“Streamlining for Success: Boeing’s Strategic Asset Divestment to Enhance Profitability and Competitiveness”

Introduction

Boeing, a leading aerospace company, has announced plans to divest certain key assets as part of a strategic initiative aimed at enhancing profitability and competitiveness in the global market. This move comes as the company seeks to streamline operations, focus on core business areas, and optimize its portfolio to better align with evolving industry demands. By shedding non-core assets, Boeing aims to improve financial performance, increase operational efficiency, and strengthen its position in the aerospace sector. This divestiture strategy reflects Boeing’s commitment to driving long-term growth and delivering value to its shareholders while maintaining its leadership in innovation and technology.

Impact Of Boeing’s Asset Divestiture On The Aerospace Industry

Boeing’s recent decision to divest key assets marks a significant strategic shift aimed at enhancing its profitability and competitiveness within the aerospace industry. This move, while primarily focused on strengthening the company’s financial position, is poised to have far-reaching implications across the sector. As Boeing seeks to streamline its operations and concentrate on core competencies, the ripple effects of this divestiture will likely influence various stakeholders, including suppliers, competitors, and customers.

To begin with, Boeing’s divestiture strategy is expected to reshape its operational landscape by allowing the company to allocate resources more efficiently. By shedding non-core assets, Boeing can focus on its primary business areas, such as commercial airplanes, defense, space, and security. This realignment is anticipated to enhance the company’s ability to innovate and respond to market demands more swiftly. Consequently, Boeing’s increased agility could lead to the development of more advanced aerospace technologies, potentially setting new industry standards and driving competition.

Moreover, the divestiture is likely to impact Boeing’s supply chain dynamics. As the company narrows its focus, it may renegotiate contracts with suppliers or seek new partnerships that align more closely with its strategic objectives. This could result in a shift in the balance of power within the supply chain, as suppliers may need to adapt to Boeing’s evolving requirements or risk losing business. Additionally, smaller suppliers might find new opportunities to collaborate with Boeing, fostering innovation and diversification within the industry.

In parallel, Boeing’s competitors are expected to closely monitor the divestiture process, as it may present both challenges and opportunities. On one hand, competitors could capitalize on any temporary disruptions in Boeing’s operations to gain market share. On the other hand, they may also face increased pressure to enhance their own offerings in response to Boeing’s renewed focus on core areas. This competitive dynamic could spur a wave of innovation across the aerospace sector, benefiting the industry as a whole.

Furthermore, customers, including airlines and government agencies, are likely to experience the effects of Boeing’s divestiture. As the company refines its product portfolio, customers may benefit from improved products and services tailored to their specific needs. However, there could also be short-term uncertainties regarding the availability and pricing of certain products, as Boeing transitions its operations. In the long run, customers may enjoy greater value and reliability from a more focused and financially robust Boeing.

In addition to these direct impacts, Boeing’s divestiture strategy may also influence broader industry trends. For instance, the move could signal a shift towards greater specialization within the aerospace sector, as companies increasingly concentrate on their core strengths to remain competitive. This trend may encourage other industry players to reevaluate their own asset portfolios and consider similar divestitures to optimize their operations.

In conclusion, Boeing’s decision to divest key assets represents a pivotal moment for the aerospace industry. While the primary goal is to bolster the company’s profitability and competitiveness, the implications of this move are likely to extend beyond Boeing itself. As the company refocuses its efforts on core areas, the resulting changes in supply chain dynamics, competitive pressures, and customer experiences will shape the future of the aerospace sector. Ultimately, Boeing’s divestiture strategy may serve as a catalyst for innovation and transformation, driving the industry towards greater efficiency and specialization.

Strategic Reasons Behind Boeing’s Decision To Divest Key Assets

Boeing’s recent decision to divest key assets marks a significant strategic shift aimed at enhancing its profitability and competitiveness in the global aerospace market. This move comes at a time when the company is navigating a complex landscape characterized by evolving market demands, technological advancements, and intensified competition. By shedding certain non-core assets, Boeing seeks to streamline its operations, focus on its core competencies, and allocate resources more efficiently to areas with the highest growth potential.

One of the primary strategic reasons behind Boeing’s divestiture plan is the need to optimize its portfolio. Over the years, the company has expanded into various segments, some of which may no longer align with its long-term strategic objectives. By divesting these non-essential assets, Boeing can concentrate on its core business areas, such as commercial airplanes, defense, space, and security. This focus allows the company to leverage its expertise, drive innovation, and maintain a competitive edge in these critical sectors.

Moreover, the divestiture is expected to generate significant capital, which can be reinvested into research and development initiatives. In an industry where technological innovation is paramount, staying ahead of the curve is crucial for maintaining market leadership. By reallocating resources to R&D, Boeing can accelerate the development of next-generation aircraft and technologies, thereby meeting the evolving needs of its customers and addressing emerging market trends. This strategic reinvestment not only enhances Boeing’s product offerings but also strengthens its position as a leader in aerospace innovation.

In addition to optimizing its portfolio and boosting R&D efforts, Boeing’s divestiture strategy is also driven by the need to improve operational efficiency. By shedding non-core assets, the company can reduce operational complexities and focus on streamlining its supply chain and production processes. This increased efficiency is expected to result in cost savings, which can be passed on to customers in the form of more competitive pricing. Furthermore, a leaner operational structure enables Boeing to respond more swiftly to market changes and customer demands, thereby enhancing its agility and responsiveness in a dynamic industry.

Another critical factor influencing Boeing’s decision is the intensifying competition in the aerospace sector. With rivals such as Airbus making significant strides in expanding their market share, Boeing must take proactive measures to maintain its competitive position. Divesting non-core assets allows the company to concentrate its efforts on areas where it can achieve the greatest impact and differentiation. By focusing on its strengths and core capabilities, Boeing can better compete with its rivals and capture a larger share of the market.

Finally, the divestiture aligns with Boeing’s broader strategic vision of sustainable growth and value creation. By prioritizing its core business areas and investing in innovation, the company aims to deliver long-term value to its shareholders while contributing to the advancement of the aerospace industry. This strategic realignment not only positions Boeing for future success but also reinforces its commitment to delivering cutting-edge solutions that meet the needs of its customers and stakeholders.

In conclusion, Boeing’s decision to divest key assets is a strategic move designed to enhance its profitability and competitiveness in the aerospace market. By optimizing its portfolio, reinvesting in R&D, improving operational efficiency, and focusing on core competencies, the company is well-positioned to navigate the challenges of the industry and achieve sustainable growth. As Boeing continues to execute its strategic vision, it remains committed to driving innovation and delivering value to its customers and shareholders.

How Boeing’s Divestiture Could Enhance Its Competitive Edge

Boeing’s recent decision to divest key assets marks a significant strategic shift aimed at enhancing its profitability and competitive edge in the aerospace industry. This move comes at a time when the company is navigating a complex landscape characterized by evolving market demands, technological advancements, and intensified competition. By shedding non-core assets, Boeing seeks to streamline its operations, focus on its core competencies, and ultimately strengthen its position in the global market.

The rationale behind Boeing’s divestiture strategy is multifaceted. Primarily, it allows the company to reallocate resources towards areas that promise higher returns and align more closely with its long-term strategic goals. In an industry where innovation and efficiency are paramount, concentrating efforts on core business segments such as commercial airplanes, defense, space, and security can provide Boeing with a sharper competitive focus. This strategic realignment is expected to enhance operational efficiency, reduce costs, and improve overall financial performance.

Moreover, divesting non-core assets can provide Boeing with the financial flexibility needed to invest in research and development. As the aerospace industry continues to evolve, driven by technological advancements and changing customer preferences, staying at the forefront of innovation is crucial. By channeling resources into R&D, Boeing can accelerate the development of new technologies and products, thereby maintaining its competitive edge. This proactive approach not only positions the company to meet current market demands but also prepares it for future challenges and opportunities.

In addition to financial and operational benefits, divestiture can also enhance Boeing’s strategic partnerships and collaborations. By focusing on its core areas, Boeing can forge stronger alliances with key stakeholders, including suppliers, customers, and industry partners. These partnerships are essential for driving innovation, improving supply chain efficiency, and expanding market reach. Furthermore, a more streamlined and focused Boeing is likely to be more agile and responsive to market changes, enabling it to capitalize on emerging opportunities more effectively.

While the divestiture strategy presents numerous advantages, it is not without its challenges. Successfully executing such a strategy requires careful planning and execution to ensure that the divested assets do not disrupt ongoing operations or negatively impact existing customer relationships. Additionally, Boeing must manage the transition of affected employees and maintain morale during this period of change. Effective communication and strategic planning are critical to mitigating these risks and ensuring a smooth transition.

In conclusion, Boeing’s decision to divest key assets represents a strategic move aimed at enhancing its profitability and competitiveness in the aerospace industry. By focusing on core competencies, reallocating resources towards innovation, and strengthening strategic partnerships, Boeing is positioning itself to navigate the challenges and opportunities of a rapidly evolving market. While the path to successful divestiture is fraught with challenges, the potential benefits in terms of operational efficiency, financial performance, and market positioning make it a compelling strategy. As Boeing embarks on this transformative journey, its ability to execute this strategy effectively will be crucial in determining its future success and maintaining its leadership position in the global aerospace industry.

Financial Implications Of Boeing’s Asset Divestment Strategy

Boeing’s recent decision to divest key assets marks a significant shift in its strategic approach, aimed at enhancing profitability and competitiveness in an increasingly challenging aerospace market. This move comes as the company seeks to streamline operations, reduce costs, and focus on core business areas that promise sustainable growth. The financial implications of this asset divestment strategy are multifaceted, impacting not only Boeing’s balance sheet but also its long-term market positioning.

To begin with, divesting non-core assets allows Boeing to reallocate resources more efficiently. By shedding businesses and operations that do not align with its primary objectives, the company can concentrate its efforts on areas with higher growth potential. This strategic realignment is expected to free up capital, which can be reinvested into research and development, thereby fostering innovation and maintaining Boeing’s competitive edge in the aerospace industry. Moreover, the divestment proceeds can be used to strengthen the company’s financial position, reducing debt levels and improving liquidity, which are crucial for navigating economic uncertainties.

In addition to resource reallocation, Boeing’s asset divestment strategy is likely to result in a leaner organizational structure. This streamlining can lead to cost savings through reduced operational complexities and improved efficiency. By focusing on its core competencies, Boeing can enhance its operational agility, enabling it to respond more swiftly to market demands and technological advancements. This agility is particularly important in the aerospace sector, where rapid innovation and evolving customer needs require companies to be adaptable and forward-thinking.

Furthermore, the divestment strategy may also have implications for Boeing’s relationships with stakeholders, including investors, customers, and suppliers. For investors, the move signals a commitment to enhancing shareholder value by prioritizing profitability and sustainable growth. The anticipated improvements in financial performance could lead to increased investor confidence and potentially higher stock valuations. For customers, a more focused Boeing could mean better products and services, as the company channels its resources into developing cutting-edge technologies and solutions that meet the evolving needs of the aerospace market. Suppliers, on the other hand, may experience changes in their partnerships with Boeing, as the company refines its supply chain to align with its streamlined operations.

However, it is important to consider the potential risks associated with Boeing’s asset divestment strategy. Divesting key assets may lead to short-term disruptions, as the company adjusts to a new operational model. There is also the possibility of losing valuable expertise and capabilities that were part of the divested assets. To mitigate these risks, Boeing must carefully manage the transition process, ensuring that it retains critical knowledge and skills while effectively integrating the remaining operations.

In conclusion, Boeing’s decision to divest key assets represents a strategic effort to boost profitability and competitiveness in a dynamic aerospace market. By reallocating resources, streamlining operations, and focusing on core business areas, the company aims to enhance its financial performance and market position. While the strategy presents opportunities for growth and innovation, it also entails risks that must be managed with precision. As Boeing navigates this transformative phase, its ability to execute the divestment strategy effectively will be crucial in determining its future success in the aerospace industry.

Potential Challenges And Risks In Boeing’s Divestiture Plan

Boeing’s recent announcement to divest key assets as part of its strategy to enhance profitability and competitiveness has garnered significant attention from industry analysts and stakeholders. While the move is seen as a proactive step towards streamlining operations and focusing on core competencies, it is not without its potential challenges and risks. As Boeing embarks on this ambitious divestiture plan, it must navigate a complex landscape that could impact its long-term objectives.

One of the primary challenges Boeing faces is the potential disruption to its existing operations. Divesting key assets, particularly those that have been integral to the company’s supply chain and production processes, could lead to short-term operational inefficiencies. This disruption may affect Boeing’s ability to meet current production targets and fulfill existing orders, thereby impacting customer satisfaction and potentially leading to financial penalties. To mitigate this risk, Boeing will need to ensure a seamless transition by carefully selecting which assets to divest and implementing robust contingency plans.

Moreover, the divestiture plan could pose risks related to workforce management. The sale or transfer of certain business units may result in workforce reductions or reassignments, which could lead to decreased employee morale and productivity. Boeing must address these human resource challenges by providing clear communication, support, and retraining opportunities to affected employees. By doing so, the company can maintain a motivated workforce that is aligned with its strategic goals.

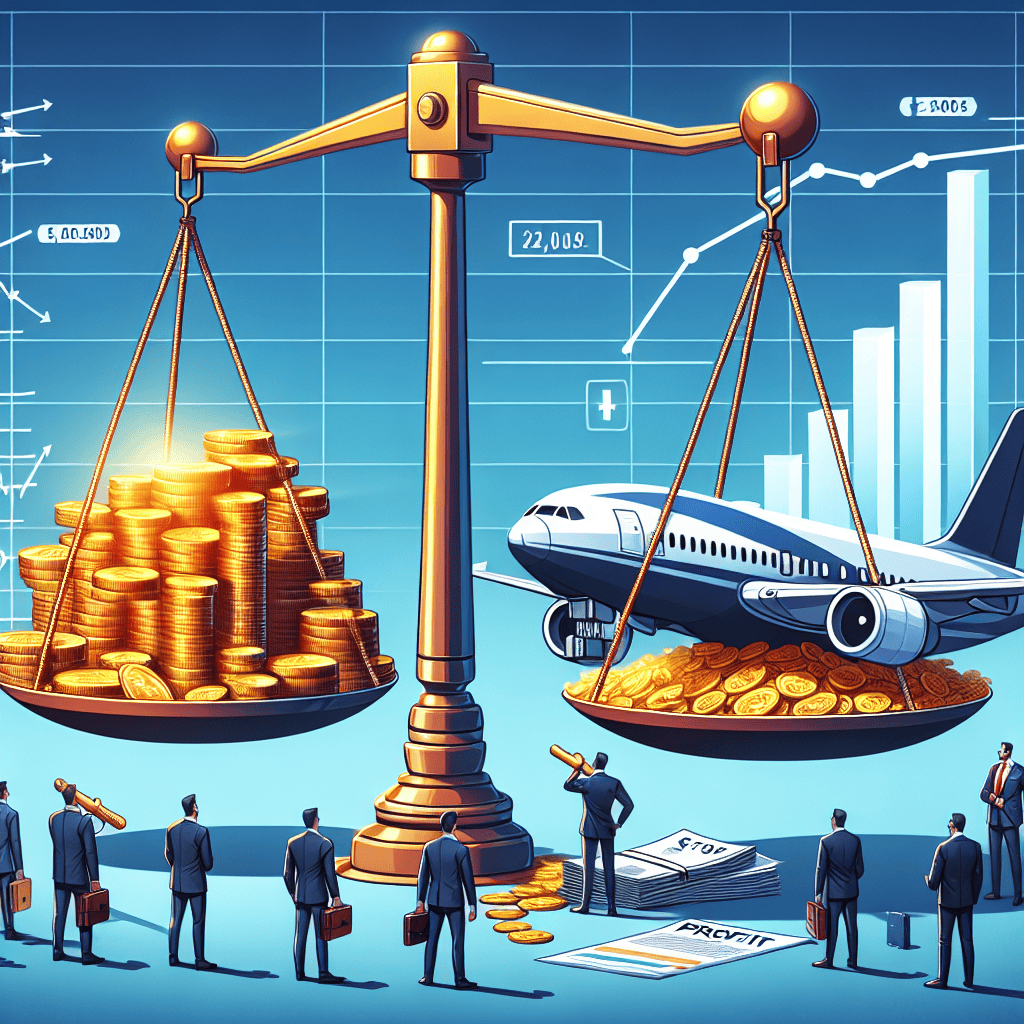

In addition to operational and workforce challenges, Boeing must also consider the financial implications of its divestiture plan. While the sale of non-core assets is expected to generate immediate capital, there is a risk that the proceeds may not meet expectations due to market conditions or valuation discrepancies. Furthermore, the divestiture process itself can be costly, involving legal, advisory, and restructuring expenses. Boeing will need to carefully assess the financial trade-offs and ensure that the long-term benefits of divestiture outweigh the short-term costs.

Another significant risk is the potential impact on Boeing’s competitive position in the aerospace industry. By divesting certain assets, Boeing may inadvertently cede market share to competitors who are eager to capitalize on any perceived weaknesses. This is particularly relevant in an industry characterized by rapid technological advancements and intense competition. To counteract this risk, Boeing must strategically reinvest the proceeds from asset sales into areas that will enhance its competitive edge, such as research and development, innovation, and strategic partnerships.

Furthermore, regulatory and compliance challenges could arise during the divestiture process. Boeing operates in a highly regulated industry, and any asset sale must comply with a myriad of legal and regulatory requirements. Failure to adhere to these regulations could result in delays, fines, or even the nullification of transactions. Therefore, Boeing must engage with regulatory bodies early in the process and ensure that all divestiture activities are conducted in full compliance with applicable laws.

In conclusion, while Boeing’s divestiture plan holds the promise of increased profitability and competitiveness, it is fraught with potential challenges and risks. The company must carefully manage operational disruptions, workforce implications, financial trade-offs, competitive dynamics, and regulatory compliance to ensure the success of its strategy. By addressing these challenges head-on and leveraging its strengths, Boeing can position itself for sustainable growth and continued leadership in the aerospace industry.

Long-term Benefits Of Boeing’s Asset Divestiture For Shareholders

Boeing’s recent decision to divest key assets marks a significant strategic shift aimed at enhancing its profitability and competitiveness in the aerospace industry. This move, while initially raising eyebrows among stakeholders, is poised to offer substantial long-term benefits for shareholders. By shedding non-core assets, Boeing is not only streamlining its operations but also reallocating resources to areas with higher growth potential, thereby positioning itself more favorably in the market.

To begin with, asset divestiture allows Boeing to focus on its core competencies, such as commercial aircraft manufacturing and defense contracts. By concentrating on these areas, the company can leverage its expertise and resources more effectively, leading to improved operational efficiency. This strategic focus is expected to result in cost savings and increased productivity, which are crucial for enhancing profitability. Moreover, by divesting non-essential assets, Boeing can reduce its debt burden, thereby improving its financial health and providing a more stable foundation for future growth.

In addition to operational efficiencies, the divestiture strategy is likely to enhance Boeing’s competitive edge. The aerospace industry is characterized by rapid technological advancements and intense competition. By reallocating resources from divested assets to research and development, Boeing can accelerate innovation and bring cutting-edge products to market more swiftly. This proactive approach not only strengthens Boeing’s market position but also ensures that it remains at the forefront of technological advancements, thereby attracting more customers and increasing market share.

Furthermore, the divestiture is expected to generate significant cash inflows, which can be strategically reinvested to drive growth. For shareholders, this means potential increases in dividends and share buybacks, both of which are attractive propositions. By returning capital to shareholders, Boeing demonstrates its commitment to enhancing shareholder value, which is likely to boost investor confidence and positively impact the company’s stock price. Additionally, the reinvestment of proceeds into high-growth areas can lead to sustainable long-term returns, further benefiting shareholders.

Another critical aspect of Boeing’s asset divestiture is the potential for strategic partnerships and collaborations. By divesting certain assets, Boeing opens up opportunities to form alliances with other industry players, thereby expanding its reach and capabilities. These partnerships can lead to shared resources, reduced costs, and access to new markets, all of which contribute to increased competitiveness. For shareholders, such collaborations can translate into enhanced growth prospects and a more diversified revenue stream, reducing the risk associated with market fluctuations.

Moreover, the divestiture aligns with broader industry trends towards specialization and agility. As the aerospace sector evolves, companies that can quickly adapt to changing market dynamics are more likely to succeed. By focusing on its core strengths and divesting non-core assets, Boeing is positioning itself as a more agile and responsive entity. This strategic alignment not only ensures long-term sustainability but also enhances the company’s ability to capitalize on emerging opportunities, ultimately benefiting shareholders.

In conclusion, Boeing’s decision to divest key assets is a forward-thinking strategy that promises substantial long-term benefits for shareholders. By streamlining operations, enhancing competitiveness, and fostering strategic partnerships, Boeing is well-positioned to deliver sustainable growth and increased shareholder value. While the immediate impact of the divestiture may be subject to scrutiny, the long-term advantages are clear, making this a prudent move for the aerospace giant.

Comparing Boeing’s Divestiture Strategy With Industry Rivals

In the ever-evolving aerospace industry, companies are constantly seeking strategies to enhance profitability and maintain competitiveness. Boeing, a titan in the aerospace sector, has recently announced its decision to divest certain key assets as part of a broader strategy to streamline operations and focus on core competencies. This move is not unprecedented in the industry; rather, it reflects a growing trend among major aerospace firms to reassess and realign their business portfolios. By examining Boeing’s divestiture strategy in comparison to its industry rivals, we can gain insights into the broader implications of such strategic decisions.

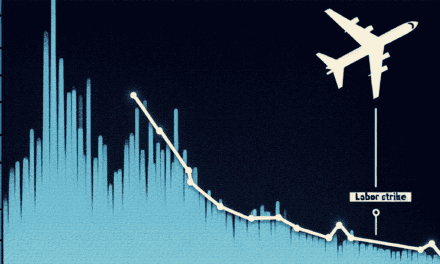

Boeing’s decision to divest certain assets is primarily driven by the need to optimize its operational efficiency and financial performance. In recent years, the company has faced significant challenges, including production delays, regulatory scrutiny, and the financial impact of the COVID-19 pandemic. These factors have necessitated a reevaluation of its business model, prompting Boeing to focus on its most profitable and strategically important segments. By shedding non-core assets, Boeing aims to allocate resources more effectively, reduce operational complexity, and enhance its ability to innovate in key areas such as commercial aircraft and defense systems.

In comparison, Boeing’s industry rivals have also embraced divestiture as a strategic tool to bolster their market positions. For instance, Airbus, Boeing’s primary competitor, has similarly engaged in divestiture activities to streamline its operations. Airbus has focused on divesting non-essential businesses and assets that do not align with its long-term strategic goals. This approach has allowed Airbus to concentrate on its core aerospace and defense segments, thereby improving its competitive edge and financial stability. The parallel strategies of Boeing and Airbus underscore a common industry trend where leading aerospace companies are prioritizing agility and focus over diversification.

Moreover, other aerospace firms, such as Lockheed Martin and Northrop Grumman, have also pursued divestiture strategies to enhance their competitiveness. Lockheed Martin, for example, has divested certain non-core business units to concentrate on its defense and space segments, which are deemed more strategically valuable. Similarly, Northrop Grumman has streamlined its operations by divesting businesses that do not align with its core focus on aerospace and defense technologies. These examples illustrate a broader industry pattern where divestiture is leveraged as a means to sharpen strategic focus and improve financial performance.

While divestiture can offer significant benefits, it is not without risks. Companies must carefully assess which assets to divest and ensure that the process does not disrupt ongoing operations or erode shareholder value. For Boeing, the challenge lies in executing its divestiture strategy effectively while maintaining its leadership position in the aerospace industry. The company must balance the need to streamline operations with the imperative to invest in innovation and growth areas that will drive future success.

In conclusion, Boeing’s decision to divest key assets is emblematic of a wider industry trend where aerospace companies are increasingly focusing on core competencies to enhance profitability and competitiveness. By comparing Boeing’s strategy with those of its rivals, it becomes evident that divestiture is a strategic tool employed by many leading firms to navigate the complexities of the aerospace market. As Boeing moves forward with its divestiture plans, the company will need to carefully manage the process to ensure it achieves its strategic objectives while maintaining its competitive edge in the global aerospace industry.

Q&A

1. **What is Boeing planning to divest?**

Boeing is planning to divest certain non-core assets and business units that are not central to its primary operations in aerospace and defense.

2. **Why is Boeing divesting these assets?**

The divestment is aimed at boosting profitability and enhancing competitiveness by allowing Boeing to focus more on its core business areas.

3. **How will the divestment impact Boeing’s financial performance?**

The divestment is expected to improve Boeing’s financial performance by reducing operational costs and potentially generating capital from the sale of these assets.

4. **What are the potential benefits of this divestment for Boeing?**

Potential benefits include increased operational efficiency, a stronger focus on core competencies, and improved financial health.

5. **How might this divestment affect Boeing’s workforce?**

The divestment could lead to workforce restructuring, including potential layoffs or reassignments, depending on the assets being sold and the needs of the remaining business units.

6. **What challenges might Boeing face during this divestment process?**

Challenges could include finding suitable buyers, negotiating favorable terms, and managing the transition of affected employees and operations.

7. **How does this divestment align with Boeing’s long-term strategy?**

The divestment aligns with Boeing’s long-term strategy by streamlining operations, focusing on core areas of growth, and positioning the company for sustainable profitability and competitiveness in the aerospace industry.

Conclusion

Boeing’s decision to divest key assets is a strategic move aimed at enhancing its profitability and competitiveness in the aerospace industry. By shedding non-core or underperforming assets, Boeing can streamline its operations, reduce costs, and focus on its core competencies, such as commercial aircraft production and defense contracts. This divestiture strategy may also provide Boeing with additional capital to invest in innovation, research, and development, thereby strengthening its market position. However, the success of this approach will depend on how effectively Boeing manages the divestiture process and reallocates resources to areas with the highest growth potential. Overall, this move could position Boeing more favorably against competitors, provided it is executed with careful consideration of market dynamics and long-term strategic goals.