“Bitcoin Breaks Records, But Nvidia’s Five-Year Surge Steals the Spotlight!”

Introduction

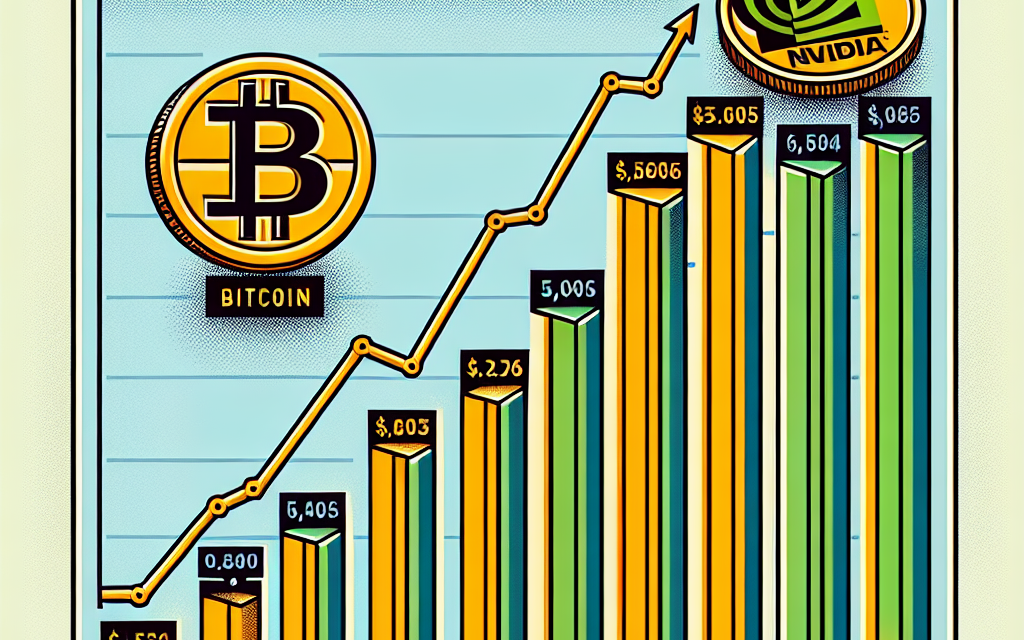

In the ever-evolving landscape of financial markets, Bitcoin has once again captured headlines by reaching a new record high, reaffirming its status as a dominant force in the world of cryptocurrencies. This milestone underscores Bitcoin’s enduring appeal and its role as a barometer for the broader digital asset market. However, while Bitcoin’s recent surge is noteworthy, it pales in comparison to the remarkable five-year performance of Nvidia, a leading technology company renowned for its advancements in graphics processing units (GPUs) and artificial intelligence. Nvidia’s stock has not only outpaced Bitcoin’s gains over this period but has also solidified its position as a powerhouse in the tech industry, driven by its strategic innovations and expanding market presence. This juxtaposition highlights the dynamic nature of investment opportunities and the diverse pathways to substantial returns in today’s financial ecosystem.

Bitcoin’s Record High: What It Means for Cryptocurrency Investors

Bitcoin, the pioneering cryptocurrency, has once again captured the attention of investors and financial analysts worldwide by reaching a record high. This milestone underscores the growing acceptance and integration of digital currencies into mainstream financial systems. As Bitcoin’s value surges, it prompts a renewed interest in the potential of cryptocurrencies as viable investment vehicles. For cryptocurrency investors, this record high signifies not only the resilience of Bitcoin but also the broader implications for the digital currency market. However, while Bitcoin’s ascent is noteworthy, it is essential to consider its performance in a broader context, particularly when compared to other investment opportunities such as Nvidia, a leading technology company.

Bitcoin’s recent peak highlights its volatility, a characteristic that has both attracted and deterred investors. The cryptocurrency’s value is influenced by a myriad of factors, including regulatory developments, technological advancements, and macroeconomic trends. As such, investors must navigate these complexities to make informed decisions. The record high serves as a reminder of Bitcoin’s potential for substantial returns, yet it also underscores the inherent risks associated with its unpredictable nature. Consequently, investors are encouraged to approach Bitcoin with a balanced perspective, recognizing both its opportunities and challenges.

In contrast, Nvidia’s performance over the past five years presents a compelling narrative of consistent growth and innovation. The technology giant has significantly outperformed Bitcoin, delivering remarkable returns to its shareholders. Nvidia’s success can be attributed to its strategic positioning in key sectors such as artificial intelligence, gaming, and data centers. The company’s ability to adapt to evolving technological landscapes and capitalize on emerging trends has solidified its status as a formidable player in the tech industry. This impressive track record offers a stark comparison to Bitcoin’s volatility, highlighting the potential benefits of investing in established companies with a proven history of growth.

Moreover, Nvidia’s performance underscores the importance of diversification in investment portfolios. While Bitcoin offers the allure of high returns, it is crucial for investors to consider a balanced approach that includes a mix of asset classes. Diversification can mitigate risks and enhance the potential for long-term financial stability. By investing in a combination of cryptocurrencies, equities, and other asset types, investors can better navigate the uncertainties of the financial markets.

Furthermore, the juxtaposition of Bitcoin’s record high and Nvidia’s five-year performance invites a broader discussion on the evolving landscape of investment opportunities. As digital currencies continue to gain traction, they are increasingly viewed as a legitimate component of diversified portfolios. However, traditional investments, such as equities in technology companies, remain integral to achieving financial goals. This dynamic interplay between emerging and established investment options reflects the ongoing transformation of the financial ecosystem.

In conclusion, Bitcoin’s record high is a significant milestone for cryptocurrency investors, symbolizing both the potential and volatility inherent in digital currencies. However, when compared to Nvidia’s impressive five-year performance, it becomes evident that diversification and strategic investment choices are paramount. As investors navigate this complex landscape, they must weigh the allure of cryptocurrencies against the stability and growth potential offered by established companies. Ultimately, a balanced approach that embraces both innovation and tradition will be key to achieving long-term financial success in an ever-evolving market.

Nvidia’s Five-Year Performance: A Closer Look at Its Market Dominance

In recent years, the financial markets have witnessed remarkable developments, with Bitcoin and Nvidia emerging as two of the most talked-about entities. Bitcoin, the pioneering cryptocurrency, has reached record highs, capturing the attention of investors worldwide. However, despite its impressive performance, Nvidia’s five-year trajectory in the market has significantly outpaced Bitcoin’s growth, underscoring the semiconductor giant’s dominance in the tech industry.

To understand Nvidia’s market supremacy, it is essential to examine the factors contributing to its exceptional performance. Nvidia, a leader in graphics processing units (GPUs), has consistently demonstrated its ability to innovate and adapt to the evolving demands of technology. Over the past five years, the company has expanded its influence beyond traditional gaming markets, venturing into artificial intelligence (AI), data centers, and autonomous vehicles. This strategic diversification has not only bolstered Nvidia’s revenue streams but also solidified its position as a critical player in the tech ecosystem.

Moreover, Nvidia’s commitment to research and development has been instrumental in maintaining its competitive edge. By investing heavily in cutting-edge technologies, the company has been able to deliver products that meet the high-performance requirements of modern applications. For instance, Nvidia’s GPUs have become indispensable in AI research, where their parallel processing capabilities significantly accelerate machine learning tasks. This has led to widespread adoption of Nvidia’s products across various industries, further driving its growth.

In contrast, Bitcoin’s journey, while impressive, has been marked by volatility and regulatory challenges. As a decentralized digital currency, Bitcoin operates outside the traditional financial system, which has both advantages and drawbacks. On one hand, it offers a level of anonymity and freedom from government control that appeals to many users. On the other hand, its lack of regulation has led to concerns about security and stability, causing fluctuations in its value. Despite reaching record highs, Bitcoin’s market performance has been unpredictable, making it a riskier investment compared to established tech companies like Nvidia.

Furthermore, Nvidia’s strategic partnerships and acquisitions have played a crucial role in its sustained growth. By collaborating with industry leaders and acquiring promising startups, Nvidia has been able to integrate new technologies and expand its product offerings. This approach has not only enhanced its market presence but also allowed it to tap into emerging trends, such as the growing demand for AI-driven solutions and cloud computing services.

In addition to its technological advancements, Nvidia’s financial management has been exemplary. The company has consistently delivered strong financial results, with impressive revenue growth and profitability. This financial stability has instilled confidence among investors, contributing to its robust stock performance over the past five years. In comparison, Bitcoin’s value is largely driven by market sentiment and speculative trading, which can lead to significant price swings.

In conclusion, while Bitcoin’s record highs have captured headlines, Nvidia’s five-year performance underscores its market dominance and strategic acumen. Through innovation, diversification, and strategic partnerships, Nvidia has positioned itself as a leader in the tech industry, outpacing Bitcoin’s growth and establishing a solid foundation for future success. As the technology landscape continues to evolve, Nvidia’s ability to adapt and innovate will likely ensure its continued prominence in the market.

Comparing Bitcoin and Nvidia: Investment Strategies for 2023

In recent years, the financial landscape has been dramatically reshaped by the rise of digital currencies and the burgeoning tech industry. Bitcoin, the pioneering cryptocurrency, has once again captured headlines by reaching a record high. This surge has reignited discussions about its potential as a lucrative investment. However, when examining the broader picture, it becomes evident that Nvidia, a leading technology company specializing in graphics processing units (GPUs) and artificial intelligence (AI), has outperformed Bitcoin significantly over the past five years. This comparison between Bitcoin and Nvidia offers valuable insights for investors contemplating their strategies for 2023.

To begin with, Bitcoin’s recent ascent to a record high underscores its volatile nature and the speculative interest it continues to generate. As a decentralized digital currency, Bitcoin operates independently of traditional financial institutions, offering a unique appeal to those seeking alternatives to conventional investments. Its value is largely driven by market sentiment, regulatory developments, and macroeconomic factors. While Bitcoin’s potential for high returns is undeniable, its volatility poses substantial risks, making it a challenging asset for risk-averse investors.

In contrast, Nvidia’s performance over the past five years highlights the strength and stability of investing in technology companies with a solid foundation and growth trajectory. Nvidia has consistently demonstrated its ability to innovate and adapt to the evolving demands of the tech industry. The company’s GPUs are integral to a wide range of applications, from gaming and data centers to AI and autonomous vehicles. This diversification has enabled Nvidia to capitalize on multiple growth opportunities, resulting in a robust financial performance that has significantly outpaced Bitcoin’s returns over the same period.

Moreover, Nvidia’s strategic positioning in the AI sector further enhances its appeal as a long-term investment. As AI continues to revolutionize industries, Nvidia’s cutting-edge technology and expertise position it as a key player in this transformative field. The company’s commitment to research and development ensures that it remains at the forefront of technological advancements, providing investors with confidence in its sustained growth potential.

When considering investment strategies for 2023, it is crucial to weigh the potential rewards against the inherent risks associated with each asset. Bitcoin, with its decentralized nature and potential for high returns, may appeal to those with a higher risk tolerance and a keen interest in the cryptocurrency market. However, its volatility necessitates a cautious approach, with investors advised to diversify their portfolios to mitigate potential losses.

On the other hand, Nvidia offers a more stable investment option, backed by a track record of consistent growth and innovation. Its strong market position and strategic focus on emerging technologies make it an attractive choice for investors seeking long-term value. By investing in Nvidia, individuals can benefit from the company’s continued expansion in high-growth sectors, providing a balanced approach to portfolio diversification.

In conclusion, while Bitcoin’s recent record high captures the imagination of many investors, Nvidia’s impressive five-year performance underscores the importance of considering both potential returns and associated risks. As 2023 unfolds, investors are encouraged to carefully evaluate their investment strategies, taking into account their risk tolerance and long-term financial goals. By doing so, they can make informed decisions that align with their objectives, whether they choose to embrace the volatility of cryptocurrencies or the stability of established technology companies like Nvidia.

The Rise of Bitcoin: Factors Driving Its Recent Surge

Bitcoin, the pioneering cryptocurrency, has recently reached a record high, capturing the attention of investors and financial analysts worldwide. This surge can be attributed to a confluence of factors that have bolstered its value and appeal. One of the primary drivers of Bitcoin’s recent ascent is the growing institutional interest in digital currencies. Major financial institutions and corporations have increasingly recognized Bitcoin as a legitimate asset class, integrating it into their portfolios and balance sheets. This institutional adoption has not only provided Bitcoin with a veneer of legitimacy but has also significantly increased its demand.

Moreover, the macroeconomic environment has played a crucial role in Bitcoin’s rise. With central banks around the world maintaining low interest rates and engaging in quantitative easing to combat economic slowdowns, traditional fiat currencies have faced devaluation pressures. In this context, Bitcoin has emerged as a potential hedge against inflation, attracting investors seeking to preserve their wealth. Additionally, the ongoing geopolitical uncertainties and the global pandemic have further underscored the need for alternative assets, driving more individuals and institutions towards Bitcoin.

Technological advancements and regulatory developments have also contributed to Bitcoin’s upward trajectory. The maturation of blockchain technology has enhanced the security and efficiency of Bitcoin transactions, making it more accessible and user-friendly. Furthermore, regulatory clarity in several jurisdictions has alleviated some of the uncertainties surrounding Bitcoin, encouraging more widespread adoption. As governments and regulatory bodies continue to refine their approaches to digital currencies, the path for Bitcoin’s growth appears increasingly clear.

Despite Bitcoin’s impressive performance, it is noteworthy that Nvidia, a leading technology company, has outperformed Bitcoin significantly over the past five years. Nvidia’s success can be attributed to its strategic positioning in the burgeoning fields of artificial intelligence, gaming, and data centers. The company’s innovative graphics processing units (GPUs) have become indispensable in these sectors, driving robust revenue growth and investor confidence. As the demand for high-performance computing continues to rise, Nvidia’s prospects remain promising.

The juxtaposition of Bitcoin’s recent surge with Nvidia’s long-term performance highlights the diverse opportunities available in the financial markets. While Bitcoin offers a glimpse into the future of decentralized finance and digital assets, Nvidia represents the transformative potential of technology in reshaping industries. Investors are thus presented with a spectrum of choices, each with its own set of risks and rewards.

In conclusion, Bitcoin’s record high is a testament to the evolving landscape of finance and technology. The factors driving its recent surge, including institutional adoption, macroeconomic conditions, and technological advancements, underscore the growing acceptance and integration of digital currencies into the global financial system. However, the remarkable performance of Nvidia over the past five years serves as a reminder of the enduring value of innovation and strategic foresight in the technology sector. As both Bitcoin and Nvidia continue to chart their respective paths, they offer valuable insights into the dynamic interplay between finance and technology, shaping the future of investment opportunities.

Nvidia’s Growth Story: Key Innovations and Market Trends

In recent years, the financial markets have witnessed remarkable developments, with Bitcoin reaching record highs and capturing the attention of investors worldwide. However, while Bitcoin’s meteoric rise has been a focal point, Nvidia’s five-year performance has quietly surpassed it, marking a significant achievement in the tech industry. This impressive growth story can be attributed to a combination of key innovations and market trends that have propelled Nvidia to the forefront of the technology sector.

To begin with, Nvidia’s success is deeply rooted in its pioneering advancements in graphics processing units (GPUs). Originally designed to enhance gaming experiences, GPUs have evolved to become indispensable in a variety of applications beyond gaming. Nvidia’s strategic foresight in recognizing the potential of GPUs in artificial intelligence (AI) and machine learning has been a game-changer. By developing powerful GPUs capable of handling complex computations, Nvidia has positioned itself as a leader in AI technology, catering to industries ranging from healthcare to autonomous vehicles.

Moreover, Nvidia’s commitment to research and development has been instrumental in maintaining its competitive edge. The company’s continuous investment in cutting-edge technologies has resulted in a series of groundbreaking products, such as the Tensor Core GPUs, which are specifically designed to accelerate AI workloads. This innovation has not only solidified Nvidia’s dominance in the AI sector but has also opened new revenue streams, contributing significantly to its financial performance.

In addition to technological advancements, Nvidia has adeptly navigated market trends to fuel its growth. The rise of cloud computing and data centers has created a burgeoning demand for high-performance computing solutions. Nvidia’s GPUs have become integral components in data centers, providing the computational power necessary to support cloud services and big data analytics. This strategic alignment with market needs has allowed Nvidia to capitalize on the exponential growth of cloud computing, further boosting its financial success.

Furthermore, Nvidia’s strategic partnerships and acquisitions have played a crucial role in its expansion. By collaborating with leading tech companies and acquiring complementary businesses, Nvidia has been able to enhance its product offerings and expand its market reach. For instance, the acquisition of Mellanox Technologies, a leader in high-performance networking solutions, has strengthened Nvidia’s position in the data center market, enabling it to offer comprehensive solutions that integrate computing and networking capabilities.

While Bitcoin’s rise has been fueled by speculative interest and its potential as a decentralized currency, Nvidia’s growth story is grounded in tangible innovations and strategic market positioning. The company’s ability to adapt to changing technological landscapes and anticipate future trends has been a key driver of its success. As Nvidia continues to push the boundaries of what is possible with GPUs and AI, its trajectory suggests a sustained upward momentum.

In conclusion, Nvidia’s five-year performance surpassing Bitcoin’s record highs is a testament to the company’s strategic vision and innovative prowess. By capitalizing on key technological advancements and aligning with market trends, Nvidia has established itself as a dominant force in the tech industry. As the demand for AI and high-performance computing continues to grow, Nvidia’s role in shaping the future of technology remains pivotal, promising further growth and success in the years to come.

Cryptocurrency vs. Tech Stocks: Where Should You Invest?

In recent years, the financial landscape has been dramatically reshaped by the rise of cryptocurrencies and the robust performance of tech stocks. Bitcoin, the flagship cryptocurrency, has once again captured headlines by reaching a record high. This surge has reignited debates among investors about the potential of cryptocurrencies as a viable investment option. However, while Bitcoin’s meteoric rise is impressive, it is crucial to consider the broader context of investment opportunities, particularly in the technology sector. Notably, Nvidia, a leading player in the tech industry, has demonstrated a five-year performance that significantly surpasses Bitcoin’s gains, prompting investors to weigh their options carefully.

Bitcoin’s allure lies in its decentralized nature and the promise of substantial returns. Its recent peak is a testament to its volatility and potential for rapid appreciation. Many investors are drawn to Bitcoin due to its limited supply and the growing acceptance of cryptocurrencies in mainstream financial systems. However, the cryptocurrency market is notoriously unpredictable, with prices subject to dramatic fluctuations driven by regulatory changes, technological advancements, and market sentiment. Consequently, while Bitcoin can offer substantial short-term gains, it also poses significant risks that investors must consider.

In contrast, Nvidia’s performance over the past five years highlights the potential stability and growth offered by tech stocks. As a leading designer of graphics processing units (GPUs) and a pioneer in artificial intelligence (AI) technologies, Nvidia has capitalized on the increasing demand for high-performance computing. The company’s strategic investments in AI, gaming, and data centers have fueled its growth, resulting in a remarkable increase in its stock value. This consistent upward trajectory underscores the potential of tech stocks to deliver sustained returns over time, driven by innovation and market expansion.

When comparing Bitcoin and Nvidia, it is essential to recognize the differing risk profiles and growth drivers of these investment options. Bitcoin’s value is largely speculative, influenced by market perceptions and external factors such as regulatory developments. In contrast, Nvidia’s growth is underpinned by tangible advancements in technology and a strong market position. This distinction is crucial for investors seeking to balance risk and reward in their portfolios.

Moreover, the broader economic environment plays a significant role in shaping investment decisions. As global economies recover from the impacts of the COVID-19 pandemic, technological advancements continue to drive economic growth. The increasing reliance on digital infrastructure, AI, and cloud computing presents substantial opportunities for tech companies like Nvidia. This trend suggests that tech stocks may offer more predictable growth prospects compared to the volatile nature of cryptocurrencies.

Ultimately, the decision of where to invest hinges on individual risk tolerance and investment goals. For those willing to embrace volatility and potential high returns, Bitcoin remains an attractive option. However, for investors seeking stability and long-term growth, tech stocks like Nvidia present a compelling alternative. By diversifying their portfolios to include both cryptocurrencies and tech stocks, investors can potentially benefit from the strengths of each asset class while mitigating risks.

In conclusion, while Bitcoin’s recent record high is noteworthy, Nvidia’s five-year performance underscores the enduring appeal of tech stocks. As investors navigate the complexities of the financial markets, understanding the unique characteristics and growth drivers of each investment option is crucial. By carefully considering these factors, investors can make informed decisions that align with their financial objectives and risk tolerance.

Lessons from Nvidia’s Success: Insights for Bitcoin Enthusiasts

Bitcoin, the pioneering cryptocurrency, has once again captured global attention by reaching a record high. This milestone has reignited discussions about its potential as a transformative financial asset. However, while Bitcoin’s recent surge is noteworthy, it is essential to consider the broader landscape of investment opportunities. In this context, Nvidia, a leading technology company, offers valuable insights. Over the past five years, Nvidia’s performance has significantly outpaced Bitcoin, providing lessons that Bitcoin enthusiasts might find instructive.

To begin with, Nvidia’s success can be attributed to its strategic positioning in the technology sector, particularly in areas such as artificial intelligence, gaming, and data centers. The company’s ability to innovate and adapt to emerging trends has been a cornerstone of its growth. For instance, Nvidia’s graphics processing units (GPUs) have become indispensable in powering AI applications, which are increasingly integral to various industries. This adaptability highlights the importance of diversification and innovation, principles that Bitcoin investors might consider when evaluating the cryptocurrency’s long-term potential.

Moreover, Nvidia’s robust financial performance is underpinned by its commitment to research and development. By consistently investing in cutting-edge technologies, Nvidia has maintained a competitive edge, ensuring sustained growth and profitability. This focus on innovation underscores the value of continuous improvement and forward-thinking strategies. Bitcoin, while revolutionary in its own right, faces challenges such as scalability and regulatory scrutiny. Addressing these issues through technological advancements and strategic partnerships could enhance Bitcoin’s appeal and stability, much like Nvidia’s approach has bolstered its market position.

In addition to innovation, Nvidia’s success is also a testament to effective leadership and strategic vision. The company’s executives have demonstrated an acute understanding of market dynamics, enabling them to capitalize on opportunities and mitigate risks. This strategic foresight has been instrumental in navigating the volatile technology landscape. For Bitcoin, which is inherently volatile, the importance of strategic planning cannot be overstated. Investors and developers alike must anticipate market shifts and regulatory changes, ensuring that Bitcoin remains resilient and adaptable in an ever-evolving financial ecosystem.

Furthermore, Nvidia’s ability to create value for its shareholders through consistent returns and stock appreciation is noteworthy. The company’s focus on delivering tangible results has fostered investor confidence, contributing to its impressive five-year performance. In contrast, Bitcoin’s value proposition is often perceived as speculative, driven by market sentiment rather than intrinsic value. To bridge this gap, Bitcoin advocates might consider emphasizing the cryptocurrency’s utility and real-world applications, thereby enhancing its credibility and attractiveness as an investment.

Finally, Nvidia’s success story underscores the importance of a strong corporate culture and a commitment to sustainability. By fostering an environment that encourages innovation and ethical practices, Nvidia has built a reputation as a responsible and forward-thinking company. For Bitcoin, cultivating a similar ethos within its community could prove beneficial. Promoting transparency, security, and inclusivity could enhance Bitcoin’s reputation and foster trust among users and investors.

In conclusion, while Bitcoin’s recent record high is a remarkable achievement, Nvidia’s five-year performance offers valuable lessons for Bitcoin enthusiasts. By embracing innovation, strategic planning, and a commitment to value creation, Bitcoin can enhance its long-term prospects. As the cryptocurrency landscape continues to evolve, drawing insights from successful companies like Nvidia could provide a roadmap for sustainable growth and success.

Q&A

1. **What is the recent milestone achieved by Bitcoin?**

Bitcoin recently reached a record high in its market value.

2. **How has Nvidia’s performance compared to Bitcoin over the past five years?**

Nvidia’s five-year performance has significantly surpassed Bitcoin’s performance.

3. **What factors contributed to Bitcoin reaching a record high?**

Factors may include increased institutional adoption, macroeconomic conditions, and growing interest in cryptocurrencies.

4. **What has driven Nvidia’s strong performance over the past five years?**

Nvidia’s performance has been driven by advancements in GPU technology, growth in AI and data center markets, and strong gaming industry demand.

5. **How do Bitcoin and Nvidia differ as investment options?**

Bitcoin is a decentralized digital currency, while Nvidia is a technology company with tangible products and services, offering different risk and return profiles.

6. **What role does volatility play in Bitcoin’s market performance?**

Bitcoin is known for its high volatility, which can lead to rapid price changes and speculative trading.

7. **Why might investors choose Nvidia over Bitcoin despite Bitcoin’s recent high?**

Investors might prefer Nvidia for its established business model, consistent growth, and lower volatility compared to Bitcoin.

Conclusion

Bitcoin’s recent surge to a record high highlights its continued appeal and volatility in the cryptocurrency market. However, when examining long-term performance, Nvidia’s five-year growth trajectory has significantly outpaced Bitcoin’s. This disparity underscores the robust demand for Nvidia’s products, driven by advancements in AI, gaming, and data centers, which have provided more consistent and substantial returns compared to the speculative nature of Bitcoin. While Bitcoin remains a popular asset for investors seeking high-risk, high-reward opportunities, Nvidia’s performance reflects the strength and stability of a company capitalizing on technological innovation and market expansion.