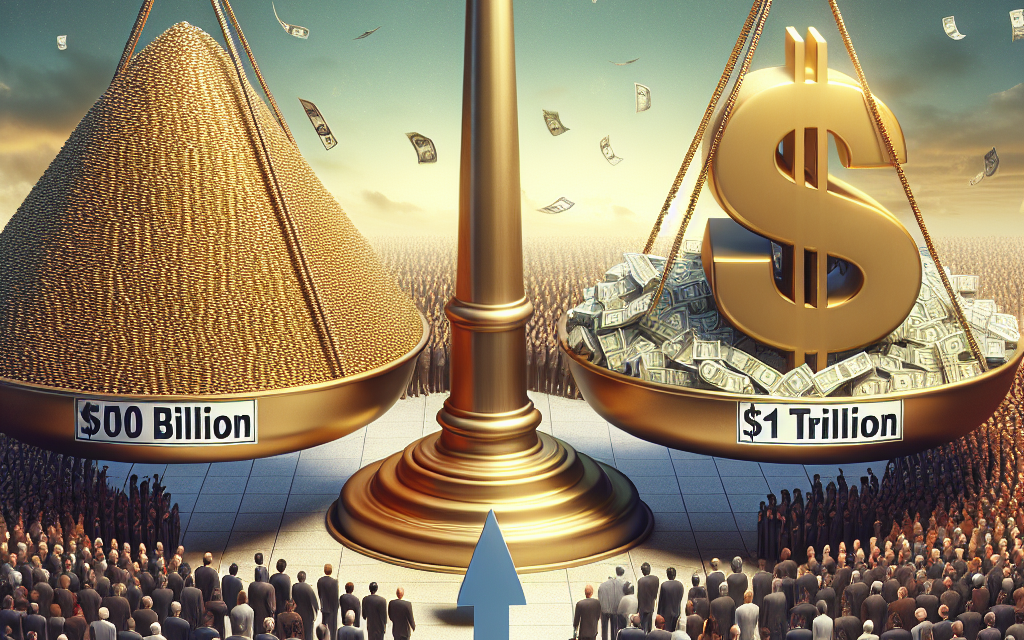

“Bank of America Consumer Investments: Surpassing $500 Billion, Aiming for $1 Trillion.”

Introduction

Bank of America (BofA) has reached a significant milestone in its consumer investments, surpassing $500 billion in assets under management. This achievement underscores the bank’s commitment to enhancing financial solutions and services for its clients. With a strategic focus on innovation and customer-centric offerings, BofA aims to double its investment portfolio to $1 trillion in the coming years. This ambitious target reflects the bank’s confidence in the growth potential of the consumer investment sector and its dedication to helping individuals achieve their financial goals through a diverse range of investment products and services.

BofA’s Strategic Vision for Consumer Investments

Bank of America (BofA) has made significant strides in the realm of consumer investments, recently surpassing the impressive milestone of $500 billion in assets under management. This achievement not only underscores the bank’s commitment to enhancing its investment services but also sets the stage for its ambitious goal of reaching $1 trillion in consumer investments. The strategic vision behind this initiative is multifaceted, focusing on innovation, accessibility, and personalized financial solutions that cater to the diverse needs of its clientele.

At the core of BofA’s strategy is the recognition that the investment landscape is evolving rapidly. With the rise of digital technology and changing consumer preferences, the bank has prioritized the integration of advanced digital tools into its investment offerings. By leveraging cutting-edge technology, BofA aims to provide clients with seamless access to their investment portfolios, real-time market insights, and personalized financial advice. This technological enhancement not only improves the user experience but also empowers clients to make informed decisions about their financial futures.

Moreover, BofA is keenly aware of the importance of accessibility in the investment space. The bank has made concerted efforts to democratize investment opportunities, ensuring that individuals from various socioeconomic backgrounds can participate in wealth-building activities. By offering a range of investment products, including low-cost index funds and robo-advisory services, BofA is breaking down barriers that have traditionally hindered access to investment markets. This inclusive approach aligns with the bank’s broader mission to promote financial literacy and empower consumers to take control of their financial destinies.

In addition to technological innovation and accessibility, BofA’s strategic vision emphasizes the importance of personalized financial solutions. Recognizing that each client has unique financial goals and risk tolerances, the bank has invested in developing tailored investment strategies that align with individual needs. Through a combination of human expertise and algorithm-driven insights, BofA’s advisors are equipped to offer customized recommendations that resonate with clients’ aspirations. This personalized approach not only enhances client satisfaction but also fosters long-term relationships built on trust and mutual understanding.

Furthermore, BofA’s commitment to sustainability and responsible investing is a key component of its strategic vision. As consumers increasingly seek investments that align with their values, the bank has expanded its offerings in environmental, social, and governance (ESG) investing. By integrating ESG criteria into its investment strategies, BofA is not only addressing the growing demand for socially responsible investment options but also positioning itself as a leader in the sustainable finance movement. This forward-thinking approach reflects the bank’s understanding of the evolving priorities of its clients and the broader societal context in which it operates.

As BofA continues to build on its momentum, the path toward achieving the $1 trillion target appears increasingly attainable. The bank’s strategic vision, characterized by innovation, accessibility, personalized solutions, and a commitment to sustainability, positions it well to meet the diverse needs of consumers in an ever-changing financial landscape. By fostering a culture of continuous improvement and responsiveness to client feedback, BofA is not only enhancing its investment offerings but also reinforcing its role as a trusted partner in the financial journeys of millions. In this way, the bank is poised to redefine the consumer investment experience, paving the way for a more inclusive and sustainable financial future.

The Impact of BofA’s $500 Billion Milestone

Bank of America (BofA) recently achieved a significant milestone by surpassing $500 billion in consumer investments, a feat that underscores the bank’s commitment to enhancing financial well-being for its clients. This achievement not only reflects the bank’s robust growth strategy but also highlights the increasing importance of consumer investment in the broader financial landscape. As BofA sets its sights on the ambitious target of reaching $1 trillion in consumer investments, the implications of this milestone are profound, affecting various stakeholders, including individual investors, the financial services industry, and the economy at large.

The $500 billion milestone signifies a growing trend among consumers who are increasingly prioritizing investment as a means to secure their financial futures. This shift is particularly noteworthy in a climate where traditional savings accounts yield minimal returns. As individuals seek to maximize their wealth, they are turning to investment vehicles that offer greater potential for growth. BofA’s achievement in this regard is indicative of a broader movement towards financial literacy and empowerment, as more consumers become educated about the benefits of investing. The bank’s extensive resources and tools, designed to facilitate investment decisions, have played a crucial role in this transformation, enabling clients to navigate the complexities of the financial markets with greater confidence.

Moreover, the impact of BofA’s milestone extends beyond individual investors. The financial services industry as a whole is witnessing a shift in how institutions approach consumer investment. As BofA leads the charge, other banks and financial firms are likely to reevaluate their strategies to remain competitive. This could result in enhanced offerings, such as lower fees, improved technology platforms, and more personalized investment advice. Consequently, consumers may benefit from a more dynamic and responsive financial ecosystem, where their needs and preferences are prioritized.

In addition to influencing the competitive landscape, BofA’s achievement has broader economic implications. As consumer investments grow, so too does the potential for increased capital flow into various sectors of the economy. This influx of investment can stimulate economic growth, create jobs, and foster innovation. When consumers invest in stocks, bonds, and other financial instruments, they contribute to the overall health of the markets, which can lead to a more stable economic environment. Furthermore, as BofA aims for the $1 trillion mark, the bank’s efforts to engage and educate consumers about investment strategies will likely encourage even greater participation in the financial markets, further amplifying these positive effects.

As BofA continues to build on its momentum, the bank’s focus on inclusivity and accessibility will be paramount. By ensuring that investment opportunities are available to a diverse range of consumers, BofA can help bridge the wealth gap that has persisted in many communities. This commitment to inclusivity not only aligns with the bank’s corporate social responsibility goals but also enhances its reputation as a leader in the financial services industry.

In conclusion, Bank of America’s achievement of exceeding $500 billion in consumer investments marks a pivotal moment in the financial sector. The implications of this milestone are far-reaching, influencing individual investors, the competitive landscape of financial services, and the broader economy. As BofA sets its sights on the ambitious goal of $1 trillion, the bank’s commitment to empowering consumers through education and accessible investment opportunities will be crucial in shaping the future of consumer finance. The journey ahead promises to be transformative, with the potential to redefine how individuals engage with their financial futures.

Pathway to $1 Trillion: BofA’s Investment Strategies

Bank of America (BofA) has recently announced a significant milestone in its consumer investment portfolio, surpassing the impressive threshold of $500 billion. This achievement not only underscores the bank’s robust growth trajectory but also sets the stage for its ambitious goal of reaching $1 trillion in consumer investments. To understand how BofA plans to navigate this pathway to $1 trillion, it is essential to examine the strategic initiatives and innovative approaches that underpin its investment strategies.

At the core of BofA’s strategy is a commitment to enhancing customer engagement through personalized financial solutions. By leveraging advanced data analytics and artificial intelligence, the bank is able to gain deeper insights into consumer behavior and preferences. This data-driven approach allows BofA to tailor its investment offerings, ensuring that they align with the unique financial goals of its diverse clientele. As a result, customers are more likely to engage with investment products that resonate with their individual needs, thereby driving overall growth in the investment portfolio.

Moreover, BofA recognizes the importance of financial education in empowering consumers to make informed investment decisions. The bank has invested significantly in educational resources, including workshops, webinars, and digital content, aimed at demystifying the investment process. By equipping consumers with the knowledge and tools necessary to navigate the complexities of investing, BofA fosters a culture of financial literacy that encourages greater participation in the investment landscape. This proactive approach not only enhances customer confidence but also contributes to the bank’s overarching goal of expanding its consumer investment base.

In addition to focusing on customer engagement and education, BofA is also strategically diversifying its investment offerings. The bank has expanded its product suite to include a wide range of investment vehicles, from traditional stocks and bonds to alternative investments such as real estate and private equity. This diversification not only caters to varying risk appetites among consumers but also positions BofA to capitalize on emerging market trends. By staying ahead of the curve and adapting its offerings to meet evolving consumer demands, BofA is well-equipped to attract a broader audience of investors.

Furthermore, BofA’s commitment to sustainability and responsible investing plays a pivotal role in its investment strategy. As consumers increasingly prioritize environmental, social, and governance (ESG) factors in their investment decisions, BofA has made significant strides in integrating ESG considerations into its investment processes. By offering sustainable investment options and promoting responsible corporate practices, the bank not only aligns itself with the values of socially conscious investors but also enhances its reputation as a forward-thinking financial institution.

As BofA continues to pursue its goal of reaching $1 trillion in consumer investments, it is clear that a multifaceted approach will be essential. By focusing on personalized solutions, enhancing financial literacy, diversifying investment offerings, and prioritizing sustainability, the bank is positioning itself for sustained growth in an increasingly competitive landscape. Ultimately, the pathway to $1 trillion is not merely a numerical target; it represents BofA’s commitment to empowering consumers and fostering a more inclusive investment environment. Through these strategic initiatives, BofA is not only redefining the investment experience for its customers but also setting a new standard for excellence in the financial services industry.

Consumer Confidence and BofA’s Investment Growth

In recent years, Bank of America (BofA) has witnessed a remarkable surge in consumer investments, surpassing the significant milestone of $500 billion. This achievement not only underscores the bank’s robust growth strategy but also reflects a broader trend in consumer confidence and engagement in the financial markets. As individuals increasingly recognize the importance of investing for their future, BofA has positioned itself to capitalize on this momentum, setting an ambitious target of reaching $1 trillion in consumer investments.

The rise in consumer investments can be attributed to several interrelated factors. First and foremost, the economic recovery following the disruptions caused by the COVID-19 pandemic has instilled a renewed sense of optimism among consumers. As job markets stabilize and disposable incomes rise, individuals are more inclined to allocate their resources toward investment opportunities. This shift in mindset is further bolstered by the proliferation of digital investment platforms, which have made it easier than ever for consumers to engage with the financial markets. BofA has adeptly harnessed these technological advancements, offering user-friendly tools and resources that empower clients to make informed investment decisions.

Moreover, the increasing availability of information and educational resources has played a pivotal role in enhancing consumer confidence. With a wealth of online content, webinars, and personalized financial advice, individuals are better equipped to navigate the complexities of investing. BofA has committed to providing comprehensive support to its clients, ensuring they have access to the knowledge necessary to build and manage their investment portfolios effectively. This commitment not only fosters trust but also encourages clients to take a more active role in their financial futures.

In addition to these factors, the current low-interest-rate environment has prompted many consumers to seek alternative avenues for growth. Traditional savings accounts and fixed-income investments often yield minimal returns, leading individuals to explore equities, mutual funds, and other investment vehicles. BofA has responded to this trend by expanding its product offerings and enhancing its advisory services, thereby catering to a diverse range of investment preferences and risk appetites. This strategic approach has not only attracted new clients but has also encouraged existing customers to increase their investment allocations.

As BofA continues to build on its success, the bank remains focused on fostering long-term relationships with its clients. By prioritizing personalized service and tailored investment strategies, BofA aims to create a seamless experience that resonates with consumers’ evolving needs. This dedication to client satisfaction is crucial, especially as the bank sets its sights on the ambitious goal of reaching $1 trillion in consumer investments. Achieving this target will require not only sustained growth but also a deep understanding of market dynamics and consumer behavior.

In conclusion, the impressive growth of consumer investments at Bank of America, now exceeding $500 billion, is a testament to the bank’s strategic vision and the increasing confidence of consumers in the financial markets. As BofA works diligently toward its goal of $1 trillion, it is essential to recognize the interplay of economic recovery, technological advancements, and consumer education that has fueled this growth. By continuing to prioritize client engagement and support, BofA is well-positioned to navigate the evolving landscape of consumer investments, ultimately contributing to a more financially literate and empowered society.

Innovations Driving BofA’s Investment Success

Bank of America (BofA) has made significant strides in the realm of consumer investments, recently surpassing the impressive milestone of $500 billion in assets under management. This achievement not only underscores the bank’s robust growth trajectory but also highlights the innovative strategies that have propelled its investment success. As BofA sets its sights on the ambitious target of reaching $1 trillion in consumer investments, it is essential to examine the innovations that are driving this remarkable progress.

One of the key innovations contributing to BofA’s investment success is the integration of advanced technology into its investment platforms. The bank has embraced digital transformation, leveraging artificial intelligence and machine learning to enhance the customer experience. By utilizing sophisticated algorithms, BofA can provide personalized investment recommendations tailored to individual client needs and risk profiles. This level of customization not only fosters greater client engagement but also empowers investors to make informed decisions, ultimately leading to improved investment outcomes.

In addition to technological advancements, BofA has also focused on expanding its product offerings to meet the diverse needs of its clientele. The introduction of a wide range of investment vehicles, including exchange-traded funds (ETFs), mutual funds, and sustainable investment options, has allowed the bank to cater to a broader audience. This diversification is particularly important in today’s dynamic market environment, where investors are increasingly seeking opportunities that align with their values and financial goals. By providing a comprehensive suite of investment products, BofA is well-positioned to attract and retain a diverse client base.

Moreover, BofA has prioritized financial education as a cornerstone of its investment strategy. Recognizing that informed investors are more likely to achieve their financial objectives, the bank has developed a robust suite of educational resources. These resources include webinars, articles, and interactive tools designed to enhance financial literacy among clients. By equipping investors with the knowledge they need to navigate the complexities of the financial markets, BofA not only fosters trust but also encourages long-term investment relationships.

Furthermore, the bank’s commitment to sustainability and responsible investing has emerged as a significant driver of its investment success. As more investors seek to align their portfolios with their ethical values, BofA has responded by integrating environmental, social, and governance (ESG) criteria into its investment processes. This focus on sustainable investing not only attracts socially conscious investors but also positions BofA as a leader in a rapidly evolving market segment. By championing responsible investment practices, the bank is not only contributing to positive societal outcomes but also enhancing its brand reputation among a growing demographic of environmentally and socially aware investors.

In conclusion, Bank of America’s impressive achievement of exceeding $500 billion in consumer investments can be attributed to a combination of innovative strategies that encompass technology, product diversification, financial education, and a commitment to sustainability. As the bank aims for the ambitious goal of reaching $1 trillion in consumer investments, it is clear that these innovations will continue to play a pivotal role in shaping its future success. By remaining agile and responsive to the evolving needs of investors, BofA is well-equipped to navigate the challenges and opportunities that lie ahead in the ever-changing landscape of consumer investments.

Comparing BofA’s Growth to Industry Competitors

Bank of America (BofA) has made significant strides in the consumer investments sector, recently surpassing the impressive milestone of $500 billion in assets under management. This achievement not only underscores the bank’s robust growth trajectory but also positions it strategically within a competitive landscape that includes other major financial institutions. As BofA sets its sights on the ambitious target of reaching $1 trillion in consumer investments, it is essential to compare its growth with that of its industry competitors to understand the dynamics at play.

In recent years, BofA has leveraged its extensive branch network and digital capabilities to attract a diverse clientele, ranging from individual investors to affluent households. This multifaceted approach has allowed the bank to capture a significant share of the market, particularly in the realm of wealth management and investment services. By offering a comprehensive suite of products, including retirement accounts, mutual funds, and personalized financial planning, BofA has effectively positioned itself as a one-stop shop for consumers seeking to grow their wealth. This strategy has not only enhanced customer loyalty but has also contributed to the bank’s impressive asset growth.

When comparing BofA’s performance to that of its competitors, it is crucial to consider the broader context of the financial services industry. Firms such as JPMorgan Chase and Wells Fargo have also made substantial investments in their consumer banking divisions, focusing on enhancing digital platforms and expanding their service offerings. For instance, JPMorgan Chase has invested heavily in technology to streamline its investment processes and improve customer experience, which has resulted in a notable increase in assets under management. Similarly, Wells Fargo has sought to revitalize its investment services by emphasizing personalized advice and innovative financial products. These efforts reflect a broader trend within the industry, where firms are increasingly recognizing the importance of adapting to changing consumer preferences.

Despite the competitive landscape, BofA’s growth trajectory remains impressive. The bank’s commitment to integrating technology into its investment services has set it apart from many of its peers. By utilizing advanced analytics and artificial intelligence, BofA has been able to offer tailored investment solutions that resonate with a wide range of clients. This focus on personalization not only enhances customer satisfaction but also drives asset growth, as clients are more likely to invest when they feel their unique needs are being addressed.

Moreover, BofA’s strategic partnerships and collaborations have further bolstered its position in the market. By aligning with fintech companies and leveraging their innovative solutions, the bank has been able to enhance its service offerings and reach a broader audience. This collaborative approach not only accelerates growth but also fosters a culture of innovation that is essential in today’s rapidly evolving financial landscape.

As BofA continues to pursue its goal of reaching $1 trillion in consumer investments, it is clear that the bank is well-positioned to navigate the competitive challenges ahead. While industry rivals are also making significant strides, BofA’s unique blend of technology, personalized service, and strategic partnerships provides a solid foundation for sustained growth. Ultimately, the bank’s ability to adapt to changing market conditions and consumer preferences will be critical in determining its success in achieving this ambitious target. As the financial services industry continues to evolve, BofA’s proactive approach may well serve as a blueprint for others seeking to thrive in an increasingly competitive environment.

Future Trends in Consumer Investments at BofA

Bank of America (BofA) has made significant strides in the realm of consumer investments, recently surpassing the impressive milestone of $500 billion in assets under management. This achievement not only underscores the bank’s commitment to enhancing its investment services but also sets the stage for ambitious future goals, including a target of reaching $1 trillion in consumer investments. As BofA navigates this transformative landscape, several trends are emerging that will likely shape the future of consumer investments.

One of the most notable trends is the increasing integration of technology in investment services. BofA has been at the forefront of leveraging digital platforms to enhance customer experience and accessibility. The rise of robo-advisors and automated investment tools has democratized access to investment opportunities, allowing a broader demographic to engage with financial markets. This technological shift is expected to continue, with BofA likely to invest further in artificial intelligence and machine learning to provide personalized investment strategies tailored to individual client needs. By harnessing data analytics, the bank can offer insights that empower consumers to make informed decisions, thereby fostering a more engaged and knowledgeable investor base.

Moreover, the growing emphasis on sustainable and responsible investing is another trend that BofA is poised to capitalize on. As consumers become increasingly aware of the social and environmental impact of their investments, there is a rising demand for products that align with personal values. BofA has already begun to expand its offerings in this area, providing clients with options that focus on environmental, social, and governance (ESG) criteria. This shift not only reflects changing consumer preferences but also positions BofA as a leader in the sustainable investment space, appealing to a new generation of investors who prioritize ethical considerations alongside financial returns.

In addition to technological advancements and a focus on sustainability, the importance of financial education cannot be overstated. As BofA aims to grow its consumer investment portfolio, it recognizes the necessity of equipping clients with the knowledge and skills needed to navigate the complexities of investing. The bank has initiated various educational programs and resources designed to enhance financial literacy among its clients. By fostering a culture of learning, BofA not only empowers individuals to take control of their financial futures but also cultivates long-term relationships built on trust and transparency.

Furthermore, the evolving regulatory landscape will play a crucial role in shaping the future of consumer investments at BofA. As regulations surrounding investment products and services continue to evolve, BofA must remain agile and responsive to ensure compliance while also meeting the needs of its clients. This adaptability will be essential as the bank seeks to innovate and expand its offerings in a manner that aligns with regulatory requirements, ultimately enhancing consumer confidence in its investment solutions.

As BofA sets its sights on the ambitious goal of reaching $1 trillion in consumer investments, it is clear that the bank is not merely focused on growth for growth’s sake. Instead, it is committed to creating a holistic investment ecosystem that prioritizes technology, sustainability, education, and compliance. By embracing these trends, BofA is well-positioned to not only achieve its financial targets but also to redefine the consumer investment experience, ensuring that it remains relevant and responsive to the evolving needs of its clients in an increasingly complex financial landscape.

Q&A

1. **What is the current asset level of BofA Consumer Investments?**

BofA Consumer Investments currently exceeds $500 billion.

2. **What is BofA’s target for Consumer Investments?**

BofA is targeting $1 trillion in Consumer Investments.

3. **What types of investments are included in BofA Consumer Investments?**

BofA Consumer Investments include retail banking, investment management, and wealth management services.

4. **What strategies is BofA implementing to reach the $1 trillion target?**

BofA is focusing on enhancing digital platforms, expanding product offerings, and improving customer engagement.

5. **What is the significance of reaching $1 trillion in Consumer Investments for BofA?**

Achieving $1 trillion would solidify BofA’s position as a leading player in the consumer investment market and enhance its competitive advantage.

6. **How does BofA plan to attract more customers to reach its investment target?**

BofA plans to attract more customers through targeted marketing, personalized financial advice, and innovative investment solutions.

7. **What impact could reaching the $1 trillion target have on BofA’s overall business?**

Reaching the $1 trillion target could lead to increased revenue, improved market share, and greater financial stability for BofA.

Conclusion

Bank of America’s consumer investments surpassing $500 billion signifies a strong commitment to enhancing customer financial well-being and expanding its market presence. The ambitious target of reaching $1 trillion reflects the bank’s strategic focus on growth, innovation, and meeting the evolving needs of consumers in a competitive financial landscape. This goal underscores BofA’s confidence in its investment strategies and its dedication to providing comprehensive financial solutions.