“Strategic Impact: Bill Gates’ Foundation Channels 69% of $49 Billion into Three Pivotal Stocks for Global Change.”

Introduction

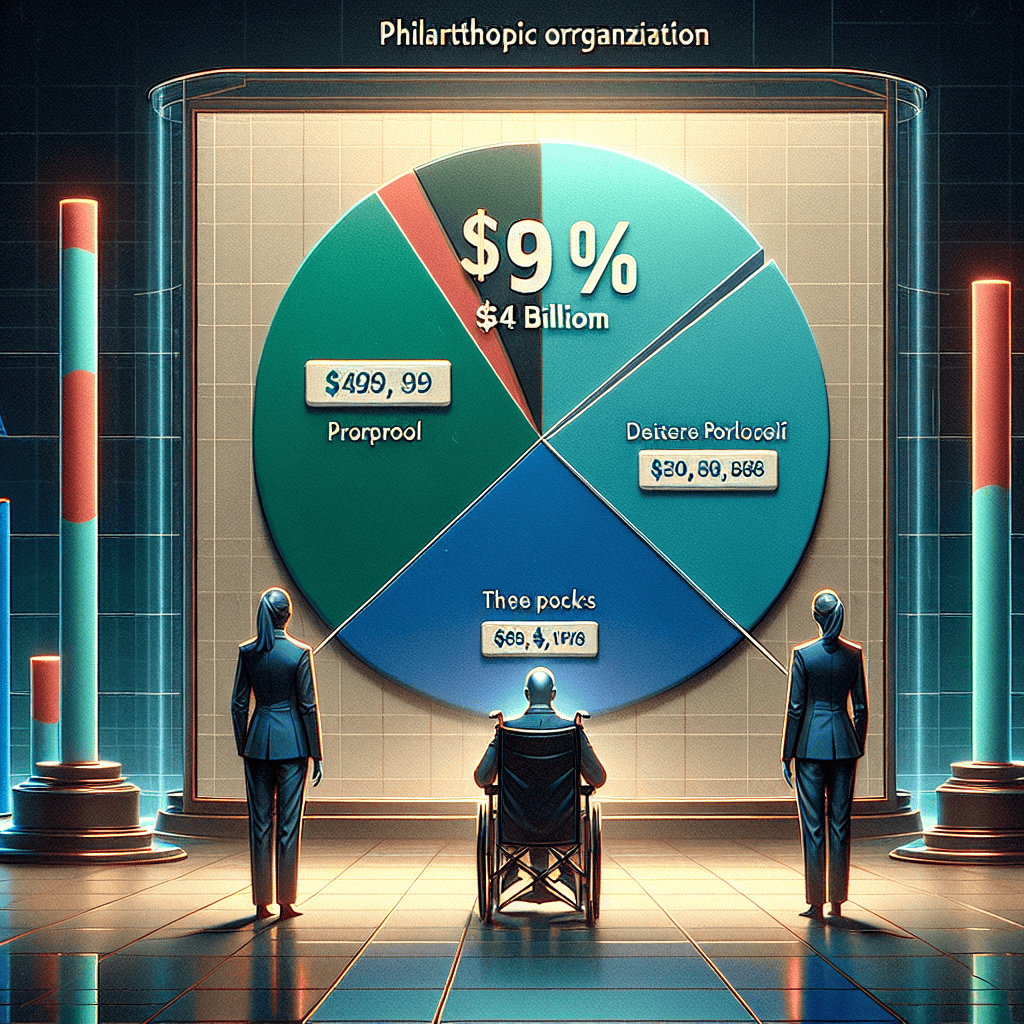

The Bill & Melinda Gates Foundation, renowned for its philanthropic efforts across the globe, has strategically allocated a significant portion of its investment portfolio into three major stocks. With a staggering 69% of its $49 billion portfolio concentrated in these key investments, the foundation demonstrates a focused approach to asset management. This investment strategy not only underscores the foundation’s commitment to financial growth but also reflects its confidence in the long-term potential of these companies. By channeling substantial resources into these select stocks, the foundation aims to bolster its financial capacity to support its wide-ranging humanitarian initiatives.

Overview Of Bill Gates’ Foundation Investment Strategy

The Bill & Melinda Gates Foundation, one of the largest private philanthropic organizations in the world, has long been recognized for its commitment to addressing global challenges such as poverty, health, and education. However, beyond its philanthropic endeavors, the foundation also manages a substantial investment portfolio, which is strategically designed to support its mission. Recently, it has come to light that a significant portion of this portfolio, precisely 69% of its $49 billion value, is concentrated in just three key stocks. This investment strategy reflects a focused approach, underscoring the foundation’s confidence in these companies’ potential to generate returns that can further its philanthropic goals.

To begin with, the foundation’s investment strategy is deeply rooted in the principles of value investing, a philosophy popularized by renowned investors like Warren Buffett. This approach involves identifying undervalued companies with strong fundamentals and long-term growth potential. By concentrating its investments in a select few stocks, the foundation aims to maximize returns while maintaining a manageable level of risk. This strategy is not uncommon among large institutional investors who seek to leverage their capital by betting on a few high-conviction ideas.

The three key stocks that dominate the foundation’s portfolio are Berkshire Hathaway, Microsoft, and Canadian National Railway. Each of these companies represents a different sector, thereby providing a degree of diversification within the concentrated portfolio. Berkshire Hathaway, led by Warren Buffett, is a conglomerate with interests spanning insurance, utilities, and consumer goods, among others. Its inclusion in the portfolio is a testament to the foundation’s trust in Buffett’s investment acumen and the company’s robust business model.

Meanwhile, Microsoft, co-founded by Bill Gates himself, remains a cornerstone of the foundation’s investments. The technology giant has consistently demonstrated its ability to innovate and adapt in a rapidly changing industry, making it a reliable source of growth and income. Microsoft’s strong financial performance and leadership in areas such as cloud computing and artificial intelligence further justify its prominent position in the portfolio.

Lastly, Canadian National Railway, a leader in the North American transportation sector, offers stability and steady returns. Railways are often considered a barometer of economic health, and Canadian National Railway’s extensive network and efficient operations make it a valuable asset. Its inclusion highlights the foundation’s interest in infrastructure and logistics, sectors that are crucial for economic development and sustainability.

In addition to these strategic choices, the foundation’s investment approach is also characterized by a long-term perspective. By holding substantial positions in these companies, the foundation can benefit from compounding returns over time, which aligns with its mission to create lasting impact. This long-term view is essential for supporting the foundation’s ongoing philanthropic activities, as it ensures a steady flow of resources to fund initiatives around the world.

In conclusion, the Bill & Melinda Gates Foundation’s investment strategy, with its significant focus on three key stocks, reflects a calculated and disciplined approach to portfolio management. By concentrating its investments in companies with strong fundamentals and growth potential, the foundation not only seeks to generate substantial returns but also to ensure the sustainability of its philanthropic efforts. This strategy underscores the foundation’s commitment to leveraging its financial resources effectively, ultimately enabling it to continue making a meaningful difference in addressing some of the world’s most pressing challenges.

The Impact Of Concentrated Investments On Portfolio Performance

Bill Gates’ foundation, known for its philanthropic endeavors, has recently made headlines with its concentrated investment strategy, allocating a significant 69% of its $49 billion portfolio into just three key stocks. This approach, while seemingly risky, underscores a broader trend in investment strategies where concentrated investments are employed to potentially enhance portfolio performance. By focusing on a select few companies, the foundation aims to leverage its resources for maximum impact, both financially and socially.

Concentrated investments, as demonstrated by the Gates Foundation, involve placing a substantial portion of a portfolio into a limited number of assets. This strategy contrasts with diversification, which spreads investments across a wide array of assets to mitigate risk. The rationale behind concentrated investments is the potential for higher returns, as investors can capitalize on the success of a few well-chosen stocks. However, this approach also entails increased risk, as the portfolio’s performance is heavily dependent on the success of these select investments.

The Gates Foundation’s decision to concentrate its investments in three key stocks reflects a high level of confidence in these companies’ potential for growth and stability. This strategy suggests that the foundation has conducted thorough research and analysis to identify companies that align with its financial goals and philanthropic mission. By investing heavily in these stocks, the foundation not only seeks to generate substantial returns but also aims to support companies that contribute positively to society, aligning with its broader mission of improving global health and reducing poverty.

Moreover, the foundation’s concentrated investment strategy highlights the importance of strategic asset allocation in achieving desired outcomes. By carefully selecting companies that are likely to perform well, the foundation can potentially enhance its portfolio’s overall performance. This approach requires a deep understanding of market trends, company fundamentals, and the broader economic landscape. It also necessitates a willingness to accept the inherent risks associated with placing a large portion of the portfolio in a few stocks.

In addition to potential financial gains, concentrated investments can also provide investors with greater influence over the companies in which they invest. By holding significant stakes, investors like the Gates Foundation can engage more effectively with company management, advocating for practices that align with their values and objectives. This influence can be particularly valuable for organizations with a strong commitment to social responsibility, as it allows them to drive positive change within the companies they support.

However, it is crucial to acknowledge the potential downsides of concentrated investments. The reliance on a few key stocks means that any adverse developments affecting these companies could have a significant impact on the portfolio’s performance. This risk underscores the importance of continuous monitoring and evaluation of the selected investments to ensure they remain aligned with the investor’s goals and risk tolerance.

In conclusion, the Gates Foundation’s decision to invest 69% of its $49 billion portfolio in three key stocks exemplifies the potential benefits and risks associated with concentrated investments. While this strategy can lead to substantial financial returns and increased influence over invested companies, it also requires careful consideration and management of associated risks. As such, investors must weigh the potential rewards against the inherent risks when adopting a concentrated investment approach, ensuring that their strategies align with their overall objectives and risk tolerance.

Analyzing The Three Key Stocks In The Foundation’s Portfolio

The Bill & Melinda Gates Foundation, renowned for its philanthropic efforts across the globe, has recently drawn attention not only for its charitable work but also for its strategic investment choices. With a staggering $49 billion portfolio, the foundation has allocated a significant 69% of its investments into just three key stocks. This concentrated investment strategy reflects a high level of confidence in these companies’ potential for growth and stability. Understanding the rationale behind these choices provides insight into the foundation’s financial strategy and its alignment with broader philanthropic goals.

Firstly, one of the cornerstone investments in the foundation’s portfolio is Berkshire Hathaway. This conglomerate, led by the legendary investor Warren Buffett, is known for its diverse range of holdings across various industries, including insurance, utilities, and consumer goods. The foundation’s substantial investment in Berkshire Hathaway underscores a shared philosophy of long-term value investing. Buffett’s proven track record of generating consistent returns through prudent management and strategic acquisitions aligns with the foundation’s need for stable and sustainable financial growth to support its charitable endeavors. Moreover, the relationship between Gates and Buffett, who are not only business allies but also close friends, further solidifies this investment choice.

Transitioning to the second key stock, the foundation has placed a significant bet on Microsoft, the technology giant co-founded by Bill Gates himself. Microsoft’s dominance in the software industry, coupled with its successful ventures into cloud computing and artificial intelligence, makes it a compelling investment. The company’s robust financial performance and innovative product pipeline ensure a steady stream of revenue, which is crucial for the foundation’s ongoing funding needs. Additionally, Microsoft’s commitment to corporate social responsibility and sustainability resonates with the foundation’s mission to address global challenges, creating a synergy between the company’s operations and the foundation’s objectives.

Finally, the third major investment is in Canadian National Railway, a leader in the North American transportation sector. This choice may initially seem surprising, given the foundation’s focus on technology and innovation. However, Canadian National Railway represents a strategic investment in essential infrastructure, which is vital for economic growth and development. The company’s extensive rail network facilitates the efficient movement of goods across the continent, supporting industries ranging from agriculture to manufacturing. By investing in Canadian National Railway, the foundation not only seeks financial returns but also contributes to the broader economic stability that underpins its philanthropic initiatives.

In conclusion, the Bill & Melinda Gates Foundation’s decision to concentrate 69% of its $49 billion portfolio in Berkshire Hathaway, Microsoft, and Canadian National Railway reflects a strategic blend of stability, innovation, and infrastructure. Each investment aligns with the foundation’s overarching goal of generating sustainable financial returns to support its global charitable activities. By leveraging the strengths of these key stocks, the foundation ensures a robust financial foundation that enables it to continue addressing pressing global issues. This investment strategy highlights the intricate balance between financial acumen and philanthropic commitment, demonstrating how strategic investments can amplify the impact of charitable efforts worldwide.

The Role Of Philanthropy In Investment Decisions

Bill Gates’ foundation, the Bill & Melinda Gates Foundation, has long been recognized for its significant contributions to global health, education, and poverty alleviation. However, its investment strategies also play a crucial role in sustaining its philanthropic endeavors. Recently, it was revealed that the foundation has allocated a substantial 69% of its $49 billion portfolio into just three key stocks. This strategic concentration raises intriguing questions about the intersection of philanthropy and investment decisions.

To understand the rationale behind such concentrated investments, it is essential to consider the foundation’s overarching mission. The foundation aims to maximize its impact on global issues, and its investment strategy is designed to support this mission by ensuring financial sustainability and growth. By focusing on a few select stocks, the foundation can potentially achieve higher returns, which in turn, can be channeled into its philanthropic activities. This approach underscores the importance of aligning investment decisions with the foundation’s long-term goals.

Moreover, the choice of these three key stocks is not arbitrary. Each company represents sectors that are not only financially robust but also align with the foundation’s values and objectives. For instance, investing in companies that prioritize innovation and sustainability can complement the foundation’s efforts in promoting global health and environmental stewardship. This alignment between investment and mission is a testament to the foundation’s commitment to responsible investing, where financial returns are balanced with social and environmental considerations.

In addition to aligning with the foundation’s mission, concentrated investments can also offer practical advantages. By focusing on a limited number of stocks, the foundation can leverage its resources more effectively, conducting in-depth research and maintaining close relationships with the companies in which it invests. This level of engagement can provide the foundation with valuable insights into the companies’ operations and strategies, enabling it to make informed decisions that support both financial and philanthropic objectives.

However, it is important to acknowledge the risks associated with such a concentrated investment strategy. By placing a significant portion of its portfolio in just three stocks, the foundation is exposed to market volatility and company-specific risks. Any adverse developments in these companies could have a substantial impact on the foundation’s financial health. To mitigate these risks, the foundation likely employs rigorous risk management practices, including continuous monitoring and evaluation of its investments.

Furthermore, the foundation’s investment strategy highlights the broader role of philanthropy in shaping investment decisions. As philanthropic organizations increasingly recognize the potential of their financial assets to drive social change, they are adopting more sophisticated investment approaches. This trend reflects a growing awareness that financial resources can be leveraged not only to fund charitable activities but also to influence corporate behavior and promote sustainable practices.

In conclusion, the Bill & Melinda Gates Foundation’s decision to invest 69% of its $49 billion portfolio in three key stocks exemplifies the intricate relationship between philanthropy and investment. By aligning its investment strategy with its mission, the foundation seeks to maximize its impact on global challenges while ensuring financial sustainability. This approach underscores the evolving role of philanthropy in investment decisions, where financial returns are harmonized with social and environmental objectives. As philanthropic organizations continue to navigate this complex landscape, their investment strategies will undoubtedly play a pivotal role in shaping a more sustainable and equitable future.

How Bill Gates’ Foundation Balances Risk And Reward

The Bill & Melinda Gates Foundation, one of the largest philanthropic organizations in the world, has long been recognized for its strategic approach to addressing global challenges. Recently, the foundation’s investment strategy has garnered attention, particularly due to its concentrated portfolio. With 69% of its $49 billion portfolio invested in just three key stocks, the foundation exemplifies a unique approach to balancing risk and reward. This concentrated investment strategy raises questions about how such a large entity manages potential risks while aiming for substantial returns to fund its philanthropic endeavors.

To understand the foundation’s investment approach, it is essential to consider the rationale behind concentrating investments in a few select stocks. By focusing on a limited number of companies, the foundation can leverage its resources to gain significant influence and insight into these businesses. This strategy allows for a deeper understanding of the companies’ operations, financial health, and long-term prospects. Moreover, it enables the foundation to align its investments with its broader mission, supporting companies that contribute to societal progress and innovation.

One of the primary reasons for this concentrated investment strategy is the foundation’s confidence in the chosen companies’ ability to deliver consistent returns. By selecting stocks with a proven track record of performance and stability, the foundation mitigates some of the inherent risks associated with a concentrated portfolio. Furthermore, these companies often operate in sectors that are resilient to economic fluctuations, providing a buffer against market volatility. This approach reflects a calculated risk-taking attitude, where the potential for high returns is balanced against the likelihood of financial setbacks.

In addition to financial considerations, the foundation’s investment choices are influenced by its commitment to ethical and sustainable practices. The selected companies are often leaders in their respective industries, known for their innovation and dedication to corporate social responsibility. By investing in such entities, the foundation not only seeks financial returns but also aims to promote positive change in areas such as healthcare, education, and technology. This alignment of financial and philanthropic goals underscores the foundation’s holistic approach to investment, where profit and purpose are intertwined.

While the concentrated investment strategy has its advantages, it is not without challenges. The foundation must continuously monitor the performance of its chosen stocks and remain vigilant to any changes in the market or the companies’ operations. This requires a robust risk management framework and a team of skilled analysts who can provide timely insights and recommendations. By maintaining a proactive stance, the foundation can swiftly adapt to any emerging risks, ensuring that its portfolio remains aligned with its long-term objectives.

In conclusion, the Bill & Melinda Gates Foundation’s investment strategy exemplifies a sophisticated balance between risk and reward. By concentrating 69% of its $49 billion portfolio in three key stocks, the foundation demonstrates confidence in its chosen companies’ ability to deliver consistent returns while supporting its broader mission. This approach reflects a nuanced understanding of the interplay between financial performance and societal impact, highlighting the foundation’s commitment to leveraging its resources for the greater good. As the foundation continues to navigate the complexities of the investment landscape, its strategy serves as a compelling example of how large entities can effectively balance financial objectives with philanthropic goals.

The Influence Of Market Trends On The Foundation’s Investments

The Bill & Melinda Gates Foundation, renowned for its philanthropic efforts across the globe, has recently made headlines with its strategic investment choices. With a staggering $49 billion portfolio, the foundation has allocated a significant 69% of its investments into just three key stocks. This decision underscores the influence of prevailing market trends on the foundation’s investment strategy, reflecting a calculated approach to balancing risk and reward while supporting its overarching mission.

In recent years, the financial landscape has been characterized by rapid technological advancements, shifting consumer behaviors, and an increased focus on sustainability. These trends have not only reshaped industries but have also influenced investment strategies worldwide. The Gates Foundation, with its substantial resources, is no exception. By concentrating a large portion of its portfolio in a select few stocks, the foundation demonstrates a keen awareness of these market dynamics and a commitment to leveraging them for both financial returns and social impact.

One of the primary factors driving this concentrated investment strategy is the foundation’s focus on companies that align with its values and long-term goals. For instance, technology companies that are at the forefront of innovation and have a track record of sustainable practices are particularly attractive. These companies not only promise robust financial returns but also contribute to societal progress, aligning with the foundation’s mission to improve global health and reduce poverty. By investing heavily in such stocks, the foundation can amplify its impact, supporting businesses that drive positive change while ensuring the growth of its endowment.

Moreover, the foundation’s investment choices are influenced by the increasing importance of environmental, social, and governance (ESG) criteria in the investment community. As investors become more conscious of the ethical implications of their portfolios, companies that prioritize ESG factors are gaining favor. The Gates Foundation’s decision to invest significantly in stocks that meet these criteria reflects a broader trend towards responsible investing. This approach not only mitigates risks associated with environmental and social issues but also positions the foundation as a leader in promoting sustainable business practices.

In addition to these considerations, the foundation’s investment strategy is shaped by the need to maintain a steady flow of funds to support its philanthropic activities. By concentrating investments in high-performing stocks, the foundation can generate substantial returns, ensuring that it has the resources necessary to fund its initiatives. This approach requires a careful balance between risk and reward, as over-reliance on a few stocks can expose the portfolio to market volatility. However, the foundation’s choice to invest in well-established companies with strong growth prospects mitigates this risk, providing a stable financial base for its charitable endeavors.

In conclusion, the Bill & Melinda Gates Foundation’s decision to invest 69% of its $49 billion portfolio in three key stocks is a testament to the influence of market trends on its investment strategy. By aligning its investments with technological advancements, ESG criteria, and its philanthropic mission, the foundation not only seeks to maximize financial returns but also to drive meaningful social impact. This strategic approach highlights the foundation’s commitment to leveraging its resources for the greater good, ensuring that its investments contribute to a more equitable and sustainable future.

Future Implications Of The Foundation’s Investment Choices

The Bill & Melinda Gates Foundation, renowned for its philanthropic efforts across the globe, has recently made headlines with its strategic investment choices. With a staggering $49 billion portfolio, the foundation has allocated a significant 69% of its investments into just three key stocks. This concentrated investment strategy raises intriguing questions about the future implications for both the foundation and the sectors in which these companies operate. As we delve into the potential outcomes of these investment choices, it is essential to consider the broader context of the foundation’s mission and the industries involved.

To begin with, the foundation’s decision to focus heavily on a select few stocks suggests a high level of confidence in these companies’ long-term growth prospects. This approach aligns with the foundation’s overarching goal of achieving sustainable impact through its investments. By channeling substantial resources into these firms, the foundation not only seeks financial returns but also aims to influence and drive innovation within these industries. This strategy reflects a growing trend among large institutional investors to leverage their financial power to effect positive change in areas such as healthcare, technology, and sustainable development.

Moreover, the foundation’s investment choices could have significant ripple effects on the sectors in which these companies operate. For instance, if one of the key stocks is in the healthcare sector, the foundation’s backing could accelerate advancements in medical research and development. This, in turn, could lead to breakthroughs in treatments and technologies that address pressing global health challenges. Similarly, if another stock is in the technology sector, the foundation’s investment might spur innovation in areas such as artificial intelligence, renewable energy, or digital infrastructure. These advancements could have far-reaching implications, potentially transforming industries and improving quality of life worldwide.

Furthermore, the foundation’s concentrated investment strategy may also influence other investors and stakeholders. As one of the world’s largest philanthropic organizations, the Gates Foundation’s investment decisions are closely watched by both the financial community and the public. By placing a substantial portion of its portfolio in a few select stocks, the foundation may signal confidence in these companies’ ability to deliver both financial returns and social impact. This could attract additional investment from other institutional and individual investors, further amplifying the potential impact of these companies’ initiatives.

However, it is important to acknowledge the inherent risks associated with such a concentrated investment approach. While the foundation’s strategy may yield significant rewards, it also exposes the portfolio to increased volatility and potential losses if any of the chosen companies underperform. This underscores the importance of rigorous due diligence and ongoing monitoring to ensure that the foundation’s investments align with its mission and risk tolerance.

In conclusion, the Bill & Melinda Gates Foundation’s decision to invest 69% of its $49 billion portfolio in three key stocks carries profound implications for the future. By concentrating its investments, the foundation aims to drive innovation and impact within targeted sectors, potentially catalyzing advancements that address global challenges. While this strategy presents opportunities for significant returns and influence, it also entails risks that must be carefully managed. As the foundation continues to navigate this complex landscape, its investment choices will undoubtedly shape not only its own future but also the broader trajectory of the industries it supports.

Q&A

1. **What is the name of Bill Gates’ foundation?**

The Bill & Melinda Gates Foundation.

2. **How much is the foundation’s portfolio worth?**

$49 billion.

3. **What percentage of the portfolio is invested in three key stocks?**

69%.

4. **Which company is the largest holding in the foundation’s portfolio?**

Berkshire Hathaway.

5. **What is the second key stock in the foundation’s portfolio?**

Microsoft.

6. **What is the third key stock in the foundation’s portfolio?**

Canadian National Railway.

7. **Why does the foundation invest heavily in these stocks?**

The foundation invests in these stocks due to their stability, strong performance, and alignment with its long-term financial goals.

Conclusion

The Bill & Melinda Gates Foundation’s decision to invest 69% of its $49 billion portfolio in three key stocks underscores a strategic focus on concentrated investments in companies that align with its financial and philanthropic goals. This approach suggests confidence in the long-term growth and stability of these companies, potentially reflecting sectors that the foundation believes will drive future innovation and societal benefit. By concentrating its investments, the foundation may also be leveraging its influence to support and shape industries that align with its mission to address global challenges.