“Strategic Shift: Boeing Entrusts Surveillance Expertise to Thales”

Introduction

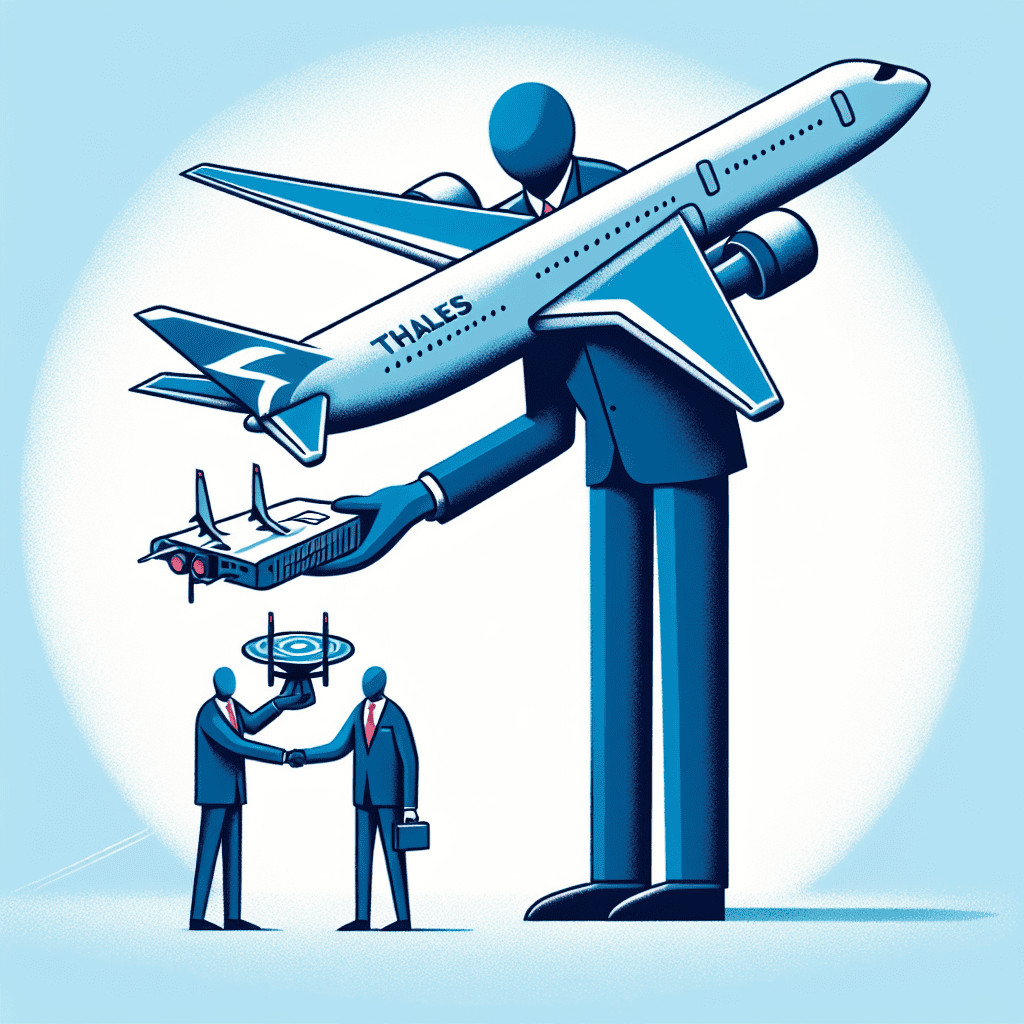

In a strategic move to streamline its operations and focus on core business areas, Boeing has announced the divestiture of its small defense surveillance division to Thales, a global leader in aerospace, defense, and security solutions. This transaction marks a significant shift in Boeing’s defense strategy, allowing the company to concentrate on its larger defense and aerospace projects while ensuring that the specialized surveillance division continues to thrive under Thales’ stewardship. The acquisition by Thales is expected to enhance its portfolio of defense capabilities, leveraging the advanced technologies and expertise developed by Boeing’s division to bolster its position in the global defense market. This divestiture aligns with Boeing’s broader efforts to optimize its business structure and drive long-term growth and innovation in its key sectors.

Impact Of Boeing’s Divestment On The Defense Industry

Boeing’s recent decision to divest its small defense surveillance division to Thales marks a significant shift in the landscape of the defense industry. This strategic move, while primarily a business decision, carries broader implications for the sector, influencing competitive dynamics, technological innovation, and market positioning. As Boeing realigns its focus, the divestment allows the company to concentrate on its core competencies, such as commercial aviation and larger defense projects. This realignment is crucial for Boeing as it seeks to streamline operations and enhance profitability in an increasingly competitive market. By shedding non-core assets, Boeing can allocate resources more efficiently, potentially leading to improved performance in its primary business areas.

On the other hand, Thales, a global leader in aerospace, defense, and security, stands to benefit significantly from this acquisition. The integration of Boeing’s surveillance division into Thales’ existing portfolio enhances its capabilities in defense surveillance technology. This acquisition not only strengthens Thales’ position in the defense sector but also expands its technological offerings, enabling it to provide more comprehensive solutions to its clients. Consequently, Thales is likely to experience an increase in market share, as it can now offer a broader range of products and services to meet the evolving needs of defense agencies worldwide.

Moreover, this divestment reflects a broader trend within the defense industry, where companies are increasingly focusing on specialization and strategic partnerships. As defense budgets fluctuate and technological advancements accelerate, companies are compelled to adapt by honing their expertise in specific areas. This trend towards specialization allows firms to innovate more effectively, as they can dedicate resources to developing cutting-edge technologies within their niche. In this context, Boeing’s divestment can be seen as a strategic move to remain competitive by concentrating on areas where it can maintain a leadership position.

Furthermore, the divestment may also have implications for the competitive dynamics within the defense industry. As Thales strengthens its position, other companies may feel pressured to pursue similar acquisitions or partnerships to maintain their competitive edge. This could lead to a wave of consolidation within the industry, as firms seek to bolster their capabilities and expand their market presence. Such consolidation could result in a more concentrated market, with a few dominant players driving innovation and setting industry standards.

In addition to affecting competitive dynamics, Boeing’s divestment may also influence technological innovation within the defense sector. By transferring its surveillance division to Thales, Boeing effectively entrusts the development of this technology to a company with a strong track record in defense innovation. Thales’ expertise and resources could accelerate the development of advanced surveillance technologies, potentially leading to breakthroughs that benefit the entire industry. This transfer of technology and expertise underscores the importance of collaboration and knowledge sharing in driving innovation within the defense sector.

In conclusion, Boeing’s divestment of its small defense surveillance division to Thales is a strategic move with far-reaching implications for the defense industry. By allowing Boeing to focus on its core competencies and enabling Thales to enhance its technological offerings, this transaction exemplifies the ongoing trend towards specialization and strategic partnerships within the sector. As the industry continues to evolve, such strategic realignments will likely play a crucial role in shaping the future of defense technology and market dynamics.

Strategic Reasons Behind Boeing’s Sale To Thales

Boeing’s recent decision to divest its small defense surveillance division to Thales marks a significant strategic shift for the aerospace giant. This move, while surprising to some, aligns with Boeing’s broader strategy to streamline its operations and focus on core areas that promise higher growth and profitability. By selling this division to Thales, a company renowned for its expertise in defense and aerospace technology, Boeing is not only offloading a non-core asset but also ensuring that the division continues to thrive under a company with a strong focus in this area.

The rationale behind Boeing’s divestiture can be traced back to its strategic priorities. In recent years, Boeing has been grappling with various challenges, including the aftermath of the 737 MAX crisis, supply chain disruptions, and the impact of the COVID-19 pandemic on the aviation industry. These challenges have necessitated a reevaluation of its business portfolio to ensure long-term sustainability and competitiveness. By divesting non-core assets, Boeing can reallocate resources and capital to areas that are more aligned with its strategic objectives, such as commercial aircraft production, space exploration, and advanced defense systems.

Moreover, the sale to Thales is a testament to Boeing’s commitment to optimizing its business operations. Thales, with its robust portfolio in defense and surveillance technologies, is well-positioned to enhance the capabilities of the acquired division. This transaction allows Boeing to focus on its strengths while ensuring that the division’s employees and customers benefit from Thales’ specialized expertise and global reach. The synergy between Thales’ existing operations and the newly acquired division is expected to foster innovation and drive growth, ultimately benefiting both companies.

In addition to operational considerations, financial factors also played a crucial role in Boeing’s decision. The divestiture is expected to improve Boeing’s financial health by reducing its debt burden and enhancing liquidity. This is particularly important as Boeing seeks to recover from the financial setbacks of recent years and invest in future growth opportunities. By streamlining its portfolio, Boeing can better manage its financial resources and focus on high-margin businesses that offer greater returns on investment.

Furthermore, the sale aligns with broader industry trends where companies are increasingly focusing on their core competencies. In a rapidly evolving technological landscape, specialization has become key to maintaining a competitive edge. By divesting its small defense surveillance division, Boeing is not only aligning with this trend but also positioning itself to better respond to market demands and technological advancements.

In conclusion, Boeing’s decision to sell its small defense surveillance division to Thales is a strategic move aimed at optimizing its business operations and financial performance. By focusing on core areas and divesting non-core assets, Boeing is better positioned to navigate the challenges of the aerospace industry and capitalize on future growth opportunities. The transaction with Thales ensures that the division continues to thrive under a company with specialized expertise, benefiting employees, customers, and stakeholders alike. As Boeing continues to refine its strategic priorities, this divestiture represents a step towards a more focused and resilient business model.

How Thales Plans To Integrate Boeing’s Surveillance Division

In a strategic move that has captured the attention of the defense and aerospace sectors, Boeing has divested its small defense surveillance division to Thales, a global leader in advanced technologies for defense, aerospace, and security. This acquisition marks a significant step for Thales as it seeks to enhance its capabilities and expand its footprint in the defense surveillance market. The integration of Boeing’s surveillance division into Thales’ existing operations is poised to bring about a synergy that could redefine the landscape of defense surveillance technologies.

Thales, known for its robust portfolio in defense and security solutions, plans to leverage the advanced technologies and expertise acquired from Boeing to bolster its surveillance capabilities. The division, which specializes in cutting-edge surveillance systems, will complement Thales’ existing offerings, allowing the company to provide more comprehensive solutions to its clients. By integrating these new technologies, Thales aims to enhance its ability to deliver state-of-the-art surveillance systems that meet the evolving needs of modern defense operations.

One of the primary strategies Thales intends to employ in integrating Boeing’s surveillance division is the alignment of technological innovations. By combining the advanced surveillance technologies from Boeing with Thales’ existing research and development efforts, the company anticipates creating a more robust and versatile suite of products. This integration is expected to facilitate the development of next-generation surveillance systems that offer improved accuracy, reliability, and operational efficiency. Moreover, Thales plans to invest in further research and development to ensure that the integrated technologies remain at the forefront of innovation.

In addition to technological integration, Thales is focusing on streamlining operational processes to ensure a seamless transition. This involves aligning the organizational structures and cultures of both entities to foster collaboration and efficiency. Thales is committed to retaining key talent from Boeing’s surveillance division, recognizing the value of their expertise and experience. By doing so, Thales aims to maintain continuity in operations while also infusing new perspectives and ideas into its existing teams.

Furthermore, Thales is keen on expanding its market reach through this acquisition. The integration of Boeing’s surveillance division is expected to open new avenues for Thales in markets where Boeing has established a strong presence. This strategic expansion aligns with Thales’ long-term vision of becoming a global leader in defense surveillance solutions. By capitalizing on Boeing’s existing customer relationships and market insights, Thales aims to strengthen its position in the industry and explore new business opportunities.

As Thales embarks on this integration journey, it remains committed to maintaining the highest standards of quality and security. The company recognizes the critical nature of defense surveillance systems and is dedicated to ensuring that the integrated solutions meet the stringent requirements of its clients. Thales plans to implement rigorous quality control measures and adhere to industry best practices to deliver reliable and secure surveillance systems.

In conclusion, the acquisition of Boeing’s small defense surveillance division represents a strategic milestone for Thales. By integrating advanced technologies, streamlining operations, and expanding market reach, Thales is poised to enhance its capabilities and solidify its position as a leader in defense surveillance solutions. As the integration process unfolds, the industry will be watching closely to see how Thales leverages this acquisition to drive innovation and deliver cutting-edge solutions to its clients worldwide.

Financial Implications Of The Boeing-Thales Deal

Boeing’s recent decision to divest its small defense surveillance division to Thales marks a significant shift in the aerospace giant’s strategic focus, with substantial financial implications for both companies. This move is part of Boeing’s broader strategy to streamline its operations and concentrate on its core competencies, particularly in the commercial aviation and larger defense sectors. By offloading this division, Boeing aims to reallocate resources more efficiently, potentially enhancing its financial performance in the long term.

The divestiture aligns with Boeing’s ongoing efforts to optimize its portfolio, especially in the wake of financial challenges exacerbated by the global pandemic and the grounding of its 737 MAX aircraft. By shedding non-core assets, Boeing can focus on areas with higher growth potential and profitability. This strategic realignment is expected to improve Boeing’s balance sheet, providing the company with greater financial flexibility to invest in innovation and development within its primary business areas.

On the other hand, Thales, a global leader in aerospace, defense, and security, stands to benefit significantly from this acquisition. The addition of Boeing’s defense surveillance division will enhance Thales’ capabilities in intelligence, surveillance, and reconnaissance (ISR) technologies. This acquisition is likely to bolster Thales’ position in the defense market, allowing it to offer a more comprehensive suite of solutions to its clients. Furthermore, the integration of Boeing’s advanced technologies and expertise into Thales’ existing operations could lead to synergies that drive cost efficiencies and innovation.

Financially, the deal is expected to be mutually beneficial. For Boeing, the divestiture will likely result in an immediate influx of capital, which can be used to reduce debt or reinvest in strategic initiatives. This capital injection is crucial for Boeing as it seeks to recover from recent financial setbacks and strengthen its competitive position in the aerospace industry. Additionally, by focusing on its core businesses, Boeing can potentially achieve higher margins and improved financial performance over time.

For Thales, the acquisition represents an opportunity to expand its market share and enhance its product offerings. The financial outlay required for this acquisition is anticipated to be offset by the long-term revenue potential generated from the expanded capabilities and customer base. Moreover, Thales’ strategic acquisition aligns with its growth objectives, positioning the company to capitalize on increasing global demand for advanced defense and surveillance solutions.

In conclusion, the divestiture of Boeing’s small defense surveillance division to Thales carries significant financial implications for both companies. For Boeing, this move is a strategic step towards optimizing its portfolio and strengthening its financial position, allowing it to focus on its core business areas. Meanwhile, Thales stands to gain from enhanced capabilities and market presence, which could translate into increased revenue and profitability. As both companies navigate the evolving aerospace and defense landscape, this deal underscores the importance of strategic realignment and targeted investments in driving long-term financial success.

Future Prospects For Thales In The Defense Sector

In a strategic move that underscores the evolving landscape of the defense industry, Boeing has divested its small defense surveillance division to Thales, a global leader in aerospace, defense, and security. This acquisition marks a significant step for Thales as it seeks to expand its footprint in the defense sector, particularly in the realm of surveillance technologies. The transaction not only highlights Thales’ commitment to enhancing its capabilities but also reflects broader trends in the defense industry where companies are increasingly focusing on specialized areas to maintain competitive advantages.

The divestiture by Boeing is part of a broader strategy to streamline its operations and concentrate on core areas that align with its long-term objectives. By shedding this division, Boeing can reallocate resources to other segments that promise higher returns and strategic value. This decision aligns with the company’s ongoing efforts to optimize its portfolio and focus on areas such as commercial aviation and space exploration, where it has traditionally held a strong market position.

For Thales, the acquisition represents a valuable opportunity to bolster its defense portfolio, particularly in the surveillance domain. Surveillance technologies are becoming increasingly critical in modern defense strategies, driven by the need for enhanced situational awareness and intelligence gathering. By integrating Boeing’s surveillance division, Thales can leverage advanced technologies and expertise to offer more comprehensive solutions to its clients. This move is expected to enhance Thales’ competitive edge in the defense market, allowing it to better meet the evolving needs of military and security organizations worldwide.

Moreover, the acquisition aligns with Thales’ strategic vision of becoming a leader in digital transformation and cybersecurity within the defense sector. As defense operations become more reliant on digital technologies, the ability to provide secure and reliable surveillance solutions is paramount. Thales’ existing capabilities in cybersecurity, combined with the newly acquired surveillance technologies, position the company to offer integrated solutions that address the complex challenges faced by defense organizations today.

In addition to strengthening its technological capabilities, the acquisition is likely to open new avenues for Thales in terms of market reach and customer base. By inheriting Boeing’s existing contracts and relationships, Thales can expand its presence in key markets, particularly in North America, where Boeing has a well-established footprint. This expanded market access is expected to drive growth and create new business opportunities for Thales, further solidifying its position as a leading player in the global defense industry.

Looking ahead, the integration of Boeing’s surveillance division into Thales’ operations will be a critical factor in realizing the full potential of this acquisition. Effective integration will require careful planning and execution to ensure that the combined entity can deliver on its promises of enhanced capabilities and customer value. Thales’ track record of successful integrations and its commitment to innovation provide a strong foundation for achieving these objectives.

In conclusion, Boeing’s divestiture of its small defense surveillance division to Thales represents a strategic realignment for both companies, with significant implications for the future of the defense sector. For Thales, this acquisition is a pivotal step in its journey to becoming a leader in defense surveillance technologies, offering enhanced solutions that meet the demands of modern military and security operations. As the defense industry continues to evolve, Thales’ expanded capabilities and market reach position it well to capitalize on emerging opportunities and drive future growth.

Boeing’s Focus Shift Post-Divestment

Boeing’s recent decision to divest its small defense surveillance division to Thales marks a significant shift in the company’s strategic focus. This move is part of a broader effort by Boeing to streamline its operations and concentrate on its core competencies, particularly in the areas of commercial aviation and large-scale defense projects. By transferring this division to Thales, a company renowned for its expertise in defense and aerospace technology, Boeing aims to enhance its operational efficiency and allocate resources more effectively.

The divestment aligns with Boeing’s long-term strategy to prioritize its strengths and address the evolving demands of the aerospace industry. In recent years, Boeing has faced numerous challenges, including production delays, regulatory scrutiny, and financial setbacks. Consequently, the company has been compelled to reassess its business model and make strategic adjustments to ensure sustainable growth. By shedding non-core assets, Boeing can focus on enhancing its competitive edge in key areas such as aircraft manufacturing and defense systems.

Moreover, this divestment allows Boeing to redirect its resources towards innovation and development in its primary sectors. The aerospace giant has been investing heavily in new technologies, such as autonomous flight systems and sustainable aviation solutions, to meet the increasing demand for environmentally friendly and efficient air travel. By concentrating on these areas, Boeing can better position itself to capitalize on emerging market opportunities and maintain its leadership in the industry.

In addition to bolstering its core operations, Boeing’s divestment also reflects a broader trend within the aerospace and defense sector. Companies are increasingly seeking to optimize their portfolios by divesting non-core assets and focusing on areas with the highest growth potential. This strategic realignment enables firms to enhance their competitive positioning and respond more effectively to market dynamics. For Boeing, the sale of its small defense surveillance division to Thales is a step towards achieving greater operational agility and financial stability.

Furthermore, the divestment is expected to benefit Thales by expanding its capabilities in defense surveillance technology. As a global leader in aerospace and defense, Thales is well-positioned to integrate the acquired assets into its existing portfolio and leverage its expertise to deliver innovative solutions to its customers. This acquisition not only strengthens Thales’ market position but also underscores the company’s commitment to advancing its technological capabilities in the defense sector.

While the divestment marks a significant shift in Boeing’s strategic focus, it also highlights the company’s commitment to adapting to changing market conditions. By concentrating on its core strengths and divesting non-essential assets, Boeing aims to enhance its operational efficiency and drive long-term growth. This strategic realignment is crucial for the company as it navigates the challenges and opportunities presented by the rapidly evolving aerospace industry.

In conclusion, Boeing’s decision to divest its small defense surveillance division to Thales represents a pivotal moment in the company’s strategic evolution. By focusing on its core competencies and reallocating resources towards innovation and development, Boeing is positioning itself for future success in the competitive aerospace market. This move not only reflects the company’s commitment to operational excellence but also underscores its determination to adapt to the changing landscape of the industry. As Boeing continues to refine its strategic focus, it remains poised to capitalize on emerging opportunities and maintain its leadership in the global aerospace sector.

Market Reactions To The Boeing-Thales Transaction

The recent divestiture by Boeing of its small defense surveillance division to Thales has sparked a variety of reactions across the market, reflecting both strategic realignments within the aerospace and defense sectors and broader industry trends. This transaction, which underscores Boeing’s ongoing efforts to streamline its operations and focus on core competencies, has been met with a mix of optimism and caution by investors and industry analysts alike. As Boeing seeks to consolidate its resources and enhance its competitive edge in key areas such as commercial aviation and large-scale defense projects, the sale of this division to Thales is seen as a strategic move to offload non-core assets.

In the immediate aftermath of the announcement, Boeing’s stock experienced a modest uptick, suggesting that investors are generally supportive of the company’s decision to divest. This positive market reaction can be attributed to the perception that Boeing is taking proactive steps to strengthen its financial position and operational focus. By shedding a smaller, less integral part of its business, Boeing can potentially allocate more resources towards innovation and development in areas that promise higher returns. Moreover, this move aligns with Boeing’s broader strategy of optimizing its portfolio to better navigate the challenges and opportunities in the post-pandemic aerospace landscape.

Conversely, Thales’ acquisition of the defense surveillance division has been interpreted as a strategic expansion of its capabilities in the defense sector. Thales, a global leader in advanced technologies for defense and security, is poised to integrate Boeing’s surveillance assets into its existing portfolio, thereby enhancing its offerings and market position. This acquisition is expected to bolster Thales’ ability to deliver comprehensive surveillance solutions to its clients, leveraging the acquired technologies to meet the growing demand for sophisticated defense systems. Consequently, Thales’ stock also saw a favorable response, reflecting investor confidence in the company’s growth trajectory and strategic vision.

However, while the market’s initial reaction has been largely positive, some analysts have raised concerns about the potential challenges that may arise from this transaction. For Boeing, the divestiture could lead to short-term disruptions as the company adjusts to the loss of a division, albeit a small one, that contributed to its overall revenue stream. Additionally, there is the question of how effectively Boeing will be able to reinvest the proceeds from the sale into its core business areas. The success of this divestiture will ultimately depend on Boeing’s ability to execute its strategic plans and capitalize on emerging opportunities in the aerospace sector.

On the other hand, Thales faces the challenge of seamlessly integrating the acquired division into its operations. This process will require careful management to ensure that the transition is smooth and that the anticipated synergies are realized. Furthermore, Thales must navigate the competitive landscape of the defense industry, where technological advancements and geopolitical factors can significantly impact market dynamics.

In conclusion, the divestiture of Boeing’s small defense surveillance division to Thales represents a significant development in the aerospace and defense sectors, with implications for both companies and the broader market. While the transaction has been met with general approval from investors, it also presents challenges that both Boeing and Thales must address to ensure long-term success. As the industry continues to evolve, the strategic decisions made by these companies will play a crucial role in shaping their future trajectories and maintaining their competitive positions.

Q&A

1. **What division did Boeing divest?**

Boeing divested its small defense surveillance division.

2. **Who acquired the division from Boeing?**

Thales acquired the division from Boeing.

3. **What type of products or services did the divested division focus on?**

The division focused on defense surveillance products and services.

4. **Why did Boeing decide to divest this division?**

Boeing likely divested the division to streamline operations and focus on core business areas, though specific reasons were not publicly detailed.

5. **How does this acquisition benefit Thales?**

The acquisition enhances Thales’ capabilities in defense surveillance and expands its portfolio in the defense sector.

6. **When was the divestment announced?**

The specific date of the announcement is not provided, but it occurred before October 2023.

7. **What impact does this divestment have on Boeing’s business strategy?**

The divestment allows Boeing to concentrate resources on its primary aerospace and defense operations, potentially improving efficiency and profitability.

Conclusion

Boeing’s decision to divest its small defense surveillance division to Thales represents a strategic realignment, allowing Boeing to streamline its operations and focus on core areas of growth and innovation. For Thales, this acquisition enhances its capabilities in defense surveillance, expanding its portfolio and strengthening its position in the defense sector. The transaction reflects broader industry trends of consolidation and specialization, as companies seek to optimize their resources and adapt to evolving market demands. Overall, this move is likely to benefit both companies by aligning their strategic objectives with their operational strengths.