“Ken Griffin Shifts Gears: From Nvidia to Next-Gen AI, Betting Big on Tomorrow’s Tech Titans”

Introduction

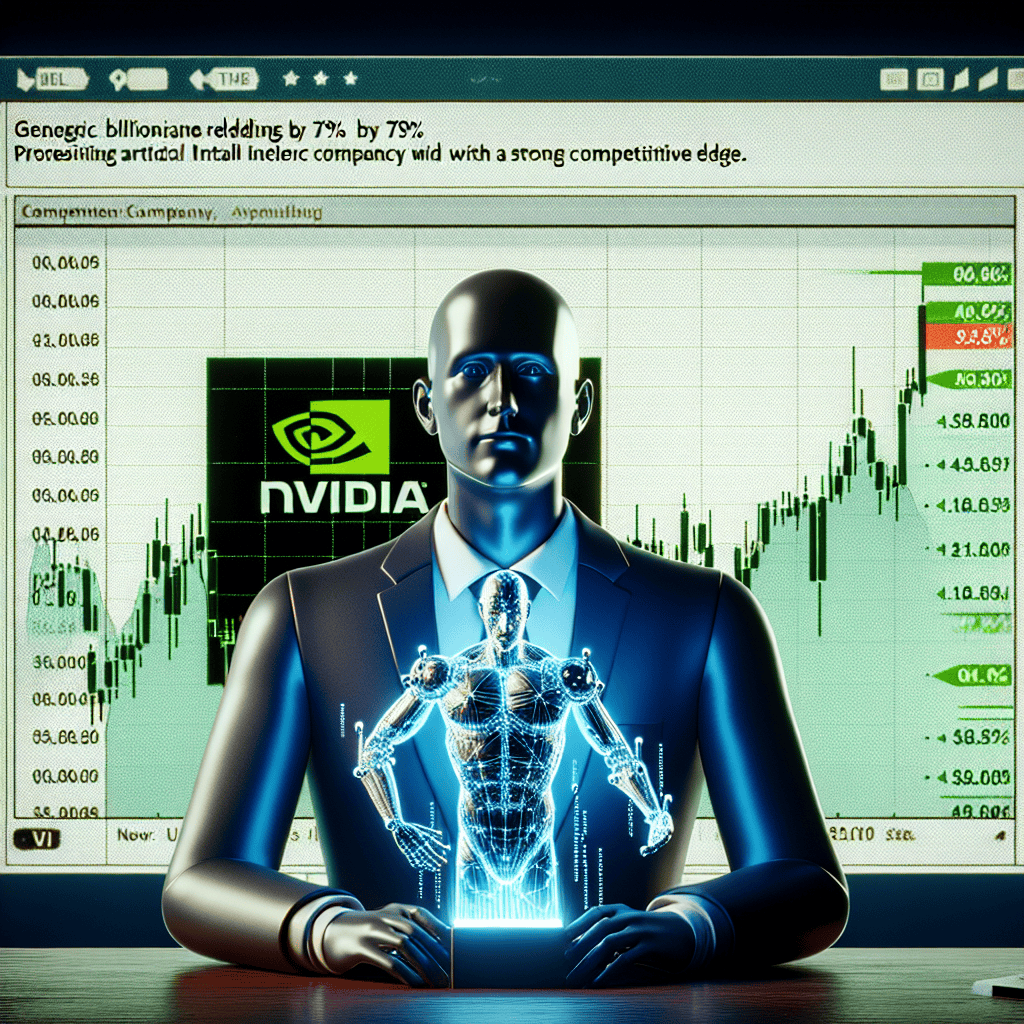

Billionaire Ken Griffin, the founder and CEO of Citadel, has made a significant shift in his investment strategy by reducing the hedge fund’s holdings in Nvidia by 79%. This move comes as Griffin reallocates capital towards a promising AI stock that is gaining attention for its strong competitive edge in the rapidly evolving technology sector. Nvidia, known for its leadership in graphics processing units (GPUs) and AI hardware, has been a staple in many investment portfolios. However, Griffin’s decision to pivot away from Nvidia highlights his confidence in the potential of this emerging AI company to deliver substantial returns. This strategic reallocation underscores the dynamic nature of investment strategies in the tech industry, where innovation and competitive advantage are key drivers of growth and profitability.

Impact Of Ken Griffin’s Investment Shift On Nvidia’s Market Position

In recent financial developments, billionaire investor Ken Griffin has made a significant shift in his investment strategy by reducing Citadel’s holdings in Nvidia by a substantial 79%. This move has sparked considerable interest and speculation within the financial community, as Nvidia has long been a dominant player in the technology sector, particularly in the realm of graphics processing units (GPUs) and artificial intelligence (AI). Griffin’s decision to reallocate resources towards a promising AI stock with a strong competitive edge suggests a strategic pivot that could have far-reaching implications for Nvidia’s market position.

Nvidia has been a stalwart in the tech industry, renowned for its cutting-edge innovations and leadership in AI and machine learning technologies. The company’s GPUs are integral to a wide array of applications, from gaming to data centers, and have been pivotal in advancing AI research and development. However, Griffin’s decision to divest a significant portion of Citadel’s holdings in Nvidia indicates a potential reassessment of the company’s future growth prospects. This move may reflect a broader trend among investors who are seeking opportunities in emerging AI technologies that promise to redefine the competitive landscape.

The reallocation of investment from Nvidia to a new AI stock underscores the dynamic nature of the technology sector, where rapid advancements and innovations can swiftly alter market dynamics. While Nvidia has maintained a strong foothold in the industry, the emergence of new players with innovative solutions and technologies presents both challenges and opportunities. Griffin’s strategic shift suggests that he perceives greater potential in a company that is poised to capitalize on the next wave of AI advancements, potentially offering superior returns compared to Nvidia.

This investment shift also highlights the increasing importance of competitive edge in the AI sector. As AI technologies continue to evolve, companies that can differentiate themselves through unique capabilities, superior technology, or strategic partnerships are likely to gain a significant advantage. Griffin’s decision to invest in a company with a strong competitive edge suggests a focus on long-term growth and sustainability, recognizing that the AI landscape is becoming increasingly competitive and that only those with a distinct advantage will thrive.

The impact of Griffin’s investment shift on Nvidia’s market position is multifaceted. On one hand, it may signal to other investors that there are emerging opportunities in the AI sector that warrant attention, potentially leading to a reevaluation of Nvidia’s valuation and growth prospects. On the other hand, Nvidia’s established position and continued innovation in AI and GPU technologies cannot be overlooked. The company remains a formidable force, with a robust pipeline of products and a strong track record of performance.

In conclusion, Ken Griffin’s decision to reduce Citadel’s Nvidia holdings by 79% in favor of a promising AI stock with a strong competitive edge reflects a strategic realignment that could influence Nvidia’s market position. While Nvidia continues to be a leader in the tech industry, the emergence of new players and technologies presents both challenges and opportunities. As the AI sector evolves, the ability to maintain a competitive edge will be crucial for companies seeking to secure their place in this rapidly changing landscape. Investors and industry observers will undoubtedly be watching closely to see how these developments unfold and what they mean for the future of AI and technology investment.

Analyzing The Competitive Edge Of The New AI Stock In Citadel’s Portfolio

In recent financial maneuvers that have captured the attention of market analysts and investors alike, billionaire Ken Griffin has made a significant shift in Citadel’s investment strategy by reducing its holdings in Nvidia by 79%. This decision, while surprising to some, underscores a strategic pivot towards a promising AI stock that Griffin believes possesses a strong competitive edge. As Nvidia has long been a dominant player in the AI and semiconductor industries, this move raises questions about the emerging opportunities that have caught Griffin’s discerning eye.

The AI landscape is rapidly evolving, with new technologies and companies continually reshaping the market dynamics. In this context, Citadel’s decision to reallocate its resources suggests a calculated bet on a company that not only shows potential for growth but also offers a unique advantage over its competitors. This competitive edge is likely rooted in innovative technology, strategic partnerships, or a robust intellectual property portfolio that sets it apart in the crowded AI sector.

One of the key factors that may have influenced Griffin’s decision is the new AI stock’s ability to address specific market needs more effectively than its peers. In an industry where technological advancements occur at a breakneck pace, the ability to innovate and adapt is crucial. The company in question may have developed cutting-edge solutions that cater to emerging trends, such as edge computing, AI-driven automation, or advanced machine learning algorithms. These innovations not only enhance the company’s product offerings but also position it as a leader in addressing the future demands of AI applications.

Moreover, the strategic partnerships and collaborations that the new AI stock has forged could play a pivotal role in its competitive positioning. By aligning with key players in technology, research, and industry, the company can leverage synergies that amplify its capabilities and market reach. Such alliances often lead to accelerated development cycles, access to new markets, and the ability to offer comprehensive solutions that integrate seamlessly with existing technologies. This network of partnerships can be a formidable asset, providing the company with a competitive moat that is difficult for rivals to breach.

Additionally, the company’s intellectual property portfolio may offer a significant advantage. In the AI sector, where proprietary algorithms and technologies are highly valued, a strong IP portfolio can serve as both a shield and a sword. It protects the company from potential infringement while also enabling it to assert its dominance through licensing agreements and strategic litigation if necessary. This legal and technological fortification can deter competitors and attract investors seeking stability and growth potential.

Furthermore, the financial health and management acumen of the company are likely to have been scrutinized by Griffin and his team. A solid balance sheet, prudent capital allocation, and a visionary leadership team are essential components that contribute to a company’s long-term success. These factors, combined with a clear strategic vision and execution capability, can instill confidence in investors and stakeholders, reinforcing the company’s competitive edge.

In conclusion, Ken Griffin’s decision to significantly reduce Citadel’s Nvidia holdings in favor of a new AI stock reflects a strategic shift towards a company with a compelling competitive advantage. By focusing on innovation, strategic partnerships, intellectual property, and sound management, this emerging player in the AI sector is poised to capitalize on future opportunities and challenges. As the AI landscape continues to evolve, Citadel’s investment strategy highlights the importance of identifying and backing companies that are not only at the forefront of technological advancement but also possess the strategic foresight to maintain their edge in a rapidly changing world.

Strategic Reasons Behind Ken Griffin’s Reduction In Nvidia Holdings

In a strategic move that has captured the attention of investors and market analysts alike, billionaire Ken Griffin, founder of the hedge fund Citadel, has significantly reduced his holdings in Nvidia by 79%. This decision comes amidst a broader reallocation of assets towards a promising artificial intelligence (AI) stock that Griffin believes holds a strong competitive edge in the rapidly evolving tech landscape. The decision to divest from Nvidia, a company that has been at the forefront of the AI and semiconductor industries, may seem surprising at first glance. However, a closer examination of the strategic reasons behind this shift reveals a calculated approach to capitalizing on emerging opportunities within the AI sector.

Nvidia has long been a dominant player in the graphics processing unit (GPU) market, with its products being integral to AI research and development. The company’s GPUs are widely used in data centers, gaming, and autonomous vehicles, making it a staple in the portfolios of many investors. Despite Nvidia’s strong market position and impressive growth trajectory, Griffin’s decision to reduce Citadel’s stake suggests a nuanced understanding of the market dynamics at play. One key factor influencing this decision is the increasing competition within the semiconductor industry. As more companies enter the market with innovative solutions, Nvidia faces mounting pressure to maintain its leadership position. This competitive landscape may have prompted Griffin to reassess the risk-reward profile of holding a substantial position in Nvidia.

Moreover, the AI sector is witnessing a surge of innovation, with new companies emerging that are poised to disrupt traditional players. Griffin’s pivot towards a promising AI stock indicates a strategic bet on a company that he believes possesses a unique advantage in this burgeoning field. While the identity of this AI stock remains undisclosed, it is likely that Griffin has identified a firm with cutting-edge technology or a novel approach that sets it apart from its competitors. This move aligns with Citadel’s broader investment philosophy of seeking out opportunities with high growth potential and a sustainable competitive edge.

In addition to competitive pressures, macroeconomic factors may have also played a role in Griffin’s decision. The semiconductor industry is highly sensitive to global supply chain disruptions and geopolitical tensions, which can impact production and profitability. By diversifying Citadel’s portfolio and reducing exposure to Nvidia, Griffin may be seeking to mitigate these risks while positioning the fund to benefit from the growth of a new AI leader. Furthermore, the decision to invest in a promising AI stock reflects a forward-looking approach that anticipates the transformative impact of AI technologies across various industries. As AI continues to revolutionize sectors such as healthcare, finance, and transportation, companies that can harness its potential are likely to experience significant growth. Griffin’s strategic reallocation of assets suggests confidence in the ability of this undisclosed AI company to capitalize on these opportunities and deliver substantial returns.

In conclusion, Ken Griffin’s decision to reduce Citadel’s Nvidia holdings by 79% and invest in a promising AI stock underscores a strategic shift towards capturing emerging opportunities in the AI sector. By reassessing the competitive landscape and considering macroeconomic factors, Griffin is positioning Citadel to benefit from the next wave of technological innovation. This move not only highlights the dynamic nature of investment strategies but also reflects a keen understanding of the evolving market dynamics that are shaping the future of the tech industry.

The Future Of AI Investments: Insights From Ken Griffin’s Recent Moves

In the ever-evolving landscape of artificial intelligence (AI) investments, the strategic decisions of influential investors often serve as a barometer for emerging trends and opportunities. Recently, Ken Griffin, the billionaire founder of Citadel, made headlines by significantly reducing his firm’s holdings in Nvidia, a leading player in the AI hardware sector, by 79%. This move has sparked considerable interest and speculation within the investment community, as Griffin reallocates resources towards a promising AI stock that he believes possesses a strong competitive edge.

Nvidia has long been a dominant force in the AI industry, renowned for its cutting-edge graphics processing units (GPUs) that power a wide array of AI applications, from autonomous vehicles to advanced data analytics. The company’s robust performance and market leadership have made it a staple in many investment portfolios. However, Griffin’s decision to divest a substantial portion of Citadel’s Nvidia holdings suggests a strategic pivot towards new opportunities within the AI sector.

The rationale behind this shift can be attributed to several factors. Firstly, the AI landscape is rapidly expanding, with numerous companies vying for a share of the market. As a result, investors are increasingly seeking out firms that not only demonstrate technological innovation but also possess a sustainable competitive advantage. Griffin’s move indicates a belief that the AI stock he is investing in offers such an advantage, potentially positioning it as a future leader in the industry.

Moreover, the decision to reduce Nvidia holdings aligns with a broader trend among investors to diversify their AI portfolios. While Nvidia remains a formidable player, the dynamic nature of AI technology means that new entrants with novel approaches can quickly disrupt established players. By reallocating resources, Griffin is likely aiming to capitalize on emerging technologies and business models that could redefine the AI landscape.

In addition, this strategic reallocation underscores the importance of adaptability in investment strategies. The AI sector is characterized by rapid technological advancements and shifting market dynamics. Investors like Griffin must remain agile, continuously assessing the competitive landscape and adjusting their portfolios to align with evolving opportunities. This approach not only mitigates risk but also positions investors to capture significant returns from high-growth sectors.

Furthermore, Griffin’s decision highlights the critical role of research and analysis in investment decision-making. Identifying a promising AI stock with a strong competitive edge requires a deep understanding of the technology, market trends, and competitive landscape. It involves evaluating factors such as the company’s intellectual property, strategic partnerships, and potential for scalability. Griffin’s move suggests that he has identified a company that excels in these areas, offering a compelling value proposition that justifies the reallocation of resources.

In conclusion, Ken Griffin’s recent reduction of Citadel’s Nvidia holdings in favor of a promising AI stock reflects a strategic shift towards diversification and adaptability in the face of a rapidly evolving AI landscape. This move underscores the importance of identifying companies with sustainable competitive advantages and highlights the need for continuous research and analysis in investment decision-making. As the AI sector continues to grow and transform, Griffin’s actions serve as a valuable insight into the future of AI investments, emphasizing the potential rewards of strategic foresight and agility in navigating this dynamic industry.

How Citadel’s Portfolio Adjustments Reflect Broader Market Trends

In recent developments within the financial sector, billionaire Ken Griffin, founder of the prominent hedge fund Citadel, has made a significant adjustment to his investment portfolio by reducing Citadel’s holdings in Nvidia by 79%. This strategic move has captured the attention of market analysts and investors alike, as it reflects broader market trends and the evolving landscape of technology investments. Griffin’s decision to pivot away from Nvidia, a leading player in the semiconductor industry, underscores a growing interest in the burgeoning field of artificial intelligence (AI), where new opportunities are emerging with promising potential.

Nvidia has long been a dominant force in the tech industry, renowned for its cutting-edge graphics processing units (GPUs) that power everything from gaming to data centers. However, the rapid evolution of AI technologies has prompted investors to reassess their portfolios, seeking companies that not only have a strong foothold in AI but also possess a competitive edge that can sustain long-term growth. In this context, Griffin’s decision to reduce Citadel’s Nvidia holdings is indicative of a broader shift in investment strategies, as investors increasingly prioritize companies that are at the forefront of AI innovation.

The reallocation of Citadel’s resources into a promising AI stock highlights the growing importance of AI in shaping the future of technology and business. As AI continues to revolutionize various industries, from healthcare to finance, companies that can harness its potential are poised to become leaders in their respective fields. This shift in focus is not merely a reaction to current market conditions but rather a strategic move to capitalize on the transformative power of AI, which is expected to drive significant economic growth in the coming years.

Moreover, Griffin’s decision aligns with a broader trend among institutional investors who are increasingly seeking out companies with a strong competitive edge in AI. This trend is driven by the recognition that AI is not just a technological advancement but a fundamental shift in how businesses operate and compete. Companies that can leverage AI to enhance their products, services, and operations are likely to gain a significant advantage over their competitors, making them attractive investment opportunities.

In addition to reflecting broader market trends, Citadel’s portfolio adjustments also underscore the importance of adaptability in investment strategies. As the technology landscape continues to evolve at a rapid pace, investors must remain agile and responsive to emerging trends and opportunities. By reallocating resources towards a promising AI stock, Griffin demonstrates a proactive approach to portfolio management, ensuring that Citadel remains well-positioned to capitalize on future growth opportunities.

In conclusion, Ken Griffin’s decision to reduce Citadel’s Nvidia holdings by 79% and invest in a promising AI stock with a strong competitive edge is a strategic move that reflects broader market trends and the growing importance of AI in shaping the future of technology and business. As investors increasingly prioritize companies that are at the forefront of AI innovation, this shift in focus underscores the need for adaptability and foresight in investment strategies. By aligning with these trends, Citadel is poised to capitalize on the transformative power of AI, ensuring its continued success in an ever-evolving market landscape.

The Role Of AI In Shaping Investment Strategies For Billionaires

In recent years, the rapid advancement of artificial intelligence (AI) has significantly influenced investment strategies, particularly among billionaires who are constantly seeking to optimize their portfolios. A prime example of this trend is Ken Griffin, the billionaire founder of Citadel, who recently made headlines by reducing his firm’s holdings in Nvidia by 79%. This decision, while surprising to some, underscores the evolving landscape of AI and its impact on investment decisions. Nvidia, a leading player in the AI hardware sector, has long been a favorite among investors due to its cutting-edge graphics processing units (GPUs) that power AI applications. However, Griffin’s decision to divest a substantial portion of Citadel’s Nvidia holdings suggests a strategic pivot towards emerging opportunities within the AI domain.

The rationale behind Griffin’s move can be attributed to the dynamic nature of AI technology and the competitive edge offered by new entrants in the market. As AI continues to evolve, so too do the companies that drive its innovation. Griffin’s decision to invest in a promising AI stock with a strong competitive edge highlights the importance of staying ahead of the curve in a rapidly changing industry. This strategic shift reflects a broader trend among billionaire investors who are increasingly focusing on companies that not only have a robust technological foundation but also possess the agility to adapt to new developments in AI.

Moreover, the decision to reduce Nvidia holdings aligns with a growing recognition that diversification within the AI sector is crucial for long-term success. While Nvidia remains a dominant force, the emergence of new players with innovative solutions presents lucrative opportunities for investors willing to take calculated risks. By reallocating resources to a promising AI stock, Griffin is positioning Citadel to capitalize on potential breakthroughs that could redefine the industry. This approach underscores the importance of identifying companies with unique value propositions and the potential to disrupt established markets.

Furthermore, Griffin’s investment strategy is indicative of a broader shift towards AI-driven decision-making processes. As AI technology becomes more sophisticated, it is increasingly being used to analyze vast amounts of data and identify investment opportunities that may not be immediately apparent to human analysts. This reliance on AI for investment insights is transforming the way billionaires like Griffin approach portfolio management, enabling them to make more informed decisions based on data-driven analysis.

In addition to enhancing investment strategies, AI is also reshaping the competitive landscape by enabling companies to develop innovative products and services that cater to evolving consumer demands. This, in turn, creates new avenues for growth and profitability, attracting the attention of savvy investors. By focusing on companies that leverage AI to gain a competitive edge, investors can tap into the transformative potential of this technology and secure a foothold in the future of the industry.

In conclusion, Ken Griffin’s decision to reduce Citadel’s Nvidia holdings and invest in a promising AI stock with a strong competitive edge exemplifies the role of AI in shaping investment strategies for billionaires. As AI continues to revolutionize industries and drive innovation, investors must remain vigilant and adaptable, seeking out opportunities that align with the evolving technological landscape. By embracing AI-driven insights and focusing on companies with the potential to disrupt traditional markets, investors can position themselves for success in an increasingly competitive and dynamic environment.

Lessons For Investors From Ken Griffin’s Bold Portfolio Rebalancing

In the ever-evolving landscape of financial markets, the strategic decisions of influential investors often serve as a beacon for others seeking to navigate the complexities of investment. Ken Griffin, the billionaire founder of Citadel, recently made headlines with a significant rebalancing of his portfolio, reducing his holdings in Nvidia by a staggering 79%. This move, while surprising to some, underscores the importance of adaptability and foresight in investment strategies. Griffin’s decision to pivot from Nvidia, a titan in the semiconductor industry, to a promising AI stock with a strong competitive edge, offers valuable lessons for investors aiming to optimize their portfolios.

Firstly, Griffin’s actions highlight the necessity of continuous evaluation and re-evaluation of investment positions. Nvidia, known for its cutting-edge graphics processing units (GPUs) and a key player in the AI and gaming sectors, has been a favorite among investors. However, Griffin’s substantial reduction in Nvidia holdings suggests a strategic shift based on emerging opportunities and potential risks. This move serves as a reminder that even well-performing stocks require regular assessment against market dynamics and future growth prospects. Investors should remain vigilant, ensuring their portfolios are aligned with both current market conditions and long-term objectives.

Moreover, Griffin’s pivot to a promising AI stock underscores the importance of identifying and capitalizing on emerging trends. The AI sector, characterized by rapid innovation and transformative potential, presents a fertile ground for investment. By reallocating resources to a company with a strong competitive edge in AI, Griffin demonstrates the value of foresight in recognizing industries poised for exponential growth. This strategic shift emphasizes the need for investors to stay informed about technological advancements and their implications for various sectors. By doing so, they can position themselves to benefit from the next wave of innovation.

In addition to recognizing emerging trends, Griffin’s portfolio rebalancing underscores the significance of diversification. While Nvidia remains a formidable player in the tech industry, concentrating too heavily on a single stock or sector can expose investors to unnecessary risk. By diversifying his holdings, Griffin mitigates potential volatility and enhances the resilience of his portfolio. This approach serves as a crucial lesson for investors, highlighting the importance of spreading investments across different assets to achieve a balanced risk-reward profile.

Furthermore, Griffin’s decision-making process reflects the importance of maintaining a long-term perspective. While short-term market fluctuations can be unsettling, successful investors like Griffin focus on the bigger picture, making strategic decisions based on anticipated future developments. This long-term outlook allows investors to weather temporary setbacks and capitalize on opportunities that may not be immediately apparent. By adopting a similar mindset, investors can cultivate patience and discipline, essential traits for navigating the complexities of financial markets.

In conclusion, Ken Griffin’s bold portfolio rebalancing offers several key lessons for investors. His decision to reduce Nvidia holdings and invest in a promising AI stock underscores the importance of adaptability, foresight, diversification, and a long-term perspective. By continuously evaluating investment positions, identifying emerging trends, and maintaining a balanced portfolio, investors can enhance their ability to achieve sustainable growth. As the financial landscape continues to evolve, these principles remain vital for those seeking to emulate the success of seasoned investors like Griffin.

Q&A

1. **Who is Ken Griffin?**

Ken Griffin is the founder and CEO of Citadel, a leading global financial institution.

2. **What action did Ken Griffin take regarding Nvidia holdings?**

Ken Griffin reduced Citadel’s holdings in Nvidia by 79%.

3. **Why did Ken Griffin reduce Nvidia holdings?**

The reduction was part of a strategic decision to reallocate investments.

4. **What type of stock did Ken Griffin invest in after reducing Nvidia holdings?**

He invested in a promising AI stock.

5. **What is notable about the AI stock Ken Griffin invested in?**

The AI stock has a strong competitive edge.

6. **What is Citadel?**

Citadel is a global financial institution known for its hedge fund and market-making operations.

7. **What is the significance of the investment shift by Ken Griffin?**

The shift indicates a strategic move to capitalize on emerging opportunities in the AI sector.

Conclusion

Ken Griffin’s decision to significantly reduce Citadel’s holdings in Nvidia by 79% to invest in a promising AI stock with a strong competitive edge suggests a strategic shift in investment focus. This move indicates confidence in the potential of the new AI stock to deliver superior returns, possibly due to its innovative technology, market position, or growth prospects. By reallocating resources, Griffin aims to capitalize on emerging opportunities within the AI sector, reflecting a proactive approach to portfolio management and a keen eye for future market leaders.