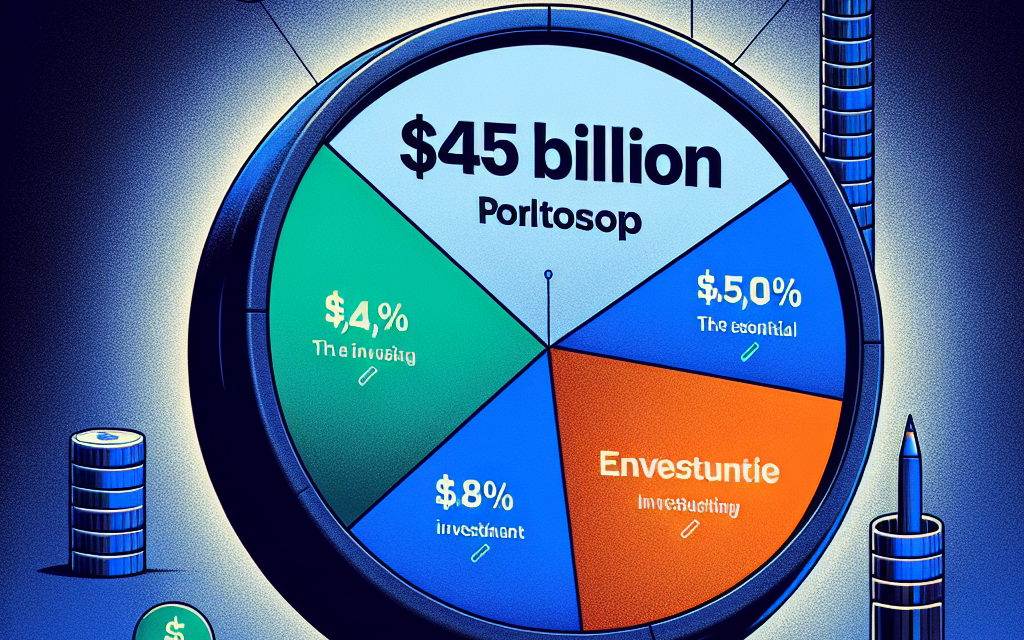

“Bill Gates’ $45 Billion Portfolio: A Strategic Bet on Four Titans Driving Tomorrow’s Innovation.”

Introduction

Bill Gates, the co-founder of Microsoft and one of the world’s most renowned philanthropists, has a substantial investment portfolio valued at approximately $45 billion. Notably, a significant portion of this portfolio—around 80%—is concentrated in just four key stocks. This strategic allocation reflects Gates’ investment philosophy and his confidence in these companies’ long-term growth potential. The concentration in these select stocks highlights a focused approach to wealth management, emphasizing stability and robust returns. Gates’ investment choices are closely watched by market analysts and investors, offering insights into the strategies of one of the most influential figures in the business world.

Analyzing Bill Gates’ Investment Strategy: The Power of Concentration

Bill Gates, co-founder of Microsoft and one of the world’s most renowned philanthropists, has long been a figure of interest not only for his technological innovations but also for his investment strategies. His $45 billion portfolio, managed through the Bill & Melinda Gates Foundation Trust, is a testament to his strategic acumen and belief in the power of concentrated investments. Remarkably, 80% of this vast portfolio is invested in just four key stocks, a strategy that underscores Gates’ confidence in these companies and his approach to wealth management.

To begin with, it is essential to understand the rationale behind such a concentrated investment strategy. Diversification is a common principle in investment, aimed at minimizing risk by spreading investments across various assets. However, Gates’ approach suggests a different philosophy, one that aligns with the investment strategies of other successful investors like Warren Buffett. By focusing on a select few companies, Gates demonstrates a deep conviction in their long-term potential and stability. This strategy allows for a more profound understanding of each company’s operations, market position, and growth prospects, enabling more informed decision-making.

The four key stocks that dominate Gates’ portfolio are Berkshire Hathaway, Microsoft, Canadian National Railway, and Waste Management. Each of these companies represents a different sector, providing a degree of diversification within the concentrated strategy. Berkshire Hathaway, led by Warren Buffett, is a conglomerate with a diverse range of businesses and investments, offering stability and growth potential. Gates’ significant investment in Berkshire Hathaway reflects his trust in Buffett’s management and the company’s robust business model.

Microsoft, the company Gates co-founded, remains a cornerstone of his portfolio. Despite stepping down from its day-to-day operations, Gates’ continued investment in Microsoft highlights his enduring belief in its innovative capabilities and market leadership. The company’s consistent performance in the technology sector, driven by its cloud computing and software solutions, aligns with Gates’ vision of technological advancement and its impact on the future.

Canadian National Railway, another key holding, represents Gates’ interest in essential infrastructure and transportation. Railways are a critical component of the economy, facilitating the movement of goods across vast distances. Canadian National Railway’s strategic position in North America and its efficient operations make it a reliable investment, providing steady returns and growth opportunities.

Lastly, Waste Management is a reflection of Gates’ commitment to sustainability and environmental responsibility. As a leader in waste management and recycling services, the company plays a vital role in addressing environmental challenges. Gates’ investment in Waste Management aligns with his philanthropic efforts to promote sustainable practices and improve global health.

In conclusion, Bill Gates’ investment strategy, characterized by a concentrated portfolio, highlights his confidence in a select group of companies that align with his values and vision for the future. By investing heavily in Berkshire Hathaway, Microsoft, Canadian National Railway, and Waste Management, Gates not only seeks financial returns but also supports companies that contribute to technological innovation, infrastructure development, and environmental sustainability. This approach underscores the power of concentration in investment, demonstrating that with thorough research and conviction, a focused portfolio can yield significant benefits. As Gates continues to influence both the business and philanthropic worlds, his investment strategy serves as a compelling example of how concentration, when executed with insight and foresight, can be a powerful tool in wealth management.

The Top Four Stocks in Bill Gates’ Portfolio: A Deep Dive

Bill Gates, the co-founder of Microsoft and a prominent figure in the world of technology and philanthropy, has long been a subject of interest not only for his groundbreaking contributions to the tech industry but also for his investment strategies. His investment portfolio, valued at approximately $45 billion, is particularly noteworthy for its concentrated nature, with 80% of it invested in just four key stocks. This strategic focus reflects Gates’ investment philosophy and offers insights into the sectors and companies he believes hold significant potential for growth and stability.

The first of these four stocks is Berkshire Hathaway, the multinational conglomerate led by Warren Buffett. Gates’ substantial investment in Berkshire Hathaway is a testament to his confidence in Buffett’s management acumen and the company’s diversified business model. Berkshire Hathaway’s portfolio spans various industries, including insurance, utilities, and consumer goods, providing a robust foundation that aligns with Gates’ preference for stable, long-term investments. Moreover, the conglomerate’s consistent performance and prudent capital allocation strategies make it an attractive choice for investors seeking reliable returns.

Transitioning to the second key stock, Microsoft remains a cornerstone of Gates’ portfolio. Despite stepping down from his day-to-day role at the company, Gates continues to hold a significant stake in the tech giant. Microsoft’s dominance in the software industry, coupled with its successful ventures into cloud computing and artificial intelligence, underscores its position as a leader in technological innovation. The company’s ability to adapt to changing market dynamics and its commitment to research and development further solidify its status as a valuable asset in Gates’ investment strategy.

Next, we turn our attention to Canadian National Railway, another major component of Gates’ portfolio. This investment highlights Gates’ interest in infrastructure and transportation, sectors that are crucial to economic growth and development. Canadian National Railway’s extensive network and efficient operations make it a vital player in North America’s transportation landscape. The company’s focus on sustainability and technological advancements in rail logistics aligns with Gates’ broader vision of supporting environmentally responsible and forward-thinking enterprises.

Finally, the fourth key stock in Gates’ portfolio is Waste Management, a leader in waste disposal and recycling services. This investment reflects Gates’ commitment to sustainability and environmental stewardship. Waste Management’s innovative approaches to waste reduction and its emphasis on renewable energy initiatives resonate with Gates’ philanthropic efforts to address climate change and promote sustainable practices. The company’s strong market position and consistent financial performance make it a compelling choice for investors who prioritize both profitability and social responsibility.

In conclusion, Bill Gates’ investment portfolio, with its heavy concentration in these four key stocks, offers a window into his strategic thinking and priorities. By focusing on companies with strong leadership, diversified operations, and a commitment to innovation and sustainability, Gates demonstrates a keen understanding of the factors that drive long-term value creation. His investments in Berkshire Hathaway, Microsoft, Canadian National Railway, and Waste Management not only reflect his confidence in these companies’ future prospects but also align with his broader vision of fostering progress and addressing global challenges. As such, Gates’ portfolio serves as both a financial blueprint and a reflection of his enduring commitment to making a positive impact on the world.

How Bill Gates’ Investment Choices Reflect His Vision for the Future

Bill Gates, co-founder of Microsoft and one of the world’s most renowned philanthropists, has long been a figure of interest not only for his technological innovations but also for his investment strategies. His $45 billion portfolio, managed through the Bill & Melinda Gates Foundation Trust, is a testament to his strategic foresight and commitment to shaping a sustainable future. Notably, 80% of this vast portfolio is concentrated in just four key stocks, reflecting Gates’ vision for the future and his confidence in these sectors’ potential to drive significant change.

To begin with, Gates’ substantial investment in Berkshire Hathaway, the conglomerate led by Warren Buffett, underscores his belief in the value of diversified, long-term investments. Berkshire Hathaway’s wide-ranging interests, from insurance and utilities to consumer goods and transportation, provide a stable foundation that aligns with Gates’ prudent investment philosophy. This choice highlights his trust in Buffett’s management acumen and the conglomerate’s ability to generate consistent returns over time. Moreover, it reflects Gates’ understanding of the importance of diversification in mitigating risk while capitalizing on various economic sectors.

Transitioning to the technology sector, Gates’ significant stake in Microsoft is hardly surprising. As the company he co-founded, Microsoft represents not only a personal legacy but also a continued belief in the transformative power of technology. The company’s ongoing innovations in cloud computing, artificial intelligence, and productivity software are pivotal in driving digital transformation across industries. Gates’ investment in Microsoft signifies his confidence in the company’s ability to remain at the forefront of technological advancement, thereby shaping the future of work and communication.

Furthermore, Gates’ investment in Canadian National Railway (CNR) highlights his recognition of the critical role infrastructure plays in economic development and sustainability. Railways are an efficient and environmentally friendly mode of transportation, essential for moving goods across vast distances with minimal carbon emissions. By investing in CNR, Gates is not only supporting a vital component of North America’s supply chain but also endorsing sustainable practices that align with his broader environmental goals. This investment reflects his understanding of the interconnectedness of infrastructure and sustainability in fostering long-term economic growth.

In addition to these sectors, Gates’ significant investment in Waste Management, Inc. underscores his commitment to addressing environmental challenges. Waste Management is a leader in waste disposal and recycling services, playing a crucial role in promoting sustainable waste management practices. Gates’ investment in this company aligns with his vision of a circular economy, where resources are reused and recycled to minimize environmental impact. By supporting Waste Management, Gates is advocating for innovative solutions to one of the world’s most pressing environmental issues, thereby contributing to a more sustainable future.

In conclusion, Bill Gates’ investment choices are a reflection of his vision for a future that is technologically advanced, economically robust, and environmentally sustainable. By concentrating 80% of his portfolio in these four key stocks, Gates demonstrates a strategic approach that balances financial prudence with a commitment to driving positive change. His investments in diversified conglomerates, technology, infrastructure, and environmental solutions highlight his belief in the power of these sectors to shape a better world. As such, Gates’ portfolio serves not only as a testament to his financial acumen but also as a blueprint for leveraging capital to foster innovation and sustainability.

The Role of Tech Giants in Bill Gates’ $45 Billion Portfolio

Bill Gates, co-founder of Microsoft and one of the world’s most renowned philanthropists, has long been a figure of interest not only for his technological innovations but also for his investment strategies. His $45 billion portfolio, managed through the Bill & Melinda Gates Foundation Trust, reflects a strategic focus on a select group of companies, with a staggering 80% of the portfolio concentrated in just four key stocks. This concentrated investment approach underscores the significant role that tech giants play in Gates’ financial strategy, highlighting his confidence in the enduring value and growth potential of these companies.

To begin with, it is essential to understand the rationale behind such a concentrated investment strategy. Gates’ portfolio is not merely a collection of stocks but a carefully curated selection that aligns with his long-term vision and values. By focusing on a few key companies, Gates can leverage his deep understanding of the technology sector, gained from decades of experience, to make informed investment decisions. This approach allows him to capitalize on the growth trajectories of these companies, which are often at the forefront of innovation and technological advancement.

Among the four key stocks that dominate Gates’ portfolio, Microsoft unsurprisingly holds a prominent position. As the company he co-founded, Gates has an intrinsic connection to Microsoft and a profound understanding of its operations and potential. Microsoft’s consistent performance, driven by its cloud computing services, software products, and enterprise solutions, makes it a cornerstone of Gates’ investment strategy. The company’s ability to adapt to changing technological landscapes and maintain its competitive edge further solidifies its place in his portfolio.

In addition to Microsoft, Gates has shown a strong inclination towards other tech giants that have demonstrated resilience and growth. For instance, Apple, another major holding in his portfolio, represents a significant portion of his investments. Apple’s innovative product line, robust ecosystem, and loyal customer base have contributed to its sustained success in the technology sector. Gates’ investment in Apple reflects his belief in the company’s ability to continue delivering value to its shareholders through innovation and strategic expansion.

Furthermore, Gates’ portfolio includes substantial investments in Amazon, a company that has revolutionized e-commerce and cloud computing. Amazon’s relentless focus on customer satisfaction, coupled with its diversification into various sectors such as artificial intelligence and logistics, positions it as a formidable player in the tech industry. Gates’ confidence in Amazon’s long-term growth prospects is evident in his substantial investment, which aligns with his broader strategy of investing in companies that are shaping the future of technology.

Lastly, Alphabet, the parent company of Google, is another key stock in Gates’ portfolio. Alphabet’s dominance in digital advertising, search engine technology, and its ventures into autonomous vehicles and artificial intelligence make it a compelling investment choice. Gates’ investment in Alphabet underscores his recognition of the company’s potential to drive technological innovation and generate substantial returns.

In conclusion, the role of tech giants in Bill Gates’ $45 billion portfolio is both significant and strategic. By concentrating 80% of his investments in four key stocks, Gates demonstrates his confidence in the enduring value and growth potential of these companies. His investment strategy reflects a deep understanding of the technology sector and a commitment to leveraging innovation for long-term success. As these tech giants continue to shape the future, Gates’ portfolio stands as a testament to the transformative power of technology in the modern world.

Diversification vs. Concentration: Lessons from Bill Gates’ Investments

Bill Gates, co-founder of Microsoft and one of the world’s most renowned philanthropists, has long been a figure of interest not only for his technological innovations and charitable endeavors but also for his investment strategies. His $45 billion portfolio, managed through his investment firm, Cascade Investment LLC, is a testament to his financial acumen. Interestingly, a significant portion of this portfolio—approximately 80%—is concentrated in just four key stocks. This investment approach raises intriguing questions about the balance between diversification and concentration, offering valuable lessons for investors.

Traditionally, diversification is heralded as a fundamental principle of investing. By spreading investments across a wide array of assets, investors can mitigate risk and reduce the impact of any single asset’s poor performance on the overall portfolio. This strategy is particularly appealing to those who seek stability and long-term growth. However, Gates’ concentrated investment approach challenges this conventional wisdom, suggesting that under certain circumstances, concentration can be equally, if not more, effective.

The rationale behind Gates’ concentrated investments lies in his deep understanding and confidence in the companies he chooses. By focusing on a select few stocks, Gates can leverage his insights and expertise to maximize returns. This approach requires a thorough analysis of each company’s fundamentals, market position, and growth potential. Gates’ significant stakes in companies such as Microsoft, Berkshire Hathaway, Canadian National Railway, and Waste Management reflect his belief in their long-term value and resilience.

Moreover, Gates’ investment strategy underscores the importance of conviction in investing. While diversification can protect against downside risk, it may also dilute potential gains. Concentrated investments, on the other hand, allow investors to capitalize on their strongest convictions, potentially leading to substantial returns. This strategy, however, is not without its risks. A concentrated portfolio is inherently more volatile, as it is more susceptible to the fluctuations of its individual components. Therefore, it requires a high level of confidence and a willingness to endure short-term volatility for the prospect of long-term gains.

Gates’ approach also highlights the significance of aligning investments with one’s expertise and values. His investments in companies like Waste Management and Canadian National Railway reflect his interest in sustainable practices and infrastructure development. By investing in sectors he understands and values, Gates not only seeks financial returns but also contributes to areas that align with his broader vision for societal progress.

For individual investors, the lessons from Gates’ investment strategy are multifaceted. While diversification remains a prudent strategy for many, especially those with limited resources or expertise, there is merit in considering a more concentrated approach if one possesses deep knowledge and conviction in specific sectors or companies. It is crucial, however, to balance this concentration with an awareness of the associated risks and a readiness to adapt to changing market conditions.

In conclusion, Bill Gates’ $45 billion portfolio serves as a compelling case study in the debate between diversification and concentration. His success demonstrates that while diversification is a valuable tool for risk management, a well-researched and conviction-driven concentrated portfolio can also yield significant rewards. Ultimately, the choice between these strategies depends on an investor’s individual circumstances, expertise, and risk tolerance, offering a nuanced perspective on the art of investing.

The Impact of Bill Gates’ Investments on the Stock Market

Bill Gates, co-founder of Microsoft and one of the world’s most prominent philanthropists, has long been a figure of interest not only for his technological innovations but also for his investment strategies. His $45 billion portfolio, managed through the Bill & Melinda Gates Foundation Trust, is a testament to his strategic acumen in the financial markets. Notably, 80% of this vast portfolio is concentrated in just four key stocks, a decision that has significant implications for the stock market and investors worldwide.

To understand the impact of Gates’ investments, it is essential to first consider the companies that dominate his portfolio. These include Berkshire Hathaway, Microsoft, Canadian National Railway, and Waste Management. Each of these companies represents a sector with robust growth potential and stability, reflecting Gates’ preference for long-term value over short-term gains. By allocating such a substantial portion of his portfolio to these stocks, Gates not only underscores his confidence in their future performance but also influences market perceptions and investor behavior.

The concentration of investments in these four stocks can lead to increased market volatility, particularly when Gates makes significant buy or sell decisions. For instance, any substantial change in his holdings could trigger a ripple effect, prompting other investors to follow suit. This phenomenon, often referred to as the “Gates Effect,” can lead to fluctuations in stock prices, as market participants react to the perceived endorsement or withdrawal of support from one of the world’s most influential investors.

Moreover, Gates’ investment choices highlight broader trends within the stock market. His focus on companies like Berkshire Hathaway and Microsoft suggests a strong belief in the enduring value of established, well-managed firms with a track record of consistent performance. This preference aligns with a growing trend among investors who seek stability in an increasingly uncertain economic environment. By emphasizing these stocks, Gates reinforces the notion that long-term growth and sustainability are paramount, encouraging other investors to adopt a similar approach.

In addition to influencing market trends, Gates’ investments have a tangible impact on the companies themselves. His substantial holdings can provide these firms with a sense of stability and confidence, knowing they have the backing of a high-profile investor. This support can be particularly beneficial during periods of economic uncertainty, as it may help to attract additional investment and bolster the company’s market position. Furthermore, Gates’ involvement often brings increased scrutiny and attention to these companies, potentially leading to improved corporate governance and strategic decision-making.

While Gates’ concentrated investment strategy carries inherent risks, it also offers significant rewards. By focusing on a select group of companies, he can leverage his influence to drive positive change and innovation within these organizations. This approach not only benefits the companies in which he invests but also contributes to the broader economic landscape by promoting sustainable growth and development.

In conclusion, Bill Gates’ $45 billion portfolio, with its heavy concentration in four key stocks, has a profound impact on the stock market. His investment decisions shape market trends, influence investor behavior, and provide stability to the companies he supports. As such, Gates’ portfolio serves as a powerful example of how strategic investment choices can drive both financial success and positive change in the business world.

Understanding the Sectors Dominated by Bill Gates’ Key Investments

Bill Gates, the co-founder of Microsoft and a prominent figure in the world of technology and philanthropy, has amassed a substantial investment portfolio valued at approximately $45 billion. Notably, a significant portion of this portfolio, around 80%, is concentrated in just four key stocks. This strategic allocation reflects Gates’ investment philosophy and provides insight into the sectors he believes hold the most promise for growth and stability. Understanding the sectors dominated by these key investments offers a glimpse into the economic trends and industries that are likely to shape the future.

First and foremost, one of the most significant investments in Gates’ portfolio is in the technology sector, a domain he is intimately familiar with due to his pioneering work at Microsoft. This sector is characterized by rapid innovation and a constant drive towards digital transformation. Gates’ investment in technology underscores his confidence in the continued expansion and influence of this sector. As technology becomes increasingly integrated into every aspect of daily life, from communication to healthcare, the potential for growth remains substantial. Moreover, the technology sector’s resilience during economic downturns further solidifies its appeal as a cornerstone of Gates’ investment strategy.

In addition to technology, Gates has also placed a considerable emphasis on the consumer goods sector. This sector encompasses companies that produce essential products and services, which are consistently in demand regardless of economic conditions. By investing in consumer goods, Gates is tapping into the stability and reliability that these companies offer. The sector’s ability to weather economic fluctuations makes it an attractive option for investors seeking long-term growth. Furthermore, as global populations continue to rise, the demand for consumer goods is expected to increase, providing a steady stream of revenue for companies within this sector.

Another critical area of focus for Gates is the healthcare sector. This sector is poised for significant growth due to several factors, including an aging global population, advancements in medical technology, and an increasing emphasis on personalized medicine. Gates’ investment in healthcare reflects his recognition of the sector’s potential to drive innovation and improve quality of life. The ongoing development of new treatments and therapies, coupled with the expansion of healthcare access in emerging markets, positions this sector as a key player in the global economy. Additionally, the healthcare sector’s inherent resilience during economic downturns adds an element of stability to Gates’ portfolio.

Lastly, Gates has shown a keen interest in the financial services sector. This sector plays a crucial role in facilitating economic growth by providing essential services such as banking, insurance, and investment management. By investing in financial services, Gates is capitalizing on the sector’s ability to generate consistent returns and its integral role in supporting other industries. As financial markets continue to evolve and adapt to new technologies, the sector is expected to remain a vital component of the global economy.

In conclusion, Bill Gates’ $45 billion portfolio, with 80% invested in four key stocks, highlights his strategic focus on technology, consumer goods, healthcare, and financial services. These sectors not only offer potential for growth and innovation but also provide stability and resilience in an ever-changing economic landscape. By understanding the sectors dominated by Gates’ key investments, one can gain valuable insights into the future trends and opportunities that are likely to shape the global economy.

Q&A

1. **What is the total value of Bill Gates’ portfolio?**

$45 billion.

2. **What percentage of Bill Gates’ portfolio is invested in four key stocks?**

80%.

3. **Which company is the largest holding in Bill Gates’ portfolio?**

Microsoft.

4. **What is the second largest stock holding in the portfolio?**

Berkshire Hathaway.

5. **Name one of the other two key stocks in Bill Gates’ portfolio.**

Canadian National Railway.

6. **What is the fourth key stock in the portfolio?**

Waste Management.

7. **Why might Bill Gates have a concentrated investment strategy?**

To leverage high conviction in select companies for potentially higher returns.

Conclusion

Bill Gates’ $45 billion portfolio, with 80% invested in four key stocks, reflects a highly concentrated investment strategy that underscores his confidence in these companies’ long-term growth potential. This approach suggests a focus on sectors or businesses where Gates sees significant value and stability, likely leveraging his deep understanding of technology and market trends. Such concentration can lead to substantial returns if these companies perform well, but it also carries increased risk due to reduced diversification. Gates’ investment choices may also indicate his strategic priorities and interests, potentially aligning with his philanthropic goals and vision for future innovation.