and shifting consumer preferences both domestically and internationally. While China has established itself as a dominant player in the EV market, the future may present challenges that could reshape its export trajectory.

To begin with, the rapid growth of China’s EV sector has been remarkable, driven by substantial government support, technological advancements, and a burgeoning domestic market. However, as the initial wave of enthusiasm begins to wane, the saturation of the domestic market could lead to a decrease in export volumes. As more consumers in China opt for electric vehicles, the focus may shift from exporting to meeting local demand. This transition could result in manufacturers prioritizing domestic sales over international markets, thereby impacting export figures.

Moreover, the competitive landscape for electric vehicles is becoming increasingly crowded. Countries around the world are ramping up their own EV production capabilities, with significant investments being made in research and development. For instance, European and American automakers are intensifying their efforts to produce competitive electric models, which could erode China’s market share in key regions. As these manufacturers innovate and enhance their offerings, they may attract consumers who previously considered Chinese brands, leading to a potential decline in exports.

In addition to competition, regulatory changes and trade policies could further complicate China’s export ambitions. As nations implement stricter environmental regulations and tariffs on imported vehicles, Chinese manufacturers may face additional hurdles in accessing foreign markets. These barriers could deter potential buyers and complicate logistics, ultimately resulting in a slowdown of exports. Furthermore, geopolitical tensions may also play a role in shaping trade relationships, as countries reassess their reliance on foreign EVs amid concerns over supply chain vulnerabilities.

Transitioning to consumer preferences, it is essential to recognize that the global market for electric vehicles is evolving. As consumers become more discerning, they are increasingly seeking vehicles that not only meet their environmental needs but also align with their lifestyle and brand values. This shift may lead to a preference for established brands with a reputation for quality and reliability, which could disadvantage newer entrants from China. Consequently, if Chinese manufacturers do not adapt to these changing consumer expectations, they may struggle to maintain their export levels.

Despite these challenges, it is important to acknowledge that China’s EV industry is not without its strengths. The country continues to lead in battery technology and production, which remains a critical component of electric vehicles. Additionally, the Chinese government is likely to continue supporting the industry through subsidies and incentives, which could bolster domestic production and innovation. However, the focus may increasingly shift towards enhancing the quality and reputation of Chinese brands rather than solely pursuing export growth.

In conclusion, while China’s electric vehicle exports have experienced significant growth in recent years, projections for 2025 suggest a potential slowdown. Factors such as market saturation, heightened competition, regulatory challenges, and evolving consumer preferences are likely to influence this trend. As the industry navigates these complexities, it will be crucial for Chinese manufacturers to adapt and innovate in order to sustain their position in the global EV market.

Q&A

1. **Question:** What is the primary reason for the expected slowdown in China’s electric vehicle exports by 2025?

**Answer:** The primary reason is anticipated increased competition from domestic and international manufacturers, along with potential regulatory changes and market saturation.

2. **Question:** How has China’s electric vehicle export growth been characterized in recent years?

**Answer:** China’s electric vehicle export growth has been characterized by rapid expansion, driven by strong demand in global markets and significant investments in EV technology.

3. **Question:** Which markets are crucial for China’s electric vehicle exports?

**Answer:** Key markets include Europe, Southeast Asia, and North America, where demand for electric vehicles is rising.

4. **Question:** What impact might government policies have on China’s electric vehicle exports by 2025?

**Answer:** Government policies, such as subsidies and tariffs, could either support or hinder export growth, depending on how they are structured and implemented.

5. **Question:** How might advancements in technology influence China’s electric vehicle export trends?

**Answer:** Advancements in battery technology and autonomous driving features could enhance the competitiveness of Chinese EVs, but if other countries catch up, it may slow export growth.

6. **Question:** What role do consumer preferences play in the future of China’s electric vehicle exports?

**Answer:** Shifts in consumer preferences towards sustainability and brand loyalty may affect demand for Chinese EVs, potentially leading to a slowdown if local brands gain favor.

7. **Question:** What are the potential consequences for Chinese manufacturers if exports slow down?

**Answer:** If exports slow down, Chinese manufacturers may face overcapacity, reduced revenues, and increased pressure to innovate or pivot to domestic markets.

Conclusion

China’s electric vehicle exports are projected to slow down by 2025 due to increasing domestic competition, potential trade barriers, and a maturing global market. As local manufacturers focus on meeting domestic demand and enhancing technology, the rapid growth seen in previous years may stabilize. Additionally, geopolitical tensions and regulatory changes could further impact export dynamics, leading to a more cautious approach in international markets.