“Think Twice: The Unstoppable Stock That Demands a Second Look!”

Introduction

Investing in the stock market can be a lucrative endeavor, but it also comes with its share of risks and uncertainties. As investors seek opportunities to grow their wealth, certain stocks often capture attention due to their impressive performance and potential for future gains. However, before diving headfirst into what seems like an unstoppable stock, it’s crucial to exercise caution and conduct thorough research. This introduction explores the essential considerations and potential pitfalls that investors should be aware of before committing their hard-earned money to a stock that appears to be on an unstoppable upward trajectory. By understanding the underlying factors and market dynamics, investors can make informed decisions and mitigate risks, ensuring that their investment strategy aligns with their financial goals and risk tolerance.

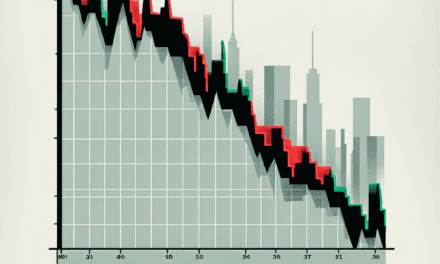

Understanding Market Volatility: Risks Involved with Unstoppable Stocks

Investing in the stock market has always been a venture fraught with both opportunities and risks. In recent years, the allure of so-called “unstoppable stocks” has captured the attention of many investors, promising substantial returns and seemingly endless growth. However, before diving headfirst into these enticing opportunities, it is crucial to understand the inherent market volatility and the risks associated with such investments.

Unstoppable stocks, often characterized by their rapid growth and strong market performance, can be incredibly appealing. They frequently belong to sectors experiencing significant innovation or disruption, such as technology or renewable energy. While these stocks can offer impressive returns, they are not immune to the fluctuations and unpredictability that define the stock market. Market volatility, a measure of how much the price of a security fluctuates over time, can significantly impact the value of these investments.

One of the primary risks associated with investing in unstoppable stocks is their susceptibility to market corrections. These corrections, which are declines of 10% or more in the price of a security or market index, can occur suddenly and without warning. For stocks that have experienced rapid growth, a market correction can lead to substantial losses, eroding the gains that initially attracted investors. Moreover, the higher the stock has climbed, the more pronounced the impact of a correction can be, leaving investors vulnerable to significant financial setbacks.

In addition to market corrections, unstoppable stocks are often subject to heightened levels of speculation. Speculative investments are driven more by market sentiment and investor behavior than by the underlying fundamentals of the company. This can lead to inflated stock prices that do not accurately reflect the company’s true value or potential for future growth. When the market eventually corrects itself, these inflated prices can plummet, resulting in considerable losses for investors who bought in at the peak.

Furthermore, the sectors in which unstoppable stocks typically reside are often characterized by rapid technological advancements and intense competition. While innovation can drive growth, it can also lead to obsolescence. Companies that fail to keep pace with technological changes or that are outmaneuvered by competitors may see their stock prices decline sharply. Investors must remain vigilant and informed about industry trends and the competitive landscape to mitigate these risks.

Another factor to consider is the potential for regulatory changes. Industries experiencing rapid growth and innovation often attract the attention of regulators, who may impose new rules or restrictions that can impact a company’s operations and profitability. For instance, technology companies may face increased scrutiny regarding data privacy, while renewable energy firms might encounter changes in government subsidies or environmental regulations. Such regulatory shifts can introduce additional volatility and uncertainty into the market, affecting the performance of unstoppable stocks.

In conclusion, while the allure of unstoppable stocks is undeniable, investors must approach these opportunities with caution and a thorough understanding of the associated risks. Market volatility, speculative behavior, technological advancements, and regulatory changes all contribute to the complex landscape in which these stocks operate. By remaining informed and adopting a strategic approach, investors can better navigate the challenges and uncertainties inherent in investing in unstoppable stocks, ultimately making more informed and prudent investment decisions.

Evaluating Company Fundamentals: A Key Step Before Investing

Investing in the stock market can be an exhilarating yet daunting endeavor, especially when faced with the allure of an “unstoppable” stock. While the potential for high returns is enticing, it is crucial to approach such investments with a discerning eye. One of the most important steps in this process is evaluating the company’s fundamentals. This involves a comprehensive analysis of various financial and operational aspects that can provide insights into the company’s true value and potential for sustainable growth.

To begin with, understanding a company’s financial health is paramount. This can be achieved by examining key financial statements such as the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of the company’s assets, liabilities, and shareholders’ equity at a given point in time. A strong balance sheet typically indicates a company with a solid financial foundation, characterized by manageable debt levels and sufficient assets to cover liabilities. Meanwhile, the income statement reveals the company’s profitability over a specific period, highlighting revenue, expenses, and net income. A consistent track record of revenue growth and profitability is often a positive indicator of a company’s operational efficiency and market competitiveness.

In addition to financial statements, it is essential to consider the company’s cash flow. The cash flow statement offers insights into how the company generates and utilizes cash, which is crucial for maintaining operations and funding future growth. Positive cash flow from operating activities suggests that the company can sustain its operations without relying heavily on external financing. This is particularly important for assessing the company’s ability to weather economic downturns or industry-specific challenges.

Beyond financial metrics, evaluating the company’s competitive position within its industry is equally important. This involves analyzing factors such as market share, competitive advantages, and barriers to entry. A company with a dominant market position or unique competitive advantages, such as proprietary technology or strong brand recognition, is often better positioned to capitalize on growth opportunities and fend off competitors. Furthermore, understanding the industry dynamics, including regulatory environment and potential disruptors, can provide valuable context for assessing the company’s long-term prospects.

Another critical aspect to consider is the quality of the company’s management team. Effective leadership can significantly influence a company’s strategic direction and operational execution. Evaluating the management’s track record, experience, and alignment with shareholder interests can offer insights into their ability to navigate challenges and drive sustainable growth. Additionally, transparency and communication with investors are indicative of a management team committed to maintaining trust and accountability.

While these fundamental factors provide a solid foundation for evaluating a company, it is also important to consider broader economic and market conditions. Macroeconomic trends, such as interest rates, inflation, and geopolitical events, can impact a company’s performance and valuation. Therefore, staying informed about these external factors can help investors make more informed decisions.

In conclusion, while the prospect of investing in an “unstoppable” stock is appealing, it is imperative to conduct a thorough evaluation of the company’s fundamentals. By analyzing financial health, competitive position, management quality, and external factors, investors can gain a deeper understanding of the company’s true potential. This disciplined approach not only mitigates risks but also enhances the likelihood of making sound investment decisions that align with one’s financial goals.

The Role of Economic Indicators in Stock Performance

When considering an investment in a seemingly unstoppable stock, it is crucial to examine the broader economic indicators that can significantly influence its performance. Economic indicators, which include metrics such as GDP growth, unemployment rates, inflation, and consumer confidence, provide valuable insights into the overall health of an economy. These indicators can serve as a barometer for potential stock performance, offering investors a more comprehensive understanding of the market environment in which a company operates.

To begin with, GDP growth is a fundamental economic indicator that reflects the economic activity within a country. A robust GDP growth rate often signals a thriving economy, which can lead to increased corporate profits and, consequently, higher stock prices. Conversely, a slowdown in GDP growth may indicate economic challenges that could adversely affect a company’s performance. Therefore, investors should closely monitor GDP trends to assess whether the economic environment is conducive to the growth of the stock in question.

In addition to GDP, unemployment rates are another critical indicator to consider. Low unemployment rates generally suggest a strong labor market, which can lead to higher consumer spending and increased demand for goods and services. This, in turn, can boost the revenues and profitability of companies, potentially driving up their stock prices. However, rising unemployment rates may signal economic distress, leading to reduced consumer spending and lower corporate earnings. As such, understanding the dynamics of the labor market can provide investors with valuable insights into the potential trajectory of a stock’s performance.

Moreover, inflation is an economic indicator that can have a profound impact on stock performance. Moderate inflation is often seen as a sign of a growing economy, as it can lead to higher revenues for companies. However, high inflation can erode purchasing power and increase costs for businesses, potentially squeezing profit margins and negatively affecting stock prices. Investors should be vigilant in monitoring inflation trends and consider how they might influence the financial health of the company they are interested in.

Consumer confidence is another vital indicator that can affect stock performance. High levels of consumer confidence typically indicate that individuals are optimistic about their financial prospects, leading to increased spending and investment. This can be beneficial for companies, as it may result in higher sales and improved profitability. On the other hand, declining consumer confidence can signal economic uncertainty, which may lead to reduced spending and negatively impact a company’s bottom line. By keeping an eye on consumer confidence levels, investors can gain insights into potential shifts in market sentiment that could influence stock performance.

In conclusion, while a stock may appear unstoppable based on its recent performance, it is essential for investors to consider the broader economic indicators that can impact its future trajectory. By analyzing GDP growth, unemployment rates, inflation, and consumer confidence, investors can gain a more nuanced understanding of the economic landscape and make more informed investment decisions. These indicators not only provide a snapshot of the current economic climate but also offer valuable foresight into potential challenges and opportunities that may arise. Therefore, a thorough examination of these economic indicators is indispensable for investors seeking to navigate the complexities of the stock market and make prudent investment choices.

Diversification: Why Relying on One Stock Can Be Risky

Investing in the stock market can be an exhilarating endeavor, especially when a particular stock appears to be on an unstoppable upward trajectory. However, before committing a significant portion of your portfolio to a single stock, it is crucial to consider the risks associated with such a concentrated investment strategy. Diversification, a fundamental principle in investing, serves as a safeguard against the inherent volatility and unpredictability of the market. By spreading investments across various assets, investors can mitigate potential losses and enhance the stability of their portfolios.

To begin with, relying heavily on one stock exposes investors to company-specific risks. These risks can stem from a variety of factors, including management decisions, competitive pressures, regulatory changes, or unforeseen events that could adversely affect the company’s performance. For instance, even a seemingly unstoppable stock can experience a sudden downturn if the company faces a scandal or a significant shift in market dynamics. In such cases, investors who have concentrated their investments in that single stock may find themselves facing substantial losses.

Moreover, market conditions can change rapidly, and what seems like a promising investment today may not hold the same potential tomorrow. Economic downturns, shifts in consumer preferences, or technological advancements can all impact a company’s prospects. By diversifying their portfolios, investors can better navigate these uncertainties. A well-diversified portfolio typically includes a mix of asset classes, such as stocks, bonds, and real estate, as well as investments in different sectors and geographic regions. This approach helps to balance the risks and rewards, ensuring that the performance of one asset does not disproportionately affect the overall portfolio.

In addition to reducing risk, diversification can also enhance returns over the long term. While it is true that a single stock may outperform the market in the short run, a diversified portfolio is more likely to achieve consistent returns over time. This is because different asset classes and sectors often perform differently under varying economic conditions. For example, when the stock market is experiencing a downturn, bonds or other fixed-income securities may provide stability and income. Similarly, international investments can offer exposure to growth opportunities in emerging markets, which may not be available in domestic markets.

Furthermore, diversification allows investors to take advantage of the benefits of compounding. By reinvesting dividends and capital gains from a diversified portfolio, investors can generate additional returns, which can significantly enhance the value of their investments over time. This compounding effect is less pronounced when investments are concentrated in a single stock, as the potential for reinvestment is limited to the performance of that one asset.

In conclusion, while the allure of investing in an unstoppable stock can be tempting, it is essential to recognize the risks associated with such a strategy. Diversification remains a cornerstone of prudent investing, offering a balanced approach that mitigates risks and enhances the potential for long-term returns. By spreading investments across a range of assets, investors can protect themselves from the uncertainties of the market and build a more resilient portfolio. Therefore, before placing all your bets on a single stock, consider the benefits of diversification and the peace of mind it can bring to your investment journey.

Analyzing Historical Performance: Lessons from Past Market Trends

When considering an investment in a stock that appears unstoppable, it is crucial to analyze its historical performance and draw lessons from past market trends. This approach not only provides a comprehensive understanding of the stock’s trajectory but also offers insights into potential future movements. By examining historical data, investors can identify patterns and anomalies that may influence their decision-making process.

To begin with, historical performance analysis involves scrutinizing a stock’s price movements over a significant period. This examination allows investors to discern trends, such as consistent growth, volatility, or periods of stagnation. For instance, a stock that has demonstrated steady growth over several years may suggest a robust business model and sound management practices. However, it is essential to consider the broader market context during these periods. Economic conditions, industry developments, and geopolitical events can all impact a stock’s performance, either positively or negatively.

Moreover, understanding past market trends can help investors anticipate potential risks and opportunities. For example, a stock that has weathered economic downturns with minimal impact may indicate resilience and a strong market position. Conversely, a stock that has experienced significant declines during market corrections might be more susceptible to external pressures. By identifying these patterns, investors can make more informed decisions about the stock’s potential to withstand future market fluctuations.

In addition to price trends, analyzing historical performance also involves evaluating key financial metrics. Metrics such as earnings per share (EPS), revenue growth, and return on equity (ROE) provide valuable insights into a company’s financial health and operational efficiency. A consistent increase in EPS and revenue growth may signal a company’s ability to expand its market share and generate profits. On the other hand, declining ROE could indicate inefficiencies or challenges in utilizing shareholder equity effectively. By examining these metrics over time, investors can assess whether a company’s financial performance aligns with its stock price movements.

Furthermore, historical performance analysis should not be limited to quantitative data alone. Qualitative factors, such as management changes, product innovations, and strategic partnerships, can also significantly influence a stock’s trajectory. For instance, a company that has consistently introduced innovative products or services may be better positioned to capture market opportunities and drive growth. Similarly, strategic partnerships or acquisitions can enhance a company’s competitive advantage and expand its market reach. By considering these qualitative factors, investors can gain a more holistic view of a stock’s potential.

While historical performance analysis provides valuable insights, it is important to recognize its limitations. Past performance is not always indicative of future results, and unforeseen events can disrupt even the most stable trends. Therefore, investors should use historical analysis as one component of a broader investment strategy, incorporating other factors such as current market conditions, industry outlook, and individual risk tolerance.

In conclusion, before investing in a seemingly unstoppable stock, it is essential to conduct a thorough analysis of its historical performance. By examining price trends, financial metrics, and qualitative factors, investors can gain a deeper understanding of the stock’s past behavior and potential future movements. This approach not only helps identify risks and opportunities but also enables investors to make more informed decisions in an ever-evolving market landscape.

The Impact of Regulatory Changes on Stock Value

Investing in the stock market often involves a careful analysis of various factors that can influence the value of a stock. One such critical factor is the impact of regulatory changes, which can significantly alter the landscape for companies and, consequently, their stock value. As investors consider putting their money into what appears to be an unstoppable stock, it is essential to understand how regulatory changes can affect its performance and future prospects.

Regulatory changes can come in many forms, including new laws, amendments to existing regulations, or shifts in policy priorities. These changes can be driven by a variety of factors, such as political shifts, economic conditions, or societal demands. For instance, a government may introduce stricter environmental regulations in response to growing concerns about climate change. While such regulations aim to address critical issues, they can also impose additional costs on companies, particularly those in industries heavily reliant on natural resources or energy consumption.

When a company faces new regulatory requirements, it may need to invest in new technologies, alter its production processes, or even change its business model to comply. These adjustments can lead to increased operational costs, which may, in turn, affect the company’s profitability and, ultimately, its stock value. For example, a company that must invest heavily in reducing its carbon emissions may see a temporary dip in profits as it allocates resources to meet these new standards. Consequently, investors might react by selling off shares, leading to a decline in stock value.

Moreover, regulatory changes can also create uncertainty in the market, as companies and investors alike try to anticipate the potential impacts of new rules. This uncertainty can lead to increased volatility in stock prices, as market participants adjust their expectations and strategies. In some cases, the mere anticipation of regulatory changes can cause stock prices to fluctuate, even before any official announcements are made. Therefore, investors must remain vigilant and informed about potential regulatory developments that could affect their investments.

On the other hand, regulatory changes can also present opportunities for certain companies, particularly those that are well-positioned to adapt or even benefit from the new landscape. For instance, companies that have already invested in sustainable practices may find themselves at a competitive advantage when new environmental regulations are introduced. These companies may experience increased demand for their products or services, leading to potential growth in their stock value. Thus, while regulatory changes can pose challenges, they can also create opportunities for savvy investors who can identify companies poised to thrive in the new environment.

In conclusion, while the allure of investing in an unstoppable stock can be tempting, it is crucial for investors to consider the potential impact of regulatory changes on stock value. By understanding how these changes can affect a company’s operations, profitability, and market position, investors can make more informed decisions and better manage the risks associated with their investments. As the regulatory landscape continues to evolve, staying informed and adaptable will be key to navigating the complexities of the stock market and achieving long-term investment success.

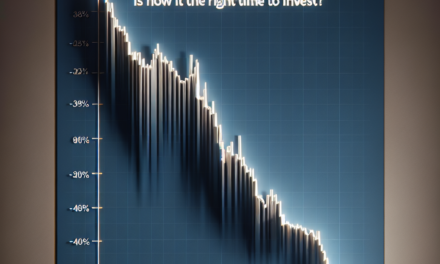

Emotional Investing: How to Avoid Making Impulsive Decisions

Investing in the stock market can be an exhilarating experience, especially when a particular stock is perceived as unstoppable. The allure of high returns and the excitement of being part of a success story can be tempting. However, it is crucial to approach such opportunities with caution and a clear mind. Emotional investing, driven by impulses rather than rational analysis, can lead to significant financial setbacks. Therefore, understanding how to avoid making impulsive decisions is essential for any investor aiming to achieve long-term success.

To begin with, it is important to recognize the emotional triggers that can influence investment decisions. Fear of missing out, commonly known as FOMO, is a powerful motivator that can lead investors to make hasty decisions. When a stock is rapidly gaining value, the fear of being left behind can push individuals to invest without conducting thorough research. This emotional response often results in buying at inflated prices, which can be detrimental when the market corrects itself. Thus, maintaining a disciplined approach and resisting the urge to follow the crowd is vital.

Moreover, it is essential to establish a well-defined investment strategy before entering the market. A clear plan, based on individual financial goals and risk tolerance, serves as a roadmap for making informed decisions. By setting specific criteria for buying and selling stocks, investors can mitigate the influence of emotions. For instance, determining a target price for selling a stock can prevent the temptation to hold on for too long in hopes of further gains. Similarly, setting a stop-loss order can limit potential losses by automatically selling a stock if it falls below a predetermined price. These strategies help in maintaining objectivity and reducing the impact of emotional biases.

In addition to having a strategy, conducting comprehensive research is paramount. Understanding the fundamentals of a company, such as its financial health, competitive position, and growth prospects, provides a solid foundation for making investment decisions. Relying solely on market trends or the opinions of others can lead to misguided choices. By analyzing a company’s earnings reports, balance sheets, and industry trends, investors can make informed judgments about its potential for long-term success. This analytical approach helps in distinguishing between a genuinely unstoppable stock and one that is merely experiencing temporary hype.

Furthermore, it is beneficial to cultivate patience and a long-term perspective. The stock market is inherently volatile, with prices fluctuating due to various factors. Reacting impulsively to short-term market movements can result in buying high and selling low, a common pitfall for emotional investors. Instead, focusing on the underlying value of an investment and its potential over time can lead to more rational decision-making. By adopting a long-term mindset, investors can weather market fluctuations and benefit from the compounding effect of their investments.

Lastly, seeking advice from financial professionals can provide valuable insights and help in maintaining objectivity. Financial advisors can offer guidance based on their expertise and experience, helping investors navigate the complexities of the market. By discussing investment strategies and potential risks with a professional, individuals can gain a broader perspective and make more informed decisions.

In conclusion, while the prospect of investing in an unstoppable stock is enticing, it is crucial to approach such opportunities with caution. By recognizing emotional triggers, establishing a clear investment strategy, conducting thorough research, maintaining patience, and seeking professional advice, investors can avoid making impulsive decisions. Ultimately, a disciplined and informed approach is key to achieving long-term success in the stock market.

Q&A

1. **What is the stock being referred to as “unstoppable”?**

– The specific stock is not mentioned; the term “unstoppable” is often used in financial articles to describe a stock with strong growth potential or momentum.

2. **What are the potential risks associated with investing in this stock?**

– Market volatility, overvaluation, regulatory changes, and company-specific issues such as management decisions or financial health.

3. **What factors contribute to the stock’s perceived unstoppable nature?**

– Strong financial performance, innovative products or services, market leadership, and positive industry trends.

4. **What should investors consider before investing in this stock?**

– Thorough research on the company’s fundamentals, understanding market conditions, assessing personal risk tolerance, and considering diversification.

5. **How can market conditions affect the performance of this stock?**

– Economic downturns, interest rate changes, and geopolitical events can impact stock performance negatively or positively.

6. **What role does company management play in the stock’s potential success?**

– Effective leadership, strategic decision-making, and transparent communication can drive company growth and investor confidence.

7. **What are some alternative investment strategies to consider?**

– Diversification across different sectors, investing in index funds or ETFs, and considering bonds or other asset classes for risk management.

Conclusion

Before investing in this seemingly unstoppable stock, it’s crucial to exercise caution by thoroughly evaluating the company’s financial health, market position, and growth potential. Consider the broader economic environment, potential risks, and the stock’s valuation relative to its peers. Diversification and a clear understanding of your investment goals and risk tolerance are essential to mitigate potential losses. Conducting comprehensive research and possibly consulting with a financial advisor can help ensure that your investment decision aligns with your long-term financial strategy.