“Brace for Impact: Unveiling the Power Moves in a $12 Trillion Market Showdown”

Introduction

“Brace for Impact: Five Stocks, Three Days, $12 Trillion in Market Cap Earnings” delves into a pivotal moment in the financial world, where the stakes are high and the outcomes uncertain. This analysis focuses on a critical three-day period during which five of the most influential companies, collectively valued at $12 trillion, are set to release their earnings reports. These reports have the potential to significantly sway market dynamics, investor sentiment, and economic forecasts. The narrative explores the anticipation, strategies, and potential repercussions of these earnings announcements, offering insights into how these corporate giants could shape the financial landscape.

Understanding the Market Dynamics: A Deep Dive into the $12 Trillion Earnings Week

In the world of finance, few events capture the attention of investors and analysts alike as intensely as earnings season. This period, when publicly traded companies disclose their financial performance for the previous quarter, often sets the tone for market sentiment and investment strategies. Among these, a particularly significant event is the earnings week of five major companies, collectively representing a staggering $12 trillion in market capitalization. Understanding the dynamics of this week is crucial for investors aiming to navigate the complexities of the stock market.

To begin with, the sheer scale of these companies means that their earnings reports can have a profound impact on the broader market. These firms, often leaders in their respective industries, not only influence their own stock prices but also set trends that ripple across sectors. Consequently, the anticipation surrounding their earnings announcements is palpable, with investors keenly analyzing every detail to gauge future performance and market direction.

Moreover, the concentration of such substantial market capitalization in just a few companies underscores the current landscape of the stock market, where a handful of giants wield significant influence. This concentration can lead to heightened volatility during earnings week, as any unexpected results—be they positive or negative—can trigger swift and substantial market reactions. For instance, a positive earnings surprise from one of these companies might buoy investor confidence, leading to a rally not just in the stock itself but also in related sectors. Conversely, a disappointing report could spark a sell-off, dragging down indices and affecting investor sentiment more broadly.

In addition to the immediate market reactions, the earnings reports of these companies provide valuable insights into broader economic trends. For example, a technology giant’s earnings might reveal shifts in consumer behavior or technological advancements, while a major retailer’s report could offer clues about consumer spending patterns and economic health. Thus, these earnings are not just about individual company performance but also serve as barometers for the economy at large.

Furthermore, the strategic decisions and forward guidance provided by these companies during their earnings calls are closely scrutinized. Investors and analysts pay particular attention to management’s commentary on future growth prospects, potential challenges, and strategic initiatives. This guidance can significantly influence market expectations and investment decisions, as it offers a glimpse into how these companies plan to navigate an ever-evolving economic landscape.

As we delve deeper into the implications of this earnings week, it is essential to consider the role of external factors that might influence these reports. Macroeconomic conditions, such as interest rates, inflation, and geopolitical tensions, can all impact company performance and investor sentiment. Therefore, a comprehensive analysis of these earnings must take into account not only the numbers themselves but also the broader context in which these companies operate.

In conclusion, the $12 trillion earnings week is a pivotal event in the financial calendar, offering a wealth of information and insights for investors. By understanding the market dynamics at play, investors can better position themselves to capitalize on opportunities and mitigate risks. As these five companies unveil their financial results, the ripple effects will be felt across the market, underscoring the interconnectedness of today’s global economy. Thus, staying informed and adaptable is key to navigating the complexities of this high-stakes week.

Key Players in the Spotlight: Analyzing the Five Stocks Driving Market Movements

In the ever-evolving landscape of global finance, the stock market remains a dynamic arena where fortunes can shift in the blink of an eye. This week, the spotlight is firmly fixed on five pivotal stocks, each poised to release their earnings reports over the next three days. Collectively, these companies represent a staggering $12 trillion in market capitalization, underscoring their significant influence on market movements. As investors brace for impact, understanding the potential implications of these earnings reports is crucial.

To begin with, the technology sector continues to be a dominant force, with two of the five companies hailing from this industry. The first is a leading tech giant renowned for its innovative consumer electronics and software solutions. Historically, its earnings reports have been a bellwether for the tech industry, often setting the tone for market sentiment. Investors will be keenly observing its performance in key markets, particularly in light of recent supply chain disruptions and evolving consumer preferences. Any indication of robust growth or unexpected challenges could have a ripple effect across the sector.

Transitioning to the second tech titan, this company has carved out a niche in cloud computing and artificial intelligence. Its earnings report is anticipated to provide insights into the broader adoption of cloud services and the competitive landscape of AI technologies. As businesses increasingly rely on digital transformation, the company’s performance could serve as a barometer for the health of the tech industry at large. Moreover, its strategic investments and partnerships will be scrutinized for their potential to drive future growth.

Shifting focus to the financial sector, the third company in the spotlight is a major player in global banking. With interest rates and inflationary pressures at the forefront of economic discussions, its earnings report will be closely analyzed for indications of how these factors are impacting profitability. Additionally, insights into consumer lending trends and credit quality will be pivotal in assessing the broader economic outlook. As financial institutions navigate a complex macroeconomic environment, this company’s performance could offer valuable clues about the sector’s resilience.

In the realm of consumer goods, the fourth company is a household name with a diverse portfolio of products. Its earnings report will shed light on consumer spending patterns and the impact of inflation on purchasing behavior. As supply chain challenges persist, investors will be particularly interested in how the company is managing costs and maintaining profitability. Furthermore, its strategies for innovation and market expansion will be key areas of focus, as they could influence its competitive positioning in the industry.

Finally, the energy sector is represented by a leading multinational corporation known for its extensive operations in oil and gas. With global energy markets experiencing volatility, its earnings report will be pivotal in understanding the sector’s trajectory. Factors such as geopolitical tensions, regulatory changes, and the transition to renewable energy sources will be critical in shaping its outlook. Investors will be eager to assess how the company is adapting to these challenges and capitalizing on emerging opportunities.

In conclusion, as these five stocks prepare to unveil their earnings, the market is poised for potential volatility. The insights gleaned from these reports will not only influence individual stock performance but also provide a broader perspective on economic trends and sectoral dynamics. As investors navigate this critical period, staying informed and vigilant will be essential in making strategic decisions.

Investor Strategies: How to Navigate the Three-Day Earnings Surge

As the financial world braces for a pivotal three-day period, investors are keenly focused on the earnings reports of five major companies, collectively representing a staggering $12 trillion in market capitalization. This concentrated burst of financial disclosures presents both opportunities and challenges for investors seeking to navigate the volatile waters of the stock market. Understanding the dynamics at play during this earnings surge is crucial for making informed investment decisions.

To begin with, the anticipation surrounding these earnings reports is palpable, as they are expected to provide critical insights into the health and future prospects of some of the world’s largest corporations. Investors are particularly interested in how these companies have managed to navigate recent economic headwinds, including inflationary pressures, supply chain disruptions, and shifting consumer behaviors. The outcomes of these reports will likely set the tone for market sentiment in the coming months, influencing not only the stocks in question but also broader market indices.

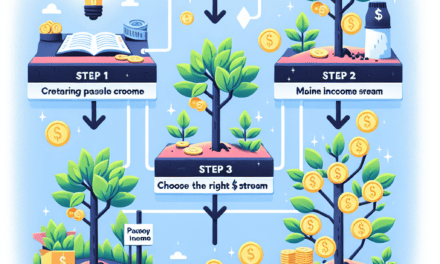

In light of this, investors should adopt a strategic approach to manage the potential volatility that accompanies such significant market events. One effective strategy is to diversify one’s portfolio, thereby mitigating the risk associated with any single stock’s performance. By spreading investments across various sectors and asset classes, investors can cushion the impact of unexpected earnings surprises, whether positive or negative. This approach not only reduces risk but also positions investors to capitalize on growth opportunities in different areas of the market.

Moreover, it is essential for investors to maintain a long-term perspective, even amidst the short-term fluctuations that earnings reports can trigger. While the immediate market reaction to earnings announcements can be dramatic, it is important to remember that the intrinsic value of a company is determined by its long-term fundamentals rather than its quarterly performance. Therefore, investors should focus on the underlying business models, competitive advantages, and growth prospects of these companies, rather than being swayed by temporary market volatility.

In addition to diversification and a long-term outlook, investors should also pay close attention to the guidance provided by company executives during earnings calls. These discussions often offer valuable insights into management’s expectations for future performance, strategic initiatives, and potential challenges. By analyzing this information, investors can better assess the alignment between a company’s current valuation and its future growth potential, thereby making more informed investment decisions.

Furthermore, it is crucial for investors to stay informed about macroeconomic trends and geopolitical developments that could impact the market environment. Factors such as interest rate changes, fiscal policies, and international trade dynamics can significantly influence investor sentiment and market performance. By keeping abreast of these broader trends, investors can better anticipate potential market shifts and adjust their strategies accordingly.

In conclusion, the upcoming three-day earnings surge represents a critical juncture for investors, offering both risks and opportunities. By employing a diversified investment strategy, maintaining a long-term perspective, closely monitoring company guidance, and staying informed about macroeconomic trends, investors can navigate this period with greater confidence. As the market digests the earnings reports of these five influential companies, those who are well-prepared will be best positioned to capitalize on the insights and opportunities that emerge.

Market Reactions: What to Expect from the $12 Trillion Earnings Announcement

As the financial world braces for a pivotal moment, the upcoming earnings announcements from five of the most influential companies, collectively holding a staggering $12 trillion in market capitalization, are poised to send ripples through global markets. Investors, analysts, and market enthusiasts alike are keenly observing the developments, anticipating how these earnings reports will shape the economic landscape. The significance of these announcements cannot be overstated, as they encompass a substantial portion of the market’s total value, thereby holding the potential to influence investment strategies and economic forecasts worldwide.

To begin with, the anticipation surrounding these earnings reports is fueled by the diverse sectors these companies represent, ranging from technology and finance to consumer goods and healthcare. Each sector has its unique set of challenges and opportunities, which will be reflected in the earnings outcomes. For instance, the technology sector, often seen as a bellwether for innovation and growth, is expected to reveal insights into how companies are navigating supply chain disruptions and evolving consumer demands. Meanwhile, the financial sector’s performance will likely provide a window into the broader economic recovery, as interest rates and inflation continue to be focal points for investors.

Moreover, the timing of these announcements is particularly crucial, as they come at a juncture where global markets are grappling with a myriad of uncertainties. Geopolitical tensions, fluctuating commodity prices, and ongoing pandemic-related disruptions have created a complex backdrop against which these earnings will be scrutinized. Consequently, market participants are eager to discern how these companies have managed to adapt and thrive amidst such challenges. The earnings reports will not only shed light on past performance but also offer guidance on future prospects, which is invaluable for investors seeking to make informed decisions.

In addition to the immediate financial results, the forward-looking statements and strategic initiatives outlined by these companies will be of paramount importance. Investors will be keen to understand how these industry giants plan to sustain growth and maintain competitive advantages in an increasingly dynamic environment. Whether through technological innovation, strategic acquisitions, or expansion into new markets, the strategies unveiled in these earnings calls will likely set the tone for market sentiment in the coming months.

Furthermore, the market’s reaction to these earnings announcements will be closely monitored, as it will provide insights into investor confidence and risk appetite. A positive reception could signal a renewed sense of optimism, potentially driving stock prices higher and encouraging broader market participation. Conversely, any negative surprises or cautious outlooks could trigger volatility, prompting investors to reassess their portfolios and risk exposure.

In conclusion, the impending earnings announcements from these five titans of industry represent a critical juncture for global markets. As investors brace for impact, the insights gleaned from these reports will not only influence individual stock performance but also have far-reaching implications for market dynamics and economic forecasts. By understanding the nuances of these earnings and their potential impact, market participants can better navigate the complexities of the current financial landscape, making informed decisions that align with their investment objectives. As such, the next few days promise to be a defining moment in the ongoing narrative of market evolution and economic resilience.

Historical Comparisons: Lessons from Past High-Impact Earnings Weeks

In the world of finance, few events capture the attention of investors and analysts like a high-stakes earnings week. The anticipation surrounding the release of quarterly earnings reports from major corporations can send ripples through the stock market, influencing investment strategies and market sentiment. As we brace for an upcoming earnings week where five major stocks, collectively representing a staggering $12 trillion in market capitalization, are set to report their financial results over the span of just three days, it is instructive to look back at historical precedents. By examining past high-impact earnings weeks, we can glean valuable insights into potential market reactions and investor behavior.

Historically, earnings weeks of this magnitude have often been characterized by heightened volatility and significant market movements. For instance, during the dot-com boom of the late 1990s, earnings reports from tech giants frequently led to dramatic shifts in stock prices, as investors reacted to both the promise and peril of rapidly evolving technology sectors. Similarly, the financial crisis of 2008 saw earnings announcements from major banks and financial institutions play a pivotal role in shaping market dynamics, as investors sought clarity amidst economic uncertainty.

One key lesson from these historical episodes is the importance of investor expectations. When market participants anticipate strong earnings growth, any deviation from these expectations—whether positive or negative—can lead to pronounced market reactions. For example, during the early 2000s, companies that exceeded earnings expectations often saw their stock prices soar, while those that fell short experienced sharp declines. This underscores the critical role of market sentiment and the power of surprise in driving stock price movements.

Moreover, past high-impact earnings weeks have highlighted the interconnectedness of global markets. In today’s increasingly globalized economy, the performance of major corporations can have far-reaching implications, influencing not only their own stock prices but also those of their suppliers, competitors, and even entire sectors. This interconnectedness was vividly illustrated during the European debt crisis, when earnings reports from multinational corporations provided crucial insights into the health of the global economy, affecting markets worldwide.

Another important consideration is the role of macroeconomic factors in shaping earnings outcomes and market reactions. During periods of economic expansion, strong corporate earnings can reinforce investor confidence and fuel further market gains. Conversely, in times of economic contraction, disappointing earnings reports can exacerbate market downturns, as investors reassess their risk exposure and adjust their portfolios accordingly. The interplay between corporate earnings and broader economic conditions is a recurring theme in financial history, offering valuable lessons for navigating future earnings weeks.

As we approach this highly anticipated earnings week, it is essential for investors to remain vigilant and informed. By drawing on historical comparisons, we can better understand the potential implications of these earnings announcements and prepare for the market volatility that may ensue. While past performance is not always indicative of future results, the lessons learned from previous high-impact earnings weeks can provide valuable guidance for navigating the complexities of today’s financial markets. In this ever-evolving landscape, staying attuned to both historical precedents and current market dynamics will be crucial for making informed investment decisions.

Risk Management: Protecting Your Portfolio During Volatile Earnings Periods

As the financial world braces for a pivotal earnings season, investors are keenly aware of the potential volatility that can accompany the release of quarterly results from major corporations. With five of the largest companies, collectively holding a staggering $12 trillion in market capitalization, set to report their earnings over a span of just three days, the stakes are undeniably high. This period of concentrated financial disclosures presents both opportunities and risks, making it imperative for investors to adopt effective risk management strategies to protect their portfolios.

To begin with, understanding the nature of earnings volatility is crucial. Earnings reports provide a snapshot of a company’s financial health, revealing insights into revenue growth, profit margins, and future guidance. These reports can significantly influence stock prices, often leading to sharp movements based on whether the results meet, exceed, or fall short of market expectations. Consequently, the anticipation surrounding these announcements can lead to heightened market volatility, as investors react swiftly to new information.

In light of this, diversification emerges as a fundamental risk management tool. By spreading investments across a variety of sectors and asset classes, investors can mitigate the impact of adverse price movements in any single stock. This approach reduces the portfolio’s overall risk, as the performance of different assets may not be correlated. For instance, while technology stocks might experience volatility due to earnings surprises, other sectors such as healthcare or consumer staples may remain relatively stable, providing a buffer against potential losses.

Moreover, employing options strategies can offer additional protection during volatile earnings periods. Options, such as puts and calls, allow investors to hedge their positions by providing the right, but not the obligation, to buy or sell a stock at a predetermined price. For example, purchasing put options can serve as an insurance policy against a decline in stock prices, thereby limiting potential losses. Conversely, selling covered calls can generate additional income, which can offset some of the risks associated with holding volatile stocks.

Another prudent approach is to maintain a focus on long-term investment goals, rather than being swayed by short-term market fluctuations. While earnings reports can cause temporary disruptions, it is essential to remember that investing is a marathon, not a sprint. By keeping a long-term perspective, investors can avoid making impulsive decisions based on short-lived market reactions. This mindset encourages patience and discipline, allowing portfolios to recover from temporary setbacks and capitalize on long-term growth opportunities.

Furthermore, staying informed and conducting thorough research is vital for effective risk management. Investors should closely monitor not only the earnings reports themselves but also the broader economic context and industry trends. Understanding the factors driving a company’s performance can provide valuable insights into its future prospects and help investors make informed decisions. Additionally, keeping abreast of analyst forecasts and market sentiment can offer clues about potential market reactions, enabling investors to anticipate and prepare for possible outcomes.

In conclusion, as the financial markets brace for the impact of earnings reports from five major companies, investors must prioritize risk management to safeguard their portfolios. By diversifying investments, utilizing options strategies, maintaining a long-term perspective, and staying informed, investors can navigate the challenges of volatile earnings periods with confidence. Ultimately, these strategies not only protect against potential losses but also position investors to seize opportunities that may arise in the aftermath of these critical financial disclosures.

Future Implications: Long-Term Effects of the $12 Trillion Market Cap Earnings

The recent earnings reports from five major companies, collectively representing a staggering $12 trillion in market capitalization, have sent ripples through the financial markets, prompting investors and analysts to ponder the long-term implications of these results. As these corporate giants unveiled their financial performance over a span of just three days, the immediate market reactions were palpable, with stock prices experiencing significant volatility. However, beyond the short-term fluctuations, the broader implications of these earnings reports warrant a closer examination, as they hold the potential to shape the future landscape of the global economy.

To begin with, the earnings results from these companies serve as a barometer for the overall health of the economy. Given their substantial market influence, their performance often reflects broader economic trends. For instance, robust earnings growth may indicate a thriving economy, characterized by strong consumer demand and business investment. Conversely, disappointing results could signal underlying economic challenges, such as supply chain disruptions or shifts in consumer behavior. Therefore, the financial health of these companies can provide valuable insights into the trajectory of economic recovery or potential downturns.

Moreover, the earnings reports have significant implications for investor sentiment and market confidence. Positive earnings surprises can bolster investor confidence, leading to increased capital inflows and higher stock valuations. This, in turn, can create a virtuous cycle, as rising stock prices enhance consumer wealth and spending, further stimulating economic growth. On the other hand, earnings misses or downward revisions to future guidance can erode investor confidence, potentially triggering sell-offs and increased market volatility. Consequently, the long-term effects of these earnings reports extend beyond the companies themselves, influencing broader market dynamics and investor behavior.

In addition to their impact on market sentiment, the earnings results also have strategic implications for the companies involved. Strong financial performance can provide these firms with the resources and confidence to pursue strategic initiatives, such as mergers and acquisitions, research and development, or expansion into new markets. These actions can drive long-term growth and competitiveness, further solidifying their positions as industry leaders. Conversely, weaker-than-expected earnings may necessitate cost-cutting measures or strategic realignments, potentially affecting their ability to innovate and compete effectively in the future.

Furthermore, the earnings reports underscore the growing importance of technology and innovation in shaping the future of business. Many of these companies operate in sectors characterized by rapid technological advancements, such as information technology, e-commerce, and renewable energy. As such, their financial performance often reflects their ability to adapt to changing technological landscapes and capitalize on emerging opportunities. This highlights the need for companies across industries to prioritize innovation and digital transformation to remain competitive in an increasingly dynamic business environment.

Lastly, the earnings results have implications for regulatory and policy considerations. As these companies wield significant economic influence, their financial performance can attract scrutiny from regulators and policymakers. Issues such as market concentration, data privacy, and environmental sustainability may come to the forefront, prompting discussions on regulatory frameworks and corporate governance. Therefore, the long-term effects of these earnings reports may extend beyond financial markets, influencing policy debates and shaping the regulatory landscape.

In conclusion, the recent earnings reports from these five major companies have far-reaching implications that extend beyond immediate market reactions. They provide insights into the health of the economy, influence investor sentiment, shape corporate strategies, underscore the importance of innovation, and raise regulatory considerations. As such, understanding the long-term effects of these earnings is crucial for investors, policymakers, and business leaders alike, as they navigate an ever-evolving economic landscape.

Q&A

1. **What is “Brace for Impact: Five Stocks, Three Days, $12 Trillion in Market Cap Earnings”?**

– It refers to a significant event in the stock market where five major companies, collectively valued at $12 trillion, are set to release their earnings reports over a span of three days.

2. **Which companies are involved in this event?**

– The specific companies are not mentioned, but they are likely to be major players in the stock market, possibly from sectors like technology, finance, or consumer goods.

3. **Why is this event significant?**

– The combined market capitalization of $12 trillion indicates that these companies have a substantial impact on the stock market and the economy. Their earnings reports can influence market trends and investor sentiment.

4. **What could be the potential impact of these earnings reports?**

– Depending on the results, the reports could lead to significant stock price movements, affecting not only the companies involved but also the broader market indices.

5. **How should investors prepare for this event?**

– Investors might consider reviewing their portfolios, assessing the potential risks and opportunities, and possibly adjusting their investment strategies based on the anticipated outcomes of the earnings reports.

6. **What are some possible outcomes of the earnings reports?**

– Possible outcomes include better-than-expected earnings leading to stock price increases, or disappointing results causing declines. The reports could also provide insights into future company performance and market conditions.

7. **How often do such events occur in the stock market?**

– Earnings seasons occur quarterly, but the convergence of multiple high-cap companies reporting in a short timeframe is less common and can create heightened market volatility.

Conclusion

“Brace for Impact: Five Stocks, Three Days, $12 Trillion in Market Cap Earnings” highlights the significant influence of major companies on the stock market, particularly during earnings season. The article underscores the volatility and potential market shifts that can occur when companies with substantial market capitalizations report their earnings in a condensed timeframe. It emphasizes the importance for investors to closely monitor these events, as the performance and guidance of these companies can have far-reaching implications for market sentiment and investment strategies. The piece concludes by suggesting that while such concentrated earnings periods can present risks, they also offer opportunities for informed investors to capitalize on market movements.