-

Table of Contents

- Introduction

- Cash App Exec Teases Square Integration: What It Means for Users

- The Future of Digital Payments: Cash App and Square’s Potential Merger

- How Cash App’s Integration with Square Could Revolutionize Transactions

- Cash App and Square: A New Era of Seamless Financial Services

- Exploring the Benefits of Cash App’s Integration with Square

- Cash App Exec’s Hint: What Square Integration Could Look Like

- The Impact of Cash App and Square Integration on Small Businesses

- Cash App and Square: Bridging the Gap in Digital Finance

- What Users Can Expect from Cash App’s Potential Square Integration

- Cash App Exec’s Announcement: A Closer Look at Square Integration Plans

- Q&A

- Conclusion

“Unlock Seamless Transactions: Cash App and Square Unite for a Smarter Financial Future.”

Introduction

In recent developments within the financial technology sector, a Cash App executive has sparked significant interest by hinting at a potential integration with Square, the widely recognized payment processing platform. This potential collaboration could signify a strategic move to enhance user experience and streamline financial transactions across both platforms. As Cash App continues to expand its functionalities and user base, the prospect of integrating with Square could offer a seamless ecosystem for personal and business financial management, leveraging the strengths of both services. This anticipated integration is poised to not only bolster the capabilities of Cash App but also to reinforce Square’s position in the competitive fintech landscape, promising innovative solutions for users and merchants alike.

Cash App Exec Teases Square Integration: What It Means for Users

In a recent development that has captured the attention of financial technology enthusiasts, a Cash App executive has hinted at a potential integration with Square, a move that could significantly enhance the user experience for millions of individuals and businesses. This potential integration is poised to create a seamless ecosystem that bridges personal finance management with business transactions, offering a comprehensive suite of services under one umbrella. As the financial technology landscape continues to evolve, such integrations are becoming increasingly important, providing users with more streamlined and efficient ways to manage their financial activities.

Cash App, a popular mobile payment service developed by Block, Inc., formerly known as Square, Inc., has been at the forefront of digital payment solutions, offering users the ability to send and receive money with ease. On the other hand, Square has established itself as a leader in providing point-of-sale solutions and business management tools for merchants. The prospect of integrating these two platforms suggests a strategic move to leverage the strengths of both services, potentially creating a more cohesive experience for users who engage in both personal and business transactions.

The implications of this integration are manifold. For individual users, the merging of Cash App and Square could mean enhanced functionality and convenience. Users might soon be able to manage their personal finances and business transactions from a single platform, reducing the need to switch between different applications. This could lead to improved financial oversight, as users gain a more holistic view of their financial activities. Moreover, the integration could introduce new features that enhance the user experience, such as advanced analytics, budgeting tools, and personalized financial advice, all of which could empower users to make more informed financial decisions.

For businesses, particularly small and medium-sized enterprises, the integration of Cash App and Square could offer significant advantages. By combining the robust point-of-sale capabilities of Square with the user-friendly interface of Cash App, businesses could streamline their operations and improve customer engagement. This could lead to increased sales and customer satisfaction, as businesses are able to offer more flexible payment options and a more seamless checkout experience. Additionally, businesses could benefit from enhanced data insights, allowing them to better understand customer behavior and tailor their offerings accordingly.

Furthermore, the integration could foster greater financial inclusion by making digital payment solutions more accessible to a wider audience. As more individuals and businesses adopt these technologies, the barriers to entry for participating in the digital economy could be lowered, enabling more people to benefit from the convenience and efficiency of digital transactions. This aligns with the broader trend of democratizing financial services, ensuring that more people have access to the tools they need to manage their finances effectively.

In conclusion, the potential integration of Cash App and Square represents a significant step forward in the evolution of financial technology. By combining the strengths of both platforms, this integration could offer users a more comprehensive and seamless financial management experience. As the details of this integration continue to unfold, it will be interesting to see how it shapes the future of digital payments and financial services. Users and businesses alike stand to benefit from the enhanced functionality and convenience that such an integration promises, marking a new chapter in the ongoing transformation of the financial landscape.

The Future of Digital Payments: Cash App and Square’s Potential Merger

In the rapidly evolving landscape of digital payments, the potential integration of Cash App and Square has become a topic of significant interest. Recently, a Cash App executive hinted at the possibility of a merger between these two financial platforms, sparking discussions about the future of digital transactions. As the financial technology sector continues to expand, the integration of Cash App and Square could represent a pivotal moment in the industry, offering a seamless experience for users and businesses alike.

Cash App, a mobile payment service developed by Block, Inc., formerly known as Square, Inc., has gained immense popularity due to its user-friendly interface and versatile features. It allows users to send and receive money, invest in stocks, and even purchase Bitcoin. On the other hand, Square is renowned for its point-of-sale solutions, enabling businesses to process payments efficiently. The potential merger of these two platforms could create a comprehensive ecosystem that caters to both individual users and businesses, enhancing the overall digital payment experience.

One of the primary benefits of integrating Cash App and Square is the potential for increased convenience. By combining the functionalities of both platforms, users could enjoy a unified interface that simplifies financial transactions. For instance, individuals could seamlessly transfer funds between their personal accounts and business accounts, streamlining the process of managing finances. Moreover, businesses could benefit from enhanced payment processing capabilities, allowing them to accept a wider range of payment methods and improve customer satisfaction.

Furthermore, the integration could lead to the development of innovative financial products and services. By leveraging the strengths of both Cash App and Square, the merged platform could introduce new features that cater to the evolving needs of users. For example, enhanced data analytics could provide businesses with valuable insights into consumer behavior, enabling them to make informed decisions and optimize their operations. Additionally, the integration could facilitate the introduction of new investment opportunities, empowering users to diversify their portfolios and achieve their financial goals.

In addition to these advantages, the potential merger could also strengthen the security of digital transactions. As cyber threats continue to pose significant risks to the financial sector, the integration of Cash App and Square could lead to the implementation of robust security measures. By combining their resources and expertise, the platforms could develop advanced encryption technologies and fraud detection systems, ensuring that users’ financial information remains protected.

However, it is important to consider the challenges that may arise from such an integration. Merging two distinct platforms requires careful planning and execution to ensure a smooth transition. Technical complexities, such as system compatibility and data migration, must be addressed to prevent disruptions in service. Additionally, regulatory compliance is a critical consideration, as the merger would need to adhere to financial regulations and data protection laws.

Despite these challenges, the potential integration of Cash App and Square holds promise for the future of digital payments. As the financial technology sector continues to evolve, the merger could set a precedent for other companies seeking to enhance their offerings and remain competitive in the market. By providing a comprehensive and secure platform for users and businesses, the integration could redefine the digital payment landscape and pave the way for further innovation in the industry. As discussions around this potential merger continue, stakeholders and users alike will be keenly observing the developments, eager to see how this integration could shape the future of financial transactions.

How Cash App’s Integration with Square Could Revolutionize Transactions

In recent developments within the financial technology sector, a Cash App executive has hinted at a potential integration with Square, a move that could significantly transform the landscape of digital transactions. This potential integration is poised to create a seamless ecosystem for users, enhancing the way individuals and businesses manage their financial activities. As both Cash App and Square are products of Block, Inc., formerly known as Square, Inc., the synergy between these platforms could lead to a more cohesive user experience, offering a multitude of benefits for both consumers and merchants.

Cash App, known for its user-friendly interface and peer-to-peer payment capabilities, has rapidly gained popularity among individuals seeking a convenient way to manage their finances. On the other hand, Square has established itself as a robust platform for businesses, providing tools for point-of-sale transactions, inventory management, and analytics. By integrating these two platforms, Block, Inc. could potentially offer a comprehensive solution that caters to both personal and business financial needs, thereby streamlining operations and enhancing efficiency.

One of the primary advantages of this integration would be the unification of user accounts. Currently, individuals and businesses using both Cash App and Square must manage separate accounts, which can be cumbersome and time-consuming. A unified account system would allow users to access all their financial data in one place, simplifying the process of tracking expenses, managing income, and analyzing financial trends. This streamlined approach could lead to improved financial literacy and better decision-making for users.

Moreover, the integration could facilitate a more seamless transaction process for businesses. With Cash App’s peer-to-peer payment capabilities combined with Square’s point-of-sale solutions, businesses could offer customers a wider range of payment options, enhancing the overall customer experience. This could be particularly beneficial for small businesses and entrepreneurs who rely on flexible payment solutions to accommodate diverse customer preferences. Additionally, the integration could enable businesses to leverage Cash App’s growing user base, potentially expanding their reach and increasing sales.

Furthermore, the potential integration could lead to enhanced security measures. Both Cash App and Square have invested heavily in security protocols to protect user data and prevent fraudulent activities. By combining their resources and expertise, Block, Inc. could develop even more robust security features, providing users with greater peace of mind when conducting transactions. This heightened security could also foster increased trust among users, encouraging more individuals and businesses to adopt these platforms for their financial needs.

In addition to these benefits, the integration could pave the way for innovative financial products and services. By leveraging the data and insights gained from both Cash App and Square, Block, Inc. could develop new offerings tailored to the evolving needs of their users. This could include personalized financial advice, targeted marketing campaigns, and customized product recommendations, all of which could enhance user engagement and satisfaction.

In conclusion, the potential integration of Cash App with Square represents a significant opportunity to revolutionize the way transactions are conducted. By creating a unified platform that caters to both personal and business financial needs, Block, Inc. could streamline operations, enhance security, and foster innovation. As the financial technology landscape continues to evolve, this integration could set a new standard for digital transactions, ultimately benefiting users and businesses alike.

Cash App and Square: A New Era of Seamless Financial Services

In a recent development that has captured the attention of the financial technology sector, a Cash App executive has hinted at a potential integration with Square, marking a significant step towards creating a more unified financial ecosystem. This potential integration could herald a new era of seamless financial services, offering users an enhanced experience by combining the strengths of both platforms. As the financial landscape continues to evolve, the integration of Cash App and Square could provide a more comprehensive suite of services, catering to both individual users and businesses.

Cash App, known for its user-friendly interface and peer-to-peer payment capabilities, has gained immense popularity among consumers seeking a convenient way to manage their finances. On the other hand, Square has established itself as a formidable player in the business sector, offering a range of services from point-of-sale systems to business analytics. By integrating these two platforms, users could benefit from a more cohesive experience, bridging the gap between personal finance management and business transactions.

The potential integration could also streamline operations for businesses that rely on both Cash App and Square. For instance, small business owners who use Square for their point-of-sale transactions could seamlessly transfer funds to their Cash App accounts, simplifying the process of managing their finances. This would not only save time but also reduce the complexity associated with handling multiple financial platforms. Moreover, the integration could enhance the analytical capabilities available to businesses, providing them with deeper insights into consumer behavior and financial trends.

Furthermore, this move could position the combined platform as a formidable competitor in the financial technology space, challenging other major players by offering a more comprehensive range of services. As the demand for digital financial solutions continues to grow, the integration of Cash App and Square could attract a broader user base, appealing to both tech-savvy consumers and traditional users seeking a more streamlined approach to managing their finances.

In addition to the potential benefits for users and businesses, the integration could also have significant implications for the financial technology industry as a whole. By setting a precedent for collaboration between different financial platforms, this move could encourage other companies to explore similar partnerships, fostering innovation and competition within the sector. This could ultimately lead to the development of more advanced financial solutions, benefiting consumers and businesses alike.

However, it is important to consider the challenges that may arise from such an integration. Ensuring the security and privacy of user data will be paramount, as the merging of two platforms could potentially expose vulnerabilities. Additionally, the integration process itself may present technical challenges, requiring careful planning and execution to ensure a smooth transition for users.

In conclusion, the hint of a potential integration between Cash App and Square represents an exciting opportunity to redefine the landscape of financial services. By combining the strengths of both platforms, users could enjoy a more seamless and comprehensive experience, while businesses could benefit from enhanced operational efficiency and analytical capabilities. As the financial technology sector continues to evolve, this integration could serve as a catalyst for further innovation and collaboration, ultimately shaping the future of digital finance.

Exploring the Benefits of Cash App’s Integration with Square

The recent announcement by a Cash App executive hinting at a potential integration with Square has sparked considerable interest in the financial technology sector. This development, if realized, could signify a transformative shift in how digital payments and financial services are delivered to consumers and businesses alike. As both Cash App and Square are products of Block, Inc., formerly known as Square, Inc., the integration seems not only feasible but also strategically advantageous. By examining the potential benefits of this integration, one can appreciate the broader implications for users and the financial technology landscape.

To begin with, the integration of Cash App with Square could streamline financial transactions for users by creating a more cohesive ecosystem. Cash App, known for its user-friendly interface and peer-to-peer payment capabilities, has gained significant popularity among individual users. On the other hand, Square has established itself as a robust platform for businesses, offering point-of-sale solutions, payment processing, and business analytics. By merging these two platforms, users could experience a seamless transition between personal and business transactions, thereby enhancing user experience and satisfaction.

Moreover, this integration could lead to increased efficiency and cost savings for businesses. Currently, businesses using Square must manage separate systems for personal and business transactions if they also use Cash App. An integrated platform would eliminate the need for multiple accounts and systems, reducing administrative overhead and simplifying financial management. This could be particularly beneficial for small to medium-sized enterprises (SMEs), which often operate with limited resources and could greatly benefit from streamlined operations.

In addition to operational efficiencies, the integration could also foster innovation in financial services. By combining the technological capabilities of both platforms, Block, Inc. could develop new features and services that leverage the strengths of each. For instance, businesses could gain access to enhanced data analytics tools that draw from both personal and business transaction data, providing deeper insights into consumer behavior and market trends. This could enable businesses to make more informed decisions and tailor their offerings to better meet customer needs.

Furthermore, the integration could expand the reach of both Cash App and Square, attracting a broader user base. As digital payments continue to grow in popularity, offering a comprehensive solution that caters to both individual and business needs could position Block, Inc. as a leader in the financial technology space. This could also lead to increased adoption of digital payment solutions, as users and businesses seek out platforms that offer convenience, efficiency, and innovation.

While the potential benefits of integrating Cash App with Square are significant, it is important to consider the challenges that may arise. Ensuring data security and privacy will be paramount, as the integration would involve handling sensitive financial information across platforms. Additionally, maintaining the distinct brand identities and user experiences of both Cash App and Square will be crucial to retaining their respective user bases.

In conclusion, the hinted integration of Cash App with Square presents a promising opportunity to enhance the delivery of digital financial services. By creating a unified platform that caters to both personal and business needs, Block, Inc. could drive innovation, efficiency, and growth in the financial technology sector. As the industry continues to evolve, such integrations may become increasingly common, reshaping the way individuals and businesses manage their financial transactions.

Cash App Exec’s Hint: What Square Integration Could Look Like

In recent developments within the financial technology sector, a Cash App executive has hinted at a potential integration with Square, sparking considerable interest and speculation among industry analysts and users alike. This potential integration could signify a strategic move to enhance user experience and streamline financial transactions across platforms. As both Cash App and Square are under the umbrella of Block, Inc., formerly known as Square, Inc., the integration seems not only feasible but also a logical step towards creating a more cohesive ecosystem for users.

Cash App, known for its user-friendly interface and seamless peer-to-peer payment capabilities, has garnered a substantial user base since its inception. Meanwhile, Square has established itself as a formidable player in the payment processing industry, particularly among small to medium-sized businesses. The integration of these two platforms could potentially offer a more comprehensive suite of services, thereby attracting a broader audience and increasing user engagement.

One of the primary benefits of such an integration would be the unification of financial services, allowing users to manage personal and business transactions within a single platform. This could lead to enhanced efficiency, as users would no longer need to switch between different applications to handle various financial tasks. Moreover, the integration could facilitate a more seamless flow of funds between personal and business accounts, thereby simplifying the financial management process for entrepreneurs and small business owners.

Furthermore, the integration could pave the way for innovative features that leverage the strengths of both platforms. For instance, Square’s robust point-of-sale systems could be complemented by Cash App’s mobile payment solutions, offering businesses a more versatile and adaptable payment infrastructure. Additionally, the integration could enable the development of new financial products and services, such as integrated lending solutions or advanced analytics tools, which could provide users with deeper insights into their financial health and business performance.

Another potential advantage of this integration is the enhancement of security measures. By consolidating resources and expertise, Cash App and Square could implement more sophisticated security protocols, thereby safeguarding user data and transactions more effectively. This would not only bolster user confidence but also position the integrated platform as a leader in secure financial technology solutions.

However, it is important to consider the challenges that may arise from such an integration. Merging two distinct platforms requires careful planning and execution to ensure a smooth transition for users. There may be technical hurdles to overcome, such as ensuring compatibility between different systems and maintaining the reliability and speed of transactions. Additionally, user education and support will be crucial to help users navigate the new integrated platform and fully leverage its capabilities.

In conclusion, the hint of a potential integration between Cash App and Square presents exciting possibilities for the future of financial technology. By combining their strengths, these platforms could offer a more comprehensive and efficient solution for both personal and business financial management. While challenges remain, the potential benefits of such an integration are significant, promising to enhance user experience and drive innovation in the industry. As the financial technology landscape continues to evolve, the integration of Cash App and Square could serve as a model for future collaborations, setting a new standard for seamless and secure financial services.

The Impact of Cash App and Square Integration on Small Businesses

The recent hint by a Cash App executive regarding a potential integration with Square has sparked considerable interest among small business owners and financial analysts alike. This development, if realized, could significantly alter the landscape of digital payments and financial management for small enterprises. Cash App, a mobile payment service developed by Block, Inc., formerly known as Square, has already established itself as a formidable player in the peer-to-peer payment space. Meanwhile, Square has been a pioneer in providing point-of-sale solutions and financial services to small businesses. The integration of these two platforms could create a seamless ecosystem that enhances operational efficiency and customer experience for small businesses.

To begin with, the integration could streamline payment processes for small businesses. Currently, many small enterprises use Square for in-person transactions and Cash App for online or peer-to-peer payments. By merging these platforms, businesses could manage all transactions through a single interface, reducing the complexity and time associated with handling multiple payment systems. This unified approach could also minimize errors and discrepancies in financial records, thereby improving accuracy in bookkeeping and financial reporting.

Moreover, the integration could offer small businesses enhanced data analytics capabilities. Both Cash App and Square collect valuable transaction data that can provide insights into consumer behavior and sales trends. By combining these data sets, businesses could gain a more comprehensive understanding of their operations and customer preferences. This, in turn, could inform strategic decisions such as inventory management, marketing campaigns, and customer engagement strategies. Enhanced data analytics could also help businesses identify new opportunities for growth and expansion.

In addition to operational benefits, the integration could also enhance the customer experience. A unified platform could offer customers more payment options and greater flexibility in how they choose to pay. For instance, customers could seamlessly switch between using Cash App for online purchases and Square for in-store transactions, all while enjoying a consistent and user-friendly experience. This could lead to increased customer satisfaction and loyalty, as businesses would be better equipped to meet the diverse payment preferences of their clientele.

Furthermore, the integration could facilitate access to financial services for small businesses. Square has already made strides in offering financial products such as loans and credit facilities to small enterprises. By integrating with Cash App, these services could be expanded and made more accessible to a broader range of businesses. This could be particularly beneficial for small businesses that may struggle to secure financing through traditional banking channels. Access to capital is often a critical factor in the growth and sustainability of small enterprises, and the integration could provide a much-needed boost in this regard.

However, it is important to consider potential challenges that may arise from this integration. Data security and privacy concerns are paramount, as the merging of platforms would involve the handling of sensitive financial information. Ensuring robust security measures and compliance with regulatory standards would be essential to maintain trust among users. Additionally, the integration process itself could be complex and require significant resources and time to implement effectively.

In conclusion, the potential integration of Cash App and Square holds promising implications for small businesses. By streamlining payment processes, enhancing data analytics, improving customer experience, and expanding access to financial services, this development could provide small enterprises with valuable tools to thrive in an increasingly competitive market. Nevertheless, careful consideration of security and implementation challenges will be crucial to realizing the full benefits of this integration. As the situation unfolds, small businesses and industry stakeholders will be keenly observing the impact of this potential game-changer in the digital payments landscape.

Cash App and Square: Bridging the Gap in Digital Finance

In the ever-evolving landscape of digital finance, the integration of platforms has become a pivotal strategy for enhancing user experience and expanding service offerings. Recently, a Cash App executive hinted at a potential integration with Square, a move that could significantly bridge the gap between these two financial services. This development is poised to reshape the way users interact with digital financial tools, offering a more seamless and comprehensive experience.

Cash App, a mobile payment service developed by Block, Inc., formerly known as Square, Inc., has gained immense popularity due to its user-friendly interface and versatile features. It allows users to send and receive money, invest in stocks, and even purchase Bitcoin. On the other hand, Square is renowned for its robust point-of-sale systems and financial services tailored for businesses. The potential integration of these platforms could create a unified ecosystem that leverages the strengths of both, thereby enhancing their value proposition to users.

The hint of integration comes at a time when the demand for cohesive digital financial solutions is at an all-time high. Consumers and businesses alike are seeking platforms that not only offer diverse functionalities but also ensure a seamless transition between personal and business financial management. By integrating Cash App with Square, users could potentially enjoy a more streamlined experience, where personal transactions and business operations coexist within a single platform. This could eliminate the need for multiple applications, thereby simplifying financial management for users.

Moreover, the integration could foster greater financial inclusivity. Cash App has been instrumental in providing financial services to underbanked populations, offering an accessible entry point into the digital economy. By aligning with Square’s business-oriented services, there is potential to extend these benefits to small businesses and entrepreneurs who may lack access to traditional banking services. This could empower a new wave of business owners, providing them with the tools necessary to thrive in a competitive market.

Furthermore, the integration could enhance data analytics capabilities, offering users deeper insights into their financial habits. By combining Cash App’s personal finance data with Square’s business analytics, users could gain a holistic view of their financial health. This could enable more informed decision-making, allowing individuals and businesses to optimize their financial strategies.

However, the integration is not without its challenges. Ensuring data security and privacy will be paramount, as the merging of platforms could potentially expose sensitive information to greater risks. It will be crucial for Block, Inc. to implement robust security measures to protect user data and maintain trust. Additionally, the integration process must be executed with precision to avoid disruptions in service and ensure a smooth transition for users.

In conclusion, the potential integration of Cash App and Square represents a significant step forward in the digital finance sector. By bridging the gap between personal and business financial services, this move could offer users a more comprehensive and seamless experience. While challenges remain, the benefits of such an integration could be far-reaching, fostering financial inclusivity and empowering users with enhanced tools for managing their finances. As the digital finance landscape continues to evolve, the integration of Cash App and Square could set a new standard for what users expect from their financial platforms.

What Users Can Expect from Cash App’s Potential Square Integration

In recent developments, a Cash App executive has hinted at a potential integration with Square, sparking considerable interest among users and industry observers alike. This potential merger of functionalities could herald a new era of convenience and efficiency for users of both platforms. As these two financial services giants explore the possibilities of integration, users can anticipate a range of enhancements that could significantly streamline their financial transactions.

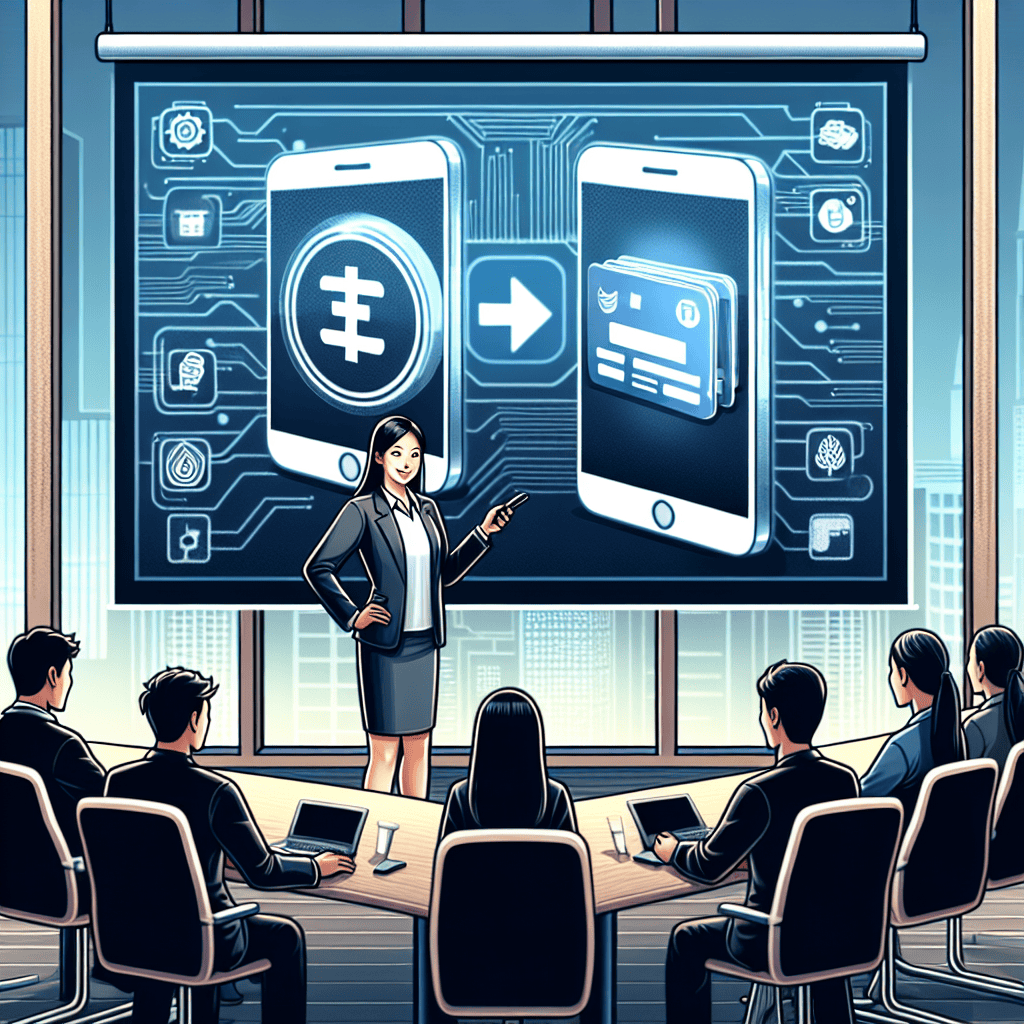

To begin with, the integration of Cash App with Square could lead to a more seamless user experience. Currently, users who utilize both platforms must navigate separate interfaces and manage distinct accounts. By merging these services, users could benefit from a unified platform that simplifies financial management. This could mean a single login for both services, allowing users to access their funds, make payments, and manage transactions without the need to switch between apps. Such a streamlined approach would not only save time but also reduce the complexity associated with managing multiple financial accounts.

Moreover, the integration could enhance the functionality of both platforms. Cash App, known for its peer-to-peer payment capabilities, and Square, renowned for its point-of-sale solutions, could together offer a comprehensive suite of financial services. For instance, small business owners who use Square for transactions could easily transfer funds to their Cash App accounts, facilitating smoother cash flow management. This could be particularly beneficial for entrepreneurs and freelancers who require efficient financial tools to manage their business operations.

In addition to improved functionality, users can also expect enhanced security features as a result of this integration. Both Cash App and Square have robust security measures in place, and a combined platform could leverage the strengths of each to offer even greater protection for users’ financial data. This could include advanced encryption technologies, multi-factor authentication, and real-time fraud detection systems. As cyber threats continue to evolve, the integration of these platforms could provide users with peace of mind, knowing that their financial information is safeguarded by state-of-the-art security protocols.

Furthermore, the potential integration could lead to innovative financial products and services. By combining their resources and expertise, Cash App and Square could develop new offerings that cater to the diverse needs of their user base. This might include personalized financial advice, investment opportunities, or even new credit products tailored to individual user profiles. Such innovations could empower users to make more informed financial decisions and achieve their financial goals more effectively.

While the prospect of integration is exciting, it is important to note that such a transition would require careful planning and execution. Both companies would need to address potential challenges, such as ensuring compatibility between their systems and maintaining service reliability during the integration process. However, given the track record of both Cash App and Square in delivering user-centric solutions, there is reason to be optimistic about the potential benefits of this integration.

In conclusion, the hinted integration between Cash App and Square holds significant promise for users. By offering a more seamless user experience, enhanced functionality, improved security, and innovative financial products, this potential merger could redefine the way users interact with their financial services. As the industry awaits further developments, users can look forward to a future where managing their finances is more convenient and efficient than ever before.

Cash App Exec’s Announcement: A Closer Look at Square Integration Plans

In a recent development that has captured the attention of financial technology enthusiasts and industry analysts alike, a Cash App executive has hinted at a potential integration with Square, sparking widespread speculation about the future of these two prominent platforms. This announcement, while not entirely unexpected given the shared parent company, Block, Inc., has nonetheless ignited discussions about the implications of such a move for users and the broader fintech landscape.

Cash App, known for its user-friendly interface and seamless peer-to-peer payment capabilities, has grown exponentially since its inception. It has become a staple for millions of users who appreciate its simplicity and efficiency in handling everyday transactions. On the other hand, Square has established itself as a formidable player in the payment processing industry, particularly among small to medium-sized businesses. Its suite of services, ranging from point-of-sale systems to business analytics, has empowered countless entrepreneurs to streamline their operations and enhance customer experiences.

The potential integration of Cash App with Square could signify a strategic alignment aimed at leveraging the strengths of both platforms. By combining Cash App’s robust consumer base with Square’s comprehensive business solutions, Block, Inc. could create a more cohesive ecosystem that caters to both individual users and businesses. This integration could facilitate a seamless flow of transactions between consumers and merchants, thereby enhancing the overall user experience.

Moreover, the integration could pave the way for innovative features that capitalize on the synergies between the two platforms. For instance, users might benefit from enhanced financial tools that offer insights into spending habits, savings goals, and investment opportunities. Businesses, in turn, could gain access to a broader customer base and more sophisticated payment solutions, potentially driving growth and profitability.

However, while the prospects of such an integration are promising, it is essential to consider the challenges that may arise. Merging two distinct platforms requires careful planning and execution to ensure a smooth transition for users. Technical hurdles, such as data migration and system compatibility, must be addressed to prevent disruptions. Additionally, maintaining user trust and privacy will be paramount, as any perceived compromise could have significant repercussions.

Furthermore, regulatory considerations cannot be overlooked. The financial technology sector is subject to stringent regulations designed to protect consumers and ensure fair competition. Any integration efforts must comply with these regulations to avoid potential legal pitfalls. This necessitates a thorough understanding of the regulatory landscape and proactive engagement with relevant authorities.

In conclusion, the hint of a Cash App and Square integration presents an exciting opportunity for Block, Inc. to redefine the boundaries of financial technology. By harnessing the strengths of both platforms, the company could offer a more comprehensive and integrated solution that meets the evolving needs of users and businesses alike. While challenges undoubtedly exist, the potential benefits of such an integration are substantial, promising to enhance user experiences and drive innovation in the fintech space. As the industry awaits further details, the anticipation surrounding this development underscores the dynamic nature of financial technology and its capacity to transform the way we manage and interact with money.

Q&A

1. **Question:** What is Cash App?

**Answer:** Cash App is a mobile payment service developed by Block, Inc. (formerly Square, Inc.) that allows users to transfer money to one another using a mobile phone app.

2. **Question:** Who is the parent company of Cash App?

**Answer:** The parent company of Cash App is Block, Inc., formerly known as Square, Inc.

3. **Question:** What recent hint did a Cash App executive give regarding integration?

**Answer:** A Cash App executive hinted at potential integration with Square’s broader ecosystem, suggesting deeper connectivity between Cash App and Square’s services.

4. **Question:** What is Square known for?

**Answer:** Square is known for its financial services, merchant services aggregator, and mobile payment company, providing point-of-sale solutions and business tools.

5. **Question:** Why is integration between Cash App and Square significant?

**Answer:** Integration is significant because it could enhance user experience by providing seamless financial services across both platforms, potentially increasing user engagement and business opportunities.

6. **Question:** What potential benefits could arise from Cash App and Square integration?

**Answer:** Potential benefits include streamlined financial transactions, improved data analytics for businesses, and a unified platform for personal and business financial management.

7. **Question:** How might users benefit from this integration?

**Answer:** Users might benefit from easier money transfers, consolidated financial services, and enhanced features that leverage both Cash App and Square’s capabilities.

8. **Question:** What impact could this integration have on merchants?

**Answer:** Merchants could experience improved payment processing, better customer insights, and more efficient financial management tools, enhancing their business operations.

9. **Question:** Has there been any official announcement regarding the integration?

**Answer:** As of now, there has been no official announcement, only hints and suggestions from executives about the possibility of future integration.

10. **Question:** What strategic advantage does this integration offer Block, Inc.?

**Answer:** The integration offers Block, Inc. a strategic advantage by potentially increasing its market share, enhancing its service offerings, and creating a more cohesive ecosystem for users and businesses.

Conclusion

The potential integration of Cash App with Square, as hinted by a Cash App executive, suggests a strategic move to create a more cohesive financial ecosystem under the Block, Inc. umbrella. This integration could enhance user experience by providing seamless transitions between personal finance management and business transactions, leveraging the strengths of both platforms. It may also drive increased user engagement and retention by offering a unified interface and expanded functionalities. Additionally, this move could position Block, Inc. more competitively in the fintech space, potentially leading to increased market share and revenue growth. However, successful integration will require careful consideration of user privacy, data security, and the distinct needs of both Cash App and Square users to ensure a smooth and beneficial transition.