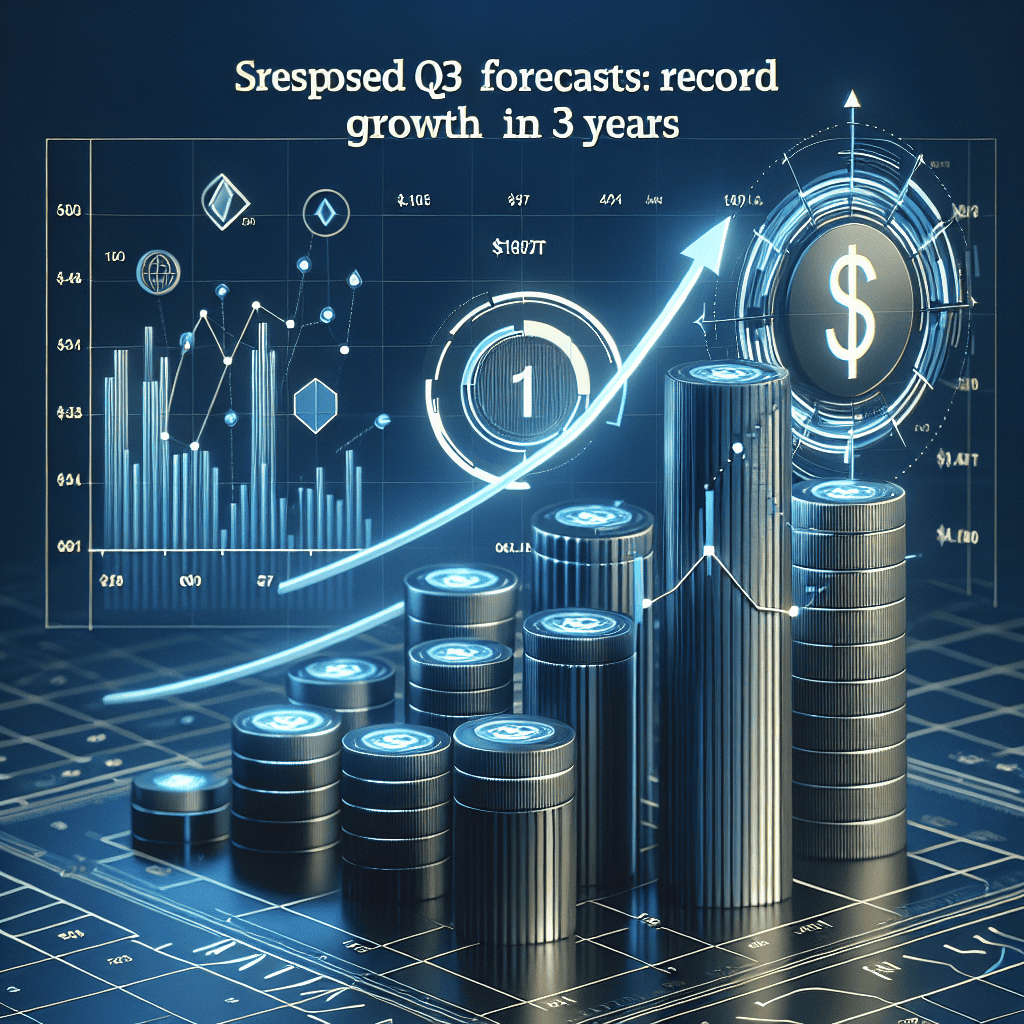

“Blackstone Breaks Barriers: $1.108T AUM and Unprecedented Fund Growth in Just 3 Years!”

Introduction

Blackstone, a leading global investment firm, has exceeded expectations in the third quarter, reporting an impressive $1.108 trillion in assets under management (AUM). This milestone marks a significant achievement for the firm, showcasing its robust growth trajectory and strategic prowess in the investment landscape. Over the past three years, Blackstone has experienced record fund growth, underscoring its ability to navigate complex market dynamics and deliver value to its investors. The firm’s performance in Q3 not only highlights its strong operational capabilities but also reinforces its position as a dominant force in the global financial sector.

Blackstone’s Q3 Success: Key Factors Behind Surpassing Forecasts

In the third quarter of 2023, Blackstone, the world’s largest alternative asset manager, reported a remarkable performance that exceeded market expectations. The firm announced an impressive $1.108 trillion in assets under management (AUM), marking a significant milestone in its growth trajectory. This achievement not only underscores Blackstone’s robust financial health but also highlights its strategic prowess in navigating the complexities of the global financial landscape. Several key factors contributed to Blackstone’s ability to surpass forecasts, with record fund growth over the past three years playing a pivotal role.

To begin with, Blackstone’s strategic diversification across various asset classes has been instrumental in its success. By expanding its portfolio to include real estate, private equity, credit, and hedge fund solutions, the firm has effectively mitigated risks associated with market volatility. This diversification strategy has allowed Blackstone to capitalize on emerging opportunities across different sectors, thereby enhancing its revenue streams. Moreover, the firm’s ability to identify and invest in high-growth potential assets has further bolstered its financial performance, enabling it to consistently deliver value to its investors.

In addition to diversification, Blackstone’s focus on innovation and technology has been a key driver of its recent success. The firm has made significant investments in digital transformation initiatives, leveraging advanced analytics and artificial intelligence to optimize its investment processes. This technological edge has not only improved operational efficiency but also enhanced decision-making capabilities, allowing Blackstone to stay ahead of the curve in a rapidly evolving market environment. Furthermore, the integration of technology has facilitated better risk management practices, ensuring that the firm remains resilient in the face of economic uncertainties.

Another critical factor contributing to Blackstone’s outstanding performance is its strong emphasis on sustainability and responsible investing. In recent years, there has been a growing demand for investments that align with environmental, social, and governance (ESG) criteria. Blackstone has responded to this trend by integrating ESG considerations into its investment strategies, thereby attracting a broader base of investors who prioritize sustainable growth. This commitment to responsible investing has not only enhanced Blackstone’s reputation but also opened up new avenues for growth, as more investors seek to align their portfolios with their values.

Furthermore, Blackstone’s global reach and extensive network have played a significant role in its ability to surpass forecasts. With a presence in major financial markets around the world, the firm has been able to tap into diverse investment opportunities and forge strategic partnerships that drive growth. This global perspective has enabled Blackstone to navigate geopolitical challenges and capitalize on cross-border synergies, further strengthening its competitive position in the industry.

Lastly, the firm’s strong leadership and experienced management team have been crucial in steering Blackstone towards achieving its ambitious goals. Under the guidance of CEO Stephen Schwarzman and President Jonathan Gray, Blackstone has maintained a clear strategic vision and demonstrated a commitment to excellence. Their leadership has fostered a culture of innovation and adaptability, empowering the firm to respond effectively to changing market dynamics and seize new opportunities for growth.

In conclusion, Blackstone’s ability to surpass third-quarter forecasts and achieve record fund growth over the past three years can be attributed to a combination of strategic diversification, technological innovation, a focus on sustainability, global reach, and strong leadership. These factors have collectively positioned Blackstone as a formidable force in the alternative asset management industry, setting the stage for continued success in the years to come. As the firm continues to navigate the complexities of the global financial landscape, its commitment to delivering value to investors remains unwavering, ensuring that it remains at the forefront of the industry.

Analyzing Blackstone’s Record Fund Growth Over Three Years

In the third quarter of 2023, Blackstone, the world’s largest alternative asset manager, reported a remarkable achievement by surpassing market forecasts with an impressive $1.108 trillion in assets under management (AUM). This milestone not only underscores Blackstone’s robust financial health but also highlights its strategic prowess in navigating the complexities of the global financial landscape. Over the past three years, Blackstone has demonstrated an exceptional capacity for fund growth, setting a record that has captured the attention of investors and analysts alike.

To understand the factors contributing to Blackstone’s record fund growth, it is essential to examine the strategic initiatives and market conditions that have facilitated this success. One of the key drivers has been Blackstone’s diversified investment approach, which spans real estate, private equity, credit, and hedge fund solutions. By maintaining a well-balanced portfolio, Blackstone has effectively mitigated risks and capitalized on emerging opportunities across various sectors. This diversification strategy has not only enhanced returns but also attracted a broad spectrum of investors seeking stability and growth in uncertain times.

Moreover, Blackstone’s ability to adapt to changing market dynamics has played a crucial role in its fund growth. The firm has consistently demonstrated agility in responding to economic shifts, such as the post-pandemic recovery and evolving interest rate environments. By leveraging its deep industry expertise and global reach, Blackstone has been able to identify and invest in high-potential assets, thereby driving substantial value creation for its investors. This proactive approach has been instrumental in building investor confidence and fostering long-term partnerships.

In addition to its strategic investment decisions, Blackstone’s commitment to innovation has been a significant factor in its recent success. The firm has embraced technological advancements to enhance its operational efficiency and investment processes. By integrating data analytics and artificial intelligence into its decision-making framework, Blackstone has gained valuable insights into market trends and asset performance. This technological edge has enabled the firm to make informed investment choices, optimize portfolio management, and ultimately deliver superior returns to its clients.

Furthermore, Blackstone’s emphasis on sustainability and responsible investing has resonated with a growing number of investors who prioritize environmental, social, and governance (ESG) considerations. The firm’s dedication to integrating ESG principles into its investment strategy has not only aligned with global sustainability goals but also attracted capital from institutional investors seeking to make a positive impact. This alignment with investor values has been a key differentiator for Blackstone, contributing to its record fund growth over the past three years.

As Blackstone continues to build on its success, the firm remains focused on maintaining its competitive edge in the alternative asset management industry. By prioritizing innovation, diversification, and sustainability, Blackstone is well-positioned to navigate future challenges and capitalize on emerging opportunities. The firm’s ability to consistently deliver strong performance and exceed market expectations underscores its status as a leader in the financial sector.

In conclusion, Blackstone’s achievement of surpassing $1.108 trillion in AUM and setting a record for fund growth over the past three years is a testament to its strategic acumen and adaptability. Through a combination of diversified investments, technological innovation, and a commitment to sustainability, Blackstone has solidified its position as a formidable force in the global financial landscape. As the firm looks to the future, it remains poised to continue its trajectory of growth and success, further enhancing its reputation as a trusted partner for investors worldwide.

The Impact of $1.108T AUM on Blackstone’s Market Position

Blackstone’s recent financial performance has captured significant attention, as the firm reported surpassing its third-quarter forecasts with an impressive $1.108 trillion in assets under management (AUM). This milestone not only underscores Blackstone’s robust growth trajectory but also solidifies its position as a formidable player in the global investment landscape. The implications of reaching such a substantial AUM are multifaceted, influencing both the firm’s market position and its strategic capabilities.

To begin with, achieving $1.108 trillion in AUM enhances Blackstone’s competitive edge in the investment management industry. This substantial asset base provides the firm with increased leverage to negotiate favorable terms with potential investment partners and clients. Moreover, it allows Blackstone to diversify its investment portfolio across various asset classes, thereby mitigating risks and optimizing returns. The ability to manage such a vast pool of assets also reflects the firm’s operational efficiency and its capacity to attract and retain high-caliber talent, which are critical components in maintaining its market leadership.

Furthermore, the record fund growth over the past three years is indicative of Blackstone’s strategic foresight and adaptability in a rapidly evolving financial environment. This growth can be attributed to the firm’s proactive approach in identifying emerging market trends and capitalizing on new investment opportunities. By expanding its presence in sectors such as technology, real estate, and infrastructure, Blackstone has successfully tapped into high-growth areas that promise substantial returns. This strategic diversification not only enhances the firm’s revenue streams but also reinforces its resilience against market volatility.

In addition to bolstering its market position, Blackstone’s impressive AUM has significant implications for its stakeholders. For investors, the firm’s ability to consistently deliver strong performance and exceed forecasts instills confidence and reinforces trust in its investment strategies. This trust is crucial in attracting new investors and retaining existing ones, thereby ensuring a steady inflow of capital. For clients, Blackstone’s expansive AUM translates into access to a broader range of investment opportunities and tailored solutions that meet their specific needs and objectives.

Moreover, the firm’s financial success has a ripple effect on the broader economy. As Blackstone continues to invest in various sectors, it contributes to job creation, infrastructure development, and technological innovation. These investments not only drive economic growth but also enhance the quality of life for communities around the world. Consequently, Blackstone’s market position is not only a reflection of its financial prowess but also its commitment to creating long-term value for society.

In conclusion, Blackstone’s achievement of $1.108 trillion in AUM marks a significant milestone in its growth journey, reinforcing its status as a leader in the investment management industry. The firm’s strategic initiatives, coupled with its ability to adapt to changing market dynamics, have been instrumental in driving record fund growth over the past three years. As Blackstone continues to expand its asset base and diversify its investment portfolio, it is well-positioned to capitalize on future opportunities and navigate potential challenges. Ultimately, the impact of this achievement extends beyond the firm itself, influencing its stakeholders and contributing to broader economic development.

Strategic Moves That Led to Blackstone’s Q3 Outperformance

In the third quarter of 2023, Blackstone, the world’s largest alternative asset manager, reported a remarkable performance that exceeded market expectations. The firm announced an impressive $1.108 trillion in assets under management (AUM), marking a significant milestone in its growth trajectory. This achievement is not only a testament to Blackstone’s strategic acumen but also highlights the effectiveness of its investment strategies and operational efficiencies. The record fund growth over the past three years can be attributed to a series of strategic moves that have positioned the firm at the forefront of the asset management industry.

One of the key factors contributing to Blackstone’s outperformance is its diversified investment portfolio. By maintaining a balanced mix of real estate, private equity, credit, and hedge fund solutions, Blackstone has been able to mitigate risks and capitalize on opportunities across various sectors. This diversification strategy has allowed the firm to navigate economic uncertainties and market volatilities with resilience. Moreover, Blackstone’s ability to identify and invest in high-growth sectors, such as technology and healthcare, has further bolstered its portfolio performance, driving substantial returns for its investors.

In addition to its diversified portfolio, Blackstone’s focus on innovation and technology has played a crucial role in its recent success. The firm has invested heavily in data analytics and artificial intelligence to enhance its investment decision-making processes. By leveraging advanced technologies, Blackstone has gained deeper insights into market trends and consumer behaviors, enabling it to make more informed investment choices. This technological edge has not only improved the firm’s operational efficiencies but also provided a competitive advantage in identifying lucrative investment opportunities ahead of its peers.

Furthermore, Blackstone’s strategic expansion into global markets has significantly contributed to its AUM growth. The firm has been proactive in exploring emerging markets, recognizing the potential for higher returns in regions with rapid economic development. By establishing a strong presence in Asia, Latin America, and other growth markets, Blackstone has tapped into new revenue streams and diversified its geographical exposure. This global expansion strategy has not only increased the firm’s asset base but also enhanced its ability to deliver value to its investors on a global scale.

Another pivotal element in Blackstone’s success is its commitment to sustainability and responsible investing. The firm has integrated environmental, social, and governance (ESG) considerations into its investment processes, aligning its strategies with the growing demand for sustainable investments. By prioritizing ESG factors, Blackstone has attracted a broader range of investors who are increasingly focused on ethical and sustainable investment practices. This commitment to sustainability has not only enhanced Blackstone’s reputation but also contributed to its robust fund growth, as more investors seek to align their portfolios with their values.

In conclusion, Blackstone’s impressive third-quarter performance and record fund growth over the past three years can be attributed to a combination of strategic diversification, technological innovation, global expansion, and a strong commitment to sustainability. These strategic moves have enabled the firm to outperform its competitors and solidify its position as a leader in the asset management industry. As Blackstone continues to adapt to the evolving market landscape, its strategic initiatives are likely to drive further growth and success in the years to come.

Blackstone’s Investment Strategies: A Deep Dive into Recent Growth

Blackstone, a global leader in investment management, has recently surpassed its third-quarter forecasts, reporting an impressive $1.108 trillion in assets under management (AUM). This milestone not only highlights the firm’s robust growth trajectory but also underscores its strategic prowess in navigating the complexities of the financial markets. Over the past three years, Blackstone has achieved record fund growth, a testament to its innovative investment strategies and its ability to adapt to changing economic landscapes.

One of the key drivers behind Blackstone’s remarkable performance is its diversified investment approach. By allocating capital across a wide array of asset classes, including private equity, real estate, credit, and hedge fund solutions, the firm has effectively mitigated risks while maximizing returns. This diversification strategy has allowed Blackstone to capitalize on emerging opportunities in various sectors, thereby enhancing its overall portfolio performance. Moreover, the firm’s emphasis on long-term value creation has resonated well with investors, attracting significant inflows and contributing to its burgeoning AUM.

In addition to diversification, Blackstone’s focus on strategic acquisitions and partnerships has played a crucial role in its recent growth. By identifying and investing in high-potential companies and assets, the firm has been able to generate substantial returns for its investors. For instance, Blackstone’s acquisition of key real estate assets in high-demand markets has not only bolstered its real estate portfolio but also provided a steady stream of income. Furthermore, the firm’s strategic partnerships with industry leaders have facilitated access to new markets and innovative technologies, thereby enhancing its competitive edge.

Another factor contributing to Blackstone’s success is its commitment to sustainability and responsible investing. Recognizing the growing importance of environmental, social, and governance (ESG) factors, the firm has integrated these considerations into its investment processes. By prioritizing sustainable practices and investing in companies that align with ESG principles, Blackstone has not only mitigated potential risks but also tapped into the increasing demand for responsible investment options. This approach has not only attracted a new wave of environmentally conscious investors but also reinforced the firm’s reputation as a forward-thinking investment manager.

Furthermore, Blackstone’s adeptness at leveraging technology and data analytics has been instrumental in its ability to identify lucrative investment opportunities. By harnessing advanced analytical tools and artificial intelligence, the firm has gained valuable insights into market trends and consumer behavior, enabling it to make informed investment decisions. This technological edge has not only enhanced Blackstone’s operational efficiency but also provided a competitive advantage in an increasingly data-driven industry.

In conclusion, Blackstone’s surpassing of its third-quarter forecasts and achieving record fund growth over the past three years can be attributed to its strategic investment approach, focus on diversification, and commitment to sustainability. By continuously adapting to market dynamics and leveraging technological advancements, the firm has solidified its position as a leader in the investment management industry. As Blackstone continues to navigate the evolving financial landscape, its innovative strategies and forward-thinking mindset are likely to drive further growth and success in the years to come.

How Blackstone’s Record Fund Growth is Shaping the Industry

Blackstone, a global leader in investment and asset management, has recently reported surpassing its third-quarter forecasts, achieving an impressive $1.108 trillion in assets under management (AUM). This milestone not only highlights Blackstone’s robust financial health but also underscores its strategic prowess in navigating the complexities of the global market. The firm’s record fund growth over the past three years has been a testament to its innovative approach and adaptability, setting a benchmark for the industry and influencing the broader landscape of asset management.

The remarkable growth in Blackstone’s AUM can be attributed to several key factors. Firstly, the firm’s diversified investment strategy has played a crucial role in its success. By spreading investments across various sectors, including real estate, private equity, credit, and hedge fund solutions, Blackstone has effectively mitigated risks while capitalizing on emerging opportunities. This diversification not only enhances the firm’s resilience against market volatility but also positions it to leverage growth in different economic cycles.

Moreover, Blackstone’s commitment to innovation has been instrumental in driving its fund growth. The firm has consistently embraced technological advancements to enhance its investment processes and improve operational efficiency. By integrating data analytics and artificial intelligence into its decision-making framework, Blackstone has been able to identify lucrative investment opportunities with greater precision and speed. This technological edge has not only given Blackstone a competitive advantage but has also set a precedent for other firms in the industry to follow.

In addition to its strategic diversification and technological innovation, Blackstone’s focus on sustainability and responsible investing has resonated well with investors. As environmental, social, and governance (ESG) considerations become increasingly important in investment decisions, Blackstone has proactively integrated these principles into its investment strategy. By prioritizing sustainable practices and aligning its investments with ESG criteria, Blackstone has attracted a growing number of investors who are keen on making a positive impact while achieving financial returns. This alignment with investor values has further fueled the firm’s fund growth and solidified its reputation as a forward-thinking leader in the industry.

Furthermore, Blackstone’s ability to adapt to changing market dynamics has been a critical factor in its success. The firm has demonstrated agility in responding to economic shifts, geopolitical uncertainties, and evolving investor preferences. By maintaining a flexible investment approach and continuously reassessing its strategies, Blackstone has been able to navigate challenges effectively and seize new opportunities. This adaptability has not only contributed to its record fund growth but has also reinforced its position as a resilient and reliable partner for investors.

As Blackstone continues to shape the asset management industry with its record fund growth, its influence extends beyond financial metrics. The firm’s success serves as a model for other asset managers, highlighting the importance of diversification, innovation, sustainability, and adaptability in achieving long-term growth. By setting new standards and pushing the boundaries of traditional investment practices, Blackstone is not only redefining the industry but also paving the way for a more dynamic and sustainable future in asset management.

In conclusion, Blackstone’s achievement of surpassing $1.108 trillion in AUM and its record fund growth over the past three years underscore its strategic acumen and leadership in the industry. Through diversification, innovation, sustainability, and adaptability, Blackstone has not only achieved remarkable financial success but has also set a new paradigm for asset management. As the firm continues to evolve and influence the industry, its impact will likely be felt for years to come, shaping the future of investment and asset management on a global scale.

Future Prospects for Blackstone After Surpassing Q3 Forecasts

Blackstone’s recent financial performance has captured the attention of investors and analysts alike, as the firm reported surpassing its third-quarter forecasts with an impressive $1.108 trillion in assets under management (AUM). This milestone not only highlights Blackstone’s robust growth trajectory but also sets the stage for a promising future. The firm’s record fund growth over the past three years underscores its strategic prowess and adaptability in an ever-evolving financial landscape. As we delve into the future prospects for Blackstone, it is essential to consider the factors that have contributed to its success and how these elements might shape its path forward.

To begin with, Blackstone’s ability to exceed expectations in the third quarter can be attributed to its diversified investment strategy. By maintaining a balanced portfolio across various asset classes, including real estate, private equity, credit, and hedge fund solutions, Blackstone has effectively mitigated risks while capitalizing on emerging opportunities. This diversification not only provides a buffer against market volatility but also positions the firm to seize growth prospects in different sectors. As global markets continue to recover and adapt post-pandemic, Blackstone’s diversified approach will likely remain a cornerstone of its strategy, enabling it to navigate uncertainties and capitalize on new trends.

Moreover, Blackstone’s commitment to innovation and technology has played a pivotal role in its recent achievements. By leveraging advanced data analytics and artificial intelligence, the firm has enhanced its decision-making processes, leading to more informed investment choices. This technological edge has allowed Blackstone to identify lucrative opportunities and optimize its portfolio management, thereby driving superior returns for its investors. As technology continues to reshape the financial industry, Blackstone’s focus on innovation will be crucial in maintaining its competitive advantage and sustaining its growth momentum.

In addition to its strategic and technological initiatives, Blackstone’s emphasis on sustainability and responsible investing has resonated well with investors and stakeholders. The firm has made significant strides in integrating environmental, social, and governance (ESG) considerations into its investment processes, aligning its objectives with the growing demand for sustainable and ethical investment practices. This commitment not only enhances Blackstone’s reputation but also attracts a broader base of investors who prioritize ESG factors. As the global emphasis on sustainability intensifies, Blackstone’s proactive approach in this domain is likely to bolster its appeal and drive further growth.

Furthermore, Blackstone’s strong leadership and experienced management team have been instrumental in steering the firm towards its current success. The ability to anticipate market trends, coupled with a keen understanding of investor needs, has enabled Blackstone to craft strategies that deliver consistent value. As the firm continues to expand its global footprint, its leadership’s vision and expertise will be vital in navigating complex regulatory environments and fostering strategic partnerships.

Looking ahead, Blackstone’s future prospects appear promising, bolstered by its strategic diversification, technological innovation, commitment to sustainability, and strong leadership. However, the firm must remain vigilant in the face of potential challenges, such as geopolitical tensions, regulatory changes, and economic fluctuations. By staying agile and responsive to these dynamics, Blackstone can continue to build on its recent successes and maintain its position as a leading global investment firm. As it charts its course forward, Blackstone’s ability to adapt and innovate will be key to sustaining its growth and delivering value to its investors in the years to come.

Q&A

1. **What is Blackstone’s AUM as of Q3?**

Blackstone’s assets under management (AUM) as of Q3 are $1.108 trillion.

2. **Did Blackstone surpass its Q3 forecasts?**

Yes, Blackstone surpassed its Q3 forecasts.

3. **What notable achievement did Blackstone reach in terms of fund growth?**

Blackstone achieved record fund growth over the past three years.

4. **How does Blackstone’s recent performance compare to previous quarters?**

Blackstone’s recent performance shows significant growth, surpassing previous quarters’ forecasts.

5. **What factors contributed to Blackstone’s record fund growth?**

Factors contributing to Blackstone’s record fund growth include strategic investments, market conditions, and effective management.

6. **How has Blackstone’s AUM changed over the past three years?**

Blackstone’s AUM has seen substantial growth over the past three years, reaching a record $1.108 trillion.

7. **What impact does Blackstone’s performance have on its market position?**

Blackstone’s strong performance and record fund growth enhance its market position as a leading investment firm.

Conclusion

Blackstone’s performance in surpassing Q3 forecasts, with assets under management (AUM) reaching $1.108 trillion and achieving record fund growth over the past three years, underscores its robust strategic positioning and operational excellence in the investment management industry. This milestone reflects the firm’s ability to effectively navigate market dynamics, attract substantial investor capital, and deliver strong returns, reinforcing its status as a leading global investment firm. The record growth trajectory also highlights Blackstone’s successful expansion and diversification strategies, positioning it well for sustained future growth and competitive advantage in the financial sector.