“Cash Out or Cash In: Billionaires Bet Big by Selling Shares of This Market Darling!”

Introduction

In recent financial news, a notable trend has emerged as several billionaires have chosen to divest their holdings in a particularly popular stock, sparking widespread interest and speculation within the investment community. This strategic move by some of the world’s wealthiest individuals has prompted analysts and investors alike to scrutinize the underlying factors driving this decision. The sale of shares by these influential figures not only impacts the stock’s market dynamics but also raises questions about the future prospects of the company involved. As these high-profile transactions unfold, they offer a unique glimpse into the investment strategies of the ultra-wealthy and their perspectives on the evolving economic landscape.

Reasons Behind Billionaires Selling Shares of This Popular Stock

In recent months, a noticeable trend has emerged among some of the world’s wealthiest individuals: the decision to sell shares of a particularly popular stock. This development has sparked widespread interest and speculation, prompting analysts and investors alike to delve into the underlying reasons for such a move. While the motivations of billionaires can be as varied as their investment portfolios, several key factors appear to be influencing this decision.

To begin with, market conditions have played a significant role in shaping the strategies of these affluent investors. The stock market has experienced considerable volatility, driven by a combination of geopolitical tensions, inflationary pressures, and shifts in monetary policy. In such an environment, even the most robust stocks can face downward pressure, prompting investors to reassess their positions. For billionaires, who often have substantial holdings in a single company, diversifying their portfolios by selling shares can be a prudent way to mitigate risk and preserve wealth.

Moreover, the decision to sell shares may also be influenced by the desire to capitalize on high valuations. Over the past few years, certain stocks have seen their prices soar to unprecedented levels, fueled by strong earnings reports and optimistic growth projections. For investors who acquired these shares at a lower cost basis, the current high valuations present an attractive opportunity to realize significant gains. By selling shares at a peak, billionaires can lock in profits and reallocate their capital to other ventures or asset classes that may offer better long-term returns.

In addition to market dynamics and valuation considerations, personal financial planning can also drive the decision to sell shares. Billionaires, like any other investors, must manage their liquidity needs and tax obligations. Selling shares can provide the necessary funds for philanthropic endeavors, lifestyle expenses, or estate planning. Furthermore, with potential changes in tax legislation on the horizon, some investors may choose to sell shares now to take advantage of the current tax rates, thereby minimizing future liabilities.

Another factor that cannot be overlooked is the strategic realignment of investment portfolios. As industries evolve and new opportunities arise, billionaires may opt to divest from certain stocks to focus on emerging sectors or technologies. This shift in focus can be driven by a desire to stay ahead of market trends or to invest in areas that align with their personal values or business interests. By reallocating their resources, these investors can position themselves to benefit from the next wave of innovation and growth.

Lastly, it is important to consider the influence of external advisors and market sentiment. Billionaires often rely on a team of financial experts to guide their investment decisions. These advisors may recommend selling shares based on a comprehensive analysis of market conditions, company performance, and future prospects. Additionally, the actions of other prominent investors can create a ripple effect, prompting others to follow suit in a bid to avoid potential losses or capitalize on perceived opportunities.

In conclusion, the decision by billionaires to sell shares of a popular stock is driven by a confluence of factors, including market volatility, high valuations, personal financial planning, strategic realignment, and expert advice. While each investor’s motivations may differ, the overarching theme is one of careful consideration and strategic foresight. As the financial landscape continues to evolve, it will be intriguing to observe how these decisions impact the broader market and the investment strategies of others.

Impact on Market Trends When Billionaires Sell Shares

The decision by billionaires to sell shares of a popular stock often sends ripples through the financial markets, influencing both investor sentiment and market trends. When high-profile investors divest significant portions of their holdings, it can signal a variety of underlying factors that merit close examination. These actions are not merely transactions; they are events that can alter the landscape of the stock market, affecting everything from stock prices to investor confidence.

To begin with, the sale of shares by billionaires can lead to immediate fluctuations in stock prices. This is primarily because such sales are often interpreted as a lack of confidence in the stock’s future performance. Investors, both institutional and retail, closely monitor the activities of these financial titans, and their decisions can trigger a domino effect. For instance, if a billionaire known for their astute investment strategies decides to offload a substantial number of shares, other investors might follow suit, fearing that the stock may be overvalued or that there are potential risks on the horizon. Consequently, this can lead to a decline in the stock’s price, at least in the short term.

Moreover, the impact of these sales extends beyond immediate price changes. They can also influence broader market trends, particularly if the stock in question is a major component of a market index. When billionaires sell shares of a company that holds significant weight in an index, it can lead to shifts in the index’s performance, thereby affecting the market as a whole. This is especially true in cases where the stock is part of a sector that is already experiencing volatility. The sale can exacerbate existing trends, leading to increased market instability.

In addition to affecting stock prices and market indices, the actions of billionaires can also shape investor sentiment. The stock market is as much about perception as it is about numbers, and the decisions of influential investors can sway public opinion. When billionaires sell shares, it can create a narrative that the stock or even the sector is no longer a safe bet. This can lead to a broader reevaluation of investment strategies among other investors, who may decide to diversify their portfolios or shift their focus to other sectors perceived as more stable or promising.

Furthermore, it is important to consider the reasons behind these sales. Billionaires may choose to sell shares for a variety of reasons, not all of which are related to the performance of the stock itself. For instance, they might be reallocating their assets, funding new ventures, or responding to personal financial needs. Understanding the context of these sales is crucial for investors who are trying to interpret their implications. A sale driven by personal financial strategy may not necessarily indicate a lack of confidence in the stock’s future.

In conclusion, when billionaires opt to sell shares of a popular stock, it is an event that can have significant repercussions on market trends. From influencing stock prices and market indices to shaping investor sentiment, these sales are pivotal moments that require careful analysis. Investors must look beyond the immediate impact and consider the broader context to make informed decisions. As such, the actions of billionaires serve as both a barometer and a catalyst for market dynamics, underscoring the intricate interplay between individual decisions and collective market behavior.

Analyzing the Financial Strategies of Billionaires

In recent months, a noticeable trend has emerged among some of the world’s wealthiest individuals: the decision to sell shares of a particularly popular stock. This strategic move has captured the attention of financial analysts and investors alike, prompting a closer examination of the underlying motivations and potential implications. As billionaires divest from this stock, it is essential to understand the broader financial strategies at play and the factors influencing these high-stakes decisions.

To begin with, the stock in question has been a staple in many investment portfolios, known for its robust performance and significant market presence. However, the decision by billionaires to sell shares suggests a shift in their investment strategies, possibly driven by a combination of market conditions, valuation concerns, and personal financial goals. One possible explanation for this trend is the perception that the stock may have reached or even exceeded its peak valuation. In such cases, selling shares allows investors to capitalize on their gains, thereby securing profits before any potential market corrections occur.

Moreover, the current economic climate, characterized by volatility and uncertainty, may also be influencing these decisions. With inflationary pressures and geopolitical tensions affecting global markets, billionaires might be opting to diversify their portfolios to mitigate risk. By reallocating their investments into other asset classes or emerging markets, they can potentially safeguard their wealth against unforeseen downturns. This approach aligns with the broader financial strategy of maintaining a balanced and diversified portfolio, which is a cornerstone of prudent investment management.

In addition to market dynamics, personal financial objectives play a crucial role in shaping investment decisions. For some billionaires, selling shares could be part of a broader strategy to free up capital for new ventures or philanthropic endeavors. As these individuals often have access to exclusive investment opportunities, liquidating a portion of their holdings in a popular stock can provide the necessary funds to explore innovative projects or support charitable causes. This aspect of financial strategy underscores the multifaceted nature of wealth management, where personal values and aspirations intersect with market considerations.

Furthermore, the decision to sell shares may also be influenced by tax considerations. In certain jurisdictions, capital gains taxes can significantly impact the net proceeds from stock sales. By strategically timing their transactions, billionaires can optimize their tax liabilities, thereby enhancing their overall financial position. This tax-efficient approach is a testament to the sophisticated financial planning that often accompanies high-net-worth individuals’ investment strategies.

While the sale of shares by billionaires might initially raise concerns among other investors, it is important to recognize that such actions do not necessarily indicate a lack of confidence in the stock’s long-term prospects. Instead, they reflect a nuanced approach to wealth management, where multiple factors are weighed to achieve specific financial objectives. As these individuals continue to navigate the complexities of the financial landscape, their strategies offer valuable insights into the art of investment decision-making.

In conclusion, the recent trend of billionaires selling shares of a popular stock highlights the intricate interplay between market conditions, personal financial goals, and strategic planning. By examining these decisions through a comprehensive lens, investors can gain a deeper understanding of the financial strategies employed by some of the world’s most successful individuals. As the economic environment continues to evolve, the actions of these billionaires will undoubtedly remain a focal point for those seeking to emulate their success in the ever-changing world of finance.

How Billionaire Stock Sales Affect Retail Investors

In recent months, a noticeable trend has emerged among some of the world’s wealthiest individuals: the decision to sell shares of a particularly popular stock. This development has sparked considerable interest and speculation among retail investors, who are keen to understand the implications of such high-profile sales. The actions of billionaires often serve as a barometer for market sentiment, and their decisions can have a profound impact on the behavior of smaller investors. As these affluent individuals divest from certain holdings, it is crucial to explore how these moves might influence the broader market and, more specifically, retail investors.

To begin with, the sale of shares by billionaires can be interpreted in various ways. On one hand, it may signal a lack of confidence in the future performance of the stock, prompting retail investors to reconsider their own positions. On the other hand, these sales might simply reflect a strategic reallocation of assets, driven by personal financial goals or tax considerations. Regardless of the underlying motivation, the sheer scale of these transactions can lead to increased volatility in the stock’s price, as the market reacts to the perceived implications of such high-profile divestments.

Moreover, the actions of billionaires often attract significant media attention, further amplifying their impact on retail investors. News of a prominent figure selling shares can lead to a flurry of speculation and analysis, with financial pundits offering varying interpretations of the move. This media coverage can create a feedback loop, where retail investors, influenced by the opinions of experts and commentators, make decisions based on the perceived wisdom of these wealthy individuals. Consequently, the sale of shares by billionaires can have a cascading effect, influencing the behavior of a wide range of market participants.

In addition to the psychological impact, there are also practical considerations for retail investors to bear in mind. The sale of large blocks of shares can affect the supply and demand dynamics of a stock, potentially leading to price fluctuations. For retail investors, who may not have the resources or expertise to navigate such volatility, this can present both opportunities and risks. On one hand, a temporary dip in the stock’s price might offer a buying opportunity for those with a long-term investment horizon. On the other hand, the increased uncertainty could deter risk-averse investors from maintaining or expanding their positions.

Furthermore, it is important for retail investors to consider the broader context in which these sales occur. The decision of a billionaire to sell shares may be influenced by factors that are not immediately apparent to the average investor, such as insider knowledge or access to proprietary research. As such, retail investors should exercise caution and conduct their own due diligence before making investment decisions based solely on the actions of wealthy individuals.

In conclusion, while the sale of shares by billionaires can have a significant impact on retail investors, it is essential to approach these developments with a critical eye. By understanding the potential motivations behind such sales and considering the broader market context, retail investors can make more informed decisions. Ultimately, while the actions of billionaires may provide valuable insights, they should not be the sole determinant of an individual’s investment strategy. Instead, retail investors should strive to develop a comprehensive understanding of the market, taking into account a wide range of factors to guide their investment choices.

The Role of Insider Information in Billionaire Stock Transactions

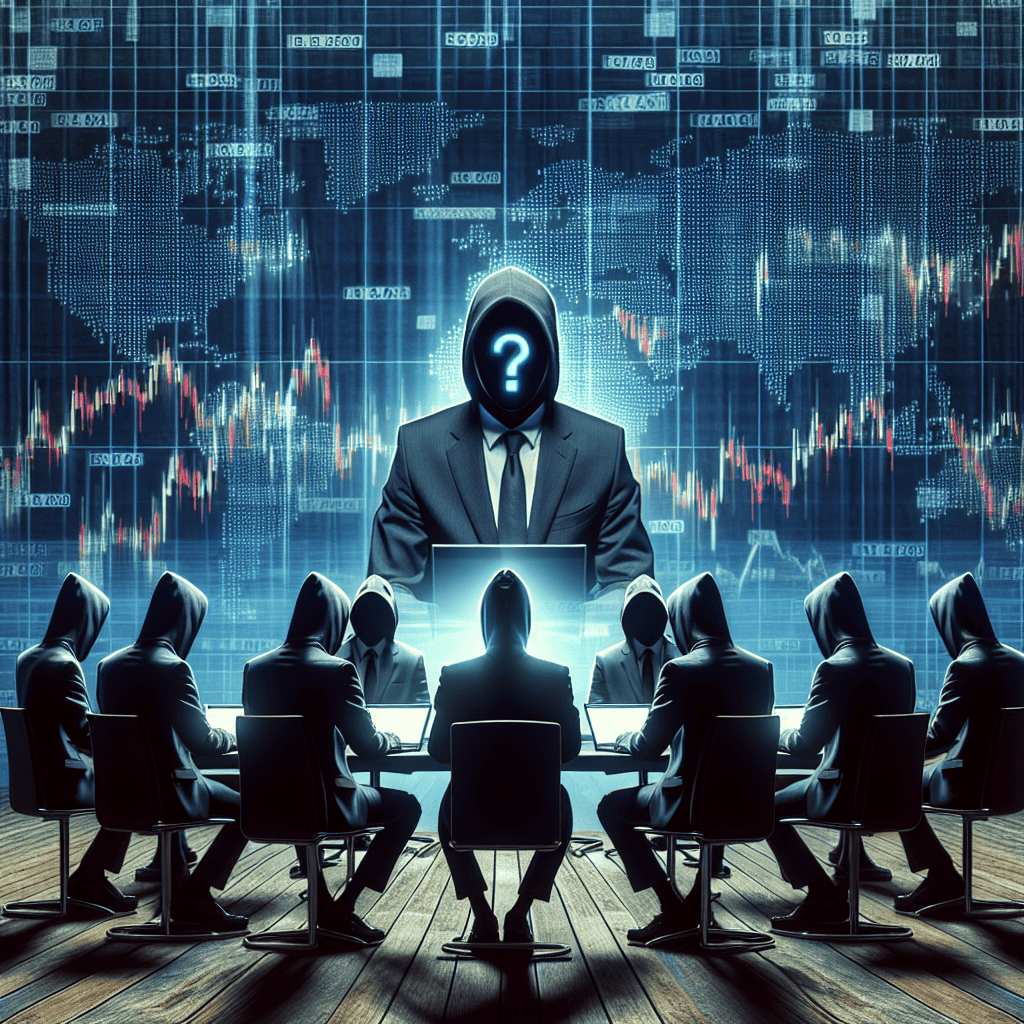

In the intricate world of stock markets, the actions of billionaires often capture the attention of investors and analysts alike. Recently, a notable trend has emerged as several billionaires have opted to sell shares of a particularly popular stock. This development raises questions about the role of insider information in such high-profile transactions. Understanding the dynamics of insider information is crucial, as it can significantly influence market behavior and investor decisions.

Insider information refers to non-public knowledge about a company that can provide a competitive advantage in trading its stocks. This information can range from upcoming mergers and acquisitions to changes in executive leadership or financial performance forecasts. When billionaires, who often have privileged access to such information, decide to sell shares, it can signal potential shifts in the company’s future prospects. Consequently, these actions are scrutinized for any indications of insider trading, which is illegal and unethical.

The decision of billionaires to sell shares can be driven by various factors, including personal financial strategies, tax considerations, or a reassessment of the company’s valuation. However, the timing of these transactions often leads to speculation about whether they are based on insider information. For instance, if a billionaire sells a significant portion of their holdings shortly before a company announces disappointing earnings, it raises suspicions about whether they acted on information not yet available to the public.

To mitigate the risks associated with insider trading, regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States have established stringent rules and monitoring systems. These regulations require insiders, including executives and major shareholders, to disclose their transactions within a specified timeframe. This transparency aims to level the playing field for all investors, ensuring that no one has an unfair advantage based on privileged information.

Despite these regulations, the perception of insider information influencing billionaire stock transactions persists. This perception is partly fueled by the complex nature of financial markets, where information asymmetry is a constant challenge. Billionaires, by virtue of their extensive networks and resources, are often better positioned to access and interpret market-relevant information. This advantage, while not necessarily illegal, can create an uneven landscape for average investors.

Moreover, the media plays a significant role in shaping public perception of these transactions. Headlines highlighting billionaire stock sales can trigger market reactions, as investors attempt to decipher the underlying reasons. This phenomenon underscores the importance of critical analysis and due diligence when interpreting such news. Investors must consider a range of factors, including market conditions, company fundamentals, and broader economic trends, rather than relying solely on the actions of high-profile individuals.

In conclusion, the decision of billionaires to sell shares of a popular stock inevitably draws attention to the potential influence of insider information. While regulatory frameworks exist to prevent illegal insider trading, the perception of information asymmetry remains a challenge. Investors must navigate this complex landscape with caution, recognizing that billionaire transactions, while informative, are just one piece of the broader market puzzle. By maintaining a balanced perspective and focusing on comprehensive analysis, investors can make informed decisions that align with their financial goals.

Future Predictions for the Stock After Billionaire Sales

In recent months, the financial world has been abuzz with news that several high-profile billionaires have opted to sell shares of a particularly popular stock. This development has sparked widespread speculation about the future trajectory of the stock in question. As investors and analysts alike attempt to decipher the implications of these sales, it is crucial to consider the potential reasons behind such decisions and the possible outcomes for the stock’s future performance.

To begin with, it is important to recognize that billionaire investors often have access to a wealth of information and resources that can inform their investment decisions. Therefore, their choice to sell shares may be indicative of underlying concerns about the stock’s future prospects. One possible explanation for these sales could be a perceived overvaluation of the stock. In recent years, the stock market has experienced significant volatility, with certain stocks reaching unprecedented highs. Consequently, some investors may believe that the stock’s current price does not accurately reflect its intrinsic value, prompting them to liquidate their holdings.

Moreover, the decision to sell shares could also be influenced by broader economic factors. For instance, rising interest rates and inflationary pressures have created an environment of uncertainty, leading some investors to adopt a more cautious approach. In such a context, selling shares of a popular stock may be seen as a strategic move to mitigate potential risks and preserve capital. Additionally, geopolitical tensions and regulatory changes can also play a role in shaping investment strategies, further complicating the decision-making process for investors.

Despite these considerations, it is essential to acknowledge that the sale of shares by billionaires does not necessarily signal an impending decline in the stock’s value. In fact, the stock market is inherently unpredictable, and numerous factors can influence its performance. For instance, the company’s fundamentals, such as its revenue growth, profitability, and competitive positioning, remain critical determinants of its long-term success. If the company continues to demonstrate strong financial performance and maintains its competitive edge, the stock may still have significant growth potential.

Furthermore, it is worth noting that the actions of billionaire investors can sometimes create opportunities for other market participants. When high-profile individuals sell shares, it can lead to short-term price fluctuations, potentially creating attractive entry points for other investors. In this context, those with a long-term investment horizon may view the current situation as an opportunity to acquire shares at a more favorable price, particularly if they have confidence in the company’s future prospects.

In conclusion, while the decision by several billionaires to sell shares of a popular stock has undoubtedly raised questions about its future trajectory, it is important to approach the situation with a balanced perspective. By considering the potential motivations behind these sales and evaluating the company’s underlying fundamentals, investors can make more informed decisions about their own investment strategies. Ultimately, the stock’s future performance will depend on a complex interplay of factors, including market conditions, economic trends, and the company’s ability to adapt and thrive in an ever-evolving landscape. As such, investors should remain vigilant and continue to monitor developments closely, while also being mindful of the inherent uncertainties that characterize the stock market.

Lessons for Investors from Billionaire Stock Selling Decisions

In recent months, a noticeable trend has emerged among some of the world’s wealthiest individuals: the decision to sell shares of a particularly popular stock. This move has sparked considerable interest and speculation among investors, prompting many to question the underlying reasons and potential implications. While the motivations of billionaires can be as varied as their investment portfolios, examining these decisions can offer valuable lessons for investors at all levels.

To begin with, it is essential to understand that billionaires often have access to a wealth of information and resources that inform their investment strategies. Their decisions to sell shares are rarely impulsive; rather, they are typically the result of careful analysis and strategic planning. For instance, one common reason for selling shares is portfolio diversification. By reducing their holdings in a single stock, these investors can mitigate risk and ensure that their wealth is not overly concentrated in one area. This approach underscores the importance of diversification, a fundamental principle that can help protect investors from market volatility.

Moreover, the timing of these sales can also provide insights into market conditions. Billionaires may choose to sell shares when they perceive that a stock has reached its peak value, allowing them to capitalize on their investments before a potential downturn. This strategy highlights the significance of market timing, a skill that requires a keen understanding of market trends and economic indicators. While predicting market movements with precision is challenging, staying informed and vigilant can help investors make more informed decisions.

In addition to market timing, tax considerations often play a crucial role in the decision to sell shares. For high-net-worth individuals, managing tax liabilities is a critical aspect of financial planning. By strategically selling shares, billionaires can take advantage of tax-loss harvesting or offset gains with losses, thereby optimizing their tax positions. This practice serves as a reminder of the importance of tax planning in investment strategies, emphasizing that effective management of tax obligations can significantly impact overall returns.

Furthermore, the sale of shares by billionaires can sometimes signal a shift in their investment focus. As industries evolve and new opportunities arise, these investors may choose to reallocate their capital to sectors with higher growth potential. This behavior underscores the dynamic nature of investing and the need for adaptability. Investors should remain open to reassessing their portfolios and be willing to pivot when necessary to capitalize on emerging trends.

While the actions of billionaires can offer valuable lessons, it is crucial for individual investors to recognize that their circumstances and objectives may differ significantly. The scale of resources and risk tolerance available to billionaires is not always applicable to the average investor. Therefore, while it is beneficial to glean insights from their strategies, it is equally important to tailor investment decisions to one’s unique financial situation and goals.

In conclusion, the decision by billionaires to sell shares of a popular stock provides a window into the complex considerations that inform high-stakes investment strategies. From diversification and market timing to tax planning and adaptability, these actions offer a wealth of lessons for investors seeking to navigate the ever-changing financial landscape. By understanding and applying these principles, investors can enhance their own strategies and work towards achieving their financial objectives.

Q&A

1. **Question:** Why are billionaires opting to sell shares of this popular stock?

**Answer:** Billionaires may be selling shares due to market conditions, profit-taking, portfolio diversification, or concerns about the company’s future performance.

2. **Question:** Which popular stock are billionaires selling?

**Answer:** The specific stock is not mentioned; it would depend on the current market trends and news.

3. **Question:** How does the sale of shares by billionaires impact the stock price?

**Answer:** Large sales by billionaires can lead to a decrease in stock price due to increased supply and potential loss of investor confidence.

4. **Question:** What are some reasons billionaires might sell shares besides financial gain?

**Answer:** Reasons might include tax planning, philanthropic efforts, personal liquidity needs, or strategic business decisions.

5. **Question:** How can retail investors react to billionaires selling shares?

**Answer:** Retail investors might reassess their own positions, conduct further research, or consider the sale as a signal to buy or sell.

6. **Question:** Are there any regulatory implications when billionaires sell large amounts of stock?

**Answer:** Yes, large sales may require disclosure to regulatory bodies like the SEC, and could be subject to insider trading rules if the seller has non-public information.

7. **Question:** What sectors are typically involved when billionaires sell shares?

**Answer:** Billionaires might sell shares in any sector, but technology, finance, and consumer goods are common due to their large market capitalizations.

Conclusion

Billionaires opting to sell shares of a popular stock can indicate several potential conclusions. It may suggest that these investors anticipate a decline in the stock’s future performance or believe it has reached a peak valuation, prompting them to realize gains. This action could also reflect a strategic reallocation of their investment portfolios, possibly due to changing market conditions or personal financial strategies. Additionally, such moves might influence market perceptions, potentially leading other investors to reassess their positions in the stock. However, it’s essential to consider broader market trends and individual circumstances before drawing definitive conclusions about the stock’s future trajectory.