“BlackRock’s Oversight: A Costly Misstep in Retirement Security”

Introduction

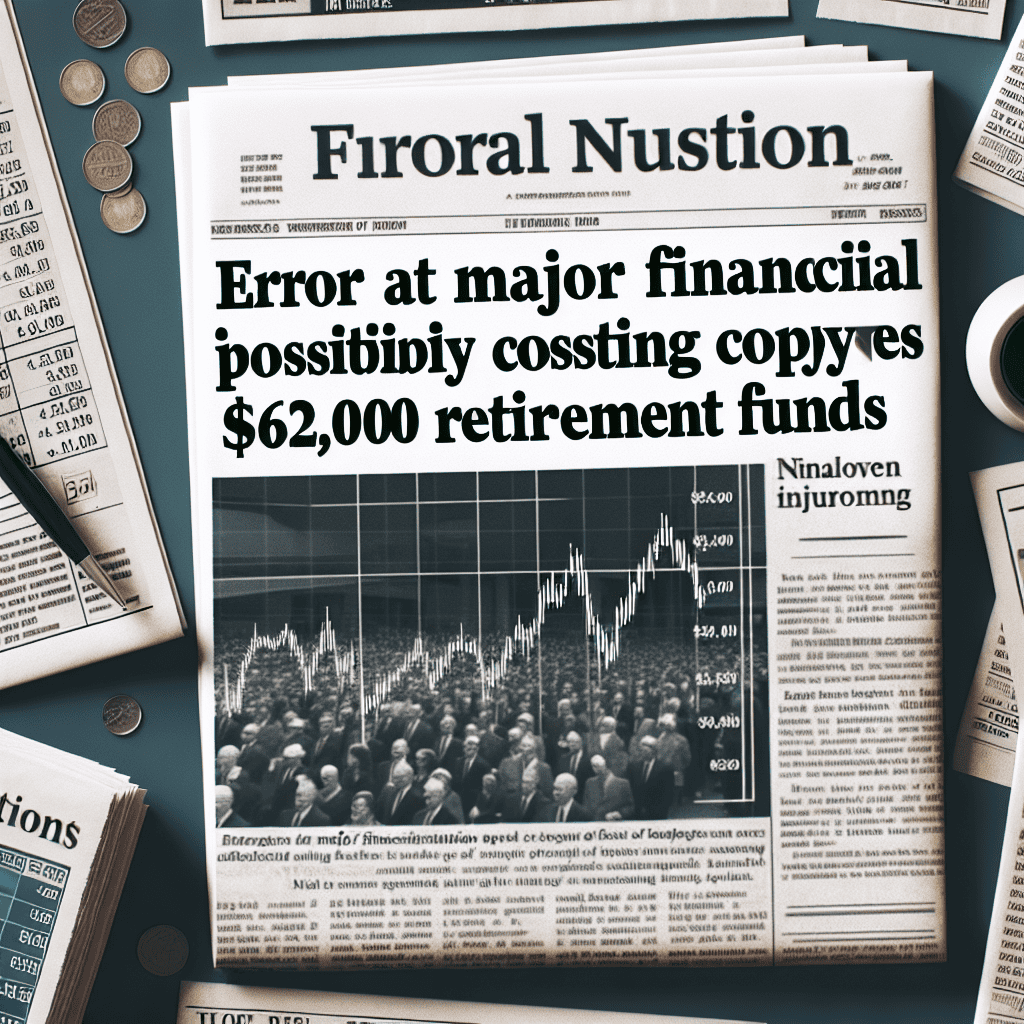

BlackRock, the world’s largest asset manager, recently identified a significant error that could potentially impact the retirement savings of numerous workers, with losses estimated to reach up to $625,000. This revelation has raised concerns among investors and stakeholders, highlighting the critical importance of accurate financial management and oversight in safeguarding retirement funds. The error, which underscores the complexities and challenges inherent in managing vast portfolios, has prompted BlackRock to take immediate corrective actions to address the issue and mitigate any adverse effects on affected individuals. As the situation unfolds, it serves as a stark reminder of the vulnerabilities within financial systems and the need for rigorous checks and balances to protect the financial futures of millions of workers.

Impact of Financial Errors on Retirement Savings

In recent developments, BlackRock, one of the world’s largest asset management firms, has identified a significant error that could potentially cost workers up to $625,000 in their retirement funds. This revelation underscores the profound impact that financial errors can have on retirement savings, a concern that resonates deeply with individuals planning for their future financial security. As retirement savings are a critical component of financial planning, any missteps in their management can have long-lasting consequences.

The error discovered by BlackRock highlights the intricate nature of financial management and the importance of accuracy in handling retirement funds. It serves as a stark reminder of the complexities involved in managing large-scale investment portfolios and the potential repercussions of even minor miscalculations. In this case, the error could lead to a substantial shortfall in the retirement savings of affected individuals, emphasizing the need for meticulous oversight and robust error-checking mechanisms within financial institutions.

Transitioning to the broader implications, this incident raises questions about the reliability of financial institutions and the systems they employ to manage clients’ investments. Trust is a cornerstone of the relationship between investors and financial managers, and any breach of this trust can have far-reaching effects. Investors rely heavily on the expertise and diligence of financial institutions to safeguard their assets and ensure their growth over time. Therefore, errors of this magnitude can erode confidence and prompt individuals to reconsider their investment strategies and the entities they choose to manage their funds.

Moreover, the potential financial loss of $625,000 is not merely a number; it represents years of diligent saving and planning by individuals who have entrusted their future to professional management. For many, this sum could mean the difference between a comfortable retirement and financial insecurity. It is crucial to recognize that retirement savings are not just about accumulating wealth but also about ensuring a stable and secure future. Consequently, any threat to these savings can have a profound psychological impact on individuals, causing anxiety and uncertainty about their financial well-being in retirement.

In light of this, it is imperative for financial institutions to implement stringent measures to prevent such errors from occurring. This includes adopting advanced technologies for error detection, enhancing transparency in reporting, and fostering a culture of accountability within the organization. By doing so, they can mitigate the risk of errors and reinforce the trust that clients place in them.

Furthermore, this incident serves as a call to action for individuals to take a more active role in managing their retirement savings. While professional management is invaluable, it is equally important for individuals to stay informed about their investments and regularly review their financial statements. By maintaining an active interest in their financial health, individuals can better safeguard their retirement savings against potential errors.

In conclusion, the error uncovered by BlackRock is a poignant reminder of the critical importance of accuracy and trust in financial management. It highlights the potential impact of financial errors on retirement savings and underscores the need for both financial institutions and individuals to remain vigilant. As the financial landscape continues to evolve, ensuring the security and growth of retirement funds must remain a top priority for all stakeholders involved.

BlackRock’s Role in Managing Retirement Funds

BlackRock, a global leader in investment management, has recently identified a significant error that could potentially impact the retirement savings of numerous workers, with losses estimated to reach as high as $625,000 per individual. This revelation underscores the critical role that BlackRock plays in managing retirement funds and highlights the importance of meticulous oversight in financial management. As the world’s largest asset manager, BlackRock is entrusted with the responsibility of overseeing trillions of dollars in assets, including those earmarked for retirement. This trust is built on a foundation of expertise, reliability, and a commitment to maximizing returns for investors. However, the recent discovery of an error in their management processes serves as a stark reminder of the complexities and challenges inherent in managing such vast sums of money.

The error in question was identified during a routine audit, a process that is integral to ensuring the accuracy and integrity of financial management. Audits are designed to uncover discrepancies and ensure compliance with regulatory standards, and in this instance, they have proven their worth. The error, which involved miscalculations in the allocation of funds, has the potential to significantly impact the retirement savings of affected individuals. For many workers, retirement savings represent a lifetime of hard work and planning, and any threat to these funds is understandably a cause for concern.

In response to the discovery, BlackRock has taken swift action to address the issue. The company has initiated a comprehensive review of its processes and systems to identify the root cause of the error and implement corrective measures. This proactive approach is indicative of BlackRock’s commitment to maintaining the trust of its clients and ensuring the security of their investments. Furthermore, BlackRock has pledged to work closely with affected individuals to rectify any discrepancies and ensure that their retirement savings are restored to their rightful levels.

The incident also highlights the broader challenges faced by asset managers in today’s complex financial landscape. With the increasing complexity of financial instruments and the ever-evolving regulatory environment, asset managers must remain vigilant and adaptable. This requires a continuous investment in technology and human resources to ensure that systems are robust and capable of handling the demands placed upon them. BlackRock’s response to the error demonstrates the importance of having a strong framework in place to quickly identify and address issues as they arise.

Moreover, this situation serves as a reminder to investors of the importance of staying informed and engaged with their retirement plans. While asset managers like BlackRock play a crucial role in managing investments, individuals must also take an active interest in their financial futures. Regularly reviewing account statements, understanding investment strategies, and seeking professional advice when necessary are all essential steps in safeguarding one’s retirement savings.

In conclusion, the recent error uncovered by BlackRock underscores the critical role that asset managers play in managing retirement funds and the importance of maintaining rigorous oversight and accountability. While the potential impact on affected individuals is significant, BlackRock’s swift response and commitment to rectifying the issue demonstrate their dedication to upholding the trust placed in them by investors. As the financial landscape continues to evolve, both asset managers and investors must remain vigilant and proactive in ensuring the security and growth of retirement savings.

How Errors in Investment Calculations Occur

In the complex world of investment management, precision is paramount. Even minor errors in calculations can have significant repercussions, as recently highlighted by BlackRock’s discovery of a potential error that could cost workers up to $625,000 in retirement funds. This incident underscores the importance of accuracy in financial computations and serves as a reminder of the potential consequences when mistakes occur. Understanding how such errors can arise is crucial for both investors and financial professionals.

Investment calculations are inherently complex, involving numerous variables and assumptions. These calculations often rely on sophisticated models that incorporate factors such as interest rates, inflation, market volatility, and individual investment choices. Given the intricate nature of these models, there is always a risk of human error, whether it be in data entry, formula application, or interpretation of results. Moreover, the use of outdated or incorrect data can further exacerbate the problem, leading to inaccurate projections and misguided investment strategies.

In addition to human error, technological glitches can also contribute to miscalculations. Financial institutions like BlackRock employ advanced software systems to manage vast amounts of data and perform complex analyses. While these systems are designed to enhance accuracy and efficiency, they are not infallible. Software bugs, system malfunctions, or integration issues can introduce errors into the calculations, potentially affecting thousands of investors. Regular system audits and updates are essential to mitigate these risks, but they cannot entirely eliminate the possibility of technological failures.

Furthermore, the dynamic nature of financial markets adds another layer of complexity to investment calculations. Market conditions can change rapidly, influenced by geopolitical events, economic indicators, and investor sentiment. These fluctuations can render previous assumptions invalid, necessitating constant adjustments to investment models. Failure to promptly update these models can result in projections that no longer reflect the current market reality, leading to suboptimal investment decisions.

Another factor contributing to errors in investment calculations is the challenge of accurately predicting future events. Investment models often rely on historical data to forecast future performance, but past trends do not always predict future outcomes. Unforeseen events, such as economic recessions or global pandemics, can disrupt markets and invalidate previous assumptions. This inherent uncertainty makes it difficult to achieve perfect accuracy in investment projections, highlighting the need for robust risk management strategies to cushion against potential miscalculations.

To address these challenges, financial institutions must prioritize transparency and communication with their clients. When errors are identified, it is crucial to promptly inform affected investors and outline the steps being taken to rectify the situation. This approach not only helps maintain trust but also provides an opportunity to educate investors about the complexities and inherent risks of investment management.

In conclusion, the potential error uncovered by BlackRock serves as a stark reminder of the intricacies involved in investment calculations and the significant impact that even minor mistakes can have on investors’ financial futures. By understanding the various factors that contribute to these errors, financial professionals can implement more effective safeguards and strategies to minimize their occurrence. As the financial landscape continues to evolve, maintaining a commitment to accuracy, transparency, and continuous improvement will be essential in safeguarding the interests of investors and ensuring the integrity of the investment management industry.

Steps to Safeguard Your Retirement Investments

In light of recent revelations by BlackRock, one of the world’s largest asset management firms, concerning an error that could potentially cost workers up to $625,000 in retirement funds, it is imperative for individuals to take proactive steps to safeguard their retirement investments. This incident underscores the importance of vigilance and due diligence in managing one’s financial future. As retirement planning is a critical component of financial security, understanding how to protect these investments is essential.

To begin with, it is crucial to regularly review your retirement account statements. By doing so, you can ensure that all transactions are accurate and that your investments are performing as expected. This practice not only helps in identifying any discrepancies early on but also allows you to make informed decisions about reallocating assets if necessary. Moreover, staying informed about the performance of your investments can provide peace of mind and a clearer picture of your financial trajectory.

In addition to regular reviews, diversifying your investment portfolio is another key strategy to safeguard your retirement funds. Diversification involves spreading your investments across various asset classes, such as stocks, bonds, and real estate, to reduce risk. By not putting all your eggs in one basket, you can mitigate the impact of market volatility on your overall portfolio. This approach can be particularly beneficial in uncertain economic times, as it provides a buffer against potential losses in any single investment.

Furthermore, it is advisable to stay informed about changes in financial regulations and policies that may affect your retirement savings. Keeping abreast of such developments can help you make timely adjustments to your investment strategy. For instance, changes in tax laws or contribution limits can have significant implications for your retirement planning. By staying informed, you can take advantage of opportunities to maximize your savings and avoid potential pitfalls.

Another important step is to consult with a financial advisor who can provide personalized guidance based on your unique financial situation and retirement goals. A professional advisor can help you navigate the complexities of retirement planning, offering insights into investment options and strategies that align with your objectives. Additionally, they can assist in identifying potential risks and developing a comprehensive plan to address them. Engaging with a knowledgeable advisor can be a valuable resource in ensuring that your retirement investments are well-protected.

Moreover, it is essential to be aware of the fees associated with your retirement accounts, as these can significantly impact your long-term savings. High fees can erode your investment returns over time, so it is important to understand what you are being charged and to seek out low-cost investment options when possible. Comparing fees across different providers and investment products can help you make more cost-effective choices, ultimately enhancing your retirement savings.

In conclusion, while the recent error uncovered by BlackRock serves as a stark reminder of the potential vulnerabilities in retirement planning, it also highlights the importance of taking proactive measures to protect your investments. By regularly reviewing account statements, diversifying your portfolio, staying informed about regulatory changes, consulting with financial advisors, and being mindful of fees, you can better safeguard your retirement funds. These steps not only help in mitigating risks but also empower you to take control of your financial future, ensuring a more secure and comfortable retirement.

The Importance of Transparency in Financial Management

In the realm of financial management, transparency is not merely a virtue but a necessity, as evidenced by a recent revelation from BlackRock, one of the world’s largest asset management firms. The company uncovered an error that could potentially cost workers up to $625,000 in their retirement funds. This incident underscores the critical importance of transparency in financial management, highlighting the need for meticulous oversight and open communication between financial institutions and their clients.

The error, which was identified during an internal review, involved a miscalculation in the retirement fund projections for a significant number of workers. Such a discrepancy, if left unaddressed, could have profound implications for individuals relying on these funds for their post-retirement livelihood. The potential financial shortfall of $625,000 is not just a number; it represents the dreams and security of countless individuals who have entrusted their financial futures to BlackRock’s stewardship.

In light of this discovery, BlackRock has taken immediate steps to rectify the situation, demonstrating a commitment to transparency and accountability. The firm has pledged to communicate openly with affected clients, providing them with detailed information about the error and the measures being implemented to correct it. This proactive approach is essential in maintaining trust and confidence among investors, who expect their financial managers to act with integrity and diligence.

Moreover, this incident serves as a poignant reminder of the broader implications of transparency in financial management. In an industry where complex transactions and intricate financial instruments are the norm, the potential for errors is ever-present. Therefore, financial institutions must prioritize transparency, not only as a means of compliance but as a fundamental principle guiding their operations. By doing so, they can foster a culture of accountability and trust, which is crucial for the long-term success of both the institution and its clients.

Furthermore, transparency in financial management extends beyond the immediate rectification of errors. It involves a commitment to ongoing communication and education, ensuring that clients are well-informed about their investments and the factors that may impact their financial outcomes. This includes providing clear and accessible information about fees, risks, and potential returns, enabling clients to make informed decisions about their financial futures.

In addition to benefiting clients, transparency also serves the interests of financial institutions. By fostering an environment of openness and accountability, firms can enhance their reputation and build stronger relationships with their clients. This, in turn, can lead to increased client retention and growth, as investors are more likely to remain loyal to institutions that demonstrate a commitment to transparency and ethical conduct.

In conclusion, the recent error uncovered by BlackRock highlights the critical importance of transparency in financial management. As financial institutions navigate an increasingly complex and dynamic landscape, they must prioritize transparency as a core value, ensuring that they act in the best interests of their clients. By doing so, they can build trust, enhance their reputation, and ultimately contribute to the financial well-being of the individuals and communities they serve. As the financial industry continues to evolve, transparency will remain a cornerstone of effective and responsible financial management, guiding institutions toward a more ethical and sustainable future.

Lessons Learned from BlackRock’s Error

In a recent revelation, BlackRock, one of the world’s largest asset management firms, uncovered a significant error that could potentially cost workers up to $625,000 in their retirement funds. This discovery has sent ripples through the financial community, prompting both investors and financial institutions to reassess their strategies and safeguards. The incident underscores the critical importance of meticulous oversight and the need for robust systems to prevent such costly mistakes. As we delve into the lessons learned from BlackRock’s error, it becomes evident that the implications extend beyond the immediate financial impact, offering valuable insights for both individual investors and financial institutions.

To begin with, the error highlights the necessity of rigorous auditing processes within financial institutions. BlackRock’s oversight serves as a stark reminder that even the most reputable firms are not immune to mistakes. This incident should prompt financial institutions to re-evaluate their internal controls and auditing mechanisms to ensure that errors are detected and rectified promptly. By implementing more stringent checks and balances, firms can safeguard against potential oversights that could have far-reaching consequences for their clients.

Moreover, the situation emphasizes the importance of transparency and communication between financial institutions and their clients. In the wake of the error, BlackRock’s response will be closely scrutinized by both investors and regulators. It is crucial for firms to maintain open lines of communication, providing timely and accurate information to their clients. This transparency not only helps in managing client expectations but also builds trust, which is essential for maintaining long-term relationships in the financial sector.

Additionally, the incident serves as a wake-up call for individual investors to take a more active role in managing their retirement funds. While many individuals rely on financial institutions to handle their investments, it is imperative for investors to remain informed and engaged with their portfolios. Regularly reviewing account statements, understanding investment strategies, and seeking professional advice when necessary can help individuals make informed decisions and mitigate potential risks.

Furthermore, the error underscores the importance of diversification in investment portfolios. While BlackRock’s mistake may have been an isolated incident, it highlights the inherent risks associated with relying too heavily on a single investment strategy or asset manager. Diversification can help spread risk and reduce the impact of any single error or market fluctuation on an individual’s overall financial health. Investors should consider a balanced approach, incorporating a mix of asset classes and investment vehicles to achieve their long-term financial goals.

In light of BlackRock’s error, regulatory bodies may also take a closer look at the oversight and compliance measures in place within the financial industry. This could lead to the implementation of more stringent regulations aimed at protecting investors and ensuring the integrity of financial markets. While increased regulation may pose challenges for financial institutions, it ultimately serves to enhance the stability and reliability of the financial system as a whole.

In conclusion, the error uncovered by BlackRock serves as a poignant reminder of the complexities and challenges inherent in managing retirement funds. It highlights the need for robust internal controls, transparent communication, active investor engagement, diversification, and potentially increased regulatory oversight. By learning from this incident, both financial institutions and individual investors can take proactive steps to safeguard their financial futures and ensure that similar errors are avoided in the future.

The Future of Retirement Fund Management After BlackRock’s Discovery

In recent developments, BlackRock, one of the world’s leading asset management firms, has identified a significant error that could potentially impact the retirement savings of numerous workers, with losses estimated to reach as high as $625,000 per individual. This revelation has sent ripples through the financial industry, prompting a reevaluation of retirement fund management practices. As the implications of this discovery unfold, it is crucial to understand the broader context and potential future directions for retirement fund management.

The error identified by BlackRock underscores the complexities inherent in managing retirement funds. With millions of individuals relying on these funds for their financial security in retirement, even minor miscalculations can have profound consequences. The error in question involved a misalignment in the assumptions used to project future returns, which, over time, compounded to create a significant shortfall in expected retirement savings. This situation highlights the importance of precision and accuracy in financial modeling and the need for robust systems to detect and correct such discrepancies promptly.

In light of this discovery, there is an increasing emphasis on the role of technology in enhancing the accuracy and reliability of retirement fund management. Advanced data analytics and machine learning algorithms offer promising solutions to improve predictive modeling and risk assessment. By leveraging these technologies, asset managers can better anticipate market fluctuations and adjust their strategies accordingly, thereby safeguarding the financial interests of their clients. Moreover, the integration of artificial intelligence in financial services can facilitate real-time monitoring and early detection of anomalies, reducing the likelihood of errors going unnoticed.

Furthermore, the BlackRock incident has sparked a broader conversation about transparency and accountability in the financial industry. Investors are demanding greater clarity regarding the methodologies and assumptions underlying their retirement fund projections. In response, asset management firms are increasingly adopting more transparent practices, providing clients with detailed insights into their investment strategies and the factors influencing their performance. This shift towards greater transparency not only helps build trust with clients but also encourages a more informed and engaged investor base.

Additionally, the discovery has prompted regulatory bodies to reassess existing guidelines and standards governing retirement fund management. There is a growing recognition of the need for more stringent oversight and regular audits to ensure compliance with best practices. Regulatory agencies are likely to introduce new measures aimed at enhancing the resilience and integrity of retirement funds, thereby protecting the interests of individual investors.

As the financial industry adapts to these changes, it is essential for individuals to take a proactive role in managing their retirement savings. This includes staying informed about the performance of their investments, understanding the risks involved, and seeking professional advice when necessary. By taking an active interest in their financial future, individuals can make more informed decisions and mitigate potential risks.

In conclusion, BlackRock’s discovery of a significant error in retirement fund projections serves as a wake-up call for the financial industry. It highlights the need for greater precision, transparency, and accountability in managing retirement savings. As technology continues to evolve, it offers promising solutions to enhance the accuracy and reliability of financial modeling. Meanwhile, regulatory bodies are likely to implement stricter guidelines to safeguard investors’ interests. Ultimately, by fostering a culture of transparency and encouraging individuals to take an active role in their financial planning, the industry can work towards a more secure and sustainable future for retirement fund management.

Q&A

1. **What was the error uncovered by BlackRock?**

BlackRock discovered an error in their target-date funds that potentially misallocated assets, affecting the growth of retirement savings.

2. **How much could the error potentially cost workers?**

The error could potentially cost workers up to $625,000 in their retirement funds.

3. **Which type of funds were affected by the error?**

The error affected BlackRock’s target-date funds, which are commonly used in retirement savings plans.

4. **What is a target-date fund?**

A target-date fund is a type of investment fund that automatically adjusts its asset allocation to become more conservative as the target retirement date approaches.

5. **How did BlackRock respond to the discovery of the error?**

BlackRock initiated a review of the affected funds and communicated with clients to address and rectify the issue.

6. **What impact does this error have on investors?**

The error could lead to lower-than-expected returns for investors, potentially affecting their retirement savings and financial planning.

7. **What steps are being taken to prevent future errors?**

BlackRock is likely implementing enhanced oversight and review processes to prevent similar errors in the future, although specific measures were not detailed.

Conclusion

The discovery by BlackRock of an error potentially costing workers up to $625,000 in retirement funds underscores the critical importance of accurate financial management and oversight in retirement planning. Such errors can have significant long-term impacts on individuals’ financial security, highlighting the need for robust systems and regular audits to prevent and quickly rectify discrepancies. This incident serves as a reminder for both financial institutions and individuals to maintain vigilance and ensure transparency in managing retirement assets to safeguard against potential financial losses.