“High Stakes in the Skies: Boeing’s Earnings Day Turbulence Amid Worker Strike”

Introduction

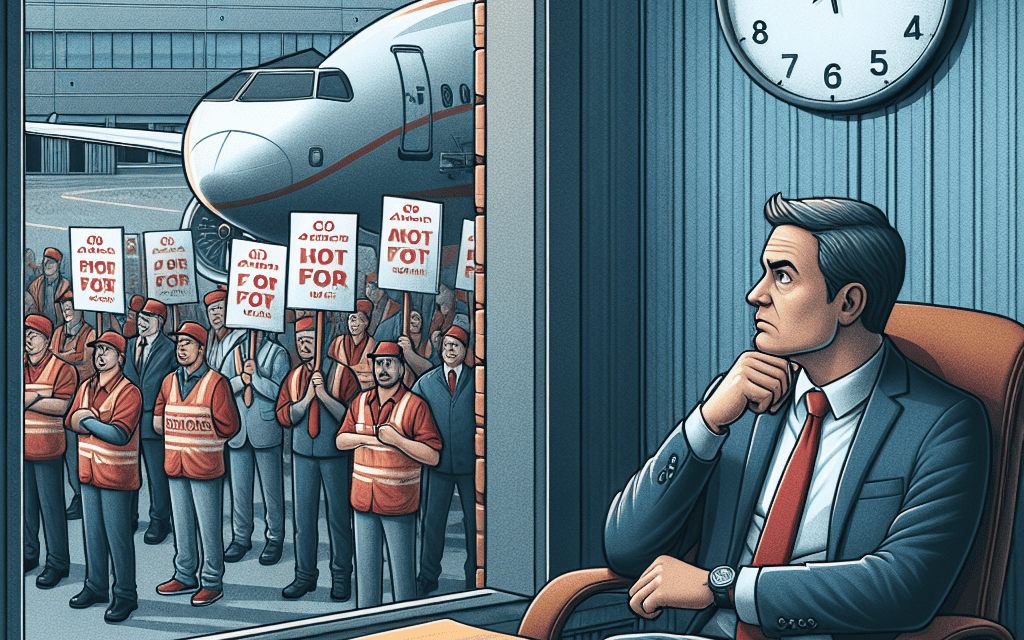

Boeing’s earnings day, typically a closely watched event for investors and industry analysts, took on an added layer of tension as a workers’ strike loomed large over the proceedings. The strike, initiated by a significant portion of Boeing’s workforce, underscored the growing discontent among employees over labor conditions and contract negotiations. For Boeing’s CEO, the strike transformed what would have been a routine financial disclosure into a high-stakes challenge, with the potential to impact not only the company’s immediate financial performance but also its long-term operational stability and reputation. As the strike unfolded, stakeholders were left on edge, eager to see how the leadership would navigate this critical juncture.

Impact of Boeing Workers’ Strike on Company Earnings

The recent strike by Boeing workers has cast a significant shadow over the company’s earnings day, transforming what is typically a routine financial disclosure into a high-stakes event for the CEO and stakeholders alike. As the aerospace giant prepared to announce its quarterly earnings, the strike underscored the broader challenges facing the company, highlighting labor relations as a critical factor in its operational and financial performance. The timing of the strike could not have been more pivotal, as it coincided with Boeing’s efforts to recover from previous setbacks, including production delays and supply chain disruptions.

The strike, initiated by a substantial portion of Boeing’s workforce, primarily revolves around demands for better wages, improved working conditions, and enhanced job security. These demands reflect broader trends in the labor market, where workers across various industries are increasingly vocal about their rights and expectations. For Boeing, the strike represents not only an immediate operational challenge but also a potential long-term impact on its reputation and ability to attract and retain skilled labor. As the company navigates these turbulent waters, the CEO faces the daunting task of balancing the immediate need to resolve the strike with the strategic imperative of maintaining investor confidence.

In the short term, the strike has already begun to affect Boeing’s production schedules, with potential delays in the delivery of key aircraft models. This disruption comes at a time when the company is striving to meet rising demand in the commercial aviation sector, driven by a post-pandemic recovery in air travel. Consequently, any prolonged industrial action could exacerbate existing supply chain issues, further straining Boeing’s ability to fulfill orders and meet customer expectations. The financial implications of such disruptions are significant, as they could lead to penalties, loss of future contracts, and a decline in market share.

Moreover, the strike has intensified scrutiny on Boeing’s management practices, with analysts and investors keenly observing how the company addresses the grievances of its workforce. The outcome of this labor dispute could set a precedent for future negotiations, not only within Boeing but also across the aerospace industry. As such, the CEO’s handling of the situation is under the microscope, with stakeholders eager to see a resolution that aligns with both the company’s financial goals and its commitment to social responsibility.

In light of these challenges, Boeing’s earnings day has become a critical juncture for the company. The financial results, while important, are now part of a broader narrative that includes labor relations, operational resilience, and strategic foresight. Investors will be looking for assurances that Boeing can navigate the current crisis while positioning itself for sustainable growth in the future. This requires a delicate balancing act, as the company must demonstrate fiscal prudence while also investing in its workforce and addressing their concerns.

In conclusion, the Boeing workers’ strike has transformed the company’s earnings day into a pivotal moment for the CEO and the broader leadership team. The strike not only highlights the immediate operational challenges but also underscores the importance of effective labor relations in ensuring long-term success. As Boeing seeks to resolve the dispute and restore normalcy, the company’s ability to manage this crisis will be a key determinant of its future trajectory in the competitive aerospace industry.

CEO’s Response to Boeing Workers’ Strike

As Boeing’s CEO faced the daunting task of presenting the company’s quarterly earnings, an unexpected challenge loomed large: a workers’ strike that threatened to overshadow the financial results. The strike, initiated by a significant portion of Boeing’s workforce, was not merely a demand for better wages and benefits but also a call for improved working conditions and job security. This labor unrest added a layer of complexity to the earnings day, turning it into a nail-biter for the CEO, who had to address both the financial community and the concerns of the striking workers.

In response to the strike, the CEO took a measured approach, acknowledging the workers’ grievances while emphasizing the company’s commitment to resolving the issues at hand. He began by expressing respect for the employees’ right to voice their concerns, recognizing that the workforce is the backbone of Boeing’s operations. This acknowledgment was crucial in setting a tone of understanding and empathy, which is essential in labor negotiations. The CEO underscored the importance of maintaining open lines of communication with the workers’ representatives, signaling a willingness to engage in constructive dialogue.

Transitioning to the financial implications of the strike, the CEO candidly addressed the potential impact on Boeing’s operations and earnings. He noted that while the strike posed challenges, the company had contingency plans in place to mitigate disruptions. This assurance was aimed at calming investors’ nerves, as the strike’s timing coincided with a critical period for Boeing, which is striving to recover from previous setbacks, including production delays and regulatory scrutiny. By highlighting the company’s resilience and strategic planning, the CEO sought to instill confidence in Boeing’s ability to navigate the current turbulence.

Furthermore, the CEO outlined the steps Boeing is taking to address the workers’ demands. He mentioned ongoing negotiations with union leaders, emphasizing the company’s commitment to reaching a fair and equitable agreement. This approach not only demonstrated Boeing’s dedication to resolving the strike but also reinforced the CEO’s role as a mediator who balances the interests of employees and shareholders. By focusing on collaboration and mutual understanding, the CEO aimed to foster a sense of unity and shared purpose within the company.

In addition to addressing the immediate concerns of the strike, the CEO took the opportunity to discuss Boeing’s long-term vision for its workforce. He highlighted initiatives aimed at enhancing employee well-being, such as investments in training programs and career development opportunities. These initiatives are designed to equip workers with the skills needed to thrive in an evolving aerospace industry, thereby ensuring Boeing’s competitiveness in the global market. By linking the resolution of the strike to broader strategic goals, the CEO positioned Boeing as a forward-thinking company that values its employees as integral partners in its success.

As the earnings day unfolded, the CEO’s response to the workers’ strike was closely scrutinized by analysts, investors, and employees alike. His ability to address the strike with transparency and resolve was pivotal in shaping perceptions of Boeing’s leadership during a challenging period. Ultimately, the CEO’s handling of the situation underscored the importance of effective communication and strategic foresight in navigating complex labor relations, setting the stage for Boeing’s continued growth and stability in the years to come.

Financial Implications of the Boeing Strike

The recent strike by Boeing workers has cast a shadow over the company’s earnings day, transforming what is typically a routine financial disclosure into a high-stakes event for the CEO and stakeholders alike. As the aerospace giant grapples with the implications of labor unrest, the financial community is keenly observing how this disruption might affect Boeing’s fiscal health and future projections. The strike, initiated by a significant portion of Boeing’s workforce, underscores the growing tensions between management and employees over issues such as wages, benefits, and working conditions. This labor action comes at a critical juncture for Boeing, which has been striving to recover from previous setbacks, including the 737 MAX crisis and pandemic-induced challenges.

The timing of the strike could not be more precarious, as it coincides with Boeing’s efforts to ramp up production and meet delivery targets that are crucial for its financial recovery. Consequently, the strike’s impact on production schedules and delivery timelines is a primary concern for investors. Delays in aircraft deliveries could lead to financial penalties and strained relationships with customers, further complicating Boeing’s path to stability. Moreover, the strike has the potential to disrupt the supply chain, affecting not only Boeing but also its numerous suppliers and partners who rely on the company’s production schedules.

In light of these challenges, the CEO faces the daunting task of addressing investor concerns while simultaneously negotiating with labor representatives to reach a resolution. The outcome of these negotiations will likely have significant implications for Boeing’s financial performance in the coming quarters. A prolonged strike could exacerbate existing financial pressures, while a swift resolution might help mitigate some of the immediate impacts. However, even a quick settlement may not fully assuage investor concerns, as the underlying issues that led to the strike could resurface if not adequately addressed.

Furthermore, the strike highlights broader industry trends, such as the increasing assertiveness of labor unions in advocating for better compensation and working conditions. This development is not unique to Boeing, as similar labor actions have been observed across various sectors, reflecting a shift in the balance of power between employers and employees. As such, Boeing’s handling of the strike could set a precedent for other companies facing similar challenges, making the situation even more critical for the aerospace industry as a whole.

In addition to the immediate financial implications, the strike also raises questions about Boeing’s long-term strategic direction. The company must navigate the delicate balance between maintaining profitability and ensuring employee satisfaction, a challenge that requires careful consideration of both short-term financial goals and long-term sustainability. The CEO’s ability to effectively manage this balance will be crucial in determining Boeing’s future trajectory and its ability to remain competitive in a rapidly evolving industry landscape.

As earnings day approaches, all eyes are on Boeing’s leadership to see how they will address these multifaceted challenges. The financial community eagerly awaits insights into how the company plans to mitigate the strike’s impact and what measures will be implemented to prevent similar disruptions in the future. Ultimately, the resolution of this labor dispute will serve as a litmus test for Boeing’s resilience and adaptability in the face of adversity, with significant implications for its financial health and industry standing.

Historical Context of Labor Strikes at Boeing

The history of labor strikes at Boeing is a testament to the complex relationship between the aerospace giant and its workforce, a dynamic that has shaped the company’s trajectory over the decades. As Boeing’s CEO faces a tense earnings day amid a current workers’ strike, it is essential to understand the historical context of labor actions within the company to fully grasp the implications of this ongoing situation.

Boeing’s labor relations have been marked by a series of significant strikes, each reflecting broader economic and social trends. The first major strike occurred in 1948, when the International Association of Machinists and Aerospace Workers (IAM) led a walkout that lasted 140 days. This strike was emblematic of post-war labor unrest, as workers sought to secure better wages and working conditions in a rapidly expanding industry. The resolution of this strike set a precedent for future negotiations, establishing a pattern of collective bargaining that would become a cornerstone of Boeing’s labor relations.

Moving forward to the 1970s, Boeing faced another pivotal strike in 1977, which lasted 51 days. This period was characterized by economic challenges, including inflation and a recession, which heightened tensions between management and labor. The strike underscored the workers’ demands for job security and fair compensation amidst economic uncertainty. The resolution of this strike involved significant concessions from both sides, highlighting the necessity of compromise in maintaining industrial harmony.

The 1990s brought another wave of labor unrest, with a notable strike in 1995 that lasted 69 days. This strike was driven by concerns over job outsourcing and the impact of globalization on the workforce. As Boeing expanded its operations internationally, workers feared the erosion of job security and the potential loss of benefits. The resolution of this strike involved agreements that addressed these concerns, reflecting the evolving nature of labor relations in a globalized economy.

In the early 2000s, Boeing experienced yet another significant strike in 2005, lasting 28 days. This strike was primarily focused on healthcare benefits and pension plans, issues that were becoming increasingly contentious across various industries. The resolution of this strike involved a delicate balance between maintaining competitive employee benefits and ensuring the company’s financial stability.

As Boeing’s CEO now navigates the current strike, it is clear that the historical context of labor actions at the company provides valuable insights into the challenges and opportunities that lie ahead. The ongoing strike is not an isolated event but rather part of a continuum of labor relations that have shaped Boeing’s history. Understanding this context allows for a more nuanced perspective on the current situation, highlighting the importance of addressing workers’ concerns while ensuring the company’s long-term viability.

In conclusion, the historical context of labor strikes at Boeing reveals a complex interplay between economic forces, worker demands, and corporate strategy. As the company faces another critical moment in its history, the lessons learned from past strikes can inform the path forward, emphasizing the need for dialogue, compromise, and a shared commitment to the future success of both the company and its workforce.

Strategies for Resolving Labor Disputes at Boeing

The recent strike by Boeing workers has cast a shadow over the company’s earnings day, transforming it into a tense moment for the CEO and stakeholders alike. As the aerospace giant grapples with this labor dispute, it becomes imperative to explore strategies that could effectively resolve such conflicts and restore harmony within the organization. Labor disputes, particularly in industries as complex and high-stakes as aerospace, require a nuanced approach that balances the needs of the workforce with the strategic objectives of the company.

To begin with, open communication is a cornerstone in resolving labor disputes. Establishing a transparent dialogue between management and employees can help bridge the gap that often exists in understanding each other’s perspectives. By fostering an environment where workers feel heard and valued, Boeing can mitigate misunderstandings and build trust. Regular meetings, feedback sessions, and open forums can serve as platforms for employees to voice their concerns and for management to provide clarity on company policies and decisions.

Moreover, involving a neutral third party, such as a mediator, can be instrumental in facilitating negotiations. Mediators can help both parties articulate their positions and work towards a mutually beneficial agreement. This approach not only expedites the resolution process but also ensures that the discussions remain focused and productive. Mediation can be particularly effective in de-escalating tensions and preventing the dispute from further impacting the company’s operations and reputation.

In addition to mediation, revisiting and potentially revising the existing labor contracts can address the root causes of dissatisfaction among workers. By conducting a thorough review of the terms and conditions of employment, Boeing can identify areas that may require adjustments to align with the evolving needs of its workforce. This could include revising wage structures, improving working conditions, or enhancing benefits packages. Such proactive measures demonstrate the company’s commitment to its employees’ well-being and can significantly reduce the likelihood of future disputes.

Furthermore, investing in employee development and career progression opportunities can serve as a long-term strategy to prevent labor unrest. By providing training programs, mentorship, and clear pathways for advancement, Boeing can empower its workforce and foster a sense of loyalty and motivation. Employees who see a future within the company are more likely to remain engaged and less inclined to resort to strikes as a means of expressing their grievances.

Additionally, fostering a culture of inclusivity and diversity can play a crucial role in resolving labor disputes. By ensuring that all employees feel respected and valued, regardless of their background or position, Boeing can create a more cohesive and harmonious work environment. This involves not only implementing policies that promote diversity but also actively encouraging diverse perspectives in decision-making processes.

Finally, it is essential for Boeing’s leadership to demonstrate empathy and understanding during such disputes. Acknowledging the challenges faced by workers and showing a genuine willingness to address their concerns can go a long way in rebuilding trust. Leadership that is perceived as compassionate and responsive can inspire confidence and cooperation among employees, paving the way for a more amicable resolution.

In conclusion, while the strike by Boeing workers has undoubtedly turned earnings day into a nail-biter for the CEO, it also presents an opportunity for the company to reassess and refine its approach to labor relations. By prioritizing open communication, mediation, contract revisions, employee development, inclusivity, and empathetic leadership, Boeing can not only resolve the current dispute but also lay the groundwork for a more resilient and harmonious future.

Stakeholder Reactions to Boeing’s Earnings Amid Strike

As Boeing prepared to announce its quarterly earnings, the atmosphere was charged with anticipation, not just for the financial figures but also for the ongoing strike by its workers. The strike, initiated by a significant portion of Boeing’s workforce, has added a layer of complexity to the company’s financial narrative, turning what would typically be a routine earnings day into a high-stakes event for CEO David Calhoun. The strike, primarily driven by demands for better wages and improved working conditions, has captured the attention of stakeholders, including investors, analysts, and employees, all eager to understand how these developments will impact Boeing’s financial health and strategic direction.

The timing of the strike could not be more critical. Boeing, like many in the aerospace industry, is navigating a challenging landscape marked by supply chain disruptions, fluctuating demand, and the lingering effects of the global pandemic. Against this backdrop, the strike has introduced additional uncertainty, prompting stakeholders to scrutinize the company’s earnings report for any signs of vulnerability or resilience. Investors, in particular, are keen to assess whether the strike will exacerbate existing challenges or if Boeing has the operational agility to mitigate its impact.

As the earnings report was unveiled, it became evident that the strike had indeed left its mark. Production delays and increased labor costs were highlighted as significant factors affecting the company’s bottom line. However, Boeing’s leadership was quick to emphasize their commitment to resolving the labor dispute, underscoring ongoing negotiations with union representatives. This assurance was aimed at calming investor nerves and demonstrating that the company is actively working towards a resolution that aligns with both employee welfare and business objectives.

In addition to financial metrics, stakeholders were also interested in Boeing’s strategic response to the strike. The company outlined several initiatives designed to enhance operational efficiency and reduce dependency on any single production site, thereby minimizing the risk of future disruptions. These measures, while promising, were met with cautious optimism, as stakeholders recognized the complexity of implementing such changes in a timely manner.

The reaction from the workforce, however, was mixed. While some employees expressed hope that the company’s commitment to negotiations would lead to meaningful improvements, others remained skeptical, citing past grievances and a perceived lack of transparency in management’s communication. This division within the workforce highlights the delicate balance Boeing must maintain as it seeks to address employee concerns while safeguarding its financial interests.

Analysts, meanwhile, offered varied interpretations of the earnings report. Some viewed the strike as a temporary setback, likely to be resolved without long-term consequences for Boeing’s market position. Others, however, warned that prolonged labor unrest could erode customer confidence and lead to a loss of market share, particularly if competitors capitalize on Boeing’s operational challenges.

In conclusion, Boeing’s earnings day, overshadowed by the workers’ strike, has underscored the intricate interplay between labor relations and corporate performance. For CEO David Calhoun, the task ahead is formidable: navigating the immediate challenges posed by the strike while steering the company towards sustainable growth. As stakeholders continue to monitor developments closely, the resolution of this labor dispute will undoubtedly serve as a critical indicator of Boeing’s ability to adapt and thrive in an increasingly complex business environment.

Long-term Effects of Strikes on Boeing’s Business Operations

The recent strike by Boeing workers has cast a long shadow over the company’s earnings day, transforming it into a tense affair for the CEO and stakeholders alike. Strikes, by their very nature, disrupt the normal flow of business operations, and when they occur in a company as pivotal as Boeing, the ramifications can be far-reaching. The immediate impact of such labor actions is often visible in the form of halted production lines and delayed deliveries, but the long-term effects can be even more profound, influencing everything from financial performance to corporate reputation.

To begin with, the financial implications of a strike are significant. Boeing, a major player in the aerospace industry, relies heavily on its workforce to maintain its production schedules and meet delivery deadlines. When workers down tools, the company faces the dual challenge of lost revenue and increased costs. The interruption in production can lead to a backlog of orders, which not only affects current earnings but also has the potential to impact future revenue streams. Moreover, the costs associated with resolving a strike, including potential wage increases and benefits enhancements, can strain the company’s financial resources.

Beyond the immediate financial concerns, strikes can also have a lasting impact on Boeing’s relationships with its clients. Airlines and other customers depend on Boeing to deliver aircraft on time, and any delays can disrupt their operations and plans. This can lead to strained relationships and, in some cases, customers may turn to competitors to fulfill their needs. The erosion of trust between Boeing and its clients can have long-term consequences, potentially affecting the company’s market share and competitive position.

Furthermore, the reputational damage resulting from a strike can be substantial. In today’s interconnected world, news of labor disputes spreads quickly, and public perception can be influenced by how a company handles such situations. A prolonged strike can lead to negative media coverage, which can tarnish Boeing’s image as a reliable and efficient manufacturer. This reputational hit can have a ripple effect, influencing investor confidence and potentially affecting the company’s stock price.

In addition to these external challenges, strikes can also have internal repercussions. The relationship between management and employees can be strained during a strike, leading to a decrease in morale and productivity even after the dispute is resolved. This can create a challenging work environment, making it difficult for Boeing to attract and retain top talent. In an industry where skilled labor is crucial, maintaining a motivated and committed workforce is essential for long-term success.

Moreover, the strategic direction of the company can be influenced by the outcomes of labor disputes. Management may need to reassess their approach to labor relations, potentially leading to changes in corporate policies and practices. This can involve a shift towards more collaborative and inclusive decision-making processes, which, while beneficial in the long run, may require significant adjustments in the short term.

In conclusion, while the immediate effects of a strike are often the most visible, the long-term impacts on Boeing’s business operations can be equally significant. From financial performance and client relationships to reputation and internal dynamics, the repercussions of labor disputes are multifaceted and complex. As Boeing navigates these challenges, the company’s ability to adapt and respond effectively will be crucial in determining its future trajectory in the competitive aerospace industry.

Q&A

1. **What was the main issue leading to the Boeing workers’ strike?**

The main issue leading to the Boeing workers’ strike was disputes over labor contracts, including demands for better wages, benefits, and job security.

2. **How did the strike impact Boeing’s earnings day?**

The strike turned Boeing’s earnings day into a tense situation as it created uncertainty about production schedules and financial forecasts, potentially affecting investor confidence.

3. **What were the financial implications of the strike for Boeing?**

The financial implications included potential delays in aircraft deliveries, increased labor costs, and possible penalties, which could negatively impact quarterly and annual earnings.

4. **How did Boeing’s CEO respond to the strike?**

Boeing’s CEO likely engaged in negotiations with union leaders to resolve the strike quickly, emphasizing the importance of reaching a fair agreement to minimize disruptions.

5. **What role did the union play in the strike?**

The union represented the workers’ interests, organizing the strike to pressure Boeing into meeting their demands for improved labor conditions.

6. **Were there any long-term effects anticipated from the strike?**

Long-term effects could include strained labor relations, potential changes in labor policies, and adjustments in production strategies to prevent future disruptions.

7. **How did investors react to the news of the strike on earnings day?**

Investors reacted with caution, as the strike introduced uncertainty into Boeing’s financial outlook, potentially affecting stock prices and market confidence.

Conclusion

The Boeing workers’ strike significantly heightened the tension surrounding the company’s earnings day, placing immense pressure on the CEO. The strike underscored the ongoing labor challenges and operational disruptions that could impact Boeing’s financial performance and strategic goals. As investors and stakeholders closely monitored the situation, the CEO faced the critical task of addressing labor concerns while reassuring the market of Boeing’s resilience and future prospects. The outcome of the earnings day, influenced by the strike, would likely have lasting implications for the company’s leadership and its ability to navigate complex labor relations.