“Asian Markets Soar: Samsung Electronics Sparks a New Wave of Growth!”

Introduction

Asian markets experienced a significant upswing, driven by a robust performance from Samsung Electronics, which spearheaded the rally. Investors showed renewed confidence as Samsung’s shares surged following positive earnings forecasts and strategic advancements in technology sectors. This momentum was mirrored across various Asian stock exchanges, with technology and manufacturing sectors seeing notable gains. The rally reflects broader optimism about economic recovery and growth prospects in the region, underscoring the pivotal role of leading tech companies like Samsung in shaping market dynamics.

Impact Of Samsung Electronics On Asian Market Growth

The recent surge in Asian markets has captured the attention of global investors, with Samsung Electronics playing a pivotal role in this upward trajectory. As one of the largest and most influential technology companies in the world, Samsung Electronics has long been a bellwether for the health of the Asian markets. Its recent performance has not only bolstered investor confidence but also highlighted the interconnectedness of regional economies. This rally, led by Samsung, underscores the significant impact that a single corporation can have on broader market dynamics.

To begin with, Samsung Electronics’ impressive quarterly earnings report has been a major catalyst for the recent market surge. The company reported a substantial increase in profits, driven by robust demand for its semiconductor products and consumer electronics. This positive financial performance has had a ripple effect across the Asian markets, as investors view Samsung’s success as indicative of broader economic resilience. Moreover, the company’s strong results have alleviated concerns about potential supply chain disruptions, which have been a lingering issue for many industries in the wake of the global pandemic.

In addition to its financial performance, Samsung’s strategic initiatives have also contributed to the market rally. The company’s continued investment in cutting-edge technologies, such as artificial intelligence and 5G, has positioned it as a leader in innovation. This forward-thinking approach has not only strengthened Samsung’s competitive edge but also inspired confidence in the broader technology sector. As a result, other tech companies in the region have experienced a boost in their stock prices, further fueling the market’s upward momentum.

Furthermore, Samsung’s influence extends beyond the technology sector, impacting various industries across Asia. The company’s extensive supply chain network involves numerous suppliers and partners throughout the region, creating a symbiotic relationship that amplifies its economic impact. As Samsung thrives, so too do its partners, leading to a cascading effect that benefits a wide array of industries. This interconnectedness highlights the importance of Samsung as a cornerstone of the Asian economic landscape.

The rally in Asian markets, led by Samsung Electronics, also reflects broader macroeconomic trends. The region has been experiencing a gradual recovery from the economic disruptions caused by the pandemic, with many countries implementing policies to stimulate growth and attract investment. Samsung’s success serves as a testament to the effectiveness of these measures, reinforcing the perception of Asia as a dynamic and resilient economic powerhouse. Consequently, international investors have been increasingly drawn to the region, seeking to capitalize on its growth potential.

However, it is important to acknowledge that the current market rally is not without its challenges. Geopolitical tensions, fluctuating currency values, and potential regulatory changes remain as potential headwinds that could impact future growth. Nevertheless, Samsung’s strong performance provides a solid foundation for continued optimism, as it demonstrates the company’s ability to navigate complex global dynamics successfully.

In conclusion, the surge in Asian markets, spearheaded by Samsung Electronics, highlights the profound impact that a single corporation can have on regional economic growth. Through its impressive financial performance, strategic initiatives, and extensive supply chain network, Samsung has not only bolstered investor confidence but also reinforced the perception of Asia as a thriving economic region. As the company continues to innovate and expand its influence, it will undoubtedly remain a key driver of market growth in the years to come.

Key Factors Behind Samsung’s Market Leadership

Asian markets have recently experienced a significant surge, with Samsung Electronics at the forefront of this rally. This remarkable performance can be attributed to several key factors that have positioned Samsung as a market leader, driving investor confidence and influencing broader market trends. Understanding these factors provides insight into the dynamics of the Asian markets and the pivotal role Samsung plays within them.

To begin with, Samsung’s robust financial performance has been a major catalyst for its leadership in the market. The company has consistently reported strong quarterly earnings, driven by its diverse product portfolio that spans semiconductors, consumer electronics, and telecommunications equipment. This diversification not only mitigates risks associated with market volatility but also allows Samsung to capitalize on emerging trends across different sectors. For instance, the global demand for semiconductors has surged due to the proliferation of digital technologies and the expansion of 5G networks, areas where Samsung has established a formidable presence.

Moreover, Samsung’s commitment to innovation has reinforced its competitive edge, enabling it to maintain its leadership position. The company invests heavily in research and development, ensuring that it remains at the cutting edge of technology. This focus on innovation is evident in its advancements in semiconductor technology, where Samsung has made significant strides in developing smaller, more efficient chips. These innovations not only enhance the performance of Samsung’s own products but also attract a wide range of clients who rely on Samsung’s technology for their devices, further solidifying its market dominance.

In addition to its technological prowess, Samsung’s strategic partnerships and acquisitions have played a crucial role in its market leadership. By forming alliances with other industry leaders and acquiring companies that complement its core business areas, Samsung has expanded its capabilities and market reach. These strategic moves have allowed Samsung to enter new markets and strengthen its position in existing ones, thereby driving growth and enhancing its competitive advantage.

Furthermore, Samsung’s strong brand reputation and global presence have contributed significantly to its market leadership. The company is recognized worldwide for its high-quality products and innovative solutions, which have earned it a loyal customer base. This brand strength not only boosts sales but also attracts investors who view Samsung as a reliable and stable investment. Additionally, Samsung’s extensive global supply chain and distribution network enable it to efficiently deliver products to markets around the world, ensuring that it can meet the demands of its diverse customer base.

Another factor underpinning Samsung’s market leadership is its proactive approach to sustainability and corporate social responsibility. In an era where consumers and investors are increasingly concerned about environmental and social issues, Samsung’s commitment to sustainable practices has enhanced its reputation and appeal. The company has implemented various initiatives aimed at reducing its carbon footprint, promoting recycling, and supporting community development, which resonate with stakeholders who prioritize ethical and sustainable business practices.

In conclusion, Samsung Electronics’ leadership in the Asian markets is the result of a combination of strong financial performance, a commitment to innovation, strategic partnerships, a robust brand reputation, and a focus on sustainability. These factors have not only driven Samsung’s success but have also contributed to the broader surge in Asian markets, as investors and stakeholders recognize the company’s pivotal role in shaping the future of technology and commerce. As Samsung continues to navigate the complexities of the global market, its ability to adapt and innovate will likely sustain its leadership position and influence in the years to come.

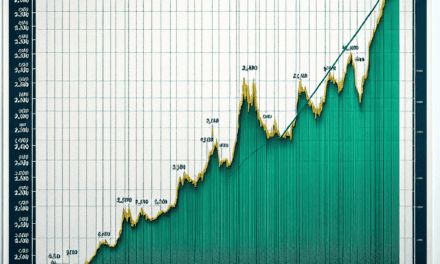

Asian Stock Markets: A Closer Look At The Surge

Asian stock markets have recently experienced a significant surge, with Samsung Electronics at the forefront of this rally. This upward momentum has captured the attention of investors and analysts alike, as it signals a potential shift in the economic landscape of the region. The rally in Asian markets can be attributed to a confluence of factors, including robust corporate earnings, favorable economic policies, and a resurgence in consumer demand. As we delve deeper into the dynamics of this surge, it becomes evident that Samsung Electronics plays a pivotal role in driving this positive trend.

To begin with, Samsung Electronics, a bellwether for the technology sector, has reported impressive quarterly earnings, surpassing market expectations. This performance has instilled confidence among investors, who view the company as a barometer for the broader tech industry. The strong earnings report is largely attributed to the increased demand for semiconductors, driven by the global shift towards digitalization and the proliferation of connected devices. As a result, Samsung’s stock has seen a substantial increase, which has, in turn, buoyed the overall sentiment in Asian markets.

Moreover, the positive impact of Samsung’s performance extends beyond the technology sector. The company’s success has had a ripple effect, boosting investor confidence in other sectors such as consumer electronics, telecommunications, and manufacturing. This cross-sector optimism is further reinforced by supportive economic policies implemented by various Asian governments. These policies, aimed at stimulating growth and fostering innovation, have created a conducive environment for businesses to thrive. Consequently, investors are increasingly optimistic about the region’s economic prospects, leading to a surge in stock prices across multiple industries.

In addition to corporate earnings and economic policies, the resurgence in consumer demand has played a crucial role in the recent rally. As economies in Asia gradually recover from the disruptions caused by the pandemic, consumer confidence has been on the rise. This renewed confidence is reflected in increased spending on goods and services, which has provided a much-needed boost to businesses. The technology sector, in particular, has benefited from this trend, as consumers continue to invest in the latest gadgets and digital solutions. Samsung Electronics, with its diverse product portfolio, is well-positioned to capitalize on this growing demand, further solidifying its leadership position in the market.

Furthermore, the rally in Asian markets is not an isolated phenomenon but rather part of a broader global trend. As economies worldwide begin to recover, there is a growing appetite for risk among investors, who are seeking higher returns in emerging markets. This shift in investment strategy has led to increased capital inflows into Asia, further propelling the surge in stock prices. The region’s strong economic fundamentals, coupled with its strategic importance in the global supply chain, make it an attractive destination for investors looking to diversify their portfolios.

In conclusion, the recent surge in Asian stock markets, led by Samsung Electronics, is a testament to the resilience and dynamism of the region’s economy. The confluence of robust corporate earnings, favorable economic policies, and a resurgence in consumer demand has created a positive feedback loop, driving stock prices higher. As investors continue to seek opportunities in Asia, the region is poised to maintain its upward trajectory, offering promising prospects for growth and development in the coming months.

Samsung’s Role In Driving Technology Sector Gains

Asian markets have experienced a significant surge, with Samsung Electronics at the forefront of this rally, playing a pivotal role in driving gains within the technology sector. As one of the largest and most influential technology companies in the world, Samsung’s performance often serves as a bellwether for the broader market, particularly in Asia. The recent uptick in its stock price has not only buoyed investor sentiment but also underscored the company’s critical role in the global technology landscape.

Samsung Electronics, a leader in semiconductor manufacturing, consumer electronics, and telecommunications, has consistently demonstrated resilience and innovation. This has been particularly evident in its ability to navigate the complex challenges posed by global supply chain disruptions and fluctuating demand patterns. The company’s robust performance can be attributed to several key factors, including its strategic investments in research and development, its diversified product portfolio, and its ability to capitalize on emerging technological trends.

One of the primary drivers of Samsung’s recent success is its semiconductor division, which has benefited from the growing demand for chips across various industries. As the world becomes increasingly digital, the need for semiconductors in everything from smartphones to automobiles has surged. Samsung’s advanced manufacturing capabilities and its commitment to expanding its production capacity have positioned it well to meet this demand. Moreover, the company’s focus on developing cutting-edge technologies, such as artificial intelligence and 5G, has further strengthened its competitive edge.

In addition to its semiconductor business, Samsung’s consumer electronics division has also contributed to its strong performance. The company’s ability to innovate and deliver high-quality products has resonated with consumers worldwide, leading to increased sales of its smartphones, televisions, and home appliances. Furthermore, Samsung’s strategic partnerships and collaborations with other technology firms have enabled it to enhance its product offerings and expand its market reach.

The positive impact of Samsung’s performance on Asian markets cannot be overstated. As a major component of various stock indices, the company’s stock price movements have a significant influence on market trends. The recent rally in Samsung’s shares has not only lifted the technology sector but has also provided a boost to investor confidence across the region. This, in turn, has led to increased capital inflows and heightened market activity, further fueling the upward momentum.

Moreover, Samsung’s success has had a ripple effect on other technology companies in Asia, many of which are part of its extensive supply chain. As Samsung continues to thrive, its suppliers and partners have also benefited from increased orders and business opportunities. This interconnectedness highlights the importance of Samsung’s role in the broader technology ecosystem and underscores its influence on regional economic growth.

In conclusion, Samsung Electronics’ leadership in the technology sector has been instrumental in driving gains in Asian markets. The company’s ability to innovate, adapt, and capitalize on emerging trends has not only bolstered its own performance but has also had a positive impact on the broader market. As Samsung continues to push the boundaries of technology, its role as a catalyst for growth in the region is likely to remain significant. The recent surge in Asian markets, led by Samsung, serves as a testament to the company’s enduring influence and its pivotal role in shaping the future of the technology sector.

Investor Sentiment: How Samsung Influences Market Trends

Investor sentiment plays a crucial role in shaping market trends, and nowhere is this more evident than in the recent surge of Asian markets, with Samsung Electronics at the forefront of this rally. As one of the largest and most influential companies in Asia, Samsung’s performance often serves as a barometer for the region’s economic health. The company’s recent successes have not only bolstered its own stock value but have also had a ripple effect across various sectors, underscoring the interconnectedness of global markets.

To begin with, Samsung Electronics’ impressive quarterly earnings report has been a significant catalyst for the current market upswing. The company reported a substantial increase in profits, driven by robust demand for its semiconductor products and consumer electronics. This positive financial performance has instilled confidence among investors, who view Samsung as a bellwether for the technology sector. Consequently, this optimism has spilled over into other tech stocks, lifting the entire sector and contributing to the broader market rally.

Moreover, Samsung’s strategic initiatives have further reinforced investor confidence. The company’s commitment to innovation, particularly in areas such as artificial intelligence and 5G technology, positions it as a leader in the next wave of technological advancements. By investing heavily in research and development, Samsung is not only securing its future growth but also setting industry standards that competitors strive to meet. This forward-thinking approach has resonated with investors, who are eager to capitalize on the potential long-term gains.

In addition to its technological prowess, Samsung’s global reach and diversified product portfolio have made it a resilient player in the face of economic uncertainties. The company’s ability to navigate supply chain disruptions and geopolitical tensions has demonstrated its operational agility. This resilience has reassured investors, who are increasingly wary of external risks that could impact market stability. As a result, Samsung’s strong performance has become a stabilizing force, encouraging investment in Asian markets even amid global economic challenges.

Furthermore, the positive sentiment surrounding Samsung has had a domino effect on related industries. For instance, suppliers and partners within Samsung’s extensive network have also experienced stock price increases, as investors anticipate increased demand for their products and services. This interconnectedness highlights the importance of Samsung’s role in the broader economic ecosystem, where its success can drive growth across multiple sectors.

While Samsung’s influence on market trends is undeniable, it is essential to consider the broader context in which these developments are occurring. The global economic landscape is currently characterized by a mix of opportunities and challenges, including fluctuating interest rates, trade tensions, and evolving consumer preferences. In this environment, companies like Samsung that demonstrate strong fundamentals and strategic foresight are well-positioned to thrive, thereby shaping investor sentiment and market dynamics.

In conclusion, the recent surge in Asian markets, led by Samsung Electronics, underscores the profound impact that a single influential company can have on investor sentiment and market trends. Samsung’s robust financial performance, strategic initiatives, and operational resilience have not only driven its own success but have also contributed to a broader market rally. As investors continue to navigate an ever-changing economic landscape, the role of key players like Samsung in shaping market sentiment will remain a critical factor in determining future trends.

Comparative Analysis: Samsung And Other Asian Tech Giants

In recent months, Asian markets have experienced a significant surge, with Samsung Electronics emerging as a pivotal force driving this upward momentum. As one of the leading tech giants in Asia, Samsung’s performance has not only bolstered investor confidence but also set a benchmark for other technology companies in the region. This comparative analysis seeks to explore the factors contributing to Samsung’s success and how it stands in relation to other prominent Asian tech firms.

To begin with, Samsung Electronics has demonstrated remarkable resilience and adaptability in the face of global economic challenges. The company’s strategic investments in semiconductor technology and its expansion into emerging markets have played a crucial role in its recent success. By capitalizing on the growing demand for advanced chips, Samsung has positioned itself as a leader in the semiconductor industry, a sector that is increasingly becoming the backbone of modern technology. This strategic focus has allowed Samsung to not only maintain its competitive edge but also to drive substantial revenue growth.

In comparison, other Asian tech giants such as Huawei, Sony, and Tencent have also made significant strides, albeit in different areas. Huawei, for instance, has been focusing on strengthening its position in the telecommunications sector, particularly with the rollout of 5G technology. Despite facing geopolitical challenges, Huawei’s commitment to innovation and its robust research and development efforts have enabled it to remain a formidable player in the tech industry. Similarly, Sony has been leveraging its expertise in consumer electronics and entertainment to capture a larger share of the market. The company’s success in gaming and digital imaging has contributed to its strong financial performance, highlighting its ability to diversify and adapt to changing consumer preferences.

Meanwhile, Tencent, a major player in the digital and social media landscape, has been capitalizing on the increasing demand for online services and entertainment. The company’s strategic investments in gaming, social media, and fintech have allowed it to tap into new revenue streams and expand its global footprint. Tencent’s ability to innovate and adapt to the rapidly evolving digital landscape has been instrumental in its sustained growth.

While each of these companies has its unique strengths and challenges, Samsung’s recent performance stands out due to its comprehensive approach to innovation and market expansion. The company’s ability to integrate cutting-edge technology with consumer needs has been a key factor in its success. Moreover, Samsung’s commitment to sustainability and corporate responsibility has further enhanced its reputation, making it an attractive choice for socially conscious investors.

In conclusion, the surge in Asian markets, led by Samsung Electronics, underscores the dynamic nature of the region’s tech industry. As these companies continue to innovate and expand, they are not only shaping the future of technology but also contributing to the overall economic growth of Asia. While Samsung’s leadership in the semiconductor sector has been a significant driver of its recent success, the achievements of other tech giants like Huawei, Sony, and Tencent highlight the diverse opportunities and challenges within the industry. As the global demand for technology continues to rise, these companies are well-positioned to capitalize on emerging trends and drive further growth in the Asian markets.

Future Outlook: Sustainability Of The Asian Market Rally

The recent surge in Asian markets, spearheaded by Samsung Electronics, has captured the attention of global investors and analysts alike. This rally, characterized by significant gains across various sectors, raises questions about its sustainability and the factors that could influence its future trajectory. As we delve into the dynamics of this market upswing, it is essential to consider both the underlying economic conditions and the broader geopolitical landscape that could impact its longevity.

To begin with, the robust performance of Samsung Electronics has been a pivotal driver of the current rally. As a leading player in the technology sector, Samsung’s impressive quarterly earnings have instilled confidence among investors, reflecting strong demand for its semiconductor products and consumer electronics. This demand is largely fueled by the ongoing digital transformation across industries, which has accelerated in the wake of the COVID-19 pandemic. Consequently, Samsung’s success has had a ripple effect, boosting investor sentiment and encouraging capital inflows into the broader Asian markets.

However, while Samsung’s performance is undoubtedly a significant factor, it is not the sole contributor to the market rally. The economic recovery in key Asian economies, such as China and India, has also played a crucial role. These countries have shown resilience in bouncing back from the pandemic-induced downturn, supported by government stimulus measures and a resurgence in consumer spending. Furthermore, the gradual reopening of international borders and the resumption of global trade have provided additional impetus for growth, benefiting export-oriented Asian economies.

Despite these positive developments, the sustainability of the Asian market rally is not without challenges. One of the primary concerns is the potential for inflationary pressures, which could arise from supply chain disruptions and rising commodity prices. Central banks in the region may face the difficult task of balancing economic growth with inflation control, potentially leading to tighter monetary policies that could dampen market enthusiasm. Additionally, geopolitical tensions, particularly those involving major economies like the United States and China, could introduce volatility and uncertainty, affecting investor confidence.

Moreover, the ongoing transition towards sustainable and green technologies presents both opportunities and challenges for Asian markets. As countries strive to meet their climate commitments, there is a growing emphasis on renewable energy and sustainable practices. This shift could drive innovation and create new investment opportunities, particularly in sectors such as electric vehicles and clean energy. However, it also necessitates significant capital investment and policy support, which may vary across different countries and impact the pace of adoption.

In light of these factors, the future outlook for the Asian market rally hinges on a delicate balance of economic, geopolitical, and environmental considerations. Investors will need to remain vigilant, closely monitoring developments in these areas to make informed decisions. While the current momentum is encouraging, it is crucial to recognize that market dynamics are inherently fluid and subject to change. As such, a cautious yet optimistic approach may be warranted, with an emphasis on diversification and risk management to navigate potential uncertainties.

In conclusion, the Asian market rally, led by Samsung Electronics, presents a promising yet complex landscape for investors. By understanding the interplay of various factors influencing this rally, stakeholders can better assess its sustainability and position themselves strategically for future opportunities. As the global economy continues to evolve, the resilience and adaptability of Asian markets will be key determinants of their long-term success.

Q&A

1. **What caused the Asian markets to surge recently?**

The surge in Asian markets was primarily driven by strong performance in the technology sector, with Samsung Electronics leading the rally due to positive earnings reports and optimistic forecasts.

2. **How did Samsung Electronics contribute to the market rally?**

Samsung Electronics reported better-than-expected quarterly earnings, which boosted investor confidence and led to a significant rise in its stock price, positively influencing the broader market.

3. **Which other sectors benefited from the rally in Asian markets?**

Besides technology, sectors such as consumer electronics, semiconductors, and manufacturing also saw gains as investor sentiment improved across the board.

4. **What external factors supported the market surge?**

External factors included easing geopolitical tensions, favorable trade agreements, and positive economic data from major economies, which collectively bolstered market confidence.

5. **How did other major Asian indices perform during the rally?**

Major Asian indices such as the Nikkei 225, Hang Seng, and Shanghai Composite experienced significant gains, reflecting the overall positive sentiment in the region.

6. **What impact did the rally have on global markets?**

The rally in Asian markets had a positive spillover effect on global markets, with increased investor optimism leading to gains in European and U.S. stock markets as well.

7. **What are analysts predicting for the future of Asian markets following this surge?**

Analysts are cautiously optimistic, suggesting that if current economic conditions persist and corporate earnings continue to improve, Asian markets could maintain their upward trajectory in the near term.

Conclusion

Asian markets experienced a significant surge, primarily driven by the strong performance of Samsung Electronics. As a leading player in the technology sector, Samsung’s robust earnings and positive outlook have instilled investor confidence, contributing to a broader market rally across the region. This upward momentum reflects optimism about economic recovery and growth prospects in Asia, with technology stocks playing a pivotal role. The rally underscores the importance of major tech companies in influencing market trends and highlights the interconnectedness of global markets, as positive developments in one region can have widespread effects.