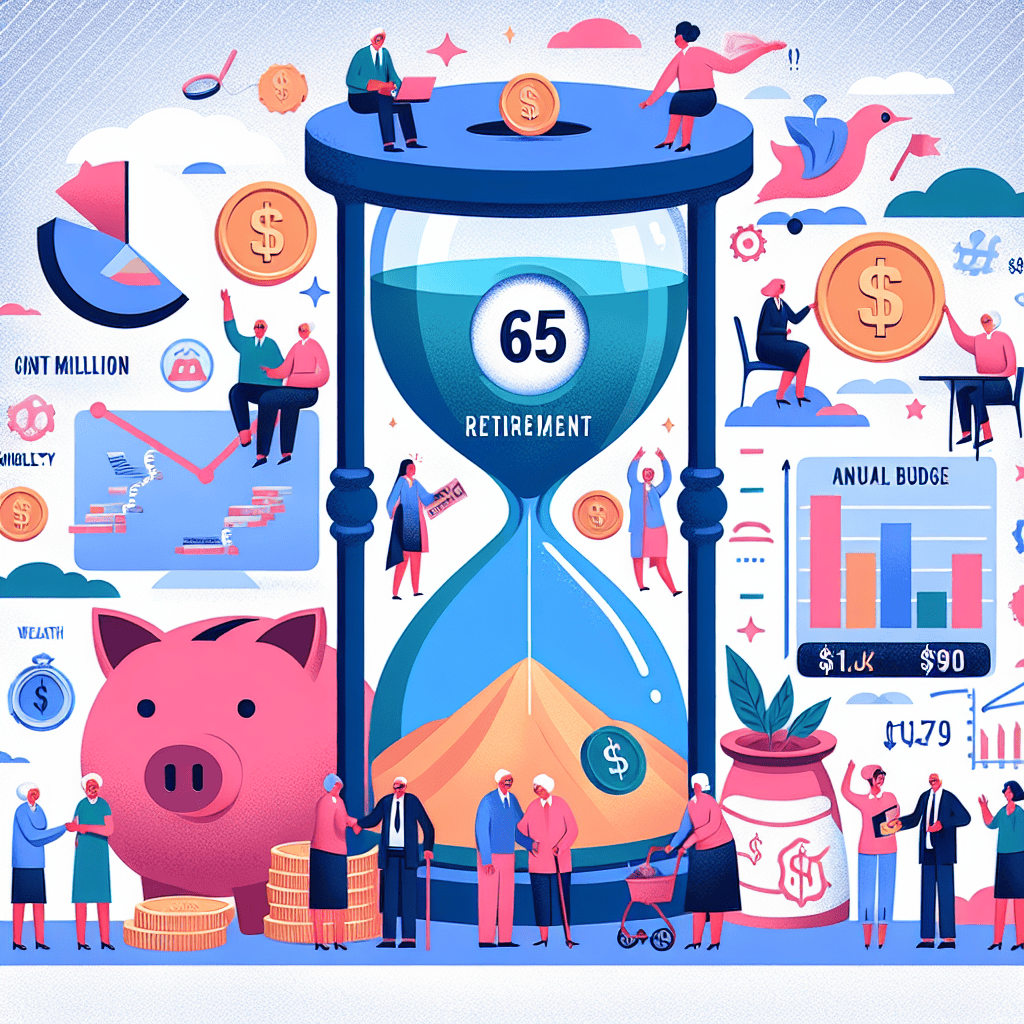

“Navigating Retirement: Making $1 Million Last with a $90K Lifestyle”

Introduction

Retiring at 65 with $1 million in savings and a $90,000 annual budget is a scenario that many prospective retirees contemplate as they plan for their golden years. This financial strategy requires careful consideration of various factors, including life expectancy, investment returns, inflation, healthcare costs, and lifestyle choices. The feasibility of maintaining a $90,000 annual budget depends on how well these elements are managed and whether the retiree’s financial plan can sustain their desired standard of living throughout retirement. By analyzing these components, individuals can better understand the potential challenges and opportunities associated with retiring under these conditions, ultimately guiding them toward a more secure and fulfilling retirement.

Evaluating Retirement Savings: Is $1 Million Enough for a $90K Annual Budget?

As individuals approach the age of retirement, a common question arises: is it feasible to retire at 65 with $1 million in savings while maintaining an annual budget of $90,000? This query is particularly pertinent in today’s economic climate, where inflation, healthcare costs, and longevity are significant considerations. To address this question, it is essential to evaluate various factors that influence the sustainability of retirement savings.

Firstly, understanding the concept of the 4% rule is crucial. This rule of thumb suggests that retirees can withdraw 4% of their retirement savings annually, adjusted for inflation, without depleting their funds over a 30-year retirement period. Applying this rule to a $1 million portfolio would result in an initial withdrawal of $40,000 per year. Clearly, this amount falls short of the desired $90,000 annual budget, indicating that relying solely on the 4% rule may not suffice.

However, it is important to consider additional sources of income that can supplement retirement savings. Social Security benefits, for instance, can play a significant role in bridging the gap between the 4% rule withdrawal and the desired budget. The average Social Security benefit for retirees is approximately $1,500 per month, or $18,000 annually. When combined with the $40,000 from the 4% rule, this brings the total to $58,000 per year, still short of the $90,000 target.

To further close this gap, retirees might explore other income streams such as part-time work, rental income, or annuities. Part-time work not only provides additional income but also offers social engagement and a sense of purpose. Rental properties, while requiring initial investment and ongoing management, can yield steady income. Annuities, on the other hand, can provide a guaranteed income stream for life, though they often come with fees and less flexibility.

Moreover, it is essential to consider the impact of inflation on retirement savings. Inflation erodes purchasing power over time, meaning that the $90,000 budget today may not suffice in the future. Historically, inflation has averaged around 3% per year, which can significantly affect long-term financial planning. Therefore, retirees should factor in inflation when calculating their future expenses and adjust their withdrawal strategy accordingly.

Healthcare costs are another critical consideration. As individuals age, healthcare expenses tend to increase, and these costs can consume a substantial portion of a retiree’s budget. It is advisable to account for these expenses by investing in health savings accounts (HSAs) or purchasing long-term care insurance to mitigate potential financial burdens.

Furthermore, investment strategy plays a pivotal role in ensuring the longevity of retirement savings. A diversified portfolio that balances risk and return is essential. While equities offer growth potential, they also come with volatility. Conversely, bonds provide stability but may yield lower returns. Striking the right balance between these asset classes can help sustain withdrawals over a prolonged retirement period.

In conclusion, retiring at 65 with $1 million and a $90,000 annual budget is challenging but not impossible. It requires a comprehensive approach that includes leveraging additional income sources, accounting for inflation and healthcare costs, and maintaining a well-diversified investment portfolio. By carefully planning and adjusting strategies as needed, retirees can enhance the likelihood of achieving their financial goals and enjoying a comfortable retirement.

Strategies for Stretching $1 Million in Retirement

Retiring at 65 with $1 million and maintaining a $90,000 annual budget is a goal that many aspire to achieve. However, the feasibility of this plan depends on a variety of factors, including investment strategies, lifestyle choices, and economic conditions. To ensure that the $1 million nest egg lasts throughout retirement, it is crucial to adopt strategies that maximize financial resources while minimizing risks.

One of the first considerations is the withdrawal rate. Financial experts often recommend the 4% rule, which suggests withdrawing 4% of the retirement savings in the first year and adjusting for inflation thereafter. For a $1 million portfolio, this translates to $40,000 in the first year, which is significantly less than the desired $90,000 budget. Therefore, retirees may need to explore alternative strategies to bridge this gap. One approach is to supplement withdrawals with other income sources, such as Social Security benefits, pensions, or part-time work. By doing so, retirees can reduce the strain on their savings and extend the longevity of their portfolio.

Another strategy involves optimizing investment allocations. A well-diversified portfolio that balances growth and income can help sustain withdrawals over a long retirement period. Typically, this involves a mix of stocks, bonds, and other assets that align with the retiree’s risk tolerance and financial goals. Stocks offer the potential for higher returns, which can help combat inflation and increase the portfolio’s value over time. Conversely, bonds provide stability and income, which can be crucial during market downturns. Regularly reviewing and rebalancing the portfolio ensures that it remains aligned with the retiree’s objectives and market conditions.

In addition to investment strategies, managing expenses is vital for stretching retirement savings. Retirees should conduct a thorough review of their spending habits and identify areas where they can cut costs without compromising their quality of life. This might involve downsizing to a smaller home, relocating to a more affordable area, or reducing discretionary spending on travel and entertainment. By prioritizing essential expenses and making informed choices, retirees can maintain their desired lifestyle while preserving their financial resources.

Healthcare costs are another critical consideration, as they tend to increase with age. To mitigate these expenses, retirees should explore options such as Medicare, supplemental insurance plans, and health savings accounts. Planning for long-term care is also essential, as it can be a significant financial burden. Long-term care insurance or setting aside a portion of savings for potential healthcare needs can provide peace of mind and financial security.

Furthermore, tax-efficient strategies can enhance the sustainability of retirement savings. Retirees should consider the tax implications of their withdrawals and explore options such as Roth conversions or tax-loss harvesting to minimize their tax liability. Consulting with a financial advisor or tax professional can provide valuable insights and help retirees make informed decisions.

In conclusion, retiring at 65 with $1 million and a $90,000 annual budget is achievable with careful planning and strategic management of resources. By adopting a sustainable withdrawal strategy, optimizing investments, managing expenses, and considering healthcare and tax implications, retirees can enhance the longevity of their savings and enjoy a financially secure retirement. While challenges may arise, proactive planning and informed decision-making can help retirees navigate the complexities of retirement and achieve their financial goals.

The Impact of Inflation on a $90K Annual Retirement Budget

Retirement planning is a complex process that requires careful consideration of various factors, one of which is inflation. When contemplating whether one can retire at 65 with $1 million and maintain a $90,000 annual budget, it is crucial to understand how inflation can impact this financial strategy. Inflation, the gradual increase in prices over time, erodes the purchasing power of money, meaning that the same amount of money will buy fewer goods and services in the future than it does today. Therefore, when planning for retirement, it is essential to account for inflation to ensure that the retirement savings will last throughout one’s lifetime.

To begin with, consider the historical average inflation rate, which has been approximately 3% per year in the United States. While this rate can fluctuate, using it as a baseline can help retirees estimate how much their expenses might increase over time. For instance, if a retiree plans to spend $90,000 in their first year of retirement, they should anticipate needing more than that amount in subsequent years to maintain the same standard of living. In fact, with a 3% inflation rate, the cost of living could double in about 24 years, meaning that by the time a retiree reaches 89, they might need $180,000 annually to cover the same expenses.

Moreover, it is important to consider how inflation affects different categories of expenses. Healthcare costs, for example, tend to rise faster than the general inflation rate, posing a significant challenge for retirees who may face increased medical expenses as they age. Consequently, a $90,000 annual budget might need to be adjusted more aggressively to account for these higher costs. Additionally, other essential expenses such as housing, food, and transportation are also subject to inflationary pressures, further emphasizing the need for a flexible and adaptive financial plan.

In light of these considerations, retirees should explore strategies to mitigate the impact of inflation on their retirement savings. One approach is to invest in assets that have historically outpaced inflation, such as stocks or real estate. By maintaining a diversified investment portfolio, retirees can potentially achieve returns that help preserve their purchasing power over time. Furthermore, incorporating inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can provide a hedge against inflation and offer a more stable income stream.

Another strategy is to adopt a dynamic withdrawal plan, which involves adjusting the amount withdrawn from retirement savings based on inflation and investment performance. This approach allows retirees to increase their withdrawals during periods of low inflation and strong market returns, while reducing them during times of high inflation or poor market performance. By being flexible with their withdrawal strategy, retirees can better manage their resources and extend the longevity of their savings.

In conclusion, while retiring at 65 with $1 million and a $90,000 annual budget is feasible, it requires careful planning and consideration of inflation’s impact on future expenses. By understanding the potential effects of inflation and implementing strategies to counteract them, retirees can enhance their financial security and enjoy a comfortable retirement. Ultimately, the key to a successful retirement lies in proactive planning, continuous monitoring of financial goals, and the ability to adapt to changing economic conditions.

Investment Options to Sustain a $90K Annual Budget in Retirement

Retirement planning is a crucial aspect of financial management, and for many, the goal is to retire comfortably at the age of 65. With a nest egg of $1 million and an annual budget of $90,000, the question arises: is it feasible to sustain this lifestyle throughout retirement? To address this, it is essential to explore various investment options that can help maintain, or even grow, the retirement fund while supporting the desired annual expenditure.

First and foremost, understanding the importance of a diversified investment portfolio is key. Diversification helps mitigate risks by spreading investments across different asset classes, such as stocks, bonds, and real estate. Stocks, for instance, have historically provided higher returns compared to other asset classes, albeit with greater volatility. By allocating a portion of the portfolio to stocks, retirees can potentially benefit from capital appreciation and dividend income, which can contribute to meeting the $90,000 annual budget.

Bonds, on the other hand, offer a more stable and predictable income stream. They are generally considered less risky than stocks and can provide regular interest payments. Including bonds in the investment mix can help balance the overall risk of the portfolio while ensuring a steady flow of income. Moreover, the interest from bonds can be reinvested or used to cover part of the annual expenses, thus preserving the principal amount.

Real estate investment is another viable option for retirees seeking to sustain their budget. Real estate can generate rental income, which can supplement other sources of retirement income. Additionally, real estate often appreciates over time, providing an opportunity for capital gains. However, it is important to consider the responsibilities and potential risks associated with property management, as well as market fluctuations that may affect property values.

In addition to traditional investment vehicles, retirees might consider annuities as a means to secure a guaranteed income stream. Annuities are insurance products that provide regular payments for a specified period or for the lifetime of the retiree. By purchasing an annuity, retirees can ensure a portion of their income is guaranteed, reducing the uncertainty associated with market volatility. However, it is crucial to carefully evaluate the terms and fees associated with annuities, as they can vary significantly.

Furthermore, retirees should not overlook the impact of inflation on their purchasing power. Inflation can erode the value of money over time, making it essential to choose investments that have the potential to outpace inflation. Equities, for example, have historically outperformed inflation over the long term, making them a valuable component of a retirement portfolio.

Finally, it is advisable for retirees to periodically review and adjust their investment strategy to align with changing financial goals and market conditions. Consulting with a financial advisor can provide valuable insights and help retirees make informed decisions about their investment options.

In conclusion, retiring at 65 with $1 million and maintaining a $90,000 annual budget is achievable with careful planning and strategic investment choices. By diversifying the portfolio across various asset classes, considering annuities for guaranteed income, and accounting for inflation, retirees can work towards sustaining their desired lifestyle throughout their retirement years.

Balancing Lifestyle and Finances: Retiring at 65 with $1 Million

Retiring at 65 with a nest egg of $1 million and an annual budget of $90,000 is a scenario that many individuals envision as they plan for their golden years. However, achieving a balance between maintaining a desired lifestyle and ensuring financial sustainability requires careful consideration and strategic planning. To begin with, it is essential to understand the implications of withdrawing $90,000 annually from a $1 million portfolio. This withdrawal rate equates to 9% of the initial portfolio value, which is significantly higher than the commonly recommended safe withdrawal rate of 4%. The 4% rule, a guideline derived from historical market data, suggests that retirees can withdraw 4% of their initial retirement savings, adjusted for inflation, each year without depleting their funds over a 30-year retirement period. Therefore, a 9% withdrawal rate poses a substantial risk of exhausting the retirement savings prematurely.

Moreover, the longevity of retirement savings is heavily influenced by market performance. In years of strong market returns, a higher withdrawal rate may seem sustainable. However, during market downturns, withdrawing a fixed amount can significantly erode the principal, leaving less capital to recover when markets rebound. This sequence of returns risk is a critical factor to consider, as it can dramatically affect the sustainability of retirement funds. Consequently, retirees must be prepared to adjust their spending in response to market conditions, potentially reducing withdrawals during economic downturns to preserve their portfolio.

In addition to market risks, inflation is another crucial consideration. Over time, inflation erodes purchasing power, meaning that the $90,000 budget today will not have the same value in the future. To mitigate this risk, retirees should consider investments that offer potential growth to outpace inflation, such as equities or real estate. Diversifying the investment portfolio can provide a hedge against inflation and help maintain the purchasing power of retirement savings.

Furthermore, healthcare costs are a significant concern for retirees, as they tend to increase with age. While Medicare provides some coverage, it does not cover all medical expenses, and out-of-pocket costs can be substantial. Therefore, it is prudent to allocate a portion of the retirement budget to healthcare expenses and consider supplemental insurance options to cover potential gaps in coverage.

Another aspect to consider is lifestyle choices. Retirees may need to evaluate their spending habits and prioritize essential expenses over discretionary ones. This may involve downsizing their home, relocating to a more affordable area, or adjusting travel plans to align with their financial situation. By making informed lifestyle choices, retirees can stretch their savings further and reduce the risk of depleting their funds.

In conclusion, retiring at 65 with $1 million and a $90,000 annual budget is a challenging but not impossible goal. It requires a comprehensive understanding of financial risks, a willingness to adapt to changing circumstances, and a commitment to prudent financial management. By carefully balancing lifestyle aspirations with financial realities, retirees can work towards achieving a sustainable and fulfilling retirement. Ultimately, seeking the guidance of a financial advisor can provide valuable insights and help retirees navigate the complexities of retirement planning, ensuring that their financial resources support their desired lifestyle throughout their retirement years.

Healthcare Costs in Retirement: Planning with a $90K Annual Budget

When planning for retirement, one of the most significant considerations is healthcare costs, which can substantially impact a retiree’s budget. For those aiming to retire at 65 with $1 million in savings and a $90,000 annual budget, understanding and preparing for healthcare expenses is crucial. As life expectancy increases, retirees must ensure their financial plans can accommodate potentially rising medical costs over several decades.

To begin with, Medicare becomes available at age 65, providing a foundational layer of healthcare coverage. However, it is essential to recognize that Medicare does not cover all medical expenses. For instance, it does not include long-term care, dental, vision, or hearing services. Consequently, retirees often need supplemental insurance, such as Medigap or Medicare Advantage plans, to fill these gaps. These additional policies can vary significantly in cost, depending on the coverage level and geographic location, and should be factored into the annual budget.

Moreover, out-of-pocket expenses, including copayments, deductibles, and prescription drugs, can add up quickly. According to recent studies, the average couple retiring at 65 may need approximately $300,000 to cover healthcare costs throughout retirement. This figure underscores the importance of allocating a portion of the $90,000 annual budget specifically for medical expenses. By doing so, retirees can better manage unexpected health issues without jeopardizing their overall financial stability.

In addition to direct medical costs, retirees should also consider the potential need for long-term care, which is not covered by Medicare. Long-term care insurance can be a prudent investment, offering protection against the high costs associated with assisted living facilities or in-home care. However, premiums for such insurance can be substantial, and it is advisable to purchase a policy well before retirement to lock in lower rates. Including these premiums in the retirement budget can help ensure that funds are available when needed.

Furthermore, maintaining a healthy lifestyle can play a significant role in managing healthcare costs during retirement. By prioritizing regular exercise, a balanced diet, and routine medical check-ups, retirees can potentially reduce the risk of chronic illnesses and associated medical expenses. Preventive care is often covered by Medicare, making it a cost-effective strategy for preserving both health and financial resources.

As retirees plan their budgets, it is also wise to consider the impact of inflation on healthcare costs. Historically, medical expenses have risen faster than the general inflation rate, which can erode purchasing power over time. To mitigate this risk, retirees might consider investing a portion of their savings in assets that have the potential to outpace inflation, such as stocks or real estate. This approach can help ensure that their $1 million nest egg retains its value and continues to support their $90,000 annual budget throughout retirement.

In conclusion, while retiring at 65 with $1 million and a $90,000 annual budget is feasible, careful planning for healthcare costs is essential. By understanding Medicare’s limitations, considering supplemental insurance, preparing for long-term care, and adopting a healthy lifestyle, retirees can better manage their medical expenses. Additionally, accounting for inflation and investing wisely can help preserve their financial security. Through these strategies, retirees can enjoy a comfortable and financially stable retirement, even in the face of rising healthcare costs.

Social Security and Pension Contributions: Enhancing a $1 Million Retirement Fund

Retiring at 65 with a $1 million nest egg and a $90,000 annual budget is a scenario many envision as the ideal culmination of years of diligent saving and investing. However, the feasibility of this plan hinges on several factors, including the role of Social Security and pension contributions in enhancing the retirement fund. Understanding how these elements can supplement a $1 million retirement fund is crucial for ensuring financial stability throughout one’s golden years.

To begin with, Social Security benefits serve as a foundational component of retirement income for many Americans. The amount one receives from Social Security depends on various factors, such as the individual’s earnings history and the age at which they choose to start receiving benefits. For those retiring at 65, delaying Social Security benefits until reaching full retirement age, or even later, can result in a higher monthly payout. This strategy can significantly bolster the annual budget, reducing the reliance on personal savings to meet the $90,000 target. Moreover, Social Security benefits are adjusted for inflation, providing a measure of protection against the rising cost of living.

In addition to Social Security, pension contributions can play a pivotal role in enhancing retirement income. For individuals fortunate enough to have a pension plan, these contributions can provide a steady stream of income that complements both Social Security and personal savings. The specifics of pension plans vary widely, with some offering fixed monthly payments and others providing lump-sum distributions. Understanding the terms of one’s pension plan is essential for integrating it effectively into the overall retirement strategy. By carefully coordinating pension payouts with Social Security benefits and withdrawals from the $1 million fund, retirees can create a diversified income stream that supports their desired lifestyle.

Furthermore, it is important to consider the impact of taxes on retirement income. Both Social Security benefits and pension payments may be subject to federal and, in some cases, state taxes. Therefore, strategic tax planning is necessary to maximize the net income available for spending. Consulting with a financial advisor or tax professional can help retirees navigate the complexities of tax regulations and identify opportunities for minimizing tax liabilities.

Another critical aspect to consider is the investment strategy for the $1 million retirement fund. A well-diversified portfolio that balances growth and income can help sustain withdrawals over a potentially lengthy retirement period. While traditional wisdom suggests a more conservative approach as one ages, it is essential to ensure that the portfolio continues to generate sufficient returns to support the $90,000 annual budget. Regularly reviewing and adjusting the investment strategy in response to market conditions and personal circumstances can help maintain the fund’s longevity.

In conclusion, retiring at 65 with a $1 million fund and a $90,000 annual budget is achievable, provided that Social Security and pension contributions are effectively integrated into the retirement plan. By understanding the nuances of these income sources and implementing strategic tax and investment planning, retirees can enhance their financial security and enjoy a comfortable retirement. As with any financial endeavor, careful planning and ongoing management are key to success, ensuring that the golden years are truly golden.

Q&A

1. **Is $1 million enough to retire at 65 with a $90K annual budget?**

It depends on various factors such as investment returns, inflation, and life expectancy. Generally, $1 million may not be sufficient for a $90K annual budget without additional income sources.

2. **What is the 4% rule and how does it apply here?**

The 4% rule suggests withdrawing 4% of your retirement savings annually. For $1 million, this would be $40,000 per year, which is less than the $90K budget.

3. **How long will $1 million last with a $90K annual withdrawal?**

Without investment growth, $1 million would last approximately 11 years with a $90K annual withdrawal.

4. **What role does Social Security play in this scenario?**

Social Security can supplement income, potentially reducing the amount needed from savings to meet the $90K budget.

5. **How can investment returns impact retirement savings?**

Positive investment returns can extend the longevity of retirement savings, while negative returns can deplete them faster.

6. **What are some strategies to make $1 million last longer?**

Strategies include reducing expenses, increasing investment returns, delaying retirement, or working part-time.

7. **How does inflation affect retirement planning?**

Inflation reduces purchasing power over time, meaning the $90K budget may need to increase to maintain the same lifestyle.

Conclusion

Retiring at 65 with $1 million and a $90,000 annual budget is challenging and depends on several factors, including investment returns, inflation, healthcare costs, and lifestyle choices. Assuming a 4% withdrawal rate, which is a common rule of thumb for sustainable retirement income, $1 million would provide $40,000 annually, which is less than half of the desired $90,000 budget. To bridge this gap, retirees would need additional income sources such as Social Security, pensions, or part-time work. Alternatively, they could reduce their annual spending, increase their savings before retirement, or invest in higher-return assets, though these come with increased risk. Ultimately, while possible, retiring under these conditions requires careful financial planning and potentially adjusting expectations or strategies.