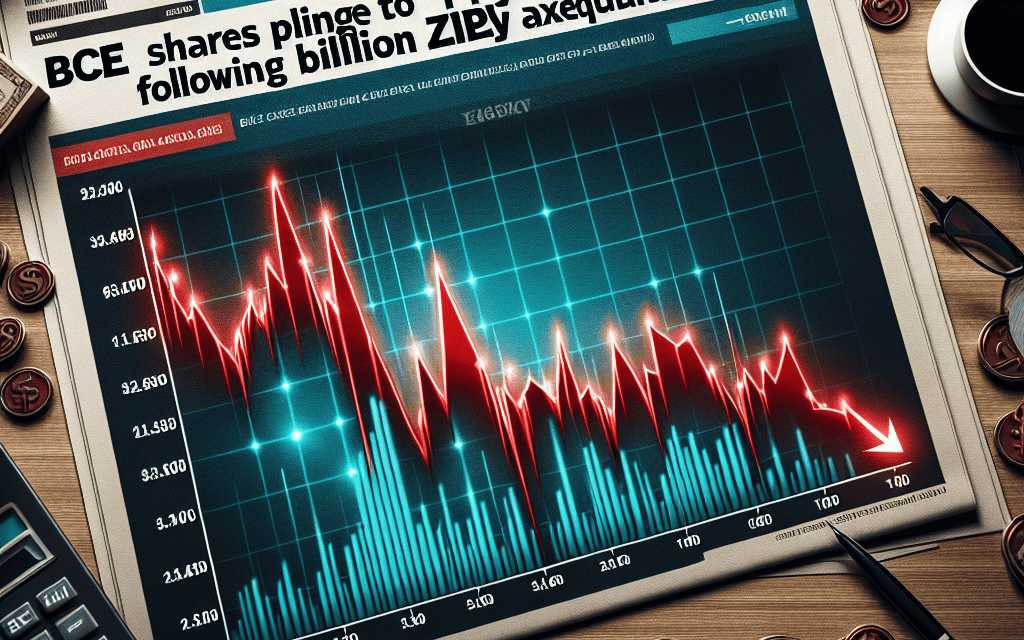

“BCE’s Bold Move: $3.6 Billion Ziply Acquisition Sends Shares to 11-Year Low”

Introduction

BCE Inc., a leading telecommunications company, has experienced a significant decline in its share value, reaching an 11-year low. This downturn follows the company’s recent announcement of its $3.6 billion acquisition of Ziply Fiber, a regional internet service provider. The acquisition, intended to expand BCE’s footprint in the broadband market, has raised concerns among investors about the financial implications and strategic direction of the company. The market’s reaction reflects apprehension over the potential risks and integration challenges associated with the deal, contributing to the sharp drop in BCE’s stock price.

Impact Of BCE’s Acquisition Strategy On Shareholder Value

BCE Inc., a prominent player in the telecommunications industry, recently made headlines with its acquisition of Ziply Fiber for a staggering $3.6 billion. This strategic move, however, has not been met with universal acclaim, as evidenced by the subsequent plunge in BCE’s share price to an 11-year low. The acquisition, intended to bolster BCE’s position in the competitive telecommunications market, has instead raised concerns among investors about the company’s long-term strategy and its impact on shareholder value.

To understand the implications of this acquisition, it is essential to consider the context in which BCE operates. The telecommunications sector is characterized by rapid technological advancements and intense competition. Companies are under constant pressure to expand their infrastructure and service offerings to meet the growing demands of consumers. In this environment, acquisitions can serve as a means to quickly gain access to new markets and technologies. However, they also carry significant risks, particularly when it comes to integrating new assets and managing increased debt levels.

BCE’s decision to acquire Ziply Fiber was likely driven by the desire to enhance its fiber-optic network capabilities and expand its footprint in the Pacific Northwest. Ziply Fiber, known for its robust infrastructure and customer base, presented an attractive opportunity for BCE to strengthen its market position. Nevertheless, the acquisition has sparked concerns about the financial burden it places on BCE. The $3.6 billion price tag represents a substantial investment, and investors are wary of the potential strain on the company’s balance sheet.

Moreover, the timing of the acquisition has raised eyebrows. With economic uncertainties looming and interest rates on the rise, the cost of financing such a large deal could weigh heavily on BCE’s financial performance. Investors are particularly concerned about the impact on the company’s ability to maintain its dividend payouts, which have been a key attraction for shareholders. The fear of reduced dividends, coupled with the increased debt load, has contributed to the sharp decline in BCE’s share price.

In addition to financial concerns, the integration of Ziply Fiber into BCE’s operations presents its own set of challenges. Mergers and acquisitions often come with the risk of cultural clashes and operational disruptions. Successfully merging two companies requires careful planning and execution to ensure that synergies are realized and that the combined entity can operate efficiently. Any missteps in this process could further erode shareholder value and undermine investor confidence.

Despite these challenges, it is important to recognize that acquisitions can also offer significant long-term benefits. If BCE can effectively integrate Ziply Fiber and leverage its assets, the company could emerge stronger and more competitive in the telecommunications landscape. The expanded network capabilities and customer base could drive revenue growth and enhance BCE’s ability to deliver innovative services to its customers.

In conclusion, while BCE’s acquisition of Ziply Fiber has led to a notable decline in its share price, it is crucial to consider both the risks and potential rewards associated with this strategic move. The impact on shareholder value will ultimately depend on BCE’s ability to manage the financial and operational challenges that accompany such a significant acquisition. As the company navigates this complex landscape, investors will be closely watching for signs of successful integration and the realization of long-term benefits.

Analyzing The Financial Implications Of BCE’s $3.6 Billion Ziply Deal

BCE Inc., a prominent player in the telecommunications industry, recently made headlines with its acquisition of Ziply Fiber for a staggering $3.6 billion. This strategic move, however, has not been met with universal acclaim, as evidenced by the subsequent plunge in BCE’s share price to an 11-year low. The acquisition, while potentially transformative, raises several questions about the financial implications for BCE and its stakeholders.

To begin with, the acquisition of Ziply Fiber represents a significant investment in expanding BCE’s footprint in the fiber-optic market. Ziply, known for its robust infrastructure and customer base in the Pacific Northwest, offers BCE an opportunity to enhance its service offerings and compete more aggressively in the high-speed internet sector. This move aligns with BCE’s long-term strategy to diversify its revenue streams and reduce reliance on traditional telecommunications services, which have been experiencing slower growth. However, the immediate financial impact of this acquisition has been less than favorable, as reflected in the market’s reaction.

The sharp decline in BCE’s share price can be attributed to several factors. Firstly, the $3.6 billion price tag is a substantial outlay, raising concerns about the company’s ability to integrate Ziply effectively and achieve the anticipated synergies. Investors are wary of the potential for unforeseen integration challenges, which could lead to increased operational costs and erode profit margins. Moreover, the acquisition has been financed through a combination of debt and equity, which has implications for BCE’s financial health. The increased debt burden may strain the company’s balance sheet, potentially affecting its credit rating and increasing borrowing costs in the future.

Furthermore, the timing of the acquisition has also contributed to investor apprehension. The telecommunications industry is currently navigating a complex landscape marked by rapid technological advancements and shifting consumer preferences. As such, there is a degree of uncertainty regarding the long-term viability of large-scale acquisitions in this sector. Investors are particularly concerned about the potential for disruptive technologies to render existing infrastructure obsolete, thereby diminishing the value of BCE’s investment in Ziply.

Despite these challenges, it is important to consider the potential upside of the acquisition. By acquiring Ziply, BCE gains access to a well-established network and a loyal customer base, which could provide a solid foundation for future growth. Additionally, the acquisition positions BCE to capitalize on the increasing demand for high-speed internet services, driven by the proliferation of remote work and digital entertainment. If managed effectively, the integration of Ziply could enhance BCE’s competitive position and drive long-term shareholder value.

In conclusion, while the immediate market reaction to BCE’s acquisition of Ziply Fiber has been negative, it is essential to adopt a balanced perspective when evaluating the financial implications of this deal. The acquisition presents both risks and opportunities, and its ultimate success will depend on BCE’s ability to navigate the integration process and adapt to the evolving telecommunications landscape. As the company moves forward, it will be crucial for BCE to communicate its strategic vision clearly and demonstrate its commitment to delivering value to shareholders. Only time will tell whether this bold move will pay off, but for now, the market remains cautiously optimistic about BCE’s future prospects.

Market Reactions To BCE’s 11-Year Low Share Price

BCE Inc., one of Canada’s largest telecommunications companies, recently experienced a significant downturn in its stock performance, with shares plunging to an 11-year low. This decline followed the company’s announcement of its $3.6 billion acquisition of Ziply Fiber, a move that has sparked considerable debate among investors and market analysts. The acquisition, intended to expand BCE’s footprint in the fiber-optic internet market, was initially perceived as a strategic maneuver to enhance its competitive edge. However, the immediate market reaction suggests a more complex narrative, as investors weigh the potential benefits against the inherent risks of such a substantial investment.

The acquisition of Ziply Fiber, a regional internet service provider in the Pacific Northwest, represents BCE’s ambition to strengthen its position in the rapidly growing fiber-optic sector. Fiber-optic technology is increasingly seen as the future of high-speed internet, offering faster and more reliable connections compared to traditional broadband. By acquiring Ziply, BCE aims to tap into this burgeoning market, potentially unlocking new revenue streams and solidifying its status as a leader in telecommunications. Nevertheless, the market’s response indicates a degree of skepticism regarding the timing and financial implications of the deal.

One of the primary concerns among investors is the significant financial outlay required for the acquisition. The $3.6 billion price tag, while reflective of Ziply’s strategic value, represents a substantial commitment for BCE. This expenditure comes at a time when the telecommunications industry is facing mounting pressures, including increased competition, regulatory challenges, and the need for continuous technological upgrades. Consequently, investors are wary of the potential strain on BCE’s financial resources and the impact on its ability to maintain dividend payouts, which have historically been a key attraction for shareholders.

Moreover, the integration of Ziply Fiber into BCE’s existing operations presents its own set of challenges. Mergers and acquisitions in the telecommunications sector often involve complex logistical and operational hurdles, as companies strive to harmonize disparate systems and cultures. The success of such endeavors is not guaranteed, and any missteps could lead to disruptions in service or increased operational costs, further eroding investor confidence.

Despite these concerns, some analysts argue that the long-term benefits of the acquisition could outweigh the immediate drawbacks. The demand for high-speed internet continues to grow, driven by the proliferation of digital services and the increasing reliance on remote work and online education. By expanding its fiber-optic capabilities, BCE is positioning itself to capitalize on these trends, potentially securing a larger share of the market and enhancing its competitive standing.

In light of these considerations, the market’s reaction to BCE’s acquisition of Ziply Fiber underscores the delicate balance between risk and reward that companies must navigate in today’s dynamic business environment. While the initial drop in share price reflects investor apprehension, it also highlights the importance of strategic foresight and effective execution in realizing the full potential of such investments. As BCE moves forward with its integration plans, the company’s ability to address these challenges and deliver on its promises will be closely monitored by stakeholders, who remain cautiously optimistic about the future prospects of this ambitious endeavor.

Strategic Risks And Opportunities In BCE’s Ziply Acquisition

BCE Inc., a leading telecommunications and media company in Canada, recently made headlines with its acquisition of Ziply Fiber for $3.6 billion. This strategic move, however, has not been met with universal acclaim, as evidenced by the subsequent plunge in BCE’s shares to an 11-year low. The acquisition, while potentially transformative, presents both significant risks and opportunities for BCE, necessitating a closer examination of the strategic implications involved.

To begin with, the acquisition of Ziply Fiber represents a bold step for BCE in expanding its footprint in the North American telecommunications market. Ziply Fiber, known for its robust fiber-optic network in the Pacific Northwest, offers BCE an opportunity to enhance its service offerings and reach a broader customer base. This expansion aligns with BCE’s long-term strategy to diversify its revenue streams and reduce its reliance on the Canadian market. By integrating Ziply’s advanced infrastructure, BCE can potentially accelerate its growth in the high-demand fiber-optic sector, which is crucial for supporting the increasing data needs of consumers and businesses alike.

However, the acquisition is not without its challenges. The immediate market reaction, as reflected in the sharp decline in BCE’s share price, underscores investor concerns about the financial and operational risks associated with such a significant investment. The $3.6 billion price tag, while indicative of Ziply’s value, also represents a substantial financial commitment for BCE. This raises questions about the company’s ability to effectively integrate Ziply’s operations and realize the anticipated synergies. Moreover, the acquisition comes at a time when the telecommunications industry is facing heightened competition and regulatory scrutiny, both of which could impact BCE’s ability to achieve a smooth and profitable integration.

In addition to these operational challenges, BCE must also navigate the complexities of managing a cross-border acquisition. The integration of Ziply Fiber into BCE’s existing operations will require careful coordination and alignment of business processes, corporate cultures, and strategic objectives. This is particularly important given the differences in market dynamics and regulatory environments between Canada and the United States. Successfully managing these complexities will be critical to ensuring that the acquisition delivers the expected benefits and enhances BCE’s competitive position in the North American market.

Despite these challenges, the acquisition of Ziply Fiber also presents significant opportunities for BCE. By leveraging Ziply’s advanced fiber-optic network, BCE can enhance its technological capabilities and offer more competitive services to its customers. This could lead to increased customer satisfaction and loyalty, as well as new revenue opportunities in emerging areas such as 5G and Internet of Things (IoT) applications. Furthermore, the acquisition positions BCE to capitalize on the growing demand for high-speed internet and data services, which is expected to continue rising in the coming years.

In conclusion, while the acquisition of Ziply Fiber by BCE has been met with skepticism by the market, it represents a strategic move that could yield substantial long-term benefits. The key to success will lie in BCE’s ability to effectively manage the associated risks and capitalize on the opportunities presented by this acquisition. As the company navigates this complex landscape, it will be crucial for BCE to maintain a clear focus on its strategic objectives and ensure that it remains agile and responsive to the evolving needs of its customers and the broader telecommunications market.

Long-Term Prospects For BCE Post-Ziply Acquisition

BCE Inc., a leading telecommunications company in Canada, recently made headlines with its acquisition of Ziply Fiber for $3.6 billion. This strategic move, however, has not been met with universal acclaim, as evidenced by the subsequent plunge in BCE’s share price to an 11-year low. Investors and analysts alike are now scrutinizing the long-term prospects of BCE in the wake of this significant acquisition, raising questions about the company’s future trajectory and financial health.

To begin with, the acquisition of Ziply Fiber represents a bold step for BCE as it seeks to expand its footprint in the competitive North American telecommunications market. Ziply Fiber, known for its robust fiber-optic network in the Pacific Northwest, offers BCE an opportunity to enhance its service offerings and tap into new revenue streams. This move aligns with BCE’s broader strategy to invest in high-speed internet infrastructure, which is increasingly seen as a critical component of modern telecommunications services. By integrating Ziply’s assets, BCE aims to bolster its position in the market and drive long-term growth.

However, the immediate reaction from the market suggests a degree of skepticism about the acquisition’s potential benefits. The sharp decline in BCE’s share price reflects investor concerns about the financial implications of the deal. The $3.6 billion price tag is substantial, and there are questions about whether the anticipated synergies and revenue growth will materialize quickly enough to justify the investment. Moreover, the acquisition comes at a time when the telecommunications industry is facing significant challenges, including regulatory pressures, technological disruptions, and evolving consumer preferences.

Despite these concerns, there are reasons to remain optimistic about BCE’s long-term prospects. The integration of Ziply Fiber could provide BCE with a competitive edge in the fiber-optic market, which is expected to experience robust growth in the coming years. As demand for high-speed internet continues to rise, BCE’s expanded network capabilities could position it well to capture a larger share of the market. Furthermore, the acquisition may enable BCE to offer more comprehensive service packages, thereby enhancing customer satisfaction and loyalty.

In addition to potential market advantages, BCE’s strong financial foundation provides a degree of reassurance. The company has a history of prudent financial management and has consistently demonstrated its ability to navigate complex market dynamics. This financial resilience could prove invaluable as BCE works to integrate Ziply Fiber and realize the full potential of the acquisition. Moreover, BCE’s commitment to innovation and investment in cutting-edge technologies may further bolster its competitive position in the long run.

Nevertheless, it is crucial for BCE to address the concerns of its stakeholders and communicate a clear vision for the future. Transparency about the integration process and expected outcomes will be key to restoring investor confidence. Additionally, BCE must remain vigilant in monitoring industry trends and adapting its strategies accordingly to ensure sustained growth and profitability.

In conclusion, while the acquisition of Ziply Fiber has introduced a degree of uncertainty into BCE’s immediate financial outlook, the long-term prospects remain promising. By leveraging Ziply’s assets and capabilities, BCE has the potential to strengthen its market position and drive future growth. However, the company must navigate the challenges ahead with strategic foresight and effective execution to fully capitalize on this significant investment. As the telecommunications landscape continues to evolve, BCE’s ability to adapt and innovate will be critical to its success in the years to come.

Comparing BCE’s Acquisition Approach With Industry Peers

BCE Inc., a prominent player in the telecommunications industry, recently made headlines with its acquisition of Ziply Fiber for a staggering $3.6 billion. This strategic move, however, has not been met with universal acclaim, as evidenced by the subsequent plunge in BCE’s shares to an 11-year low. To understand the implications of this acquisition, it is essential to compare BCE’s approach with that of its industry peers, who have also been active in mergers and acquisitions to bolster their market positions.

In recent years, the telecommunications sector has witnessed a flurry of mergers and acquisitions, driven by the need to expand service offerings, enhance technological capabilities, and achieve economies of scale. Companies like AT&T and Verizon have pursued acquisitions with a focus on diversifying their portfolios and integrating vertically. For instance, AT&T’s acquisition of Time Warner was aimed at combining content creation with distribution, thereby creating a comprehensive media and telecommunications conglomerate. Similarly, Verizon’s purchase of AOL and Yahoo was intended to strengthen its digital media and advertising capabilities.

In contrast, BCE’s acquisition of Ziply Fiber appears to be a more traditional approach, focusing on expanding its core telecommunications infrastructure. Ziply Fiber, known for its robust fiber-optic network in the Pacific Northwest, offers BCE an opportunity to enhance its broadband services and increase its footprint in the United States. This move aligns with BCE’s strategy to invest in high-quality network assets, which are crucial for meeting the growing demand for high-speed internet and data services.

However, the market’s reaction to BCE’s acquisition suggests a degree of skepticism about the company’s ability to integrate Ziply Fiber successfully and generate the anticipated synergies. Unlike its peers, who have diversified into content and digital services, BCE’s focus remains predominantly on telecommunications infrastructure. This singular focus may be perceived as a limitation in an industry where convergence and diversification are increasingly seen as pathways to growth and resilience.

Moreover, the timing of the acquisition raises questions about BCE’s strategic foresight. The telecommunications industry is currently navigating a complex landscape marked by rapid technological advancements, regulatory challenges, and shifting consumer preferences. While expanding its fiber-optic network is undoubtedly a step in the right direction, BCE must also consider how to leverage this infrastructure to offer innovative services that meet evolving customer needs.

In addition, BCE’s acquisition strategy contrasts with the more cautious approach adopted by some of its peers, who have opted for strategic partnerships and joint ventures instead of outright acquisitions. These collaborations allow companies to share risks and resources while exploring new markets and technologies. For example, T-Mobile’s partnership with Sprint enabled it to expand its 5G network without the financial burden of a full acquisition.

In conclusion, BCE’s acquisition of Ziply Fiber underscores its commitment to strengthening its telecommunications infrastructure. However, the market’s reaction highlights the challenges associated with this approach, particularly in an industry where diversification and innovation are key drivers of success. As BCE navigates the integration of Ziply Fiber, it must also consider how to adapt its strategy to remain competitive in a rapidly evolving landscape. By learning from the experiences of its industry peers, BCE can better position itself to capitalize on future opportunities and mitigate potential risks.

Investor Sentiment And Future Outlook For BCE Shares

BCE Inc., a prominent player in the telecommunications industry, recently witnessed a significant decline in its share value, reaching an 11-year low. This downturn followed the company’s announcement of its $3.6 billion acquisition of Ziply Fiber, a move that has sparked considerable debate among investors and analysts alike. The acquisition, intended to bolster BCE’s presence in the fiber-optic market, has instead raised concerns about the company’s strategic direction and financial health. As a result, investor sentiment has shifted, prompting a reevaluation of BCE’s future prospects.

The acquisition of Ziply Fiber was initially perceived as a strategic maneuver to enhance BCE’s competitive edge in the rapidly evolving telecommunications landscape. By expanding its fiber-optic network, BCE aimed to meet the growing demand for high-speed internet services, a sector that has seen exponential growth in recent years. However, the substantial financial outlay required for this acquisition has led to apprehensions about the company’s ability to manage its debt levels effectively. Consequently, investors have become increasingly wary, fearing that the acquisition may strain BCE’s financial resources and impact its ability to generate sustainable returns.

Moreover, the timing of the acquisition has also contributed to the negative sentiment surrounding BCE shares. The telecommunications industry is currently facing a myriad of challenges, including regulatory pressures, technological disruptions, and intense competition. In this context, BCE’s decision to pursue such a significant acquisition has been met with skepticism, as investors question whether the company can successfully integrate Ziply Fiber into its existing operations while navigating these external pressures. This skepticism has been reflected in the market, with BCE shares experiencing a sharp decline as investors reassess their positions.

In addition to these concerns, the broader economic environment has also played a role in shaping investor sentiment. Rising interest rates and inflationary pressures have created an uncertain economic landscape, prompting investors to adopt a more cautious approach. In such a climate, companies with high levels of debt, like BCE, are often viewed with increased scrutiny. The acquisition of Ziply Fiber, while strategically sound in theory, has thus been perceived as a risky move that could exacerbate BCE’s financial vulnerabilities in an already challenging economic context.

Despite these challenges, it is important to consider the potential long-term benefits of the acquisition. By expanding its fiber-optic network, BCE is positioning itself to capitalize on the growing demand for high-speed internet services, a trend that is expected to continue in the coming years. If successfully integrated, Ziply Fiber could enhance BCE’s service offerings and provide a competitive advantage in the market. However, realizing these benefits will require careful management and execution, as well as a clear strategic vision to navigate the complexities of the telecommunications industry.

In conclusion, the recent plunge in BCE shares following the Ziply acquisition reflects a complex interplay of factors, including investor concerns about financial stability, strategic direction, and broader economic conditions. While the acquisition presents potential opportunities for growth, it also poses significant risks that must be carefully managed. As BCE moves forward, its ability to address these challenges and reassure investors will be crucial in shaping the future outlook for its shares. Ultimately, the company’s success will depend on its capacity to balance short-term financial pressures with long-term strategic goals, ensuring sustainable growth in an increasingly competitive market.

Q&A

1. **What caused BCE shares to plunge to an 11-year low?**

The plunge was triggered by BCE’s $3.6 billion acquisition of Ziply, which raised concerns among investors about the financial impact and strategic rationale of the deal.

2. **How much did BCE spend on acquiring Ziply?**

BCE spent $3.6 billion on acquiring Ziply.

3. **What is the market’s reaction to the acquisition?**

The market reacted negatively, with BCE shares dropping to their lowest level in 11 years, indicating investor skepticism about the acquisition’s benefits.

4. **What are the concerns surrounding the acquisition?**

Concerns include the high cost of the acquisition, potential integration challenges, and doubts about the strategic fit and long-term value creation.

5. **How long has it been since BCE shares were this low?**

BCE shares have not been this low in 11 years.

6. **What is Ziply, and why did BCE acquire it?**

Ziply is a telecommunications company, and BCE acquired it to expand its market presence and enhance its service offerings, although the strategic benefits are being questioned by investors.

7. **What are analysts saying about the acquisition?**

Analysts are expressing caution, highlighting the financial burden of the acquisition and questioning whether the expected synergies and growth opportunities justify the investment.

Conclusion

BCE’s shares have plummeted to an 11-year low following its $3.6 billion acquisition of Ziply, indicating investor concerns over the strategic and financial implications of the deal. The significant drop in share value suggests skepticism about the potential benefits of the acquisition, such as synergies or market expansion, and raises questions about the company’s ability to effectively integrate Ziply into its operations. This market reaction underscores the challenges BCE faces in convincing stakeholders of the long-term value and growth prospects associated with this substantial investment.