“Record Cash, Strategic Sales: Navigating Profit Challenges at Berkshire Hathaway”

Introduction

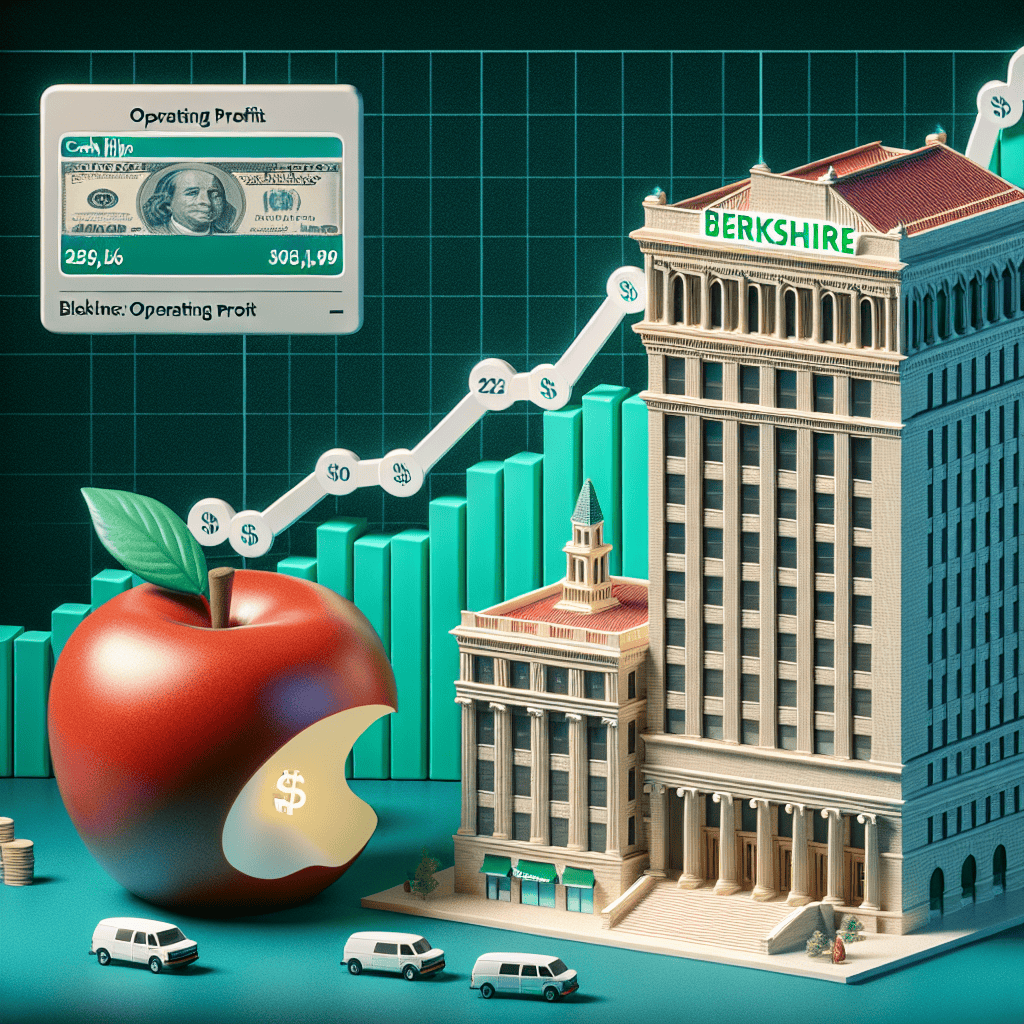

Berkshire Hathaway, the multinational conglomerate led by renowned investor Warren Buffett, has reported a record high in its cash reserves, reaching unprecedented levels amid strategic sales of its holdings in Apple Inc. and Bank of America. This financial maneuvering comes as the company navigates a complex economic landscape, balancing its investment portfolio while maintaining liquidity. Despite the surge in cash reserves, Berkshire Hathaway has experienced a decline in its operating profit, reflecting the broader challenges faced by its diverse range of businesses. This development highlights the intricate dynamics of managing a vast conglomerate in a fluctuating market environment, as Berkshire Hathaway continues to adapt its strategies to optimize financial performance and shareholder value.

Berkshire’s Cash Reserves: Strategies Behind the Record High

Berkshire Hathaway, the multinational conglomerate led by the legendary investor Warren Buffett, has recently reported a record high in its cash reserves, reaching an impressive $157 billion. This milestone comes amid strategic sales of shares in major companies like Apple and Bank of America, reflecting a cautious yet calculated approach to capital management. While the increase in cash reserves is noteworthy, it coincides with a decline in operating profit, prompting analysts and investors to scrutinize the underlying strategies that have led to this financial positioning.

The accumulation of such a substantial cash reserve is not merely a byproduct of divestment but rather a deliberate strategy employed by Berkshire Hathaway. In recent years, Buffett has been known for his prudent investment philosophy, often emphasizing the importance of maintaining liquidity to capitalize on future opportunities. This approach allows the conglomerate to remain agile, ready to deploy capital when market conditions are favorable or when attractive investment opportunities arise. By selling shares in companies like Apple and Bank of America, Berkshire is not only realizing gains from previous investments but also ensuring that it has the financial flexibility to navigate uncertain economic landscapes.

Moreover, the decision to increase cash reserves can be seen as a response to the current economic environment, characterized by volatility and unpredictability. With concerns about inflation, interest rate hikes, and geopolitical tensions, maintaining a robust cash position provides a buffer against potential downturns. This conservative stance is consistent with Buffett’s long-standing investment principles, which prioritize risk management and long-term value creation over short-term gains.

However, the rise in cash reserves has not come without its challenges. Berkshire Hathaway’s operating profit has experienced a decline, raising questions about the balance between liquidity and profitability. The decrease in operating profit can be attributed to several factors, including the performance of its diverse portfolio of businesses, which range from insurance and energy to manufacturing and retail. Fluctuations in these sectors, coupled with broader economic pressures, have impacted the conglomerate’s overall earnings.

Despite the decline in operating profit, Berkshire’s financial health remains robust, supported by its diversified business model and strategic investments. The conglomerate’s ability to generate substantial cash flow from its operations provides a solid foundation for future growth. Furthermore, the decision to hold a significant cash reserve is not indicative of a lack of investment opportunities but rather a reflection of Buffett’s disciplined approach to capital allocation.

In conclusion, Berkshire Hathaway’s record-high cash reserves highlight the conglomerate’s strategic foresight and commitment to maintaining financial flexibility. While the decline in operating profit presents challenges, it is important to recognize the broader context in which these financial decisions are made. By prioritizing liquidity and risk management, Berkshire is well-positioned to navigate the complexities of the current economic landscape and seize opportunities as they arise. As the company continues to adapt to changing market conditions, its cash reserves serve as both a testament to its prudent investment philosophy and a strategic asset for future endeavors.

Impact of Apple and BofA Sales on Berkshire’s Portfolio

Berkshire Hathaway, the multinational conglomerate led by the legendary investor Warren Buffett, has recently made headlines with its strategic financial maneuvers, particularly concerning its holdings in Apple Inc. and Bank of America (BofA). As the company navigates the complexities of the current economic landscape, its cash reserves have soared to unprecedented levels, reaching a record high. This development comes in the wake of significant sales of its stakes in Apple and BofA, two of its most prominent investments. However, despite this increase in liquidity, Berkshire Hathaway has reported a decline in its operating profit, prompting analysts and investors to scrutinize the implications of these moves on its overall portfolio.

To understand the impact of the sales of Apple and BofA shares on Berkshire’s portfolio, it is essential to consider the strategic rationale behind these decisions. Apple, a cornerstone of Berkshire’s equity portfolio, has been a remarkable success story, contributing significantly to the conglomerate’s financial performance over the years. The decision to trim its stake in Apple may be seen as a prudent move to capitalize on the tech giant’s high valuation, thereby realizing substantial gains. Similarly, the reduction in BofA holdings could be interpreted as a response to the evolving dynamics of the financial sector, where regulatory changes and interest rate fluctuations present both opportunities and challenges.

The increase in Berkshire’s cash reserves, now at a record high, provides the company with enhanced financial flexibility. This liquidity positions Berkshire to seize potential investment opportunities that may arise in the future, particularly in times of market volatility or economic downturns. The substantial cash buffer also underscores Buffett’s cautious approach, reflecting his preference for maintaining a strong balance sheet to weather uncertainties. However, this conservative stance has not been without its critics, as some investors express concerns over the opportunity cost of holding excessive cash in a low-interest-rate environment.

Despite the bolstered cash position, Berkshire Hathaway’s operating profit has experienced a decline, raising questions about the underlying factors contributing to this downturn. The conglomerate’s diverse range of businesses, spanning insurance, utilities, manufacturing, and retail, has faced varying degrees of pressure amid global economic challenges. Supply chain disruptions, inflationary pressures, and shifts in consumer behavior have all played a role in affecting the performance of Berkshire’s subsidiaries. Consequently, the decline in operating profit may reflect broader macroeconomic trends rather than specific issues within the company’s portfolio.

In light of these developments, the sales of Apple and BofA shares and the resulting cash accumulation highlight Berkshire Hathaway’s strategic adaptability. The conglomerate’s ability to pivot its investment strategy in response to changing market conditions is a testament to its resilience and long-term vision. While the decline in operating profit may pose short-term challenges, Berkshire’s robust cash reserves provide a cushion to navigate these headwinds and potentially capitalize on future growth opportunities.

In conclusion, the impact of the sales of Apple and BofA shares on Berkshire Hathaway’s portfolio is multifaceted. While these transactions have contributed to a record high in cash reserves, they also coincide with a decline in operating profit. As the company continues to adapt to the evolving economic landscape, its strategic decisions will be closely watched by investors and analysts alike. Ultimately, Berkshire’s ability to balance liquidity with investment opportunities will be crucial in shaping its future trajectory and maintaining its status as a formidable force in the global business arena.

Analyzing Berkshire’s Operating Profit Decline

Berkshire Hathaway, the multinational conglomerate led by the legendary investor Warren Buffett, has recently made headlines with its record-high cash reserves, a development that coincides with notable sales of its holdings in Apple and Bank of America. However, this financial milestone is juxtaposed with a decline in the company’s operating profit, prompting analysts and investors to delve deeper into the underlying factors contributing to this downturn.

To begin with, Berkshire’s cash reserves have surged to unprecedented levels, reaching a staggering $157 billion. This accumulation of cash is largely attributed to the strategic divestment of shares in two of its most significant investments: Apple and Bank of America. The decision to reduce its stake in these companies reflects a broader strategy of capital reallocation, allowing Berkshire to maintain liquidity and seize potential opportunities in an ever-evolving market landscape. While this move has bolstered the company’s cash position, it has also raised questions about the impact on its overall profitability.

In contrast to the robust cash reserves, Berkshire’s operating profit has experienced a decline, a development that warrants a closer examination of the factors at play. One of the primary contributors to this decline is the performance of Berkshire’s diverse portfolio of businesses, which spans various industries including insurance, energy, and consumer goods. The insurance sector, a cornerstone of Berkshire’s operations, has faced challenges due to increased claims and natural disasters, which have exerted pressure on profit margins. Additionally, the energy sector has been grappling with fluctuating commodity prices and regulatory changes, further impacting the conglomerate’s bottom line.

Moreover, the broader economic environment has also played a role in shaping Berkshire’s operating profit trajectory. The lingering effects of the COVID-19 pandemic, coupled with geopolitical tensions and supply chain disruptions, have created a complex backdrop for businesses worldwide. These factors have not only affected consumer demand but have also led to increased operational costs, thereby squeezing profit margins across various sectors. As a result, Berkshire’s diverse portfolio has not been immune to these challenges, contributing to the observed decline in operating profit.

Despite these headwinds, it is important to recognize that Berkshire Hathaway’s financial strategy remains rooted in a long-term perspective. The company’s decision to bolster its cash reserves, even at the expense of short-term profitability, underscores its commitment to maintaining financial flexibility and resilience. This approach allows Berkshire to navigate uncertain economic conditions while positioning itself to capitalize on future investment opportunities that align with its value-driven philosophy.

Furthermore, the decline in operating profit should be viewed within the context of Berkshire’s overall financial health. The conglomerate’s strong balance sheet, characterized by minimal debt and substantial equity, provides a solid foundation for weathering economic fluctuations. This financial strength, coupled with a diversified portfolio of businesses, positions Berkshire to adapt to changing market dynamics and continue delivering value to its shareholders over the long term.

In conclusion, while Berkshire Hathaway’s record-high cash reserves and strategic divestments have captured attention, the decline in operating profit highlights the challenges faced by its diverse portfolio in a complex economic environment. By maintaining a focus on long-term value creation and financial resilience, Berkshire is well-equipped to navigate these challenges and seize opportunities that align with its investment philosophy. As the company continues to adapt to evolving market conditions, its strategic decisions will undoubtedly shape its future trajectory and influence its standing in the global business landscape.

Warren Buffett’s Investment Philosophy: Cash Versus Assets

Warren Buffett’s investment philosophy has long been a subject of fascination and study for investors worldwide. His approach, characterized by a keen eye for value and a preference for holding substantial cash reserves, has been instrumental in shaping the strategies of Berkshire Hathaway, the conglomerate he leads. Recently, Berkshire Hathaway’s cash reserves reached a record high, a development that coincides with the company’s decision to trim its holdings in Apple and Bank of America. This strategic move, while seemingly counterintuitive given the robust performance of these stocks, underscores Buffett’s cautious and calculated approach to investment.

The accumulation of cash at Berkshire Hathaway is not merely a byproduct of asset sales but a deliberate strategy that reflects Buffett’s investment philosophy. He has often emphasized the importance of liquidity, particularly in uncertain economic times. By maintaining a substantial cash reserve, Berkshire is well-positioned to capitalize on opportunities that may arise during market downturns. This approach allows the company to act swiftly and decisively when attractive investments become available, without the need to liquidate other assets at potentially unfavorable prices.

However, the decision to reduce stakes in Apple and Bank of America, two of Berkshire’s most significant investments, has raised questions among analysts and investors. Apple, in particular, has been a cornerstone of Berkshire’s portfolio, contributing significantly to its overall performance. Yet, Buffett’s decision to sell a portion of these holdings is consistent with his philosophy of rebalancing the portfolio to manage risk and ensure long-term growth. By diversifying its investments and reducing exposure to any single asset, Berkshire can mitigate potential losses and maintain financial stability.

Despite the increase in cash reserves, Berkshire Hathaway reported a decline in operating profit, a development that may seem at odds with the company’s overall financial strategy. This decline can be attributed to several factors, including fluctuations in the insurance sector, which is a significant component of Berkshire’s business operations. The insurance industry is inherently volatile, with profits often subject to the whims of natural disasters and other unforeseen events. Nevertheless, Buffett’s long-term perspective allows him to weather these short-term fluctuations, focusing instead on the broader picture of sustained growth and profitability.

Moreover, the decline in operating profit does not necessarily indicate a fundamental weakness in Berkshire’s business model. Instead, it highlights the challenges of managing a diverse conglomerate with interests spanning multiple industries. Buffett’s ability to navigate these complexities is a testament to his investment acumen and strategic foresight. By maintaining a balance between cash reserves and asset holdings, he ensures that Berkshire remains resilient in the face of economic uncertainties.

In conclusion, Warren Buffett’s investment philosophy, characterized by a preference for liquidity and a cautious approach to asset management, continues to guide Berkshire Hathaway’s financial strategy. The record high in cash reserves, coupled with the strategic sale of Apple and Bank of America shares, reflects a deliberate effort to manage risk and position the company for future opportunities. While the decline in operating profit may raise concerns, it is essential to view this development within the broader context of Buffett’s long-term vision. His ability to adapt and respond to changing market conditions ensures that Berkshire Hathaway remains a formidable player in the global investment landscape.

The Role of Cash Reserves in Berkshire’s Long-Term Strategy

Berkshire Hathaway, the conglomerate led by the legendary investor Warren Buffett, has recently made headlines as its cash reserves reached an unprecedented high. This development comes in the wake of strategic sales of shares in major companies like Apple and Bank of America, which have been pivotal components of Berkshire’s investment portfolio. While the increase in cash reserves might seem counterintuitive given the current economic climate, it is essential to understand the role these reserves play in Berkshire’s long-term strategy. Simultaneously, the company has reported a decline in operating profit, prompting analysts and investors to scrutinize the implications of these financial maneuvers.

To begin with, Berkshire’s accumulation of cash reserves is not a new phenomenon. Historically, Buffett has emphasized the importance of maintaining a robust cash position to capitalize on opportunities that arise during market downturns. This strategy allows Berkshire to act swiftly and decisively when attractive investments become available, often at discounted prices. The current record high in cash reserves suggests that Buffett and his team are preparing for potential market volatility or economic uncertainty, positioning the company to seize opportunities that others might miss.

Moreover, the decision to sell shares in Apple and Bank of America, two of Berkshire’s most significant holdings, aligns with this strategic approach. While these sales might raise eyebrows, they reflect a calculated move to rebalance the portfolio and ensure liquidity. Apple, in particular, has been a stellar performer for Berkshire, contributing significantly to its earnings. However, by trimming its position, Berkshire can lock in profits and reduce exposure to any potential downturns in the tech sector. Similarly, the sale of Bank of America shares could be seen as a response to the evolving landscape of the financial industry, where regulatory changes and economic shifts might impact future profitability.

Despite the increase in cash reserves, Berkshire’s recent financial report indicates a decline in operating profit. This decline can be attributed to several factors, including challenges faced by its diverse range of subsidiaries. From insurance to energy and consumer goods, these businesses have encountered varying degrees of pressure due to inflationary trends, supply chain disruptions, and changing consumer behaviors. While these challenges are not unique to Berkshire, they underscore the importance of maintaining a flexible and adaptive strategy.

In light of these developments, it is crucial to consider how Berkshire’s cash reserves serve as a buffer against economic uncertainties. They provide the company with the agility to navigate turbulent times without being forced into hasty decisions. Furthermore, these reserves enable Berkshire to pursue acquisitions or investments that align with its long-term vision, ensuring sustained growth and value creation for its shareholders.

In conclusion, Berkshire Hathaway’s record-high cash reserves, coupled with the strategic sales of Apple and Bank of America shares, highlight the company’s commitment to a prudent and forward-thinking investment strategy. While the decline in operating profit may raise concerns, it is essential to view it within the broader context of Berkshire’s diversified operations and the external challenges they face. Ultimately, the role of cash reserves in Berkshire’s long-term strategy is to provide stability, flexibility, and the capacity to capitalize on opportunities, reinforcing the company’s position as a formidable player in the global investment landscape.

Market Reactions to Berkshire’s Financial Moves

Berkshire Hathaway, the multinational conglomerate led by the legendary investor Warren Buffett, has recently made headlines with its financial maneuvers, capturing the attention of market analysts and investors alike. The company reported a record high in its cash reserves, a development that coincides with its strategic sales of shares in Apple and Bank of America. However, this financial milestone is juxtaposed with a decline in its operating profit, prompting a nuanced analysis of Berkshire’s current market position and future prospects.

To begin with, Berkshire’s cash reserves have surged to unprecedented levels, reaching a staggering $157 billion. This accumulation of cash is indicative of the company’s cautious approach in the face of an uncertain economic landscape. By maintaining a robust cash position, Berkshire ensures it has the flexibility to seize potential investment opportunities or weather any unforeseen economic downturns. This strategy aligns with Buffett’s long-standing investment philosophy of being prepared to act decisively when market conditions are favorable.

Simultaneously, Berkshire’s decision to trim its holdings in Apple and Bank of America has sparked considerable interest. Apple, a cornerstone of Berkshire’s investment portfolio, has been a significant contributor to the conglomerate’s financial success in recent years. The partial divestment from Apple suggests a strategic rebalancing of the portfolio, possibly to mitigate risk or capitalize on the tech giant’s high valuation. Similarly, the reduction in Bank of America shares may reflect a cautious stance towards the financial sector amid evolving regulatory and economic challenges.

Despite these strategic moves, Berkshire’s operating profit has experienced a decline, a development that warrants closer examination. The decrease in operating profit can be attributed to several factors, including the performance of its diverse subsidiaries. Notably, the insurance sector, a critical component of Berkshire’s business model, has faced headwinds due to increased claims and natural disasters. Additionally, the conglomerate’s manufacturing and retail operations have been impacted by supply chain disruptions and inflationary pressures, further contributing to the dip in profitability.

In light of these developments, market reactions have been mixed. On one hand, the record cash reserves are viewed positively, as they position Berkshire to capitalize on future investment opportunities. On the other hand, the decline in operating profit raises questions about the company’s ability to sustain its growth trajectory in a challenging economic environment. Investors are keenly observing how Berkshire will deploy its cash reserves, with potential acquisitions or strategic investments likely to influence market sentiment.

Moreover, the sales of Apple and Bank of America shares have prompted discussions about Berkshire’s investment strategy moving forward. While some analysts interpret these sales as a prudent reallocation of resources, others speculate about potential shifts in the conglomerate’s investment focus. The market will be closely monitoring any new investments or changes in Berkshire’s portfolio, as these decisions will provide insights into the company’s long-term strategic vision.

In conclusion, Berkshire Hathaway’s recent financial moves have generated significant interest and debate within the investment community. The record high in cash reserves underscores the company’s cautious yet opportunistic approach, while the decline in operating profit highlights the challenges it faces in the current economic climate. As Berkshire navigates these complexities, its future actions will undoubtedly continue to shape market perceptions and influence investor confidence.

Future Prospects for Berkshire Hathaway Amid Financial Shifts

Berkshire Hathaway, the multinational conglomerate led by the legendary investor Warren Buffett, has recently made headlines with its financial maneuvers, reflecting both strategic foresight and adaptability in a fluctuating economic landscape. The company has reported a record high in its cash reserves, a development that has piqued the interest of investors and analysts alike. This accumulation of cash comes in the wake of significant sales of shares in two of its major holdings, Apple Inc. and Bank of America. While these sales have contributed to the burgeoning cash pile, they also signal a potential shift in Berkshire’s investment strategy, raising questions about the company’s future direction.

The decision to sell portions of its stakes in Apple and Bank of America, two of Berkshire’s most prominent investments, suggests a cautious approach in response to current market conditions. Apple, a tech giant with a robust track record, has been a cornerstone of Berkshire’s portfolio, providing substantial returns over the years. Similarly, Bank of America has been a reliable performer in the financial sector. However, the partial divestment from these companies indicates that Berkshire is perhaps positioning itself to capitalize on new opportunities or to safeguard against potential market volatility. This strategic realignment is underscored by the company’s growing cash reserves, which now stand at an unprecedented level.

Despite the positive implications of a strong cash position, Berkshire Hathaway has also reported a decline in its operating profit, a development that cannot be overlooked. The decrease in operating profit highlights the challenges faced by the conglomerate’s diverse array of businesses, which span industries such as insurance, energy, and transportation. This decline may be attributed to a variety of factors, including economic headwinds, increased competition, and evolving consumer preferences. Nevertheless, Berkshire’s robust cash reserves provide a buffer against these challenges, offering the company flexibility to navigate through uncertain times.

Looking ahead, the future prospects for Berkshire Hathaway appear to be a blend of cautious optimism and strategic recalibration. The substantial cash reserves position the company to seize new investment opportunities as they arise, potentially in emerging sectors or undervalued assets. Moreover, the cash cushion allows Berkshire to weather economic downturns, ensuring stability and resilience in its operations. This financial strength is a testament to Buffett’s prudent management and long-term vision, which have consistently guided the company through various market cycles.

Furthermore, the partial divestment from Apple and Bank of America may also reflect a broader strategy to diversify Berkshire’s investment portfolio. By reallocating resources, the company can explore new avenues for growth and innovation, aligning with evolving market trends and consumer demands. This strategic diversification could enhance Berkshire’s competitive edge, enabling it to maintain its position as a leading conglomerate in the global market.

In conclusion, Berkshire Hathaway’s record-high cash reserves, coupled with its strategic sales of Apple and Bank of America shares, underscore a period of financial shifts and strategic recalibration. While the decline in operating profit presents challenges, the company’s strong cash position offers a foundation for future growth and stability. As Berkshire navigates this evolving landscape, its ability to adapt and capitalize on new opportunities will be crucial in shaping its future trajectory. Through prudent management and strategic foresight, Berkshire Hathaway is poised to continue its legacy of success in the ever-changing world of business and finance.

Q&A

1. **What is the record high cash level for Berkshire Hathaway?**

Berkshire Hathaway’s cash holdings reached a record high of approximately $157 billion.

2. **Which major investments did Berkshire Hathaway reduce its holdings in?**

Berkshire Hathaway reduced its holdings in Apple and Bank of America.

3. **What was the reason for the decline in Berkshire Hathaway’s operating profit?**

The decline in operating profit was attributed to weaker performance in some of its business segments, including insurance underwriting.

4. **How did Berkshire Hathaway’s insurance business perform?**

The insurance business experienced a decline in underwriting profit, contributing to the overall decrease in operating profit.

5. **What is the significance of Berkshire Hathaway’s cash reserves?**

The significant cash reserves provide Berkshire Hathaway with flexibility for future investments and acquisitions.

6. **How did the sales of Apple and Bank of America shares impact Berkshire’s portfolio?**

The sales reduced Berkshire’s exposure to these companies, potentially reallocating capital to other opportunities.

7. **What is Warren Buffett’s strategy regarding cash reserves?**

Warren Buffett prefers to maintain substantial cash reserves to capitalize on investment opportunities during market downturns or when attractive deals arise.

Conclusion

Berkshire Hathaway’s financial position reflects a strategic shift as its cash reserves reach a record high, driven by the sale of shares in major holdings like Apple and Bank of America. This increase in liquidity suggests a cautious approach, potentially preparing for future investment opportunities or economic uncertainties. However, the decline in operating profit indicates challenges in its core business operations, possibly due to market conditions or internal inefficiencies. Overall, while the robust cash position provides flexibility, the dip in operating profit highlights areas needing attention to sustain long-term growth.