“Boeing’s Turbulent Quarter: $6B Loss Looms as Union Vote Approaches”

Introduction

Boeing, the aerospace giant, is grappling with a significant financial setback, reporting a staggering $6 billion loss in its latest quarterly earnings. This financial turmoil comes at a critical juncture as the company faces an impending union vote, which could further impact its operational dynamics. The loss underscores the challenges Boeing is encountering, including supply chain disruptions, production delays, and increased competition in the aerospace sector. As the union vote looms, the outcome could have profound implications for Boeing’s labor relations and future strategic direction, adding another layer of complexity to its efforts to stabilize and recover financially.

Boeing’s Financial Struggles: Analyzing the $6B Quarterly Loss

Boeing, a titan in the aerospace industry, is currently navigating turbulent financial waters, as evidenced by its staggering $6 billion quarterly loss. This financial setback has sent ripples through the industry, raising questions about the company’s future strategies and stability. The loss, which is one of the most significant in Boeing’s history, can be attributed to a confluence of factors that have been building over recent years. As the company grapples with these challenges, an upcoming union vote adds another layer of complexity to its already intricate situation.

To understand the roots of Boeing’s financial struggles, one must consider the broader context of the aerospace sector. The industry has been reeling from the impacts of the COVID-19 pandemic, which severely disrupted global travel and, consequently, the demand for new aircraft. Although there has been a gradual recovery, the pace has been uneven, with airlines cautious about expanding their fleets amid economic uncertainties. This hesitancy has directly affected Boeing’s order book, leading to reduced revenues and increased pressure on its financial performance.

Moreover, Boeing has been dealing with the fallout from the 737 Max crisis, which not only tarnished its reputation but also resulted in substantial financial penalties and compensation payouts. The grounding of the 737 Max fleet worldwide led to a significant loss of trust among customers and regulators, necessitating extensive efforts to rebuild confidence in the safety and reliability of its aircraft. These efforts have been costly, both in terms of financial resources and time, further straining the company’s balance sheet.

In addition to these external challenges, Boeing has faced internal operational issues that have exacerbated its financial woes. Production delays and quality control problems have plagued several of its key programs, including the 787 Dreamliner. These issues have led to delivery delays and increased costs, compounding the financial strain on the company. As Boeing works to address these operational inefficiencies, it must also contend with rising material and labor costs, which have squeezed profit margins even further.

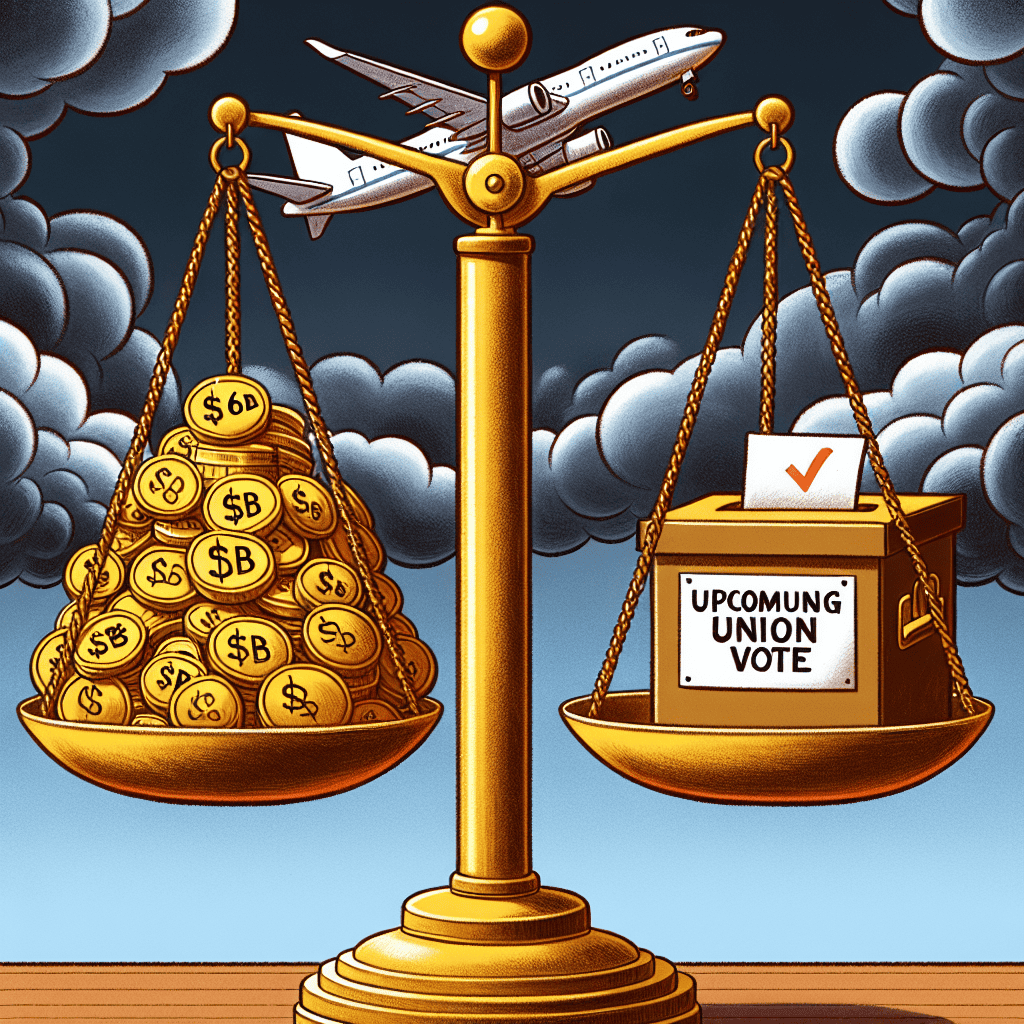

Amidst these financial challenges, Boeing is also preparing for an upcoming union vote, which could have significant implications for its labor relations and operational stability. The vote, which involves a substantial portion of Boeing’s workforce, comes at a time when labor unions are increasingly vocal about workers’ rights and benefits. A favorable outcome for the union could lead to increased labor costs for Boeing, adding another layer of financial pressure. Conversely, a vote against unionization could lead to unrest and potential disruptions in production, further complicating the company’s recovery efforts.

As Boeing navigates this complex landscape, it is imperative for the company to adopt a multifaceted approach to address its financial and operational challenges. This includes strengthening its supply chain resilience, enhancing quality control measures, and fostering a collaborative relationship with its workforce. Additionally, Boeing must continue to innovate and adapt to the evolving demands of the aerospace market, ensuring that it remains competitive in a rapidly changing environment.

In conclusion, Boeing’s $6 billion quarterly loss underscores the myriad challenges facing the company as it seeks to regain its footing in the aerospace industry. While the road to recovery may be fraught with obstacles, a strategic and comprehensive approach could enable Boeing to emerge stronger and more resilient in the face of adversity. As the upcoming union vote looms, the company’s ability to navigate these challenges will be closely watched by industry stakeholders and investors alike.

The Impact of Union Votes on Boeing’s Future

Boeing, a titan in the aerospace industry, is currently navigating turbulent skies as it faces a staggering $6 billion quarterly loss. This financial setback comes at a critical juncture, with an impending union vote that could significantly influence the company’s trajectory. The confluence of these events underscores the intricate relationship between financial performance and labor relations, highlighting the potential impact of union decisions on Boeing’s future.

The substantial quarterly loss can be attributed to a confluence of factors, including supply chain disruptions, increased production costs, and lingering effects of the COVID-19 pandemic. These challenges have strained Boeing’s financial resources, compelling the company to reassess its operational strategies. As Boeing grapples with these financial difficulties, the upcoming union vote adds another layer of complexity to its strategic planning.

Union votes are pivotal moments for any corporation, particularly in industries where labor plays a crucial role in production and innovation. For Boeing, the stakes are exceptionally high. The outcome of the union vote could determine the company’s ability to implement cost-saving measures, negotiate labor contracts, and maintain operational efficiency. A vote in favor of unionization could empower workers to demand better wages and working conditions, potentially increasing operational costs for Boeing. Conversely, a vote against unionization might allow the company to retain greater control over its labor policies, albeit at the risk of employee dissatisfaction.

The relationship between Boeing and its workforce has historically been marked by both collaboration and contention. In recent years, tensions have escalated due to layoffs, wage disputes, and concerns over job security. These issues have fueled the push for unionization, as employees seek a stronger voice in negotiations with management. The upcoming vote is a manifestation of these underlying tensions, reflecting the workforce’s desire for greater influence over their working conditions.

As Boeing prepares for the union vote, it must also consider the broader implications for its competitive position in the aerospace industry. The company is already facing stiff competition from rivals such as Airbus, which has been capitalizing on Boeing’s recent challenges to expand its market share. Any disruptions resulting from labor disputes could further erode Boeing’s competitive edge, making it imperative for the company to strike a delicate balance between addressing employee concerns and maintaining operational efficiency.

Moreover, the outcome of the union vote could have ripple effects throughout the aerospace industry, influencing labor relations and unionization efforts at other companies. A successful unionization effort at Boeing could embolden workers at other firms to pursue similar initiatives, potentially reshaping the labor landscape across the sector. This possibility underscores the broader significance of the upcoming vote, extending its impact beyond Boeing’s immediate financial and operational concerns.

In conclusion, Boeing’s current predicament highlights the intricate interplay between financial performance and labor relations. The $6 billion quarterly loss serves as a stark reminder of the challenges facing the company, while the impending union vote represents a critical juncture in its ongoing efforts to navigate these challenges. As Boeing charts its course forward, the outcome of the union vote will undoubtedly play a pivotal role in shaping its future, influencing not only its internal dynamics but also its position within the global aerospace industry.

Understanding Boeing’s Financial Challenges in 2023

In 2023, Boeing finds itself navigating a turbulent financial landscape, marked by a staggering $6 billion quarterly loss. This financial setback is a significant concern for the aerospace giant, which has been striving to recover from previous challenges, including the 737 Max crisis and the global pandemic’s impact on air travel. The current financial difficulties are compounded by an impending union vote, which could further influence the company’s operational dynamics and financial health.

To understand the roots of Boeing’s financial challenges, it is essential to consider the broader context of the aerospace industry. The sector has been grappling with supply chain disruptions, fluctuating demand, and increased competition. These factors have placed immense pressure on Boeing to adapt and innovate while maintaining profitability. The $6 billion loss underscores the severity of these challenges, highlighting the need for strategic adjustments to regain financial stability.

One of the critical issues contributing to Boeing’s financial woes is the ongoing supply chain crisis. The pandemic-induced disruptions have led to delays in the production and delivery of aircraft, affecting Boeing’s ability to meet customer demands and fulfill orders. Consequently, the company has faced increased costs and reduced revenues, exacerbating its financial strain. Moreover, the global semiconductor shortage has further complicated production processes, as modern aircraft rely heavily on advanced electronics and systems.

In addition to supply chain issues, Boeing is contending with a competitive market environment. Rival companies, such as Airbus, have been capitalizing on Boeing’s struggles, capturing market share and securing new orders. This competitive pressure has forced Boeing to reconsider its pricing strategies and product offerings, which, in turn, has impacted its profit margins. The need to invest in research and development to stay ahead of technological advancements adds another layer of financial burden.

Amid these challenges, the upcoming union vote presents a potential turning point for Boeing. The vote, which involves thousands of workers, could lead to changes in labor agreements, affecting wages, benefits, and working conditions. A favorable outcome for the union could result in increased labor costs for Boeing, further straining its financial resources. On the other hand, a successful negotiation could foster a more collaborative relationship between management and employees, potentially enhancing productivity and morale.

The union vote also highlights the importance of labor relations in Boeing’s overall strategy. As the company seeks to navigate its financial challenges, maintaining a skilled and motivated workforce is crucial. Effective communication and negotiation with union representatives will be essential in achieving a balance between cost management and employee satisfaction.

In response to these multifaceted challenges, Boeing is likely to implement a series of strategic initiatives aimed at cost reduction and operational efficiency. These may include streamlining production processes, renegotiating supplier contracts, and exploring new markets for growth opportunities. Additionally, Boeing may intensify its focus on sustainability and innovation, aligning with industry trends and customer expectations.

In conclusion, Boeing’s $6 billion quarterly loss in 2023 serves as a stark reminder of the complex challenges facing the aerospace industry. The interplay of supply chain disruptions, competitive pressures, and labor dynamics underscores the need for strategic agility and resilience. As Boeing prepares for the upcoming union vote, the outcome will undoubtedly influence its path forward, shaping the company’s efforts to restore financial stability and maintain its position as a leader in the global aerospace market.

How Union Decisions Could Shape Boeing’s Recovery

Boeing, a titan in the aerospace industry, is currently navigating turbulent skies as it faces a staggering $6 billion quarterly loss. This financial setback comes at a critical juncture, with an impending union vote that could significantly influence the company’s path to recovery. The intricate relationship between Boeing’s financial health and its workforce’s decisions underscores the importance of understanding how union actions might shape the company’s future.

The financial loss, attributed to a combination of supply chain disruptions, increased production costs, and lingering impacts from the COVID-19 pandemic, has placed Boeing in a precarious position. As the company grapples with these challenges, the role of its workforce, particularly the unionized segment, becomes increasingly pivotal. The upcoming union vote is not merely a procedural event; it is a potential turning point that could redefine labor relations and operational strategies within Boeing.

Historically, unions have played a crucial role in advocating for workers’ rights, negotiating better wages, and ensuring safe working conditions. At Boeing, the union’s influence is particularly pronounced, given the highly skilled nature of the workforce and the technical demands of aerospace manufacturing. As the union prepares to vote, several key issues are at the forefront, including job security, wage adjustments, and benefits. The outcome of this vote could either stabilize or further complicate Boeing’s efforts to regain its financial footing.

In light of the financial losses, Boeing’s management is likely to approach the union negotiations with a focus on cost containment and operational efficiency. However, this approach must be balanced with the need to maintain a motivated and skilled workforce. The union, representing thousands of employees, holds significant leverage in these discussions. A favorable agreement could lead to enhanced productivity and morale, while a contentious negotiation might result in strikes or work stoppages, further exacerbating Boeing’s financial woes.

Moreover, the union’s decision will have broader implications beyond immediate labor relations. It could influence investor confidence, affect stock prices, and shape public perception of Boeing’s corporate responsibility. In an industry where reputation and reliability are paramount, the stakes are high. A harmonious resolution could signal stability and resilience, attracting potential investors and reassuring stakeholders. Conversely, a protracted dispute might raise concerns about Boeing’s ability to manage internal challenges effectively.

As Boeing navigates this complex landscape, it must also consider the competitive pressures from other aerospace giants. The global aerospace market is fiercely competitive, with companies vying for contracts and market share. Any disruption in Boeing’s operations could provide an opportunity for competitors to gain an edge. Therefore, the outcome of the union vote is not just a matter of internal policy but a strategic factor that could influence Boeing’s position in the global market.

In conclusion, the upcoming union vote at Boeing is a critical event that could shape the company’s recovery trajectory. As Boeing contends with a significant financial loss, the decisions made by its unionized workforce will play a crucial role in determining the company’s ability to overcome current challenges and secure a stable future. The interplay between financial strategy and labor relations will be pivotal in defining Boeing’s path forward, making the union’s decision a matter of considerable consequence for the company’s recovery efforts.

Boeing’s Strategic Response to Financial Losses

Boeing, a titan in the aerospace industry, is currently navigating turbulent financial waters, having reported a staggering $6 billion loss in the latest quarter. This financial setback comes at a critical juncture as the company faces an impending union vote, which could further influence its operational dynamics. The confluence of these challenges necessitates a strategic response from Boeing, aimed at stabilizing its financial health while maintaining workforce morale and productivity.

The reported quarterly loss can be attributed to several factors, including supply chain disruptions, increased production costs, and delays in aircraft deliveries. These issues have been exacerbated by the lingering effects of the COVID-19 pandemic, which has reshaped the global aviation landscape. As airlines worldwide grapple with fluctuating demand and evolving travel restrictions, Boeing has found itself in a precarious position, striving to meet contractual obligations while managing its financial liabilities.

In response to these challenges, Boeing is implementing a multi-faceted strategy designed to mitigate losses and position the company for future growth. Central to this strategy is a renewed focus on cost management and operational efficiency. By streamlining production processes and optimizing resource allocation, Boeing aims to reduce overheads and improve its bottom line. Additionally, the company is exploring opportunities to diversify its revenue streams, with an emphasis on expanding its services and defense segments, which have shown resilience amid the downturn in commercial aviation.

Moreover, Boeing is actively engaging with its supply chain partners to address bottlenecks and enhance the reliability of its production schedules. By fostering closer collaboration and communication, the company seeks to build a more resilient supply chain capable of withstanding external shocks. This approach not only helps in mitigating immediate disruptions but also lays the groundwork for long-term stability and growth.

As Boeing navigates these financial challenges, the upcoming union vote looms large on the horizon. The outcome of this vote could have significant implications for the company’s labor relations and operational strategies. Recognizing the importance of maintaining a harmonious relationship with its workforce, Boeing is prioritizing open dialogue and negotiation with union representatives. By addressing employee concerns and fostering a collaborative work environment, the company hopes to secure a favorable outcome that aligns with its strategic objectives.

In tandem with these efforts, Boeing is also investing in innovation and technology to drive future growth. The company is committed to advancing its research and development initiatives, with a focus on sustainable aviation solutions and next-generation aircraft technologies. By positioning itself at the forefront of industry innovation, Boeing aims to capture new market opportunities and enhance its competitive edge.

In conclusion, Boeing’s strategic response to its $6 billion quarterly loss is characterized by a comprehensive approach that addresses both immediate financial challenges and long-term growth prospects. Through cost management, supply chain optimization, labor relations, and technological innovation, the company is laying the foundation for a more resilient and sustainable future. As the union vote approaches, Boeing’s ability to navigate these complex dynamics will be crucial in determining its trajectory in the ever-evolving aerospace industry.

The Role of Labor Unions in Boeing’s Business Strategy

Boeing, a titan in the aerospace industry, is currently navigating turbulent financial skies, reporting a staggering $6 billion quarterly loss. This financial setback comes at a critical juncture as the company faces an impending union vote, which could significantly influence its business strategy moving forward. The role of labor unions in Boeing’s operations has long been a subject of considerable importance, shaping not only the company’s internal dynamics but also its competitive edge in the global market.

Labor unions have historically played a pivotal role in advocating for workers’ rights, ensuring fair wages, and maintaining safe working conditions. At Boeing, unions such as the International Association of Machinists and Aerospace Workers (IAM) have been instrumental in negotiating contracts that balance the interests of the workforce with the company’s operational goals. As Boeing grapples with its current financial challenges, the upcoming union vote is poised to be a decisive factor in determining the future trajectory of its labor relations and, by extension, its overall business strategy.

The financial loss reported by Boeing can be attributed to a confluence of factors, including supply chain disruptions, increased production costs, and a slowdown in aircraft demand. These challenges have been exacerbated by the lingering effects of the COVID-19 pandemic, which has reshaped the landscape of the aviation industry. In this context, the role of labor unions becomes even more critical, as they have the potential to influence how Boeing navigates these challenges. By advocating for job security and fair compensation, unions can help ensure that the workforce remains motivated and productive, which is essential for the company’s recovery and long-term success.

Moreover, the upcoming union vote is not merely a matter of internal company politics; it has broader implications for Boeing’s competitive position in the aerospace sector. A strong union presence can lead to more stable labor relations, reducing the likelihood of strikes or work stoppages that could further disrupt production schedules. This stability is crucial for Boeing as it seeks to regain its footing in a highly competitive market, where rivals such as Airbus are also vying for dominance. By fostering a collaborative relationship with its unions, Boeing can enhance its operational efficiency and focus on innovation, which are key drivers of success in the aerospace industry.

In addition to its impact on labor relations, the union vote also holds significance for Boeing’s corporate reputation. In an era where corporate social responsibility is increasingly scrutinized, how Boeing engages with its workforce can influence public perception and investor confidence. A positive outcome from the union vote, characterized by mutual agreement and cooperation, could bolster Boeing’s image as a company that values its employees and is committed to sustainable business practices.

As Boeing prepares for the upcoming union vote, it must carefully consider the role of labor unions in shaping its business strategy. By recognizing the value that unions bring to the table, Boeing can leverage this relationship to address its current financial challenges and position itself for future growth. Ultimately, the outcome of the union vote will serve as a barometer for Boeing’s ability to adapt to changing market conditions and maintain its status as a leader in the aerospace industry. Through strategic collaboration with its unions, Boeing can chart a course toward stability and success, even amidst the financial headwinds it currently faces.

Financial Turbulence: Boeing’s Path Forward After Major Losses

Boeing, a titan in the aerospace industry, is currently navigating a turbulent financial landscape, having reported a staggering $6 billion loss in the latest quarter. This financial setback comes at a critical juncture as the company faces an impending union vote, which could further influence its operational dynamics. The confluence of these challenges underscores the complex environment in which Boeing operates, necessitating a strategic reassessment to stabilize its financial footing and maintain its competitive edge.

The reported quarterly loss is attributed to a confluence of factors, including supply chain disruptions, increased production costs, and lingering impacts from the COVID-19 pandemic. These elements have collectively strained Boeing’s financial resources, compelling the company to reevaluate its cost structures and operational efficiencies. Moreover, the aerospace giant has been grappling with delays in the delivery of its 787 Dreamliner and 737 MAX aircraft, exacerbating its financial woes. These delays not only impact revenue streams but also erode customer confidence, posing a significant challenge to Boeing’s market position.

In addition to these operational hurdles, Boeing is on the cusp of a pivotal union vote, which could have far-reaching implications for its labor relations and cost management strategies. The vote, driven by employee concerns over job security, wages, and working conditions, reflects broader tensions within the company. A successful unionization effort could lead to increased labor costs and necessitate renegotiations of existing contracts, further straining Boeing’s financial resources. Conversely, a failure to unionize might perpetuate employee dissatisfaction, potentially affecting productivity and morale.

As Boeing contends with these internal and external pressures, the company is also facing heightened competition from rivals such as Airbus. The European aerospace manufacturer has been capitalizing on Boeing’s setbacks, securing new orders and expanding its market share. This competitive pressure underscores the urgency for Boeing to address its operational inefficiencies and restore its reputation as a reliable aircraft manufacturer. To this end, Boeing has announced plans to streamline its production processes and invest in new technologies aimed at enhancing efficiency and reducing costs.

Furthermore, Boeing’s leadership is actively engaging with stakeholders to navigate this challenging period. The company has initiated dialogues with suppliers to address bottlenecks in the supply chain and is exploring strategic partnerships to bolster its technological capabilities. These efforts are complemented by a renewed focus on sustainability, with Boeing committing to reducing its carbon footprint and investing in sustainable aviation fuels. Such initiatives are not only critical for meeting regulatory requirements but also for aligning with the evolving expectations of customers and investors.

In conclusion, Boeing’s current financial turbulence presents a formidable challenge, yet it also offers an opportunity for transformation. By addressing its operational inefficiencies, engaging constructively with its workforce, and leveraging technological advancements, Boeing can chart a path toward recovery and long-term success. The upcoming union vote will undoubtedly play a crucial role in shaping this trajectory, highlighting the importance of effective leadership and strategic foresight. As Boeing navigates these complexities, its ability to adapt and innovate will be paramount in securing its position as a leader in the aerospace industry.

Q&A

1. **What is the main financial issue Boeing is facing?**

Boeing is facing a $6 billion quarterly loss.

2. **What is a significant upcoming event for Boeing?**

An upcoming union vote is a significant event for Boeing.

3. **How might the union vote impact Boeing?**

The union vote could impact labor relations and potentially lead to strikes or changes in labor costs.

4. **What are some potential reasons for Boeing’s financial loss?**

Potential reasons could include production delays, supply chain issues, or decreased demand for aircraft.

5. **How has Boeing’s stock been affected by the financial loss?**

Boeing’s stock may have experienced volatility or a decline due to the financial loss.

6. **What are analysts saying about Boeing’s future prospects?**

Analysts might be concerned about Boeing’s ability to recover financially and manage labor relations effectively.

7. **What steps is Boeing taking to address the financial loss?**

Boeing may be implementing cost-cutting measures, negotiating with unions, or seeking to boost sales to address the financial loss.

Conclusion

Boeing’s $6 billion quarterly loss highlights significant financial challenges for the aerospace giant, exacerbated by ongoing production issues, supply chain disruptions, and the impact of the COVID-19 pandemic on the aviation industry. This financial strain comes at a critical juncture as the company faces an upcoming union vote, which could further influence its operational and labor dynamics. The outcome of the union vote may affect Boeing’s ability to implement cost-saving measures and negotiate labor contracts, potentially impacting its recovery strategy. The company’s leadership will need to navigate these challenges carefully to stabilize its financial position and restore investor confidence.